In Part 1 and Part 2, I laid out my approach to web 3.0 business models. These are sometimes called “decentralized platforms”. Or “protocols”. I don’t really buy either of these as I think they overemphasize the decentralized aspect. And that is rarely enough to win as a competitive service.

I think most of the business models we are seeing emerge in web 3.0 are “platform-protocol hybrids“, which I described in Part 2. With most of the action in financial services right now. Also called DeFi or decentralized finance. I pointed to Coinbase.

A Quick Review of Web 3.0

Recall from Part 2 that Web 3.0 is an interesting mix of blockchain technology, consensus mechanisms, community building, smart contracts and DAOs. There is a lot of different stuff happening at the same time.

- Blockchain is a new technology paradigm based on cryptography that will be built upon for decades.

- DAOs and other forms of governance are being tested based with much more focus on consensus and community.

- Disrupting corporate and government authority over digital activity is a big priority. The objective is to shift control and benefits back to users and contributors.

According to Andrei Hagiu and Julian Wright, two big differences in web 2.0 are:

- A credible commitment not to exploit participants. Or at least not without giving participants a say. So no more increasing fees over time, de-platforming users randomly, and changing algorithms at will.

- A better alignment of incentives with participants. The value created by the platform is shared with everyone. Decision-making is done more by voting and consensus.

Jessie Walden of Andreesen Horowitz says there are three components of crypto success:

- Product / market fit.

- Community participation.

- Sufficient decentralization (community ownership).

The need for product / market fit is arguably why so many “decentralized platforms” have not had big success. Being decentralized is not enough to pull users away from web 2.0 companies. It can be part of a competing solution, but is rarely enough alone. One area we have seen success is in cryptocurrencies like Bitcoin. This is because these are very simple, utility-like services. They don’t have complicated customer value propositions that must innovate and evolution over time.

My working conclusion (thus far) is the following:

Most of Web 3.0 Will Be Platform-Protocol Hybrids (Probably)

For all the talk about decentralization and independence from centralized authorities, most of the companies based on blockchain have points of centralized control. They have to.

Running a business, doing innovation, making customer-facing improvements, etc. These all require leadership and management. They require continual operating and strategic decisions. Virtually every one of my 6 levels of competition is about management and staff making decisions. If nobody has any authority over the service, how can you possibly compete as a growing, evolving service?

As mentioned, there are some rare exceptions, like Bitcoin, where a pure protocol network with independence from authority can operate and succeed. But I think most of web 3.0 is going to be a mix of authority / leadership and decentralization. Which I call platform-protocol hybrids.

