In Part 1, I went through the basics of Etsy 1.0 (2005-2020). Its business model and strategy were mostly about:

- An ecommerce site with a large inventory of one-of-a-kind items that are handcrafted and /or curated.

- A business model that is a two-sided marketplace with network effects. Which is somewhat cross-border and global.

- A long-term strategy that is mostly about:

- Building its sellers and inventory, which are their most significant source of differentiation.

- Effective brand and performance marketing.

- Search and discovery tools for their non-standard products.

But here is how Etsy describes its strategy and mission. Note the comments about keeping commerce human.

From their 10k, here is Etsy’s standard summary of their strategy.

If you are familiar with Etsy 1.0, you will notice a couple of changes in the bottom of this second slide. You can see two changes. They have added:

- Leveraging their marketplace playbook across their “House of Brands”. Which are Etsy, Reverb, Elo7 and depop.

- Using the power of “human connections”. This is also mentioned in their Mission Statement. Note the below excerpt.

These two newer parts of their strategy are what I consider to be Etsy 2.0. This is what is different going forward. These two things, plus their ongoing geographic expansion.

Before I get to that, let me talk about the weaknesses of their largely successful business model thus far.

What I Don’t Like About Etsy 1.0

The biggest problem is the low frequency of usage by consumers.

That’s #1, #2 and #3 on my list of problems. Consumers just don’t buy crafts that often. It’s for special occasions. It’s for gifts. That’s very different than buying groceries 2-3 times per week. Or buying stuff from Amazon every week out of an increasing habit.

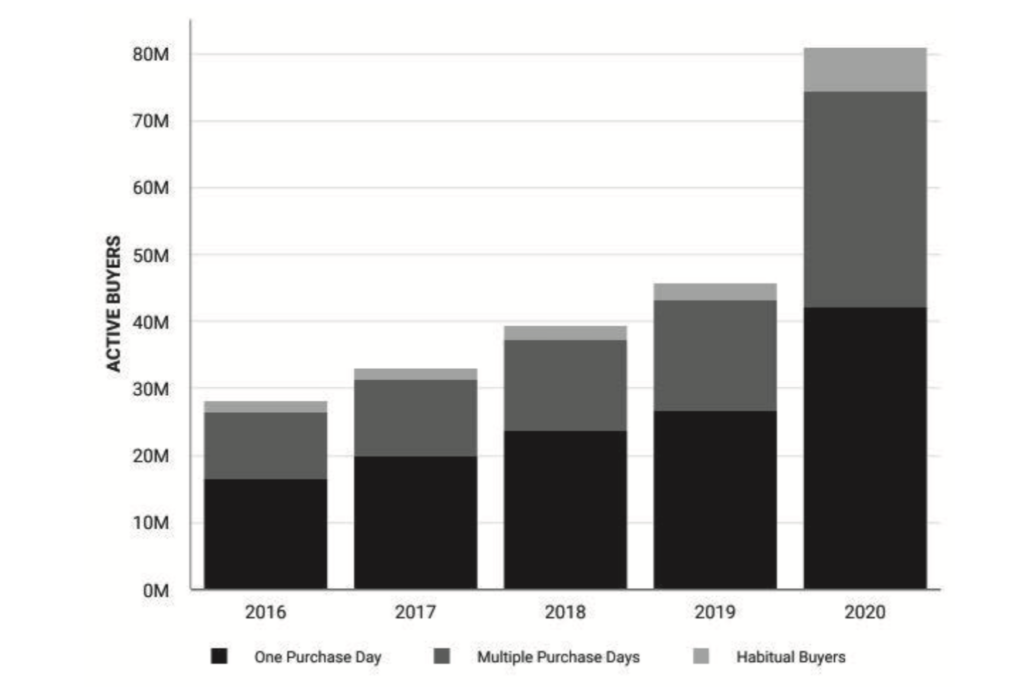

If we look at Etsy’s buyers over time, the growth looks fine over time.

