Huawei has just announced its 2021 financial results, with the title “Solid Operations, Investing in the Future”. That is actually a pretty good summary of their strategy post-US tech ban.

It was also interesting because CFO Meng Wanzhou is now back in China, after years in Canadian custody. She presented the financial results, along with rotating Chairman Guo Ping (whom I interviewed a few years back – see here and the picture below).

Recall, Huawei found itself in the middle of the China-US tech war. This disrupted quite a bit of its business:

- Getting cut off from the US tech supply chain hit them in their access to high-end semiconductors and smartphone operating systems. The most direct impact of this was in their consumer business outside of China.

- Their carrier business was politically pushed out of many Western markets. Either in part or entirely.

- It raised a lot of uncertainty about the company’s future in terms of access to technology. This can be important for carriers making long-term tech decisions.

But now the political dust has settled. The current sanctions don’t appear to be advancing or receding significantly.

So what is their strategy going forward?

I think Huawei has largely answered this question now. And there are some good lessons in tech strategy in this. Here are my top 3.

Lesson 1: A Core Business Doesn’t Have to be High Growth or Super Profitable to Be Powerful.

Huawei’s core business has always been China plus International Telecommunications (ICT). It’s the global carrier business. They began by designing and manufacturing simple telecommunications equipment like PBX switches in the early 1990’s. And they began investing in R&D. This began what would become a +30-year march in manufacturing and R&D scale. This took them from fixed into wireless. From 3G to 5G. And it all the technologies surrounding ICT. It also took them from China to +170 markets. And to +$100B in revenue.

But ICT has never been a particularly profitable business. Selling equipment and related services to carriers is difficult. And the technology becomes obsolete fairly quickly, requiring constant re-investment. ICT growth is steady but not awesome. It’s a tough manufacturing and research-intensive business where the only way to win is by getting to global scale. Founder Ren Zhengfei has joked he would gone into a different business if he knew how hard ICT is.

But Huawei’s global carrier business is the source of their strength. Because while ICT does not through off a lot of cash, it does get you +190,000 employees, most of whom are engineers. And with over 100,000 staff in R&D, Huawei amassed tremendous brainpower. That is the key resource. And Huawei has very deployed a very effective and well-thought-out HR system that motivates this army of engineers.

That’s lesson #1. You can create a powerful business without rapid growth or big profits.

So, post political fallout, has this core business of Huawei been changed? That has been my #1 question.

- Is the international portion of their carrier business decreasing?

- Are international carriers comfortable with Huawei as a long-term technology partner?

- Is Huawei getting politically locked out of more markets?

- Is Huawei going from a global to a China-only carrier business?

And the answer (for 2021) is No. This look pretty solid.

