Chinese recruiting company Kanzhun has gone public on the Nasdaq. It runs a pretty interesting recruiting platform called Boss Zhipin.

An Introduction to Boss Zhipin

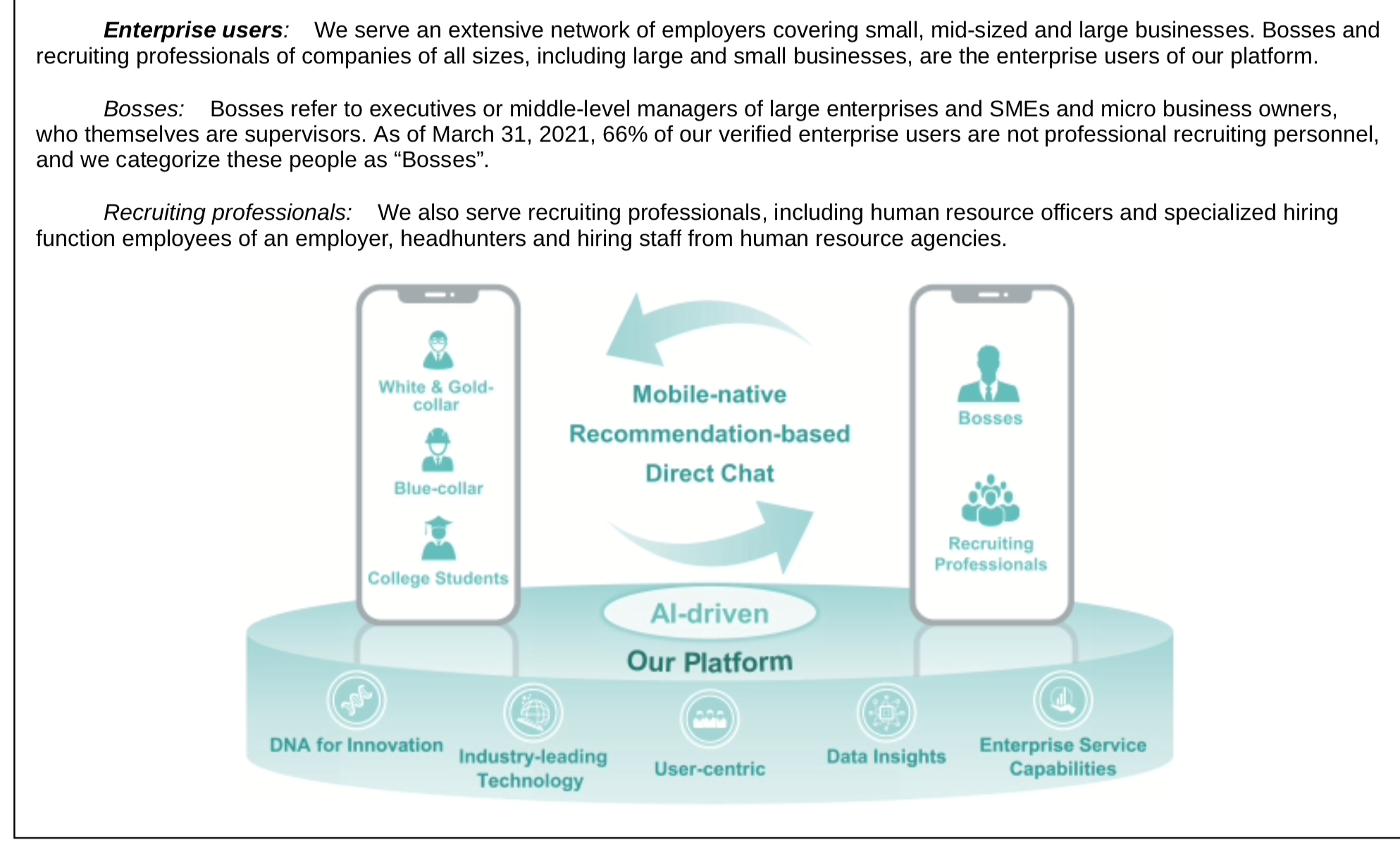

Boss Zhipin is a marketplace platform for recruiting. So this is a pretty standard platform for connecting job-seekers and companies (and recruiting agencies).

- In 2020, it had 25M monthly active users (which includes both job seekers and employers / recruiting agencies).

- It claims to have 86M verified job seekers and 13M verified enterprise users, of which 66% are the “bosses” (i.e., the decision-makers).

What makes Boss Zhipin more interesting is it is trying to solve the low success rate on most recruiting platforms. Most are characterized by lots of resume uploading and lots of reading by employers. It’s very inefficient with a low success rate.

