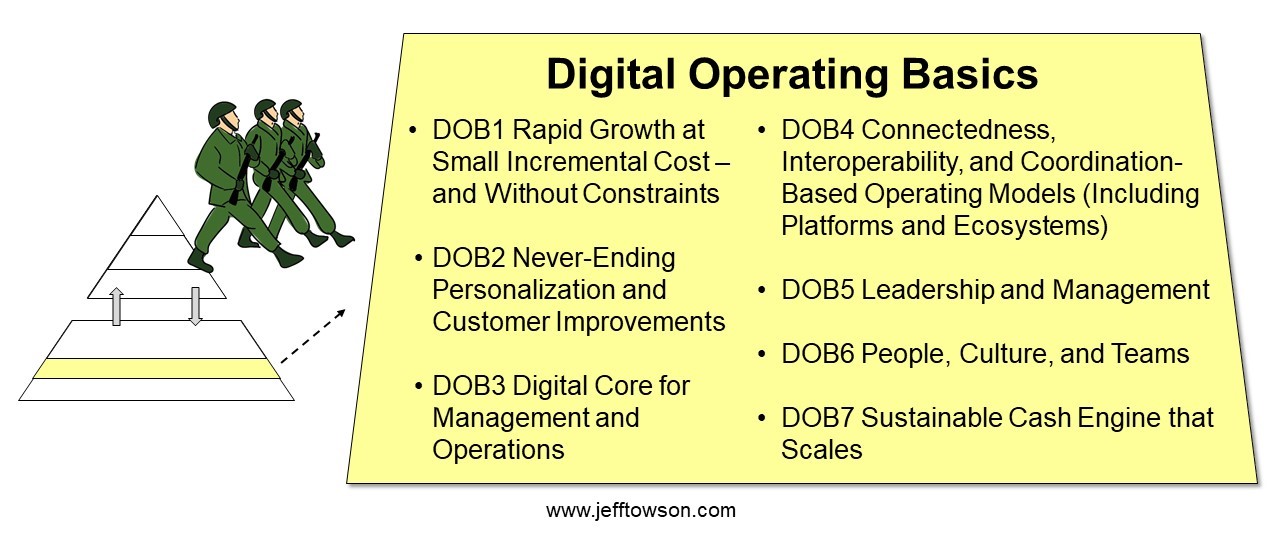

Here are my digital operating basics.

——-

Related articles:

- Why I Really Like Amazon’s Strategy, Despite the Crap Consumer Experience (US-Asia Tech Strategy – Daily Article)

- 3 Big Questions for GoTo (Gojek + Tokopedia) Going Forward (2 of 2)(Winning Tech Strategy – Daily Article)

- Why Netflix and Amazon Prime Don’t Have Long-Term Power. (2 of 2) (US-Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Digital Operating Basics 2: Digital Core

- Digital Operating Basics 3: Personalization and Customer Improvements

- Retail and Ecommerce

- New retail / OMO

From the Company Library, companies for this article are:

- n/a

Photo by Craig Lovelidge on Unsplash

——–Transcription Below

:

