In Part 1 (From Big, Dumb Bureaucracies to Zero-Human Operations (pt 1 of 2), I made the following argument:

- In the industrial age, enterprises were built on the advantages of scale. Companies went from workshops and small factories to big factories capable of mass production.

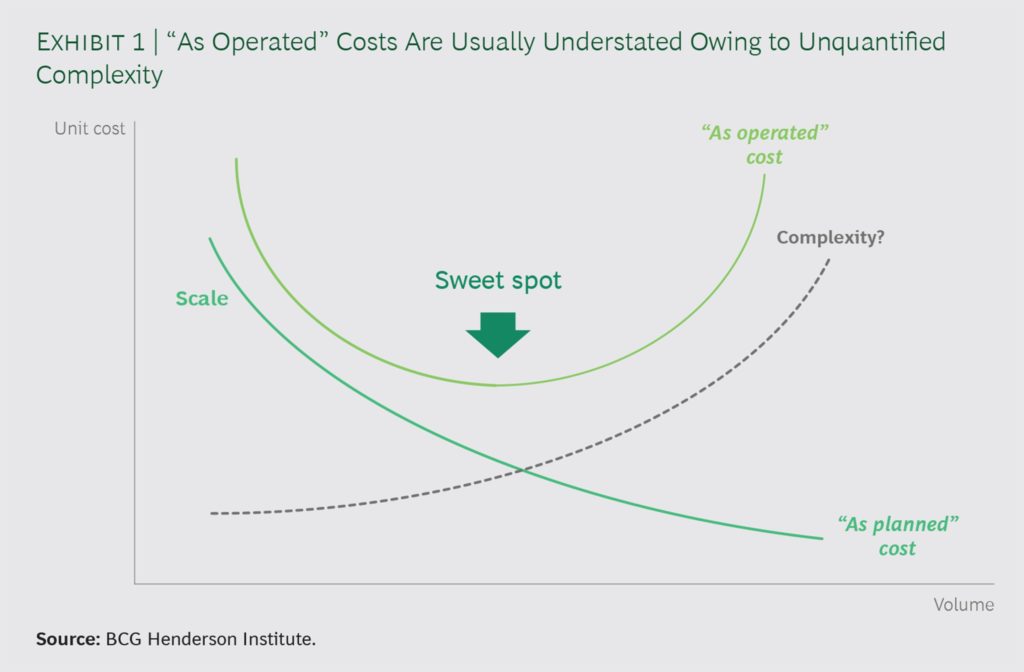

- Superior scale gave companies multiple advantages, including cost efficiencies and the ability to create far more complicated products. The cost advantages have been represented by the dark green line in the graphic below.

But…

- There are also increasing problems with increasing scale, scope, connectivity and complexity. Bureaucracy grows. Complexity increases and becomes difficult to manage. Customer service declines. And while management focuses on standardization and specialization, these problems just increase and increase. This is shown in the above graphic by the dashed line.

- At a certain scale, the benefits of scale become outweighed by the increasing costs and other problems. The net result is the light green line in the graphic.

So factories, car companies, CPG companies and other enterprises get stronger as they get bigger. But they only grow to a certain size. And then smaller competitors typically take part of their business.

My simple take-away is that we human beings are limited in our ability to organize and handle complexity and scale. A well-run company with solid middle and upper management cannot design, produce and sell +10,000 different types of products. And it cannot effectively manage ten million employees. It is the human element that is the limiting factor.

But…(you knew it was coming).

Software may be changing this. Because while human-run operations are limited. Software-run operations actually scale up quite easily. A video can be watched on YouTube by 1,000 people or by 1B people. Software also handles increasing complexity quite easily. Amazon and Alibaba can sell 10M different products pretty much the same way they sell 1M products. Try doing that in a regular retail store. Try training your sales associates and customer service reps to be knowledgeable about all those items.

As more and more processes are being handled by software, the traditional limits on scale, scope, rate of learning, connectivity and complexity are decreasing. In fact, in some cases, the process actually performs better and better as it increases in scale. The algorithm gets smarter. More data is captured. For example, the more you watch YouTube and Netflix the better the service becomes.

So if a big, dumb bureaucracy is one end of the operational spectrum, a pure AI factory with no human involvement in operations is perhaps the other extreme. Imagine an enterprise with zero humans in the core operational processes. With only software, data and AI. Human would design and oversee the system, but the operations would not be all software. And could have all the benefits of scale without any of the limitations I just discussed. Possible?

A book called Competing in the Age of AI (by Karim Lakhani and Marco Iansiti) makes some of this argument. And some of the above thinking is from them. I agree with about 50% of that book. And while they use the term “AI factory”, I prefer “zero-human operations”.

Which brings us to Ant Financial, which is arguably China’s most ambitious AI factory.

Yes, Ant Financial Is Really Awesome.

Every time I visit Alibaba in Hangzhou, I always ask about Ant Financial. Specifically, I want to know how much credit is being issued. To consumers on Taobao? To merchants? What about installment payments vs. credit? And what about on Singles’ Day? How much of that +$30B of spending was done with credit?

And they always politely decline to answer my questions.