Boss Zhipin’s solution is to directly connect candidates with the decision-makers (i.e., the bosses). In practice, that means three things:

- AI-driven recommendations in personalized newsfeeds. So it’s not a lot of searching for terms and qualifications.

- Direct, real-time chatting. So candidates and decision-makers can directly interact.

- A mobile first user experience.

The company is a great example of two of the digital concepts I talk about a lot:

- Marketplace Platforms. You can see this below under Soft Advantages.

- Digital Operating Basics. You can see this below under Operating Speed and Excellence.

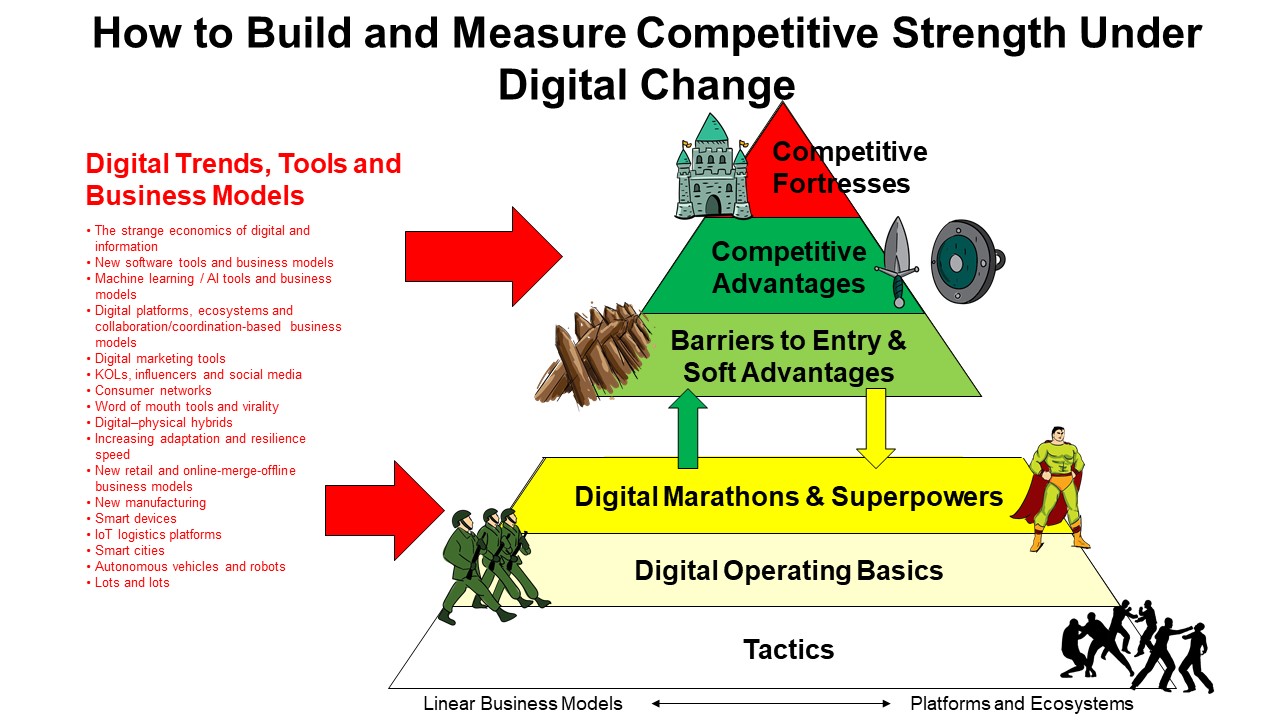

Here is the complete version of my 6 levels of digital competition.

Why Recruiting Marketplaces Are Pretty Attractive Platforms

Boss Zhipin is a simple marketplace. You have people looking for jobs and companies looking to hire. So just two user groups. And there is a lot to like about this type of marketplace.

- These are highly differentiated services. These are not commodity services like Uber, where customers don’t really care about one driver versus another. And it’s not even buying apparel or hotel reservations where consumers do care about the type of product but generally only at the category level (beach hotels vs city hotel, shampoo types). For recruiting, consumers care very much about the individual company they want to join. And companies care very much about the individual person they want to hire. These are very, very differentiated services.

- The market is highly fragmented. This is not a consumer choosing between a large and small hotel chains. And between lots of individual hotels and accommodations. This is every individual person and lots and lots of employers, including lots of SMEs. It is very, very fragmented.

- These are needed, not just wanted, services. This is not about getting people to watch videos, which they like but don’t need. It’s not about making shopping more entertaining so people do more of it. When people need jobs, they absolutely need them. And when companies need employees, they absolutely need them. Recruiting has high user intent for both groups.

