I have described digital business models as either pipelines or platforms. That’ s a standard distinction.

- In a pipeline, a firm creates value with a linear process (similar to a pipeline), where inputs are turned into something more valuable for the customer. You concentrate assets and activities in a linear sequence internally to achieve this.

- A platform is a network-based business model where value is created by enabling interactions between users. And I have argued that platforms are just a simplified version of an ecosystem, where multiple parties also interact to create value. I have outlined 5 common types of platforms.

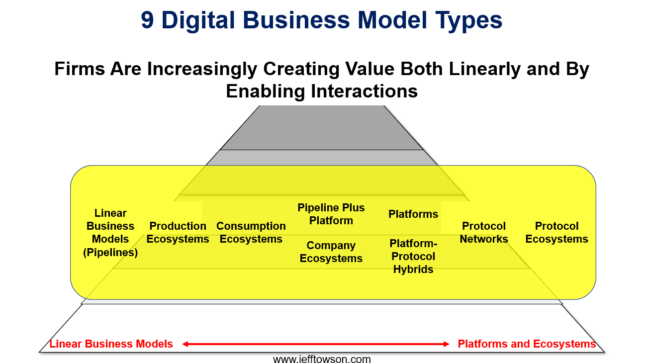

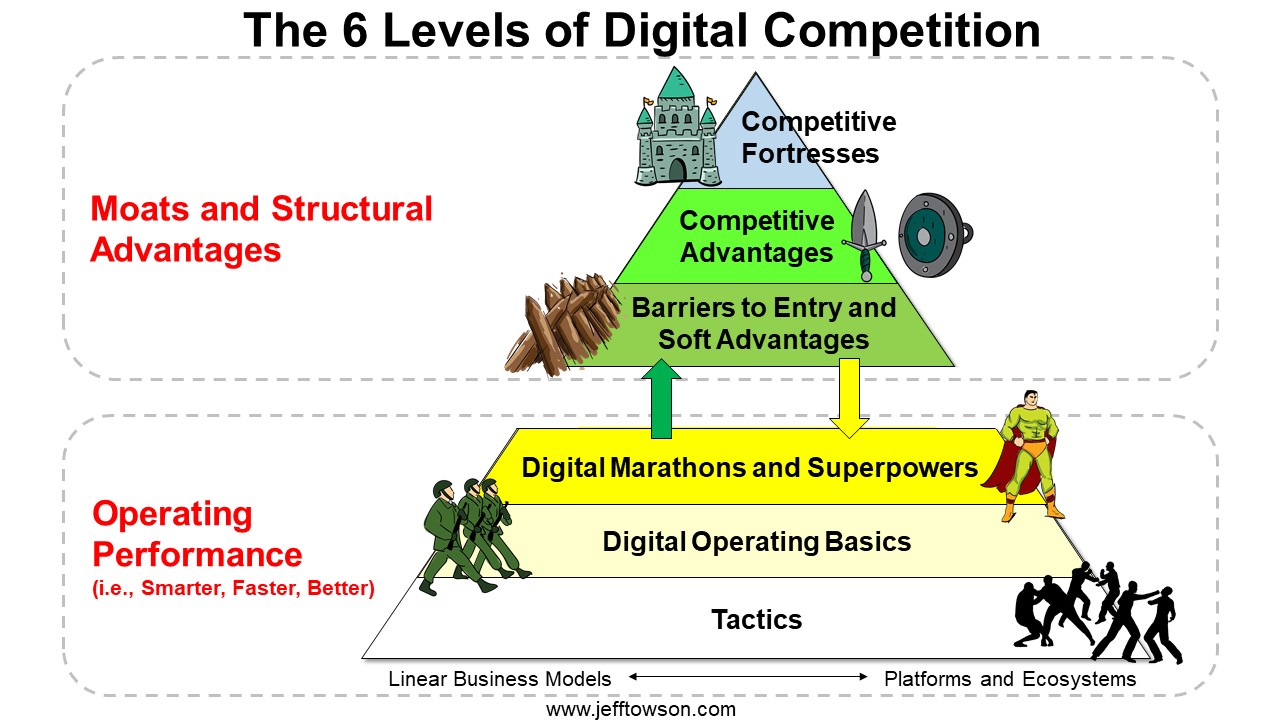

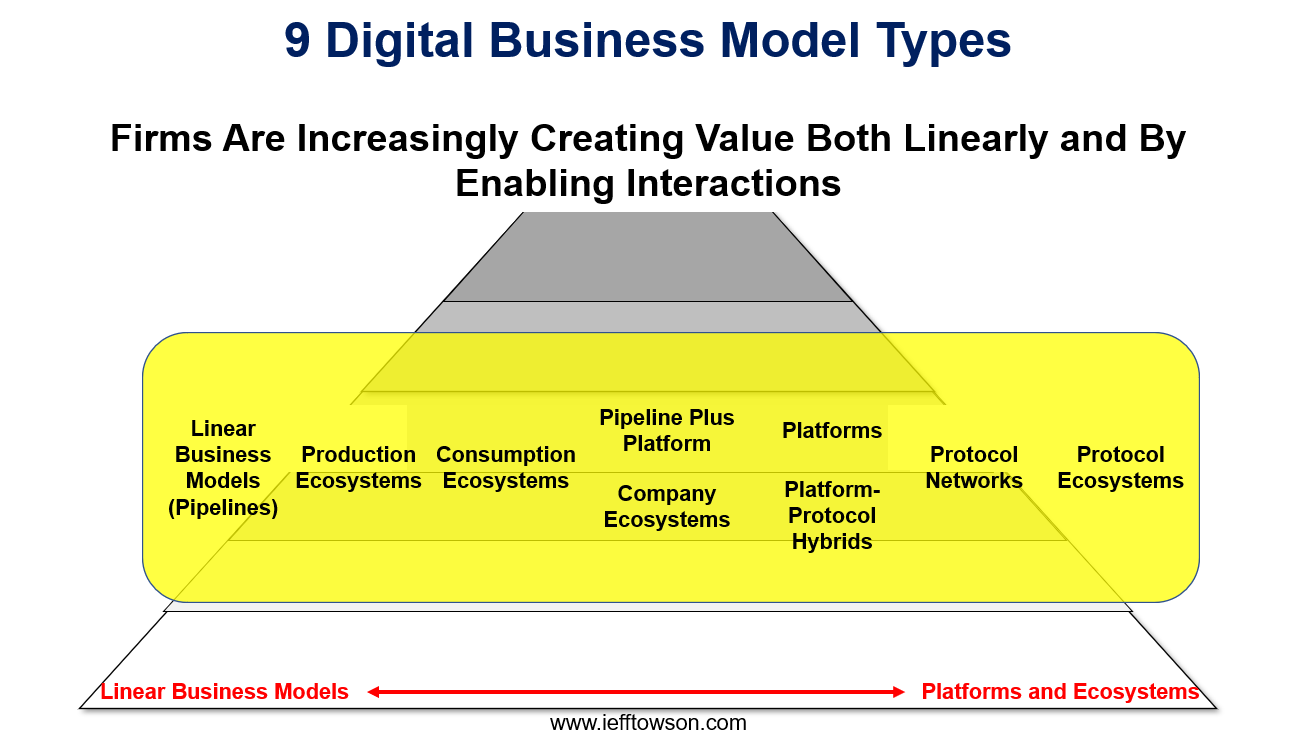

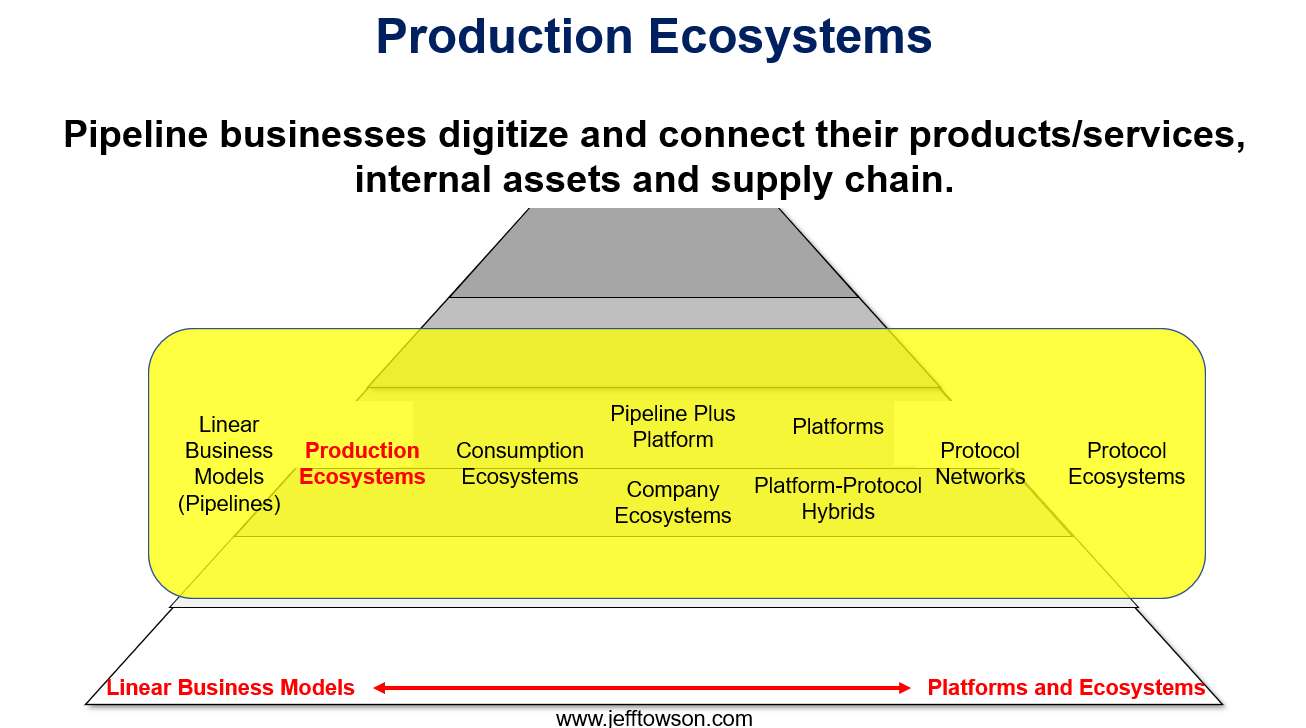

However, this binary distinction of linear business models vs. platforms / ecosystems is not really true. There is actually a spectrum of business model types that