A subscriber suggested I look at Russian ecommerce company Ozon Holdings (OZON). It’s outside of Asia Tech Strategy, but I thought it was an interesting company. And it raises an important question about why some countries develop so much faster than others in ecommerce.

And that is really the key question for Ozon going forward. What is going to be the growth and development rate for Russian ecommerce?

An Introduction to Ozon Holdings

Ozon is basically a mini version of JD in China circa 2013. For those of you who have been following Asia Tech Strategy for a while, this company is going to be super easy for you. Ozon is directly copying proven ecommerce models (from Asia I think). Here is how the company describes itself in its latest 10k filing.

Note that it mentions its two users groups and has a clear value proposition for each of them.

- For consumers, Ozon offers wide selection, value for money and convenience (which is mostly about fast and reliable delivery. Plus some lending and good customer service.)

- Ozon carries +9M product SKUs, which makes it one of the largest multi-category assortment of products at an ecommerce company in Russia.

- For merchants, Ozon offers “commercial success”, which is a bit vague. They detail this elsewhere to mostly mean access to a large buying audience, delivery and fulfillment capabilities, data analytics tools, advertising services and supplier credit.

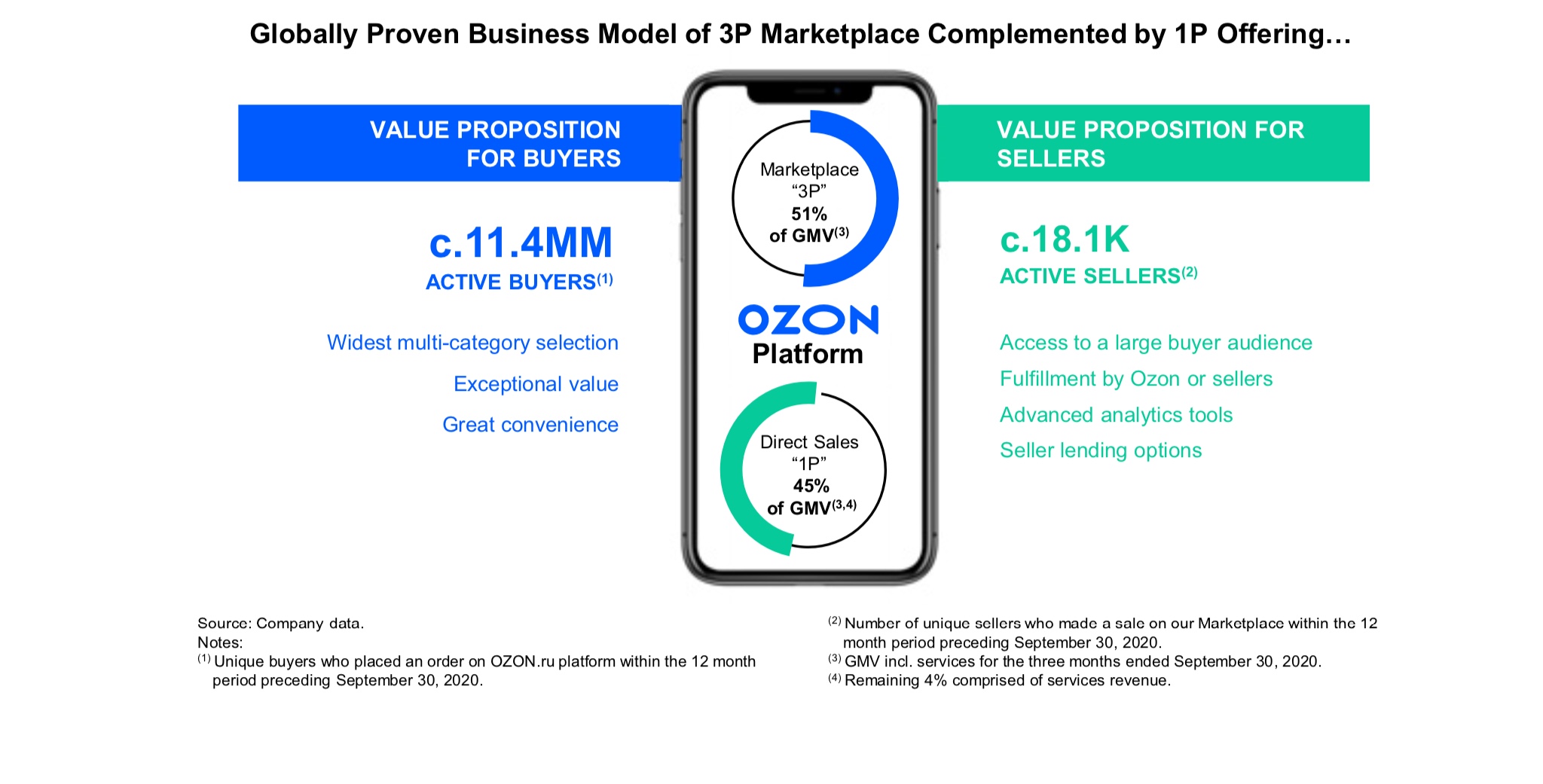

They have a nice graphic summarizing the business.

That is actually a really good headline. They flat out say they are copying a “globally proven business model”. I like that. I think copying proven business models and adapting them to developing economies is an outstanding strategy.

