I recently visited the Magazine Luiza / Magalu headquarters in Sao Paulo, Brazil. And this company should be on your radar. Magalu is definitely out front in terms of digitizing physical retail in Brazil. And they are heading towards becoming an ecommerce giant. Maybe.

Magalu: The Accidental OMO Pioneer

Nvidia is the global leader in AI semiconductors, but this was mostly by accident. The company had long specialized in GPUs for gaming and other graphics-intensive systems. And the parallel processing required for GPUs turned out to be the right approach for AI chips as well. So around 2010-2012, the company moved into AI chips with their technology and has pretty much dominated the space.

Magazine Luiza had a similar experience in online-merge-offline (OMO) retail. The company has a long history of doing ecommerce that is closely linked to its physical stores. This turned out to be a fantastic position from which to do OMO. And the company has really leaned into since around 2015.

Some history is important here.

Magazine Luiza began as a retail store in Franca, a municipality to the northeast of Sao Paulo. The daughter of the store’s founders, Luiza Helena Trajano, worked in the store in various roles after graduating in law in 1972. She eventually became the company’s director-superintendent in 1991 and grew the business to a chain of +1,000 stores across 18 Brazilian states. She would eventually become Brazil’s wealthiest woman. Today, the company has +1,500 stores in 900 Brazilian cities.

For most of this history, the Magazine Luiza retail stores were fairly standard operations by today’s standards. Its core business has traditionally been large appliances (washing machines, refrigerators, stoves), technology (televisions, phones, etc.), portable electronics and home appliances (blenders). That contrasts with fashion and apparel-focused retailers like Lojas Renner. Here are some pictures of a current Magazine Luiza store in Sao Paulo.

And for comparison, here are some other Brazilian retailers (on the same street), including competitor Casas Bahia.

So we are not talking about Walmart-type advanced retail spaces. The company has long been a leader in Brazil, but retail space in Brazil is generally less developed than what we see in the West and Asia. However, digital is now changing the space fairly rapidly.

And Magazine Luiza did something very fortuitous in the 1990s that set them up for digitization. They created “virtual stores”, which were small stores with sales associates who sold items that were not located in the stores (hence, virtual). This was done by showing customers video tapes and other types of multimedia and catalogs. Customers could place orders in the store and then pick up their items later. Larger items, such as refrigerators, could be delivered to homes. These virtual stores made a lot of sense in smaller towns. It was an asset-lite business model (less inventory, smaller spaces and few staff) and it also enabled the company to offer a large selection (which customers love). The model also made sense in the larger stores in the major cities where Magazine Luiza outlets were, reportedly, often were smaller than competitors.

Like Nvidia in GPUs, Magazine Luiza’s virtual approach positioned the company well for arrival of ecommerce a few years later. And in 2000, Luiza’s son Frederico Trajano left his private equity work in the USA and launched the company’s ecommerce division. Frederico (now CEO) had reportedly been following the rise of the internet and ecommerce in the USA. And once back at the company, he began building ecommerce for Magazine Luiza on top of an omnichannel strategy. Basically, the ecommerce activities of the business were closely tied to the physical stores and distribution operations. You could call this the first attempt at OMO. for example:

- The virtual stores could also easily start selling from the website rather than using video tapes and catalogs.

- The distribution centers were delivering to stores but also somewhat to people’s homes (i.e., large appliances). So, offering B2C ecommerce from the same distribution centers was a logical move.

The company’s ecommerce activities evolved over the next decade, but really took off in 2015-2018. This was the period during which Frederico took over as CEO and launched a series of important initiatives. I’ll talk about these in later articles but three that really mattered were:

- The launch of Luizalabs in 2014. This is the company’s innovation and engineering center, with +400 developers working on +45 squads (i.e., teams). This center develops the new digital initiatives and is key to their transition from a retailer to a competitive tech company.

- The launch of the mobile app Magalu in 2015. By 2018, it had +6M MAU.

- The launch of a marketplace platform in 2016. This is arguably their most important initiative. This is what could take the company from a fully digitized retailer to an ecommerce giant. And maybe to a commerce infrastructure player long-term. More on this later.

Looking back, it is pretty unusual history. The virtual stores really positioned the company for ecommerce. And it is unusual for a family business to have an heir with exactly the right skill set for a major technological disruption. Or maybe it was good planning? Either way, I can’t think of another similar succession in a family-run business.

Growth vs. Innovation at Magalu?

There is a lot of interesting strategy and digital innovation stuff happening at Magalu. I’ll go into these in detail in Part 2. But it’s important not to get too caught up in that stuff. Magazine Luiza appears mostly focused on ongoing incremental improvements in growth, profits, and the user experience.

The company outlines its key metrics in pretty good detail. And across all its initiatives, the three growth drivers I keep hearing management mention are:

- Increasing the number of locations and product selection.

- Increasing user convenience, especially delivery speed.

- Improving the user experience at every touchpoint (the stores, call center, delivery, etc.).

