I like specialty ecommerce. It can have great business models and there are opportunities to differentiate. So, lots of businesses can rise in the space.

And within specialty ecommerce, I really like specialty marketplaces, although these are pretty rare. It’s hard to make a marketplace work without large scale. And most specialty players don’t have this.

Which brings me to Etsy, an American and UK specialty marketplace for handmade, vintage, and other unique items. For a long-time, it has been my go-to example for specialty marketplaces. Especially the early years, which I am calling Etsy 1.0.

I’ll get to Etsy in a minute. But first a bit about specialty ecommerce.

How I Assess Specialty Ecommerce Businesses. Including Marketplaces.

Way back in Podcast 97, I looked at several specialty ecommerce businesses and came up with a simple framework for assessing their viability against the giants.

Here are my 5 questions (thus far) for assessing the viability of a specialty ecommerce company.

- Is the company sufficiently differentiated in the user experience?

- Can the company compete and/or differentiate in logistics or infrastructure without ongoing spending?

- Does the company have a strong competitive advantage in a circumscribed market?

- Is there a clear path to significant operational cash flow?

- Has the company avoided markets and situations that are attractive or strategic for the major ecommerce companies?

The first question is the key one. Ecommerce, retail, and shopping just has lots of interesting dimensions you can differentiate on. By product types. By experiences. By fun vs. purchasing. By customer segments and situations. And you can differentiate for consumers, business customers and merchants / brands (on platforms).

The second question is mostly about avoiding competing with the giants in their ongoing logistics and infrastructure spending. It’s rare to be able to sufficiently differentiate on the supply side. Although we do see it in:

- Groceries, which are perishable. Logistics needs to be rapid and/or cold chain.

- Cross-border. Luxury goods are usually sourced and delivered globally.

- Weird assembly or packaging. Buffett’s company Oriental Trading Company has this (see podcast 97).

But generally, question two is about avoiding competing with the giants on logistics and infrastructure spending. They lean into that.

Question 3 is about making sure your specialty niche is well-defended. You need to fight against rivals and new entrants. And you want, as much as possible, to scare away the giants like Amazon.

Question 4 is about having enough cash to grow, re-invest and keep fighting. You want to keep advancing the technology and products in your niche. That takes cash.

Finally, there is question 5 which is about avoiding the big boys like Amazon, Shopee and Alibaba. Question 1-4 don’t matter if you are in a space that is considered a strategic necessity for Amazon. This is the big problem with grocery and fresh fruit specialty companies in China. Alibaba has viewed grocery as strategic infrastructure and will spend like crazy to win there.

You really don’t want to be in a space that is too big or attractive space (also grocery). The big boys are not going to spend lots of time and resources to fight an entrenched company in small, specialty niche.

Ok. With that, let’s look at early Etsy.

A Summary of Etsy 1.0

Etsy is a simple marketplace platform for products (not services), with two user groups (consumers and merchants). And it’s mostly in the US and UK, although it has expanded to 5-6 other geographies (UK, France, Germany, Canada, Australia, India). And there is a significant cross-border component. They say approximately 40% of GMV has the buyer or seller in a different geography.

Etsy’s GMV and revenue is good but small for ecommerce. And its rapid growth in 2020-22 really got people’s attention:

- 2018: Revenue $0.44B

- 2019: Revenue $0.59B

- 2020: Revenue $1.7B

- 2021: Revenue $2.3B

- 2022: Revenue $2.57B

And its financials are what you would expect to see in a small marketplace platform with somewhat increasing operating leverage.

- Gross Profits is 70-72% of revenue.

- Up from 66% in 2019.

- Marketing is 27% of revenue. This is their major expense.

- Product Development is 15% of revenue.

- Operating Profit Pre-Tax is around 20% of revenue.

- Up from 10% in 2019.

This is approximate. Here are the latest specific numbers.

Finally, Etsy is asset light with negative working capital. That’s great.

- Net PP&E of $0.25B in 2022

- Working capital of around -$0.17B in 2022

The only thing I don’t like about the financials is the $2.28B of long-term debt on the 2022 balance sheet.

Ok. The key question.

Why has Etsy done well as a specialty ecommerce play against the giants like Amazon?

The short answer:

Etsy has a unique group of sellers that provide a unique inventory of items.