They also say they have a marketplace platform (“3P”). Plus a complementary online retailer (“1P”). That is basically the same as JD and Amazon (not Alibaba or Shopee). And their GMV is roughly equally split between these two models. That’s just like JD.

They are also doing the same JD-like balancing act between being an asset-lite and an asset-heavy business model. They have their own inventory as a retailer (expensive) – but they also have a marketplace (asset-lite). They do logistics in-house (expensive) but are also having their sellers do delivery (cheaper). And they have largely kept their delivery couriers in a self-employed status (cheaper).

So right away I like this. They are copying one of the most powerful business models out there. They are just at a fairly early stage of development for this model. They have 11.4M active buyers and 18,000 active sellers on the site, which makes them somewhat small. As stated, this is a mini version of JD, circa 2013.

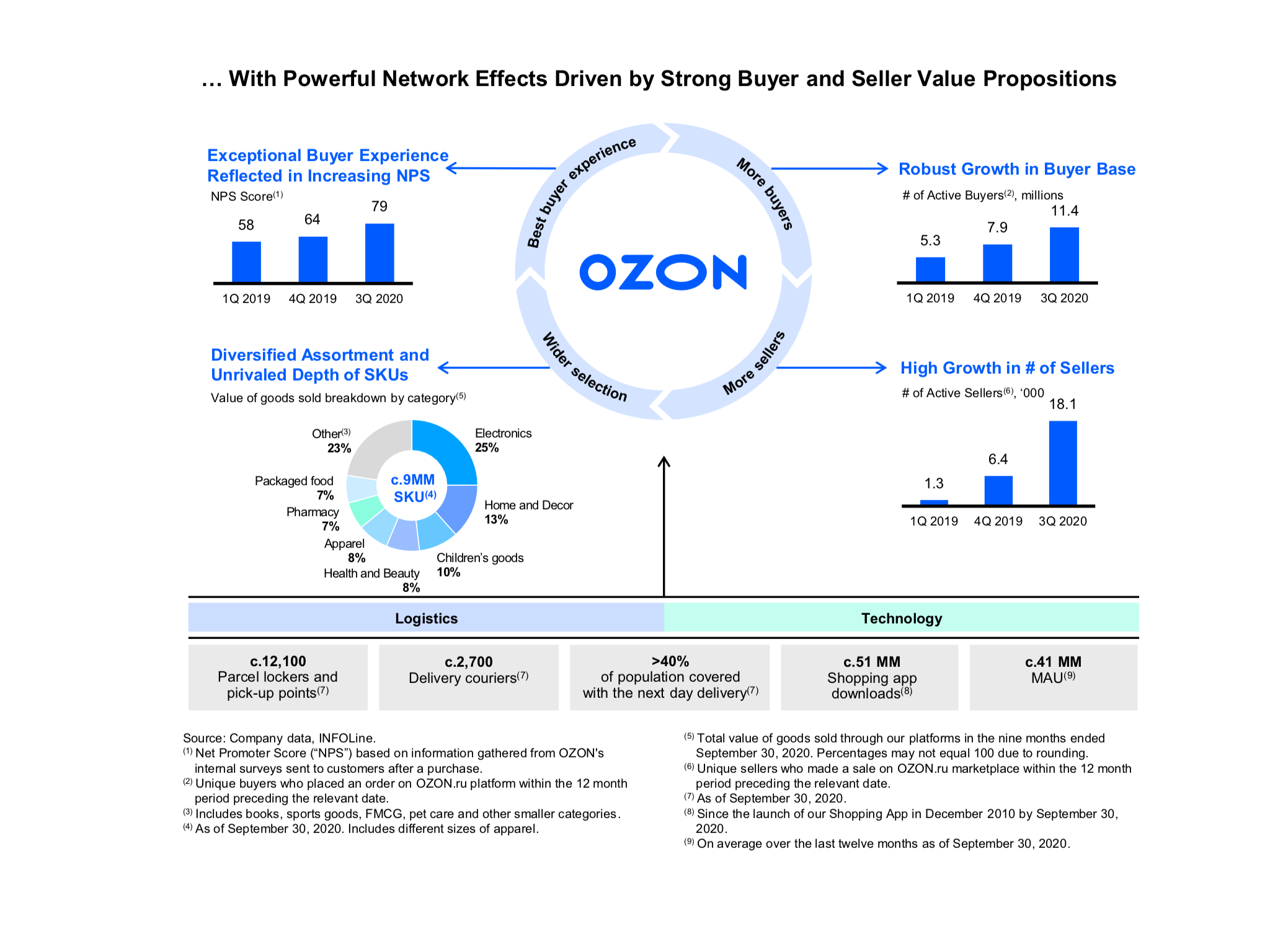

They also have a somewhat confusing graphic arguing they have network effects (which they do). There is some good data here but I don’t think this slide is actually right.

You can basically see all the key pieces for a standard marketplace platform.

- Increasing users and engagement in both groups. They show this with increasing buyer experience and net promoter scores. That’s good. Also by growth in the number of sellers and the depth of SKUs.

- There is an indirect network effect. Not the one they mention, but it a standard marketplace indirect network effect with a high threshold for viability, national scope and no real asymptotic limit. Network effects for big marketplace platforms for products are awesome.

