In Part 1, I argued there are four strategy questions for ARM:

- Will they continue to benefit from a secular trend? Is their tailwind continuing?

- What is the state of their core product and growth engine?

- What are the competitive strengths of their business model? Are they changing?

- Are there external CGT factors that will impact 1-3?

In this article, I want to focus on their competitive strengths (i.e., question 3). That is my main area of expertise. And ARM has a fantastic business model. But it has some complexity. So, it helps to view it through the right frameworks.

How I View ARM’s Business Model

There is a lot going on with ARM in terms of strategy.

It’s deep in the tech stack and is part of the architecture for CPUs in almost all smart devices (especially smartphones). So, it looks different than the typical digital business models I discuss. It’s not a business built on digital architecture. It is, as ARM says, at “the heart of advanced digital products”. Fortunately, I have 6 books on this particular subject (Moats and Marathons). And my framework is to break digital business models into 6 levels, each with specific sub-components.  I’ll go through the details. But let me first just jump to the “so what”. Most of ARM’s formidable competitive strengths (99% of smartphones for 30 years) comes from 3 digital concepts. I’ll go through these first. After that, I’ll go into some of the other factors.

I’ll go through the details. But let me first just jump to the “so what”. Most of ARM’s formidable competitive strengths (99% of smartphones for 30 years) comes from 3 digital concepts. I’ll go through these first. After that, I’ll go into some of the other factors.

Big Digital Concept #1: Standardization and Interconnection Network Effects

If you go to my Concept Library, you will see Standardization and Interconnection Network Effects listed. Standardization can be a network effect because it can decrease the coordination costs of certain interactions. For example, if everyone in China speaks Chinese, the language (a standardized product) is more valuable. It’s a network effect. If you standardize to one language, nobody needs translators. Books don’t have to be published in multiple languages. Conversations and pretty much everything happens faster. You save time and money in lots of ways. How powerful a standardization network effect is depends on two things.

- How many people, companies or protocols are people using it. Chinese is more valuable than smaller languages.

- How frequent the interactions are. The network effect only increases if people, companies and protocols are interacting with each other.

When you move to digital protocols, this all becomes more powerful. Because software is really good at connecting with lots of other things. Going digital means a dramatic increase in connectivity and interactions. Humans might talk to a couple of hundred people individually. But software can connect with billions of other devices and have complex interactions in milliseconds. So standardizing software languages and protocols can have a pretty amazing network effect. Especially when it is global. And especially when you are standardizing the core language of all smart, connected devices.

A standardization network effect is the biggest thing happening at ARM. The ISA is interacting with itself. With other software. With the chip. With other hardware. Pretty much with everything. ARM achieved this because it an early mover in low-cost, energy efficient, high-performance semiconductors. Note: Early and First Mover is a Tactic in Level 1. They were also counter-positioned (another tactic) against the much higher complexity x86 architecture being used on personal computers at the time. That’s a sequence we see every now and then.

- A first mover introduces a differentiated product that creates a new language or protocol.

- It is counter-positioned against a big incumbent, that gives them time to get to scale.

- With scale, it achieves a network effect. Sometimes globally.

So, if ARM’s biggest strength is its standardization network effect, then its most important metric is market share. Maintaining market share is their #1, #2 and #3 priority. As will be discussed, that’s why it’s critical they stay in China, even if they are getting jerked around on royalties. Most of the world is using smartphones made in China. They really don’t want another ISA to emerge from China.

An Aside on Network Effects

For those that have read my Moats and Marathons books, you know I break networks into 3 types:

- Physical Networks

- Protocol Networks

- People Networks

ARM is a protocol network. And I break network effects into 3 types:

- Direct (One-Sided) Network Effects

- Indirect (Two-Sided) Network Effects

- Standardization and Interoperability Network Effects

That’s my framework. From there, I have lots of checklists as network effects come in many types and strengths. My standard questions include:

- Are these local vs. regional vs. international network effects?

- Are they fast vs. slow network effects?

- What is the degree vs. value of the connections?