combine both internally created value and interaction-based value. You’ll notice on my 6 levels of competition I have actually put a horizontal axis at the bottom that shows this spectrum.

But I have never really filled in the details, which is the point of this article. I most commonly see 9 digital business models, which can be placed along this spectrum.

9 Types of Digital Business Models

Here is my current list of common digital business model types. You can also make a distinction between web2 and web3 models.

Common in Web2:

- Linear business models (i.e., pipelines)

- Production Ecosystems

- Consumption Ecosystems

- Company Ecosystems

- Platforms

- Pipeline plus Platform Business Model

Common in Web3 (and some Web1):

- Protocol networks (i.e., blockchains) as stand-alone businesses

- Platform-protocol hybrids

- Protocol ecosystems (i.e., building blocks)

Here is how I plot them on the spectrum of linear business model to interaction-based business model.

Note: I’ve talked about platforms, company ecosystems and pipelines extensively. And I’ve covered the web3 business models in this article.

So I’m not going to to repeat that here. In these two articles, I am going to detail the following types:

- Production Ecosystems

- Consumption Ecosystems

- Pipeline plus Platform Business Model

An Introduction to Production Ecosystems

Production and Consumption Ecosystems are terms by Professor Mohan Subramaniam, who wrote the book The Future of Competitive Strategy: Unleashing the Power of Data and Digital Ecosystems. This is a good, straight-forward book about how traditional linear businesses commonly digitize and begin to build out their interactions. Most traditional businesses can not become platforms. But most can add production and consumption ecosystems to their traditional linear businesses.

First, I’ll go through his definition for the production ecosystems, which I basically agree with.