- There are economies of scale in the fixed costs of technology and delivery. This is where they are spending a lot in both expenses and capital expenditures. That is what you would expect. They also mention they have economies of scale by geographic density in logistics. That is actually pretty cool that they talk about that. They have a nice description of the costs of fulfilment operations, including fixed costs relative to orders and utilization. As well as the importance of density of orders and the delivery distance and method.

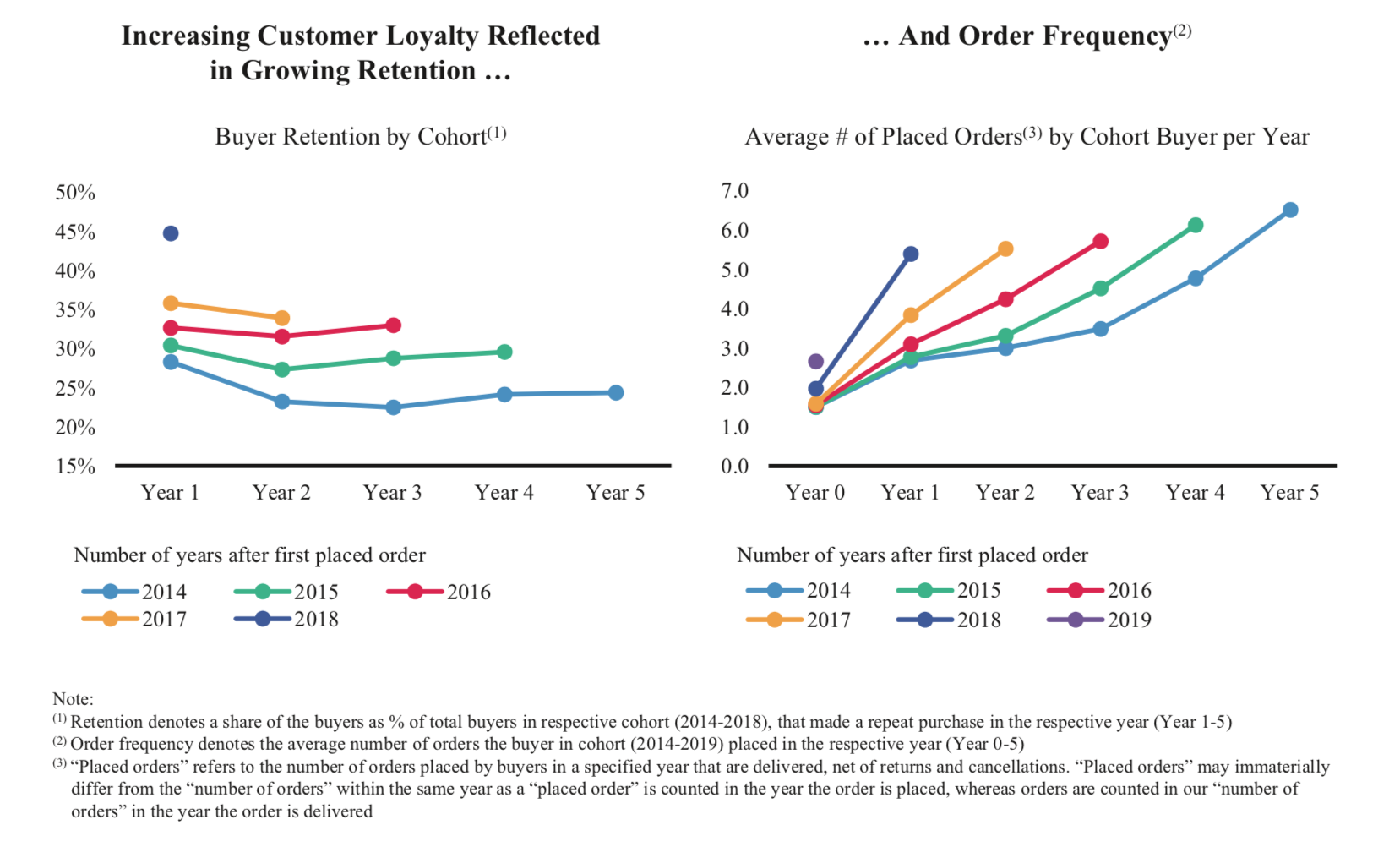

