In Part 1, I did a quick summary of the strange mix of ideas that is “web 3.0”.

- Blockchain, a new technology paradigm that will be built upon for decades.

- New forms of governance based more on consensus and community.

- How to disrupt corporate and government authority and shift control and benefits back to users and contributors.

Web 3.0 is an interesting mix of blockchain, consensus mechanisms, community, smart contracts and DAOs.

But how is this different from traditional digital platforms like YouTube and Taobao? Which are often called web 2.0.

According to Andrei Hagiu and Julian Wright, two big differences are:

- A credible commitment not to exploit participants. Or at least not without giving participants a say. So no more increasing fees over time, de-platforming users randomly, and changing algorithms at will.

- A better alignment of incentives with participants. The value created by the platform is shared with everyone. Decision-making is done more by voting and consensus.

Wright and Hagiu have written about the company Audius as an example of this. Audius is a decentralized music platform that is community owned and uses an artist-controlled music sharing protocol. Think of it as a blockchain version of Soundcloud. And a reaction to Soundcloud, which famously grew its platform with the support of independent artists and then later shifted attention to mainstream artists. Content creators and developers are rightfully wary of platforms because of such “bait and switch” behavior.

The Audius approach is:

- Artists upload their tracks to the blockchain. They get tokens for this and a certain level of engagement.

- Fans listen. They can earn tokens by curating playlists.

- Node operators host content and index the music to make it searchable.

- Developers build upon the open-source service. They can get tokens by building API integrations.

- An open audio foundation oversees the long-term direction and growth of the service. Tokens are used for governance. For a governance proposal to pass, it needs 5% of all staked tokens to vote and more than 50% must favor it.

That’s a pretty good example of a web 3.0 company. We see variations on this for lots of platform service. But we haven’t really seen many successes yet. And I think you can see the contradictions in this approach.

If the goal is a service that is beyond the control of most government and company authorities, that means any changes must be done by a consensus in a community. That is slow. And rare. And most great products and services must evolve quickly and keep innovating and improving the customer experience over time. How can you have fast, innovative services without aggressive leadership?

The main selling point for blockchain-based apps has been their security and independence from controlling authorities. Content creators like that. So do developers. But that is only a small part of a successful customer offering. Consumers want other things too, like a big product selection, fast and efficient delivery, good customer service, a cool app and so on. Before you get to the question of governance, you have to have product / market fit. You have to have a great service.

Jessie Walden of Andreesen Horowitz says there are three components of crypto success:

- Product / market fit.

- Community participation.

- Sufficient decentralization (community ownership).

Most of these “decentralized platforms” have not had enough success in #1 to pull users away from web 2.0 companies. Decentralization is not enough on its own to win in the market.

We have seen big success in cryptocurrencies like Bitcoin. This is because these are simple services that don’t require evolution over time. But most applications are far more complicated.

Here’s my approach to this. And how I think it will move forward.

Recall the 3 Types of Networks

I spoke about networks in Podcast 110 (An Intro to ANE Logistics and Franchised Physical Networks). My basic points were:

- Networks and platform business models can be two different things.

- Networks are assets made of nodes and the linkages that connect them. These assets can be tangible and intangible. Social networks are made of intangible assets. Railroads are made of tangible assets. I break them into:

- People Networks

- Physical Networks

- Protocol Networks. This is the key for web3.

- Platforms are network-based business models that operate on these assets. This is similar to how a factory is an asset but the business model is the products it produces and sells to the market. One is a cost. The other is the creation of economic value. For example, a diploma is an asset with a cost. But what you earn in your career is your business model.

- All platform business models utilize networks, but they don’t all own or control the assets they operate on.

- Sometimes you can see a clear distinction between the network and the business model. For example, internet service offered by a cable company is a business model. But the network is all the cables connecting the houses.

- Sometimes, especially in digital, it is hard to make a distinction between the platform business model and its network. For example, Facebook’s social network really is its business model.

Seeing networks as assets (nodes plus linkages) is easier when you think of physical networks, such as railroads and canals. You can literally see the nodes and linkages.

