This is Part 1 in a three part series about Ant Group. And my basic argument is Ant is well positioned to disrupt and potentially revolutionize financial services. Part 2 is located here.

You can listen to this podcast here or at iTunes, Google Podcasts and Himalaya.

Related podcasts and articles:

- #19: Ant Financial and Intro to Payment Platforms (podcast located here)

- #23: SMILE Marathon

Concepts for this class. The slides discussed in the podcast are located below and correspond to the 4 ideas below.

- Payment Platforms

- SMILE Marathon: Ml / AI factories & Human-Free Operations

- Scale Advantages

- Scale Disadvantages

Companies for this class:

- Ant Financial / Alipay / Ant Group

The cited graphics are below:

————–

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.

—–transcription below

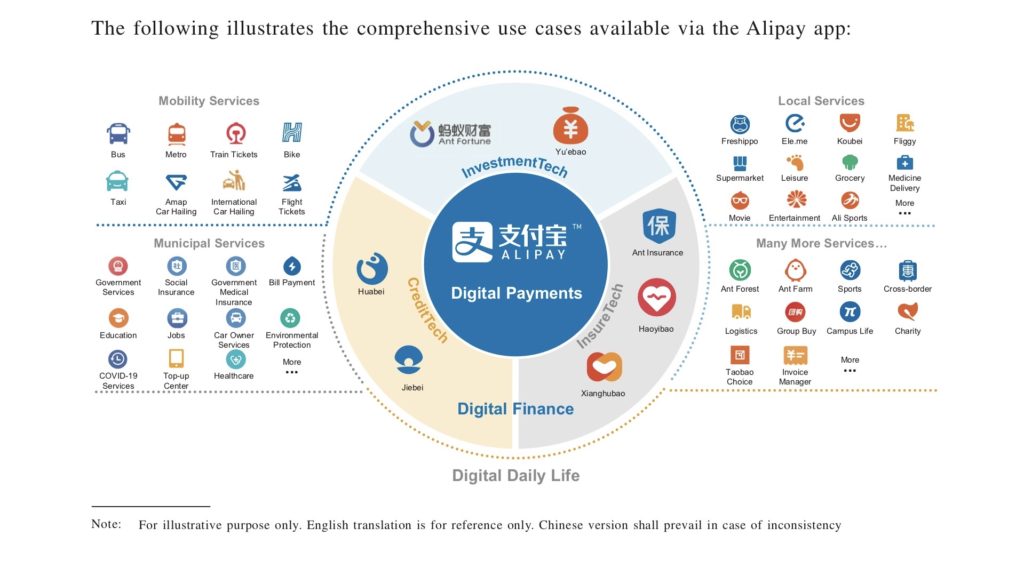

:

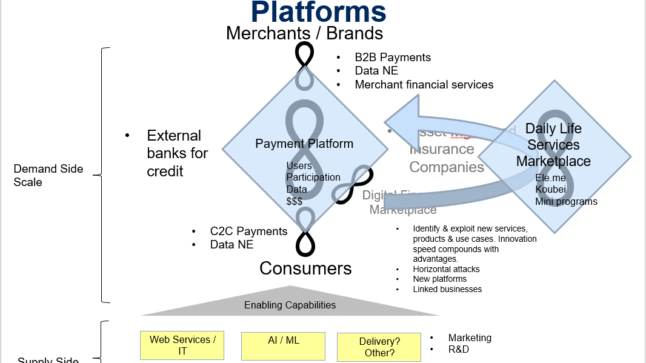

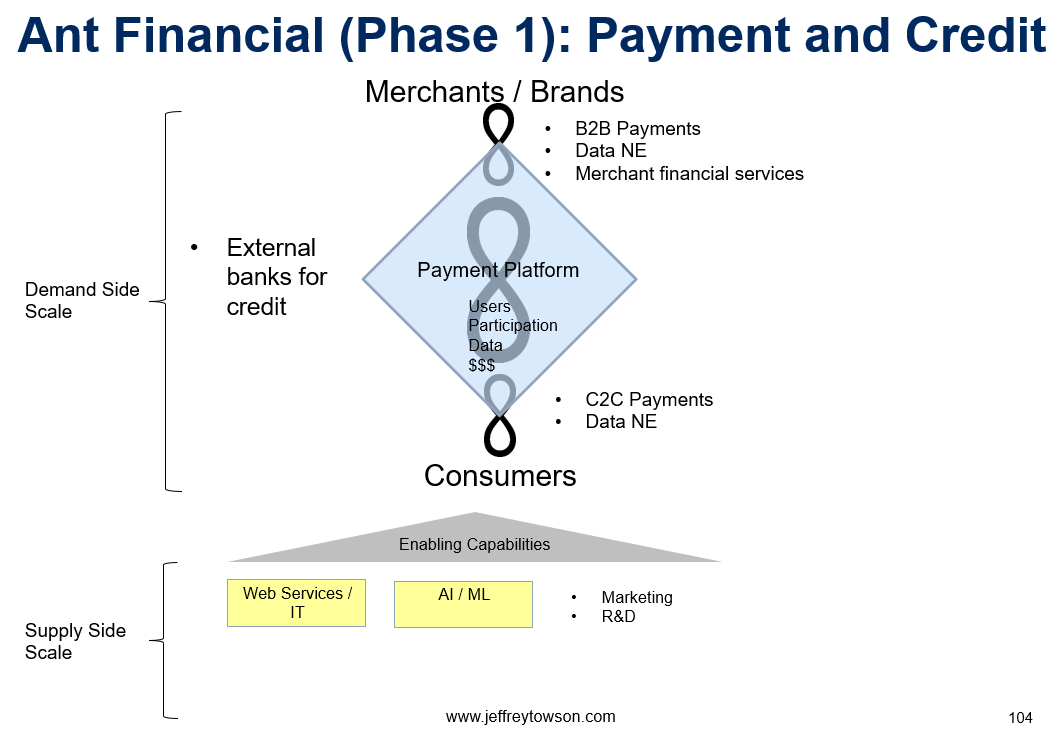

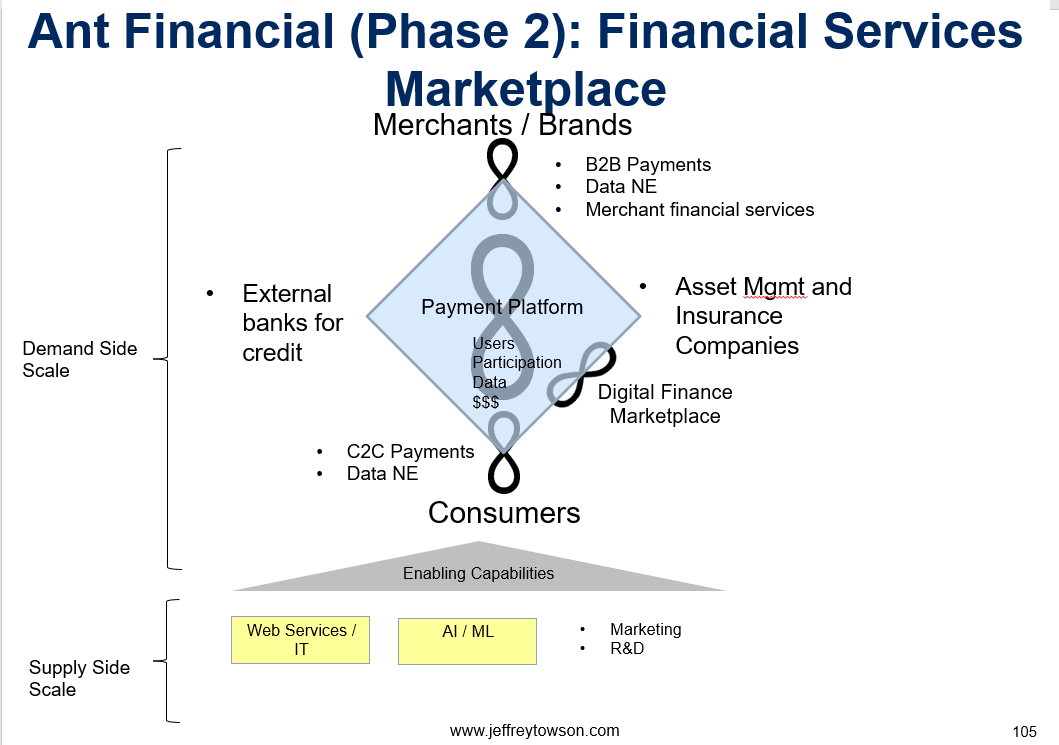

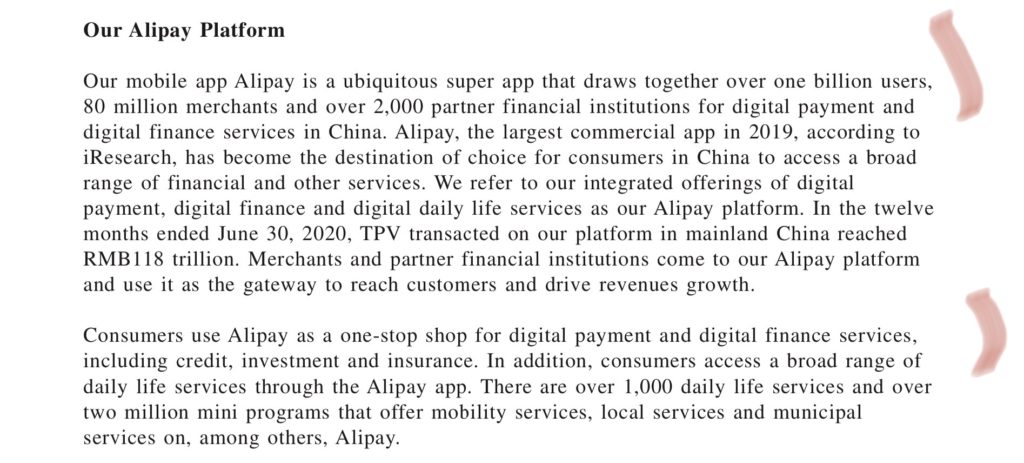

Welcome, welcome everybody. My name is Jeff Towson and this is Tech Strategy. And the topic for today, how Ant Financial, now Ant Group, is revolutionizing finance. And that’s kind of a big word, revolutionize. I could have said how they’re disrupting finance, how they’re transforming finance. No, this is one of these rare, rare situations where you gotta kind of bring out the big adjectives. What they’re doing, and we’ve now seen their playbook from their IPO filing, what they’re doing is huge. I mean, it’s massive. It’s all the superpowers and abilities and use cases that you can do with digital all put together in one massive move. And that’s not that surprising because this is Alibaba. These are the masters of digital strategy. You know, I don’t know of any group that’s better at doing this. They’ve been doing it for 20 years. They’ve been a platform digital creature from day one. And this is not the first major digital platform they built. It’s not the second, it’s not the third. I mean, they are really, really good at this. And the more I think about what they’re doing, the more I kind of go, man, this is big. Like it keeps seeming bigger and bigger to me the more I think about it. So I’m gonna lay out the case for why this is something you really need to understand. You should pay attention to it, and this is probably the beginning of something much bigger. Okay, with that sort of hyperbolic introduction, let’s go into the case. But first, if you haven’t subscribed, please go over to jeffthousen.com. You can sign up there. There’s a free trial, 30 days. See if you like it, see how valuable it is. This talk today, as more and more of these are, is really drawing on the past content, the past lectures, the past emails, the course material, which is mostly behind the paywall now. It is mostly for subscribers only. So you’ll see that as I go through this. We’re gonna talk about a lot of previous stuff. Now, I’m not gonna do this as a case where I give you a subject and then you take a stab at it, because this is really gonna be part one of three. There’s gonna be… Three different lectures on this subject. The first one I’m gonna, today I’m gonna go through kind of a lot of stuff. Next week we have an interview with Martin Reeves, who is, for those of you who aren’t familiar, he is head of the Henderson Institute at BCG. He does a lot of their digital thinking, digital strategy. So we’re gonna talk to him in a couple days about certain aspects of sort of what we’d call. adaptability innovation and why that’s increasingly important. And that’s, you know, Ant is a great example of that. And then on the third talk, we’ll talk about sort of the traps of network effects and the requirement for sustained innovation. Okay. I’ll get into more of that. So this is one of three. So today I just want to tee up a lot of the theory and get you, you know, sort of thinking in the right way before we bring Martin in. Now. Ant Financial, I have actually brought up, I guess I should start saying Ant Group since that’s their new name. Obviously, I’ve mentioned this before, Alibaba likes to name everything after animals, so Ant Financial, Fliggy, which is their travel site to sort of flying pig, Taobao is Chinese for cat, and their standard joke, I’ve heard all of their executives say, at least twice is, you know, we’re building the world’s biggest petting zoo. Okay. It’s not a bad joke. It was funnier 10 years ago. You gotta know when to retire your jokes in life because everything’s online now. But I brought this up multiple times. And I think the first time I brought this up was in podcast 28, which this is gonna be in the show notes, which was sort of an intro to Ant Financial. The title of that podcast was How Big Can Ant Financial Be? and we talked about sort of Ant Financial and payment platforms. So for those of you who are subscribers, that’s all under learning goal number 19. But it was this idea of, look, let’s start talking about Ant Financial and really, you know, the foundation was Alipay, a payment, mobile payment, and then everything built from there. So we start to talk about payment platforms. as one of the five digital platform models that I’ve kind of introduced. Marketplace platforms, audience builders, payments, collaboration, coordination, and learning platforms. But I basically teed up five different types of platform business models. I’ve gone through them a lot. One of them is payment. So merchants on one side, consumers on the other. You can send things back and forth. It’s got a network effect, an indirect network effect. And then you can also send payments. consumer to consumer, which would be considered a direct network effect. So there’s two different network effects. It’s both a you know indirect and indirect situation Fine, so we went through that in podcast 28 a bit, but I also teed up this other idea at the same time which was The advantages and disadvantages of scale There’s a lot of advantages to being bigger. It is the go-to strategy for the last 70 really a hundred years for business is get bigger. Because as you get scale, you get a lot of advantages. You get smarter, you can start to have lower per unit costs, your learning curve accelerates, you can get economies of scope, which are a little bit different than economies of scales. There’s a lot of advantages to that, but they don’t go on forever, which is why there are no 10 million employee companies in the world. and why most companies don’t dominate everywhere and don’t sell 10,000 different products from cars to saxophones to whatever, that at a certain point getting bigger starts to have problems. And I call this the disadvantages of scale. And bureaucracy, complexity, the difficulty in distribution, the difficulty in management being able to understand any of this. So we see advantages and then at a certain point, we see disadvantages with scale and you get sort of a standard U curve of, you know, strength as you get bigger. As you get bigger, your strength gets better and better, your unit costs drop, but then at a certain point they start to rise again. And there’s a whole lot of theory that goes into that. Okay, so that was kind of the first one I talked about was, let’s talk about Alipay, let’s talk about payment platforms, let’s talk about the advantages and disadvantages of scale. That’s all under podcast 28. and it’s under Learning Goal 19 for those of you on the class. All right, fine, interesting. Well, I think it’s interesting. In podcast 33, again, don’t worry about writing, you can see these down below in the notes if you wanna go back and listen to them. I did a talk called Three Ways AI is Changing Fashion, and that was an interview with one of the vice presidents at Jingdong, JD.com, about how they’re using AI in fashion. And it teed up. kind of the idea of what I called machine learning or AI factories. I also called it zero human operations, which is the idea that, as you start to use AI more and more and software, you can start to build companies without people within the core operations. And the real goal line, the holy grail is zero, zero human operations. Because once you have no humans in an operation, YouTube, you go on YouTube, you can watch forever as you watch, as things are shown to you. There aren’t really any YouTube employees in that process too much. I mean, they are actually curating the content, but by and large, the software kind of runs that thing on its own. And, you know, I brought up this idea of sort of the smile marathon that… You know, most businesses, you’re choosing one or two dimensions to compete on in an ongoing basis, uh, as opposed to having sort of structural advantages. And I called that the smile marathon, SMILE, each of those sans it’s an acronym. And depending what business you’re in, one of those is going to be probably the key dimension to compete on. S scale scope, effectiveness, efficiency, M machine learning, AI, zero human operations. I, innovation, L, rate of learning, E, ecosystem orchestration and management. And I kind of said, you know, what Ant and I brought up Ant Financial, I said Ant Financial, what they really are is a company that’s going from design from day one to be a zero human operation, that they are leading, they are a machine learning company from the foundation, they’re designed that way, unlike a traditional bank. which has branches and employees and loan officers. They don’t have any of that. The software does it all, which is why their motto is 310, which is three minutes, ah, I’m gonna get it wrong. Three minutes to apply for a loan. I think it’s one second or maybe one millisecond to get approved and zero humans involved. So it’s 310. The zero in their motto literally stands for zero humans. And that can be a very powerful thing if you can pull it off because those disadvantages to scale, I just mentioned that human beings, one of the reasons we have a hard time building companies beyond a