Etsy sellers are artisans and entrepreneurs that create and/or curate “personalized”, “vintage”, “hand-made” and “unique” products. It has a collection of products that are “hard to find elsewhere”.

The merchants on Etsy are “creative artisans and entrepreneurs” (according to Etsy), which mostly means solo individuals working from home. These solopreneurs are creating unique items themselves. Such as furniture and paintings. Or they are hunting through antique stores and other locations to find unique items. For those in the West, these are the same people who sell at flea markets. Or who make things for local craft fairs.

Etsy’s sellers are mostly women working at home because they want the money. So, whether Etsy is really about “creative artisans” vs. need the money entrepreneurs is a matter of debate. Here are some details from the 2022 annual report.

Etsy’s biggest categories are:

- Home and living items (#1)

- Jewelry and accessories (#2)

- Clothing

- Wedding and party evens

- Toys and entertainment

- Art and collectibles

- Vintage items (i.e., from certain time periods)

So, if you want handmade jeans, jewelry from the 1920’s or replica models of the latest SpaceX rocket, you go to Etsy. Which is one of the few places you can find such things.

When I log in to Etsy, the items it shows me are:

- Japanese currency from the 1920’s. I like old currencies.

- Postcards from around the world from the 1880’s.

- A picture frame that goes on the front door around the peephole. It’s a copy of the one in the tv show Friends.

- A t-shirt about physicist James Maxwell.

- A coffee coaster in the shape of the SpaceX drop ship.

- A handmade samurai sword identical to the one used in the videogame Ghosts of Tsushima.

I don’t think I would see a single one of those things on most other ecommerce sites. The factoid the company mentions over and over is most consumers say they find items on Etsy that they can’t find anywhere else. Most of Etsy’s 100M listed items are unique by creation or curation.

The seller side is the key differentiated aspect of early Etsy (Etsy 1.0). And they have pretty good retention on the merchant / seller side.

From this seller-side differentiation, we can then look at the buyer side of the marketplace.

And here Etsy has also differentiated. But not as strongly. Most of their uniqueness has been on the supply side.

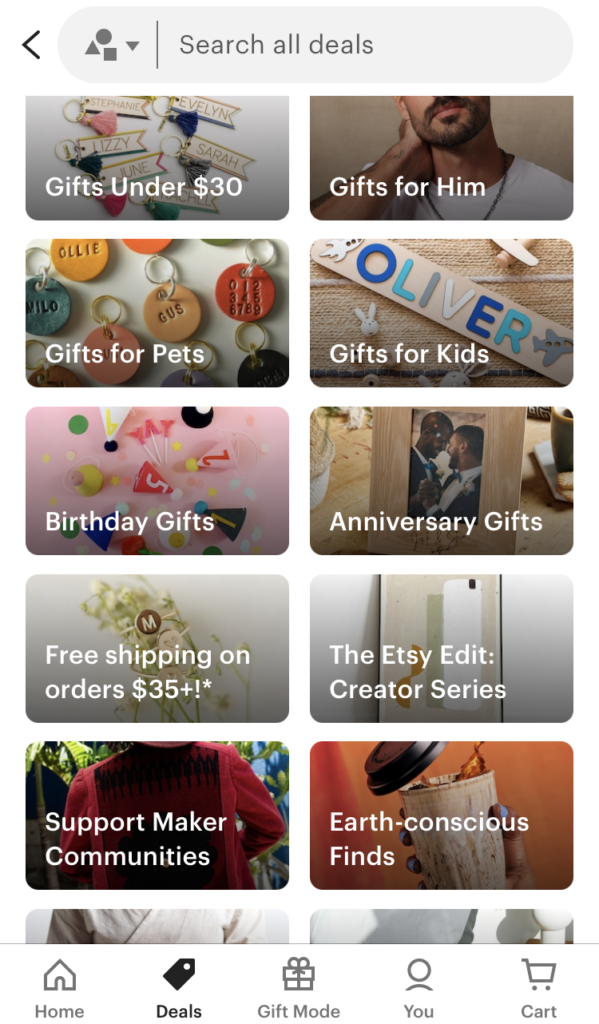

Etsy says its buyers are looking for inspiration. They want a unique style for themselves. Such as in clothing or items for their homes. Or they are looking for a special gift. Or something for a special occasion. It describes its consumer offering in terms of style, gifting, and events.