Most of my writing has been about people and company networks. The people and companies buying and selling goods and services are the nodes. The linkages can be communications, payments and so on.

But some networks are about connected, compatible devices. These networks are mostly about communications and interoperability. They are called protocol networks. Think fax machines, TCP/IP and the ethernet. You can see clear network effects in protocol networks. But the assets are the computers and the wires between them. Not people.

And this is really what Ethereum and Bitcoin are. They are protocol networks that connect machines and set the rules for how they interact. Bitcoin was a simple protocol network, with only a few functions for sending and receiving digital money. Ethereum is more daring and complicated. It is a foundational protocol network that others can build upon. You can create networks and decentralized apps (called dapps) that run on it.

So if Bitcoin is a protocol network, what are these web 3.0 decentralized platforms?

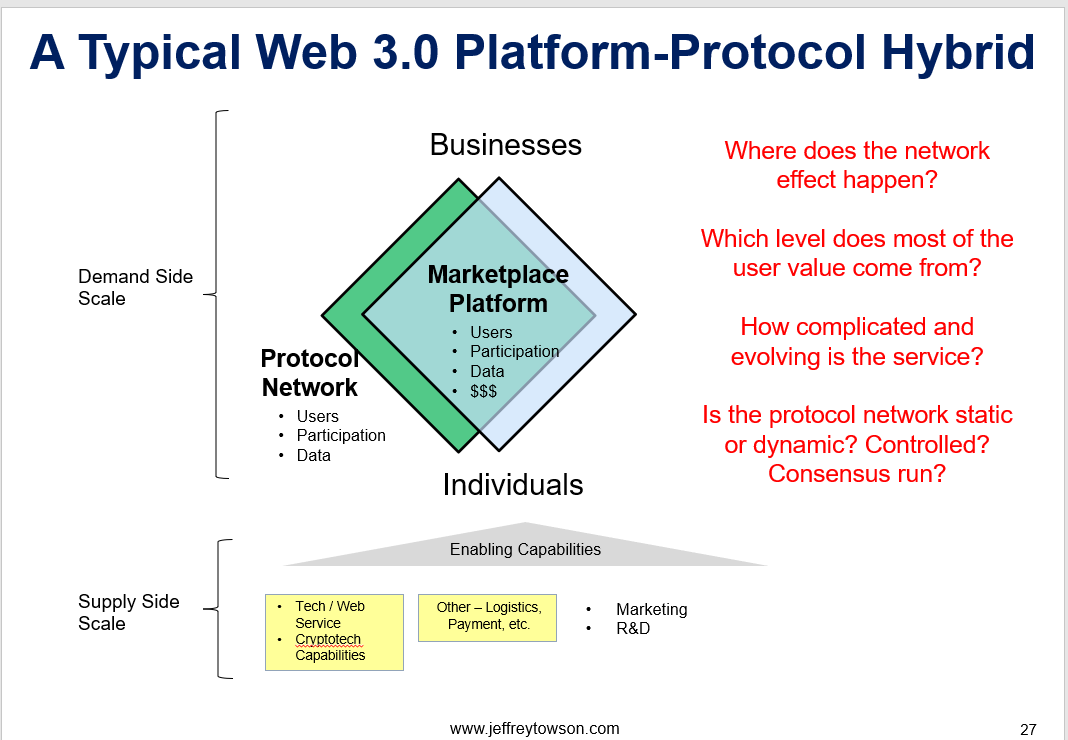

I think they are platform businesses built on top of protocol networks. I call these protocol-platform hybrids.

From Integrated to Modular, Most of Web 3.0 Will Be Platform-Protocol Hybrids (Probably).

For all the talk about decentralization and independence from authority, most of the companies based on blockchain do have points of centralized control. Most have to.

Running a business, doing innovation, making customer-facing improvements, etc. These all require leadership and management. They require continual operational and strategic decisions. Virtually every one of my 6 levels of competition is about management making decisions. There are some rare exceptions, like Bitcoin, where a pure protocol network with independence from authority can operate and succeed. But I think most of web 3.0 is going to be a mix of authority / leadership and decentralization. Which I call platform-protocol hybrids.