But it’s important to note the early stage of adoption of ecommerce in Brazil. The country is still in its earlier stages and doing the basics right and growing are more important than pioneering radically new business models. Most merchants in Brazil are not yet online, let alone selling on marketplaces. Logistics is a major challenge in much of the country. And only 5-10% of Brazil retail is currently online, compared to +20% in China. So growth in users (merchants and consumers) and revenue is ultimately paced by ecommerce development of the country.

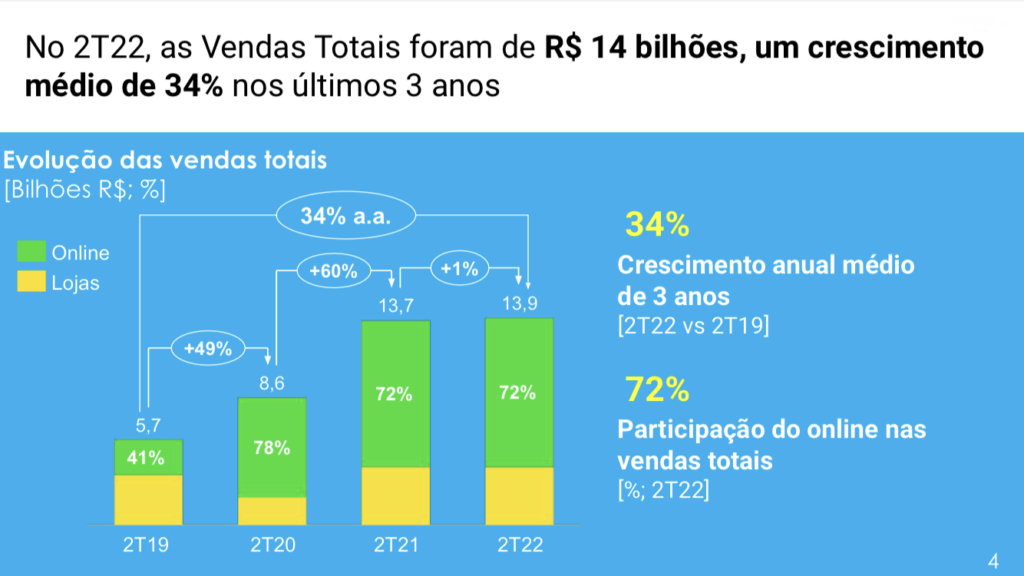

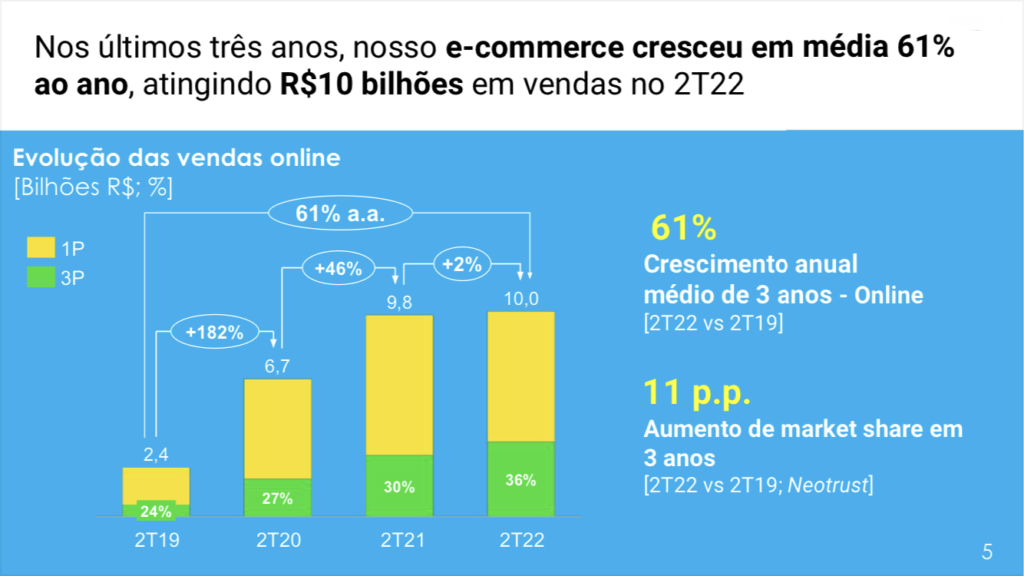

That said, growth in usage and revenue at Magazine Luiza looks pretty good. The below slides are from the second quarter 2022 investor presentations. It shows total sales (online + lojas), with the online sales in green (about 72% of total). Online sales jumped during the pandemic but was already growing steadily.

