In Part 1, I laid out some basic theory about marketplace platforms for services, which is a fascinating interesting subject. And it is much more complicated than marketplaces for products.

Ecommerce for services just has a much longer development pathway. As ecommerce and marketplaces move into more complicated services, such as medical care, legal and IT professional services, we’re going to see some interesting businesses. Services are also easier to bundle, both with other services and with products. This is something Alibaba is focused on and GoTo is positioned to this as well.

But I think there are three big strategy questions for GoTo going forward:

- Question 1: Is GoTo a Strong or Weak Type of Complementary Platforms?

- Question 2: GoTo is a Digital-Physical Hybrid. Does this Create a Strong or Weak Barriers to Entry?

- Question 3: What is the Rate of Development of Ecommerce in Indonesia?

That’s what I’ll answer in Part 2. But first some more background on GoTo.

GoTo Is Mostly Two Businesses Stuck Together

I couldn’t’ get much information on their financials. It was pretty minimal. Here is the key summary:

Note that the gross income for ecommerce is quite small as a percentage of revenue (about 3%). So, I’m assuming they are doing ecommerce mostly as a retailer at this point.

The other big take-away is these are all pretty small numbers. The overall gross revenue was about $1B annualized. So, despite the story of Indonesia being a really big market, these are still pretty small numbers.

The company discusses its strategy mostly in terms of basic platform strategy.

They are basically arguing that they have a network effect overall. I think they have network effects at the platform level. Gojek has one. Tokopedia has one. Their language describing this is pretty confusing.

They also argue they have economies of scale. I agree with this but it is mostly in IT/Web, R&D and marketing spend at this point. They point to marketing spend as “customer acquisition and promotional activities”.

They also focus on enhancing customer engagement, mostly by personalization and increasing their suite of goods and services. I agree with this but consider this just the digital operating basics.

***

Ok. That’s all fine.

But I am mostly interested in whether this combined company can “win it all” in Indonesia. Let me answer my three questions.

Question 1: Is GoTo a Strong or Weak Type of Complementary Platforms?

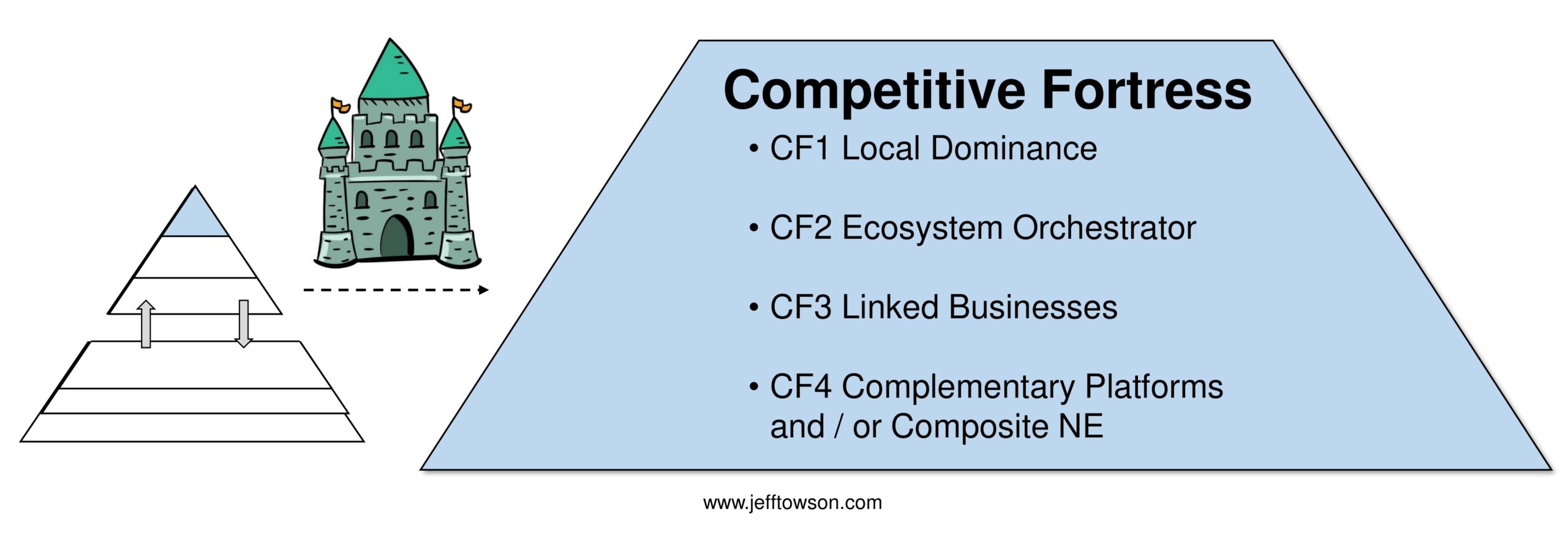

At the top of my 6 levels, I have put complementary platforms. It is one of the strongest business models in terms of competitive strength and defensibility.