certain size is because the complexity gets too much for us. No CEO can manage a company with 20 million employees in 50 geographies. No one is smart enough to do that. and no CEO or management team can sell 10,000 different products. The sales staff aren’t familiar enough with each of them to sell them effectively. It starts to break down on terms of scale, complexity, inefficiency, bureaucracy. You know, what I call the big dumb bureaucracy. And there’s this idea if you can build a zero human operation where the primary dimension you’re competing on is M, machine learning within Smile. Do those disadvantages to scale go away? Could we have endless advantages to scale without any of the negative disadvantages? Is that what’s coming? And I don’t know, but I think it might be. I don’t see anything that limits Ant Financial from selling, you know, the way they have set up their software, they can serve a thousand customers, people applying for loans, doing payments, or they can serve 10,000. or 10 million or 100 million, the software handles all of those perfectly. I mean, there are some difficulties, but not like staffing up thousands of branches of banks. And they can sell one finance product, like a mutual fund or money market fund or insurance product, or they can sell 100,000 of them. They don’t have any of those limits, at least not in theory, we’ll see what really happens in practice. Fraud is actually a big problem for them. But, so that was kind of the other way this has been brought up, which was Podcast 33. And it was under the general learning goal, which is the important thing, Learning Goal 23, which was the Smile Marathon, and this idea of machine learning, AI factories, zero human operations. Okay, so Ant has come up at least twice in the last couple months in this course. I also talked a little bit about… basics of AI that was in podcast 33 for those of you who are curious not totally relevant to this talk but AI is a cheap prediction okay that’s enough of that so this has come up I mean they’re really sitting at the intersection of a lot of things here when we start talking about AMP and one of the questions I’ve always sort of teed up is look this is all about digital tools software data data technology And there’s just an endless stream of these things happening. People are always inventing them. They’re discovering new use cases for new tools. And we have two tools and then we put them together and we get a third tool. So we have combinatorial innovation. So there’s just this sort of sea of this stuff happening all the time and as a manager or an investor and you’re looking at this, you got to decide is this important or not. And every month there’s a new tool and you got to kind of keep making the call. And my little cheat sheet, which I’ve given you, as I called the six digital superpowers, if any new tool enables you to do a new use case, a new product, a new service, a new business model, and it hits one of those six digital superpowers, uh, hit the, you know, hit the alarm button that this is going to be important and I won’t go through those six, but it’s like Dramatically, number one, dramatically improves the user experience. Number two, enables a platform business model. Number three, gets you network effects. Number four, gets you other competitive advantages. What Ant Financial is doing, apart from the fact that they appear to be a zero human operation, is they appear to be hitting all six of the superpowers in one shot. That’s why this caught my attention. I was like, wow, that’s kind of crazy. Anyways. So that’s the backstory for this. And Ant Financial finally releases their financials, which I’ve been literally been waiting two years for to see this. And I’ve been, you know, I sort of have some contact with them and I’ve been sending notes back and forth to some of the Ant Financial people and they don’t, haven’t really been sharing too much. They’ve been, you know, people knew it was big and people kind of know the funding rounds. Oh, they did a 200 plus billion dollar, you know, private round. I don’t really put too much stock in those numbers. I think there’s a lot of hinky behavior going on in those private rounds, especially closer and closer to IPO. But from what I understood, it looked big. And I frequently asked them, hey, how much is happening on the credit side? And they very polite told me not tell, said basically we’re not saying. I asked multiple times and they politely told me to kind of get lost a little bit. very politely, but it was definitely a nope. So anyways, the financials finally get released. It’s a 600 plus page document. It was just the greatest fun to sit and read that thing. And as I read these stuff, I always take my own notes and I sort of upload them to my files. I must have taken 40 pages worth of notes going through their flagging things, circling things, questions, stuff I didn’t understand, stuff that other important. And I thought I… Thought I would tell you sort of my biggest takeaways from that and tee this up. And for those of you who are subscribers, I have sent some of this out in emails over the past week or two and sort of been teeing that up. But you know, the big stuff is really coming in the next week with Martin. And then I wanna kind of release some thinking on this. But yeah, I’m trying to sort of teeing up some bigger arguments. Okay, the key stuff you jump out is like the history which I’ve gone through before, you know, people know the history. You know, Taobao gets launched 2002, 2003. This is Alibaba moving into B2C e-commerce. They had always been sort of been a B2B company. You know, they were selling stuff between Chinese manufacturers and other manufacturers and also overseas. The first item that was ever sold was actually a pair of binoculars, I believe, from a Chinese manufacturer to a Japanese buyer. You can actually see it in the Alibaba Museum in Hangzhou. They have the, well, they have a, I’m assuming it’s not the actual binoculars, but that was the first deal. They have a copy of it there, or I guess another pair. Okay, very clear, and then eBay comes in there, and part of the reason they moved from B2B2B2C was eBay was coming into China, was doing quite well. It done some acquisitions to enter and. and they saw that as a threat to their B2B business and apparently they moved into this on the B2C side serving consumers for the first time as a defensive move. That if eBay did well on the B2C side, they would probably come after B2B. So they, hence Taobao, which got launched and they did Alipay very quickly after because it was obvious to everybody who had… lived and worked in China that there was a massive trust problem. Nobody trusted anyone. You don’t want to send stuff because you’re not going to get paid. And you also don’t want to pay for stuff you haven’t received because chances are a decent chance you wouldn’t get it. Massive trust gap. And Alipay was sort of founded to bridge that gap. So they launched an escrow system where you could pay in but then Alibaba held the money. and only, you know, then the good was shipped. And then when the good was received and the buyer signed off, then the money was released. So kind of an escrow system. They also did cash on delivery a little bit depending. That was more of a JD thing, but there was some of that as well. And that was a big enabler of the interactions. Now, you know, sort of standard platform theories, oh, let’s make money on payment. No, you don’t wanna make money on payment. What you want to use is use payment to lower the coordination costs and enable the core interaction which is a transaction, a merchant and a buyer. You use payment as a way of facilitating and enabling your core interaction which is this transaction. So they did it at a very low fee unlike say PayPal which gouges people, you know, 3, 4, 5, 6 percent. It’s ridiculous. You know, they did it to enable their e-commerce play. So that was sort of back then. And they piggybacked off Taobao, which was also what PayPal did, which was Elon Musk and Peter Thiel back in the day. The difference is Taobao was fine with that because it was the same company where eBay didn’t really know that PayPal was doing that and eventually tried to stop them and ended up buying them. So they kind of piggybacked another group’s company, which is a pretty cool move, generally speaking. The difference is, okay, nobody had credit cards in China back then. Most people still don’t. Most people have, everyone has a bank account. Most people have bank cards. Not that many people have credit cards. So mobile payment makes a lot more sense. Alipay makes a lot more sense. PayPal obviously doesn’t do that. It links off your credit card originally, and now they’re trying to get your bank accounts and other stuff. I’m not a huge fan of it. those companies in the West. I think they gouge people. I don’t think there’s any reason a payment system should charge more than 30 or 40 basis points, which is kind of what Alipay does, as opposed to 3%, 4%, 5%, which is I think that’s outrageous. But they obviously don’t care what I think at