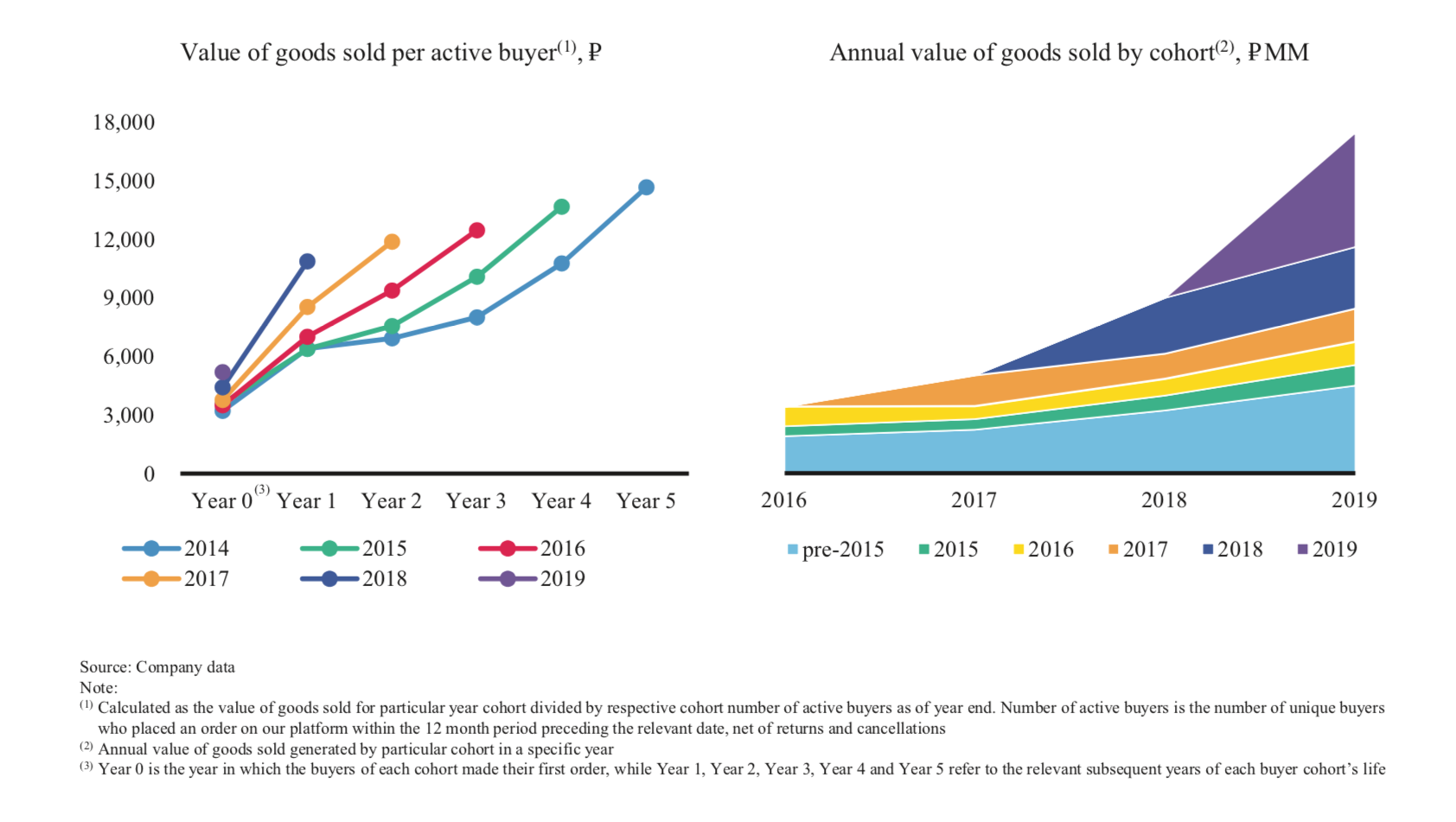

You can see lots of numbers showing growth in users and engagement. They provide a cohort analysis which is really appreciated. I hate when companies don’t include that.

And finally, the company provides some good detail on their strategy for the future. Which is basically to keep doing what they are doing – mostly growing usage by enhancing the buyer and seller experience, building out nationwide logistics infrastructure and continuing to innovate in technology. That’s the standard playbook. Good.

