In Part 1, I argued that Amazon’s ecommerce business was getting stronger over time (in terms of competitive strength). It has an impressive series of competitive advantages.

I also teed up the idea that Amazon’s video business was heading in the opposite direction. It was weak and getting weaker (in terms of competitive strength). And really, this applies to Netflix as well. I think both businesses have never had the long-term power everyone thinks.

Recall, Hamilton Helmer’s 7 Powers

Hamilton Helmer’s “7 Powers” book is widely cited in Silicon Valley. I think it is a logical approach but only applies to a very small group of digital companies. Because it is focused on identifying companies that are going to increase significantly in economic value. That means it is about identifying companies that have three attributes:

- Attractive market size and growth. How big is the company and opportunity now and in the future?

- Competitive strength. What is the market share and/or ROIC versus current and potential competitors? Both now and going forward.

- Attractive unit economics. What are the economic profits? And this depends on the previous two dimensions, external factors, management performance, the specific industry, and other factors.

When combined, these three attributes can sometimes tell you the economic value that will be created by the company in the future.

That is fine. But I am mostly isolating the competitive strength dimension.

- What is the competitive strength of a digital business and how is this being changed by new technologies?

Competitive strength is linked to and influenced by the other two dimensions. But I am trying to isolate it as much as possible. I spoke about this in Podcast 65.

Note: You can see all three dimensions in Helmer’s “fundamental equation of value”:

Value = (M0*g)*(s*m) = market scale * power

- M0 is the size of the market at time zero. g is the growth of the market. So, the first two terms are about targeting a big and / or growing market opportunity.

- s is the long-term persistent market share of the company. How much of the opportunity is it capturing?

- m is long term persistent margins of the company (i.e., operational margins after cost of capital). What is the profitability of the business?. Power is s*m, which ultimately follows from cash flow.

Which brings me back to Netflix. Because that is the company that 7 Powers cites when looking at companies with power. But, per my point, I think this is what people are getting wrong. And we can see this by running the same questions that I did for ecommerce in Part 1.

Netflix and Amazon Prime Video Are Both Relatively Weak in Long-Term Competitive Strength.

Amazon Prime Video, like Netflix, is a linear business model that offers a big bundle of digital content at a low price. That’s the pitch. Lots of movies and television shows at a low price. And you can watch anywhere (i.e., convenience).

The content is primarily films and television shows developed by Amazon and licensed from studios. And it’s mostly a subscription model, although there are a la carte purchases and video-on-demand options. So, you can view it as a content bundle. But Prime Video is also bundled within Amazon Prime memberships. So, it’s content that is also bundled with non-video services.

Some basic numbers:

- Amazon Prime membership (not just Prime Video) passed 200M subscribers in 2021.

- Netflix had about 204M worldwide subscribers at the end of 2020

- Disney+ passed 100 million in 2021.

