At Alibaba’s Investor Day, CEO Daniel Zhang outlined 11 growth stratgies. Five were under Domestic Consumption. The question for this class is which is the most effective of these? Which is most likely to succeed and move the needle?

You can listen to this podcast here or at iTunes, Google Podcasts and Himalaya.

The choices are:

- “To continue growing our digital economy user base”

- “To expand consumption categories and consumer wallet share in our digital economy”.

- “To develop new supply categories and supply-side transformation based on consumer insights.”

- “To create or redefine online / offline retail formats leveraging our digital technology”

- “To upgrade Alipay from digital check out to digital check in.”

The mentioned slides are below.

Related podcasts and articles:

- #30: Ecosystems vs. Platforms

Concepts for this class.

- Ecosystems vs. Digital Platforms

- Linked Businesses

- Complementary Platforms

Companies for this class:

- Alibaba

————

I write and speak about digital China and Asia’s latest tech trends.

I also teach Jeff’s Asia Tech Class, an online course and daily commentary for busy executives on Asia tech and China’s digital leaders.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.

—–Transcription Below

:

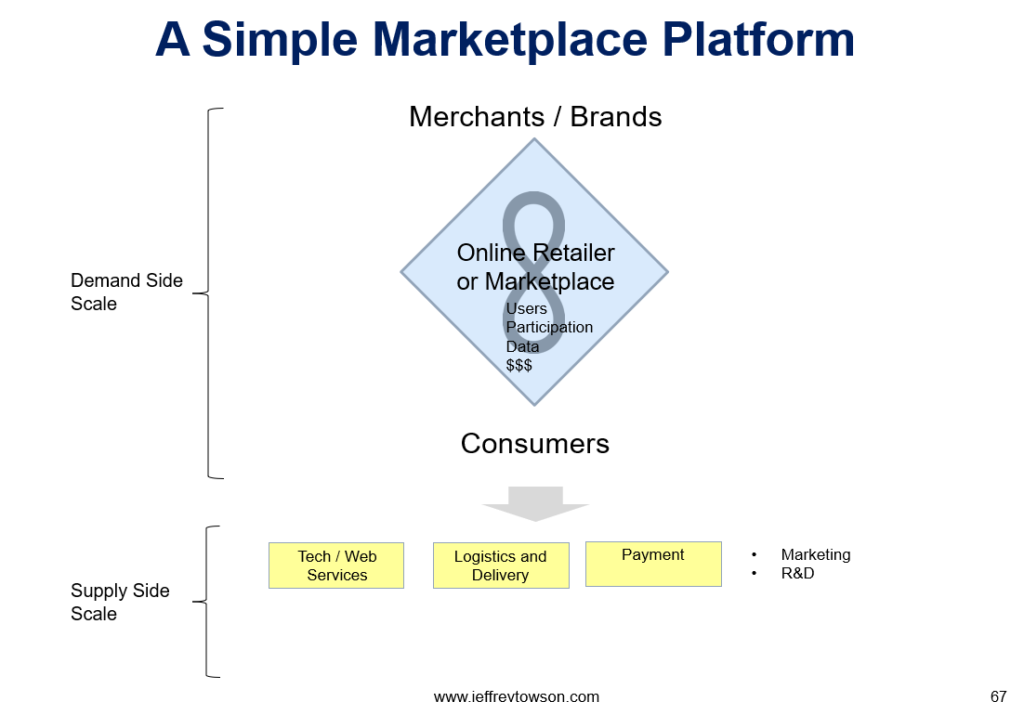

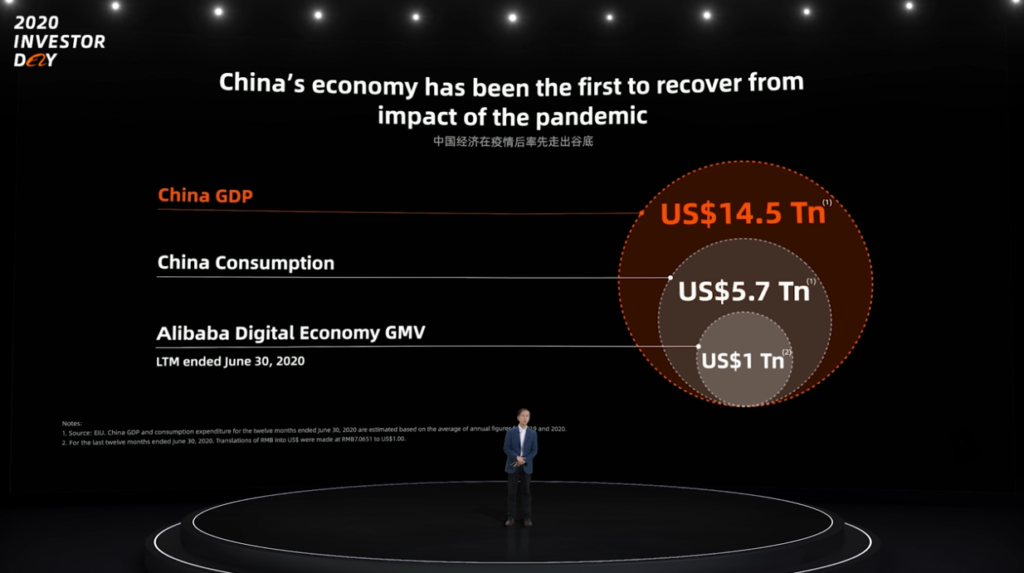

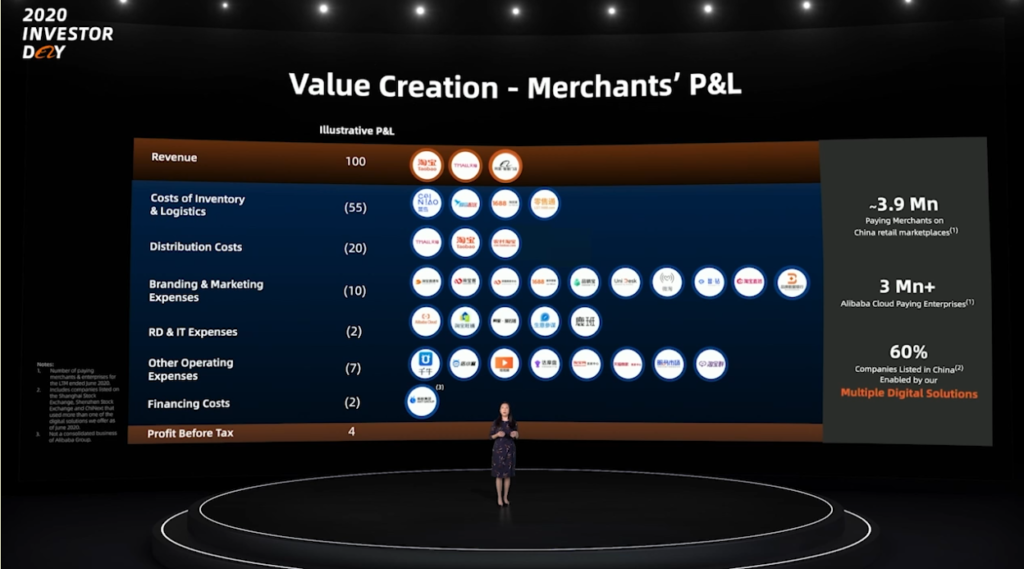

Welcome, welcome everybody. My name is Jeff Towson and this is Tech Strategy Podcast. And the question for today’s class, what is Alibaba’s best growth strategy? And this is really following up on their Investor’s Day conference, which was last week. And as part of that, CEO Daniel Jang, put forward 11 growth strategies for Alibaba. It was kind of confusing. put them into two buckets, well, three buckets, but it’s mainly domestic consumption had five strategies, i.e. growing in China based on consumer demand spending. And then the other bucket was the cloud business, Alibaba Cloud, which was another five, not gonna go into that because that’s a whole nother subject. And then there was one more, which was international growth, which was more or less AliExpress and mostly Southeast Asia. What was he talking about? Now I want to talk about sort of what is the best one in that first category of domestic and consumption, which is their core business thus far. And we’ll do this as a case. I’ll lay out the five options, the five strategies, and I’ll ask you to make a decision, which one do you think was good and why, and we’ll tie that to some theory. And it should be fun. It was a pretty great couple of days. It was online. For those of you who are subscribers, I sent you out kind of a really long email about this. on a couple days ago and there’s another one going out tonight on the cloud side of it. So it turned into kind of a writing marathon. But there’s a lot of great sort of strategy thinking in there. So anyways, we’ll talk about the five on the domestic consumption side and then everyone will vote and we’ll see where we end up. And this is the 50th podcast, which is kind of crazy from my side. So that’s 50 plus hours of me. basically talking about various companies and the digital strategies ideas underneath them. That’s kind of crazy. You know why people do interviews on podcasts is because it’s really kind of easy. You just invite someone in who’s interesting, he’s got some cool skills, knowledge, and then you talk. It’s not that much work really. And putting up a podcast, technically it’s really pretty easy. Making videos is a bit harder. But it’s a good format and it tends to be more engaging listening to two people talk or watching two people talk as opposed to one guy sitting there. So it’s pretty popular. And I thought about that and I eventually decided I wasn’t gonna do that because I don’t think it works if you’re trying to build knowledge systematically. I think you actually have to go through it like a course curriculum and go through idea after idea and they add on each other and the companies add on each other and you start to make ground. Interviews I like interview podcasts for things like AI use cases and just fun stuff but it’s scattered which is fine for some things but I kind of said look I can’t really do that I’m going to have to come up with some sort of strategy lectures kind of what you’d give in school. and that actually takes a long time. It takes a lot of time to put together an hour of speaking on a subject, especially if it’s on sort of the frontier of thinking where it’s a lot of new stuff. So I kind of chose the hardest path, I guess, and lecturing is kind of harder than interviewing, and frontier thinking is harder than saying, you know, hey, I’m going to talk to you about accounting, because you can just go chapter by chapter through the accounting textbooks. Well, there’s no textbooks for most of this, so it’s… I don’t know, it sounded like a good idea when I was starting out, when I was at the Best Buy in Las Vegas and I just randomly picked up a travel microphone and then I got back to Bangkok and I said, oh, I will plug that into my laptop and we’ll try this. It was actually a very long road. It was a lot of thinking and work to put together that much content. So this is Podcast 50 and I’m sitting here having a couple beers as I do this. I’m not really sure what the appropriate behavior in terms of drinking while teaching or drinking while podcasting is. Anyways so this is episode 50 and for those of you who aren’t subscribers please do so. You can go over to jeffthousand.com and sign up there. There’s a free 30 day trial. Try it out, join the class and see how it goes. Alright, let’s get into the content. Now, Daniel Jung gave his talk and they had some nice slides and I’ll put the link down below and I’ll also put the key slides I’m going to mention from that. But I mean, he basically began with a big vision. Right. Here’s the vision for Alibaba 2036, 16 years from now. I’m not sure how they came up with 36. And the numbers. he showed where basically or the vision was two billion consumers and 10 million profitable SMEs, small and medium enterprises. Now, I mean, this is sort of goes right to really the heart of what I’ve been saying since podcast number four, which was how did Alibaba become so successful? And it was basically where I started to talk about marketplace platforms as a business model. and you’re probably sick of me talking about that by now, but multiple user groups, you get the user groups, you serve both of them, you help them interact, and out of that, you start to generate three to four main intangible assets, which are users, engagement, data, and money. Well, money’s tangible, I guess. And, okay. So his big slide is, I mean, it’s basically telling you who the user groups are. I mean, Alibaba is a platform business from top to bottom. That’s what they do. Virtually everything they’ve built is a platform. And they’re telling you our two platforms are consumers and profitable or SME, small and medium enterprises. So, okay. And they tell you how many they want. 10 million and 2 billion. Okay. Interesting. And I think that fits right into the model. Now, you know, it’s worth noting, okay, if they’re going for 2 billion consumers, well, there aren’t 2 billion people in China. It’s 1.4-ish in China, and not all of them would be consumers. You know, 5-year-olds aren’t consumers. So, you know, they typically say this is Alibaba stuff. They have 1.2, 1.1 billion consumers in China as a demographic. Okay, so where are the other 800 million gonna come from by 2036? And they kind of dodge this question. They don’t really say. People have been asking this for years. And you know, the usual, the answer you get for sure is Southeast