all. Okay, so Alipay grows. You start to get e-wallets. You put your money in there. You link it to your bank card. 2010, Alipay’s got 300 plus million users on their payment platform. Bam, you’ve got a payment platform. And platform business models, as I’ve said, are kind of the super predators of our time, digital platforms. Company evolved some more. 2011, Alipay goes mobile, so they get a mobile app, huge deal. That’s, you know, commerce really takes off in China once people start getting mobile phones and mobile payment as opposed to on a PC. Huge deal, people start buying stuff every hour of the day, everywhere they are in life, as opposed to sitting at their PC at home at the work. 2013, Alipay launches U of Bao, which was basically a money market fund. If you’ve got a bunch of money sitting in your Alipay wallet, instead of it sitting there, you can just put it into your U of Bao money market fund. That was run through Tianhong Asset Management at the time. They’ve since pretty much been brought in as a subsidiary. It translates to extra treasure, yuabao, from Chinese to English. And they offered them a pretty good rate, which is actually important because the standard putting your money in a state-owned bank of China got you a tiny rate of return. They were actually paying so low that they were using that to subsidize other endeavors. It’s kind of one of the secrets of financial stuff in China is that the state-owned banks paid a very low interest rate to consumers on the retail side, and they used that spread enable things on the other side. So it’s kind of like consumers have been involuntarily funding and financing a lot of sort of state owned or state directed initiatives into infrastructure and other things. There weren’t a lot of options of places to put your money. Okay, but for Alibaba the key thing there was this was their first move from a payment platform into an investment product and investment service. And people were happy to do it because there was a lot of sort of pent up frustration with state banks. 2014, Alibaba gets a bank subsidiary license called MyBank, one of the first private bank licenses issued. One goes to Alibaba, one goes to Tencent. Four or five others go to other places. Ping An got one. I don’t know all of them. So that gets the ability to start offering credit. So then you can start to loan money to your consumers, you can start to loan money to your merchants who are already on your payment platform. So that gets them into credit services. Now, no, they were in payment, now they’re in investment services, now they’re in credit services. 2017, they move into Thailand. This is just because we have a lot of listeners in Thailand. They did a deal with TrueMoney. Not terribly important, but I thought you’d get a kick out of it. 2018, they start doing cross-border payments focused on Asia. Southeast Asia, really they rock and roll. This didn’t really get reported too much, but there’s been a huge amount of international activity by Alipay in the last three years. They are in literally every country you can think of in Southeast Asia, Pakistan, Myanmar, Thailand, Philippines, Singapore, Indonesia, I mean, everywhere. They have gotten, and usually what they’ve been doing is, you know, if their go-to gateway drug product, in China was payment. And then from there, they built insurance and they built other stuff. This is the same. They’re starting with cross border and domestic payments. So most of these cross border deals they’re doing are usually focused on payment, cross border payment and merchant services because if someone’s selling on Alibaba to Chinese consumers, let’s say a factory in Thailand, then you can turn around and sell that factory merchant services. That’s been their kind of go to international strategy. thus far very focused on Asia, which I think is sort of their strategic backyard. 2019 Alipay e-wallets reaches a billion people. 2019 they launched Xianghu Pao, which is sort of mutual benefit insurance, which is kind of a funny way of doing insurance without actually having to technically do insurance, which has a lot of regulatory implications. I’m not going to go into that too much. Anyways, then they plan to go public this year, Shanghai Star Market and the Hong Kong Stock Exchange, which is significant because Alibaba had famously bypassed Hong Kong to go public in New York just a handful of years ago. And then they started doing a dual listing in Hong Kong. Well, for Alipay, they’re not doing the US at all. They’re basically doing Shanghai and Hong Kong and that’s it thus far. Now, One cool number that jumps out of their filing is basically 17 trillion US dollars in payments. That is how much, and they list as 118 trillion renminbi, but let’s say US dollars, 17 trillion US dollars of payments in Alipay in the past six months alone. I mean, that’s insane. You know, the US company like PayPal, will announce very proudly, hey, we did in 2019, the whole year, three quarters of a trillion dollars, 750 billion USD in payments and mobile payments plus other stuff, because they don’t do a lot of mobile, you know, for all of 2019. Okay, Alipay, 17 trillion. In just the last 16 months, if we sort of ramp that up to annualizing, we’re talking 34, $35 trillion in a year. as compared to 750 billion by PayPal. I mean, it’s ridiculous how much money is moving on this platform. Now here’s kind of my short list of things I flagged that jump out of their filing. Mobile payments has their foundation. They refer to it as infrastructure. That’s important. Daily life services, they have rolled Ulema, which is their competitor to Metwan, under Alipay in the last six months. That’s daily services like ordering food, food delivery. Hotel, no, not hotel reservations, let’s say restaurant reservations, buying movie tickets, paying your phone bill, all of that sort of daily utility stuff that some people call the super app, but it’s a lot of stuff. They roll that under there. Credit products and services, investment products and services, and insurance products and services. That’s the scope as of today of Ant Financial. Now that’s actually a little bit complicated and they’ve, I think their language is a little confusing. And here’s literally how they describe themselves. This is from their IPO. I’m reading it word for word. This is the title of the section, our Alipay platform headline, quote, our mobile app, Alipay is a ubiquitous super app that draws together over 1 billion users, 80 million merchants and over 2000 partner financial institutions. for digital payment and digital finance services in China. Okay, skip down a little bit to the start of the next paragraph. Quote, consumers use Alipay as a one-stop shop for digital payment and digital finance services, including credit, investment, and insurance. Now, I think that’s actually kind of confusing because in the first paragraph describing themselves, we say, they say we are a ubiquitous super app. That’s one, super app is a funny word to use in a legal document. I mean that was kind of just a standard funny phrase. Now apparently super app is actually a real thing because it’s in an IPO filing. But when I look at that first thing, okay you’re a super app, you wanna be WeChat. Okay, you wanna be Gojek, you wanna be what half the companies in Mexico and Brazil online wanna be, you wanna be the super app, I got it. That’s a consumer facing proposition. Here’s everything you need in life. And within their super app they describe what we would in our class cite as user groups, user group one, consumers. Now they say 1 billion users, they’re talking about consumers. User group two, merchants, they say 80 million merchants. User group three, over 2000 partner financial institutions. They use the word partner, partner financial institutions. I would say that’s three different user groups. I’m gonna put one of my diamond, blue diamond charts in the notes here. If it’s not in the… the podcast note, click over to the webpage notes for you to see it. I would put that as three different user groups on the blue diamond. Consumers, merchants, and partner financial institutions. Okay, that’s one description of a company, but then when you jump to the second bit, they say, we are a one-stop shop for digital payment and digital finance services. Now that sounds to me like a different business. A one-stop shop is kind of like going to the mall. It’s a marketplace pitch. We are the one stop shop for hotels and flight reservations. We are the tourism portal. They’re kind of positioning themselves that way for digital finance services. So it’s like they’re a one stop shop for digital finance services. That is kind of a different play. That’s almost like a vertical marketplace in finance. Whereas the other paragraph is like, we’re the ultimate consumer super app. They’re kind of talking out of both sides of their mouths on this. And they actually put a chart in here, which I will put below, which is sort of a wheel. I think it’s super confusing. I don’t think it clarifies anything. I think, I don’t know, an iBank or something came up with that. So