Softbank has taken Arm Holdings public (Nasdaq: ARM). That means we are finally seeing their numbers again. And we’re getting a good window into how management describes its business model and strategic priorities right now.

In this first article, I’m going to detail how I think about Arm Holdings strategy, which has been enormously successful.

- In Part 2, I’m going to lay out the 5 big digital concepts powering their business model.

- And in Part 3, I’ll talk about the external factors that are changing their trajectory (mostly AI and China).

First, An Introduction to Arm Holdings

UK-based ARM was founded in 1990 as a joint venture between Apple, ULSI and Acorn Computers. It was intended to advance the development of the Acorn RISC Machine processor, which had been selected by Apple for its Newton project. ARM used to stand for Acorn RISC Machine. But ARM the company was short for Advanced RISC Machines. Confusing.

The goal was a CPU that was high performance, power efficient, easy to program and scalable This type of CPU was the key to smartphones and other handheld smart and connected devices, which need low energy usage (versus CPUs for the personal computer).

Within the design of CPUs, ARM provides the instruction set architecture (ISA) that governs how software gets run on the processors. This ISA library is what is CPU designers use to create semiconductors in various configurations and for various use cases.

So, ARM is in the CPU architecture business. And its primary customers are the semiconductor designers (Intel, Nvidia, Qualcomm) and the smart connected device OEMs (Oppo, Vivo, Xiaomi). And this is mostly about smartphones. Secondarily, they are important in some other consumer electronics, such as tablets.

ARM describes its business as architecting, designing, and licensing high performance, low cost and energy efficient CPU products and related technologies.

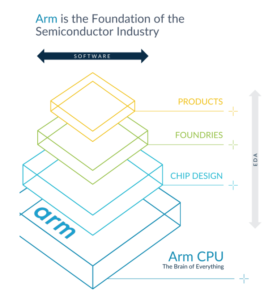

From its SEC filings, here’s how ARM shows its position in semiconductor tech stack.

So, ARM is a foundational part of the CPU stack for smartphones. But, really, they are part of the foundation of the tech stack for everything on smart, connected handheld devices. Nothing runs without processors. All the software, data, data technology depend on these CPUs. So, when we talk about software as “invisible engines”, this is really the core engine of everything.

ARM’s ISA runs on 99% of the world’s smartphones globally. A monopoly in one of the biggest secular trends of all time (i.e., global smartphone adoption). And they are positioned against the continued advancement of smart connected devices. It has been a pretty amazing rise.

And ARM is still benefiting from the increasing cost and complexity of leading-edge CPUs for smart devices. This is an important point.

Technology does get commoditized pretty fast. You usually need network effects or switching costs to protect a digital business from this.

But to be a key part of the tech stack in a rapidly advancing frontier of technology is a great position. Even if your products get copied, you have already moved on to the next generation. You can stay perpetually ahead. Especially if the cutting edge of technology requires close collaboration with semiconductor designers and manufacturers. This close collaboration and dominant position on a rapidly advancing technological frontier protects ARM from commoditization. More on that below.

Note the below graphic from ARM’s SEC filings. The cost of semiconductor design continues to increase with advances and increased complexity. In their filing, the company says that the design cost of a 7nm chip is $249M. But the design cost for a 2nm chip is $725M.

Last point.

ARM is basically in the IP licensing business, so they have a nice asset-lite business model. For revenue, they get an upfront licensing fee by companies using their ISA in the design of semiconductors. And then they get royalty fees for every semiconductor that actually gets produced. Unsurprisingly, their financials are pretty fantastic. It’s basically a cash machine.

Note the below revenue stack over time. Notice how much of their revenue is coming from sales made a decade ago.

Here is their income statement.

- Revenue is significant but not huge at $2.6B annually. They are a small percent of the overall spend on CPUs. That is great (as will be discussed).

- Gross Profit of +95%

- R&D is +40% of revenue. That is the only big expense. That is their teams of engineers writing the ISA. The company is +80% engineers.

- Operating Profit of 25%.

- No significant capex or capital costs.

Overall, it’s pretty awesome.

Note: The “related parties” mentioned are basically ARM China, which runs all their business in China. That will be discussed in Part 3.

How I Think About Arm Holdings

I break ARM into four questions:

- Are they benefiting from a secular trend?

- I like companies that have a tailwind and can naturally grow.

- ARM has been riding a global secular trend (i.e., smartphone adoption) for decades. How this will change going forward is a big question.

- What is the state of the core growth engine?

- I really like when there is great product-market-fit (PMF) on a long-term secular growth trend. And ARM has had fantastic PMF for a long time.

- But I want to see how this is changing. Growth engines usually need to adapt over the long-term.

- What are the competitive strengths of their business model?