Welcome welcome everybody. My name is Jeff Towson and this is the tech strategy podcast where we dissect the strategies of the best digital companies of the US China and Asia and the topic for today three big digital moves in China Asia retail And this is sort of a summary of a talk I’ve been giving here in Brazil, just sort of, you know, what’s next? When it comes to retail, retail plus tech, there’s a lot of operational moves, a lot of upgrades, a lot of new tools and tricks, and sort of what’s coming next. And usually that’s when you look at China Asia, because that’s the frontier. So these are sort of the three things I’ve been keeping my eye on and sort of telling people to pay attention to. And there’s basically three of them that I’ll point. Now, I’m here in Sao Paulo. I’ve been here about, gonna be here a month. Lots of fun, really busy. It’s been sort of a struggle to get this podcast out. Lots of meetings with companies, including pretty much all the digital companies that you’ve heard of for this part of the world. So that’ll be fun. I’ll talk about, so obviously a lot of that’s confidential, but some of it’s not. So I’ll talk about the, at some point I’ll talk about the part that’s not. So anyways. For those of you who are subscribers, the companies I’m working on which are coming your way, Jumia, African e-commerce, really interesting. Mercado Libre, you know, giant out of Argentina, Latin America, a lot of cool stuff, and a lot of parallels between Latin America, Southeast Asia, and China. Not that many parallels with the US and the Amazons really anymore. So I’ll talk about those. For those of you who aren’t subscribers, feel free to go over to jefftausen.com, sign up there, free 30 day trial, see what you think. Other housekeeping, not really much. Motes and Marathons part five is up on Amazon paperback and ebook. For those of you who like the China stuff, the book we wrote years ago called The One Hour China Book, which did really well for a book, which is not saying that much really. Anyways, just posted an updated version of that for 2022. So that went live yesterday. And I think that’s it. Oh, standard qualifier, nothing in this podcast or in my writing on the website is investment advice. The number is information for me and any guests may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment advice. Do your own research. And let’s get into the content. Now, as always, a couple of concepts for today. First one is digital ops. These are basically both digital operating basics. So these are operating performance moves related to digital, not strategic moves. And today, the key ones are DOB2 and DOB3, which stands for digital operating basics 2, digital operating basics 3. Number 3, we’ll, I guess, start with that one, is digital core for management and operations. And this is when you’re talking to lots of companies, particularly in Latin America, also Southeast Asia. You know, they’re really, especially retailers, they’re really just building their digital core. That’s what most of them are doing. You know, they’re putting in their first sort of data architecture, or if they have existing legacy data architecture, they’re upgrading it, they’re moving it to the web, they’re trying to get into a more usable form. And that’s usually always step one. I don’t know why I put it as DOB 3. It’s just ended up there, and now it’s too late to change. So there’s a lot of that going on. DOB 2, which is never-ending personalization and customer improvements, that usually follows right after DOB. Once you get your sort of system, I call it digital core for management and operations. And those are actually two different things. You may digitize your operations, your store, your inventory, your supply chain. That’s going to give you a lot of data and transparency. But you can also digitize management processes, the reports, dashboards, things that help management get smarter and faster. And this whole thing, digital operating basics, really the whole operating performance aspect, which if you look at my models is levels, basically fourth or sixth. The short version of all of that is smarter, faster, better. You digitize as a company, and you have to continually get smarter, faster, and better. So you could see that in both management and ops. Now DOB2, Never-Ending Personalization and Customer Improvements, this is when you start using your data to make your customers happier and make your interactions with them more effective and make your products better suited. So this can plug in at every level of the organization. Usually, people start with marketing. We’ve got a lot of data now. Let’s try and make our marketing more effective, more personalized, one-to-one, not the same message for everybody. But you can also see it in product development, which I’ll talk about. You can see it in manufacturing. If I’m in China talking with an industrial group, when they talk about this, they immediately talk about flexibility of production. That’s how they view customer improvements. But if you’re talking to, I don’t know, a CBG company like a Coke. they will immediately go to better marketing, two-way communication, personalization there, because they’re not going to change their