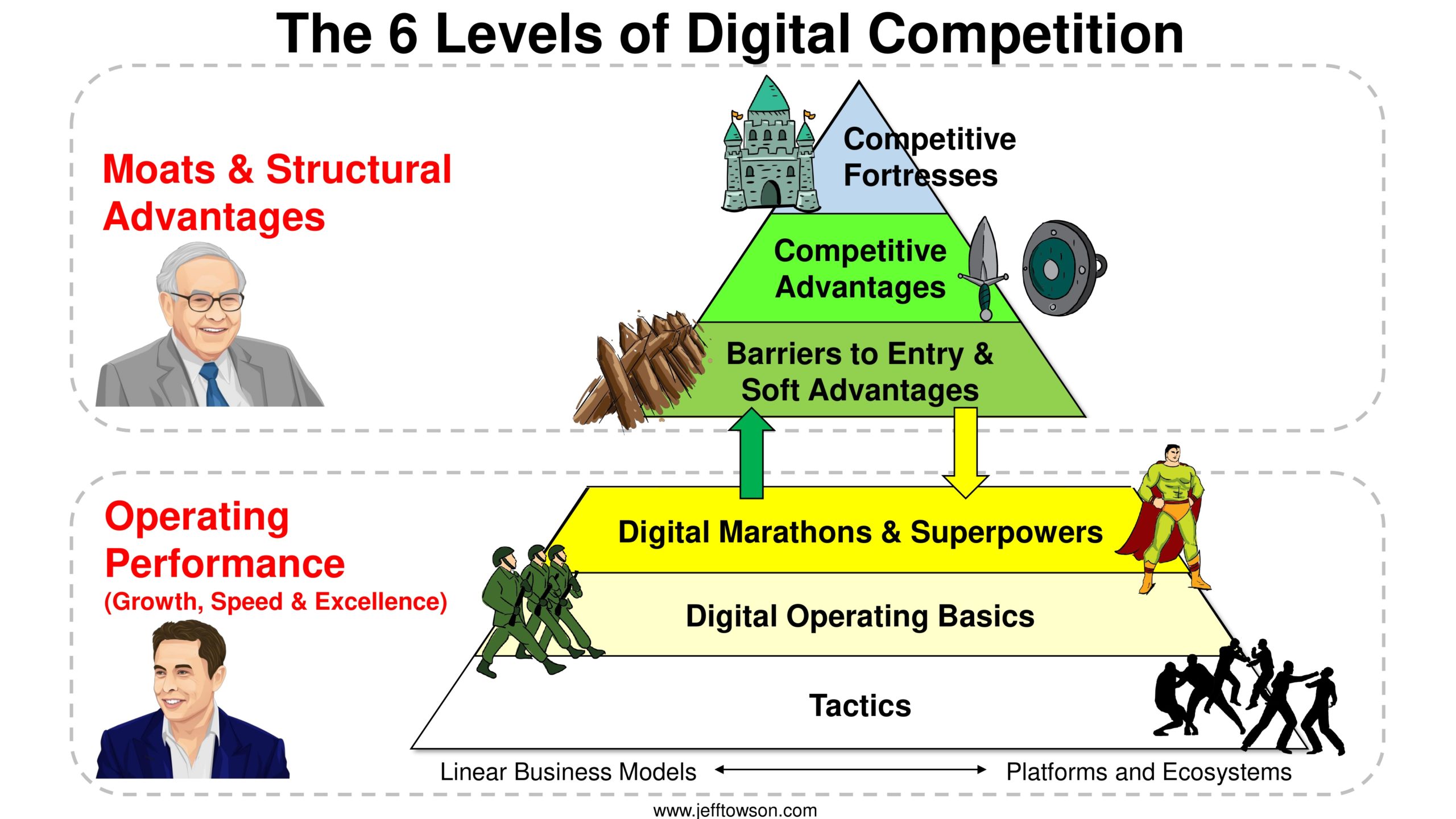

So, let’s just run my 6 levels for digital competition for the video business.

Level 1 is Competitive Fortresses. And this is the part I do like about Amazon Prime Video. It is a linked business model, that is somewhat tied to ecommerce. Although Amazon has never integrated these services in a compelling way. Note: Netflix is a stand-alone entertainment service.

Level 2: Competitive Advantages

This is where people usually discuss Amazon Prime Video and Netflix.

Running the list, a couple of minor things jump out for both companies on the demand-side. There is CA1: Share of Consumer Mind. But it is pretty weak. There are no switching costs. And there is no network effect (important).

The competitive advantages people usually point to for Amazon Prime Video and Netflix are on the supply side. They are:

- CA 12 Purchasing Economies – for licensing content.

- CA11 Fixed Costs – in IT and content creation.

CA 12 Purchasing Economies – for licensing content.

This is definitely a scale advantage. Both companies need a big content library. Plus, they need quality content, which is harder to acquire. Plus, they need some popular shows. So their purchasing power when it comes to licensing is important. And, certainly, both Netflix and Amazon are big buyers.

However…

This is not like Amazon ecommerce using its purchasing power on lots of small brands and merchants. There are only a few places to buy quality content in Hollywood. Think a handful of studios and production companies. And this is also usually the case when they license content in India and Japan and other place. They have negotiating power for sure. But there are much fewer suppliers, holding valuable intellectual property. It is a very different picture than what we see in ecommerce.

Additionally, many of these IP owners are studios that view streaming services as a strategic threat. And they often need their most popular content to build their own streaming services. So, they may not license at any price.

Overall, purchasing power is much less when licensing movies and television shows. Even for these large streaming companies.

CA 11 Fixed Costs – in IT and content creation.

This is really what everyone talks about for Netflix. That they have economies of scale in content creation. The argument goes that because Netflix has a massive user base (and is bigger than most competitors), it can have a lower content cost per user. The company can use this cost advantage for both offense and defense. They can use it to lower their prices versus competitors (which Netflix does). And they can use it to outspend their competitors in content (which Netflix also does). This is why my symbol for competitive advantage (above) is a sword and a shield. It can be offense and/or defense. Amazon and Netflix do both.