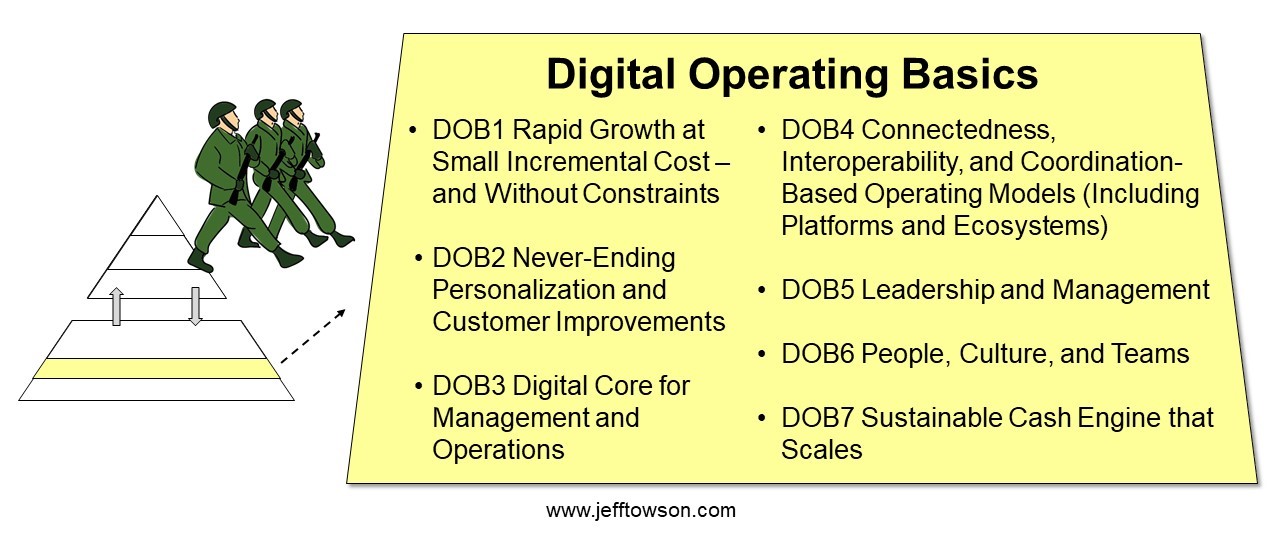

I have seen this business model over and over in legacy businesses that digitally transform. Recall, in the digital operating basics, that most companies doing digital transformation spend years building out DOB2, DOB3 and DOB4.

They almost always start with DOB3: Digital Core for Management and Operations. This means putting in lots of sensors and software systems. It means gathering data and getting real transparency into the company. The early wins for this are usually smarter, faster and more effective management. As well as improving the existing operations, usually by improving cost efficiency.

From there, digital transforming businesses usually focus on DOB2: Never-Ending Personalization and Customer Improvements. This when they start using their data and data-driven operations to improving the customer experience. Better and more cost-effective marketing is usually the first use case. They also begin to personalize their services (or at least communications) to customers or groups of customers, which does add tremendous value.

From there, businesses often do DOB4: Connectedness, Interoperability, and Coordination Based Operating Models (including Platforms and Ecosystems). This means beginning to connect their data and operations externally with other companies. This usually begins with data sharing. And they usually focus on their supply chain partners first. But it can increasingly mean coordinating in areas like product development and research. And it can mean creating new customer solutions that require all parties to operate in a coordinated fashion.

Professor Subramaniam’s definitions of Production and Consumption Ecosystems tracks with my digital operating basics pretty well. In both cases, it’s about linear businesses digitizing and connecting their assets and their products and services. And sometimes it means connecting with external parties, particularly those providing complementary products / services. If this activity focused mostly on internal assets and the supply chain, then it is a production ecosystem. If it is focused on external groups and the customer interaction, then it is a consumption ecosystem.