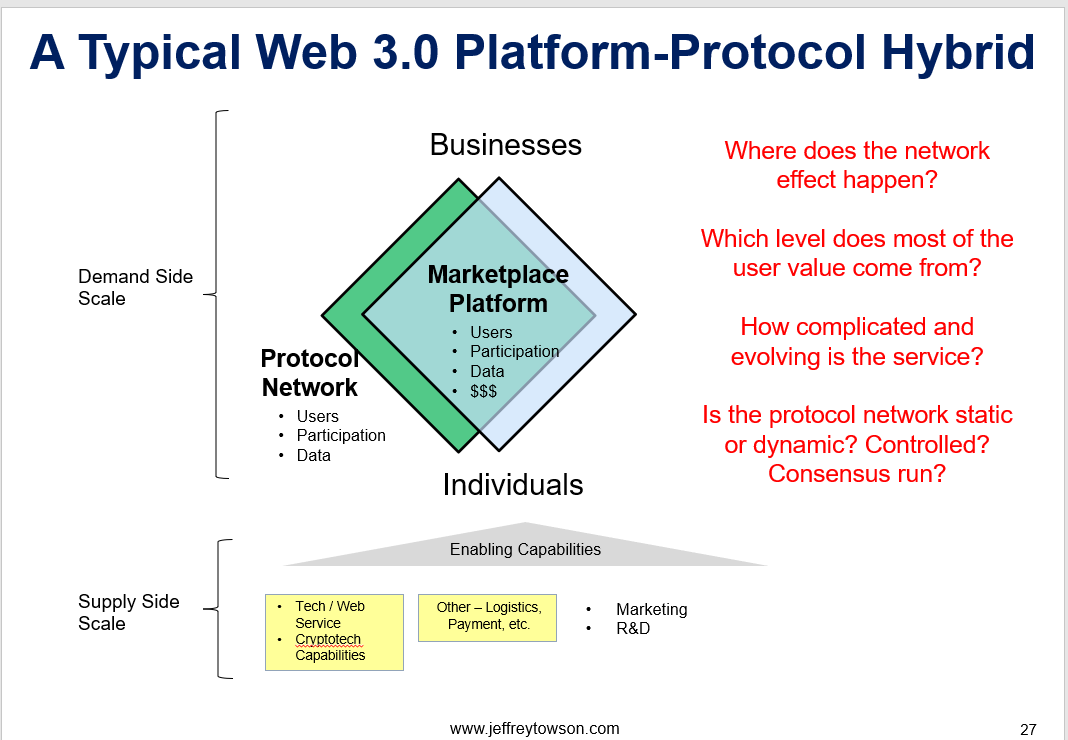

Here is my standard picture for a marketplace based on blockchain.

Compared to a normal marketplace platform:

- You can see the separation between the platform business model (controlled by the company) and the public protocol network (controlled by a foundation? or not at all?).

- You can also see additional tech capabilities. Instead of just having internal servers and cloud, there is also cryptotech capabilities. This is about building internal web capabilities but also interfacing with the blockchain protocols.

- Note some of the questions on red on the right.

With that, let’s go into Coinbase.

An Introduction to Coinbase

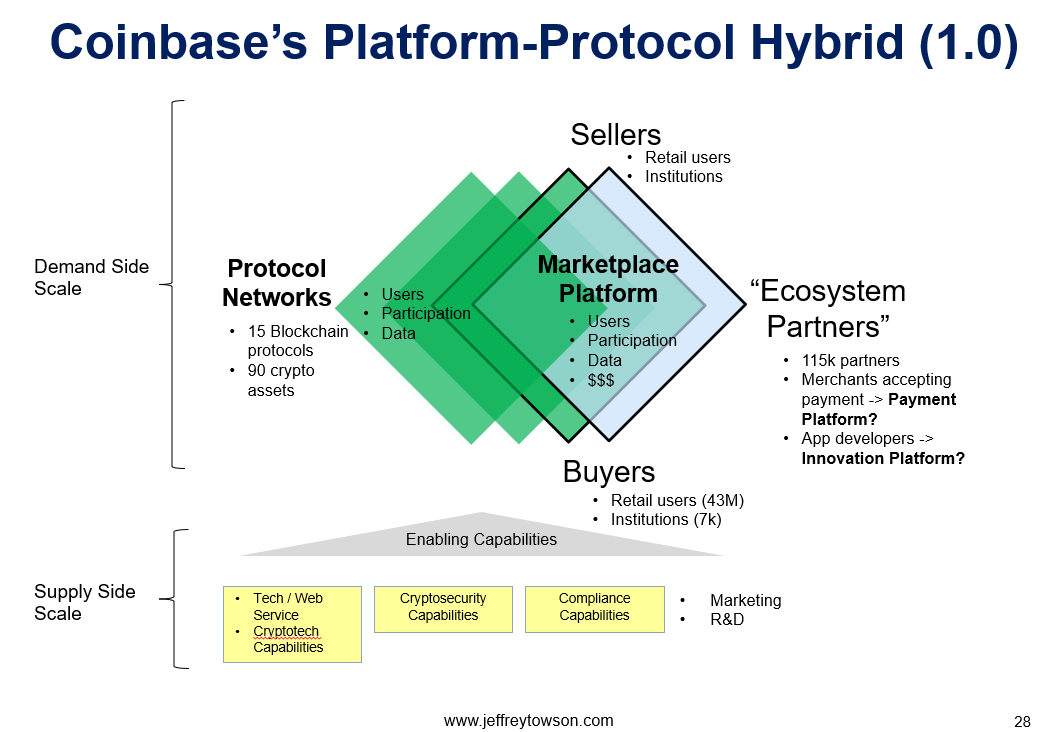

Coinbase is one of, if not the, most successful web 3.0 companies. And big surprise, it’s in finance. It’s an exchange for buying and selling cryptocurrencies, with most of the activity in Bitcoin and Ethereum. So it’s a marketplace. But it’s a platform-protocol hybrid as it is built on a public protocol. It is also a place to store digital assets in custodial wallets.