product that much. And retail is a mix of marketing ops, not that much product. So that can play out in different ways. But DOB 3, DOB 2, depending what country you’re in and what sector you’re in, that could be most of what’s going on in terms of digital transformation. And so far in my experience, that’s a lot of what’s happening in Brazil, Latin America in general. Now when you switch from an incumbent retailer’s, what I’m talking about today, to a digital native Mercado Libre, New Bank, well those companies were never, they never had to transition digitally because they’ve been digital from day one. So for them, DOB2, DOB3, it’s not that difficult. retailer with hundreds of stores, this can take five years. That’s not uncommon. So usually the digital natives have that down easily because they were just built that way, born this way from the get-go. Anyways, those are kind of the two ideas for today, and you’ll see that I’m going to sort of touch on these over and over in these three points. So DOB2, DOB3. So let me just sort of read through these points. If you happen to see the Govea Latin American retail conference, which is going on in Sao Paulo, it’s kind of the biggest retail conference in Brazil. Anyways, I basically gave a version of this talk yesterday there. So if you saw that, you can find it online if you’re really curious. But there’s a much longer version of it. So this is kind of the short, so what? But yeah. It’s um. It’s an interesting topic, but the three things I’ve been sort of pointing to is, and I’ll put these in the show notes. So let’s say point number one. Data-driven retail is going from personalization to wow experiences. Basically, the bar is being raised in terms of operating performance for digitized data-driven retail. It used to be at this level, which is personalization. that was really effective, really competitive. Well, the bar is now being raised to what I call wow experiences, which is a term I’ve stolen from Coupang in South Korea. I’ll talk about that. Point number two, online merge offline, also called new retail when you’re talking about retail. It’s moved beyond supermarkets in Asia, China. It’s now targeting department stores and increasingly specialty retail. sports stores, things like that. We’ll talk about that. Number three, retail tech, e-commerce, we can call retail e-commerce, is slowly emerging into a fight between infrastructure and attention. That we see masters of infrastructure, Alibaba, Carrefour, Walmart, and they also do other things, but that’s really their biggest strength. And then you see other e-commerce, players like TikTok, WeChat, Mini programs, where their strength is really in keeping attention. They don’t have that much in terms of infrastructure, not a lot of warehouses, not a lot of physical for it, but they’re unbelievably good at keeping people staring at screens all day. And both of those skills are important, but we clearly have different types of companies that specialize in each, and we can see those play out in different subsectors of retail. which I’ll talk about. Okay, so those are my sort of three points. Now, if you look at my standard little graphic for digital operating basics, as I said, DOB3, Digital Core for Management and Operations, this is why I like that company Snowflake so much, which I really think is one of the coolest companies out there. This is, if you wanna digitize your company, the easiest way to do that, what most people do is they sign up for AWS, they sign up for Azure. They start putting in systems, and they sort of do it step by step in a SaaS approach. But Snowflake is specialized in data ecosystems, data management. Really, so that’s why I was so excited about that company, because they’re offering what, as far as I can tell, every single company now needs to do. It’s not like some companies have to digitize their core. Everybody has to do it. And AWS, Azure, and Google play. they were a little bit slow. And Snowflake jumped in there and became the data specialist, which is just like, I mean, talk about being in an unbelievable position to grow. If they can capture that in lots of companies, and a lot of this is about lock-in. If you get there first, which a company like Snowflake did, once a company moves significantly their data architecture onto your system, it’s very hard to switch. So this is one of those cases where getting there first makes a tremendous difference. Now I think most companies are not, most companies that you talk to, the big ones, they’re gonna be multi-cloud. They’re gonna be on-premise, they’re gonna be cloud, and then they’re gonna be multi-cloud. But smaller companies are probably not. They’re gonna go with one company. So every company that, let’s say Snowflake, signs up today and gets their data running on the system that Azure doesn’t, they’ve probably got them. And it could be for decades. So there’s a lot to like about that company. OK, so you get into sort of the digital core. You start putting in the system. You start doing basic data analytics. Data analytics is like we build the warehouse. The difference between a data lake and a data warehouse is a warehouse is like tables. And it’s very organized. So it’s very good for