Recall my standard picture for a marketplace platform.

I have argued that the age of abundance is usually about capturing demand side scale. With endless options and supply available, you win but getting and retaining customers. In platform business models, that means serving multiple user groups and enabling their interactions. So, it is about growing users, participation, and data (plus cash flow). You can see this in the blue diamond above.

This requires providing enabling capabilities for the interactions. This can be warehouses or delivery people or security for payments or whatever. You can see this in the yellow boxes above.

That’s my basic diagram for a marketplace platform. But I have made a big assumption in these diagrams. I have basically assumed an integrated business model.

Within the blue diamond, I have combined the platform business model and the network asset it is using. These are usually inseparable in digital platforms anyways so it seemed ok. They offer their service, but they also keep strict control of the network. Facebook does not let anyone else have its social graph. Alibaba does not give anyone else direct access to their users and data. Most web 2.0 platform business models are vertically integrated on the demand side, keeping control of both the platform and the key network assets.

Vertically integrated approaches are pretty quite common in new types of business models and technology. It’s a good approach when new services and solutions are being worked out. That is why Tesla is doing everything in-house right now. So is SpaceX.

But over time a dominant design emerges for a product and things become modular. Specialized companies emerge to focus on specific parts of the design. The iPhone is still mostly integrated (down to the chip level) but Android and most smartphones are a modular approach. The coolest example of this is TSMC which specialized in capital intensive semiconductor fabrication. Their novel approach enabled fabless chip companies to then emerge. They effectively switched the entire semiconductor industry from an integrated to a modular approach.

I think blockchain might be doing is the same thing to platforms. I think this is mostly about separating out the protocol network from the platform business model. They are going from integrated to modular.

Which for Coinbase looks like this.

If you have bought cryptocurrency, you have probably used a currency exchange site like Coinbase. And it’s business (shown above) doesn’t look like the decentralization platforms I described at the beginning. It looks like a traditional platform business model, but with a couple of changes.

Note in the above graphic I have put the main assets (users, participation and data) in both the platform (blue diamond) and in the protocol network (green diamond). I have separated out the network from the business model. Basically, I have changed the platform from integrated to modular. For an application built on a common blockchain, like Ethereum, some data, like the videos uploaded, will likely be on the protocol network (the green diamond). But other data, like user behavior, will likely be captured by the platform business model that gets the most traffic (the blue diamond).

Consider the following prominent web 3.0 companies:

- Currency exchanges like Coinbase and Binance.

- Marketplaces for minting and selling NFTs like OpenSea and Rarible.

- Non-custodial wallets like Metamask.

- Search sites for scanning the blockchain like Etherscan.

We see same basic platform-protocol hybrid for each. But with different degrees of integration and centralization. For example, OpenSea has a very centralized approach for its NFT marketplace. But competitor Rarible is moving far more onto the protocol network. They are going towards a full DAO.

So, is everyone wrong? Are these just platform business models with a more modular approach?

Platform-Protocol Hybrids Change the Barriers to Entry. And Power of Platforms Over Users.

Think about how different YouTube would behave if the users uploaded their videos to the Ethereum blockchain? And not to YouTube’s servers. The content creators did give up ownership of their content to YouTube. And all the videos remained open for anyone to show and build apps upon?

Yes, YouTube would still be a platform business model that enabled interactions between content creators and viewers. Yes, they would still aggregate millions of videos and offer a fantastic, free service offering to consumers. They would still be doing increasing personalization. The comments sections would still be fun. They would offer various types of monetization and advertising.

But so could other companies.

- Putting the videos on the blockchain dramatically lowers the barrier to entry and changes competitive dynamic. Lots of companies could build this content into various services.

- It also changes the power dynamic between the platform and suppliers. YouTube could no longer charge a big take-rate, giving content creators only a small percentage of the revenue. They could no longer unilaterally censor people. They could no longer just change their algorithms or terms of service at will.

Look again at the platform-protocol hybrid graphic for Coinbase. Note that I have put the main assets (users, participation and data) in both the platform (blue diamond) and in the protocol network (green diamond). Some data, like the videos uploaded, would definitely be on the protocol network. The business model would be a bit different. But the industry dynamics would change dramatically.