Asia, which they over and over refer to as a strategic market for them. I.e. we’re not going there opportunistically, not going there only if the ROI works out. No, this is their backyard. They’re going after Southeast Asia. You know, that’s six to eight countries, depending how you define it. But usually when they talk about Southeast Asia, they’re not talking about India, which sometimes when you talk pan Asia, you know, people put depends how far east they’re going to go, but definitely not India. So, OK, so that gets you, let’s say, six hundred, seven hundred million population. Actually, I think it’s closer to. you know, 700, 600, but again, some of those are kids. So you look at this region, that gets you about 550. So they’re still short about 250 that’s coming from somewhere. That could be AliExpress, Russia, Poland. They’re doing pretty well in Spain and Italy right now. So we kind of know where they’re coming from on the consumer side. And then the SME side, where are all those, you know, 10 million SMEs gonna come from? We don’t really know. Alibaba.com is doing a ton of stuff cross border right now. I’ve written a bit on that. Okay, but anyways, the whole point here is like, this is a platform strategy. That’s kind of what I’ve been talking about for 46 weeks now. That’s their long-term vision. Based on this, they’re gonna get users. That’s the core asset. Then they have to get their engagement, their participation. That means a different thing if you’re talking about like Yoku, which is a video site versus Taobao, which is a commerce site. Engagement would mean different things. It also kind of tees up this idea of M&A and acquisitions. And I’m gonna put this slide in here as well, but there was a nice slide by Maggie Wu, who is their CFO. On Investor’s Day, like. You know, they have media days and they have investor days. And I tend to get invited to mostly media, but some investor days. And on the investor day, everyone always wants to hear from the CFO because all the analysts from around the world who track the stock are trying to figure out that particular cell on their Excel. You know, they got to get that number right. So they tend to listen to the CFO. On the media day, it tends to be a lot more press. They generally want current news, and I kind of am neither of those groups because I’m thinking about strategy. But I generally go to both. Anyway, so Maggie Wu gives a nice slide about, which is quote, the rationale of our M&A and investments, unquote. And that’s kind of interesting. Why do they buy all these companies? Because they invest in tons of companies. And what I thought was interesting, and I’m gonna put the slide in the notes, or not in the notes, but there’ll be the link to the notes. We’ll show you the slide. I’m sorry, in the notes, there’ll be a link to my webpage. The slides are there. On the left, they talk about an increase. Their rationale is increase investments in strategic businesses. So they kind of tell you what’s strategic for them and what’s not, what is the foundation. And they list Ant Group, they list Sineo. Ant Group would also include Alipay. And I think they’ll probably end up listing Alibaba Cloud there as well. but that’s kind of the foundation. That’s their infrastructure. Everything sits on that. That’s strategic. And then they have other categories of M&A and I’ll just read you the titles. One would be new user acquisition. One would be user engagement enhancement and another would be business digitization. I mean, that’s pretty much platform strategy. Here’s the things we’re buying, investing in to get new users onto our platform. New user acquisition is their term. than the other one, user experience enhancement. That’s creating more value for all the users, which is really about getting them to be more engaged, to do more value enhancement, experience enhancement. That’s what they get when they come to the platform. And then business digitization, that’s something we’ll talk about, or I’ll talk about shortly, which is a lot of these sort of enhancements, these value creation activities and tools they do are really… focused on the merchant and business side, the SMEs. People don’t talk about that as much, but I actually think it’s, I think Alibaba is actually doing a lot more on that side of the platform than they are on the other one. I think a company like Pinduoduo is much, doing a lot more on the consumer side. Alibaba is doing a lot on supply chain, logistics, new manufacturing, that’s all that side of the platform. And then they have one more category for their rationale for M&A, which is called tap into new sectors. And this is where they would put stuff like, you know, partnering in electric vehicles, doing real estate. I mean, this would be a pretty good jump from what they do as a business today, but if they get a big track, a lot of traction going and say automotive, that could bring in any whole new bucket of users and activities. That would be like a quantum jump in all of this. So those are kind of the big moves. When you look under like new user acquisition, they’ll list something like their investment in Xiao Hongshu, in Billy Billy, things like that, which are adding video and content to their e-commerce to get more users in, things like that. They might invest in STO Express, which is an express delivery company that they would put under user experience enhancement, faster and better delivery, things like that. Anyways. Sun Art, which is shopping malls. They bought a bunch of shopping malls, department stores. Well, actually that’s more like department stores. That would be under business digitalization, which is moving up on that side of the platform, which I’ll talk about. Anyways, you get the point. But I thought that was, when I listened to their talk, it’s pretty much the same blue diamond charts I’ve been giving you for almost a year now. The language is a little different, but I didn’t see anything they talked about. in terms of big picture, which wasn’t what I’ve been kind of laying out over the past year. So that’s good, because I don’t want to get blindsided and think I’ve missed something. And this also does tie to a couple ideas I brought up under Ant Financial, which was about this idea of the sustained innovation trap of network effects and resilience or adaptation and resilience. And if you are a pure platform… If we take a step back and look at what they’re saying, is they’re basically saying, look, we are a platform building business from top to bottom. Our M&A, our investments, our strategies, it’s all about building the platform, which means getting more users, getting more engagement, getting more data, and then hopefully that turns into some money. Now, as part of that strategy, we get a lot of strengths because platforms, as I’ve said, that’s one of my digital superpowers. If you’re a multi-sided platform with multiple user groups, you have a lot of sort of strengths like subsidizing one price of the platform with the other. You know, drinks are free for ladies on Thursday because we charge men a little bit more. You can do stuff like that. You get network effects. That’s another digital superpower. It’s scalable. It’s mostly a software business. It’s not viral, but they have a lot of the strengths you look at. Now, One of the problems with this strategy, even though it has all these strengths, is you’re not really a self-contained business like I have a restaurant, I decide what the menu is, I check the quality of the food, things like that, or I’m not a factory. It’s not under my control. They’re in the ecosystem orchestration business where they’re not building services and products themselves. They’re helping other people out within the