Chinese computer vision company SenseTime is now public. This was after years of setback after setback, including being placed on the US Treasury Department’s list of “Chinese military-industrial complex companies.” But it is now public in Hong Kong and it gives a fantastic look at the frontier of AI in China, especially computer vision.

Why SenseTime is so important:

- It is arguably the world’s leader (or at least Asia’s) in computer vision.

- It is one of China new wave of AI giants, most of which were founded in the past 5 years.

- It is an early indicator of the still unclear economics of AI software companies.

Last year, I did an article (and podcast) on Adobe, which I thought was a great example of old school software economics. It’s easy to get caught up in platform business models and digital conglomerates. And it’s easy to forget that a traditional software company that sells digital goods via licenses (and subscriptions) can have really great economics. And such companies can last for decades, which is the case with Adobe.

But that’s traditional software, where humans write the rules telling software exactly what to do in each situation. AI software is different. This is humans and machines feeding data to AI, which then writes the rules and continually evolves them. It requires a lot of computing power. It requires tons of data. And much of that data is messy and unstructured, often containing lots of long-tail scenarios. We don’t really know what the economics of a global AI software business look like yet.

I’ve been waiting to see the SenseTime numbers and business model for a long time. I think they give a great indication of how the economics and business models are evolving with AI technology.

Adobe-Style Software Economics Is a Good Starting Point

Adobe’s products, like SenseTime’s, are based on digital economics. SenseTime does sell some cameras and sensors embedded with its AI models, but the economics of its business are mostly about bits and bytes. These include:

- Zero marginal production costs.

- Low distribution costs.

- Global scalability at low cost.

- Non-rivalry, which means the goods can be used simultaneously by different users.

- Versioning, where their products can be created with different features and price points.

- The ability to bundle.

- The ability to integrate with other software and products.

That’s all good. And Adobe’s many software tools for content creators (including Premiere, Photoshop, Adobe) have used these economics to scale easily, cheaply and profitability to global scale. If you’re unfamiliar with any of these ideas, you can find them in the Concept Library under Digital Economics.

Additionally, Adobe has some really effective competitive strengths, specifically.

- Standardization and Interconnection Network Effects

- Subscriptions, Cross-Selling and Integrated Bundling

If I had to summarize Adobe’s old school software economics, I would point to:

- Zero marginal production costs, low distribution costs and the fast and low-cost scalability of digital goods.

- Freemium pricing and versioning.

- Standardization network effects.

- Switching costs.

- Subscriptions and integrated bundles.

Ok. Let me switch to SenseTime and the differences in the economics and business models of AI software.

An Introduction to SenseTime

SenseTime says it is building “industry-leading, full-stack AI capabilities, covering key fields across perception intelligence, decision intelligence, AI-enabled content generation and AI-enabled content enhancement, as well as key capabilities in AI chips, sensors and computing infrastructure.”

I’ve bolded the important stuff in that description. Basically, SenseTime is a pure breed AI company focused on the entire tech stack for computer vision.

The company was co-founded in 2014 by Tang Xiao’ou, a professor in the Department of Information Engineering at the Chinese University of Hong Kong (CUHK). There were other co-founders from his department but he is the guy most people follow. The company was based on the computer vision technology developed in his department.

The first technology launched by the company was its facial recognition algorithms, DeepID. From there it advanced rapidly into other types of image recognition – object detection, optical character recognition, video analysis, remote sensing, medical image analysis and others. It began winning international competitions for the quality of its technology.

SenseTime also benefited from the fact that computer vision is fairly easy to commercialize. That was not the case for many other types of AI, such as Natural Language Processing. Facial recognition, object detection, remote sensing and other functions were directly useful to government agencies and corporations.

- SenseTime sold contracts for policing, security and city management functions to various departments in the Chinese government.

- Computer vision was naturally useful to lots of companies, whether for studying consumer behavior in retail stores or for replacing security guards around buildings and factories.

- SenseTime’s software was also licensed to smart devices companies, which now use it in the apps on hundreds of millions of Chinese smartphones.

Overall, it took about four years for SenseTime to go from an academic project to one of the world’s most valuable AI companies. Today, it is the #1 AI company in Asia by revenue. And it has 11% of the computer vision market in China. Tang Xiao’ou is still a professor at CUHK in the Department of Information Engineering. Although he is now a professor worth an estimated $3.4B.

