In Part 1, I went through the basics of Nubank, which is building a digital bank in Latin America. And you can make an analogy between the first digital bank and the first online travel sites. In both cases:

- A digital business model was taking on long-established physical business models.

- Digital economics enabled a far better and far cheaper product.

- Digitization enabled a platform business model to emerge.

Nubank today looks like version 1.0 of a digital bank. This is not unlike how Expedia in 2005 was version 1.0 of an online travel site. But what’s next? What is version 2.0 of Nubank going to look like?

That’s the point of this article. And here’s my take:

- Nubank 1.0 is a payment platform with additional credit and banking services. Both services and cross-border payments are going to grow.

- Nubank 2.0 will be add a complementary marketplace for wealth management and insurance products. And maybe more.

Let me start with an explanation of Ant Group.

Pre-Govt Crackdown, Ant Was Building 3 Complementary Platforms

I’ve written a lot about Ant Financial. For those not familiar, Ant was building three complementary platform business models:

- A payment platform with credit services.

- Marketplace for wealth management and insurance products

- Marketplace for daily services

Here are some of the key points in Ant’s history:

- In 2011, Alipay released its mobile app. This was really the beginning of mobile payment in China. Chinese consumers had debit cards, but not credit cards. Mobile payment tied to debit cards took ecommerce from something on a personal computer (at work and home) – to online and offline everywhere. Chinese consumers began scanning QR codes and paying everywhere with their phones. It became part of daily life.

- In 2013, Alipay launched Yuebao with Tianhong Asset Management. This let users put their Alipay balances into a money market fund. This was a big improvement from the tiny rates of return and inconvenience of state banks. And it was Alipay’s first big move from payments to investment services.

- In 2014, their bank subsidiary MYbank got regulatory approval and the platform begin offering credit to consumers and small merchants. That was their big move from payments into credit services.

- In 2018, Alipay expanded into cross-border payments across Asia, usually by partnership.

- In 2019, users of Alipay e-wallets reached 1B people.

- In 2019, Alipay launched Xianghubao, a mutual benefit insurance product. This is one of their key moves into insurance.

- In the six months prior to their IPO filing in 2020, total payment volumes on Alipay totaled 118T RMB. That right. They processed $17 trillion in payments in six months. Compare that to the $100B in mobile payments in the USA for all of 2019.

Circa 2016, what Ant really had was a payment platform with credit services.

- A payment platform means merchants are one user group and consumers are another. And there is a network effect between them. These are national platforms. But they can easily go international, which is why they can be so powerful. Think MasterCard.

- However, with mobile payments, you can also easily send payments to other consumers. And merchants to other merchants. So that is two other network effects.

- I think you can increasingly add credit to the idea of payment platforms. It is a small step from pay now to pay later. However, if the credit is coming from a large number of external banks then I consider that another user group. But for mostly internally provided credit, I just consider that a payment platform with credit added as a service.

- Payment platforms also have virality (one of my six digital superpowers). This is a growth hack that enables payment platforms to grow rapidly and bring in lots of users quickly and cheaply.

- Ant refers to its payment platform as the “infrastructure” of finance. I think what they are really saying is that the network that payment creates is the foundation. It is also usually what most attracts users and creates the highest volume of activity.

