Ant Financial (now Ant Group) filed for IPO and there are tons of cool insights in their filing document. I’ve already written about the overall strategy, which is basically 3 platform business models combined.

In that article, I argued that each platform business model has a different function.

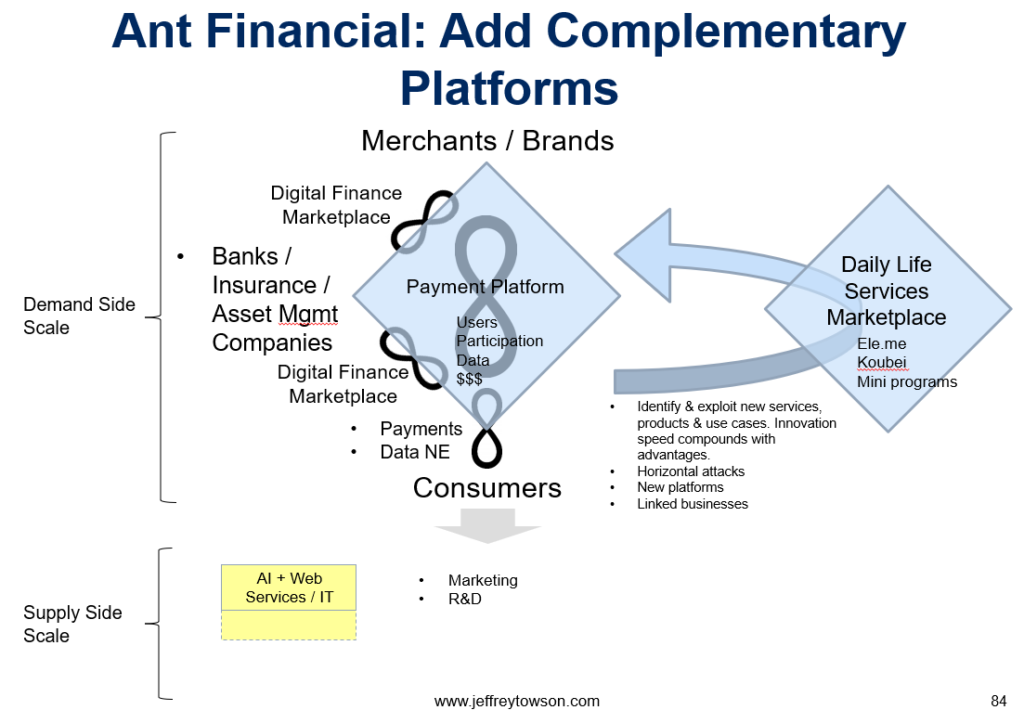

- A payment platform that Ant describes as “infrastructure”. Payment is what creates the digital network and gets users connected. These users are the nodes of the digital network. Payment interactions also create some revenue.

- A marketplace platform for doing simple, high frequency services. That gets engagement and behavioral data. They describe this as daily life services.

- A marketplace platform for financial services – mostly insurance, credit, and investments. They describe this as a portal for digital finance products and services. These are rarely used and much more complicated transactions but they are also the really big money.

In terms of my blue diamond charts, here is how I look at it:

It is the marketplace for digital finance that I want to talk about in this article. And here’s my question:

- How much credit are SMEs and rising Chinese consumers going to be using annually in about 10 years?

We know the numbers for investments and insurance in China today. But we don’t really know how much consumer credit is being used right now. We kind of know the mortgage and car loan numbers. But 75% of Chinese consumers don’t have credit cards today. And much, if not most, of that type of credit is probably happening within the big ecommerce platforms (JD, Alibaba). And these companies have not released the numbers. It’s been the big unknown for a long time.

But in the Ant filing we can see these numbers under CreditTech. Here is what they released:

- Ant has a 1.7T RMB ($250B) consumer credit balance. This is 98% held at their partner banks, but it is processed through Ant. And mostly used within the Alibaba ecosystem.