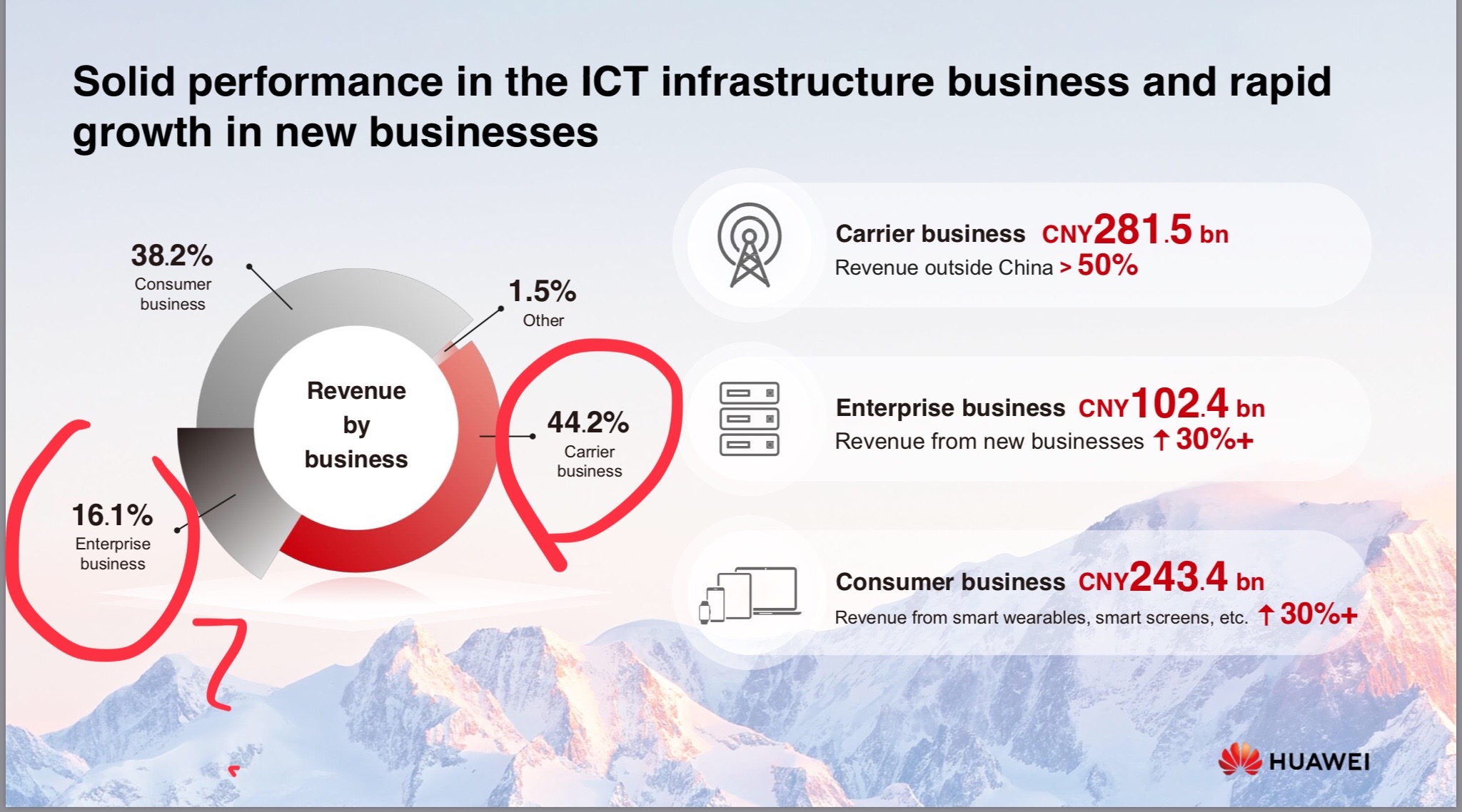

- 50% of carrier revenue in 2021 came from outside of China.

- Huawei said it has deployed 5G in 13 countries.

- Management says the carrier business has “remained stable”

From their press release:

That is important. This is the engine.

It helps that ICT is not nearly as dependent on the high performance, low energy semiconductors you need in smartphones. It also helps that you only need millions of semiconductors to do base stations. It’s nothing like the hundreds of millions you need to sell smartphones globally.

Lesson 2: Cloud and Intelligence Are the New Global Infrastructure

I once asked Guo Ping what he thought the most compelling uses cases for 5G were?

I thought it was a good question.

He was not impressed.

He basically said he didn’t know (I’m paraphrasing). That wasn’t what Huawei does. They don’t think up all the use cases, industry by industry. They provide the infrastructure that others build upon.

Huawei has always been in the global tech infrastructure business. But what is “infrastructure” is changing. It is going from hardware to software. It is going from providing connectivity to providing intelligence. Hardware and manufacturing will still be important, but Huawei is going to have become a lot more like Google and AWS if it wants to provide global infrastructure.

Which brings me to the other really important Huawei business, which is cloud. If “China plus International Telecommunications” was the foundation of the first 30 years, “China plus International Cloud” is going to be big part of the next 30.

That’s lesson #2. Cloud plus intelligence is the new infrastructure.

So, post political fallout, has this emerging business of Huawei been changed? .

The answer (for 2021) is No.

- The cloud business is under Enterprise, which totaled 102B RMB in 2021. Cloud showed +30% growth within this.

- Huawei Cloud now #2 or #3 in China, about tied with Tencent at 17%. But mostly in IaSS. They are focusing on infrastructure as a service.

- It is building off the China base, with contracts with the major banks and +600 eGovernment cloud projects. Note: The Western cloud companies will never be allowed in most of China, and especially not in areas like government and financial services.

- The company is leveraging its manufacturing capabilities to provide both software and hardware. In Thailand, Huawei is building 2-3 data centers.

This is the area to watch. I’m not sure about the supply chain issues here. And whether more standard semiconductors (which can be made in China) are sufficient.

Lesson 3: Ecosystem Development is the New Manufacturing Scale.

Huawei was built on the power of manufacturing scale, something Chinese companies have long used as their biggest weapon against international companies. Huawei leveraged its big manufacturing scale into lower costs and lower prices. And they also used their scale to outspend competitors in R&D. A pretty common playbook in China manufacturing.

But software doesn’t work like this. What tends to matter is ecosystems, users and connectivity. It’s not all about having more factories and engineers than competitors. It’s more about having platforms and projects that developers want to write and build upon. It’s about what software companies have implemented and have trained their employees it. If you are in the infrastructure business (which Huawei is), then things are shifting from a fight for manufacturing scale to a fight for ecosystem development.

