I’ve mentioned externalizing capabilities as a strategic move many times. I thought I would detail that out. It’s common strategy in digital business models. And it has been very effective at Alibaba and Amazon in particular.

Several years ago, I summarized the evolution of Alibaba’s platform business models in 7 graphics.

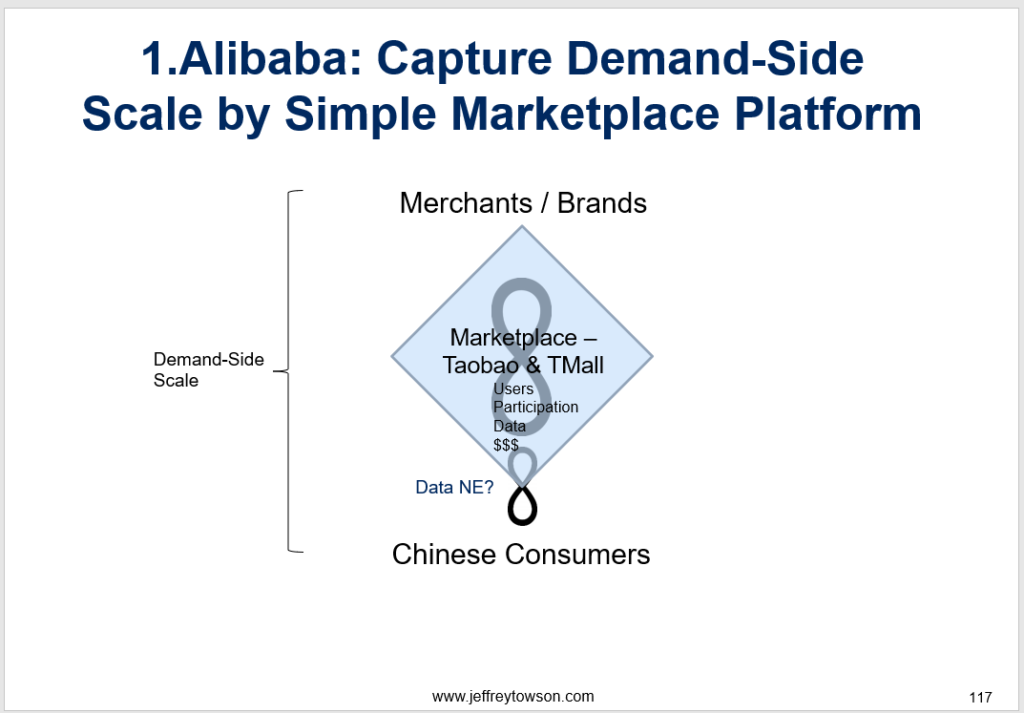

And I said in the early phases, there are three steps (which we can see at both Alibaba and Amazon):

- Build initial demand-side scale around 1-2 core interactions.