retrospective. Studies, let’s run the data analytics on what happened in the store last month. And we have all the data tagged in nice columns. Usually, you’re talking about structured data. And then people make the distinction between structured, unstructured, and semi-structured. So a company like Snowflake says, we do structured and semi-structured data. These terms aren’t really very helpful. Another way to think about it is just complicated versus simple. how many employees you have, how many customers bought. That all goes in a table. It’s very simple data. You could call that structured. Structured is basically like it fits in a table. And when you look at data warehouses, they were basically built to address that type of data. You go to the other side and call data lake, although these terms are going away a little bit. They’re more based on let’s just dump a bunch of data into this. in real time. The data’s coming in, the data’s coming in, the data’s coming in like a river flowing into a lake. That’s chaos. A lot of it’s unstructured. It could be images. It could be video. It could be a lot of data that doesn’t fit within a table. Well, that’s where AI lives because AI is very good at… I mean, that’s everything a Tesla sees when it’s going down the road. The data’s flowing in. Some of it’s structured. Most of it’s not, but it can make predictions. So that used to be the distinction, and certain companies were set up to build data warehouses. Other companies were better at data lakes. One was more suited towards retrospective standard data analysis. Another was more suited for AI predictive analysis, real time. This is a whole area of specialty, and I’m not an expert in this. But as far as I can tell, these distinctions are kind of going away. You know, the warehouses are starting to be better at AI, the lakes, it’s, now there will probably be certain companies that are better in one than the other, but a lot of the traditional definitions seem to be sort of fading a bit. Anyways, companies I’ve been talking to in Brazil, you know, I always ask them, what are you doing for your data system that you’re putting in place? And they always say Azure or Google or AWS, pretty much. I haven’t heard that much snowflake here. Fine, they’re building out, then I ask what are you doing with the data that you’re getting? And they’re basically doing data analytics retrospectively. So they’re not at the, hey, let’s start putting in an AI system. One way to think about it is traditional data analytics is it’s just like studying the numbers and looking for correlations and looking for insights, which is something management has always done. When you move to the AI side, it’s more like you’re running experiments. Let’s change A and see what happens. Let’s change B and see what happens. So the whole AI side is more like constant experimentation versus retrospective correlations and analysis. That’s a simple way to think about it. But anyways, once you get all that into place, well, DOB3, what usually happens then is, all right, we gotta, you spend a lot of money on this stuff. We got to show some points. We got to show that there’s value here. We can’t build for two years and then hope it works. So usually when you talk to these companies, they want to see some sort of return on investment in four to six months. Okay, how do you show them a quick return on investment for all the data money they just spent? We look for personalization and customer improvements. That’s DOB2. And usually the go-to place is marketing. You’re spending… $500,000 every month, every year, marketing, whatever you do. We know it’s not very effective. We know a lot of it’s wasted. We know it’s one size fits all, that the same marketing going to me is going to a grandmother. So let’s start to use the data to get more personalized in our marketing spend. So instead of sending the same thing to everybody, now we have. 20 different sort of use cases or 20 different types of profiles or sentiment levels when we break the customers into some sort of buckets, 20, 30, 40 of them, and then we start to personalize to each group. And you know, this has been sort of the… If you look at my six levels, you will see I’ve put personalization in there in DOB2. I mean it literally says personalization. and ongoing customer improvements. Now, personalization is a type of customer improvement, but it’s so powerful that I pulled it out and mentioned it separately. And you can see up in digital superpowers, marathons and superpowers, I’ve also put the idea of markets of one, which is where we personalize to such a level that every single person is their own market. We give them different marketing. We give them a different product. We give them different customer service. It’s hard to find examples of that in the real world, except for media. Netflix, even that, you could probably say YouTube. My YouTube is probably not like anyone else’s in the world. But even a company like Netflix, which will personalize, they don’t have 20 million types of shows. We’re all kind of seeing a lot of the same show, so it’s kind of personalized but not that much. In other words, within this sort of digitization of businesses, including retail, personalization