One of the things Huawei mentioned was that they are doing “fast track of ecosystem development”. They talked about building HarmonyOS for smart devices (including IoT), mindSpore (for AI) and OpenEuler. Huawei says HarmonyOS was used in 220M devices in 2021. And used by 8M developers.

Note the below summary. I think that pretty much has the key points.

***

Those are my three strategy take-aways from Huawei’s announcements.

Huawei also has some other interesting things in enterprise, smart power, smart cities, and consumer devices in China. But I don’t think these are their big strategic moves.

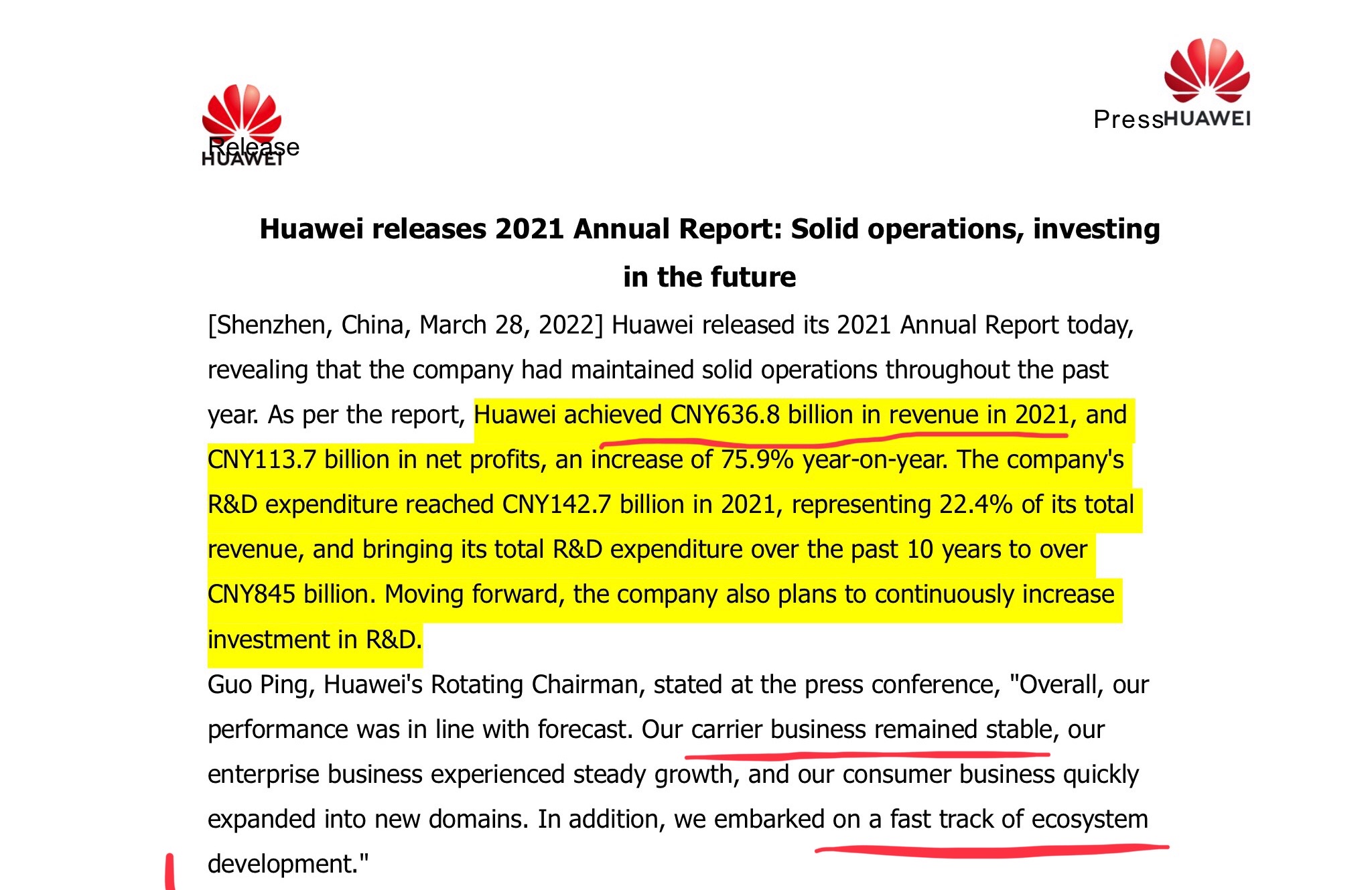

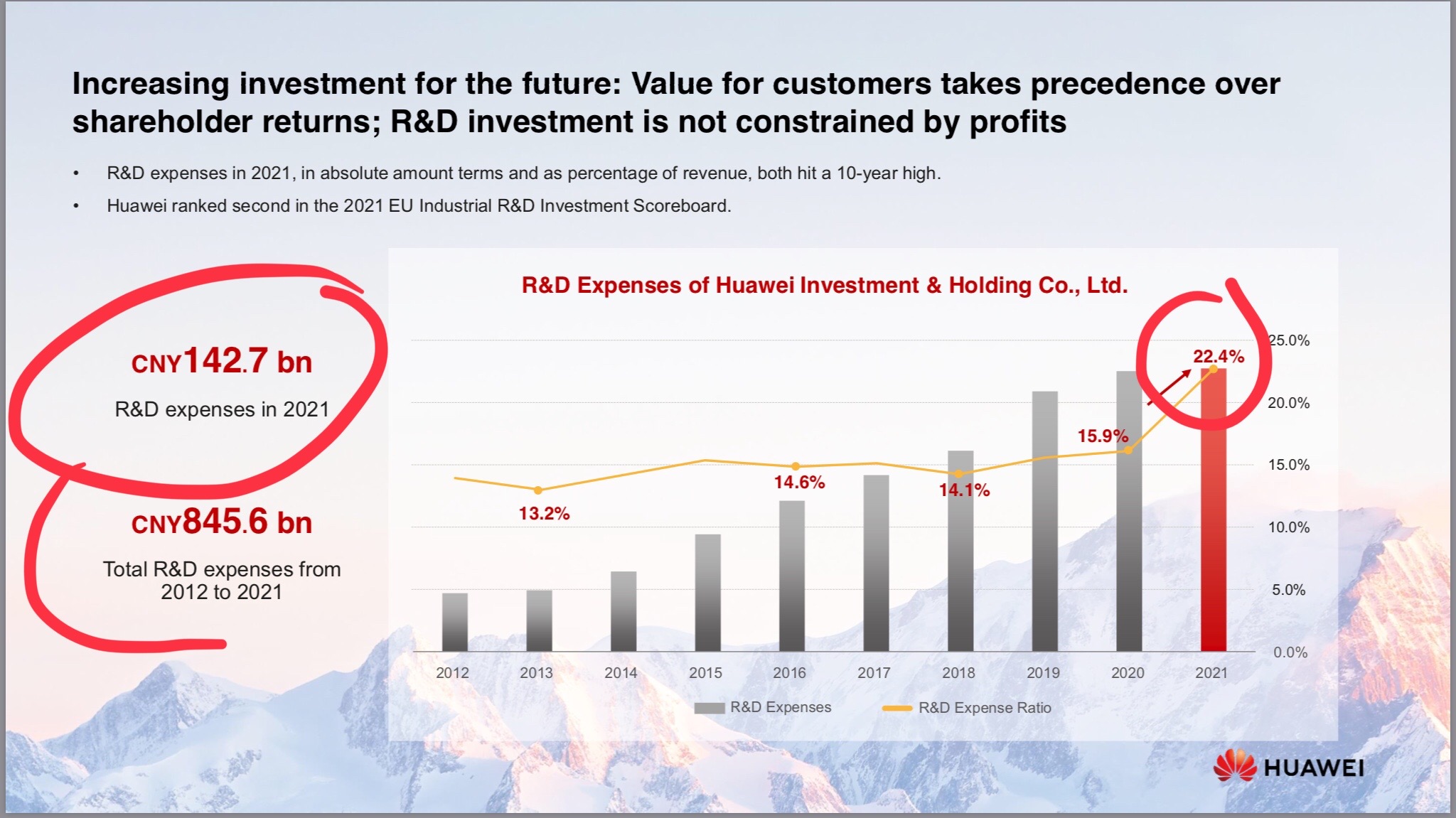

And, finally, the big number they talk about is R&D spending, which is massive. Here is the slide that matters.

You can see Huawei trying to use their scale to outspend everyone in R&D and ICT tech over time. Against Ericsson and Nokia in carrier, it will work. Against Google and AWS in cloud, it will be more competitive.

That’s it. It’s a really interesting company. It’s a shame the shares aren’t public.

jeff

- Alibaba, Android and The Emerging Art of Ecosystem Management. (Jeff’s Asia Tech Class – Podcast 57)

- 4 Things Everyone Is Getting Wrong About Huawei’s 2019 Annual Report

- Can Huawei’s HarmonyOS Break Android’s Monopoly? (Asia Tech Strategy – Podcast 73)

- Huawei Is Going to Beat Trump with Human Resources, Not Technology (Pt 1 of 3)

From the Concept Library, concepts for this article are:

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.