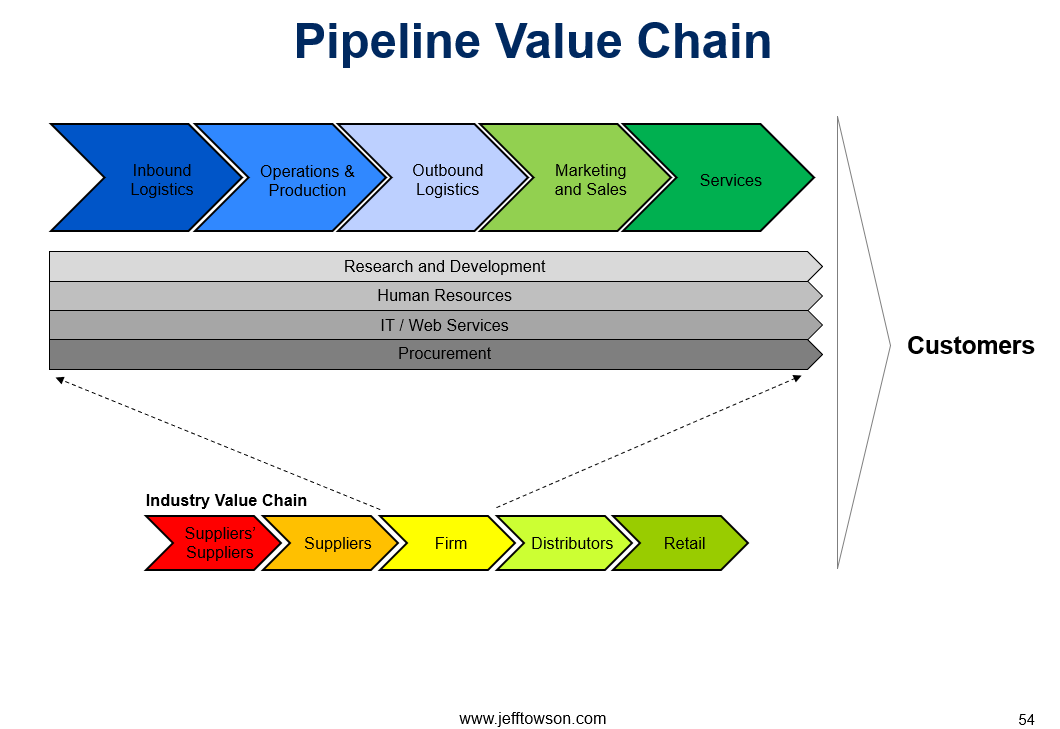

Recall, Michael Porter’s standard picture for a linear business model.

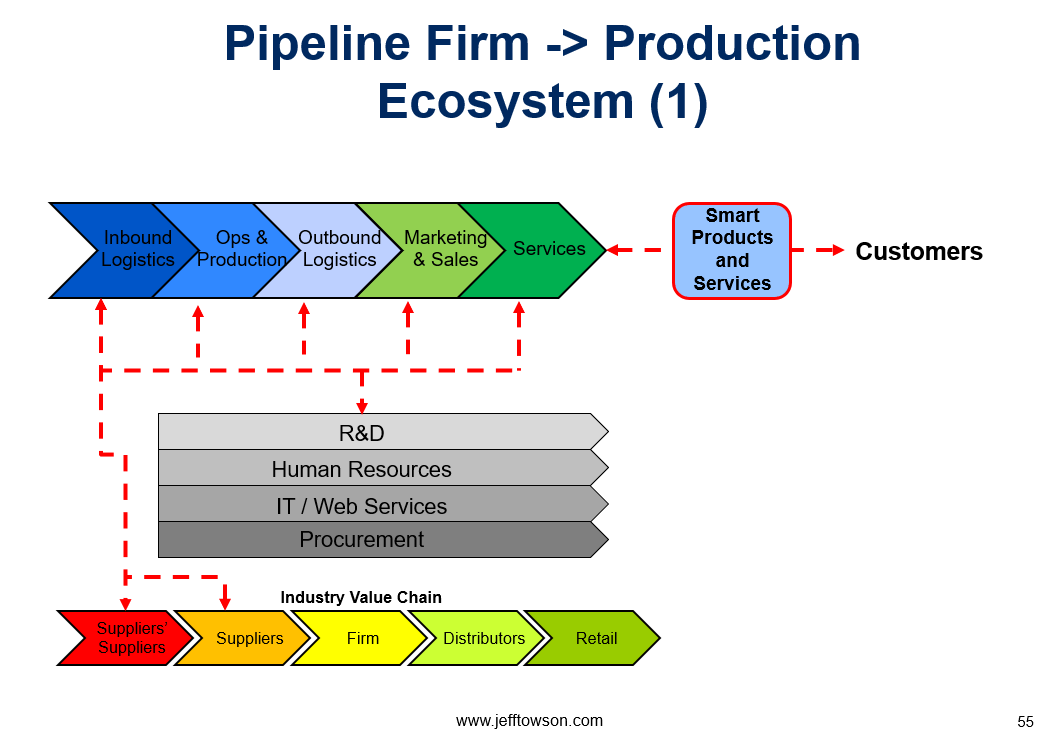

You can see the value chain of activities within a particular firm. And you can see how this firm sits in the value chain of an industry. As you digitize and connect the internal assets and supply chain, you get a production ecosystem, which looks like this.