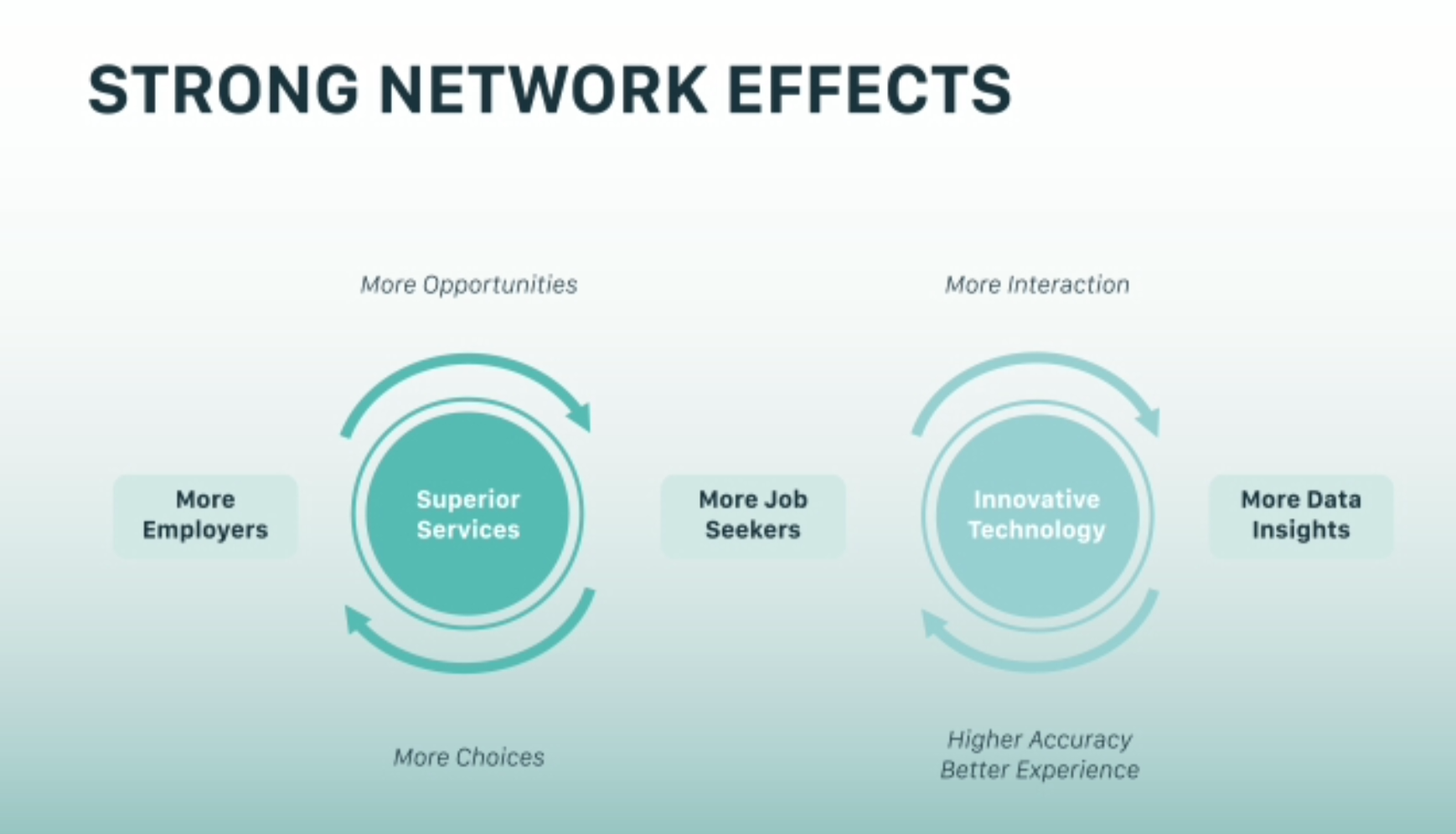

And finally, recruiting platforms have network effects.

Boss Zhipin has a good summary of its network effects in its IPO filing. That is actually pretty rare in filings. Look at the below graphic. The language is precise and quite good. It is basically summarizing an indirect network effect between job seekers and companies. And it says it also has a one-sided data network effect. I don’t really believe in data network effects. I think that is mostly just personalization and customization. But it can be an important factor.

The two-sided network effect has all the things I like:

- There is a high minimum threshold for viability. It is hard to replicate as a business because you need a large volume of companies and job seekers. You need national or at least regional coverage. And China is a big country.

