In Part 1 and Part 2, I gave some background on sports apparel in China and detailed my visit to the first Tmall – Intersport store in Beijing. It was pretty great. With lots of new digital initiatives. Note: the above picture is what happens when you change the gender setting on the magic mirror.

Here are my take-aways on what is happening in new retail in sports apparel:

Step One, Like Always, is Digitizing the Customers

A lot of what is going in the store is getting customers to log-in or scan a QR code (or get facial recognition). You have to identify customers and, if possible, tie them to their Tmall accounts. That creates the digital connection and starts to get the communication and data moving.

Step Two is Upgrading and Personalizing the Consumer Experience

Intersport was already beginning to improve how customers shop – and specifically search – within the store.

- The mobile app and various screens meant that the number of available SKUs (in-store plus online) was dramatically increased.

- They were starting to improve the shopping and discovery experience with new tools like magic mirrors.

- They were personalizing the inventory.

- They were starting to provide fast and convenient delivery or pick-up.

One of the most powerful aspects of new retail is you can personalize the items and experience person-by-person. We are used to this online. But it is something new in the physical world. Everyone has different items in their Amazon feed. But everyone sees the same items in a Zara store.

Step Three is to Increase the Number of Users and their Engagement

This is really important.

New retail, like all digital businesses, runs on users, engagement and data. It’s not enough to get people into the store. You need people to participate and to do things. This is why Facebook and Twitter are always encouraging you to post. The more engagement there is, the more data there is. The more data there is, the better the service usually becomes individually and in the aggregate over time.

My standard saying is: “When in doubt, bet on the company with the most users, engagement and data.”

Step Four is to Re-Imagine Operations and to Increasingly Merge the Online and Offline Activities

Once the customers and store operations are digitized, things can really start to change. The digital tools can be improved rapidly. Computer vision, natural language processing, virtual assistants and other tools keep emerging and improving. In the Intersport case, you can also integrate the store operations into parts of the Alibaba ecosystem.

This is all fascinating and moving fast. I think it mostly comes down to new “use cases”. In some businesses (i.e., retail coffee), new retail doesn’t generate that many new use cases. In others (i.e., supermarkets), it creates tons of possibilities.

So my primary question at Intersport was “how many use cases are there for new retail in sports apparel?”

New Retail Can Be Transformative – or Just an Operational Upgrade

Here’s the problem with new retail in a lot of sectors. There just isn’t that much to do.

I use Luckin Coffee to order coffee on my phone. The app tells me when it’s ready. I walk to the outlet and my coffee is sitting on the counter waiting for me. I scan my phone, pick it up and go.

Ok. That’s nice. But it really isn’t that different from just doing it normally. At best, it’s an upgrade in convenience.