The dashed red lines are data flow and interactions. That’s the ecosystem. If you look on the left, you can see that the internal assets are now digitized and connected. Think lots of IoT sensors and data analytics being used in logistics, operations, production, marketing, sales, and services. As well as in the key suppliers in the supply chain.

Production Ecosystems are when linear product and service businesses digitize and share interactive data from internal assets and supply chains. As well as from smart products and services. Mostly by IoT, sensors and AI. It is a data-sharing ecosystem built on the existing pipeline.

Production Ecosystems can create multiple benefits:

- It can capture basic operational efficiencies. This is from interactive data from internal assets and supply chains. You put sensors on all the assets in a factory and you can start to be more efficient. You can track maintenance requirements. You get better utilization. You can connect with key suppliers and better procurement and inventory.

- Another example is doing predictive demand and inventory management in FMCG companies. Or doing predicative analytics for agriculture assets.

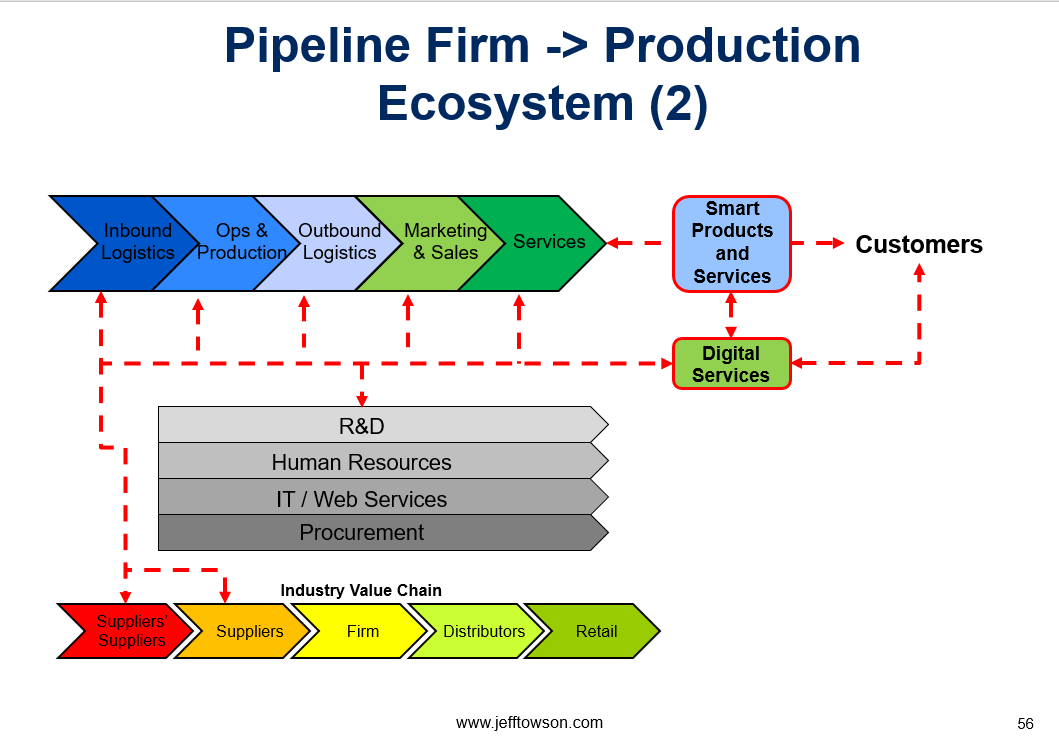

- It can capture advanced operational efficiencies. This is from interactive data from products / services and users. Look on the right in the graphic and you can see that products and services are now smart and connected. The factory is no longer selling dumb tractors, it is selling smart tractors. This creates connectivity and data flows between the customer, the product, and the company, which you can see in dashed red lines. Real-time interactive data can is now coming in from products / services and users. And this can used to capture more advanced operational efficiencies, such as more effective research and development.