The company was founded in 2012 by Brian Armstrong and Fred Ehrsam and it came out of the Y Combinator program. It positioned itself, smartly, as a trusted and easy way to buy Bitcoin using credit cards and debit cards. It was a bridge between traditional banking and cyptocurrency.

Ease of use and trust are a bit part of its appear to retail users and to institutions (hedge funds, companies, money managers, etc.). These are the two main user groups on the platform. It is a safe and easy way for them to buy, store, spend and use crypto assets.

The other user group is its “ecosystem partners”, which is mostly developers and merchants. They can accept crypto as payment. They can build apps on Coinbase. In theory, these partners could create a large payment platform or innovation platform.

But today, Coinbase is mostly a marketplace for buying and selling cryptocurrency. And the company has become the primary on-ramp for retail users into cryptocurrency. The user numbers are all big and growing fast. So are the transactions volumes on the platform. The suite of cryptocurrencies offered is also growing. As of March 2021, Coinbase was the largest cryptocurrency exchange in the United States by trading volume. The numbers cited in the 2021 IPO filing were:

- 43M verified users in +100 countries.

- 7,000 institutions.

- 150,000 ecosystem partners.

- $90B in assets on the platform.

- 96% of revenue coming from transaction fees for 15 blockchain protocols for +90 cypto assets.

The critical issue going forward is trust. Coinbase has become the primary on-ramp for retail users because it is trusted. It is the primary financial account in crypto for many users. But cryptocurrency is volatile. There are security breaches. There is lots of speculative behavior and rumors. And there are serious uncertainties in the blockchain technology itself (discussed below). So maintaining trust going forward is going to be critical for Coinbase.

To this end, the company works with regulators. It doesn’t have the libertarian, crypto-anarchist, fuck the system attitude of so much of the crypto world.

- The company has major investments in cyber security.

- The company uses custodial wallets. This increases ease of use and also decreases the issues of loss and hacking for newbie users.

- It has cybercrime insurance policies.

So lots of focus on usability, security and compliance. Which you can see in its core capability. Here is how I describe Coinbase.

Take a look at all the green diamonds. Coinbase doesn’t just interface with Bitcoin’s blockchain protocol. It interfaces with 15 different blockchain protocols (and growing).

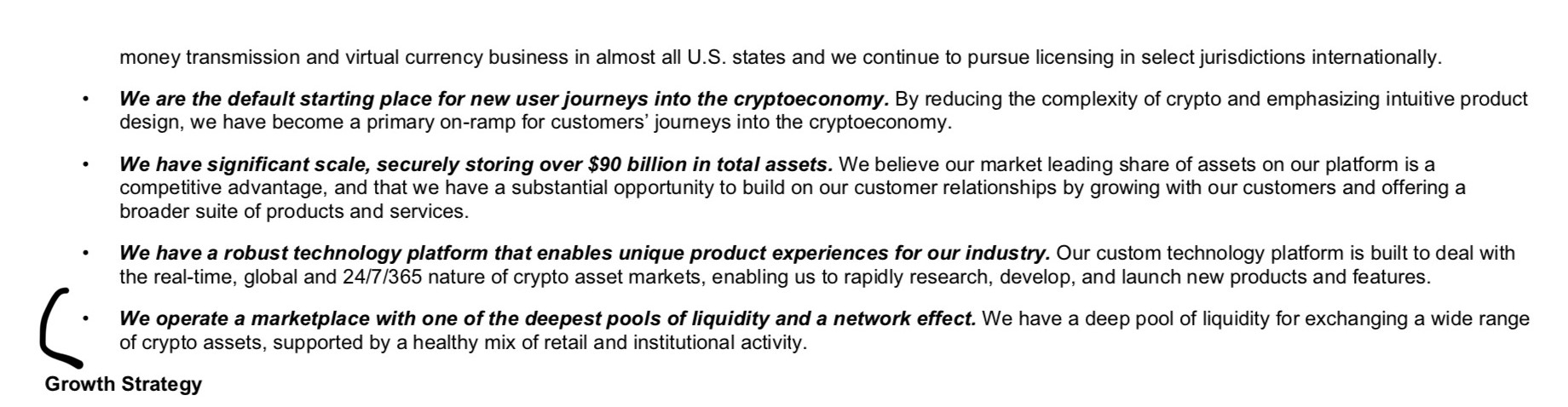

But first, take a look at the company’s description from its IPO filing.

