The recently merged Gojek and Tokopedia (i.e., GoTo) has gone public in Indonesia. And I finally got a look at their filings (thanks to a subscriber who sent me a translated copy).

GoTo is basically what you would expect. It’s a marketplace platform for local services (i.e., Gojek) combined with a marketplace for products (i.e., Tokopedia). It’s growing solidly. And it’s losing money, which is not uncommon for either of those platforms in the earlier stages.

But GoTo raises a couple of really interesting strategy questions.

- Do the geography and development status of Indonesia change the dynamics of these two marketplace platforms?

- Will this uncommon type of complementary platform business model have the same competitive strengths as complementary platforms like Tencent and Alibaba?

- Can GoTo successfully build an “ultimate B2C marketplace” for Indonesia? I’ll explain this term below.

Years ago, Alibaba combined Taobao / Tmall and Ele.me in an similar attempt to create an ultimate B2C marketplace. Their objective was to dominate the consumer wallets of China. But Alibaba doesn’t really talk about this combination anymore. Ele.me is now somewhat of an orphan within Alibaba, having been moved into and then out of Alipay / Ant in the last two years. Alibaba now mostly talks about its ecommerce platforms and its infrastructure (cloud, logistics, new retail).

So can Gojek succeed at this strategy when Alibaba couldn’t?

I’ll give you my take on that and the above questions in the next 1-2 articles. These are what I think really matters for GoTo going-forward (in terms of strategy).

But first some background on the evolution of ecommerce services.

An Intro to Gojek and the Collision in Ecommerce Services

About 3 years ago, I started writing about a strange collision happening in ecommerce services in China. We saw tech company after tech company going after local O2O services like food delivery and mobility. And also for other services like hotel reservations, beauty treatments, movie tickets, etc. Literally all the major tech players were colliding in the services area.

- Niche players like Ctrip and Didi were expanding within their specialties. Didi went from cars and taxis into bicycles and metro tickets. Ctrip went from plane tickets and hotels into live-streaming influencers and home-sharing.

- Services suites like ele.me and Meituan began offering longer lists of local services. Meituan expanded from food delivery to hotel reservations (successfully) and to mobility / bicycles (unsuccessfully).

- Major ecommerce companies like Alibaba and JD expanded into local services, which included everything from food delivery and hotels to restaurants and beauty treatments.

Gojek, pre-merger, looked a lot like the Meituan example. Now it is something closer to the Alibaba example (circa 2018). Today, GoTo is:

- Mostly Indonesia-focused

- Combining ecommerce, on-demand services and financial services

- Growing its already significant local usage:

- 55M yearly transacting users

- 14M merchants

- 5M drivers

And GoTo talks about its potential share of consumer wallet, similar to Alibaba. In its filing, it says its Gross Transaction Volume could reach 2/3 of Indonesian household consumption.

So how to take this apart?

I think we are still in the early days of ecommerce for services. I typically start by breaking ecommerce down into 4 types of product / services categories.