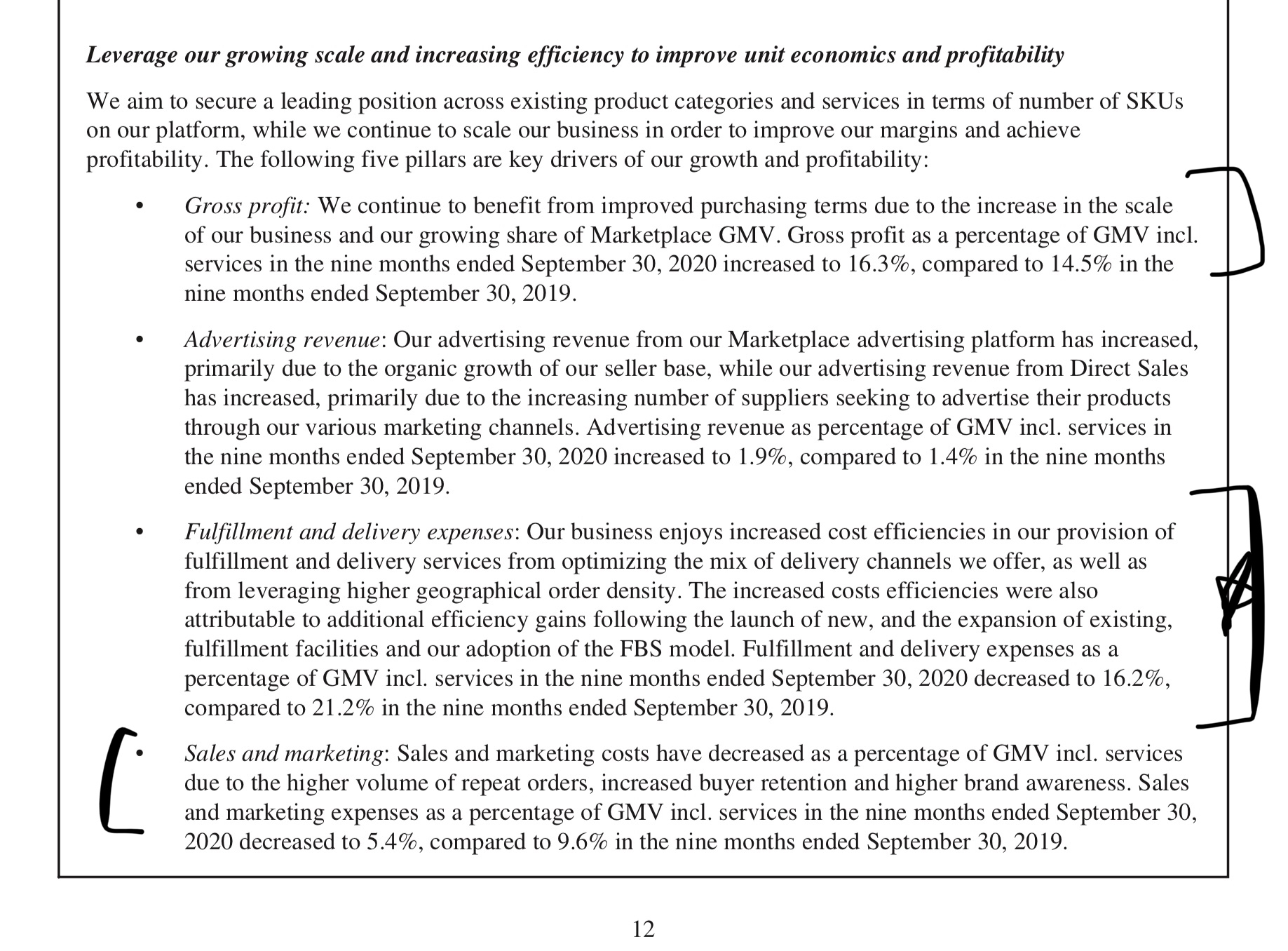

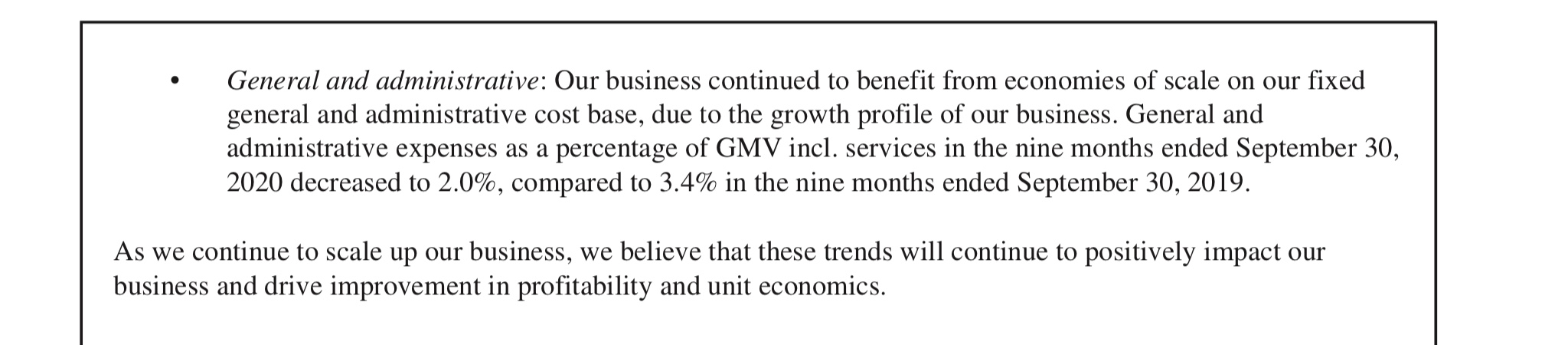

They are also taking advantage of increasing operative leverage as they grow in scale. The gross profit has increased from 14% to 16%. The percent of GMV spent on logistics has dropped from 21% to 16%. Sales and marketing expense has dropped to 5.4%. The below discussion was actually my favorite part of the filing.

Basically, this is an easy-to-understand company. It’s a great business model that we know very well. And management is running the standard playbook for this business.

So, what’s the issue?

The issue is growth. How much is the company going to grow? And how fast? And that’s not so much a question about the company as it is about the rate of development of Russian ecommerce.

Ozon’s Growth Will Be Determined by 1 Internal and 1 External Factor (Probably)

