China / Asia is usually the most dynamic frontier for retail – and especially when it integrates with ecommerce.

This is the result of a really big market and never-ending hyper-competition. It means there is always frantic innovating just to stay in the game. It’s a space I generally avoid because of the degree of competition. Although I do love it as a consumer. And there are good digital strategy lessons.

Within this space, coffee retail has historically been somewhat sleepy. There has been some innovation – but not that much. And Starbucks was the main player (in China) for a long, long time. And they were surprisingly unbloodied. It was actually really weird. I used to ask all the time “why doesn’t Starbucks have a competitor in China? Why have they had it it so easy?”

The somewhat came to an end up with the rise of Luckin Coffee in 2017. They were the first major challenger. They ended up crashing and having fraud issues, but things in coffee retail have been more vibrant and interesting since.

Looking back, there are two companies in retail coffee that have gotten my attention for their level of innovation. This is where the lessons for the rest of the world are.

Luckin Coffee is Innovating Faster in Retail Tech

When you talk about digitizing F&B retail, a lot of the attention goes to fast food outlets like McDonalds and KFC. You can find lots of CNBC and Bloomberg shows about this. Given the high labor costs of the West, there is a lot of AI and robotics focus in this area.

But it’s happening faster in China. The China operations of KFC (Yum China) have been seriously focused on digital experience and delivery for +5 years. They have been making big investments. They have been integrating into digital ecosystems like WeChat. There is certainly focus on reducing labor costs like in the West. But there is also a lot of focusing on improving the customer experience.

However…

It turns out quick service restaurants (like KFC) actually pretty complicated menus and operations. The supply chains are also pretty complicated.

It turns out retail coffee is ground zero for AI + automation in F&B retail. It turns out AI plus robotics is just really good at making drinks. And getting rid of baristas in a small operation can really change the unit economics. It also makes the business model much more scalable.

Retail coffee outlets are nice simple operations for digitization and new retail. They are the lowest hanging fruit for digitizing and automating F&B retail.

In China / Asia, we are currently seeing tons of small and increasingly automated coffee outlets popping up everywhere. They aren’t vending machines (hello Japan). But they also aren’t really full retail outlets either. They are these strange operating models that are somewhere in between. Part retail outlet. Part vending machine. Part mobile app.

And a resurfaced Luckin Coffee is probably the best company to watch in this space. Post bankruptcy and management replacement, they have emerged and grown rapidly in China. They are opening about 15 outlets per day. And have now reached 10,000 outlets in China (which makes them bigger than Starbucks). These stores are about 70% self-operated and 30% via partnership.

That makes them the largest player by outlets. And gets them economies of scale in technology and R&D. That’s why they’re really interesting. They are going to be outspending everyone else in retail technology for coffee.

However…

HeyTea is Innovating Faster in Products

As much as I like retail tech, let’s not get lost in the hype. Does tech really matter in retail F&B? Is this where you want to be the innovation leader?

And the answer is mostly no.

Which brings me to HeyTea, a highly innovative player. But not in technology. They focus their innovation on products and the user experience.

HeyTea is a company I have long been keeping an eye on. They are “Starbucks of tea”. They basically copied the premium business model of Starbucks and applied it to tea in China.

- So they opened lots of really nice outlets in high traffic locations.

- They offered more expensive but really good drinks.

- In 2023, HeyTea had about 3,000 outlets (most all in China). This is compared with about 6,500 for Starbucks and 10,000 for Luckin.

And they have a big tailwind that neither Starbucks nor Luckin has – the fact that Chinese consumers really love tea. Way more than coffee.

I make it a point to visit HeyTea when I am in China or Singapore. I look at their new products. And I check if there are lines out the door (usually there are).

And a few years ago, I sat down with Joy Tan, an ex-Didi staffer who was Chief of Staff at HeyTea. I came away with 6 reasons why HeyTea has broken out of the pack in this business.

Reason #1: Chinese Consumers Are the Big Opportunity. And They 100% Love Tea.

Krispy Kreme opened and closed pretty fast in China. Which was a shame because their stores had really fast Wi-Fi and lots of empty seats.

And while Yum! China has done great with KFC and Pizza Hut, their Taco Bell franchise is still really small. And this is their second attempt to launch this in China, with the first attempt closing about 10 years ago.

It turns out Chinese consumers just don’t like sweet donuts much. And Mexican food is not very popular. In fact, Taco Bell China has rebranded itself as California cuisine, with pictures of surfboards on the walls.

The lesson here is that consumers liking your menu in China is not enough. F&B China is too hyper-competitive. You need them to 100% love your menu. You can’t be a 6/10 with consumers in this space. You need to be 9/10 or 10/10. Or you should stay away.

And Chinese consumers do not really like coffee that much (yet). That’s the problem.

Overall, consumption is still small in China (6-10 cups per year per capita) but it is growing steadily. And that is a national average. You want to look at specific cities and neighbors. Starbucks and its coffee are doing well in first and second tier cities. But it has never been a home run as a product. It’s been more of a long, slow grind. Consumers probably like the experience of going to Starbucks more than coffee as a product.