From the annual report.

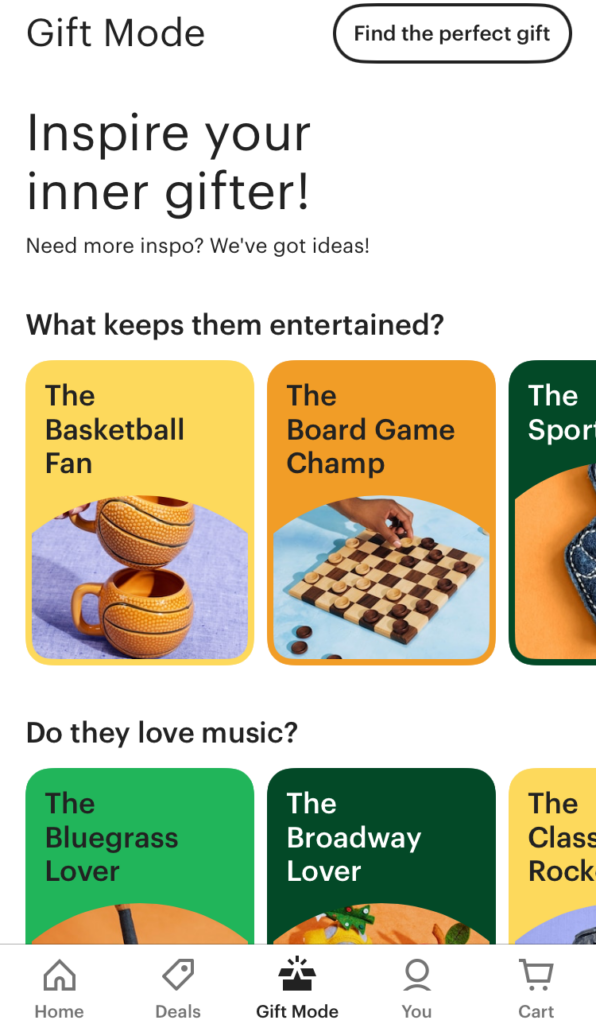

In the mobile app, you can see this same layout for gifts vs. inspiration.

Etsy 1.0 meets all my 5 specialty ecommerce questions.

Ques 1: The Company Is Strongly Differentiated on the Seller Side. And To a Lesser Degree in the Buyer Experience.

Yes, by virtue of their large offering of unique items. Which are created and curated by a unique group of sellers.

Etsy knows their sellers well and offers them various services. They say their sellers’ biggest problem is time. They are making these items by hand, unlike mass produced items. So, Etsy gives sellers tools to free up their time from the business aspects, which consumes 50% of their time.

Etsy also does lots of marketing support.

Performance marketing is a big part of what Etsy does. Instead of charging merchants upfront for marketing (like every other marketplace), Etsy pays to market their items on other sites and then recoups that money out of their sales percentage payment. Getting both sellers and their unique items into search engines is really important for Etsy’s traffic.

It’s also worth pointing out that these solopreneurs have few large places to sell their items. They can go to local craft fairs. They can go to local consignment and vintage stores. But their unique items don’t fit well in most large ecommerce sites. According to the 10K, 55% are selling multi-channel but the global scale of Etsy’s marketplace is really important.

This has made Etsy’s “search and discovery” technology important. These are not mass-produced items with SKUs that fall nicely into product categories. These are individually curated or created items. So, Etsy has invested in search and discovery functions for their unique items.

Ques 2: Etsy Has Avoided Big and Ongoing Logistics and Infrastructure Spending

They are not in an arms race with Amazon or Walmart in warehouse building and logistics spending. Or in creating a fleet of delivery riders, like Dingdong.

Etsy doesn’t have major logistics, infrastructure, or other capex spending. Which is great. And, as mentioned many times, ongoing capex spending (particularly in logistics) is how the big players use economies of scale over time.