And there is one question I am really struggling with: Where are the network effects in this business model?

- Are the network effects on the protocol network?

- Are they on the platform?

Prominent venture capitalists like Chris Dixon have argued that the network effect is shifting to the protocol network with this model. It is moving from a privately held network to a public network that anyone can use. There is a big difference between a retailer who owns stores on public streets and a retailer who owns both the stores and all the streets.

I am struggling with how this model impact network effects and other competitive advantages. It’s still early days for this.

Ok, one last question. Why are there so few successful web 3.0 apps?

Why DeFi Is the White Hot Center of Web 3.0

For all the talk about how cool this is, we don’t see many successful web 3.0 apps yet.

They haven’t disrupted the platform business models. Like at all, And most are struggling to get much consumer adoption. Everyone still uses Facebook. Not many people use Minds (no offense).

But there is one big exception to this, which is decentralized finance (i.e., DeFi). Things are really moving. Applications and companies are being built on top of the cryptocurrency blockchains. It began with exchanges, like Coinbase (hence my example). But it has been rapidly moving into lending, trading and lots of other financial services.

And one company that really makes your head spin is FTX, founded in May 2019 by MIT graduates Sam Bankman-Fried and Gary Wang. FTX is a cryptocurrency exchange that sells futures, options, derivatives and other more advanced financial products. It has been getting real traction with financial institutions and hedge funds. Which makes sense given that Bankman-Fried had previously worked at Jane Street Capital. Within two years of its founding, the exchange reached $10 billion in daily trading volume. It also acquired the naming rights to the Miami Heat’s basketball stadium and signed Kevin O’Leary (i.e., Mr. Wonderful) as an official spokesperson. Note: Kevin is reportedly paid in cryptocurrency.

The FTX business model is pretty much the same as the Coinbase one shown above. It is a platform-protocol hybrid. It turns out that decentralized finance really works well with this model. Trading operations are a bit simpler that creating complicated consumer experiences. DeFi is more suitable for a rules based protocol network with smart contracts. This is the space I am watching for web 3.0.

***

Ok. That is pretty much where I am with my thinking on web 3.0 at this point.

I’m studying blockchain as much as possible. I underestimated how important this technology is. I am also waiting for the first wave of these companies to go public so I can see them in detail. I’m pretty convinced this will be in DeFi.

Cheers from California. Here is Part 3.

Jeff

——

Related articles:

- How to Think About Web 3.0 Business Models (1 of 3) (Asia Tech Strategy – Daily Article)

- Coinbase and the Tech Uncertainties of Platform-Protocol Hybrids (3 of 3) (Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Protocol Networks

- Platform-Protocol Hybrids / Web 3.0

- Blockchain

From the Company Library, companies for this article are:

- Ethereum

- Bitcoin

- SFX

- Coinbase

Photo by Kanchanara on Unsplash

Protocol graphic by AI

——–

Fu Ming

February 5, 2022 at 9:12amThanks for this thought-provoking piece. Love it that you are applying your strategy framework to make predictions, just like in Science. It’s truly rubber meeting the road.

My touchstone to any blockchain based business idea is asking the question: how will it work better than on the traditional (centralized) platform? The vast majority of the ideas out there can’t produce a convincing answer. On that point it would be helpful to delve a bit deeper to FTX to explain why it works better than the conventional financial platform.

Secondly I agree with you DeFi has the potential to become one of the first truly successful use case of Web 3.0, arguably, mostly thanks to Finance’s numeric nature.

At the same time I also think the NFT space has the potential to contend for that prize, for two reasons: 1) it’s native to Web 3.0. 2) The global art market has been so opaque for so long it lends itself for disruption and web 3.0 might just be that magic pill.

jtowson

February 5, 2022 at 12:34pmI think for most products it has to have a better solution that a platform. Which it doesn’t.

But for institutions doing trading on SFX they just want another way to make money. It doesn’t have to be better. Just profitable.

NFT’s don’t make that much sense to me. But neither does the art world.

I think speculation is driving both as well.