ecosystem to engage with each other. So they’re kind of ecosystem orchestrators and that’s standard for a platform business model. And you can scale much faster and people do the work for you and it’s pretty fantastic. The problem is the markets and the ecosystems are always changing. So you’re always having to adapt and respond very, very quickly to what consumers and businesses are doing. And Alibaba today, even on Taobao is very different than two years ago, three years ago and it’s different than three years before that. because you’re kind of a creature of the ecosystem and the ecosystem is always changing. So you have to stay closely attuned to that at all times. And I’ve brought this up under the smile marathon. You know, okay, apart from all these structural advantages you can have, you have to know what race you’re running every day. Are you in the scale business? Are you in the artificial intelligence business? I mean, what are you doing every day? And I’ve kind of said Alibaba to a large degree. is in the innovation business, the sustained innovation business, where they always have to be continually changing what they’re doing and adapting and adding more value to their user groups and responding to the fact that they are a creature of the ecosystem, but the ecosystem is always shifting. So they’re always continually innovating all the time to keep their market share, to keep their network effects, and to keep adapting. And I would also just say this ties to this idea of adaptation and resilience. which I talked about with Martin Reeves of BCG, which is, you know, you have to be just closely attuned to the market, to your customers, to what they want, and you have to be gathering data and analyzing the data. And he referred to Alibaba as a self-tuning organization, where the data’s always coming in, they are always reacting very, very quickly at the product level, at the service level, at the business model level, and even at the vision level. So that’s kind of the game if you’re gonna be a platform company. Yes, you have all these strengths, but you have to be continually adapting and continually innovating to match and add value to a changing ecosystem. If you’re just running a restaurant on a nice popular street and you’ve got a good like location, you don’t really have to worry about any of this stuff. It’s pretty static. You control your little world and it’s fine. So that’s kind of the trade off here. And they know this and that’s why they talk so much about their culture and other things, because that’s sort of key for them for resilience and adaptability, as well as innovation. Okay, now they go into some stuff that kind of got under my skin a little bit. They put up this slide, which it’s in the notes, which is basically they start to refer to Alibaba as Alibaba digital economy. And they say, you know, within… The last 12 months, $1 trillion worth of goods, GMV, gross merchandise value, passed through the platform. And that was about 20% of the total China consumption, which is $5.7, $5.6 trillion. Retail in China is about that. Now, the US is about the same. They’re kind of neck and neck. And that was a percentage of the Chinese GDP, 14 to 15 trillion. So they said, this is our ecosystem, our digital economy. And they start to refer to the company in that form. And that tees up this idea of our growth strategies, five of the 11, the five we’re gonna talk about, are under domestic consumption. So they tee this up, we’re a certain percentage of the entire Chinese economy and of overall consumption. Now this is kind of the key takeaways for today, and these are gonna be the learning goals, the key concepts for today. I want you to think about ecosystems versus digital platforms. And… This is actually one of the learning goals already. It’s learning goal number 30, ecosystems versus platforms and digital platforms in particular. And then complimentary platforms and linked businesses. So those are kind of the three ideas I’ll go through each of them. Because this idea is kind of nonsense. And I think this is some really fuzzy thinking and I don’t think it’s helpful. When you start switching from micro to macro, everything I’ve talked to you about so far has been very sort of micro. Look, here’s a platform. There’s merchants, they’re being connected with consumers and they’re buying laptops. I can get my brain around that business. That’s one platform business, Taobao. Okay, here’s another platform business. This is Alipay. It connects merchants. with consumers and they do payment and you take a percentage, or they do credit and stuff and that would be credit tech and that links into banks. Okay, that’s another business. I can sort of take apart these multiple platform business models and I think they have five or six of them now, one by one and add them up. And that gives me a bottom up understanding of this business. As soon as you jump to this idea of we’re a digital economy, then you kind of start doing top down thinking. Well, the economy is this big and Chinese consumers spend that much and we’re 20% of that. So we’re going to make money. And if we have 10 and you start to see people do this sort of analysis back of the envelope stuff, it’s I think it’s mostly nonsense. I think you shouldn’t think about it. I think this whole term digital economy is just going to lead you down a path to nowhere. Build from the bottom up or say you don’t know. That’s those are both good answers. But don’t hand wave and sort of say, well, the economy’s this big and we’re 20%, blah, blah, blah. Now, those of you who are in my PEE or valuation classes at PKU or such, you’ve heard me rant about this before. I don’t like top-down thinking. I think it doesn’t get you anywhere. And I also don’t really like, I don’t like when people talk about the GDP of China’s, or every year this comes out, there’s a big debate, what’s the GDP? The right answer is nobody really knows. Maybe if you really think about it, you can maybe get it within plus or minus 20 or 30%, maybe. You know, what’s the sum total of all the economic activity of 1.4 billion people in the last 12 months? You know, the right answer should be something like, well, it’s like 15 trillion plus or minus 30%. So maybe it’s 11 to 19, something in there. But you can’t get it any closer than that, it’s not true. But people say, no, no, no, no, no, it grew a 7.2% with no uncertainties whatsoever. That stuff drives me absolutely crazy. And I do a little exercise in class about, you know, figure out my weight. And students, you know, tell me how you’d figure out how much I weigh. And they say, well, we’d put you on a scale and we’d take a measurement. Well, would you take one measurement or would you take five? Oh, we’d take five. Okay, would you take them today, during the day, or all at the same time? Oh, we’d take them across the day in the morning. Okay, would you take them throughout the year? Would you just take them in one day? Oh, and if you do this sort of exercise with people, well, what’s the, okay, so you have lots of measurements and then, okay, how accurate is the scale? Plus or minus one pound, two pounds? How good of a scale do you have? How much does my weight vary? Is weight even a serious idea? Does it have any uncertainty? What if I say, don’t tell me how much I weigh, tell me how happy I am? Well, how do you measure that? That’s a very vague concept. So there’s concept uncertainty, there’s definitional uncertainty, there’s measurement uncertainty, there’s calculation uncertainty, and then there’s just variation. And most, you know, I go through this exercise with them and most of them agree at the end of it that they could probably figure out what I weigh. I’ll probably weigh 140. They