In late 2020, it was revealed that Berkshire Hathaway had an investment in newly public Snowflake, the “data warehouse as a service” company. That was unusual for a couple of reasons.

- First, Buffett has always avoided new issues. Like in 50 years, he hasn’t bought a new stock issue.

- Second, Snowflake is a tech company to the core. Not totally unknown for Berkshire now, but still unusual.

But it turns out long-time Berkshire company GEICO is a customer of Snowflake. And GEICO is even an investor in the company. So that is pretty classic Berkshire behavior. They often find new investments and acquisitions in the suppliers and partners of their portfolio companies.

Regardless, Snowflake is exactly the type of company I hunt for. It’s a digital company still relatively early in its life. And it has a complicated digital business model, so there is some complexity that hopefully will be difficult for others (digital complexity is my edge). So even though Snowflake is not in China/Asia, I decided to took a look.

And the company blew me away.

I am still early in my analysis so my opinion will likely evolve. But, thus far, it is one of the most attractive business models I have seen in a long time. These two articles are my first pass analysis.

However…

This doesn’t mean Snowflake is a good investment. That depends on price and other things of course. So this is not investment advice.

But in terms of its business model, strategy and company quality (my areas), Snowflake looks like a 10 out of 10 (thus far).

An Introduction to Snowflake

Snowflake is referred to as a “data warehouse as a service” company”. Or as a “cloud computing data warehousing company”. However, the company refers to itself as a platform, with a “Data Cloud” as its primary product offering. It also refers to itself as a data ecosystem.

At this stage, Snowflake is a service for companies to consolidate, store and analyze their data. Those three initial activities for a corporate customer are important.

- Snowflake consolidates all the company’s structured and semi-structured data into one place. They create a warehouse for storage and create a “single version of the truth” for the company.

- The consolidated data can then be analyzed for insights. This can be in real-time for current decisions as well as for looking back in time at historical data. AI is getting really good at analyzing large corpuses of data.

Then it gets more interesting.

- The data can also be shared internally and used in team collaborations and projects.

- The data can integrate with many other enterprise IT systems and apps. Most enterprise apps run on data.

- The data can also be shared externally with partners, suppliers and customers.

And then…

- The data lakes of Snowflake’s growing list of clients can be used by developers creating data-intensive apps. A large volume of data is especially valuable for machine learning apps, where functionality and effectiveness are highly dependent on the quality and quantity of data. Note: data is the critical complement for algorithms – and is rapidly rising in value.

And finally in 2019, Snowflake launched a data marketplace, where data can be purchased and sold by various users.

That’s basically the story presented by the company. There is a lot of evolution happening with them company. That’s when you hear the word “ecosystem”, which usually means the business model is getting complicated and people are having a hard time explaining it.

My description of Snowflake is simpler. They are building 3 complementary platforms with 4 network effects. I will map this out in Part 2.

Snowflake runs on AWS, Azure and Google Cloud. So it is platform-agnostic. It’s a data-centric service that sits on top of the cloud services. That is clever. But it also put Snowflake in the awkward position of relying on their primary competitors. More on that later.

For revenue, Snowflake is selling a product that is really an integrated bundle of three services:

- Data storage

- Data computation

- Data services

Snowflake’s customer list is another reason the company gets a lot of attention. It’s a who’s who of corporate America, including Geico, Pepsico, Office Depot, McKesson, Nielsen, DoorDash, Instacart, Anthem Health, Pizza Hut, Kraft Heinz, Allianz, Western Union, Square, Hulu, PetCo and many others. Capital One is a big Snowflake customer.

The other thing that has really gotten people’s attention is the management team, which is top tier. The founders are data experts. And the current CEO is sort of an enterprise SaaS rock star.

The bio from Wikipedia is that the company was founded in “2012 in San Mateo, California by three data warehousing experts: Benoit Dageville, Thierry Cruanes and Marcin Żukowski. Dageville and Cruanes previously worked as data architects at Oracle Corporation; Żukowski was a co-founder of the Dutch start-up Vectorwise. The company’s first CEO was Mike Speiser, a venture capitalist at Sutter Hill Ventures.” Sequoia capital also invested in 2018.

Then in May 2019, Frank Slootman took over as CEO. Slootman is as good a CEO in enterprise software as you will find.

- He led Data Domain from its early stage (about 20 people) to an IPO and then to a sale for $2.4 billion to EMC.

- He then took ServiceNow from $75 million in revenues in 2011 to $1.5 billion in revenue in 2017. And to a market cap of $48 billion.

The Financials and Operating Numbers Look Really Good

The financials are pretty simple. And are what you would hope to see in an enterprise SaaS company at this stage.

- Smaller but rapidly growing revenue. See below. B2B enterprise depends on direct sales so it usually grows slower but more predictably than B2C. Snowflake has been growing over 100% but you would not expect to see B2C-like growth at larger revenues.