Ant Financial is the quiet giant of the digital world. It is really a big deal but is sort of below the surface. They have been expanding globally for 3-4 years. They are pretty much everywhere in SE Asia. They tried to buy MoneyGram (CFIUS blocked it). And the early goal appears to be the creation of a global payment network that serves both Chinese and international consumers. Which given their already dominant position in Mainland China, is totally doable. Note: Alipay is already at +900M users in China (and +100M SMEs) with another 200-300M outside of China.

Additionally, from this strong position in payments and mobile wallets, they have expanded dramatically into other products in the last 4-5 years.

- Zhima Credit, an independent credit filling and scoring service for individuals.

- Ant Fortune, a comprehensive wealth management app launched in 2015. Yu’e Bao, now the largest money market fund in the world, is one of the products. But Ant Fortune offers hundreds products from more than 80 Chinese fund institutions.

- Huabei (Ant Credit Pay), a virtual credit card product.

- MYbank, a private online bank.

- Jiebei (Ant Cash Now), a consumer loan service.

- Ant Insurance Services.

- Ant Financial Cloud, a cloud service for financial institutions.

- ZOLOZ, a global biometric-based identity verification platform.

It’s really awesome. But all of this is well known. And not really the point of this article.

The number I wanted you to pay attention to is 3-1-0.

3-1-0 and Ant Financial as a Zero-Human Global Operation.

You will see 3-1-0 in their public information. And it stands for:

- 3 minute application.

- 1 second approval.

- 0 humans involved.

I really wasn’t exaggerating about the zero-human operations. It’s literally in the Ant Financial brochure. They are building a financial services company with global reach, a huge suite of products and with software runing all the core operations. It’s an AI factory.

- Could it process 10M loans as easily as 100?

- Could this system offer 10,000 products as easily as 100?

- As it gets bigger and gathers more data, won’t it refine the algorithms and (in many cases) get smarter?

What would a bank look like if scale and complexity have no limits and it actually gets smarter the larger it gets?

And it actually gets better.

Because purely digital operations are good at connectivity. Instead of having meetings between finance and human resources. Or between the Omaha and the London office, a purely digital operation can just connect. The data and processes of a digital operation are linked with other all the other software modules internally. And it can also connect and interact with external enterprises and resources. You don’t have to meet with your suppliers or partners. Your software just connects with theirs. For example, Ant Financial is currently taking over Ele.me and Alibaba’s other local services. Restaurant reservations, food delivery, plane tickets, paying your utility bills, local rides and so on. They are moving all of this within Alipay. Because this thing is infinitely connectable.

Of course, all of this requires tremendous data and processing power, much of which happens in the cloud. Fortunately, Aliyun / Ali Cloud is the leading cloud service provider in China. And they are drawing on data from:

- Consumer behavioral data.

- Transaction data from sellers on Alibaba.

- Public data from education, government and other sources.

- Data from their partners

Take a moment to compare this to a typical bank. Think of the 450,000 employees at ICBC. Working at tens of thousands of branches. And how it took decades to get to this scale. Well, Ant Financial was founded in 2014. It has only 9,000 employees. And there are no real branches. Yet, it can process loans at a speed and cost that ICBC can not even dream of. According to the Alibaba museum circa Nov 2019, Ant Financial have already loaned money to +19M SME borrowers this way.

So How Big Could This Get?

I just argued that an AI factory may have no operational limits in terms of scale, scope, complexity and connectivity. The market obviously has limits. But the operations may not. And the advantages of scale may go up and up.

So could Ant Financial offer every financial product to every human and business on the planet?

Well, six year after launch the company is now in +200 countries with +1.2B users (and +100M SMEs and micro businesses). Here is some of the stuff they are doing outside of China.

- GCash, payment and cross-border blockchain for the Philippines.

- Lazada (and digital wallet Dana) in Indonesia.

- Paytm in India, now the 4th largest digital wallet in the world by users (+250M users)

- QR codes in Thailand and with TrueMoney.

- QR codes in Malaysia (note: QR codes were originally created for the automotive industry in Japan. China adapted them for consumer payments).

- Easypaisa, a digital wallet in Pakistan for cross-border remittance via blockchain.

- AlipayHK, now used by 1/3? of Hong Kong residents. You can also see QR codes at the metro.

- Kakao pay in South Korea

In February 2019, Ant Financial also acquired the British international money transfer services provider “WorldFirst” for $700 million. And in November 2019, Ant Financial announced a $1 billion fund to expand investment activities in India and Southeast Asia.

It’s all pretty cool to think. But the main take-away is the idea of zero-human operations. And what that might result in.

***

In previous Daily Updates, I presented 5 slides that showed the evolution of Alibaba as a super powerful marketplace platform. And how this led to the creation of Alipay and additional platforms (like Ant Financial). If you want more on this, here are some.

- A 3 Slide Summary of Alibaba and Marketplace Platform Strategy (Daily Update, Jeff’s Asia Tech Class)

- Alibaba and the Power of Externalizing Capabilities (Daily Update – Jeff’s Asia Tech Class)

- Alibaba and How To Cheat in Innovation Marathons (Daily Update – Jeff’s Asia Tech Class)

- Alibaba, Complementary Platforms and Why Dinosaur Packs Are Scary (Daily Update – Jeff’s Asia Tech Class)

That’s it. Have a great day. -jeff

———-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.