I recently met with Rodolfo Chung, CEO of rapidly rising Zé Delivery in Brazil. This is a beverage delivery service that was launched by AB InBev right before Covid – and then took off like a rocket during the lockdown. Basically, it’s a mobile app that lets you order any of 500 SKUs for beer, wine, and spirits on your phone and get delivery in 15-25 minutes. Orders grew from 1.5 million in 2019 to 62 million in 2021. There is a Harvard Business Review case being written about the company.

Post Covid, Zé Delivery’s growth has slowed but, according to Rodolfo, they have retained users and volume. And it is without question the biggest success within beer giant AB InBev’s push into digital and platforms. AB InBev is now replicating the Zé business model across Latin America. And I suspect Zé Delivery will become a model for how a leading CPG companies (with large scale production and distribution) can build successful direct-to-consumer digital services.

I toured their operations in a couple Sao Paulo neighborhoods and I will be doing a subsequent article on this. There is really a lot of important stuff happening with this company on the supply side. But for this article, I want to talk about the demand side of the business.

But first, here are some photos from their operations in Sao Paulo.

Motorcycle riders picking up their orders for delivery in Jabaquara. It processes +4,000 orders per week. Avg order size $10.

One of the company’s 26 “dark kitchens” in Sao Paulo for distribution

The company has a tech company feel for its +800 employees. With lots of yellow to match its logo.

Obviously, yellow is their color. And their logo is a guy with a beard named Zé . He represents the “everyman” of Brazil. And he really does jump out of my smartphone screen (bottom right).

But one of the questions we discussed was the consumer value proposition.

Rudolfo said Zé Delivery offered consumers beer, wine and spirits that are cheap, cold and fast. It’s a good price. It does deliver fast, which speaks to convenience (which usually induces demand). And it is also cold. The refrigerators in the facilities are kept really cold.

That’s a solid value proposition. But it sounds a bit like a delivery app for a supermarket or convenience store, with a larger selection of long tail alcohol types. If you view the service this way, then my assessment would be Zé is:

- A popular service with clear product market fit. The numbers are big and grew really fast.

- A business with a serious barrier to entry against digital natives, who cannot replicate the big physical infrastructure and COGS of AB InBev.

- A delivery service that can probably be replicated by other large retailers such as supermarket chains, that also have significant distribution scale and purchasing power.

If you think of the business this way, then my question is: how can this service differentiate itself on the demand-side over time?

Zé Delivery Goes From Products to “Wow” Experiences

The Zé Delivery app is pretty basic right now. They are an ecommerce retailer with lots of alcohol types. They are doing some personalization. And there are some offered bundles. But they are not doing real time bundling. So the consumer offering looks like a solid online retailer in its early iterations.

But the company is not talking about itself like a supermarket that sells products. Or like a digital version of one the many beverage stores you see around Brazil.

A typical alcohol retailer in Brazil.

The company, like parent AB InBev, talks about events and occasions where people get together and drink. Such as in bars and restaurants. And in homes and at parties and events. Zé Delivery is not just digitizing and personalizing shopping for beverages. It’s not just going for convenience. It is attempting to digitize, service and enrich the events, occasions and good times of friends and family.

That is a much more interesting digital question. How can you use digital tools to enrich the celebrations and other special times that people spend together?

The simplest version of this is to become the one-stop service for everything you need for when your friends get together on a Saturday night. Or when a family gets together on a Sunday for lunch. And Zé Delivery now offers meat and BBQ supplies (super popular in Brazil) along with the beverages. So they can expand their product offerings.

My recommendation to Rudolfo was to look at this as a dynamic, never-ending process of experimentation and innovation. It’s not about identifying 10-20 common, fun events and supporting them with tailored product bundles. It’s about adopting a posture of continually thrilling and wowing your customers at their events and occasions. And I pointed to Coupang and Xiaomi as examples of this posture.

- Xiaomi has to keep bringing customers into their stores. Retention is a challenge because people don’t buy phones that often. So Xiaomi talks about the need to continually create products that “thrill” their customers. So they keep rolling out new products like smart chopsticks and smart air purifiers. And customers always stop in to their stores to see what’s new.

- South Korean Coupang’s standard is to create “wow” experiences for their customers every day. That is their standard. We need to surprise our customers literally every day.

I think Zé Delivery could adopt the same posture. But I don’t think either of those words (wow, thrill) are the right goal or standard for Zé Delivery. I’m hunting for the right language. I think their goal is something like to continually spark the interactions between friends and family. The target is not an individual’s happiness or thrill. But the interactions between people that happen at events. I’m not sure.