Ques 3: The Company Has a Strong Competitive Advantage in a Circumscribed Market

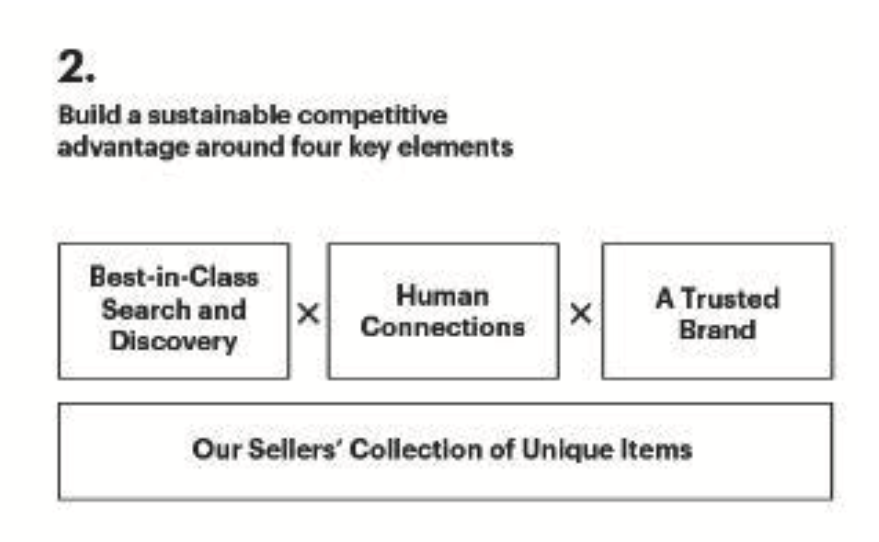

Here is what Etsy calls its sustainable competitive advantage.

That is a good summary of Etsy 1.0 strategy. But it’s not their competitive advantages. They have:

A network effect in a classic two-sided marketplace

For buyers, Etsy offers more crafts and unique items than most other platforms in the USA and the UK.

For sellers, they have a bigger pool of buyers.

And the incremental value of each new seller increases the value for buyers linearly. And also, vice-versa. Ecommerce marketplaces for products have great network effects.

Etsy’s network effect would be better if it was more global. It would also be far more powerful if it was more cross-border. This is why companies like Airbnb and Upwork are so powerful. Etsy should have gone global long ago – and far more aggressively. Crafts, hobbyists, and curators exist in all the major economies.

Second to network effects, Etsy also has economies of scale in IT spending. This can be effective if the technology is highly specialized for unique situations and buyer-seller interactions. In Etsy’s case, IT spending is a good weapon against smaller rivals and new entrants. But it’s not a huge weapon.

Finally, switching costs on the seller side can create some competitive strengths. Etsy’s ability to integrate operationally with its sellers is interesting, given the small size of most of their merchants. Etsy is dealing with solo individuals who are +90% operating from their homes. That means they have very limited operational ability. Etsy could definitely build out their suite of seller services, which could lock them in. Etsy is doing interesting things here. But it’s mostly about the network effects.

Question 4: Etsy Has Significant Operational Cash Flow

Yes. There is a long history of profitability. Their overall take rate is about 20-24% of the purchase price. They do quite well.

This operational cash flow has fueled their geographic expansion into Brazil and other places. And their recent expansion into other marketplaces. Although they did borrow significantly, which I don’t like.

Question 5: The Company Has Mostly Avoided Markets and Situations that are Attractive and/or Strategic for the Major Ecommerce Companies

Etsy is in the $2B revenue range, mostly from the USA and UK. That’s great. And it’s probably not a big enough market to attract the attention of the giants. Taking this market is not going to get you promoted to senior management at Amazon. It doesn’t move the needle enough.

Being dominant with network effects in a weird and specialized $2B ecommerce business is a great position.

Ok. That’s good. Etsy is a great example of a specialized ecommerce business.

***

That’s my breakdown of Etsy 1.0.

However, …

Etsy does have some significant weaknesses. And the company has been making some interesting moves recently.

In Part 2, I’ll go through Etsy 2.0, which is currently emerging.

Cheers, jeff

———–

Related articles:

- A Breakdown of the Verisign Business Model (2 of 2) (Tech Strategy – Daily Article)

- 3 Factors Will Determine the Future of Verisign Inc. (Tech Strategy – Podcast 191)

- A Strategy Breakdown of Arm Holdings (1 of 3) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Specialty Ecommerce

- Marketplace Platform

From the Company Library, companies for this article are:

- Etsy

Photo by Annie Spratt on Unsplash

——-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.