figure out I could probably get my weight accurately figured out. 138 to 142 throughout the year. That’s a 95% confidence interval around that. Okay, and then I turn around and say, okay, what’s the GDP of China this year? And they all say, oh, it grew by 6.2%. I’m like, dude, you just couldn’t, you just realized you couldn’t tell me how much I weigh. You’re telling me how much the whole country is generating? It’s ridiculous. No uncertainties? Down to a 10th of a decimal place, really? And it was, I rant about this stuff all the time. and then they can’t get anywhere on happiness because it’s like, it’s a vague concept to begin with. And when you start doing investing, this comes up a lot because you realize valuation is very much halfway between those two ideas. To some degree, it’s something clear like weight, and to another degree, the value of a company is more like happiness because it depends on future events that haven’t happened yet. Anyways. So we get back to this idea of what is the digital economy? Is it a real concept? Can it be measured? Can it be measured reliably? No, no, it’s kitchen nowhere. And there’s a lot of this thinking sort of bubbling around. There’s another term I’ve brought up, which is the metaverse. This idea that we’re building a big, huge online world, epic games. They talk about this a bit. They’re trying to break the app store. Apple because they want to remove all the toll booths and create a metaverse where you can live there and buy things and anyone can Open a store. Nobody controls the online world Okay, that’s kind of a vague concept too Alex Jew the founder of Musically which became tick-tock. He talks about like building a company like tick-tock wasn’t called tick-tock back then, you know It’s like building a town and first you have to convince everyone to move to your town and then you have to, you know, then they start to do things and you have to convince them to stay and build their homes and build their lives. That’s getting people to come to your website. Again, I don’t think that’s terribly helpful. If you even just take a city, I can’t figure, I mean, how would you figure out? It’s even harder when you start thinking about digital because we’re no longer just talking about cash. We’re talking about user number, activities, data. How am I possibly gonna measure all those things from a top-down perspective? So I don’t buy it. Anyways, that’s my rant. I think you do it bottom up. You look at business by business, you look at platform business by platform business, which we’ve been doing, and then you start to add them together. And that gets me to the point finally at last, which is linked to businesses. What happens if you have two platforms, and you link them together. Well, I can understand each of the two platforms. Here’s Youku, that’s an audience builder platform, a video site, and here’s Taobao, that’s a commerce platform, marketplace platform doing commerce. What are the linkages between them? Oh, I can identify those as well. It’s a linked business. I can look at users. Okay, it can be the same users. Good. We can do cross-selling. Good. We can lower our customer acquisition costs because we can sell to them immediately. that’s useful. We can just shuttle money between them. If we have one business that’s a cash machine and the other that’s not, which Youku and these video sites are not, and Taobao is, which e-commerce sites are, we can just funnel the money over. Okay, we can add money. We can add resources like tech staff. We can use IP and technology if we develop from one to the other. We can actually take it apart systematically. And say, okay, here’s the linkages. I got the two platforms, I understand those, and the three linkages that really move the needle are these. Good, I didn’t need to jump to this idea of a digital economy. I can kind of figure it out. So that’s kind of one way to think about it is linked businesses, and that’s one of the key concepts for today, linked businesses. And we can see those a lot. We can see, you know. shopping centers and hospitals might own clinics and sometimes the businesses will be in the same relative field but sometimes they won’t be. One of my favorite companies to go through with students is Bic which makes pens and razors and they used to make lighters. They still make lighters but you know smoking is going down. Those are three very different businesses making pens, making lighters and making razors mostly for guys. But it turns out there’s actually some nice linkages between those and it makes sense to sell all three together because they have very common distribution and consumer habits. So you can often find very different businesses that look nothing like, but you’ll see that the linkages make sense. So linkages, that’s been around forever. Fine. Now I think when you take the linked business idea, one of the concepts for today, and then you move it to the idea of, well, what if it’s a linked platform? Because business could be a typical pipeline type business or it could be a platform business. What if we’re linking two platforms together? Is that different? And it turns out, yeah, it really is quite different. And I call that complementary platforms. And that’s the other idea for today. Linked business and complementary platforms. Because when I take Youku and Taobao and link them, there’s a lot more going on there because… These platforms are based on users and engagement and data and money, and I can use all of those things on both platforms. There’s a lot more I can link together when you’re building something based on engagement and data and user number, as opposed to, well, I have a hotel and I have a restaurant. Let’s link these two businesses. Maybe I save a little money on the real estate. Maybe I can cross-sell a little bit. Maybe I can put it down the street. You know, the linkages aren’t as powerful in a traditional business. as they are when you start putting platforms together, which is why I call it complementary platforms. So that’s sort of level two. We go from one platform to, hey, I’ve got three platforms. That could be like Garena and Shopee in Southeast Asia. They had a gaming platform, then they added an e-commerce platform, Shopee, and then they’ve added a payment platform, Airpay. Okay, we’ve got two to three complementary platforms as opposed to one. We can figure that out from the bottom up. Okay, but then you kind of get to the Alibaba level and suddenly you’ve got five to six platforms or Tencent. And at a certain point, I kind of start to call it, the phrase I’ve been using is digital conglomerate. Where we had, because we know what a conglomerate is. We’ve seen those before. They were around forever in the United States. They started splitting them up in the seventies. You still see a lot of conglomerates in China and Asia and South Korea and Japan. where these large companies will have lots of different types of businesses. So it’s not like two linked businesses. It’s more like, look, we got 10 different businesses. We’re in real estate, we’re in musical equipment, we’re in software, you know, a lot of different. At that point, I think we’re talking a conglomerate. And the way we’ve always sort of looked at conglomerates is, you know, this is the advantages versus the disadvantages of scale and scope, which I did a whole podcast on. which was you get a lot of advantages from scale. The bigger you get as a company, you get specialization, you get economies of scale, you can get cheaper, you can add more products, you get a lot of brain power. There’s a lot of advantages to scale. However, at a certain point, the company gets so big that you start to get some disadvantages like bureaucracy, complexity, difficulty