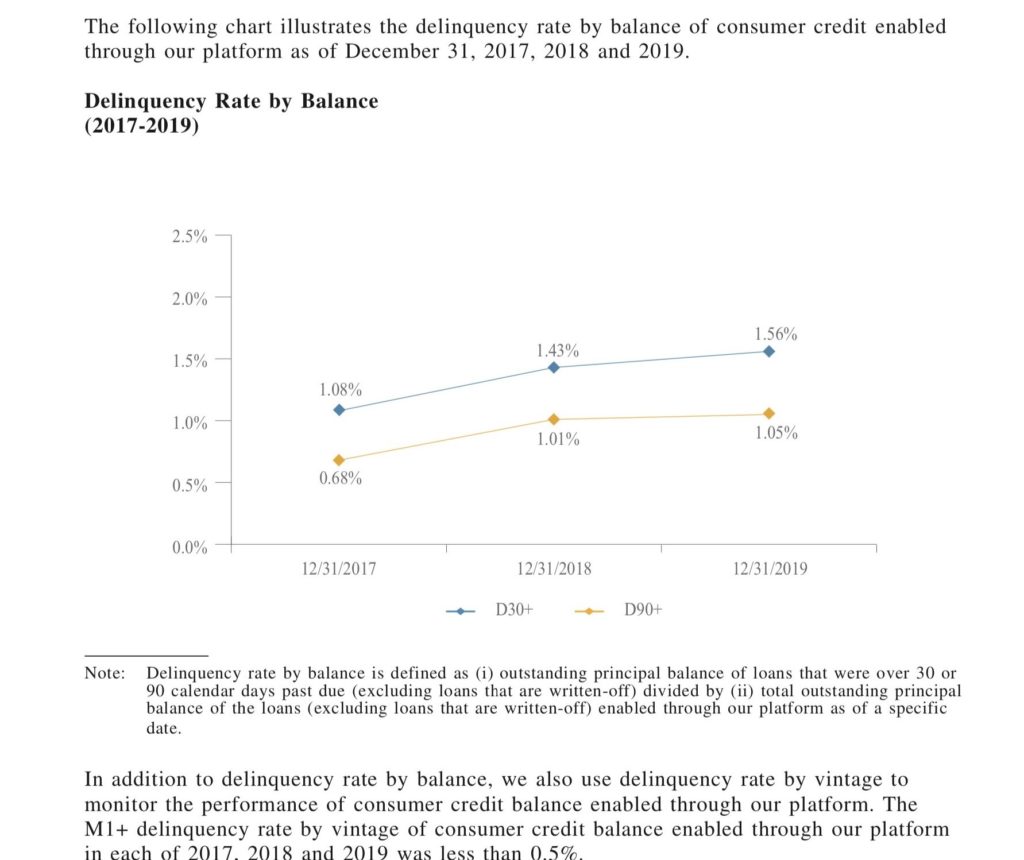

- There is a 1-1.5% delinquency rate pre-Covid across platform. This has gone up by 1% during Covid but on the consumer and SME side, delinquency is in the 1% range.

Huabei and Jiebei Are Just the Beginning

Ant claims to be the #1 source of consumer credit in China. They have 729M annually active digital finance users (people using credit or investment products).

Ant’s two consumer products are Huabei and Jiebei. Huabei, founded in 2014, is an unsecured revolving consumer credit facility for small daily expenditures. It has a 20RMB minimum with 3-12 month terms. Jiebei, founded in 2015, has a 1000RMB minimum and is for those with a successful credit history under Huabei. So Huabei is the entry product. And it steps you up to Jiebei.

And this is obviously just the beginning. They present a couple of the charts about how big the China consumer credit market will be going forward.

Of course, this is a sales document. So take those numbers with a big grain of salt. Chinese consumers using more and more credit over time as their increase in wealth is a pretty reliable trend.

Ant is also offering merchant credit to SMEs, which have traditionally been shut out of the credit markets of China. Ant has 0.4T RMB on balance (about $60B USD). This is probably not the big revenue opportunity as much as it is about enabling small merchants to join the platform and do interactions. It’s more about user growth than revenue. These loans are for merchants on Taobao and TMall. And the terms are up to 12 months (however the average is 3 months). Interest rates look to be about 1% per month. Ant uses MYbank for this, which they have 30% ownership of.