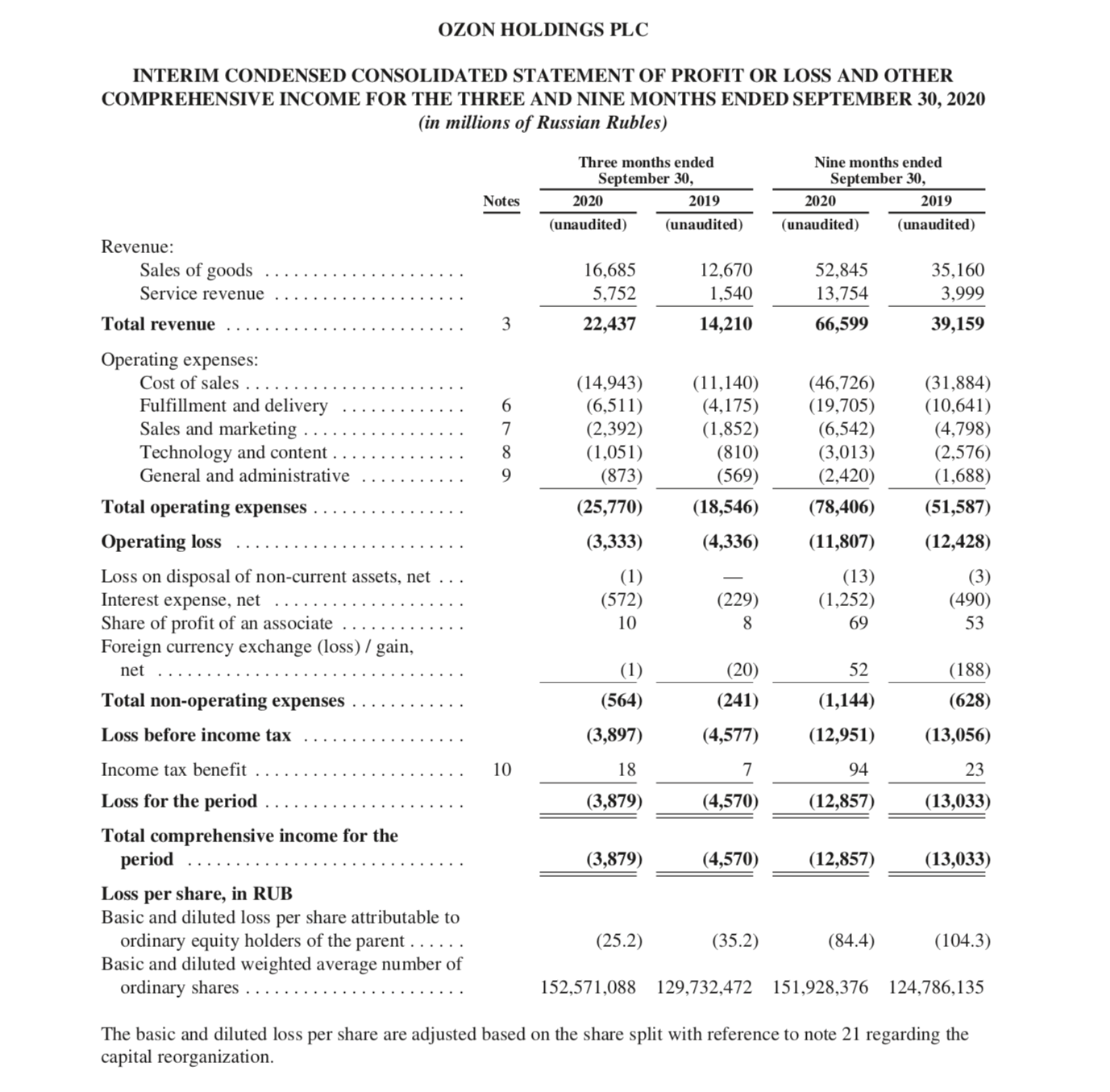

The company’s financials are standard for an ecommerce company. Revenue and gross margins are growing but there are still negative operating profits due to tech and logistics spending. However, the company is also clearly not a rocket ship. And the Ozon’s focus on extracting operating leverage is something you usually don’t see until a company’s growth slows down.

The company talks about its market extensively. And the terms it uses over and over are large, fragmented, underpenetrated and growing.

As for being a large market, that is true. Russia is the world’s 11th largest economy, with 113M internet users. And it is the world’s 6th largest retail market. And ecommerce is still only 6% of retail.