of managing things. And so those start to outweigh the advantages. And at a certain point, companies don’t get any bigger. We don’t have companies with 20 million employees. They do sort of have a optimal size. Now in the U.S., most of the conglomerates that were built in the 60s, because everyone thought there was all these advantages, which there were, they mostly got split up in the 70s, and the corporate raiders came and made a killing by breaking them up. We still see them in a lot of the world. Okay, so if we’re talking about a conglomerate, is a digital conglomerate different than a traditional conglomerate? Not necessarily a conglomerate made of platforms, but just, let’s say I have 10 different businesses that are all basically software businesses, digital businesses, maybe three of them are platforms, maybe four, five, seven of them aren’t. Is a digital conglomerate different than a traditional conglomerate? Do we have more advantages? Do those disadvantages still apply? And I’m not totally sure yet. I’ve been thinking about this a lot over the last year. These companies like Tencent and Alibaba and Google, at what point do we consider them a digital conglomerate and not just three or four linked platforms? And do they have different advantages and disadvantages? And I think certain ones of them do. especially if there are zero human operations, which I’ve talked about in the context of AI and Ant Financial. I don’t know. It’s on my question list, but that’s how I would think about it to sort of wrap this part up. Forget these terms digital economy, and I think forget the GDP stuff too. Forget the metaverse, forget all of this. Do bottom-up thinking, traditional business, platform business. pipeline business that’s digital, platform business, add two or three of them together, we get linked businesses and we can figure out the linkages. If we get multiple platforms, we can get complimentary platforms, which is quite powerful. And then we have conglomerates and this emerging sort of idea of digital conglomerates. Okay, that’s how I break it apart. And with that, let’s finally get to the question for today, which is, what is Alibaba’s best growth strategy? of the five they outlined for domestic consumption. So Daniel Jang basically put up a slide that said, here’s our five growth strategies for domestic consumption. He said, we have 11 growth strategies. And I actually thought that was kind of confusing. Like, when I look at the 11, it looks to me like platform strategy with different wording and sort of broken up in a complicated way. But okay, he said here’s five under domestic consumption, five under Alibaba Cloud, one for international. Within domestic consumption, here are the five that he listed and this slide is on, you know, the link in the notes goes to the webpage. This slide is there with the other slides. Okay, number one, to continue growing our digital economy user base. Number two, to expand consumption categories and consumer wallet share in our digital economy. Number three, to develop new supply categories and supply side transformation based on consumer insights. Four, to create or redefine online offline retail formats leveraging our digital technology. Five, to upgrade Alipay from digital checkout to digital check in. Okay, that’s a lot of verbiage. That’s a lot of, I don’t know, too many bland words there. I think an analogy would have been helpful or a photo or something, but. I’ll take you through the five and then I’ll ask you, if you were a VP at this company and they said, what do you want to focus on? And you know you want to focus on something where you can really move the needle. So when you come back a year, two years later, and they look at where their growth came from, because this is all about growth, they point to your area. So this is a lot about picking the right area to focus on. So. I’ll go through each of them and then pick, you know, which area would you focus on? Where do you think the action really is? Because it’s not gonna be in all of them equally. Some are gonna be more effective. Some are gonna be easier to pull off. Some are gonna be larger impact. There might be some that have a really large impact, but they’re very hard and they take a very long time. Others might be, hey, it’s not as big, but you can get this done easily. High probability of success. You gotta think of all that stuff when you’re playing the executive game. which I don’t because I’m terrible at it. Okay, but number one, to continue growing our digital economy user base. Okay, the key word there is user, right? This is standard. We’re a platform business model, domestically. This is about domestic consumption. One user group we’re talking about is Chinese consumers. Bam. The other group, they’ve already told us what the group is. It’s small and medium enterprises. Now those can be domestic for sure, but those can also be international because a lot of the companies that, when you’re serving domestic consumption, that could be a lot of international SMEs sending their stuff into China. But their foundation, their big engine is Chinese consumption. Okay, user number. He’s basically saying, look, we’re gonna grow our business, our quote unquote digital economy by getting more people. users on the platform. Now they actually have quite a few user groups because there’s more than one platform business here. Right there is sort of Taobao and Tmall. That’s their core business, their foundation. Okay that’s merchants and that’s consumers. A lot of SMEs but they also have big brands. But they also have Ant Group. You know they have Alipay and they have people who watch videos. So we have content creators. and they have delivery people, they have Tainiao. I mean, they do have quite a few user groups across their five to six platforms. I mean, they have insurance companies, they have banks, they have asset management companies. I mean, there’s a lot of user groups on Alibaba these days. But the two that matter most are the two they outlined in their 2036 vision, SMEs, Chinese consumers. Well, consumers, but mostly Chinese. restaurants, movie theaters, those would all be part of the user group. Now, when you look at how they’re going to grow this, how do you grow the number? So we’re not going to get them to spend more, we’re just going to get more of them on the platform. And if you look at kind of what they’re doing to do this, there’s initiatives all over the place. You know, you bring a bunch of people on the platform for Youku to watch videos, and then you can start to sell them stuff. So you can cross-sell and things like that. You share data, you share users. So examples of this new retail, the whole we’re going to build supermarkets, which are awesome, by the way. And, you know, we’re going to merge sort of the online and offline experience and you’re going to walk down to your local supermarket and it’s going to be sort of this great experience of you can pick stuff up there, have it shipped to your home, whatever you want. Now, when I saw the new retail play, everyone talked about how cool it was to go into the supermarkets. You can order on your phone, you pay with Alipay, you can have it delivered immediately, they’ll cook your dinner. It was e-commerce plus services plus retail plus logistics all in one location, 15 to 20 minutes from your house. That’s what people talked about. When I looked at it, the first thing I thought was, this is a massive jump in their user number. That’s what this is. Because when they say SMEs on our platform, they’re talking about online businesses. They’re talking about people that ship online. They are not talking about your corner convenience store. They are not talking about the corner