has kind of been the biggest lever for a while because it makes a huge difference with the perceived value of a customer. It really does. When you go on Amazon and it’s specific to you and it’s different than me, it’s That’s a fantastic increase in value. Now I walk down the store into a Zara store, you walk into the Zara store, we both see the same merchandise on the shelves. That’s the difference. So these physical retailers, as soon as they digitize, they try to personalize in the marketing for sure. Hey, Jeff, we know you like sneakers. We have a sale at Zara Sneakers, which they couldn’t do before. Or maybe they try and personalize the inventory. And the way they usually do that is they build an app. So it’s like we have the Zara store, but we have the Zara app. And the Zara app is personalized to me. So I still go into the store and the inventory’s one size fits all. But they start to move to personalization in marketing and usually inventory. That’s pretty much what 80% of retailers do after they get past DOB 3. They move to DOB 2. That’s what they’re doing. OK, so here’s the so what. That is nothing terribly, and you can personalize at different levels. You can personalize at production, inventory, marketing, service levels, pricing. There’s a lot of ways to do that. But in retail, it’s pretty much what I’m talking about. So key point number one, that standard is being raised. It used to be as a digital retailer, a digitized retailer, that was the high sort of watermark. You got to personalize. OK, the new one is wow experiences. The requirement that personalization is becoming table stakes. It’s critical. It’s not going to set you apart. And we’re already seeing this in China. We’ll see this in Latin America in a year or so. You got to go better. OK, what’s better? That’s when I point to Coupang. They describe. You know. Coupang, the South Korean e-commerce company, pretty cool company actually. The thing I like most about them is they have outstanding strategy language in their 10K. They have a really crystal clear explanation of how they’re building economies of scale, how they see their customers, where the value’s created. And one of the things they do is they say, we create wow experiences for our customers. That is the standard for every staffer. And this is a message to their staffers, not to customers. This is what they tell their people. Everything you do, every new project must wow the customer. That’s the standard. So they’re like setting sort of a standard. Basically means you have to thrill them. Now this is something that Xiaomi talks about as well. If you look at their discussion, their self-reported annual reports and stuff, they will always talk about the need to continually thrill their customers with new products. to get you to come into the store. Look at the new smart watch. Look at the new smart razor. Well, this is the same for Coupang. They have to continually thrill their customers with wow experiences. Digitized retail, that is pretty much becoming the new standard. You have to continually thrill them. What you did for them six months ago is not enough. How are you going to wow them today? I don’t know, contests, coupons, coins, new videos, sales events, you know, all of that stuff to just keep it exciting all the time. And that’s much harder to do. China is actually really good at this. Like we were talking yesterday about how many sales events there are in China. Like everyone knows Singles Day, right? Singles Day is awesome. There’s like 10 to 11 major shopping festivals in China. There’s basically one every month. That is about continually thrilling your customers. You know, it’s always something new. Ooh, let’s go back to the Xiaomi store this weekend and see what they have. Ooh, there’s another sales event with JD this weekend. Ooh, this is gonna be fun. Let’s all, what do I wanna buy? What do I want? What’s on my list? That’s kind of the new standard. And if you look at DOB2, I’ve really written it out. I think my language is actually pretty solid for that one. It’s kind of sloppy in some of these other ones, but that one I think is pretty good. Never-ending personalization and customer improvements. You have to continually improve what you’re doing for customers. Personalization is a big lever, and it never ends. This is a race that’s never over. What are we doing different this year? This month? Next month? Anyways. So if we sort of put it at that level. South Korean coupon, good example, some of their language, this is from their filings, our value, quote, to create ever improving experiences at lower prices for customers. That’s a great summary of a business plan. Like that’s really good. Quote, how we wow customers. This is their language. We are committed to delivering a wow experience to all of our customers every day. Note the. It’s an experiential thing, that’s important, and they’re doing it every single day. That’s their standard. Quote, this commitment drives every aspect of our operations and pushes us to redefine the standards of e-commerce. So they’re pushing the standard up and up and up. And then they have rocket delivery and dawn delivery, which is cool. OK. We can also look at a company like Shopee. Why is Shopee