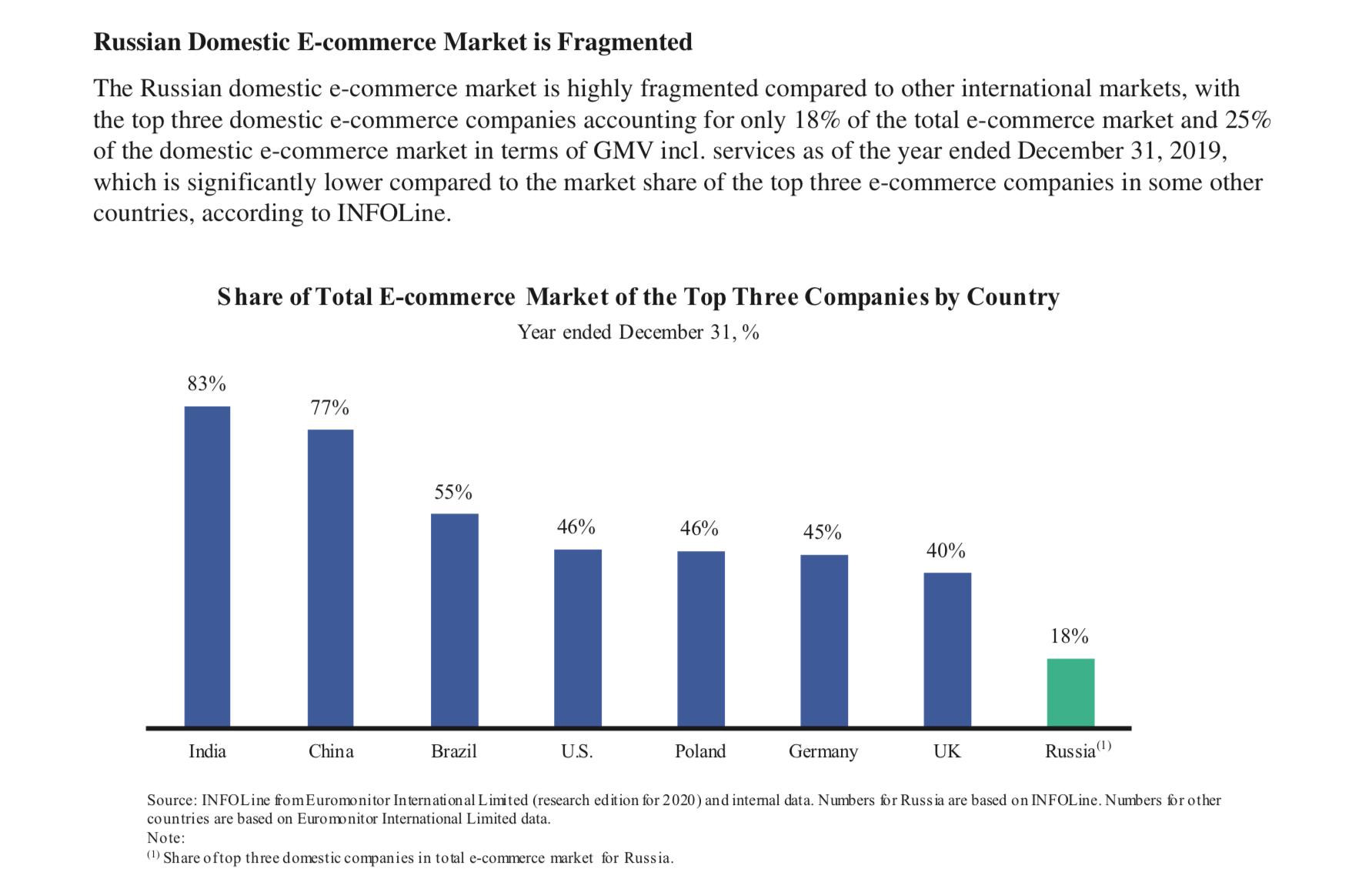

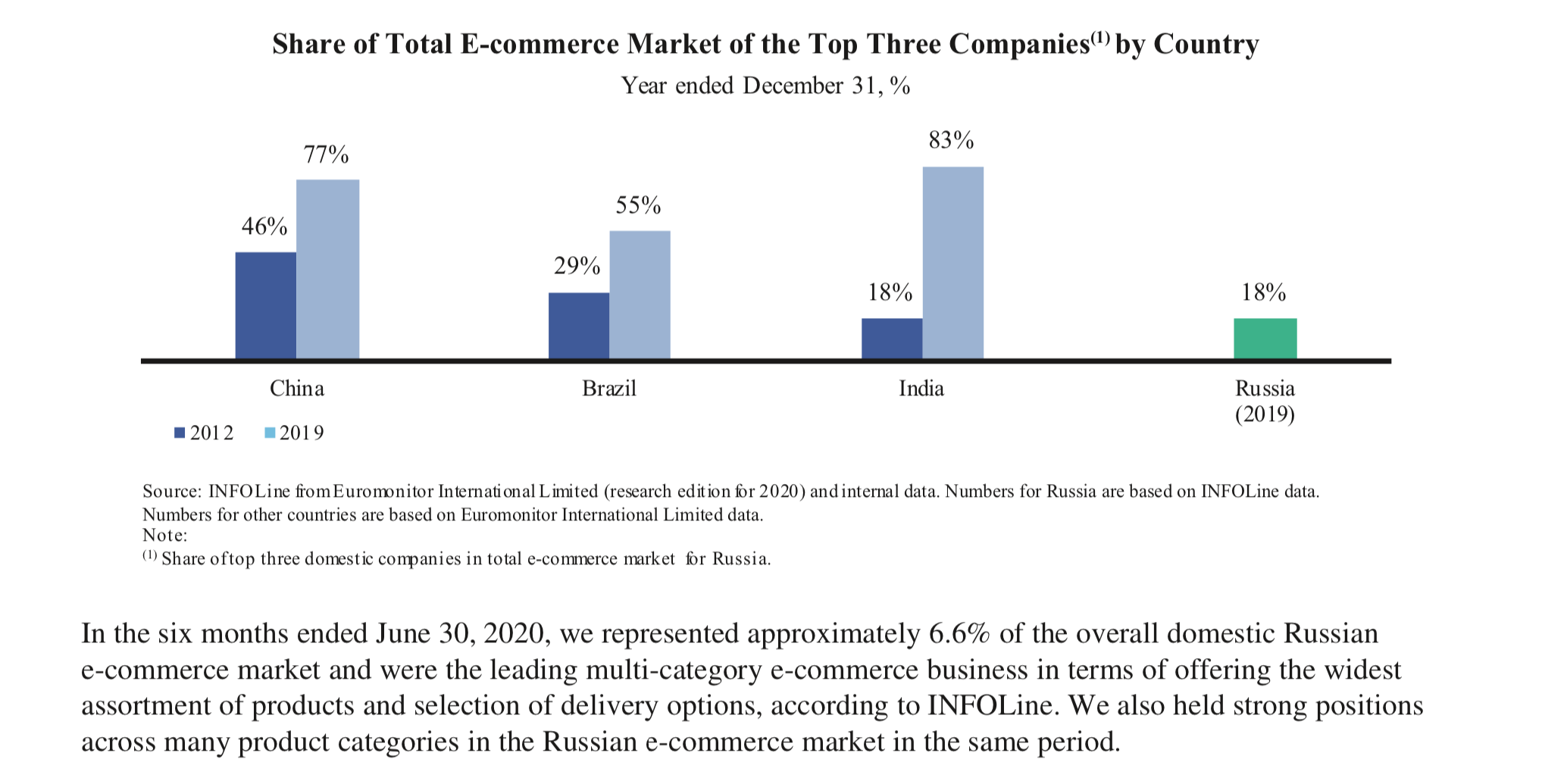

As for being a fragmented market, that is also true. The top three players have 18% of the market, which is very low. And we can predict significant consolidation due to the strength of the business model. Russian ecommerce will likely consolidate to 2-3 big players, just like we have seen in every other market. The game is about capturing demand-side scale and then building supply-side scale. That will be powerful and will collapse the market to the leaders.

Here are two convincing graphics from the 10-K.

That is an internal factor that will have an impact on growth. Ok. So far so good.

But that’s not really the big question. The big question is the growth and development of Russian ecommerce. And there are lots of indications that the market is not advancing quickly.

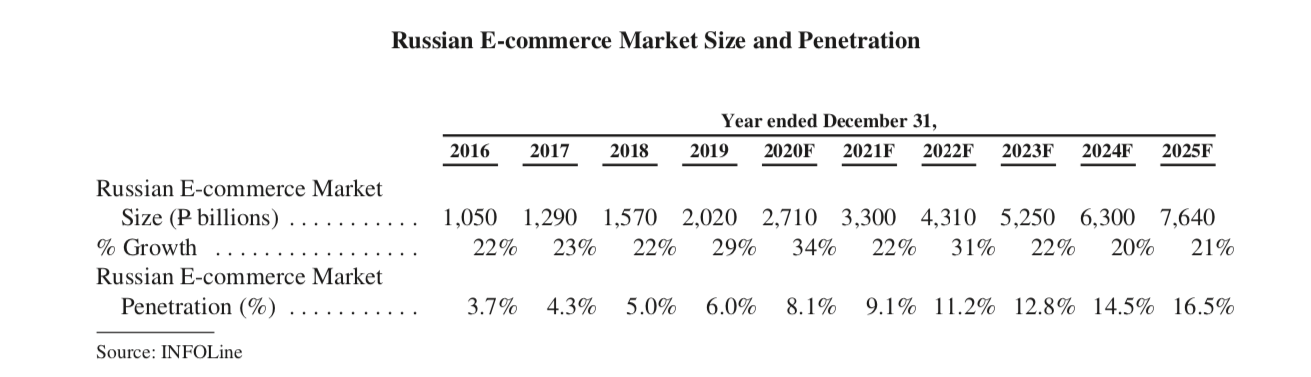

Here is what the company predicts about growth. That means this is likely the most optimistic scenario. About 20%. That is not great for ecommerce in an underpenetrated market.

I’m also not convinced the ultimate Russian ecommerce market is that big.

Russia is a massive country. And ecommerce works better in dense cities. That’s why it is so good in Asia, which has a massive population and the world’s most dense cities. Ozon has had its early growth in Moscow and St. Petersburg. That may end up being most of the market. And later growth in the smaller cities across a vast geography is going to be a lot harder than the early growth in the two big cities.

Are You a Believer in Russia?

This is really the key question. It’s the external factor. Yes, the market is underdeveloped for ecommerce. But is it going to develop? How fast?

This is a big question. And something that requires a lot of real analysis of the economy (which I don’t have). But I think we can see lots of indications of slow development.