Interestingly, after Tang studied computer science in China and the USA, he worked at Microsoft Research Asia from 2005 to 2008. For those who aren’t familiar with Microsoft Research Asia, it is where a lot of the AI leaders of China have come from.

- It was founded by China AI guru Kai Fu Lee (1998-2000).

- The current head of AI at JD (Tao Mei, who I interviewed here) was a senior research manager there.

- SenseTime’s computer vision competitor Megvii (Face++) was also founded by alumni of the center.

SenseTime’s Factory for Mass Producing AI Models

SenseTime is not a platform business model (yet). It’s a traditional linear business that makes AI algorithms. It then licenses its portfolio of AI models to government and corporate customers. It either sells just the software or it sells hardware (cameras and sensors) with its AI embedded.

It has also begun selling its AI model production capabilities as a service. This is similar to how JD sells its logistics capabilities as a service. And how Amazon sells its IT capabilities as a service (AWS).

So, in one sense, SenseTime is similar to Adobe.

- It is a traditional linear business model producing digital goods.

- These digital goods are both highly specialized and universally useful.

- It has the potential for fast and cheap global scalability, like Adobe.

- It can bundle its goods together and integrate their functions.

SenseTime has most of the attractive digital economics I just mentioned for Adobe. And, like Adobe, it spends a ton of money on research and development in its very specialized area of technology.

All of that is great. But there are definitely differences between the economics of traditional software and the economics of AI software.

Traditional software is sort of like engineering. You design the machine and tell it exactly what to do and what not to do. It’s a very controlled environment and situation. AI software is more like science. It’s not totally under your control. It is more about looking at the outside world and trying to respond to everything and anything it might encounter. So, you train AI software with training data, and it starts writing the rules itself for the scenarios it encounters.

The economics start to look different because of the huge amount of data and computing power required.

- Data is required to train the algorithms and to keep improving and retraining them. And the more long-tail scenarios you want it to be able to handle, the more data you need.

- The data can also be unstructured and needs to be tagged and cleaned, which can be very labor intensive.

- For bigger models, you need massive computing power.

The economics of many AI companies don’t really look like traditional software companies. They look like a combination of software, services and a factory.

And that is pretty much how SenseTime describes its business model. It says it does “mass production of AI models”. I view it as a really big factory for producing algorithms.

Here’s the explanation from the IPO filing.