Why are complementary platforms (CF4) so impressive?

Well, because they combine two things that are also on that short list: ecosystem orchestrators (CF2) and linked businesses (CF3).

- Both Gojek and Tokopedia are, in theory, marketplace platforms. They are both ecosystem orchestrators. That means they have lots of competitive strengths. Such as:

- Competitive advantages – usually including network effects, economies of scale and switching costs.

- Barriers to entry – usually including chicken-and-egg and digital-physical hybrids.

- Soft advantages – usually including subsidized pricing.

- They also have offer unique customer offerings that are both compelling and pretty hard to replicate. We can see that in the usage numbers in these businesses in country after country.

As I have said before, digital platforms are the super-predators of the business world.

Photo by Fausto García-Menéndez on Unsplash

But linked businesses (CF3) are also great. These are not conglomerates where you just happen to combine two or more businesses. This is where the businesses make each other strong than if they stood alone. An example of this is when real estate developers also own popular retail franchises (common in Thailand and China). Another is when Alibaba and eBay both owned payment businesses (Alipay and PayPal). Linking businesses is not without drawbacks but it can be very difficult for competitors to deal with.

And if we link two digital platforms together, we get complementary platforms. This is analogous to going from one super-predator to three hunting as a pack.

Photo by Fausto García-Menéndez on Unsplash

Such as business has the strengths of the individual platforms. But it also has combined strengths – such as:

- Competitive advantages – usually larger economies of scale in R&D, IT and marketing.

- Soft advantages – usually subsidized pricing, cross-selling and bundling.

- Unique customer offerings that are compelling and hard to match. Alibaba combining entertainment and shopping is an example of this.

And, most importantly, complementary platforms can have tremendous barriers to entry. Replicating such a business means replicating more assets. It is hard to replicate one digital platform. But doing it for two linked platforms is next to impossible. For example, you might be able to be replicate WeChat (difficult). But who could replicate Tencent’s combined social media, gaming, and ecommerce businesses? Other examples of complementary platforms are Amazon, Google, Microsoft, and Alibaba.

***

That’s a basic explanation of complementary platforms.

But, as with all of these concepts, you have to dig deeper. Marketplace platforms can be very different from each other. Some are stronger and some are weaker. Some have awesome network effects. Some have weak ones. I’m categorizing types of business models, like types of animals (“this is a big cat”). But lions are different than hyenas.

So, is GoTo a strong or weak complementary platform? How does it compare in competitive advantages, user offerings and barriers to entry?

In its current form, I think GoTo’s complementary platforms are pretty weak.

- Combining marketing and IT spend is helpful but nothing special. In fact, the IT and R&D for the two ecommerce businesses is pretty different. There is a lot of specialization.

- The merchants are going to be different for each platform and I don’t think they will combine much. I don’t see increased switching costs. And drivers are just a resource.

- The combined consumer offering is potentially interesting. If GoTo starts bundling products and services, that could be a unique offering. That is mostly what I am watching for. That would be very difficult for competitors to match.

But I generally consider this a weak type of complementary platforms. It didn’t really work for Alibaba either.

- Certainly, this model has none of the power of combining ecommerce with entertainment, which is where Alibaba and ByteDance are focusing.

- Or of combining ecommerce with cloud, which is Amazon and Alibaba.

- Or of combining social media with gaming (i.e., Tencent).

In terms of complementary platforms, I put Alibaba, Tencent, Google and Amazon at the top. I put Sea Limited and Grab in the middle. And I put GoTo lower down.

Question 2: GoTo is a Digital-Physical Hybrid. Does this Create a Strong or Weak Barrier to Entry?

I really like Digital-Physical Hybrids, which I have talked about a lot. This is in the Concept Library.

I like businesses that have the benefits of digital (scalability, low reproduction costs, ability of rapid innovation, etc.) but also have tangible, physical assets (warehouses, retail stores, etc.). The first gets you the potential for rapid innovation, growth and usually profits. The second gets you defensibility.