- Large and increasing gross margin. Currently at 59%.

- Big spending on marketing and R&D, resulting in negative operating profits.

The company has two revenue streams:

Product sales

As mentioned, they sell bundled products of storage, computation and services (no ala carte). Customers are charged based on consumption and usage, which customers like but also makes revenue harder to predict. It also means product revenue should increase with more data usage over time. As the company increases its use cases, activity and revenue should continue to increase.

Product sales are 94% of revenue and have a 65% gross margin (which is increasing).

Most product revenue comes from 1-4 year contracts based on minimum usage. Usage that is not used can be rolled over to the next contract. And these contracts are prepaid, making the working capital ridiculously negative. Snowflake also offers a monthly on-demand service, but this is mostly for onboarding and getting new customers started.

Professional services

This includes training, installation and customer service. The company sells these at a loss to onboard clients and usage.

Professional services are 6% of revenue and had a -27% gross margin (which is increasing). See below.

But this is a SaaS company so the number everyone is watching is net dollar retention. What is the net customer growth, spending and retention?

Snowflake’s net dollar retention is really high at +150%. Meaning an increase in customer spending of 58% over the same period the year prior, including customer churn.

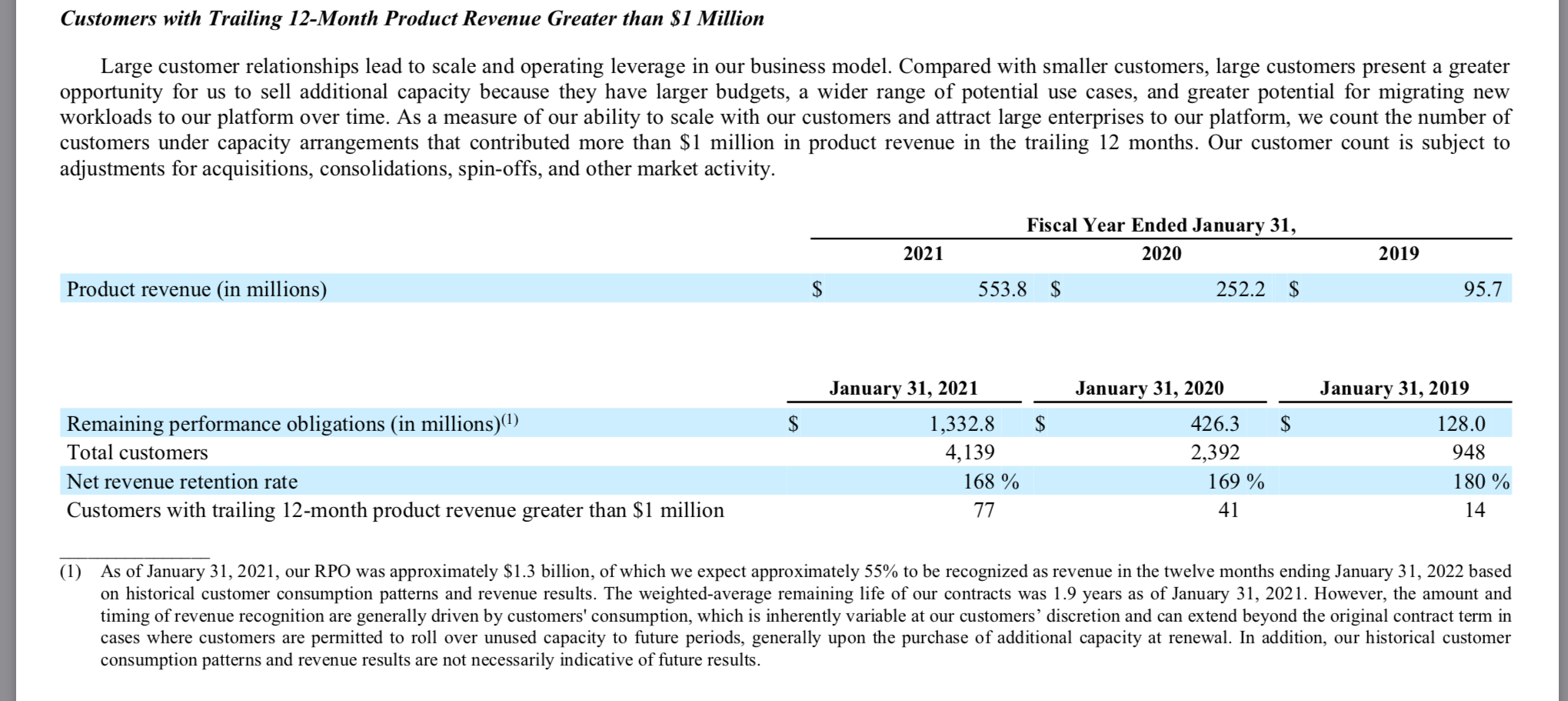

Look at the below total customer number for clients with over $1M in annual spending.