doing so well in Southeast Asia versus Lazada? Why are they doing so well in Brazil versus… Macaulay Libre is dominating here, but Shopee’s done fairly well with their sort of market entry. I would argue a big aspect of their strength is gamification. They’re a gaming company that does e-commerce. They’re not the masters of building warehouses like Alibaba. But gamification is really this, I mean, isn’t that what video games are? To thrill people, to give them great experiences so that they keep playing and the game gets fun and they level up and they do. So I would say Shopee’s success is probably based on this same standard of creating sort of wow experiences, ongoing customer improvements never ends. I think I would point to that. Anyways, that’s sort of point number one. Data-driven retail. The standard for data-driven retail is going from personalization to wow experiences. Let me move on to point two, which is going to be much faster. New retail, which is basically online merge, offline applied to retail as opposed to applied to industrial or banking or something else, is starting to transform department stores and specialty retail. Now, I don’t think that’s a surprise to anyone who’s been listening to this podcast. You know, the Alibaba, the He Ma, Fresh Hippo stores, which are totally spectacular, by the way. Amazon Go is kind of like, not a joke, because that’s kind of cocky, but let’s say, very, very underwhelming compared to say, supermarkets and hypermarkets in China, and increasingly Asia that are, you know, taking all the digital assets, all the digital capabilities, merging them with all the physical assets, the physical capabilities, stores, things like that. And the net-net of all of that is the consumer has one seamless data-driven experience with all of this. And it’s spectacular when you apply it to the right business model. Supermarkets were the first wave. Totally worked. Totally awesome. They applied it to convenience stores. Didn’t really work. Not that interesting. Shoe stores, again, not that interesting. But there’s been a lot of experimentation. The ones, okay, so the supermarkets have been talked about. You want the business model to be transformative. Something that puts all the other previous business models, supermarkets, makes them basically non-competitive. And I think that’s what we’re seeing in supermarkets. The other thing you want is you’ve got to have some killer use case. You’ve got to get people excited to come in. It helps, right? Otherwise, it’s a harder… grind to get done. And it turns out the killer use case for OMO supermarkets, new retail supermarkets, was basically seafood. Everyone came in for the seafood. It was the big thing. The whole stores took off. They’re fantastic. OK, so what’s next? Well, a lot of stuff was tried. Department stores seem to be the next thing, because we’ve seen a couple major companies go after this. talked to a bunch of department stores, they all seem to be targeting this, and it makes sense because you can kind of see the business model. So you know, Alibaba 2017, they spent $2.6 billion and bought Intime, which is basically a department store and shopping mall chain. They ended up with 30 department stores, 17 shopping malls, and they started to transform them. And big surprise, they started in Shanghai and Anzhou and started doing there. I met with the CEO several years ago. And you know, it was pretty much a simple playbook. They weren’t doing anything truly transformative yet. They were sort of putting the pieces in place. And the pieces were, big surprise, we got a shift to everyone from the store into the app. So new app, not the Alibaba app, separate in time app. Let’s get everyone using that. So everyone who comes into the department store from now on, please sign up, please sign up. That’s a great lever because it starts to get you two-way communication with your customers for the first time as opposed to every time someone comes in, hi, how may I help you today? Well, that whole question sort of tells you, you don’t even know who this person is. You don’t know what they want. You don’t know anything about them. Two-way communication via an app. gets you a lot of information. It makes your marketing dramatically more effective, and it gets you ongoing communication 24-7, no matter where they are. Big surprise. Step two, on-demand delivery. Again, pretty much the standard OMO playbook. Now, the supermarkets, they don’t usually use the standard delivery people, like the Maytwan. And usually, they have people on bicycles. And they don’t wrap. I mean, if you’re delivering groceries, you don’t need the food, you know, the carry-all that’s gonna keep your food warm, right? It’s a lot simpler. You can give people just a bag of groceries. They can ride a little scooter, even a bicycle. And usually the delivery is 15, 20, 30 minutes at most, right? That was supermarkets. Okay, on-demand delivery means something different when you’re talking about apartment store. You’re talking about makeup, you’re talking about clothes, you’re talking about a lot of stuff. So you’re not talking about 15 minutes, 20 minutes with a dude on a bicycle. You’re probably talking something more like a delivery. They say