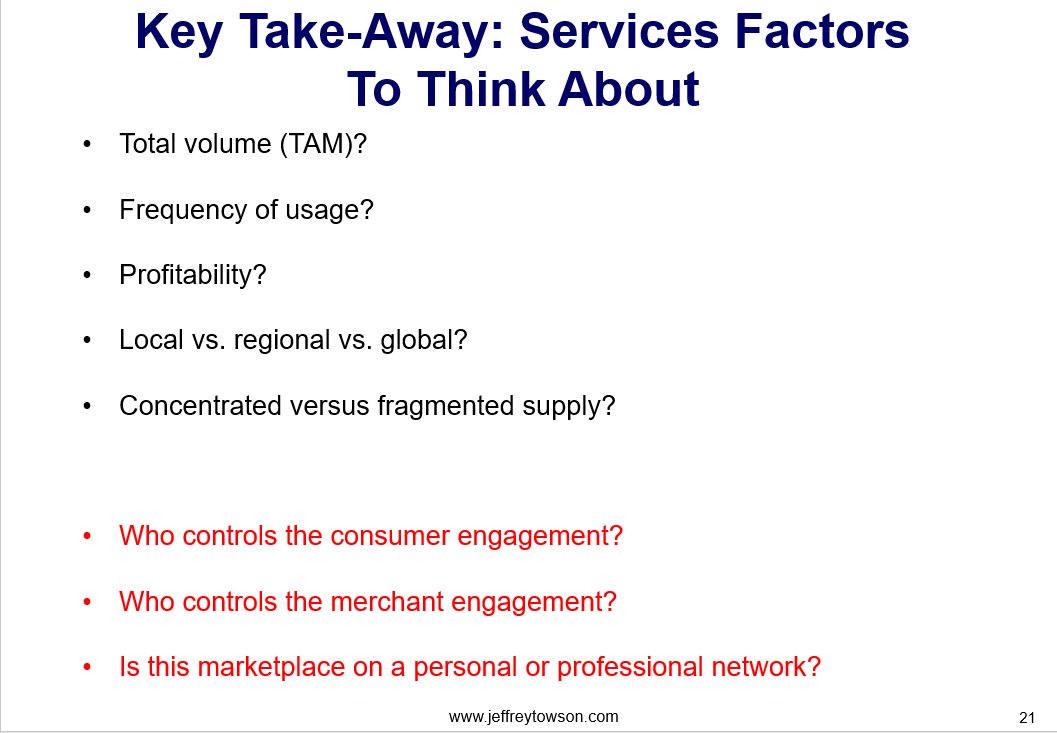

I find the distinction between commodity and differentiated services tends to be important in the competitive strength of these businesses. And the 4 factors I always think about are:

These factors tend to be helpful. For example:

- Hotel reservations are a differentiated and global service (or at least regional) with fragmented supply and a low frequency of usage. They can be quite profitable but struggle to get consumers.

- Ridesharing is a local, commodity service with fragmented supply and a high frequency of usage. It has low profitability.

- Airline reservations are a global, commodity service (or at least regional) with concentrated supply and a low frequency of usage. It also has low profits.

I would describe all of these examples as phase 1 in ecommerce services.

Phase 1 Was About Mostly Simple Services

All the examples I just gave were for fairly simple services. Buying a ticket. Getting a ride. Certainly, they have none of the complexity of providing medical or legal services. But marketplaces work well with simple services and most of these businesses were launched in 2000-2010 marketplace frenzy. And they mostly kept it simple and focused on niches.

Some other examples:

- Ctrip, Booking.com, and Expedia specialized in simple hospitality and tourism services. Airbnb is also in this category but is somewhat unique (and more attractive).

- This was mostly about moving an existing service businesses online. Hence the name OTA (online travel agency).

- These were marketplace platforms.

- Most were asset-lite digital creatures, using software for searching, matching and reviews.

- They did not have extensive operational requirements. Although Expedia and Ctrip do need lots of customer service representatives.

- Uber, Lyft, and Didi specialized in simple mobility services (initially).

- This was also mostly about moving existing service businesses online. Such as taxis, rental cars, metro tickets and bicycle rentals.

- These were marketplace platforms.

- Most were asset-lite digital creatures, using software for searching, matching and reviews.

- They also did not have extensive operational requirements. Driver onboarding required some local operations but it is not extensive.

We can see an increase in service complexity over time, which is important.

- UberEats and Grab specialized in O2O food services. They then expanded from food delivery to package and food store delivery.

- These were also marketplace platforms.

- They were less asset-lite, often hiring and contracting fleets of riders. The operational component grew significantly, which impacted unit economics.

- Fiverr and Upwork went global in B2B gig worker services.

- These were marketplace platforms.

- Most were asset-lite digital creatures, using software for searching, matching and reviews. But the matching was far more complicated. Projects were not as standardized. Professional experience and work history mattered. Transactions became ongoing relationships (which often moved off-platform).

Ok. That was a bit pedantic but I think you got the point.

My problem with Phase 1 is it was mostly about moving the traditional services world online. As opposed to reimaging services entirely. And that is what Meituan and Gojek did in phase 2. They created suites of localized services.

Phase 2 Is About Suites of Localized Services. And Maybe a Digital Lifestyle.