For example:

- In 2020, Amazon spent $11B on Prime Video and Music Content. This was up 41% from 1999. However, this includes purchased content.

- In 2020, Netflix spent $11.8 billion on content. They announced this would be increasing to $17B in 2021.

Those are pretty massive numbers. And dwarf spending by Hollywood studios.

However…

This is also not as impressive as it first seems. There is a real problem is creating “quality content” at scale.

Think about how Amazon ecommerce uses its scale to outspend rivals in IT and logistics. They build lots of warehouses and buy lots of trucks. It scales up easily with increased spending. But how do you scale up in “quality content”? You can’t just create 100 Frozen-type movies by writing a big check. Creating “quality content” is not just about the money. And nobody has figured out how to do it at scale.

This is arguably the big weakness of streaming as a business model. You need a lot of content. Even Disney, arguably the best creator of high quality IP, has struggled in the quality of their new streaming service. Disney went from making a small number of popular movies each year (Frozen, Toy Story) to making lots of mediocre-to-bad television shows (Loki, Hawkeye, everything related to Star Wars). The weakness of streaming services is it requires companies to create quality content at much larger scale. I can’t think of a single company that has figured out how to do this.

Economies of scale in content creation are not as strong as everyone thinks. Whether by in-house production, joint venture or licensing. And hasn’t this been the biggest source of Netflix’s recent problems? They are outspending everyone on content. But everyone thinks their movies really suck now. I only pay $4 for Netflix per month and I’m actually thinking of canceling. Because I can never find anything worth watching.

***

Overall, Netflix and Amazon Prime Video have some mild to moderate competitive advantages. But nothing like what we see in Amazon ecommerce. Moving on…

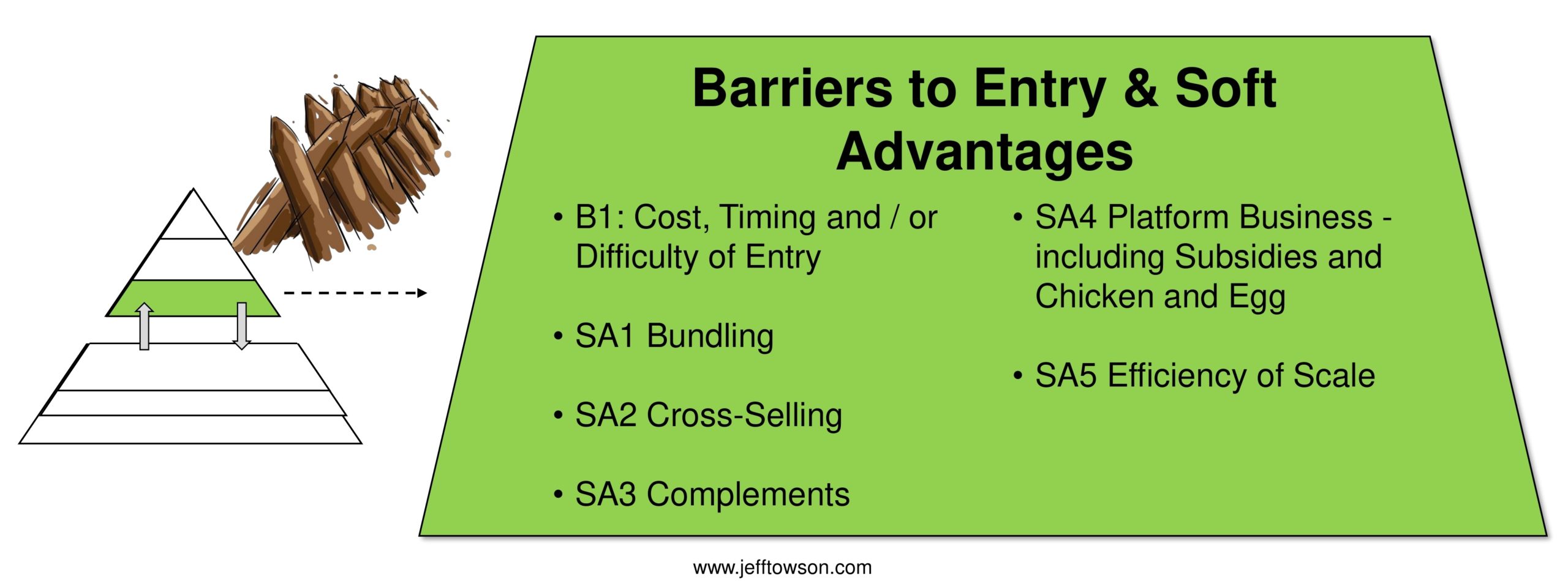

Level 3: Barriers to Entry and Soft Advantages

Take a look at Level 3.