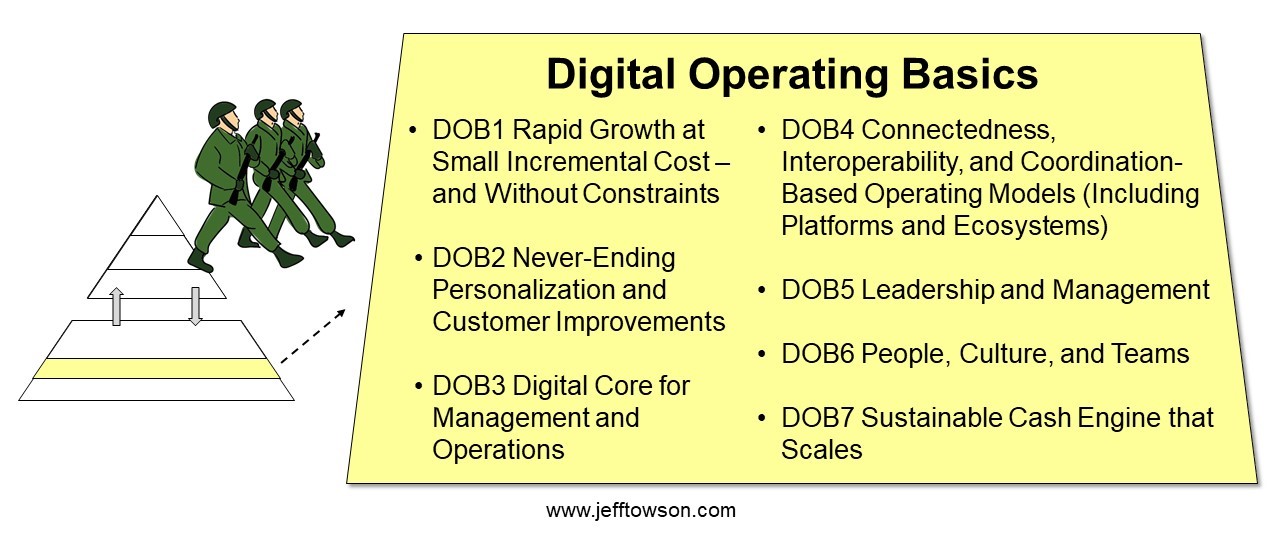

But the idea is the same. It’s about adopting a process and culture of never-ending experimentation and innovation to create such customer experiences. Which I have put under DOB2. If you look at Zé Delivery this way, it gets a lot more interesting as a digital company. And the company can start to specialize its digital operations to something a big supermarket would have difficulty copying.

Which brings me to the related topic of Ant Financial and it’s sustained innovation imperative.

First a little theory.

Nobody Talks About Negative Feedback Loops and the Network Effects Trap

I’ve mentioned many times that network effects can work in reverse just as fast. If merchants stop taking American Express cards, they become less valuable to consumers. If fewer consumers then carry them, they become less valuable to merchants. And so on. We can get a negative feedback loop.

So what would you do if you are a platform based on network effects and you are seeing fewer consumers using your app each month? Or if the cost of attracting them is increasing? Or if they are spending or posting less when they do arrive? Or if your retention is falling?

This is the network effects trap that nobody talks about. Network effects make you highly dependent on keeping activity on your site.

I think about traditional competitive advantages (like economies of scale) like having a car instead of a bicycle. With these advantages, you can go faster than your competitors. It is a structural advantage. Well, having network effects (which is also a competitive advantage) is like having an airplane. You can go much, much faster. But once in the air, you also realize there is no way to land. You have to keep your network effect going. A car losing speed is not horrible (i.e., fading economies of scale). But a plane losing altitude is catastrophic.

You can see lots of network effects-based businesses getting frantic as they lose activity (and altitude).

- Ctrip and Expedia are increasingly worried about their low frequency of usage. Search engines and meta search sites are cutting them off from their consumers.

- Entertainment platforms like TikTok are worried they are a fad and that viewers will switch to a new popular media type, like live streaming.

- All online platforms have some degree of user churn. They are a leaky bucket where you constantly have to be adding new users. And for many, this is getting harder and more expensive in an age of abundance with endless choices but limited attention.

The solution to this problem is sustained innovation. Which is an important contrast to the “wow experiences” approach I just discussed. In Part 2, I’ll discuss why this is critical for companies like Ant and Alibaba.

***

Ok. That’s enough theory for today. I hope that is helpful. I’ll write more about this company shortly.

Cheers, jeff

And, for fun, here are some pictures from around Sao Paulo.

——–

Related articles:

- Why I Really Like Amazon’s Strategy, Despite the Crap Consumer Experience (US-Asia Tech Strategy – Daily Article)

- 3 Big Questions for GoTo (Gojek + Tokopedia) Going Forward (2 of 2)(Winning Tech Strategy – Daily Article)

- Why Netflix and Amazon Prime Don’t Have Long-Term Power. (2 of 2) (US-Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Digital Operating Basics 2: Personalization and Customer Improvements

- SMILE Marathon: Sustained Innovation

- Network Effects

From the Company Library, companies for this article are:

- Ant Group

- Ze Delivery

- Ab InBev

——-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.