here’s how I would describe what they’re doing. They have combined three different platform businesses into a one-of-a-kind, comprehensive finance offering to merchants and consumers. And the three platforms are a payment platform, number one. Number two, a marketplace for simple high-frequency services. And number three, a marketplace platform for financial services, mostly insurance, credit, and investments. That’s how I describe what they’re doing. Now, in case Alibaba is listening. A year or two ago, I met with Alibaba.com, which is the B2B business that’s doing some really awesome stuff between China and the US and globally. You know, basically connecting merchants around the world that can trade and sell, you know, very, very easily anywhere in the world. And what I kind of said to them is I think what you’re doing here is you’re enabling SMEs to be MNCs. You’re basically giving small and medium businesses the ability to act like multinationals. I thought that was a pretty cool phrase. Anyways, six months later I keep reading about how that’s how they’re describing themselves. And I never got credit for that. That was totally mine. If you take my little explanation of Alipay, you gotta give me credit this time. Okay, that’s just anyone from Alibaba who’s listening. That was totally my phrase. I thought it was cool. You took it. That’s fine. You gotta give me a little tip of the hat at some point. Anyways, that’s… That’s kind of how I view what they’re doing. And here’s my explanation. Okay, they have three different, basically platform businesses that all integrate into a one of a kind comprehensive offering that none of these platforms could enable or do on their own. They all need each other to make it work, which is why this is such a unique proposition because I don’t know anyone else who’s putting the three pieces together. The foundational platform is the payment platform. Platform business model, everyone knows what this is. They refer to it in their document as infrastructure. I would say, look, it’s a platform business model. And the reason you’re calling it infrastructure is because to build a platform, the three to four assets I’ve said you’ve needed, and if you look at any of my blue diamonds, you’ll see them listed, are users, engagement, and data. And really you also need money generated. It needs to be monetizable, so four things. You have to have all four of those. None of these platforms get you all four on their own. You need to get them by the three together and then you’ve got it. So what the payment platform really gets you is users. You don’t have to make money as a payment platform. You’re not gonna get that much interesting engagement because all people do is just pay for stuff. It’s not like, you know, you’re. you’re helping them get to work or giving them food. The data is not terribly robust. What it does, it is a very powerful mechanism for getting users because it has virality. Payment has viral growth. If I want to send money to someone, they have to sign up to the platform. So it’s a viral growth mechanism for users and that becomes the core digital network on which all of this is built. The digital network, the nodes of the network, are people who have signed up for payment and merchants who have signed up. That’s your network, your digital network. Mark Zuckerberg has a social network based on people connecting to each other based on friendships and colleagues. This is a digital network based on people signing up for payment. So the payment platform is fundamental. It gets you the users you need, but it doesn’t get you necessarily a lot of money unless you want to charge three to 5%, which I think is not good. It doesn’t get you a ton of engagement that’s very interesting. That data’s all right, but it ain’t great. But it does get you users in a powerful, powerful way. Calling it infrastructure is not a bad idea. The second platform they’re building is a marketplace for simple high-frequency services. So this is ordering dinner, getting it delivered, getting a ride to the airport, hopping on a Hello Bike, which Alibaba owns. so I can pedal down the street getting a shared scooter, getting electric shared bicycles, which is a new thing in China, that’s kind of cool. Paying for vending machines. The other thing I should say, one of the reasons payment is such a powerful network on the user side is because it gets you both online and offline users. You don’t just get users who are online on their computers, you also get stores on the street, kiosks, vending machines. It gets you an online and offline digital. Network. Okay. The marketplace. What these services really get you are high frequency, simple services. Why is simple and ordering dinner is not complicated. Getting a ride to the airport in a taxi is not complicated. These are very simple services and that’s important because if you’re going to scale something up, if you want to go from 1000 rides to 10 million rides, it has to be simple. You can’t build a network effect. around complicated interactions that vary all over the place. It’s gotta be a simple, scalable service. Most everything on that platform is simple and scalable, and it’s also high frequency. These are the things you do every day, and they refer to this as their daily life services, which is a good thing. These are the things, this is like your, you know, your opt for your digital lifestyle. all the stuff you use throughout your day. You buy a cup of coffee, you send your friend a little money, you buy some movie tickets, you make a hotel reservation, daily life services, which is really what Maytwan has been doing and what WeChat has done. Okay, what that gets you is not necessarily users. I mean, Maytwan has users, but nothing like the users you get from payment, which you get a lot more, but it gets you frequency and it gets you engagement. This is how people spend their day. You learn a lot about them. There’s a lot going on there on the engagement side because it’s frequency and it’s daily life service. So that’s the second part for more than anything else gets you engagement, which is one of the core intangible assets for a platform business model. We moved to the third platform business, which is, and that’s a marketplace number two, we would call that a marketplace platform. Number three, also a marketplace platform, but this is for financial services. Now, why are financial services different? One, because they’re very infrequent. People don’t buy insurance products that often. They don’t buy mutual funds very often. This is something you do every year, every six months. Now, credit can be a little more frequent, but these are very infrequent. So, you’re not gonna get a lot of users doing this, and you’re not gonna get a lot of engagement doing this, because there’s not enough frequency, and you’re not gonna generate a ton of data. Data comes from engagement. What you are gonna get with this third platform is big, big money. This is where the big money is. Because if you can tap into the investments of 1.3 billion Chinese with rising wealth, that is a massive amount of money. If you can sell them insurance, if you can get them to start using consumer credit, those are big, big dollars. So this third platform doesn’t get you users, it doesn’t get you really… engagement, how to get you the money. So you need all three of them together to get you the core assets of the platform, users, engagement, data, and money. That’s how you build a big demand side scale phenomenon, which is what they’re building. And it all ties together. I mean, it’s a really elegant, well, I wouldn’t say elegant, it’s clever. You know, it’s sort of three different platforms, you stick it together. Now think if you didn’t have all three, how could you do this? Let’s say I just wanted to build a marketplace. Oh, the other thing I should mention about the services, the financial services marketplace, it’s also very complicated. One of the reasons that’s harder to scale and why you end up talking machine learning very, very quickly is because when you offer a credit service or an insurance product or… Suddenly you have to do things that are a lot more complicated as a service than giving someone a ride to the airport. So that tends to have a lot more machine learning, which is why we would consider Ant Financial, Ant Group at its core, a machine learning organization. This is why banks have credit officers, loan officers. It’s because of the complexity. And that’s where you can see Ant is sort of building their core operating dimension is on that complexity machine learning in this third platform. Okay, you put all those three together and you get everything you need to create one integrated, one of a kind offering. Imagine trying to compete with this if you don’t have all three platforms. If you’re just a payment platform, how do you compete with the gusher of money? coming out of the credit business or the insurance business of Ant Group. And right now, if you look at their money, most of their revenue is coming from payment and it’s coming from credit. They do have some money from