This is where Amazon Prime Video starts to look a bit better. It actually does have an entry barrier (B1) in the size of the IP library. Getting enough content to create a viable streaming service in movies and television is actually quite hard. You need a lot of content. And it has to be ok quality. Ideally with a few hit shows as well.

But does the barrier keep increasing? As Netflix keeps adding content, does the barrier get higher and higher? As a new entrant, do you need to match Netflix? Or do you just need enough content to have a viable product. And after that minimum level, the fight becomes more about quality, not quantity? That is the argument for HBO Max and Disney+. That they can’t match Netflix in terms of library size. So they are focusing on quality.

As mentioned, Amazon Prime is also a service bundle (SA1). They can bundle and cross-sell ecommerce services much better than stand-alone Netflix.

But that’s basically it. It has none of the big infrastructure of Amazon ecommerce. And no platform business model.

***

Ok. If I’m right, then why have Netflix and Amazon Prime been so successful?

Here’s my explanation for what has been going on.

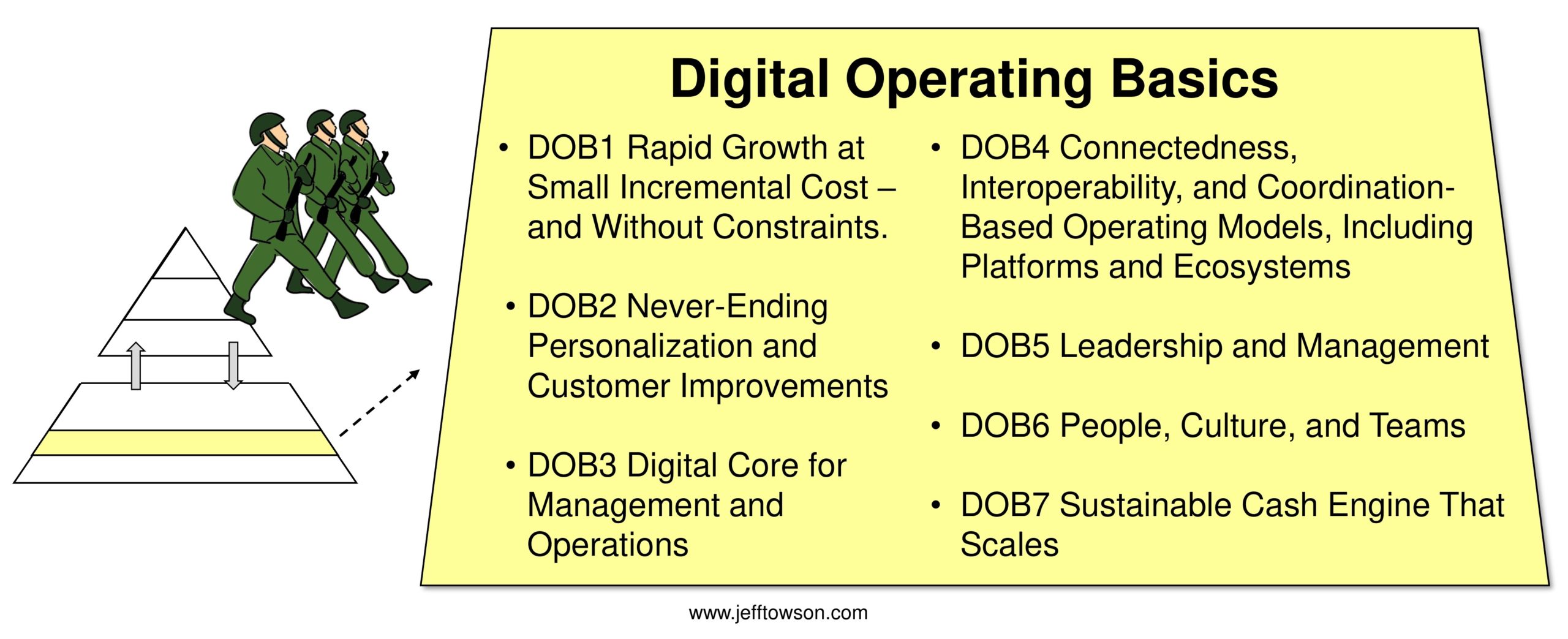

Level 5: Digital Operating Basics

This is my explanation for the success of the two companies. They both disrupted the traditional cable service with a fully digital, operating model. And with their new model, they executed against the Digital Operating Basics fairly well.