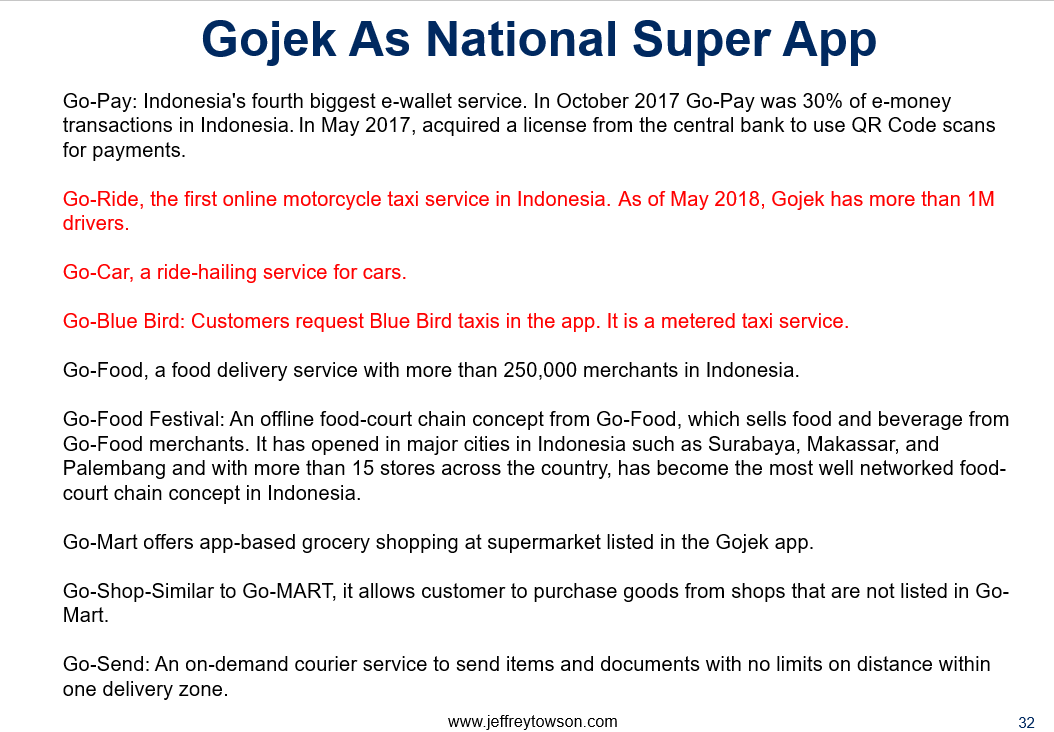

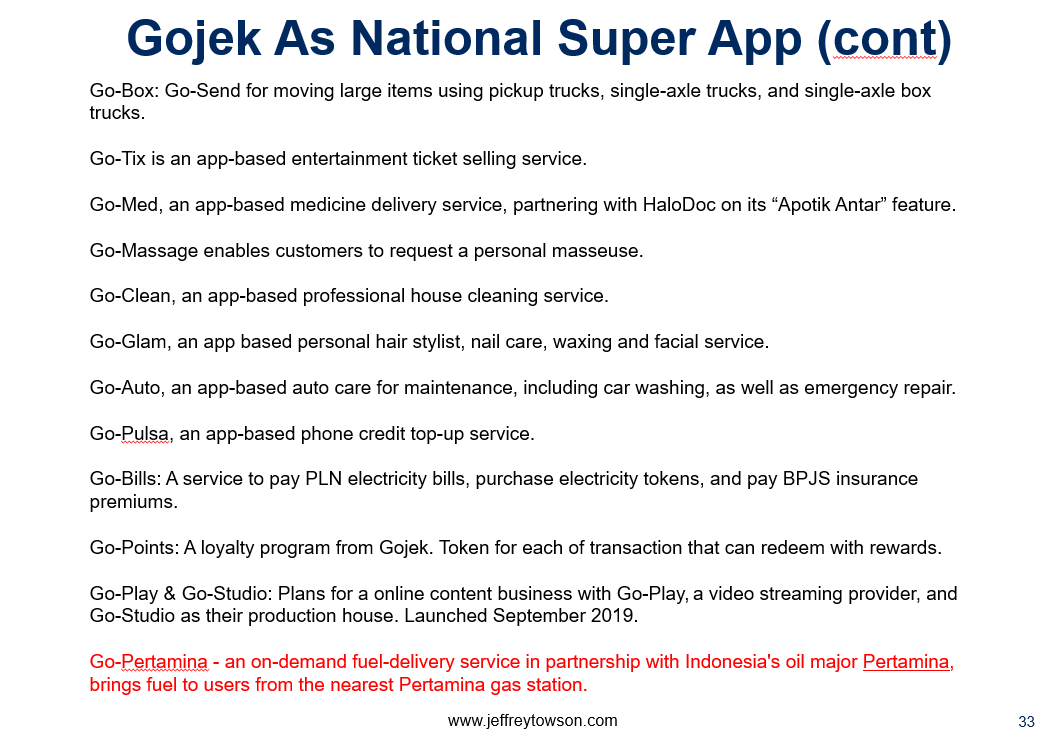

Take a look at the list of services Gojek provides in Indonesia (circa 2020). It’s awesome.

Meituan has a similar suite of services in China, where it is sometimes called the “Amazon of Services”. This makes no sense as there is nothing comparable to it in the West.

These ever-expanding suites of local services create a compelling consumer offering. They aggregate so many services that you can basically run a lot of your life on these apps. Everything from buying dinner to sending packages to paying your utilities. They become almost an operating systems for a digital lifestyle.

These services also tend to be localized. While some may be similar country to country, the services we see in Meituan and Gojek are often very local solutions within those markets.

I call this Phase 2 in the evolution of ecommerce services. And it’s hard to see how this doesn’t make a lot of phase 1 companies obsolete.

Which brings me to Phase 3, which I’m not sure I believe in yet.

Phase 3 Is About Creating an Ultimate B2C Marketplace. Maybe.

Alibaba’s goal is to capture the largest possible share of the Chinese consumer wallet. That is its total addressable market (TAM) on the consumer side. Note: it’s TAM on the merchant side is its percentage of every item on a typical merchant P&L.