My standard example for this is JD. They have a great ecommerce app (both retail and a marketplace). But they also have +2,000 warehouses across China. That is almost impossible to replicate in the short term. They can face new entrants but they are going to see them coming a long way off.

This is why I also like ecommerce more than entertainment and media. YouTube, TikTok and Facebook are digitally powerful but have no physical, tangible component. That, plus the changing technology and consumer behavior in entertainment, means the players tends to change much faster. And less predictably. As I said, I like to see my disruptors coming a long way off.

So, what about GoTo?

It has two main physical aspects. The warehouses and logistics of Tokopedia and the delivery people of GoJek.

Recall my standard question for assessing a barrier to entry: What is the cost, timing and/or difficulty for a well-funded, well-run competitor to replicate the assets and take market share?

For the army of delivery drivers, the cost, timing and/or difficulty of the physical assets is not significant. These are overwhelmingly local services. You could hire people quickly in a single city like Jakarta. The cost is also not prohibitive. It’s not difficult to replicated the physical components of ride-sharing or delivery.

However, GoTo has assembled a suite of +20 different local services. That makes it harder to replicate the overall offering. And it is a platform business model, with network effects and chicken-and-egg. So there is a barrier, but it is mostly from the digital assets.

For the logistics network, cost and timing are of the physical assets is usually the challenge. Opening warehouses is not difficult. But it does take time and money in a large country like China and the USA. And, in theory, it should be the same in Indonesia, with its huge population and massive chain of jungle-covered islands and villages.

However…

Most of GoTo’s business in Indonesia is still concentrated in 2-3 cities. In the future, the business will grow, and the logistics assets should become a tremendous barrier. But that is not the situation today. You can still probably support these 2-3 cities with a handful of warehouses. This is similar to China in 2005, when most ecommerce was in a few cities on the eastern coast.

Overall, I think the barriers to entry for GoTo are still fairly low today. And mostly coming from the digital assets, not from a digital-physical hybrid. But they should be formidable in the future, especially for the Tokopedia side of the business. You could see a JD-like competitive fortress in Indonesia. But it’s not there yet.

Which brings me to my last question.

Question 3: What is the Rate of Development of Ecommerce in Indonesia?

Indonesia today vs. Indonesia one day is the key question in terms of the total addressable market and the barriers to entry. Covering the entire country is going to be difficult in logistics. Getting merchants online is going to require lots of time and education.

So how fast is Indonesian ecommerce developing?

The typical numbers are that Indonesians spent $20.3bn online in 2018, up 20% from a year earlier. This rose rapidly to +$40B, with McKinsey & Co predicting +$60B this year. But ecommerce is still only about 3% of retail spending.

Indonesia’s population of 270 million people is attractive. But the difficulty and cost of transporting goods around country is a big problem. Indonesia has over 17,000 islands (6,000 of which are in inhabited). Typical predications are for ecommerce growth around 14-15%. That’s good but nothing like what we saw in China.

Overall, I am mostly bullish on Indonesia ecommerce.

Final Question: Is GoTo Going to Win?

My Best Answer at This Point is Yes. But Longer-Term.

Given that I’ve changed the title of this podcast to Winning Tech Strategy, I’ll try to be more pointed with my conclusions.

I think GoTo is poised to win big in Indonesia.

- It is early into the development of its digital economy.

- There are serious competitors like Shopee.

- GoTo is still a relatively small company.

- And its strengths are not what they will be one day. I don’t think this is a case of big complementary platforms and big barriers to entry yet.

But I like where this is headed. GoTo has:

- A big brand with a powerful share of the consumer mind.

- Two ecosystem orchestrators. Both with network effects.

- Economies of scale in both businesses.

I like that. I don’t see any significant competitive threats to GoTo today. And I think they will likely become much stronger as the country develops. Whether that happens in 2-3 years or 10 is the question.

Cheers, Jeff

——–

Related articles:

- GoTo Is Going for an “Ultimate B2C Marketplace” in Indonesia. But Alibaba Couldn’t Do It in China. (1 of 2)(Winning Tech Strategy – Daily Article)

- Will GoTo “Win it All” in Indonesia? (Winning Tech Strategy – Podcast 123)

From the Concept Library, concepts for this article are:

- Complementary Platforms

- Digital-Physical Hybrids

- Barriers to Entry

From the Company Library, companies for this article are:

- GoTo / Gojek / Tokopedia

Photo by Gojek Media Resources

———

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.