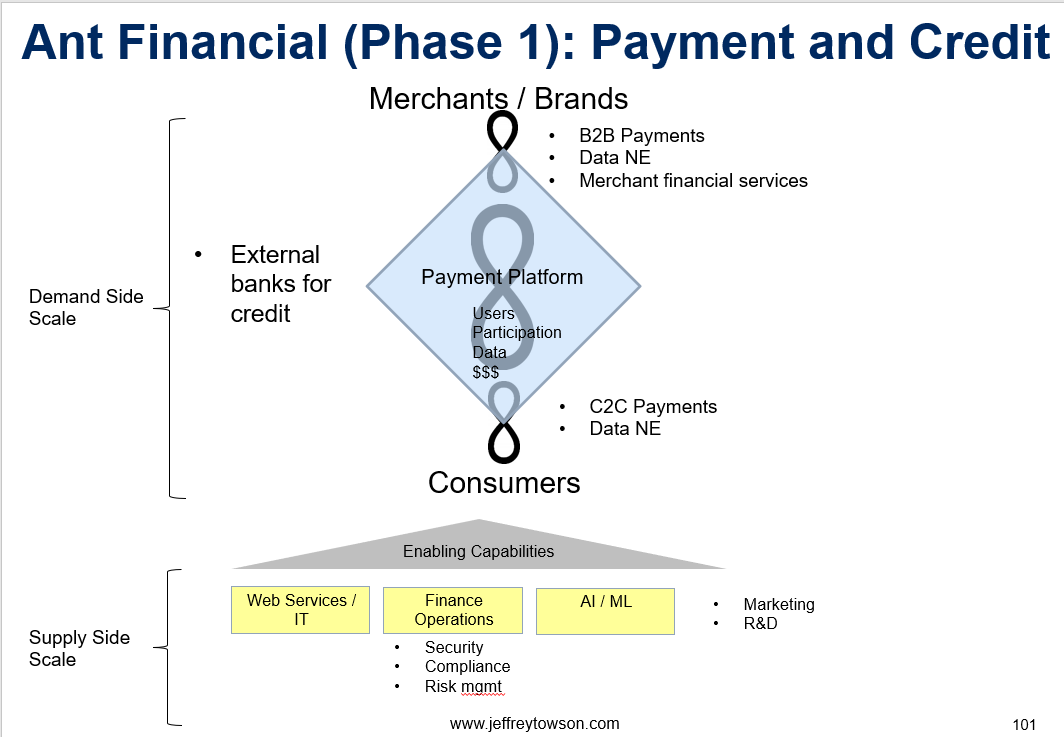

Here’s how I view Ant circa 2016.

We see a payment platform with two user groups: consumers and merchants. It is enabling payments between them. We also see three network effects (one indirect and two direct). Ant did this with mobile payments. Nubank is doing this with credit cards and mobile payment. The product is a bit different for Brazil, but the strategy is the same.

Within the platform, you can see the 3-4 assets that you need to build the platform – users, participation and data. These are what Nubank is aggressively building. Recall the following numbers mentioned for Nubank:

- 47M consumers. That is a lot of users for Latin America.

- 1M merchants. Lots of users.

- 48% of the monthly active customers are also daily active customers. That is very high engagement.

This is why I like payment platforms. They are a particularly powerful model for getting demand-side scale. You get rapidly growing users by virality. And you get very high engagement because people pay for stuff all the time.

In the graphic, you can also see 3-4 enabling capabilities at the bottom in yellow. For a digital operation, you build web services / IT, finance operations and AI. This is the same for Ant and Nubank. And no physical branches. It’s a digital bank.

One significant difference between Ant and Nubank is the credit services. Ant financial was much more aggressive in creating entirely new credit products with +100 local banks, which are a third user group on the platform. Ant oversaw the design and management of these credit products, but did not hold the assets. The banks held the loans and Ant just took fees for placement and design. The government later objected to this.

We don’t see Nubank doing this approach with local banks (yet) as they are just ramping up the credit services. But it is worth noting that most of Ant’s revenue came from payment processing and credit services.

As mentioned, you can see multiple advantages to this approach versus traditional banks:

- A dramatic improvement in the user experience.

- Digital economics, including cheap and fast growth without constraint.

- A platform business model defended by chicken-and-egg and able to subsidize prices.

- Three network effects.

- Economies of scale in IT / web services and finance operations.

- Virality

***

OK, if Nubank version 1.0 is Ant circa 2016, then what’s next? What are the next moves to watch for based on Ant’s development? Where are the next big increases in value that investors are not accounting for?

I think we can watch for 5 things in the next 3-4 years.

#1: Nubank Could Offer Asset-Lite Credit Services

The fastest way to increase Nubank’s revenue is to offer more credit services. Going from pay now to pay later is a direct expansion of their credit card and mobile business. They are doing this, but not as aggressively as Ant did.

Ant provided credit by adding +100 banks to the platform. 98% of the credit balances were held by these banks. In China, these included big banks, small banks, rural banks and trusts. It’s asset lite lending. Mostly to consumers but also to merchants.