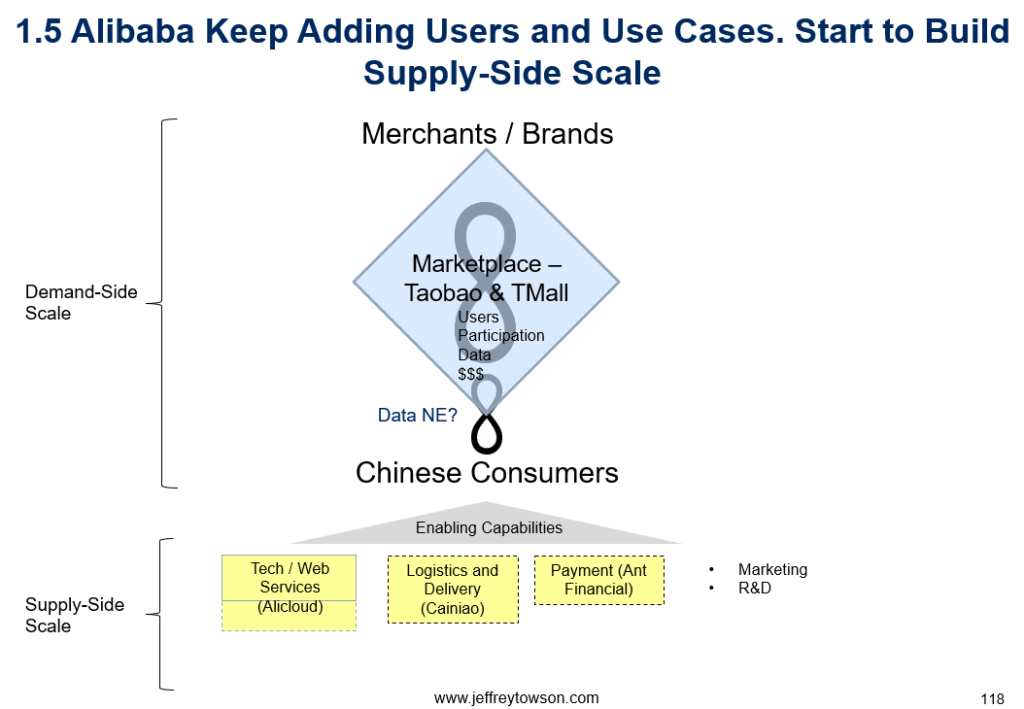

- Keep building demand-side scale. Add new users and use cases.

- Start to build supply-side scale.

This looks like this:

In a world of endless supply, most power now comes from capturing demand. It is hard to build a sustainable digital business by controlling supply side. And platforms with network effects are one of the most powerful ways of capturing demand. So in the above graphic, you can see a marketplace platform with network effect. Usually these are built around 1-2 simple interactions. In the case of Alibaba and Amazon, it’s just a simple buy/sell transaction.

From there, they start to build up some scale and advantages in the capabilities that enable the core interactions. For ecommerce for products, this is mostly web services, logistics and payment.

Supply-side scale is required and can sometimes be a competitive advantage. For marketplaces / e-commerce sites, supply-side is both technological and operational. That’s important. You need lots of servers but you also need people moving packages.

So we can list a couple of supply-side capabilities – including:

- IT / Web Services

- Logistics / Delivery

- Marketing

- R&D

And you can sometimes achieve economies of scale in these costs relative to competitors. Basically if you are larger than your competitor, your per unit costs can be lower in some areas.

An example of this is VIPShop vs. JD, which I talked about in Podcast 7 (Should Vipshop Build a Logistics Network Like JD?). I discussed the question of how does a competitor like VIPShop compete in these capabilities when they are so much smaller?

- Do they have to match the superior spending in logistics and delivery of JD?

- If they don’t, will VIPShop’s delivery costs be higher?

- If they don’t, will JD be able offer services, like same-day delivery, that VIPShop cannot match?

How smaller e-commerce sites compete with the giants is a really cool strategy question.

And we can see similar economies of scale situations in IT spending, R&D spending and marketing. Keep in mind, Coca-Cola has been crushing other soda companies in pure marketing spend (plus distribution and shelf-space power) for almost a hundred years.