- The network effect linearly increases in utility and value with more users and activity. For both user groups.

- There is a high level for the asymptote. The increasing value and utility does not flatline. The more job seekers the better. The more jobs offered the better.

Finally, the economics of Boss Zhipin look pretty good.

- It’s a software plus people business. This is not a purely digital operation, like making hotel reservations. There is a significant amount of direct selling to companies and recruiting agencies (with a direct sales force). That makes growth slower, which is common in B2B vs. B2C. But the economics are generally attractive.

- It’s complicated digitally but not operationally. Matching people for jobs is much more complicated than matching people for food delivery, hotels or rides to the airport. There is more discussion. There are more factors. It is a bigger decision. That digital complexity enables a platform like Boss Zhipin to build a superior matching product. However, it is not operationally complex, which can cripple a platform. I wrote about that in Full Truck Alliance, which is the Uber of cargo for China. It turns out matching digitally is a lot simpler than actually moving cargo all over China in trucks and warehouses.

- It appears to have good unit economics. The companies pay first. There are few fixed assets. So we see high gross margins and negative working capital. You can see this in the financials.

- The gross margin was 87% in 2020.

- The non-sales expenses totaled 67% in 2020, up from 45% in 2019.

- Operating profits could easily be 20-30%, if marketing spending is decreased.

Overall, I like marketplaces for differentiated services with unique requirements. Especially in a large market like employment in China.

Boss Zhipin is a Good Example of the Digital Operating Basics

Another concept I have been talking about is Digital Operating Basics. These are not competitive strengths versus competitors. These are not structural advantages like moats. They are part of operating speed and excellence. This is the bottom of my tower.

I have defined the Digital Operating Basics as:

- Scale and growth at small incremental cost.

- Target a real or imagined 10x or 100x market space. Disrupt an existing space or create a new one.

- Imagine an end-to-end experience in a customer’s life that could be greatly improved.

- Have the confidence that you can overcome whatever obstacles may encounter.

- Growth and scale without cost or constraints is one of the great advantages of digital.

- Continuous personalization and customer-facing innovation.

- An improving and personalized customer experience is key to continued value-add and growth.

- It enables new products and services and cross-selling more and more products and services to a larger and larger audience.

- A “market of one” is the ultimate personalization.

- A digital core for operations.

- Being a data-driven company is critical for speed, smart decision-making and incremental improvements and innovation.

- Algorithms and data are essential weapons. Combining and refining algorithms over time “can be a competitive advantage” But not always. It is mostly about continuously making changes and frequent incremental improvements. This combined with speed is tough for physical competitors to beat.

- Dynamic pricing – for markets and individual consumers.

- Ecosystem and connectedness.

- Companies need to be used to dealing with partners – and not stand-alone islands in a changing and evolution ecosystem. Every major player needs at least 10 partners for sharing data, meeting a range of consumer preferences, growing faster than it otherwise could and continually refreshing with technology and innovation.

- Connectedness is one of the strengths of digital. It is critical for adapting in complex and changing ecosystem. It also feeds data to the digital core.

- People, culture and work design create a social engine that enables innovation and execution – increasingly personalized for each customer.

- Decision-making is designed for innovation and speed. Think Teams, not organizational layers.

- Money-making at scale makes the company sustainable. It enables continuous innovation, including big bets where the ability to withstand losses is important.

- Companies need powerful moneymaking models that capture the benefits of digital scale. Target a big opportunity and increases cash gross margin by innovation and cost reductions over time.

- Use cash flow to improve innovation and technology. That can fund multiple experiments against consumer experience. Add that can revenue streams on top of the same digital core and customer base.

Compare that to how Boss describes its strengths and strategies.

You can basically see most of the digital operating basics in their plan going-forward. They mention:

- Expanding user groups and activity. They are focusing on expanding into blue-collar workers. That is about going for scale in a big market.

- Innovation that is focused on improving and personalizing the user experience.

- Improving the digital core.

- Doing freemium and cross-selling, which will keep improving the operational cash flow. That is then invested into more growth and user-focused innovation.

I see Boss Zhipin as a company that is doing the digital operating basics and building a platform with network effects. That is a very solid approach.

However…

The Problems with Recruiting Platforms

There are some complexities and issues with recruiting platforms:

#1 This is B2B and that usually means much slower growth.

It depends on businesses changing their workflows and practices. I like the analogy that B2C is like catching lightning in a bottle. It’s faster but much more unpredictable. B2B is more like mining. It’s slower but much more predictable. Recruiting platforms also require a direct sales force to sell recruiting services to large employers. It has much less of a self-service model.