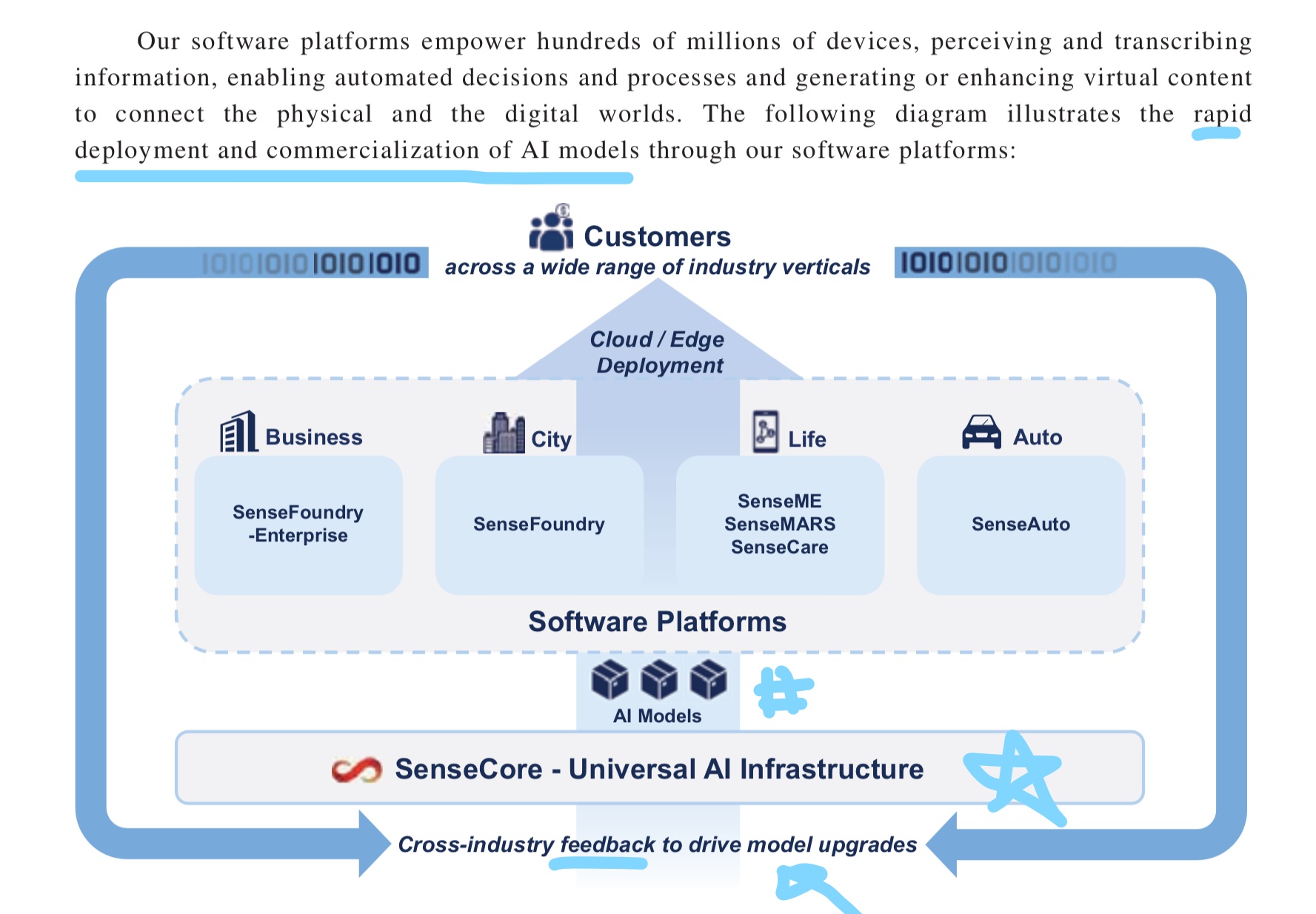

SenseCore, at the bottom of the graphic, is the factory. It churns out thousands of AI models which are then licensed by businesses, cities (i.e., governments), consumers, and car companies.

Also note the blue arrows that feed back to SenseCore from customers. The company gets data from its deployed sensors and this data improves its algorithms over time. It improves the existing ones and also the new ones being produced by the factory.