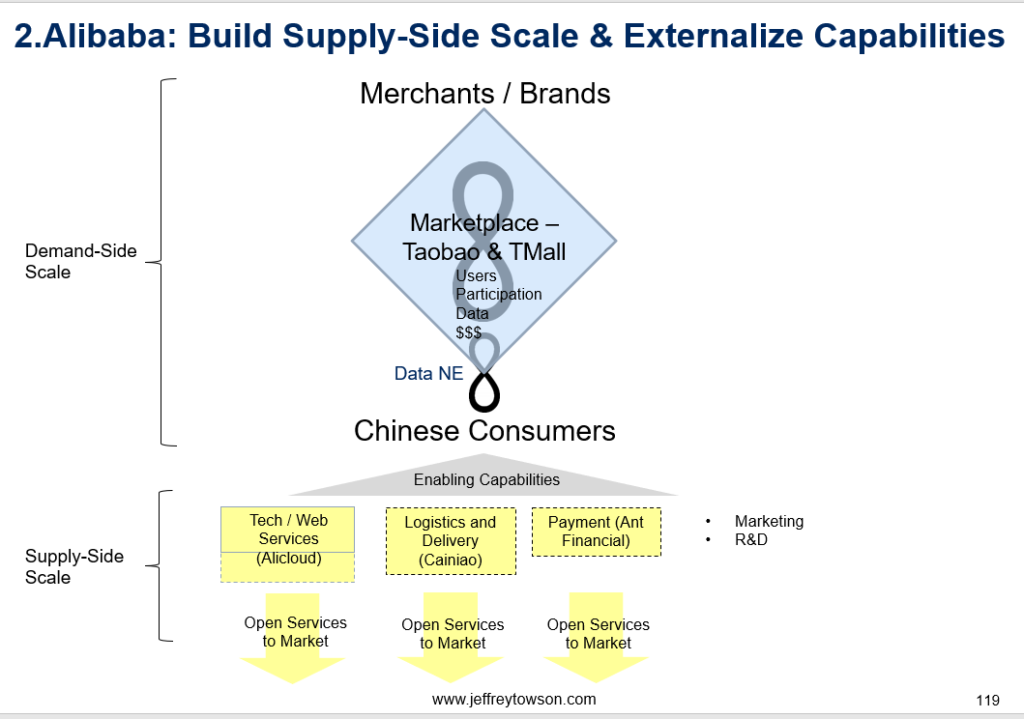

Which brings us to the concept for today – which is externalizing capabilities.

How does the above picture change if the company begins offering its internal capabilities as services to the market?

- What happens if Amazon externalizes its IT/Web Services capabilities and offers them to other businesses as a service? Well, that is how you get AWS (Amazon Web Services).

- What happens if Alibaba externalizes its payment capabilities? That gets you Ant Financial.

- JD externalizing its logistics capabilities? That got you JD Logistics, which has now gone public.

- Even Didi was trying to external the many services it offers to its drivers (discounted gas, insurance, car financing, other). They were talking about offering these to all the car owners of China.

You can see externalizing capabilities in the below chart.

And think of how this changes the competitive dynamic:

1) You can get a dramatic increase in economies of scale.

Having 3x greater revenue in an ecommerce business means you are getting a cost advantage versus smaller competitors. Your per unit costs will be lower in the major fixed costs.

But by externalizing a capability and serving the entire market (not just your own ecommerce business), you are can be 10x bigger in scale? 20x bigger? Think of the economies of scale in IT / Web Services that Amazon has versus other ecommerce companies without a business like AWS? Think of the logistics scale advantage Alibaba and JD have versus companies like VIPShop?

And that is just a cost advantage. What about spending in R&D and innovation? You can dwarf your competitors in this type of spending. Which makes a big difference. Both Amazon and Alibaba are flooding money into tech and R&D versus competitors.

2) Externalized capabilities can also create linked businesses.

- When you externalize a capability, it basically becomes its own business. So you can financially subsidize. AWS is a cash machine for Amazon’s e-commerce business. And this is one of the reasons they are able to offer delivery so much cheaper than their competitors.

- You can also get lower customer acquisition costs. Alibaba is currently selling its cloud services with a lot of focus on the merchants / brands that sell on the e-commerce platforms. They can discount based on their other business.

3) You can create complementary platforms.

Externalizing a capability and making it a separate business is often the first step to creating another platform business model. AWS, Alibaba Cloud, Cainiao and Alipay all become platform business models. And the only thing better in life that a platform business model is two of them.

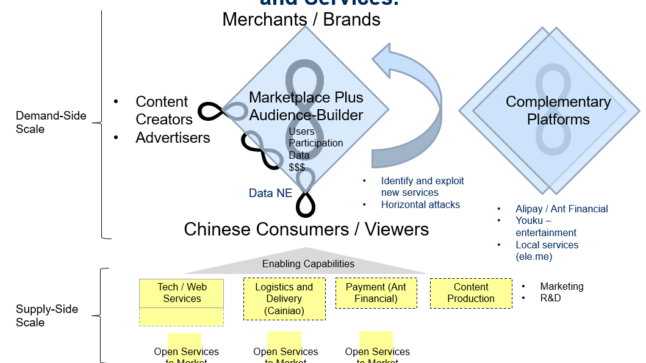

Here’s what that looks like for Alibaba.

***

Ok. That is for today. Cheers, jeff

——

Related articles:

- Amazon Has a Winning Long-Term Strategy. Amazon Prime and Netflix Don’t. (1 of 2) (US-Asia Tech Strategy – Daily Article)

- Why I Really Like Amazon’s Strategy, Despite the Crap Consumer Experience (US-Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Economies of Scale: Purchasing Economies

- Economies of Scale: Fixed Costs

- Digital Operating Basics

From the Company Library, companies for this article are:

- Amazon

- Netflix

——-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.