But Chinese consumers 100% love tea (note: they also really love hotpot and the NBA). So HeyTea has something that neither Starbucks nor Luckin has: big, proven and enthusiastic demand. It’s a 10/10 product.

And against this love of tea, HeyTea was one of the first to position themselves upmarket (similar to Starbucks). They opened nice locations in Grade A shopping malls. They used higher quality ingredients. And they priced their drinks in the 20-35 rmb range, well above the 15-20 rmb of competitors Yi Dian Dian, Coco. Miguo and Happy Lemon.

This is pretty great market positioning overall. They offer an affordable luxury product for China’s rising middle class and their increasing disposable income. It’s the Starbucks model with much better product market fit.

Reason #2: HeyTea Focuses on Thrilling their Customers and Getting Good Locations.

So much of the Luckin vs. Starbucks story has been about Starbucks’ strength in real estate vs. Luckin’s digital-first business model. And this skips over the #1 question for F&B: do consumers love your products? Are you a consumer phenomenon?

Walk into any shopping mall in China and you will see 20-30 restaurants, cafes and desert outlets – all furiously competing. They will have menus with 50 pages of items. They will all have unique approaches – like hotpot vs. vs. handmade noodles vs. seafood. They will have attractive young staff trying to grab you as you walk by. It’s a ruthless business. And your biggest strength is not digital or even location. It is your ability to continually thrill your customers so they keep coming in.

And HeyTea is good at this. This is where they focus their innovation.

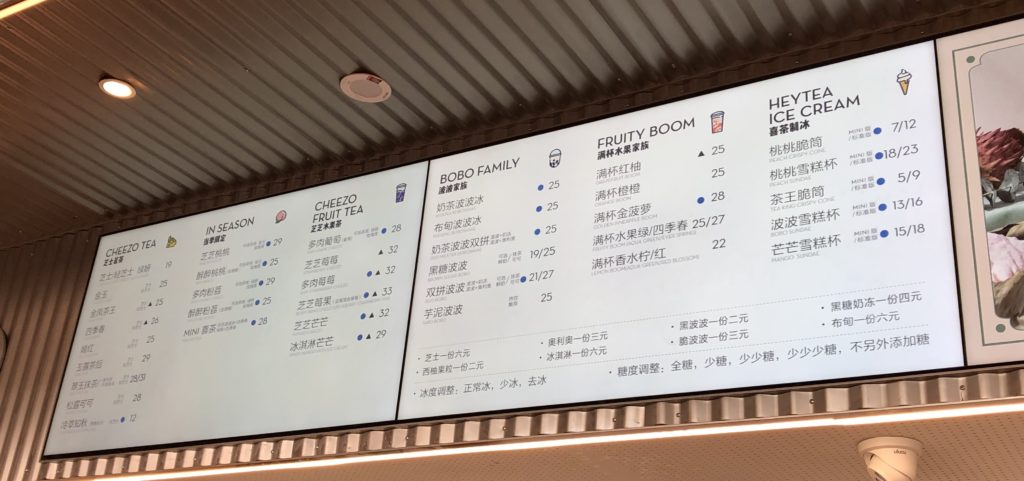

They are known for cheese tea, which is really great. They have interesting fruit teas, that are continually changing. And they make their drinks look really compelling. A typical drink has different colors in multiple layers.

Their bakery is also super interesting.

In one of the outlets I visited, they even had a bar-like area with alcoholic beverages. Note: most of their drinks are made with baijiu. They also offer ice cream with baijiu.

Constant new product introductions is standard for China F&B. But refreshing the menu and thrilling your customers are not the same thing. It’s a rare thing to actually pull off and I’m never quite sure why some companies can do it and some can’t.

One company that comes to mind in this regard is Xiaomi. When they’re not trying to convince investors they are an internet company, they are actually a really innovative consumer electronics company. They launch tons of new products that thrill their customers and keep them coming back. Every time I walk into one of their stores, it is filled with customers looking at their smart scooters, smart rice cookers, and even smart chopsticks. If you read their annual report, management constantly talks about the need to continually thrill their customers.

Basically, F&B is really hard anywhere, but especially so in China. You had better thrill your customers or have them addicted to your products (hello caffeine). Anything else is a pretty brutal business.

***

Ok. That’s it for Part 1. More in Part 2.

-Jeff

——-

Related articles:

- Lessons in Digital Operating Basics from Ram Charan. Part 1 of 2 on “Rethinking Competitive Advantage”. (Asia Tech Strategy – Podcast 98)

- Meituan vs. Ctrip vs. Alibaba: Who Will Win in China Services? (Jeff’s Asia Tech Class – Podcast 22)

From the Concept Library, concepts for this article are:

- Retail Tech

From the Company Library, companies for this article are:

- Starbucks

- HeyTea

- Luckin Coffee

———

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.