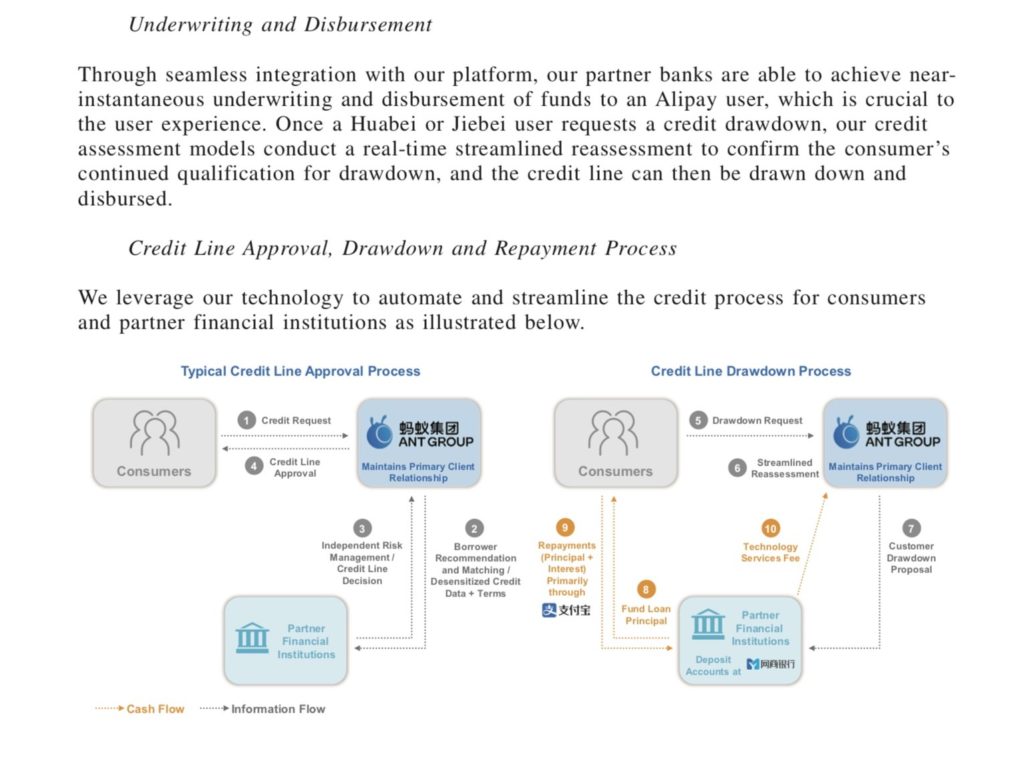

And of course, this is all done with software. So there is immediate approval and drawdown, without human involvement. I wrote about why this is so important in How Ant Financial / Alipay is Building an AI Factory in Financial Services (pt 2 of 2). This is a good example of the SMILE Operational Marathon concept I talk about. In this case, it’s the M which is Machine Learning / AI.

You can also see Ant is doing the standard digital strategy of focusing on the unmet and underserved needs of consumers and small merchants. They are creating digital tools to provide for consumers and small merchants in ways traditional banks can’t. This is not unlike what Alibaba did with Taobao, focusing on small and micro merchants. And giving them digital tools that level the playing field with larger brands and merchants.

But another interesting aspect is how they are achieving this. They are using a platform approach to credit, unlike a traditional bank.

Alibaba Did Asset-Light Ecommerce and Logistics. This is Asset-Light Credit.

Note on my chart the user group on the left of banks. This is who is providing the actual loans to consumers and SMEs.

Currently, credit is provided by about +100 banks on the platform. Which means Ant doesn’t carry the consumer credit on its balance sheet. 98% is held by the banks. These include big banks, small banks, rural banks and trusts. It’s asset light lending.

But it gets better. Because Ant is also not taking on underwriting risk or disbursement requirements. Ant is taking the best part of the business. They are designing the products, controlling the users and taking a technical service fee that is a percentage of interest paid on the credit by the consumer. But they aren’t taking the assets or the risk. Their balance sheet looks like a service company, not a lender.

One of the fascinating aspects of their CreditTech business is the division of roles between them (as the platform) and the banks (as a user group). Note the below chart from the IPO filing.

Ant is doing Product Design and Intelligent Decisioning Systems on their own. That is really important. Because when you look at how they are working with Asset Management companies in InvestTech, they are not doing product design. They are focused on Product Screening and Customer Acquisition / Education.

So in credit, they are doing product development independently as a platform. And then banks will have to provide credit to meet their specifications. They do collaborate with banks in Dynamic Credit Risk Management, which basically means banks can access their data and analytics about products and customers. Similar to Cainiao, they are controlling the data infrastructure, but not the big assets. And then you can see they put the underwriting and distribution complete under the banks.

Take a look at the chart below for how the process happens at approval and drawdown. What should jump out at you is that Ant is controlling (i.e., not sharing) the customer relationship. Ant is doing platform strategy where the key assets are users, engagement and data.

Overall, Ant is an awesome business. You can see where they are going to get users (payment) and engagement (daily life services). But I think the big money is in credit. They are capturing a big source of revenue with an asset-light business model.

That’s it for today. Thanks for reading, jeff

——-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.