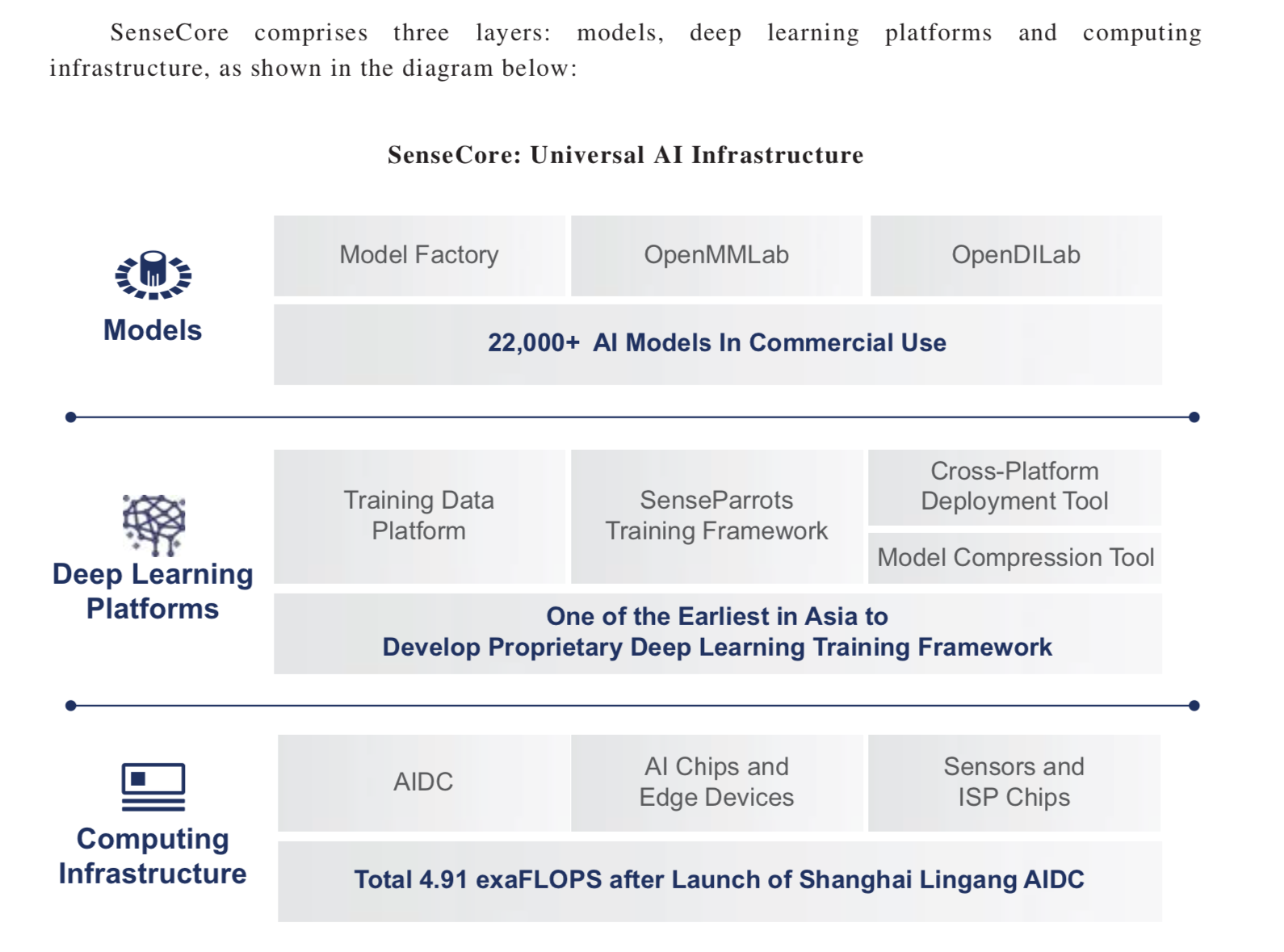

Here is a better graphic for SenseCore. This is worth going through in detail.

Note the difference between the AI Models (at the top) which are licensed to clients and run on inputted data (i.e., camera feeds), and the Deep Learning Platforms which create and improve them over time. The company has +22,00 AI models available for commercial use and this number is increasing rapidly.

The key components of the Deep Learning Platform are the repository of training data, the training frameworks and other specialized tools. All of these are increasing over time. The factory is getting bigger and better with volume. The company has an increasing amount of training data and training frameworks. And this should decrease the costs and time for creating AI models. The factory, in theory, is getting cheaper and faster.

The bottom of the graphic show the large-scale computing infrastructure SenseTime is building. It’s important to note this infrastructure is specialized for creating and running computer vision algorithms. SenseTime is developing its own AI chips, edge devices and data centers, all specialized for computer vision. They are also doing their own sensors and ISP chips. As mentioned at the beginning of this article, the company is building “industry-leading, full-stack AI capabilities…as well as key capabilities in AI chips, sensors and computing infrastructure.”

What jumps out at me from this business model is:

- This is factory for producing AI models.

- They are very focused on building economies of scale.

But what are the advantages of scale in an AI factory?

That is really the interesting question. And I’ll get into that in Part 2.

Cheers, jeff

———

Related articles:

- What Are the Advantages of Scale for an AI Software Business Like SenseTime? (2 of 3) (Asia Tech Strategy – Daily Article)

- SenseTime’s Metaverse Ambitions. Plus, Cool Case Studies (3 of 3)(Asia Tech Strategy – Daily Article)

- 3 Lessons in China AI/ML from Artefact (Data Consultants and Digital Marketers)

- Adobe Inc. and the Power of Old School Software Economics (Asia Tech Strategy – Podcast 81)

From the Concept Library, concepts for this article are:

- Artificial Intelligence

- Computer Vision

From the Company Library, companies for this article are:

- SenseTime

Photo by Nick Loggie on Unsplash

——–

This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.