But it gets better.

Because Ant was also not taking on underwriting risk or disbursement requirements. Ant was taking the best part of the business. They were designing the products, controlling the users and taking a technical service fee that was a percentage of interest paid by the consumer. But they weren’t taking the assets or the risk. Their balance sheet looked like a service company, not a lender.

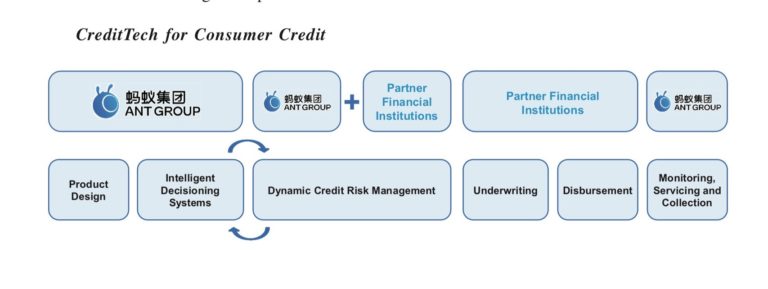

One of the fascinating aspects of Ant’s “CreditTech” business was the division of roles between them (as the platform) and the banks (as a user group). Note the below chart from the IPO filing.

Look at the bottom row. Ant was doing “Product Design” and “Intelligent Decisioning Systems” for credit products on their own, without the banks. That is different than how Ant worked with Asset Management companies in investment products. In that case, they were acting as a marketplace and not doing product design. They were focused on “Product Screening” and “Customer Acquisition / Education”. See below.

But for credit, Ant was designing the credit products and doing the key decisions. Banks had to provide credit to meet their specifications. They did collaborate with banks in “Dynamic Credit Risk Management”, which basically meant banks could access the data and analytics about products and customers. But similar to Cainiao in logistics, they were asset-lite and in control of the data infrastructure. You can see they put the underwriting and distribution completely under the banks.

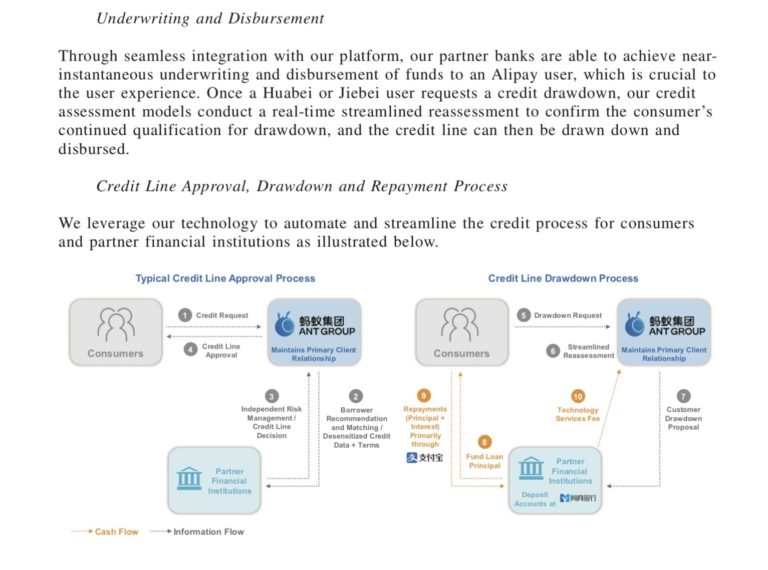

Take a look at the chart below for the process for approval and drawdown for credit. What should jump out at you is that Ant was controlling (i.e., not sharing) the customer relationship. Ant was doing platform strategy and keeping the users, engagement and data.

Compare that to what Nubank is currently doing in credit. They are offering some basic credit services to consumers. And that is similar to how Ant started. But you can see what this can grow into. And the big money is in credit. And you want to control that, the users and the data at a larger scale. Nubank offering credit in this way could create a big source of revenue with an asset-lite business model.