- Finally, you can also launch new digital services. You can add data-driven services from any of the activities in the value chains.

- This could be predicative maintenance services by companies like Caterpillar. Clients who buy their tractors can now get warnings when it needs to be maintained and have parts replaced. This can save lots of money. This can be a new source of revenue.

- This can be new informational programs by mothers who buy Pampers diapers. This could be a new revenue source. Or it could improve customer relationship management and get greater customer engagement.

You can see this in the below graphic.

Production Ecosystems are well positioned to increase personalization and to add lots of new data-driven features.

Finally, it is worth pointing out that I am mostly describing a data ecosystem. This data-sharing can evolve into operational coordination.

Example: Snowflake

I have written quite a lot about Snowflake, which is a “data intelligence” ecosystem company.

Here is how I described the company in that article:

“Snowflake is referred to as a “data warehouse as a service” company”. Or as a “cloud computing data warehousing company”. However, the company refers to itself as a platform, with a “Data Cloud” as its primary product offering. It also refers to itself as a data ecosystem.

At this stage, Snowflake is a service for companies to consolidate, store and analyze their data. Those three initial activities for a corporate customer are important.

- Snowflake consolidates all the company’s structured and semi-structured data into one place. They create a warehouse for storage and create a “single version of the truth” for the company.

- The consolidated data can then be analyzed for insights. This can be in real-time for current decisions as well as for looking back in time at historical data. AI is getting really good at analyzing large corpuses of data.

Then it gets more interesting.

- The data can also be shared internally and used in team collaborations and projects.

- The data can integrate with many other enterprise IT systems and apps. Most enterprise apps run on data.

- The data can also be shared externally with partners, suppliers and customers.

And then…

- The data lakes of Snowflake’s growing list of clients can be used by developers creating data-intensive apps. A large volume of data is especially valuable for machine learning apps, where functionality and effectiveness are highly dependent on the quality and quantity of data. Note: data is the critical complement for algorithms – and is rapidly rising in value.

And finally in 2019, Snowflake launched a data marketplace, where data can be purchased and sold by various users.”

***

Doesn’t this sound like the digital operating basics? And doesn’t it sound mostly like how you go from a pipeline business to a production ecosystem?

Final Example: Tuya

Last year, I wrote about the company Tuya, which is basically in the business of helping traditional product companies make their products smart and connected. It’s a Chinese company, which makes sense because that’s where these products are manufactured anyways.

Here’s is how I described the business in that article:

“Tuya is a Hangzhou-based company that offers an IoT platform-as-as-service (PaaS) to brands and original equipment manufacturers (OEMs). They sell this service to several thousand corporate customers, including Schneider Electric and Philips.

For their brand customers, they enable them to take a product like a toothbrush or humidifier and turn it into a smart device. They add the IoT hardware (semiconductors, Bluetooth, etc.) and software such that it is a connected device. And they provide the network and platform so both the users and the brand can connect with the device. And, given that most manufactured products come out of China / Asia, it is not surprising that a Chinese company has emerged early in IoT PaaS.”

***

That also sounds like a lot of branded products and OEM companies putting data-sharing ecosystems into their traditional businesses.

Anyways, that is a bit of theory. In Part 2, I’ll summarize Consumption Ecosystems and Pipeline Plus Platform models.

Cheers, Jeff

———

Related articles:

- 9 Digital Business Models: An Intro to Consumption Ecosystems (2 of 2) (Tech Strategy – Daily Article)

- The Big Strategy Concepts for Web 3 (1 of 3) (Tech Strategy – Daily Article)

- Why I Really Like Amazon’s Strategy, Despite the Crap Consumer Experience (US-Asia Tech Strategy – Daily Article)

- 3 Big Questions for GoTo (Gojek + Tokopedia) Going Forward (2 of 2)(Winning Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Production and Consumption Ecosystems

From the Company Library, companies for this article are:

- n/a

———

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.