What is Netflix really known for?

- Large scale. It is global.

- Cheap price for a big library.

- Convenience.

Doesn’t that sound like a description of the digital operating basics?

- DOB1 is about leveraging digital economies to grow rapidly and without capacity limits.

- DOB2 is about using data to personalize and improve the customer experience. Isn’t that what Netflix does with its personalized recommendations that you can watch whenever you want? Without commercials?

- DOB3 is about digitizing the core operations. Get away from people and tangible assets. Just have software run the operations. Isn’t that what over-the-top streaming is about?

These two companies were also good at Tactics (Level 6). They were a first / early mover with a new digital business model (T1). And they outspent everyone (T5).

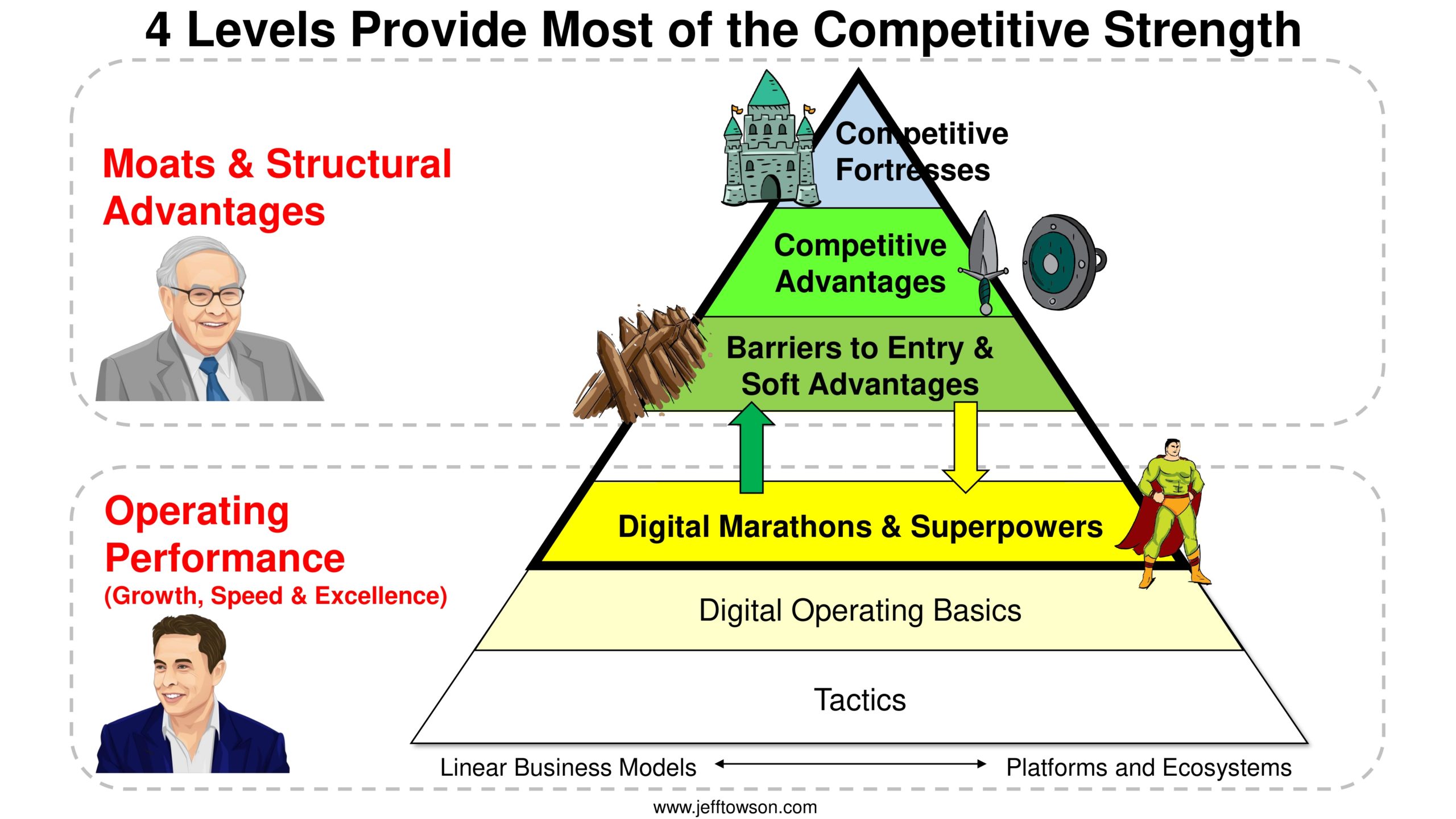

When I look at these two companies, I don’t see big structural advantages (i.e., moats).