#2: Nubank Could Create a Complementary Marketplace Platform for Investment and Insurance Products

Ant launched a completely new marketplace platform that enabled users to do transactions with asset management companies. They called this “InvestTech”. So this is putting money into mutual funds and such. This is actually very difficult to do as a marketplace because most people don’t buy investment products very often. It has a very low frequency. Plus, these are complicated services that require risk management. And people like to work with an advisor. It’s hard to build a stand-alone marketplace platform for digital finance.

But financial services is also where the big money is. It is where rising consumers put their accumulating wealth.

However, this works quite well as a complementary platform to something that gets lots of users and engagement – like a payment platform. You can add these companies as a new user group to an existing platform, as shown below.

I expect Nubank to copy this. They are already doing some initial steps in investment products and insurance. But I expect them to launch a full complementary marketplace platform in insurance and investment products.

#3: Nubank Will Go Cross-Border and Offer a Growing Suite of Financial Services Products

Here are some of the services Ant financial has launched:

- Zhima Credit, an independent credit filling and scoring service for individuals.

- Ant Fortune, a comprehensive wealth management app launched in 2015. Yu’e Bao, now the largest money market fund in the world, is one of the products. But Ant Fortune offers hundreds products from more than 80 Chinese fund institutions.

- Huabei (Ant Credit Pay), a virtual credit card product.

- MYbank, a private online bank.

- Jiebei (Ant Cash Now), a consumer loan service.

- Ant Insurance Services.

- Ant Financial Cloud, a cloud service for financial institutions.

- ZOLOZ, a global biometric-based identity verification platform.

Once you have the users and data, offering such services becomes pretty easy. Nubank already offers banking accounts for consumers and merchants. These are just additional services and not really part of the platform business model. But they can do a lot more of this.

I also expect Nubank to expand into more geographies with their payment and credit cards. And I think they will increasingly do cross-border payments. One of the few things better than a national payment platform is an international one. Ask MasterCard and Visa.

#4: Nubank Could Launch Mini-Programs within the Payments App

Ant ended up being in charge of Ele.me, which is Alibaba’s competitor to Meituan. That app offers lots of daily services like food delivery, rides, hotel bookings, movie tickets and so on. It was a bit random that they integrated Ele.me into Ant and Alipay. They basically added another complementary marketplace for daily life services.

I think they were trying to create something similar to WeChat mini-programs. And Alipay was going to be their vehicle.

That is a really interesting idea.

The two functions that get the highest frequency usage are usually messenger and payments. So if you want to launch mini-programs, those are two candidates. WeChat had both. Alipay was trying to do this from payments. Nubank could, in theory, launch mini-programs within their payment platform. It’s a daring idea. Note: WeChat Mini-Programs is now the 3rd or 4th largest ecommerce site in China by GMV.

Hey Nubank. If you want to make your stock price jump, just announce you are launching mini-programs like WeChat.

#5: Nubank Could Externalize Financial Cloud Services

In the above graphic, you can see the highly specialized tech capabilities Ant (and Nubank) built in yellow. They have specialized web services and lots of AI / machine learning for security, compliance, and risk assessment. Those very specific financial IT capabilities could be externalized and offered to the market as a financial cloud service.

This is what Alibaba has done. Ant Financial Cloud is a cloud service for financial institutions. They are very good at credit analysis, fraud detection, cyber security and regulatory compliance. This gets them additional revenue and also gets them further economies of scale in their core technology.

Nubank could become a specialized financial cloud provider for Latin America.

***

Ok. That is my explanation for Nubank and 5 things to keep watch for. I’m pretty sure 1-3 will happen. #4 and #5 are more guesses, but pretty interesting.

Cheers, Jeff

——

Related articles:

- Brazilian Nubank is Ant Financial Circa 2016 (1 of 2) (Asia Tech Strategy – Daily Article)

- Ant Financial’s Big Money is in Asset-Light Credit Tech (Jeff’s Asia Tech Class – Daily Lesson / Update)

- How Ant Financial / Ant Group is Revolutionizing Finance (1 of 3) (Jeff’s Asia Tech Class – Podcast 47)

From the Concept Library, concepts for this article are:

- Mini-programs

- Payment Platforms

- Complementary Platforms

From the Company Library, companies for this article are:

- Nubank

- Ant Financial

——–

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.