- I really like a company with great PMF on a long-term secular trend. And that has a dominant position against competitors. This not only lets them ride the trend. It also lets them capture an outsized portion of the profits.

- ARM has great competitive advantages (to be discussed). I want to see if these are getting stronger or weaker.

- Are there external CGT factors that will impact 1-3?

- The above 3 are about customers and competitors. But changes in consumer behavior (C), government action (G) and changes in technology (T) can impact this situation. I call this CGT.

- For ARM, the US-China situation and the adoption AI of are going to impact their future.

For this article, I want to talk about their main product and their core growth engine (#2 above). In the next articles, I’ll do #3 and #4. I’m not going to talk much about the secular trends #1.

Arm’s Customer Value Proposition is “Product Plus Ecosystem”

First, it’s important to think about how CPUs, firmware, operating systems, and apps work together. You can’t really separate these things. For each tech platform (smartphones, PCs, servers), they all must work together. That’s what gets you the digital engine of a smartphone or personal computer. In each case, they are really one deeply integrated thing.

- That’s Windows and Intel was always referred to as Wintel for PCs.

- It’s why Qualcomm and Android were always together for smartphones.

You can’t separate the hardware and software. So don’t try to look at ARM without thinking about how tightly integrated it is with the semiconductor companies and the operating systems.

Within this tightly integrated digital engine, ARM does ISAs for chip design. So, their primary customers are semiconductor developers and OEMs looking to put semiconductors in their products.

For these primary customers, they offer:

- An ISA library for high performance, low-cost and energy efficient.

- And their ISAs are low-cost, easy to use, flexible, and reliable / low risk.

That’s the most basic value proposition. The first point is how they differentiated from ISAs for personal computer and server chips.

But think about the value of the second point to their customers.

- They can offer a low-cost product because of their enormous economies of scale. They have IP with global scale so they can offer it cheaply (relative to the cost of the semiconductor).

- Their products are easy to use and let customers get to market fast. Especially compared with doing things internally.

- They give their customers flexibility. They have accumulated such a large library of ISAs that their customers can optimize CPUs for specific performance, power, and area (i.e., cost) requirements. This lets designers target a wide range of particular use cases with specific PPAs. Additionally, ISAs are modular building blocks. You can add them together to create what you need.

- They are reliable and low risk. All the code has to work with all the other code. And with the hardware. This creates risk. But ARM has a long history in this area and works in close collaboration with all the leading semiconductor companies. It’s the smart, low-risk choice.

This last point is important.

Everything is interoperable. The ISA has to work with the hardware. And the firmware. And operating system. And all the apps that will run on top.

ARM is really not just offering a product (as described). They are offering their customers a product AND an ecosystem of software and hardware providers that all works together.

ARM works in close collaboration with:

- Semiconductor companies. Think Qualcomm, Nvidia, and Intel.

- Semiconductor supply vendors. Think foundries such as TSMC and Intel. Think electronic design automation tools (EDA vendors such as Candence, Synopsys, and Siemens).

- Firmware and operating system companies. Think Linux, Android, Red Hat and Amazon.

- Application software developers. Think Adobe, Microsoft, etc.

And you can even put in related software tools providers, game developers and others.

ARM works with all of this. That is really what they are offering. A product and an ecosystem. A semiconductor developer or an OEM looking to put in the latest performance CPU will know that the ARM ISA will work. Because all the designers use them. Because all the supply vendors work with them. And because all the software developers write for their ISA.

- Now compare that customer value proposition to buying from someone else.

- Or to doing it internally?

- And it’s a small percentage of the cost of CPU design and development. So why take the risk?

ARM basically has had an unbeatable customer value proposition, which is one of the reasons they have 99% of the smartphone market. They argue their total addressable market (TAM) is anything with a semiconductor (with a processor) in it. That’s a $200B annual market and ARM serves about half of that ($100B). Their royalties and licenses get them about 2% of that, which is $2B.

How well they do in adjacent markets such as automotive, IoT, cloud computing and networking equipment is an important question. Discussed in Part 3.

***

Ok. That’s it for Part 1. In Part 2, I’m going to go into the business model and its competitive advantages (my area). But I wanted to start by talking about just how powerful its value proposition to its customers is. It’s really impressive.

Cheers, jeff

———–

Related articles:

- Ant Financial Is 3 Platform Business Models Combined. (Jeff’s Asia Tech Class – Daily Lesson / Update)

- Ant Financial’s Big Money is in Asset-Light Credit Tech (Jeff’s Asia Tech Class – Daily Lesson / Update)

From the Concept Library, concepts for this article are:

- Semiconductors

From the Company Library, companies for this article are:

- Arm Holdings

- Masayoshi Son / Softbank

Photo by Vishnu Mohanan on Unsplash

——-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.