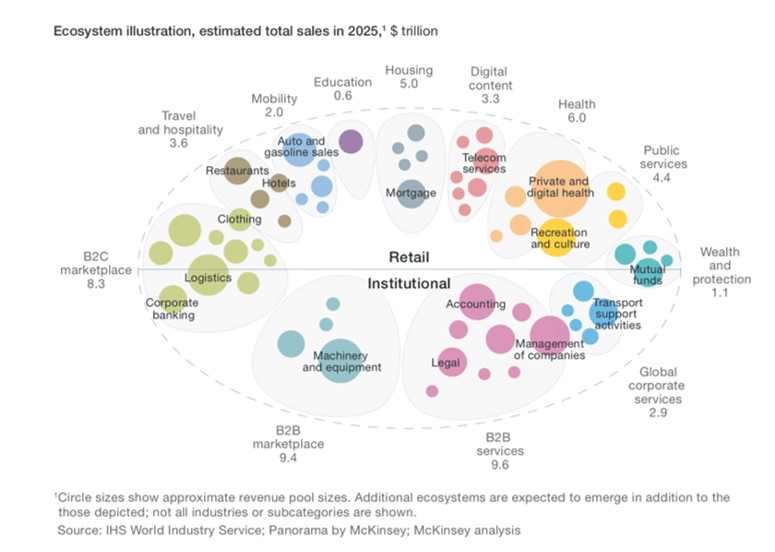

I call this the ultimate B2C marketplace strategy, a term from a McKinsey & Co paper many years ago. You can see the B2C marketplace on the left in green.

The McKinsey argument, which I 50% agree with, is that the increasing integration of physical and online assets is creating connected ecosystems for most B2C and B2B businesses. There will be ecosystems for mobility, healthcare, education and so on. And one of the biggest ecosystems will be the a B2C marketplace, where consumers can buy pretty much anything they need in life. The McKinsey argument is that the business world could collapse to 15-20 ecosystems, dominated by a very small number of companies.

I don’t really buy that. But I think we can point to 2-3 companies that have tried to build such B2C marketplaces in China. For example:

- Alibaba – which combined ecommerce, Ele.me and its “New Infrastructure of Commerce” (New Retail, Logistics, Cloud).

- WeChat – with its combination of messenger, payment, mini programs and search.

In terms of services, this is very different than Phase 1 and Phase 2.

- These Ultimate B2C Marketplaces are complete offerings of both products and services, which enables lots of cross-selling and bundling.

- These marketplaces have extensive operational requirements – including thousands of retail locations, logistics and delivery; and big logistics operations.

Isn’t this what Gojek plus Tokopedia kind of sounds like? It’s a really interesting strategy question. In Part 2, I’ll go into GoTo’s filings and give my take on whether it will work.

Last Point. I Really Liked Gojek’s Strategy for a Suite of Localized Services in Indonesia.

Gojek was founded in 2010 (as a call center). This was one year after Grab launched, but Gojek didn’t really jump into the space until 2015. They were a late entrant. And, interestingly, it was co-founded by Nadiem Makarim, who was a HBS classmate of Grab founder Anthony Tan.

Gojek got my attention around 2016 when I noticed their surge in ridesharing drivers and riders. I was surprised to see a late entrant catching up with Grab and Uber in the region so fast. Gojek had launched ridesharing in Jakarta using motorcycles – and not cars and taxis. That turned out to be a great idea and was well suited to the traffic of Jakarta. What I saw was a company that was localizing its services for the Indonesian market.

From there, the company rapidly expanded into a long list of services for Indonesia, also localized. It was very similar to the Meituan strategy. And I thought it was a particularly smart counterstrategy to Grab’s rapid expansion across SE Asia. If Grab was going for regional scale in two services (mobility, food delivery), Gojek was going for +20 highly localized services in just Indonesia (the largest market in SE Asia). I began to view Gojek as a competitive fortress in Indonesian services. I’ve been watching closely to see if Grab can break into their home market.

This doesn’t mean Grojek will make a lot of money. But I do think they are pretty well-defended. It reminded me of the strategy Meituan used to fight off Alibaba in China.

Ok. That was a bit of theory today. More about GoTo in Part 2.

Cheers, Jeff

—-

Related articles:

- 3 Big Questions for GoTo (Gojek + Tokopedia) Going Forward (2 of 2)(Winning Tech Strategy – Daily Article)

- Will GoTo “Win it All” in Indonesia? (Winning Tech Strategy – Podcast 123)

- Will Southeast Asian Grab Become Meituan or Didi? (Asia Tech Strategy – Podcast 121)

- Grab’s Big Strategy and Cash Flow Question (1 of 3) (Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Marketplace Platform for Services

- SE Asia

- Indonesia

From the Company Library, companies for this article are:

- Gojek

Photo by Gojek Media Resources

——–

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.