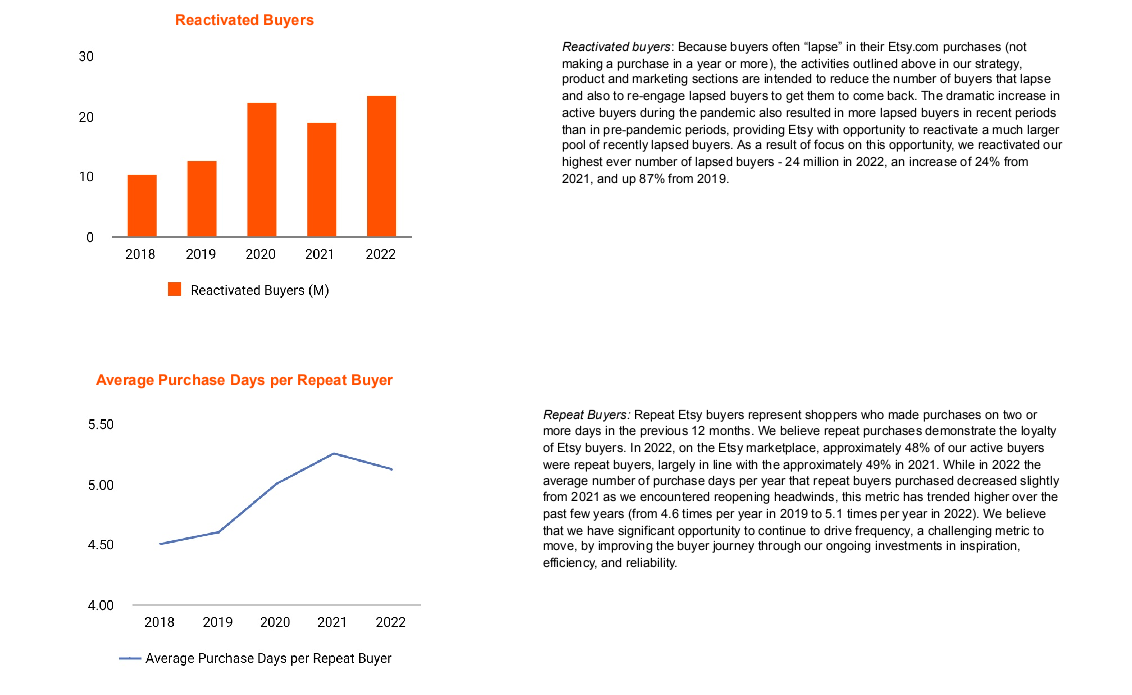

But now look at the frequency of purchases. The average purchase days year for a “repeat buyer” is 4-5 days per year. That’s really low.

Etsy talks a lot about this in their 10Ks. And you can see this frequency problem in their focus on:

- Brand and performance marketing. Etsy spends 27% of revenue on marketing. And there is a ton of detail on their marketing strategy. When your buyers have low engagement, you have to keep bringing them and new buyers to the site. That means big marketing spend.

- The focus on creating “habitual users”. They are trying to turn regular buys into more frequent buyers, which they call habitual users.

- The focus on reactivating lapsed users.

Etsy actually has great detail on its performance marketing. And they did some cool tactics for offsite vs. onsite ads. Performance marketing is a lot about getting their sellers and their inventory into search engines and other websites. The below detail is worth reading.

I talk a lot about how attention is the coin of the realm. In a digital world with endless supply, you have to capture demand. You have to get attention and engagement. Otherwise, virtually everything becomes difficult. You end up being very dependent on marketing and acquiring new users and engagement. And this game gets harder every year. You don’t want to be too dependent on the every-escalating arms race for attention and engagement.

I talk a lot about margin vs. engagement products. It’s in the Concept Library. You need products that get your profits, and you need products that get you engagement. And it is pretty rare that one product gets you both. You need to think about a portfolio of profits.

Take a look at the risk section of Etsy’s 10k. Note all the discussion about marketing.

But just trying to get people to visit, shop and then buy more is a limited strategy. Etsy should have gone after frequency and engagement by expanding into content or more engagement-based products a long time ago. They needed to expand their portfolio of products

The other thing I don’t like about Etsy 1.0 is the lack of international growth.

There is no reason why they can not have gone after more international markets a decade ago. Especially on the seller side. Companies like Upwork have built global networks of service providers with global network effects.

With that, let’s talk about Etsy going forward. Or as I call it, Etsy 2.0.

Etsy 2.0 Is About Increasing Human Connections and Differentiation

For a marketplace platform, you have to serve both buyers and sellers. You have to win on both sides.

So, what is Etsy’s main value to the buyers? In their words it is:

- The breadth and quality of seller items (as mentioned).

- The ease of finding items (i.e., convenience and user experience)

- Marketing effectiveness. I disagree. But ok.