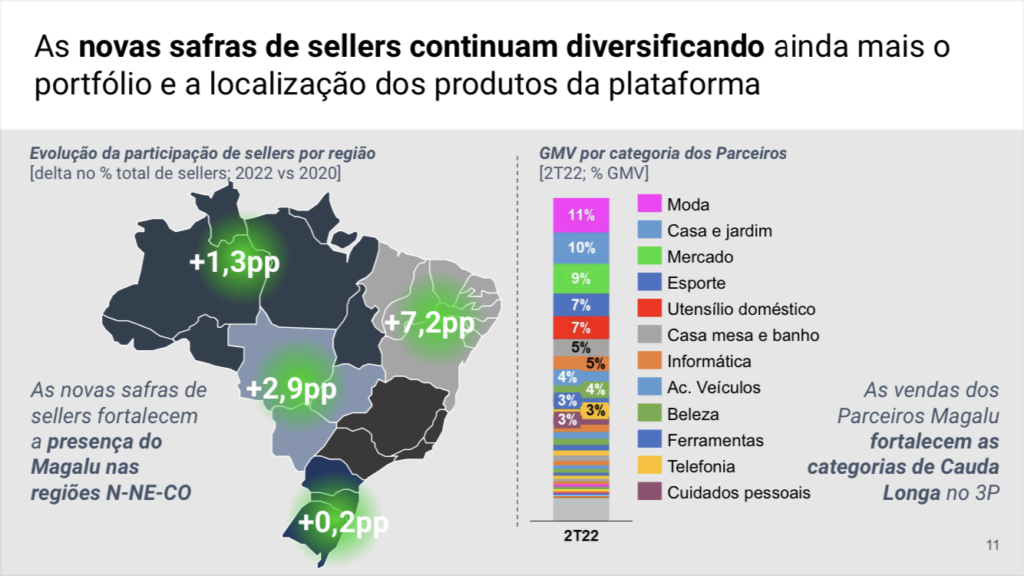

The company has been aggressively adding new product category but the core product categories are also growing. The new categories (automotive, food delivery, electronics, beauty, home, fashion, sports) are now >50% of online GMV.

They have also been building out the logistics and store infrastructure. I’ll discuss this in Part 2.

Ok. So that’s the basic situation. Which brings me to the big digital strategy questions and OMO. So why is this company so interesting?

Their New Marketplace is the Big Strategic Move

Without question, their new marketplace is the most important initiative. A digitized retailer with great stores and distribution can have a lot of competitive strength as a business. But digital marketplaces are what create ecommerce giants. That’s how you get Alibaba and Amazon. It’s a uniquely powerful business model in a big country or region. A successful retail operation going against a digital marketplace is like an army fighting an air force. The latter usually (not always) wins. And the promise of OMO is having both.

Unlike physical retail, digital marketplaces tend to be “winner take most” in their dynamics. We see the market collapse to a handful of major marketplaces over time. This follows from multiple factors, especially from network effects and from providing customers with a huge long tail of products. Digital marketplaces also have multiple dimensions for growth and innovation. They tend to expand organically into new aspects of the user experience. And they can usually outspend rivals in logistics and technology over time.

When the dust settles in ecommerce in Brazil, I expect there will only be 3-5 major marketplace platforms. I expect to see a couple of ultimate B2C marketplaces and then some specialty marketplaces. I’m assuming Mercado Libre and maybe Shopee are getting two of these spots. And based on the performance of Magalu’s marketplace in the past 2-3 years, it looks like they might well get one of these spots as well. Here are merchant seller numbers from their investor presentation. It looks like +200,000 merchants have joined their marketplace in the past 2-3 years.

And they are using their stores and staff to recruit these merchants around the country. They appear to be analog merchants going online for the first time. And they are really expanding Magalu’s long-tail categories, which is exactly what you would want to see. The below graphic shows where they are adding merchants from – and in what categories.

Sales on the marketplace have been growing at 22%.

The marketplace is now 36% of total sales.

This all looks good, but I’m don’t have much insight into these numbers. But the marketplace is the game changer (in my opinion). It opens up dimensions of growth and innovation across the user experience.

***

In part 2, I’ll go more into the bigger business model questions, especially OMO. You can definitely find a lot to read about omnichannel and ecosystems at Magalu. They are doing a lot of acquisitions, which I will talk about. And there is some pretty clever stuff happening at the store and distribution level. But within all this, what I am focusing most on:

- Digitizing the core online and physical retail operations and experience.

- Building and growing the marketplace.

- Some surgical moves in fintech and advertising.

- Larger strategic moves toward either an ultimate B2C marketplace and/or a general infrastructure for commerce in Brazil.

I’ll talk about this in Part 2.

Cheers from Sao Paulo, Jeff

————

Related articles:

- Why I Really Like Amazon’s Strategy, Despite the Crap Consumer Experience (US-Asia Tech Strategy – Daily Article)

- 3 Big Questions for GoTo (Gojek + Tokopedia) Going Forward (2 of 2)(Winning Tech Strategy – Daily Article)

- Why Netflix and Amazon Prime Don’t Have Long-Term Power. (2 of 2) (US-Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- OMO Platforms

- New Retail / Online Merge Offline (OMO)

- Brazil

From the Company Library, companies for this article are:

- Magazine Luiza / Magalu

——-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.