it’s one to two hours, something like that, and it’s within three to five kilometers radius around the store, something like that. Basically, you have to be competitive with what you could buy on e-commerce and have delivered the next day. So it’s gotta be faster than that, but it ain’t gonna be supermarket speed. Okay, fine. When I was talking with InTime, they said about 30% of the orders were happening from people who weren’t physically in the store. Compare that to the fresh hippo supermarkets, 60% to 70% of the people of the orders are from people not in the store. So it’s more powerful. And then the third thing is you start to digitize the operations. You get rid of all the cashiers. You give everyone a handheld device. You move the whole finance department up into the cloud. You move a lot of the ops up into the cloud. It helps if you’re Alibaba and you own Alibaba cloud, including financial cloud. So you get a lot of money saved there. But OK, those are all good, DOB3, DOB2. They’re not transformative. They are transformative. They’re not devastating to your customers, your competitors. Now, the one that they were looking at, so I kind of asked the CEO, what’s next? What are you doing next? And they had a couple of good ideas, but really the two that jump out are product service bundles, which I’ve talked about before. You don’t sell someone a dress. You sell them a dress plus the service to have it fitted. You don’t sell them makeup. You sell them makeup plus the person to apply the makeup and cut your hair. One price. Bundles are always a good idea if you can pull them off. And it’s all done in the person’s home. A regular department store can’t really do that very well. A data-driven department store with two-way communication with their customers and the ability to deliver within a two to three kilometer radius within an hour can do all of that. OK, that’s one lever, which is cool. But really, probably the big one here is experiential retail. So that brings us back to the idea of wow experiences. That these are going to be platforms for creating an endless, never-ending series of experiences that your customers can have that will thrill them. Come down to the store tomorrow. We’re having a special runway event. On Sunday, dresses for little girls, 10,000 different princess dresses, and all the girls come running. I mean, it’s this idea of it becomes a platform for experiences that you can’t really do in small stores. You can’t do them in a supermarket, probably like this. You can’t do them online. It’s probably the experiential retail, the wow experiences, where these OMO department stores are going to live. I’m watching them. And JD did this in Chongqing, which I’ve written about their e-space, where it’s basically the big department store that was all based on experiential, trying things out as opposed to buying anything. So anyways, that’s point number two. Watch for department stores to become maybe the testing center. the testing ground for these experiential wow services type of things. Point number three, last point. Retail and e-commerce, it more and more looks to me like a fight between infrastructure and attention. You’re going to have to do both. Most companies have to do both. You’ve got some warehouses, you’ve got some stores, that would be considered infrastructure for commerce. You’ve got some content, you’re doing videos, you’re on TikTok, you’re doing marketing. That’s about attention, not just trying to sell things. You’re trying to get people to pay attention to you. Most retailers have to do both of those things. Starbucks is minting NFTs or whatever. I don’t quite know why they’re doing that. But… We are definitely seeing certain companies become dramatically better at one or the other. It’s unlikely a company is going to be dominant in both of those capabilities. You’re never going to touch Alibaba, JD, Mercado Libre, Amazon in infrastructure. And by infrastructure I mean logistics, warehouse, physical stores, and cloud. All of that integrated. And we could see Walmart and Carrefour really do very well there. We could see a lot of traditional retailers digitize and do really well there. You’re also not going to probably touch YouTube, TikTok, WeChat, let’s say Instagram. They are masters of attention. That is all they do. And really it’s not just WeChat. You have to look at Tencent. You know, because Tencent is the gaming giant of the world. They’re unbelievably big. That is all about capturing attention. If you look at the most downloaded apps by money spent globally, number one and number two are Tencent and TikTok. So yes, you’re going to have to compete in that world. Are you going to beat those giants? Probably not. And even Alibaba can’t probably beat them. So. We can see sort of those two skills, and then the question becomes, what business are we talking about? Now, grocery stores, big surprise, Alibaba is rocking and rolling. That game is about infrastructure. And WeChat mini programs isn’t touching that stuff. They’re not building supermarkets. They’re not opening hundreds of them. No, they’re not doing that. We go over to fashion and luxury and makeup and beauty. How do you beat TikTok when they do more and more e-commerce in that