#2 Employers often work with recruiting agencies, which means a third party between the candidate and decision-maker.

Boss Zhipin works with both companies and recruiting agencies. But companies are the ultimate decision-makers so it can make the platform much less efficient.

#3 Transactions are infrequent.

People not looking for jobs don’t use Boss Zhipin. And those that do, usually leave once they find a job. There are fields like nursing where people change jobs frequently. And gig work, like Fiverr and Upwork, is high frequency by definition. But most recruiting and hiring is low frequency.

LinkedIn has the same job-seeker frequency problem. And the company did two things to overcome this:

- They added content and became an audience-builder platform too. Users could post business content and build an audience. This created another network effect. I caught this wave early on and it is how I got a lot of followers. I got there early.

- LinkedIn also became the standard for professional resumes. When you want to find someone’s background, you check LinkedIn. This is a standardization network effect. Everyone has a LinkedIn profile now.

Both of those moves got their platform much more activity on the job-seeker side. Boss Zhipin hasn’t really done this. They are going for blue collar workers, who do change jobs much more frequently.

#4 Users move off platform.

This is pretty standard across b2b sites for work. You find a cleaning person or accountant through a site and then just hire them directly going-forward. Moving off platform makes it hard to take a big commission on transactions. It’s too easy for both parties to contract directly.

Boss Zhipin and LinkedIn have both focused on building relationships with employers and HR services companies. Think switching costs. And they make their money by posting fees and value added services, not transactions and placement fees.

#5 Matching is quite difficult in recruiting.

This is really the big issue with Boss Zhipin. And this is where they are trying to be innovative in recruiting platforms.

The company talks a lot about how recruiting platforms just don’t work that well. People upload lots of resumes. Many are out of date. The information isn’t that relevant for what employers really want. Employers pull the resumes and look through them, which is low yield and highly inefficient.

Kanzhun’s diagnosis is there is a disconnect between the decision-makers (i.e., the bosses) and the candidates. Their solution is to directly connect them. And to structure the platform, not as a search function, but as a personalized newsfeed for each user. This is the same AI-driven newsfeed approach we see with TikTok and Pinduoduo.

This is a recruiting platform with an AI-driven feed plus real-time chat. That’s their approach. You can see how they describe it below.

I’m not sure how well they are actually solving the matching problem. That is my #1, #2 and #3 question for this company. Does it work better than the alternatives?

But overall, it’s an interesting company. It’s on my watchlist. And it’s a good example of digital operating basics and marketplace platforms.

Cheers, jeff

—–

Related articles:

- Lessons in Digital Operating Basics from Ram Charan. Part 1 of 2 on “Rethinking Competitive Advantage”. (Asia Tech Strategy – Podcast 98)

- Meituan vs. Ctrip vs. Alibaba: Who Will Win in China Services? (Jeff’s Asia Tech Class – Podcast 22)

From the Concept Library, concepts for this article are:

- Digital Operating Basics

- Marketplaces for Services

From the Company Library, companies for this article are:

- Boss Zhipin / Kanzhun

Photo by Jonas Lee on Unsplash

———-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.

Fu Ming

September 15, 2021 at 12:18pmThanks for the timely and insightful piece. I was just looking at this Company a few days ago.

If we think of PDD broke through by being “Disney + Costco” for China’s countryside consumers, we may be able to think of BZ as 51Job + TikTok for China’s blue collar workers. I see this as the entry point for BZ but definitely not the end point. What’s particularly impressive is BZ has reported Non-GAAP profit (excluding Stock Based Compensation) in its recent 2021Q2 earnings. It appears the model has a lot of legs, potentially another truly China-bred innovation.

jtowson

September 15, 2021 at 3:02pmI think this it is mostly about AI-driven matching as superior to search. it works in video. Or at least it complements it. I’m not totally sure it works with recruiting. But i do know that most recruiting websites suck. Uploading resumes. Searching for qualifications – instead of by personality and cultural fit. So if what they are doing works, it could make a big difference. I’m not sure how well it does yet.

Fu Ming

September 16, 2021 at 12:42amGood point. I think that’s perhaps why they picked SME + Blue Collar jobs as the entry point, where personality and cultural fit arguably play a smaller role in matching. Incidentally that’s 50% of China’s total recruiting market, according to the company. From that they can train their algorithms and move up the ladder. Of course, as you said, there is no guarantee the algo trained on blue collar jobs will work well on white collar jobs.

jtowson

September 16, 2021 at 1:35amyeah. they also said that blue collar change jobs more frequently. platforms and network effects require standardization. So you can scale up. The more complicated the service, the harder it is to do that.