restaurant, well, not up until recently. You know, 25%, 26% of retail in China is online. The other 75% is offline. There’s a whole world of companies out there that aren’t in that category. So it looked to me like they’re gonna try and add a bunch of physical retailers as a user group to their platform. and that’s millions of companies in China. So this could be a massive jump in their user number on the platform by bringing on physical retailers in addition to the online retailers, which is really what they mostly have right now, if you can get them to sign up for new retail. So who did new retail target originally? They did the supermarkets because I think there was a lot of use cases there, but they also immediately started talking about mom and pop shops. You know, these. millions of tiny little stores all over China where it’s usually just two people sitting there selling cigarettes and a beer and some soda. They went after that huge group of tiny retailers, physical retailers, as a user group. When they talk about daily life sciences, this is under Ant Group, which is really Ulama, but now they’ve put it under Alipay. This is a ton of local service companies being added as a user group. Pretty much everyone on your street, the local restaurants, the education people, the person who cuts your hair, a putician, all of that stuff, the trainer, maybe the doctor one day. That’s all about bringing local service providers as a user group onto the platform. And then the digital finance companies under, and I talked about that, that’s insurance companies, banks, asset management. So all of those things, when I look at those. Before we even talking about money or in engagements and interactions, it looks to me like just big jumps in the number of users coming onto the platforms. Okay, so that’s option number one. Do you think that is the biggest move to grow this business is just, let’s just get more users. There’s a ton of SMEs out there that aren’t even involved in this yet. Let’s bring them on. Retailers, service companies, banks, tiny banks, whatever. All right, option number two. quote, to expand consumption categories and consumer wallet share in our digital economy. OK, now that’s, you know, if your first asset you use to build these platforms as users, the second thing is engagement. OK, this is basically getting the people that are on your platform to just do more stuff. To quote, expand consumption categories and consumer wallet share. So this is like, look, you’re already on our platform as a consumer. We just, and you’re spending some money, maybe you’re buying dinner, maybe you’re buying, we wanna expand the amount of money you spend on the platform because you’re adding more categories of stuff you can buy. So our percentage of wallet, that’s kind of your total addressable market on the consumer side. And they wanna expand the percentage of your wallet as a consumer that is spent on this platform. So they add categories. And it also gets you more engagement, it gets you more data. So it’s not really about increasing the number of users. It’s like, let’s take the users we got and get them to do more and spend more. Okay. Now that is one of the reasons I really like e-commerce as opposed to the land of TikTok and Tencent because if the total addressable market on the consumer side is the wallet, I mean, that’s it. Like the total market they could get is determined by how much money is in the wallets of Chinese consumers. And that’s an awesome trend because that number keeps going up year after year. This group is getting wealthier and wealthier. So the total addressable market, the wallet size is increasing year after year. So that’s a good game to play. TikTok and Tencent and Facebook, they don’t have that game on the consumer side because they’re not fighting for a share of your wallet as a consumer. They’re fighting for a share of your attention. How much time do you spend watching TikTok? And if you’re watching TikTok, you ain’t watching Facebook, which means they can’t sell ads. And the amount of attention in the world is fixed. And there’s only 24 hours a day. That total addressable market is not increasing, at least on the time side. It could be increasing on the digital advertising side, but not in terms of attention. Attention is a zero sum game. Share of wallet is a growing market. It’s a growing pie. So I guess it’s not a zero sum game, but it’s sort of a fixed game as opposed to a growing pie. There you get what I’m trying to say badly there. Okay, is that a better game to play? We should go with strategy number two. For domestic growth, for growth of domestic consumption, we should focus on getting the people we have to spend more consumer wise. And just that’s the biggest lever we can pull. Okay. Option number three. Okay, strategy number three, quote, to develop new supply categories and supply side transformation based on consumer insights, unquote. Okay, that’s actually pretty good language. It’s kind of complicated, but it’s actually, there’s actually some really good thinking there. It’s just a little wordy. This is kind of like strategy number two, but instead of focusing on the consumer side, let’s get more of the people’s wallets. This is focused on the merchant side or the supplier side. So now in that case, we’re not going after the wallet of a small retailer, whether physical, online, on the platform. We’re really trying to get new supply categories and transform what’s happening in their business. So they say supply side transformation based on consumer insights. Now, let me explain that. There is a slide. in the notes which is by Maggie Wu which is called Value Creation Merchants P&L and she’s basically put up a P&L for a typical merchant. So at the top of it it says revenue and they have a fake number 100. Underneath that they have cost of inventory and logistics minus 55. So it’s like for every hundred dollars this merchant would spend 55 on inventory and logistics. Next line item, distribution costs, 20. So of every $100 of revenue, the merchant spends 20 on distribution. Next one, branding and marketing expenses, that’s 10. Next one, R&D and IT expenses, that’s two. Next one, other operating expenses, seven. Financing costs, two. Profit before tax at the end, the leftover is four. So what she’s basically laying out this idea of, look, on the merchant side, we’re not trying, on the consumer side, we wanna get more of your wallet. You have so much income, we want a certain percentage of it. This one’s more like, look, we’re looking at the P&L, we’re looking at the P&L of a typical merchant. We want to add value to every item on their P&L. such that they save money on each one of those items. So of their typical $100, they don’t make four, they make 20 because we’ve helped them lower their cost of inventory. We’ve helped them lower their cost of logistics. We’ve helped them lower their distribution costs. And we wanna provide as many services to them as possible because at the end of the day, the way Alibaba makes money is they take a percentage, sort of a take rate, mostly from the merchant side. So let’s say they take 2%. Everything a merchant spends of that 100, they spend 96. You know, they would typically take 2% of what used to be just the cost of goods sold. But every time they address more of those line items, they’re taking 2% of a bigger number. They’re taking 2% of more of that company’s business. As opposed to we just take 2% of the cost of goods sold. So they’re trying to add value at every one of those levels. So that’s basically what their total addressable market is. And this is how Maggie described it. Our total addressable market is to expand within the P&L of the merchants on our platform