- Person-to-person commerce experience.

That last one is interesting. In fact, it is the same “human connection” point mentioned in their mission statement.

They want to “keep commerce human”. Which they say is a contrast to the increasing automation and commoditization ecommerce. They say they want to increasingly focus on creativity and human connection.

That’s a bit fuzzy. But if you reframe it in terms of digital strategy, it’s pretty smart.

Marketplace business models tend to standardize and commoditize the supply side. By definition, they seek to enable interactions between buyers and sellers. And they want to do this efficiently at large scale. For that to be happen, you need to standardize the supply. You need to have set product and service types and categories. You need SKUs. You need ratings systems. You need effective search.

Basically, you can’t do efficient, data-driven buyer-seller interactions at large scale without standardization.

And this often leads to the commoditization of suppliers, which is a valid concern of suppliers and governments.

- Uber has totally commoditized drivers giving rides.

- Amazon and Alibaba have commoditized thousands of sellers of basic products like iPhone cases.

Standardization plus big scale tends to lead to commoditization. And especially when the products are non-differentiated.

This tends to increase the power of the platforms over suppliers dramatically. This is why the first action the Chinese government took against big tech was to address the power imbalance between small suppliers (taxi drivers, SMEs) and big platforms like Taobao and Meituan.

But this depends on how differentiated the products are.

On services marketplaces, you can divide platforms into differentiated (Airbnb) and non-differentiated (Uber). Every apartment listed on Airbnb tends to be different. A different size, view, location, etc. But every Uber driver tends to be the same. That’s why you don’t even choose which driver you want. They assign it automatically.

Differentiated marketplaces (like Airbnb) tend to be more powerful than those based on non-differentiated supply (like Uber). They usually have stronger network effects. If you add one more Uber driver, it doesn’t increase the value to the buyers beyond a certain point. But if you add one more restaurant (say Japanese) or Airbnb property, it almost adds incremental value to the buyer. Differentiated marketplaces have more powerful network effects.

That was some theory. Here’s the point.

How can you increase the differentiation on a products marketplace like Etsy?

You make the connections and interactions with sellers more human and personal.

If you know the artisan who made your custom desk on Etsy, this is no longer just about a product with an SKU. It’s a unique product with a unique seller. It’s the product and the relationship. It’s the story behind the crafted product. It’s about the person who made the product. The human connection increases differentiation.

That’s how I see Etsy 2.0’s focus on human connections.

Etsy wants to make the interactions with its sellers more human and personal. They want the buyer and seller to interact more. They want to tell stories about the seller and their crafted items. They want them to email back and forth. They want product customization. That’s good strategy.

Increased human connection and differentiation on their marketplace should have lots of benefits:

- More engagement and better and deeper interactions. It should result in more loyalty, engagement, and frequency. And it is something that Amazon can’t do. Nobody has relationships with sellers on Amazon.

- More revenue. From a higher conversion rate to sales. And likely pricing premiums.

- A more powerful marketplace with a stronger network effect.

- More data. Keep in mind, all product development and user experience improvements depend on having user data. That is hard to get if people aren’t logging in frequently.

As mentioned, the low frequency and engagement is the biggest weakness of Etsy 1.0. This is a good solution to that.

***

One last comment on this:

What is the difference between buying services on Upwork for graphic design and buying legal services from a lawyer online?

In the former, it is just a transaction. Upwork is a marketplace that standardizes and commoditizes services. There might be repeat transactions with a seller, but it is mostly just a simple transaction.

With the lawyer, it is a more complicated service. And it is much more about the relationship. He / she is part of your professional network. You might work together for years. There is a professional relationship and reputation matters.

The Upwork example is a pure marketplace for a transaction. But the lawyer example is really a combination of a professional network and a marketplace. James Currier of NFX calls this a “market network”. I think Etsy is heading in this direction with its focus on human connection and relationships.

***

Ok. That’s it for Part 2. In the final part, I’ll look at their growth strategy.

Cheers, Jeff

——–

Related articles:

- A Breakdown of the Verisign Business Model (2 of 2) (Tech Strategy – Daily Article)

- 3 Factors Will Determine the Future of Verisign Inc. (Tech Strategy – Podcast 191)

- A Strategy Breakdown of Arm Holdings (1 of 3) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Specialty Ecommerce

- Marketplace Platform

From the Company Library, companies for this article are:

- Etsy

Photo by Annie Spratt on Unsplash

——-