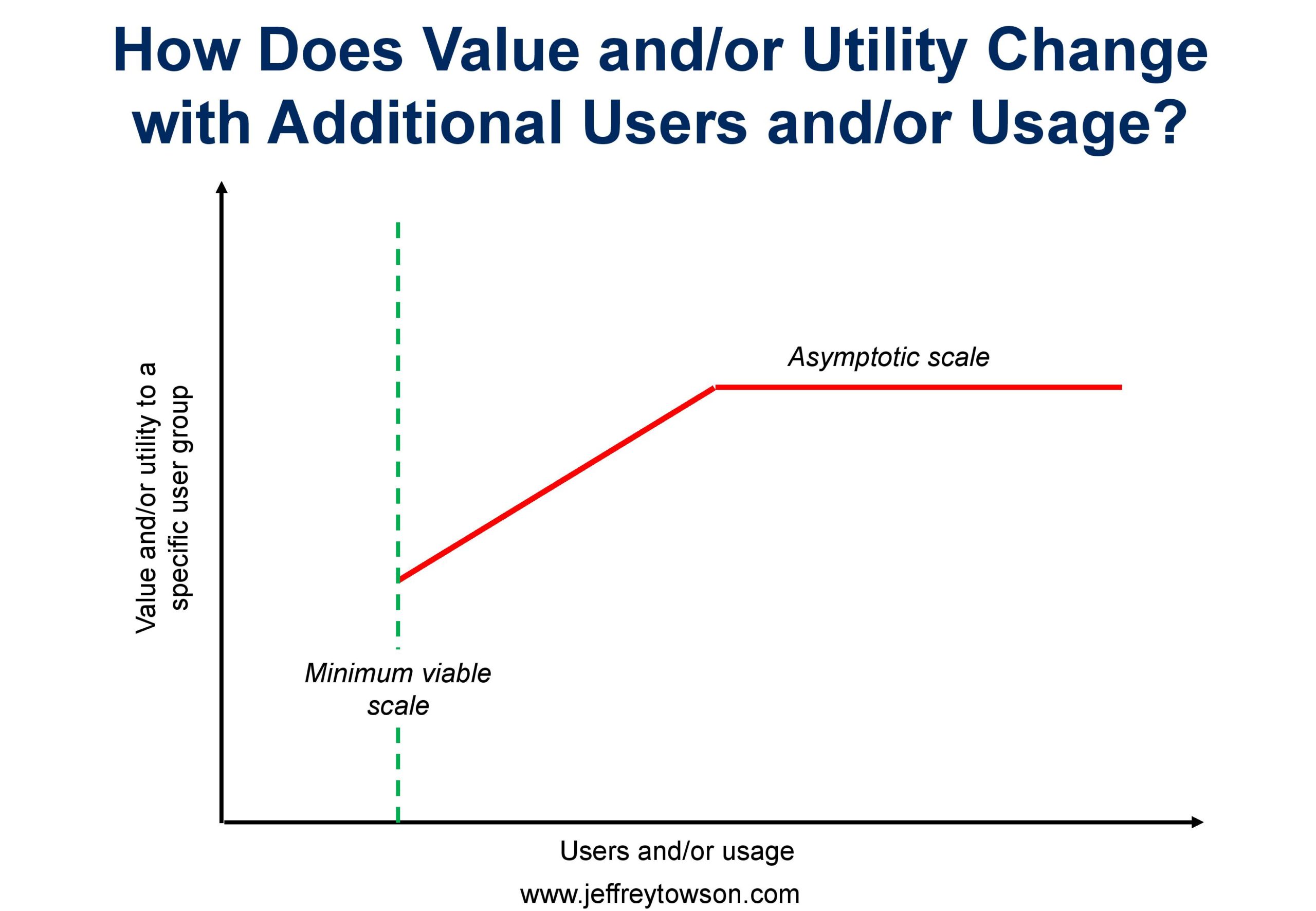

- What is the minimum viable scale vs. asymptotic scale?

- What is the congestion / saturation / degradation scale?

- Where does the network effect show linear vs. exponential growth?

And I usually show network effects visually like this. This is different than the typical exponential shown for network effects, which, like Metcalfe’s “Law” is almost never accurate.  Ok. that’s the first big concept.

Ok. that’s the first big concept.