the investment side, which is Yue Bao, but these are early days. So you gotta think five to 10 years down the road, how much money is gonna come out of that third platform. If you are one of the primary mechanisms and primary way Chinese consumers, borrow money and invest money. If you’re the go-to place for that, how much money is that? It’s a staggering number to think about. So early days, but right now the revenue’s kind of coming from payment. I think they’re gonna end up giving away the payment platform for free. Like 10 basis points, 20 basis points, something like that. So that’s kind of the first thing to think about. Well, I’m kind of a ways into this, but that’s kind of my main point for how to think about this. is three platform business models that integrate and create a one of a kind financial services offering to both merchants and consumers. Because you can offer credit to the merchants as well. You can do supplier credit, which they do through MyBank mostly. Or you can offer consumer credit, which they also do through, you know, Kobe and well, Kobe is different, but anyways, these are just the early days that they’re building out. Okay, so that’s kind of the first thing to think about. main takeaway for today. Think about Ant Group as three platform business models combined into an almost unique offering. Okay, the other another thing that got my attention in all of this is their credit business. I mean, that’s the one if I was valuing this company. That’s what I’d be focused on probably most right now. It’s the most likely to grow. And it’s an awesome question. I mean, it’s just a really interesting question. Here’s my question. Let’s say you’re doing evaluation. Here’s the question you’d have to answer. How much credit are Chinese consumers and SMEs, small, medium enterprises, how much credit are they gonna be using per year in five years and 10 years? How big is that number gonna be? Like, first of all, the question is how big is it now? And we didn’t really know. I mean, people have been asking this for a while. How much credit are Chinese consumers using online? Because most of them don’t have credit cards and when they do buy stuff online, if they use credit, it’s gonna go through, you know, Alibaba. So Alibaba knew how much they were using on the platform but they were never saying. I’ve asked quite a few times and they just wouldn’t say. Well, here’s the numbers that came out of the filing. under their credit tech business, they said Ant Group has 1.7 trillion Rem and B as a consumer credit balance as of the time of filing, so mid-2020. That’s about $250 billion worth of sort of, you know, a credit balance that’s standing. Now that’s not just them, because they don’t actually hold this. I’ll talk about that in a minute. Partner financial institutions are the ones actually holding, you know, it’s on their balance sheets. If you look at the Ant Groups balance sheet, it doesn’t really look like a financial services company at all, it looks like a technology services company. There are some aspects of this that are sitting on their balance sheet because like my bank and stuff where they are clearly sort of getting the platform going by carrying some of this themselves. So in many cases, they are the primary financial institution using the platform at this point. I think that’s gonna decrease over time. But right now in terms of credit balances, 98% of that is held at their partner banks. You know, this third user group I mentioned of partner financial institutions, well, that’s insurance companies, banks, asset managers. Their partner banks are carrying that and they actually carry the risk for this. Ant Group is not carrying the risk for this stuff. Okay, $250 billion outstanding right now. This raises the question, what’s the delinquency rate? And pre-COVID, their numbers show about, on the consumer side, about 1 to 1.5% delinquency on that balance. Now COVID, it’s gone up a little bit in the last six months because people are obviously in financial difficulties, but last year, And it’s gone up by about 1%. It looks like it’s about 2% now. It looks like it was about 1%. And that appears to be pretty stable over the last couple of years. Okay, that’s a lot of credit. That’s a big number, $250 billion. How big’s it gonna be in five years? Not just because China’s getting wealthier on the consumer side, which that absolutely is. I mean, there’s few secular trends I will bet the bank on. One of them is… rising Chinese consumers. That is a awesome secular tailwind. You know, five years, 10 years, 15 years, 20 years. But also it’s not just that they’re rising in wealth, it’s that their use of credit is increasing. You know, this idea that all Chinese consumers, you know, they’re savers, they don’t borrow. You know, people used to say it about Japanese consumers in the 1980s, right? That’s going away. You know, people say that about Singapore as well. Now, as they get wealthier, they’re going to start using more and more credit per capita in addition to being wealthier in general. Okay, so the two financial service products on the credit side that they’re offering to consumers are, now Ant basically claims in the document to be the number one source of consumer credit in China today, full stop, 730 million annual digital finance users. Now they say annually active, that will be their term, annually active. That gets back to my earlier point. Look, the problem with doing a digital marketplace platform within financial services is the low frequency of engagement. So they tell you 730 million active users, but it’s annually active. That’s very different than something that’s every week or every day. And that also includes, I think, their investment product usage. And there are two products, Hwabay, GiaBay. Hwabay started 2014. unsecured revolving consumer credit, basically like a credit card for small daily expenditures. They have a 20 rem and B minimum. So what, $3 minimum. Basically they’re loaning small amounts of money that are repaid within three to 12 months. This is sort of micro credit, micro lending. And you know, the average payback is a couple months. So, okay, fine. And then GIABAE, which sort of sits on top of that. If you do well in this, then they will up your balance and you can have a 1000 renminbi minimum. So a couple hundred bucks. But they offer that to the Hwabay user. So they’re sort of, you know, Hwabay is their entry product, micro lending. You build up a history as you do well, they can step you up to GIABA. Very, very logical. In theory, it’s a big deal. Now they’re gonna tell you in the document, oh, this is an amazingly big opportunity. It’s gonna be massive, but this is a sales document at the end of the day. So. I generally don’t believe any of that stuff. Not because I think it’s dishonest. I just, I know a sales document when I see one. I’m not going to take it too seriously. That’s the consumer side. But the other side of this is the merchant credit, the SME, the SM, you know, the small micro enterprises, small, medium or micro enterprises. Now that’s actually kind of a really cool story in itself because small businesses in China have been getting sort of screwed on the lending side for decades. If you are a small business in China, a private business going to the bank was awful. The banks you’re going to, the big four state owned banks, they really are lending to the other large entities and the state owned organizations. State owned SOEs lending to other SOEs. And if you’re a small business, you’re going in there and you’re getting actually killed on the rates where you can get a one year. facility for your small business. And it probably takes you two to three months to get approved, and it only gets you another nine months to use, and then you gotta reapply. The rates are crazy, they’re secured personally, right? Limited liabilities companies is not a thing in China. You are exposed legally if you are the legal rep of a company, you personally are exposed to the company. So it’s not been good. People have been complaining about this. Everyone knows it’s a problem. The government knows it’s a problem. And the big banks very rightly say, look, we can’t loan to these smaller businesses because there’s no track record, there’s no credit ratings, we can’t secure things, right? They are not built to loan to that group. Well, a digital platform with a lot of machine learning that knows your data because you’re active on Alibaba, they are actually in a position to start to offer small loans to a group that has been traditionally excluded. Not because it’s a… they’ve done anything wrong, it’s just the system couldn’t loan to that group. It wasn’t smart enough. Well, Alibaba is smart enough. So they’re starting to loan to these SMEs, and this is sort of Jack Ma 101. He likes to create digital tools that empower small businesses and lets them do the things that only big businesses could do. He likes to level the playing field. That’s Taobao. We are gonna offer a marketplace. that puts small businesses on the same footing as the big businesses, that’s Taobao. And we’re gonna get