game? How do you beat Shein? I mean, we see companies like Alibaba have live streaming, Taobao Live, which is important. That’s definitely part of it, but you’re not going to be as good as people. By nature of messenger, people check that all the time, all day long. They will never check an e-commerce site 50 times a day like they’ll check their messages on WeChat. So you’re always at a disadvantage there. It’s not super addictive like TikTok. Like people spend 90 plus minutes per day on TikTok. It’s like 85 million Americans. Everywhere I go in the world, Kenya, Turkey, Brazil, everybody’s on TikTok all the time. So they’re gonna win an attention or at least they’re gonna dominate. Okay, fashion, makeup, beauty. As the types of media emerge and as all of that, it’s going to be very hard to compete there. You can, but we’re definitely seeing sort of a dividing line within the retail and e-commerce world between what I think is attention and infrastructure. And then there’s a lot of stuff that’s in the muddy middle, department stores. OK. To do department stores, you need infrastructure, you need 30, 40 stores, those take decades to build. But I just got through telling you that department stores may become a platform for experiences. Well that’s kind of about attention. They may not be good at that. So we got kind of a mix there, but obviously infrastructure matters. Let’s move to smaller stores that are easier to roll out. Pop-up stores. OK, we could see pop-up stores, mini stores in areas like makeup. And we could see companies like TikTok starting to do that. Because let’s say in that case, it’s 70% about attention and it’s only 20% to 30% about infrastructure. Anyways, that’s kind of how I’m looking at it. And I’m just sort of watching to see what happens. I don’t really have any predictions. But if you look at my sort of six levels, You can see like this attention, let’s say you’re in the attention business. Now, one of the reasons TikTok, ByteDance is so good at that is because they’re running a digital marathon in machine learning, right? You look at my six levels, level four, digital marathons, digital superpowers, when that becomes so powerful, no one can touch you. Well, TikTok has been doing that in machine learning from day one. That plays right into attention. So you can see, how they’re competing, whether they’re going to be strong or the other. In the contrasting scenario, if you look at lots of warehouses and hypermarkets, that’s a barrier to entry. Because it takes a long time to build those. No one’s going to sneak up on you in three months and surprise you that they’ve just opened 200 hypermarkets. No, you’re going to see it come in five years in advance. So you can see the dynamics are going to play out differently. Now my little pet theory, which I’m just, it’s just a guess. I’m tending to think that attention is unpredictable. It’s less predictable, commanding attention. But if you have it, it pretty much trumps everything else. I’m not sure that’s true. So we’ll see, but I’m wondering if that’s ultimately what’s gonna happen, that in the digital world, all that really matters is commanding attention. Anyways, that’s sort of my three points. Yeah, I’m watching to see what happens. And let’s see, the two concepts for today, Digital Operating Basics 2, Digital Operating Basics 3, which are number three again, Digital Core for Management and Operations. And then Digital Operating Basics 2 is Never-Ending Personalization and Customer Improvements. Anyways, that’s sort of the content for today. As for me, it has been a pretty tiring but spectacular week. It’s just been meetings all day long and talks and keynotes and advising clients and stuff like that. So, you know, there’s always sort of a nice feeling when you’re completely wrecked at the end of the day. You’re tired, but kind of in a good way. And it was that’s that’s sort of been the scenario here in Sao Paulo. Looks like I’m going down to Porto Alegre. I’m trying to get to Rio. and I think maybe Florianopolis as well, but that might be a quick trip. So it’s just going to be sort of packed and then probably jump out of here. So pretty spectacular. São Paulo is really kind of growing on me. Like I was never real enthusiastic about São Paulo. It’s a big city. It’s great. There’s all, you know, restaurants and shopping centers, but, you know, there’s a lot of big cities, but the more time I spend, and I always used to spend time in Rio because Rio’s, you know, Rio. It’s really growing on me. Like, it’s just restaurants and cafes everywhere. And I’ve been going to some of the private clubs, which are sort of a tradition here, going back 30, 40, 50 years. These big clubs where everyone goes on a Saturday, there’s like pools and sports fields and families bring their kids. And I’ve gone to a couple of those in the last week and it was really fantastic. Yeah, it’s funny, the whole thing, the place is really crawling on me. Anyways, that’s it for me. I hope this is helpful. If you’re in Brazil, feel free to give me a shout out. I’m bouncing around at least for another three weeks. But other than that, I will talk to you next week. Thanks a lot. Bye bye.

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.