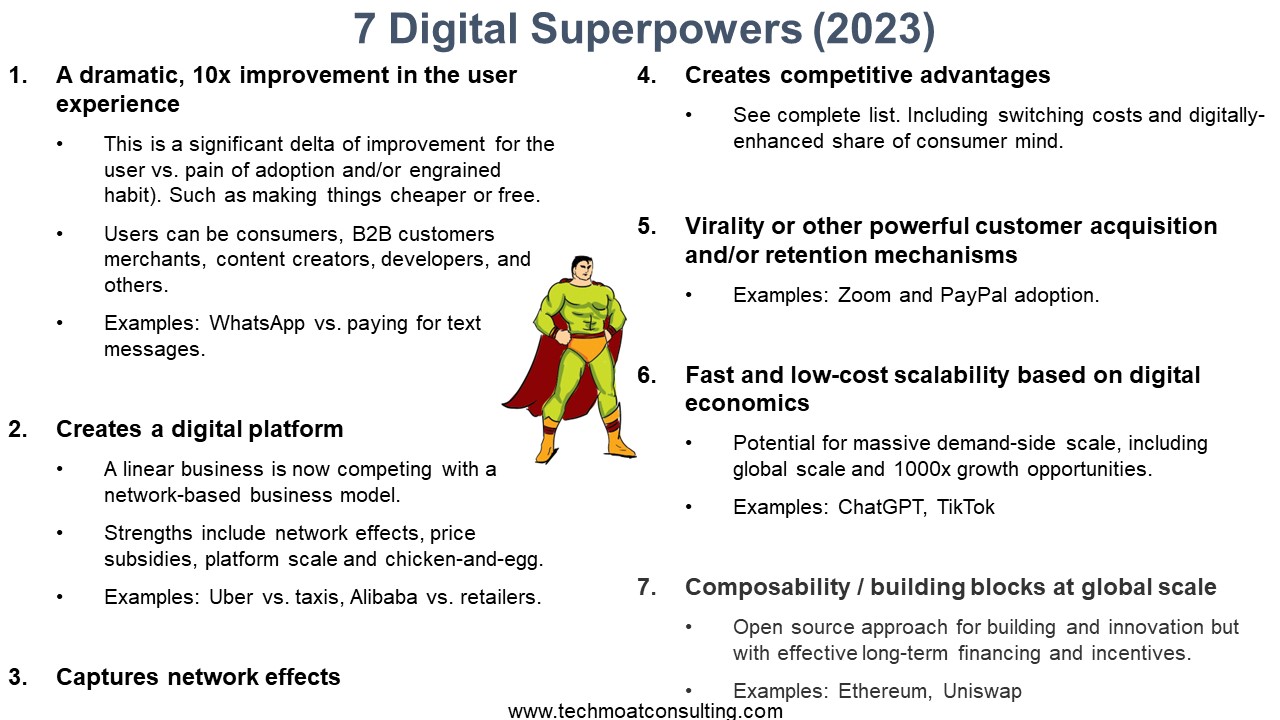

I have argued that there are some particularly big changes you should watch for with digital tools. I call these digital superpowers. If one of these happens, you can become a dramatically better business very quickly (i.e., you get a superpower). Other digital initiatives tend to just be upgrades. Luckin Coffee is a good upgrade but it doesn’t have a superpower.

One of my digital superpowers is a dramatically improved customer experience.

This is when an existing non-digitized customer experience becomes obsolete and unacceptable. Mobile payment did this to credit cards in China. Bike-sharing did this traditional bike-rental businesses. And Alibaba’s Hema is really doing this to traditional supermarkets. Last year, I asked Alibaba President Michael Evans which of the new retail business models he was most excited about and he said it was grocery and supermarkets. Mostly because of the long list of use cases it offered.

My conclusion from my visit to Intersport is that new retail for sports apparel really has lots of interesting possibilities. I think there are potential superpowers here. As mentioned, there is digitization and delivery. And there is combing the online inventory with the in-store inventory (via magic mirrors and smartphone ordering). There are good but I don’t think they are transformative.

I think the transformative / superpower areas in sports apparel are the two things that supermarkets don’t have.

1) Sports Retail has a Community that Really Cares

Runners really do care about running. They are passionate about it. They do it for years and often decades (before their knees go). And so they really care about the quality of the shoes and apparel. You don’t see this sort of enthusiasm in a supermarket.

There are active communities and events around these sports, especially running. There are marathons. People track their runs and share their routes and times in real-time. People run in groups. There are local running clubs. And there are online communities where people talk about running, hiking, bicycling, basketball, climbing and such.

All this is great for digital.

Digital tools are particularly good at creating and engaging communities (hello WeChat and Facebook). This creates lots of possibilities for new use cases in social media, social networking, communications, group activities, sharing activities, KOLs, virtual gifting, advertising and sponsorships.

Sports retail (once digitized) can expand in lots of interesting ways because of the community, communication and emotional aspects that are not present in supermarkets and retail coffee.

2) Sports Apparel is Tied with Entertainment

People who buy running and basketball shoes also watch a lot of running and basketball. They know who the famous runners and players are. And much of the appeal and perceived value of the products comes from the entertainment aspects. They may not run themselves. But they definitely watch on tv.

In a traditional physical store, there are not too many ways to tap into the entertainment aspects. You can put up pictures and play videos in the store but that is about it.

But when you merge online and physical, you can really lean into the media and entertainment aspects (which are really just digital goods). That offers lots of interesting opportunities for a fully digitized sports retail store.

- Could the Intersport store experience be combined with Youku sports content? Could you combine what customers see in the store and on their phones with live entertainment, videos and information?

- Could you combine viewership and viewership information with product sales?

- Could you do “See now, buy now”? This was Alibaba’s big push at the Singles’ Day Gala (you can buy anything you can see on the screen).

More and more in China we are seeing how content can drive e-commerce. And there is a lot of content in sports. Alibaba is very clear about their belief that their future growth will come from e-commerce and entertainment (and local services). TikTok is really big in this now.

Conclusion: New Retail for Sports Apparel Is Retail Plus Community Plus Entertainment

This is my main take-away and my working thesis. A lot of new retail is about being more efficient and productive. And about upgrading the customer experience. Fine.

But every now and then, new retail is about dramatically improving the customer experience, such that it makes the traditional stores obsolete. Hema is doing that for supermarkets. I think this will probably happen in fashion. And I think this may be possible in sports apparel. And this digital superpower can really happen when you can combine retail plus community plus entertainment.

Anyways, that’s my take. Thanks for reading.

Cheers, Jeff

———-

Related articles:

- Digitizing Sports Apparel: My Visit to the Tmall – Intersport Store in China (1 of 3)

- 3 Lessons in Digitizing Sports Apparel from Intersport and Alibaba (2 of 3)

- Alibaba and Intersport: New Retail Is a Big Deal in Sports Apparel (3 of 3)

From the Concept Library, concepts for this article are:

- Retail

- New Retail/OMO

- China

From the Company Library, companies for this article are:

- Intersport

- Alibaba

———-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.