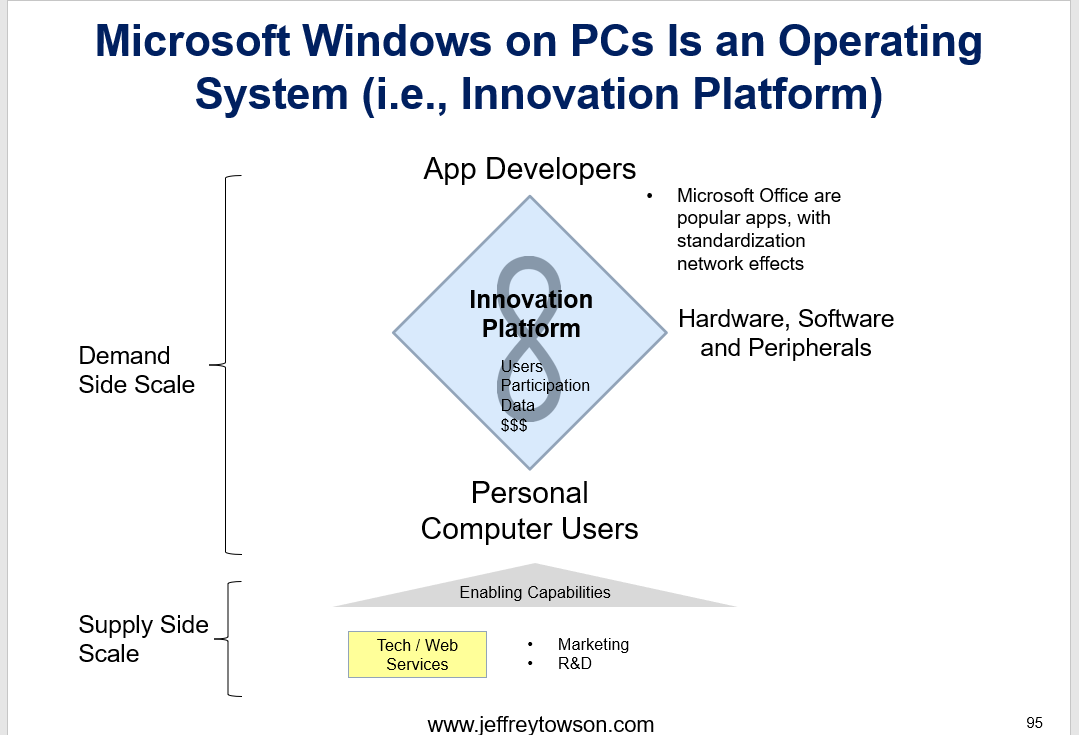

Big Digital Concept #2: The Indirect Network Effect of Operating Systems (Innovation Platforms)

Innovation platforms are rare and awesome. Think Windows operating system and Android. This is what made Steve Jobs and Bill Gates billionaires very quickly. I usually show them this way.  Note: I consider audience builder platforms a subset of this type, where they are connecting content creators with content viewers. Think YouTube and TikTok. True innovation platforms can have fairly powerful network effects that can linearly increase for a long time. The more apps in the Google Play store the better it becomes for users. And this is globally. The asymptotic line in the above graphic is fairly high. Is ARM an innovation platform? No. But Arm Holdings frequently talks about its “virtuous cycle of adoption”

Note: I consider audience builder platforms a subset of this type, where they are connecting content creators with content viewers. Think YouTube and TikTok. True innovation platforms can have fairly powerful network effects that can linearly increase for a long time. The more apps in the Google Play store the better it becomes for users. And this is globally. The asymptotic line in the above graphic is fairly high. Is ARM an innovation platform? No. But Arm Holdings frequently talks about its “virtuous cycle of adoption”

- Software developers write for ARM-powered devices because of their huge adoption and therefore big market.

- And then more chip designers choose to use ARM processes because of the big support from software developers.

So, it’s a virtuous cycle. But it’s not really an ARM network effect. ARM actually serves a fairly small number of customers as there are fairly small number of companies that design semiconductors. In 2023, ARM had about 260 customers. And 5 semiconductor companies represented over 50% of their revenue. What ARM is really doing is acting as a partner and a critical supplier for a small number of market leading semiconductor companies (think Nvidia, Intel, Qualcomm).

And these same semiconductor companies work hand-in-glove with the operating systems and their powerful innovation platforms.

So, ARM is piggybacking the powerful and global, indirect network effects of the operating system companies. And their innovation platforms. It’s all sort of mixed together in practice. You really can’t separate the semiconductor companies, the operating systems, and ARM. They are all deeply intertwined in the design, manufacturing and usage of the CPUs that are the digital engines of every smart device. It’s why Windows and Intel were always called “Wintel” in personal computers. You really can’t separate them.

So, I ascribe a lot of ARM’s competitive power to the indirect network effects that naturally occur in operating systems and their innovation platforms. And ARM is just sort of tied to this by its close working relationship with the semiconductor companies. Which tees up the last digital concept for today.

Big Digital Concept #3: Switching Costs in a “Critical B2B Business”

Here is how ARM describes its competitive strengths.

I’ve covered their first two bullet points in the previous two concepts. Now take a look at the third bullet point: “Deep Integration with Customers and Ecosystem Partners.”

I’ve covered their first two bullet points in the previous two concepts. Now take a look at the third bullet point: “Deep Integration with Customers and Ecosystem Partners.”

This is really important. As mentioned, +50% of ARMs revenue comes from 5 customers. They have a highly concentrated customer base, which is normally a problem for a business. However, ARM points out that they have worked in partnership with their top 10 customers (by royalty revenue) for over 20 years. They work in close collaboration on the development of new chips. Above, they state that it can take 2-3 years to develop a new ARM processor. And it can take another 2-3 years get to manufacturing. So, it’s a concentrated customer base. But there is deep integration in development and operations. And they cite this as one of their key strengths. I put this under Switching Costs as a competitive advantage.