them all the tools they need to do this, logistics, payment, trust, escrow, all of that. Well, this is the same thing in credit. They’re gonna start to deploy credit tools to this vastly underserved group of small businesses. Bam, that’s pretty cool. So you’ve got a cool story on both sides. Although it’s the consumer side, I like a lot more. But wait, it actually gets cooler. I think the three platforms combined is cool. I think going consumer credit digitally in China and SME sort of opening up that field, that’s also really cool. But it gets cooler because what they’re doing in the credit space is what I would call asset light credit. Alibaba is a platform business model. That’s what they do. They are platform creatures. Not only do they like to enable interactions as opposed to doing the sales themselves, they don’t sell retail, they enable merchants and consumers to interact. Not only do they like to be the platform business model, not the sort of pipeline business, they also like to do it in a way that’s very asset light where the assets, the ingenuity and the capital are being provided by the user groups, not by them. So this was my standard joke of a platform asset light business model. That’s, you know, I told the joke wrong. When you build an online retailer, that’s you building a house for yourself. When you do a platform business model where the users provide all the assets and energy, that’s the village building a castle for you. And I told the joke badly, but you get the point. I’ve told it like 20 times. They are offering credit, but they’re not carrying any of the balance sheet. They’re doing asset light credit the same way they did asset light e-commerce. and the same way they’ve done asset light logistics. All those warehouses that they’re building and being shipped around, Alibaba is not doing that. Logistics companies, express delivery companies, and other companies are doing that, and what Alibaba is providing is the data infrastructure that connects the system and makes it go. It’s the same thing. So they have, how many banks? Let me look this up, 200 I believe. They have, I’m sorry, over 100 banks are participating in the platform. This would be a user group on the platform that are providing the credit. And when the loan is extended to the consumer or the SME, it doesn’t sit on Ali Ant Financial’s balance sheet. It sits 98% on the balance sheets of the banks. So they’re taking what they call a technology service fee, but it’s really big banks, small banks, rural banks, and trusts. that are doing this. So this is asset light credit. This is asset light lending to both consumers and merchants. And they’re actually not taking the underwriting or disbursement risk. That is also being pushed. So if there’s a delinquency problem, a non-performing loan problem, it’s not Alibaba’s problem, it’s the bank’s problem. They’re pushing the assets and the risk off their balance sheet. which is pretty awesome, I love that. And there’s one chart in here which I’m gonna reproduce in the note, which is their credit tech for consumer credit diagram. And they basically lay out who is responsible for what, what is Ant Group responsible for, what are the partner financial institutions responsible for, and what are the two things they collaborate on, the things they collaborate on. Well, the two things that Ant Group is responsible for, and overseas, are product design and what they call intelligent decisioning systems. So they are the ones that are doing the data. This is basically everything that would be in the center of my Blue Diamond platform. It’s the users, it’s the data, it’s the engagement. They design the credit products themselves. They have the data, they have the engagement. And when the decisioning credit risk management, or I’m sorry, the dynamic credit risk management, that’s the other thing they do, that is jointly done by them and their partners. That’s making the decision of who’s gonna get credit and who’s not. But when it comes to underwriting and disbursement, that’s under the partners and not under them. So what’s important is one, they’re shifting the underwriting and disbursement to their partners, but they’re keeping product design and they’re keeping the interaction with the user 100% under them. It’s a very digital platform strategy approach. They control the users, they control the data, they control the engagement, and they control the design of the products. But the other stuff, the partners can have that. So it’s very much a platform business model approach. They’re just using different language to describe it. And that is actually different because when they talk about their services and investments, like offering a mutual fund, in that case, they’re not doing the product design. The asset management company that is offering their mutual fund on the Alibaba platform, so the financial platform, the asset management company is doing the product design and it’s just being offered on the marketplace. That’s not what’s happening in credit, that Alibaba is actually designing the credit products themselves. They’re not even co-designing, which is what they’re doing in insurance. No, on the credit side, they’re doing it. kind of important. Okay, I think that’s most of the points I wanted to make that when I use the word revolutionary, bringing us back to the beginning, I mean, that’s why there is a lot of powerful stuff going on here that I don’t see in any other companies. I mean, think what this is gonna mean for consumers and how they live and how they access finance products and insurance and credit and buy things on the street or in the store. Think what it means for small and medium enterprises and even micro enterprises, their ability to access credit whenever they want or insurance and reach people and sell them things, or what it means for partner banks who are going through this, or insurance companies, or even new types of insurance companies, credit companies, and investment management sort of companies. Think about the new types of companies that are gonna emerge now that we have this system. You know, it’s like looking at the first days of YouTube and saying, well, I guess this is where the major television stations will put their content. And now we see so much creativity and so many people coming out of everywhere to create things there. It’s kind of like that. Once everything’s connected, I think this will take off in a lot of directions. I think it’ll be almost impossible to replicate. Well, I shouldn’t say that. I think it’s going to be one of very few. So this is going to be one of the few. sort of tease up the idea of digital conglomerates, this idea of when you go from being a product in a service company doing a pipeline type business, opening a restaurant, selling shoes, whatever, and then you move up to the next level, which is like platform strategy, which is what you could say Taobao is. And then at a certain point, when you’ve got so many complimentary platforms all feeding on each other, that’s when you’re really at the ecosystem level. And you know, that’s 3D chess. And that’s kind of what this looks like to me. So one, it’s a digital conglomerate. And there’s this interesting idea I keep hearing floating around the FinTech world, which is not an area I have a lot of depth in. It’s a bit of a specialty. And there’s this idea floating around. I think it was Andreessen Horowitz recently did a couple of talks on this, where they basically said, everyone’s gonna be a finance company. Where, you know, it used to be… banks offered finance and loan. And then maybe the big companies like Walmart, Costco, Target, you know, they could start to offer their own credit cards. Hey, come to Target, we’ll give you a Target credit card. You can buy stuff here on the credit card, you know, and car companies would make cars, but then they realized, you know, we make more money on the financing of the cars than we do on the car. So you go into an auto dealership in the US. You know, they don’t want to sell you the car. They want to sell you the car loan. And they make more on that. So if you go into a car dealership in the U.S., you never tell them, oh, by the way, I’m going to be paying cash. Which is really the only way you should ever buy a car. I mean, car loans are a total ripoff. So if I were going to go buy a car, I would tell them, you know, I’d negotiate the whole thing right up until the last minute and then say, oh, by the way, I’m going to pay cash. and that would make them very angry because they’re gonna make their money on the car loan. They make their money as a financing company. And a lot of auto companies do this and a lot of retailers do this. But okay, if I’m a merchant on this platform, couldn’t I become a financing company? And this is kind of what the Andreessen Horowitz talk was about, which is like, look, everyone is gonna start offering financing. It’s gonna be the same way you might offer logistics. like hey I’m selling stuff and I’ll use FedEx or whatever for the logistics so I can ship anywhere. I’m Jeff Ko, I make funny sneakers, I can ship anywhere in