Does this read just like a typical marketplace platform strategy? Look at the last bullet point.

We see the same language for web 2.0 companies like YouTube and Taobao. It is describing a marketplace (i.e., the blue diamond). And it is teeing up a future innovation platform with developers. The strategy is:

- To grow the retail users, institutions and ecosystems partners.

- To build cybersecurity and cryptography technology.

- To build compliance infrastructure with real-time monitoring.

- To provide “powerful product experiences”.

And the company cites its strengths as:

- Salability

- Robust technology

- Big marketplace liquidity with a network effect.

This sounds pretty much like a standard marketplace platform. The company has to win as a platform against other platforms. It has to offer competitive services to multiple user groups. It’s just that this platform is built on a public blockchain and not on internal servers owned by the company.

Ok. So this seems straight forward.

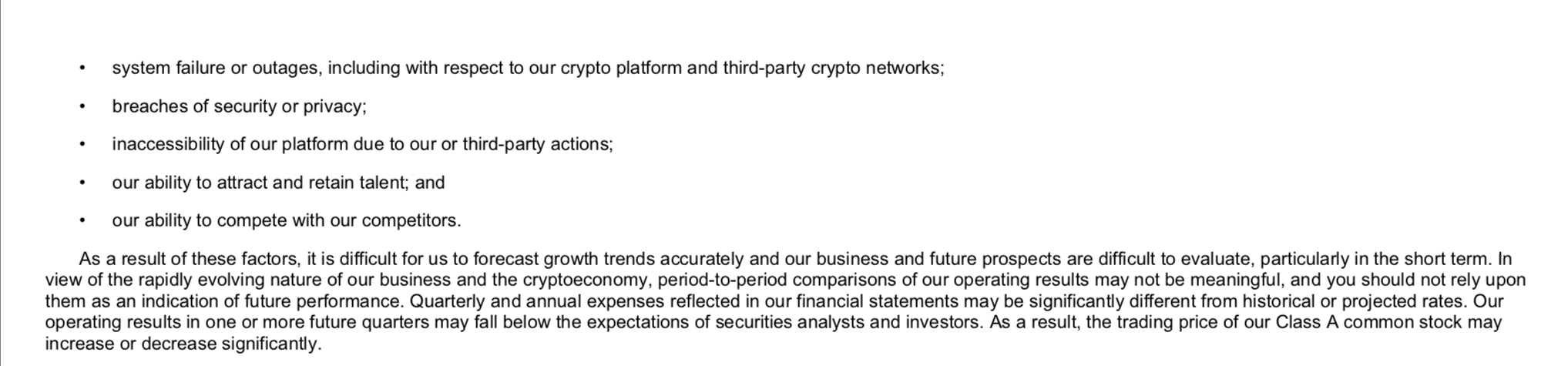

But then you start to read the risk section. And you see issues that are never discussed in any web 2.0 platform business models.

The Tech Uncertainties of Platform-Protocol Hybrids

First, take a look at the first item under Coinbase’s risk section.

They cite the need to attract, maintain and grow users and engagement. They talk about pricing. They talk about dependency on third party providers. They talk about attracting talent.

This reads almost exactly like the standard risks for a web 2.0 platform business model. This is the blue diamond in the graphic.

But then in the very next risk, they start to cite things never mentioned in companies like YouTube, Alibaba or Shopee. Look at the four bullet points I have highlighted.

These four bullet points are risks associated with all blockchain protocols. Coinbase is interfacing with 15 blockchains not under their control. Maintenance and troubleshooting these technologies is dependent on the activities of independent miners, validators and developers. In fact, the very transactions of the blockchain require miners and validators to happen. It also raises two important issues:

- Technological viability and security of crypto assets. These security issues are not included in the cybersecurity capabilities of Coinbase (shown in yellow in the graphic). These are cybersecurity issues for the protocol network (green diamond), which is outside of Coinbase’s direct control.