and do more for them and make them more efficient and productive and effective and cheaper. And all of that value, we will take a small take rate, one, two, three, 4%, but it’s of a much larger number. So that’s kind of the same game here. They’re expanding on the merchant side. That’s why the phrase they use is supply side transformation based on consumer insights. A lot of the value they’re adding is data now. They’re not just saving you money on shipping, which they’re doing. They’re also helping you understand consumers better so that you choose better items for merchandise and you sell more and your targeting needs better. All of that will improve the P&L of a merchant. Alibaba will make more money. That’s a pretty cool way of thinking about it. And you can see them sort of doing lots of initiatives that all go under this category of supply side transformation. For example, think of all the money they’re spending on Sineo. These huge logistics networks they’ve built that are becoming digitized and connected and smarter. Think of all the value that creates for merchants. They have the Tmall Innovation Center, which is basically a data-driven sort of R&D center that exists at Alibaba, and they work with the major brands, Mars Bar Snickers. This is a group that came up with Spicy Snickers, and they help them do product design in coordination with Alibaba, and instead of taking 18 months to design a new beverage, which would not be uncommon in a F&B, they can do it in three months. because it’s so data-driven and they can test it on the platform. So that’s really about adding value at the R&D level. That’s what the T-Mall Innovation Center is about. They have a project called Unimarketing where they give these merchants a dashboard of all their consumers, customers, current, potential. They take apart their needs, interests, proven versus unproven, ancillary needs, the sort of 360 degree view of consumer behavior. Again, same reason. They’re offering credit to suppliers that’s under Ant Group. So they can, you know, these small merchants can buy more and you know, stock more because they can borrow money from Alibaba and therefore sell more. Data intelligence, cloud operations, Alibaba cloud. And now the newest thing is the digitization of manufacturing, which is their new Shunchi project they’ve just announced. Same thing. It’s sort of C to M. So you can see them building themselves all the way back up into the supply chain. and adding value at all these levels and making all these merchants much more effective, and that’s effectively expanding their total addressable market. So that’s the corollary on the merchant versus the consumer side. Okay, the last two are much simpler. Number four, quote, “‘To create or redefine online, offline retail formats “‘leveraging our digital technology.'” Okay, this is almost like a subpoint. of the previous one, a sub case where, you know, this is new retail, this is online merge offline, this is the supermarkets, the shopping malls in time, this is fashion, a lot going on, mom and pop stores, which is not, not a lot is happening there. Just putting this all together, creating these new business models by integrating and trying to add value and it’s a whole sub category that I think is very, very compelling. JD is actually doing a lot in this space, which is great. I’m gonna start talking more about them in the near future. So maybe you don’t think about these big ideas of merchant side versus consumer side. Maybe it’s just like, hey, let’s just push hard on new retail because that’s a very applicable thing we can do right now. We’ve already got some traction. Let’s just really push along that dimension, simple. Okay, and number five, quote, to upgrade Alipay from digital checkout to digital check-in. Now that’s basically just talking about Ullama and Alipay. The daily life services business I’ve talked about, which is this is them trying to create a super app. Daily life services, this is buying your movie tickets, this is getting your food delivered for lunch, this is getting a coffee delivered, this is getting a bicycle. You know, this is kind of Maytwan like stuff. This is WeChat like stuff. And this is really what Ant Group is doing. They’re combining Alipay with Ullama and they’re focusing on this. So again, they say digital checkout versus check-in, which they mean is instead of using Alipay to check out, when you leave the store, it’s the last thing you use. We want people to use Alipay to check in. When you go to buy anything, you check in. Okay, fine, whatever. I mean, it’s basically them trying to be a super app that people use all day long. So again, I think that’s a sub case that let’s just focus all on that. If we can get a super app going, it’ll change all the numbers. So those are the five. So now it’s back to you. What do you think? Like if you had to bet your career, or maybe, let’s say you’re working there, which division do I wanna work in? Or the CEO calls you in and says, what do you think I should focus on? Where should we put 50% of our chips on these five strategies? Which one would you say? And you know, you gotta say why. You can’t just say, oh, that one. I mean, have an argument for why that is, even if it’s just two or three bullet points. I think this is what matters most. Size of the opportunity. It’s not a theoretical idea. It’s something provable that we’ve already seen work. I don’t see any major technological challenges. It seems doable. The likelihood of failure is small. I mean, you gotta kinda have an argument for why I’d place my chips there. And what would you say? So that’s it. So pause the recording. In the show notes, I’ve listed the five. And for those of you who are subscribers, pull out your journal or take your notes and write down. Two paragraphs, this is what I would advise the CEO if I had three to five minutes of their time, I’d say focus here. That’s where it is. Okay, so pause now and then come back. Okay, how’d you do? It’s a pretty complicated company. My inclination, I’ll just tell you my thinking now, is I like to go with what’s already somewhat been proven, where they’ve got some nice secular trends. So not something that’s totally never been done before, because that’s very difficult. And go with something that’s got some proven track record, and then push hard there. How much competition do I face? You know, big surprise, I come back to competition. It’s a lot harder to take a user from a fierce competitor than to go into something where you’re offering something that no one else offers. So I’ll put in a slide here, which is basically showing how they lay out all their platform businesses, and they put them at three levels. They put them at seed, traction, and profitability, and they’ve got a whole bunch of stuff going on at the seed level. These are ideas, they’re getting some traction, we’re testing things out, some are working, some aren’t. Traction means, okay, it’s working, it’s starting to grow, we’re seeing some real growth, and then profitability is like, now we’ve really got some scale, we’re going to actually try and turn this into money and make some profit as opposed to just go for market share and scale. Now the announcements they had were that, no, the big announcement was that AliCloud was going to be profitable by 2021. and that Sineo would as well. So they kind of told you which ones are at the profitability stage in this business, which means they’ve already got quite a lot of traction. Now when I kind of look at the list here’s here’s what’s top of my mind. Number one, to continue growing our digital economy user base. I think that’s absolutely necessary. It doesn’t strike me as a major opportunity. I think they have to do it obviously, but