the world. I can offer logistics as part of my offering because I can tap into these other things. I could very easily just offer hey I’m Jeff Ko, I make these funny sneakers and I offer logistics and I offer my own financing. Jeff financing goes with Jeff Ko, you can buy my sneakers on credit. because I can offer that now. And it’s sort of like every product, every service, every business is just gonna start offering credit the same way we can all offer logistics and payment now. I mean, that’s kind of the argument. And maybe, maybe, so you can kind of see how this is all gonna evolve very, very quickly. And I think this is the beginning of, that’s, you know, to bring it full circle and then I’ll finish up. I think that’s why I’ve kind of been hyperbolic on this. The idea of… This is revolutionary what they’re doing. We are gonna see digital finance do things we never thought it could do. And it’s gonna go into businesses everywhere that we never saw coming. And yeah, it’s pretty amazing. I feel like we’re looking at the very first steps of something new. Anyways, we’ll see. For those of you who are subscribers, the key sort of concepts for today, Learning Goal 23, which is the Smile Marathon. and think about within all of this, I just told you, this idea of human free operations, that the primary dimension you wanna compete against is not opening lots of branches of banks, it’s machine learning. That’s your key competitive dimension that you wanna be better than everyone else in your field at machine learning. What would that mean in a business like this in banking and finance, right? So that’s kind of… The Smile Marathon, that’s the learning goal. Think about machine learning as a dimension of competition, human-free operations. Learning goal 19, which was an intro to Ant Financial and payment platforms. Payment platforms are really powerful. In this case, it’s the infrastructure that’s gonna enable a lot of other things to happen. So payment platforms just as, you know, I’ve given you five platform business models to think about, five different variations. Payment was one of them. That’s an important one to think about. And I think that’s enough for today. And also maybe if you wanna think about the advantages and disadvantages of scale. But I think really those two, Learning Goal 19 and Learning Goal 23, that’s kind of the key takeaway. And I’m gonna put this under those categories, this talk and some of these articles are gonna go under there. So if you’re working your way through the six levels and the 40 plus learning goals, as you hit those, I will… I’ll send you emails with this talk and some others that sort of reinforce those ideas. I think that’s what’s really important here. Oh, and by the way, the six levels within this course are gonna go up to eight very quickly because those are done now. I just haven’t put them into the system yet. So I don’t actually have any colors for that because levels one through six, basically the colors track the levels of belts you get in karate and jiu-jitsu. You go sort of blue belt, brown belt, black belt. Well, we’ve already hit black belt, so I don’t know what level seven, eight are going to be. Gold, silver, and that is it for part one of Ant Financial. Part two next week will be the discussion with Martin Reeves about sort of Alibaba and sustained innovation and adaptability as kind of his argument will be, I think. That that is really the primary way you compete going forward is adaptability and innovation. So we’ll see, well, that’ll be an interesting discussion. Then part three, we’re gonna go into some more aspects of this. So this is the end of part one for Ant Financial, Ant Group, I guess I should start saying. Let’s see, and other stuff. Oh, thank you. Last week I put out a little question about video games and someone, I got some great suggestions. I think the last of us is definitely seems to be the consensus. So that’s literally sitting on top of the PS4. Like in the case, if I can ever get past this stupid last level on Call of Duty, I’m going into the last of us. So thank you for that. I appreciate that. Yeah, and anytime, you know, if you have any suggestions, feel free to reach out. I’m always on LinkedIn. I’m always in the background of Twitter. So that’s probably the easiest way. Or if you know my email, please feel free. I try not to be active on Twitter because I find it awful. And I find I’m awful on it, which is more disturbing. I literally deleted the app from my phone to prevent myself from behaving in ways that I would later feel bad about. But I am actually there in the background, so if you can reach me there by DM or whatever. Yeah, but that looks like last of us. So that’s great. I appreciated all the feedback. People have a lot of opinions about video games. You know, it’s good to know. They are pretty spectacular. I really feel like I got ripped off as a child. Like when I grew up. You know, this is back in the 70s and 80s. And I really feel like I got ripped off. Like video games, I got the first wave of video games. You know, I can remember Atari, and I can remember Donkey Kong. And you know, and now compared to what kids now are growing up with, it’s, dude, it’s so much better. Like, it’s amazing. Like, the graphics are unbelievable. You know, I can remember, I literally can remember playing Pong. for those of you in this age bracket. I can remember playing Pong when that first came out. And I can remember when I was just a little kid and my buddy, I came home to his house and this is in Northern California and there was the funniest computer I had ever seen sitting on the desk. And I was like, what is that? He goes, oh, my dad’s working on that. They call it the Macintosh. His dad was one of the early people at Apple. and it was just prototyping. I remember walking into the kitchen, seeing the weirdest computer, and it’s like, oh, they call that the Macintosh. It’s not out yet, but it’ll be a thing. You know, and then the Macintosh comes out. And now the video games, now you play Spider-Man on PS4 and you’re swinging through the city, and it’s amazing. So I’m a little bit envious, but you know, whatever. It all comes around in life. My father, he gripes that when he grew up, they didn’t have plastic. that everything in life was made of wood or metal. So everything in your house, your desk, every single thing was made of wood or metal because they didn’t invent plastic until, I don’t know when they invented plastic, must have been the 70s or 60s or something. That was after his early years. So I guess it all comes around. But yeah, it’s pretty amazing. And I’ve got this ridiculous like screen TV on my wall that’s so big, it’s ludicrous. But if you’re swinging along as Spider-Man in Manhattan on that game, it’s absolutely spectacular. So, whatever. Anyways, I’m just rambling, but that’s it for me for this week. And yeah, please, any suggestions are greatly appreciated. Or you know what? Like, if you’re feeling generous, go over to the podcast or Google Play or whatever and put a review on this podcast. I think I’ve got like 10 of them, 10 reviews now. And they’re generally pretty solid. I got one jerk who left me like a one rating. Yeah, I’m sorry. There’s no way you can listen to like a one hour lecture on something and give it a one. You may not think it’s great. You may not like part of it, but a one? No, that’s something else going on entirely. Honestly, that’s like me on Twitter. Like I look back and I’m like, dude, why did I do that? That didn’t make any sense. So anyways, there’s something going on. I’m trying to dilute that one. That one sort of. Jerk out over time and yeah, these are the things that that I think about when it’s like 2 a.m. And I’m on my smartphone So I have one one star bugs me. I don’t know why Anyways, I’m just rambling at this point. Okay Anyways, thank you so much for listening. I do appreciate That you’ve given me a little bit of your time. I do my best to you know to try and help and You know provide something that’s gonna make you you know smarter and more sort of more sophisticated about these subjects over time. That’s really my goal with all of this is not to provide a Hot take on whatever happens to be happening, you know going on in the news of the world I generally do think about it like how can I systematically move people up and their expertise over time? What are the things that we need to talk about? What are the building blocks? Do we need to hit it once do we need to repeat it over and over? No, do we? And that is kind of what I’m thinking about. And that’s sort of where today fits in, is this is a little bit more complicated look on something we have touched on before in terms of payment platforms and marketplaces and all of that. So that’s sort of how this fits into the bigger scheme, is this is a more complicated, subtle version of something we’ve sort of talked about most of the building blocks of, and financial before at this point. They’re just putting it together in an advanced way Anyways, that’s where we are. Okay, that’s it. Have a great week. I will talk to you next week. Bye bye.