But it gets better.

Once a customer commits to a technical architecture for a chip, they are pretty committed. This will take many years to develop. And they will then use this to generate subsequent versions. So, there is deep operational integration between ARM and its core customers (who happen to dominate the CPU market). And this becomes a decades long partnership, because they continue to build upon these technical architectures.

It gets better.

They are also well positioned as a “critical’ B2B supplier, which is one of my favorite business models. It’s also a favorite of Warren Buffett.

I have written a lot about strategic vs. critical vs. necessary costs for B2B businesses. I generally avoid businesses where they are viewed only “necessary costs” for their customers. This is like retailers buying shelves tables and trucks. The business wants acceptable quality at the lowest possible price. They will often switch suppliers to save 2%. It’s tough to sell things that a business views as only necessary. Note: this is pretty much everyone selling to Walmart.

“Strategic costs’ are the opposite. This is the expense where the business wants to maximize spending and use it as a competitive weapon. Businesses like Coca-Cola view their marketing expenses as a strategic cost and make sure they always spend more than their competitors. This is much easier situation to sell things.

“Critical costs” are even better. And that’s ARM. These are the expenses where the customer worries about having problems with the product or service. Because a problem in a critical expense can have greater ramifications. Walmart getting some low-quality tables is not a big deal. A major truck manufacturer getting a low-quality brake system could result in a big recall. An airline getting low quality airframes with structural issues that show up after ten years could end the company.

And that is how ARM is perceived by its customers. It is a critical cost. It is the thing they can’t get wrong, or the entire chip (and maybe the company) gets impacted. The company will still negotiate for a good price but even without all the switching costs they aren’t going to switch suppliers just save 5%. The risk isn’t worth it. Warren Buffett has repeatedly invested in B2B suppliers where:

- The product is critical.

- It is difficult to switch.

- It is difficult to prove a new vendor is acceptable.

- The purchase is a low percentage of the overall cost structure.

It’s just not worth it to switch. I view ARM as 50% strategic and 50% critical as a B2B product. And then it has natural switching costs on top of it. That’s fantastic.

***

Ok, those are the three big digital concepts for this business model. In the next part, I’ll finish up the business model. And then talk about the external factors. Below, I have also put some of my standard questions for assessing criticality. Cheers, jeff

Questions for Assessing the Criticality of a B2B Product or Service

- What is the cost of using a cheaper product and then having a problem?

- Do you just lose reputation and clients?

- Do you wreck a larger project? A leaking roof seal can wreck a whole house. A bad machine can ruin a clinical trial.

- Do you lose lives or hurt people? Failed drug. Failed pacemaker. Contaminated plasma.

- Do you lose the entire company? Airplanes crash and an airline out of business. Boeing will lose too.

- How long is the product / service used? Can it easily be replaced if there is a problem?

- How long is it used after installed? Is it something that stays in use for years (roofing seal, aircraft frame, performance coating)?

- When does it become obsolete?

- Is it a one-time decision you must live with forever? Can the decision be reversed?

- How difficult is it to replace? MRI machines are expensive but easy to swap out. Engine management systems designed into a car are difficult to replace.

- How many companies are proven for this product? How easy is it to create an acceptable alternative?

- Is it an advanced technology or a manufacturing process?

- You are ultimately bidding against other proven companies. For insurance, it is easy to create an alternative. For a patented drug it is harder.

- Can an unproven company become proven easily?

- Is it hard to know if a product is acceptable? Or is it hard to show?

- Does it require a 5-year study (dental implants)?

- Can you never really know (airplane frame)? What is the testability? How do you actually test plane parts or roof sealant over 10 years?

- What is the total cost to the buyer?

- Purchase, maintenance, parts, energy, and resources savings, resell?

- Is it a small or large part of the cost structure?

- Does the supplier have a low-cost position? How many others?

- Can others copy or make cheaper version?

- For the buyer, what is risk vs cost savings of an unproven versus proven supplier?

- Ideally you want low-cost critical product with huge costs for switching. And you want it to be very difficult to test if others will work.

——–

Related articles:

- The 4 Digital Concepts Powering Arm Holdings (Tech Strategy – Podcast 187)

- Ant Financial’s Big Money is in Asset-Light Credit Tech (Jeff’s Asia Tech Class – Daily Lesson / Update)

From the Concept Library, concepts for this article are:

- Semiconductors

- B2B Customer View: Necessary vs. Critical vs. Strategic

- Switching Costs

- Standardization and Interconnection Network Effects

- Indirect Network Effects

From the Company Library, companies for this article are:

- Arm Holdings

- Masayoshi Son / Softbank

Photo by Vishnu Mohanan on Unsplash

——-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.