they’ve already you know… They’ve already got pretty much everyone in China aware of this. And where’s that next big group of users? It’s not like 2012 when they were just growing like crazy on the user side. You know, where’s the next group of users going to come from? Well, probably Southeast Asia. But that’s going to take some time. So I think and plus, if they do want to grow within China, they’re going to have to take them from JD or someone else. So that’s going to be a fight. OK, necessary doesn’t strike me as the best thing to do. Number two, to expand consumption categories in consumer wallet share in our digital economy. Okay, that’s good. Get your current people to spend more. And they are doing this. They had some pretty good numbers about this that the longer you’re on Alibaba, the more you spend, which is pretty common. Same thing happens at Amazon. Same thing happens on a lot of these sites. Again, fine. I think that’s an important skill they have to be doing every day, watching their customers sort of develop over time. Number three, to develop new supply categories and supply side transformation based on consumer insights. This is really the one that got my attention because let’s say I do wanna get, take someone else’s consumers. And let’s say I do wanna get my consumers to spend more. The best lever I know how to do that is to do something that other people can’t or to do something new. Well, if you’re transforming the supply side, C to M manufacturing, logistics that can deliver within 15 minutes from a supermarket or from a little depot. I mean, if you’re doing stuff like that, these supply side, merchant side transformations that enable you to do things on the consumer side that your other competitors simply can’t match, that seems to me the bigger lever in terms of getting more users or getting your current users to do more. And I think that’s really Alibaba’s strengths. They’ve got so much capital and time and effort invested on the supply side. They can get avocados in Mexico and have them delivered to Alibaba in a couple of days. Very few competitors can do that. They have these warehouses across the country. They have these IT capabilities they can give to small merchants so they can run their businesses on AliCloud. They have payment protocols. They have a. this new manufacturing thing. I mean, all of this, I’d be trying to do as much there as possible and then translate that to stuff that others can’t do. And maybe you open up new categories of spending, and maybe you just take market share from others because they can’t match you. You know, that’s what I’d be thinking as probably where I’d spend 70% of my effort. I think if you hit the ball there, I also think that’s innovation-based. It’s on the frontier. Only the best companies can do that. I think if you really hit the ball there, it’s gonna move the other numbers in one and two. So I really like that one. Now I would have said the same thing about number four, which is to create or redefine online, offline retail formats leveraging our digital technology. That’s new retail. I would have said the same thing there. Hey, let’s do a lot of new retail formats because I think they’re cool. The problem is they don’t scale very well. You know, it’s taken them several years to open 200 fresh hippo supermarkets. On the supply side, you’re really providing digital tools to this sea of merchants. Who then do stuff with it or you’re building warehouses. The new retail formats. You know, there is a question. This may, this is really, when you think about all the businesses they’ve built, they’re all platforms except for this one. It’s not clear to me that new retail scales. It’s not clear to me. It’s a platform business at all. I think it’s very cool, but that’s not obvious to me. And then, so I’d kind of discount that one. And then number five is probably where I’d spend the other 30% of my time. To upgrade Alipay from digital checkout to digital check-in, this is let’s build a super app like WeChat. That’s really what this is. I think either of those two, number three or number five, if you were to really get a great super app going, which they don’t really have today. That could really change things. And I think the supply stuff could as well. What other companies can build a super app? Everyone wants to do it. There’s only gonna be one and maybe two. So that’s kind of where I’d focus. I’d be trying to get on either of those teams or work with them. Anyways, that’s my take on that one. I think it’s pretty cool company overall. It’s doing a lot of fantastic, really interesting stuff. So we’ll see what they do. And every year they just keep rolling out new stuff. It’s really crazy how quick they are. Anyways, that is it for the content and episode 50 podcast 50 is all signed off. It is really kind of crazy looking back at all this work and how much content was put together. It’s for all effective purposes. I’ve really written at least three books in the process of creating 50 podcasts on this. So, yeah, it’s been kind of a great experience on my side. And I really want to thank you for listening. And for those of you, some of you, I mean, some of you have been here since the very beginning, which is, it’s amazing. I really appreciate it. And then I know there’s others that have kind of come in later and binge watched, which I’m not, or binge listened, which I’m not sure is the, I’m not sure that really works with all this strategy stuff, but you know, God bless anyways. So, but anyways, thank you. Even the people who are just signed up and are just starting out, you know, welcome. I appreciate it. And I hope this is helpful. And You know, over the next six months, we’ll see if we can make it better and better and better. My goal here is really is to actually think about this a lot. My goal is to help people become really good at this. Like, you know, that’s my little dream is I would love for there to be a group of people out there one day who are just awesome at this stuff. And everybody knows who they are, whether, you know, in their industry or maybe just in their business. Him or that guy, that girl, she really just knows this stuff cold. I don’t know how she knows this. Like that’s my goal for there to be like a group out there that are just like digital gurus who can take these questions apart and sort of stun their colleagues. That’s my little dream, which is why I’m always giving you cases, which is, well, not always, but mostly where I’m trying to give you questions that you would, you know, be on the sort of hot seat to answer. What would I actually say to my boss on this question? What would I say to a client? What would I do? Because the more you can kind of put yourself in that mindset, that’s really how you get good. It’s like anything. To hit the baseball, you gotta swing the bat. And in this business, that means forcing yourself to make a decision. And I generally think writing it down helps a tremendous amount. That’s why I always sort of push you to write it down. Which I did check in with people. It turns out people do do that, which is nice. I was worried that people weren’t doing that. Turns out people are sort of stopping the tape, the podcast, and writing it down in some form. So that’s great to hear. Anyways, that’s where we are at episode 50. Eight levels, 40 learning concepts, 50 podcasts, and about 140, 150 pieces of content put together under these eight levels of thinking. So there we are and we’ll go from here onwards and upwards, but thank you for listening. Thank you for staying with me and hopefully this is working out for you. But anyways, that’s it for me. Have a great week and I will see you next week or talk to you next week. Bye bye.