***

Ok. That’s the basics for Snowflake.

But this is about digital strategy. And I have yet to see a good explanation of the business model for Snowflake. Lots of words. But I haven’t seen it clearly mapped out.

Here are my 6 initial conclusions for the business model.

Initial Conclusion 1: Snowflake Dramatically Improves the User Experience

Snowflake has 4 user groups on 3 platforms. The user groups are:

- Internal customer teams and individuals

- External customer partners

- Application developers

- Data providers

They are clearly focused mostly on aggregating demand, which is corporate customers and their internal users. That is the key activity happening at this stage.

And this is where Snowflake is dramatically improving the user experience. That is the #1 digital superpower I look for. Can you use a digital tool, product or business model to dramatically improve the user experience? Can you make other products / services almost obsolete?

Obviously, the cloud and the SaaS model have re-written the rules in this regard. Customers really like software as a service as an alternative to buying and installing servers and software on premise. Although the costs of these software services can grow significantly with scale.

With Snowflake, you can see the typical SaaS benefits for corporate clients (versus on premise):

- Easy setup

- Use as needed

- Scalable architecture across many clients

- Integration with different systems and cloud providers (AWS, Microsoft Azure, Google Cloud Platform).

- Zero planned downtime

However, Snowflake is a bit different as it is charging based on consumption, not the typical SaaS subscription model. In this, it’s closer to Google where a fee is charged each time a user accesses or analyzes the data warehouse. That means less predictable revenues than a subscription. But the revenue should naturally increase with more users, data uploaded and analytics performed.

They are also offering an on-demand model with month-to-month contracts to get customers on board. Then they are moving them to a prepaid longer-term contract. Prepaid contracts and big growth margins are both strong indications of the big value to customers.

There are two other aspects that got my attention in terms of the value proposition to users.

- This is strategic spending by customers. This is not typical and necessary corporate spending on operations, where companies try to minimize costs. Data capabilities are strategic spending where you try to outspend your competitors and gain an advantage. That is totally different spending behavior. And a much better business. CEO Frank Slootman has said “data is a strategic asset…This has been true for the past 30 years.”

- Data is an AI multiplier. Data is a complement to AI. More data makes the algorithms more valuable. And vice versa. Like hot dogs and buns. Notice how Snowflake begins with a data warehouse service but then immediately ties that to all the other software being used. To apps being developed. All of this will increase the value of the data to customers.

Generally, there are 4 situations I really like when it comes to B2B enterprise services.

- Strategic spending. As mentioned, companies spend much more freely when it is viewed as a strategic cost. This is typically in marketing and R&D. But this is also in data analytics and AI. The goal of the company is not to cut costs and be really efficient, but to outspend competitors.

- Critical workflows. Here you don’t want to outspend competitors. But you also don’t want to take any chances just to save 10%. You don’t cut corners on the computer security systems at a major bank. You don’t got to a cheaper heart surgeon to save some money. Enterprise services for critical workflows is a nice space. Note: IBM’s entire strategy is about providing the hardware, software and services for “critical workflows”.

- Key control points. Being the primary access point for a company or its users is usually a point of control. Like how Apple, Facebook, Google and WhatsApp are the primary access points for most consumers. Everyone else ends up working for you. Slack has tried to be this access point for enterprises, but it looks like Microsoft Teams is beating them.

- Platform business models. This is when an enterprise service becomes an innovation or coordination platform with lots of other functions. For example, Microsoft Teams is basically becoming the operating system for lots of enterprise apps that companies use.

Snowflake is definitely positioned strongly for #1. I think it will likely move into #2 and #3, which it mentions in its filings. And it is is definitely going for #4, which will be discussed in Part 2.

***

Ok. That’s enough for today. I’ll go into the platforms and network effects in Part 2.

Cheers, jeff

-—–

Related articles:

- Snowflake is Building 3 Complementary Platforms with 4 Network Effects (Pt 2 of 3) (Asia Tech Strategy – Daily Lesson / Update)

- Part 3: Snowflake’s Big Growth and Competition Questions (Pt 3 of 3) (Asia Tech Strategy – Daily Lesson / Update)

- Kingsoft Cloud and How to Think About Cloud Services in China (Asia Tech Strategy – Daily Lesson / Update)

- Baidu Is Externalizing and Exploiting AI. But It’s All About Cloud. (Pt 3 of 3) (Asia Tech Strategy – Daily Update)

From the Concept Library, concepts for this article are:

- Cloud Services

From the Company Library, companies for this article are:

- Snowflake

Photo by Zdeněk Macháček on Unsplash

——

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.