- Fees and speed for processing crypto asset transactions. Rising fees and slowing speed are already major problems for both Bitcoin and Ethereum. The speed of bitcoin is very slow. Ethereum 1.0 is faster but the fees (i.e., the gas) is increasing dramatically with usage. Rising (and falling?) star Solana offered a dramatically faster blockchain for transactions. But to achieve this it lessened security, resulting in problems. It turns out the Bitcoin protocol is slow and simple but secure. Ethereum is faster and flexible, but expensive and more vulnerable.

These factors are all important to the performance of Coinbase’s service. But they are in the blockchain protocol and not in the platform.

In the next risk section, it talks about Bitcoin and Ethereum specifically, which is most of Coinbase’s business. Read the below excerpt carefully. This should make you very nervous.

The first two bullet points are about the fundamental problems in the design of the Bitcoin and Ethereum protocols themselves.

- Bitcoin has a limited supply, which makes it resistant to inflation. But the rewards for mining are also going down over time. If people don’t keep doing the mining, the system stops (probably).

- Ethereum 1.0’s protocol was based on “proof of work”, where everyone competes to finish a mathematical problem. It is very labor intensive, which is why the system is resistant to tampering. But it is becoming expensive as the network becomes congestion and transactions can’t get done. And this problem is being exacerbated as usage grows. Most blockchains have a scalability problem nobody has solved. Ethereum 2.0 (being launched now) is an attempt to solve the scalability problem by shifting to a “proof of stake” protocol.

These are both fundamental issues with these blockchains. And, given that these protocols do not have strong centralized authorities (by design), it is hard make changes. The Ethereum foundation is slowly leading the shift to “proof of stake” by consensus. But you can see these design and governance problems also listed as risks in bullets 5, 6 and 8.

Now look at bullets 3 and 4. This is the problem of developers creating forks and creating alternative blockchains. That is good in that it enables innovation. But it also creates competing chains and fragments the protocol.

And finally look at the second to last bullet point. Both Bitcoin and Ethereum are based on cryptography. If new technology enables that to be broken, then the whole network becomes vulnerable. Hello quantum computing.

What jumps out at me is these are not normal business risks. These are risks and uncertainties in the entire foundation of the technology. The protocol networks have major uncertainties. And this platform business model is dependent on them.

Take a look at my Coinbase graphic again. Those green diamonds have lots of uncertainties, variations and development happening. And this is largely outside the control of the company.

A Final Comment on Web 3.0 in China

The web 3.0 business models are mostly about decentralization. About putting activities partially or entirely beyond the control of any central authority, whether government or corporate. I don’t think much of this is going to happen in China. No Bitcoin marketplaces. No Ethereum systems. Platform-protocol hybrids could emerge if the government has control of the protocol. And I suspect the government will probably build some protocols, just like it is building a digital currency. But I’m not expecting to see much. We’ll see.

Cheers, jeff

——

Related articles:

- How to Think About Web 3.0 Business Models (1 of 2) (Asia Tech Strategy – Daily Article)

- Platform-Protocol Hybrids and Why DeFi is the Center of Web 3.0 (2 of 2) (Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Protocol Networks

- Platform-Protocol Hybrids / Web 3.0

- Blockchain

From the Company Library, companies for this article are:

- Ethereum

- Bitcoin

- Coinbase

Photo by Kanchanara on Unsplash

——-

Fu Ming

February 18, 2022 at 10:31amCan you talk a bit more about coinbase.com as a centralized exchange vs coinbase wallet as decentralized?

See

https://help.coinbase.com/en/coinbase/trading-and-funding/buying-selling-or-converting-crypto/link-my-coinbase-wallet-to-my-coinbase-account

jtowson

February 18, 2022 at 11:01amyeah. I kind of skipped over the wallet part. I think the exchange is clear but the custodial wallet is interesting. I thought it was similar to a checking account, just a service. But now I’m not sure what it is. Reading more about coinbase right now.