What I see is some very effective operational performance against traditional cable companies, during a period of disruption. And that got them some short-term strength. And it gave them a window of time to grow and get to scale.

But now they are increasingly facing rivals with the same business model. And they are realizing they don’t have many structural advantages. Most of the big competitive advantages are in the top 4 levels. And, as mentioned, I don’t see much for Netflix and Amazon Prime there against rivals and new entrants.

Recall, my questions from Part 1. I asked:

Ques 2: How do these advantages play out over rivals, new entrants, and substitutes?

How do the discussed competitive advantages appear relative to large rivals?

- We should expect to see intensifying competition between large rivals with similar business models (Netflix, Amazon Prime Video, Disney+, HBO Max), etc. Absent competitive advantages, we should expect to see more focus on operational performance. And likely slowing growth, falling margins and increasing requirements to spend on content, technology and marketing.

How do the competitive advantages appear relative to smaller rivals?

- I’m not convinced niche content streaming sites aren’t going to be viable. Maybe specialty plays for cartoons, sports, comedy, etc.?

What about versus new entrants?

- Ultimately, streaming is a purely digital business. There are no tangible assets. There are no factories that need to be built. Digital businesses are easier to jump into, unless they have network effects. And that is not the case here.

- We should expect to see new entrants jump in, if they can assemble enough content to be viable. Maybe that will be harder than I think.

- Plus, unfortunately, there are a lot of traditional media companies that will have to jump into streaming, even if they lose money. They have no choice.

What are the substitutes?

- This is bad. There are tons of substitutes in entertainment. There is short videos, long videos, gaming, music, podcasting, AR/VR, etc. Metaverse is emerging.

- And most of them are free. That’s really bad. As a rule, never compete against low-cost or free substitutes.

Ques 3: How will this picture change over time?

It all basically gets worse.

- There is increasing competition from large rivals, with few structural defenses.

- We should expect new entrants.

- There are an increasing number of entertainment substitutes. Many of which are free.

What about changes in consumer behavior, technology, or regulations?

- Amazon Prime Video and Netflix are very exposed to changes in consumer behavior. This worries me. There are new types of entertainment all the time. But even within movies and television, consumer tastes change. It’s hard to adapt as a production company that creates and licenses its own content. Platform business models like YouTube benefit from endless user generated content. So the platform can adapt to changing tastes. But for Netflix, the development executives will have to keep adapting to what people want to see. Historically, they have not been great at this.

- Technology is also going to change. There is the metaverse. There is live streaming.

- Regulations are really the only good news here. There isn’t much impact.

My Conclusion: The Streaming Entertainment Bundle Is Getting Harder

Basically, I don’t like linear business models for entertainment.

It’s too hard to create quality content consistently. Especially at scale. There are few competitive advantages. Plus, there are too many substitutes, most of which are free.

I think the weaknesses of these companies were hidden during a period of tech change.

- A low-cost, over-the-top streaming model was devastating for cable companies. It was a new business model that was cheaper and more convenient.

- And being an early mover got them to scale before rivals emerged.

But I don’t see many advantages against rivals with similar business models. And I don’t see a compelling case against substitutes. In my experience, you don’t want to be in the digital content business without a network effect. And ideally with access to a long-tail of user generated content.

My recommendation for Amazon Prime Video is to:

- Sell the business.

Or

- Add an audience-builder platform that can access user generated content. Basically, add a YouTube. That would actually make it look like the ecommerce business, which is a combination of a linear business model and a marketplace platform.

That’s it for today. Cheers, jeff

——

Related articles:

- Amazon Has a Winning Long-Term Strategy. Amazon Prime and Netflix Don’t. (1 of 2) (US-Asia Tech Strategy – Daily Article)

- Why I Really Like Amazon’s Strategy, Despite the Crap Consumer Experience (US-Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Economies of Scale: Purchasing Economies

- Economies of Scale: Fixed Costs

- Digital Operating Basics

From the Company Library, companies for this article are:

- Amazon

- Netflix

Photo by Christian Wiediger on Unsplash

——-