- Payment is still mostly cash on delivery. That slows things down a lot. Mobile is the fastest. Credit cards are good. Cash on delivery is slow. China was the same in 2005-2010 as nobody had credit cards. But they jumped to mobile payment with debit cards and things accelerated.

- Sellers look slow to move online. Ozon says they have +18,000 active sellers. That is kind of low. Plus, Russia has a very high cross-border ecommerce percentage at 29%. That means the international ecommerce players are a threat. It is also consistent with a lack of available products and sellers domestically.

- Consumer behavior is changing but it’s unclear how quickly. Some countries are just slower to change in consumer behavior. We are very used to China / Asia where consumers adopt new technologies and services at a stunning rate. In Russia, we should see increased usage with improving experience, increased convenience, and wider product categories. But it may take a while. The younger generations (i.e., those without engrained habits) will likely be the leaders.

- Ozon is moving into both financing and travel services. I thought this was interesting. Usually if the core business is moving fast, that is the focus. Ozon’s movement into adjacent services may mean nothing. It is not inconsistent with how JD developed. But it may also be a search for faster growth.

But this ultimately comes down to whether you are a believer in Russia. Because things people frequently point to are:

- A reliance on Russian infrastructure.

- A lack of trust in the legal system.

- A lack of trust across the economy.

This last factor is a problem. It really does hurt investment, especially international investment. Into companies as well as infrastructure. Consumers and merchants trust each other less. Cash on delivery is probably an expression of this.

Overall, Ozon is a fascinating question. The company is a solid example of a well-known, proven and powerful business model. That is attractive.

But its growth is going to be largely determined by an economy that has real questions. And is difficult for foreigners to understand. We can get a solid answer on growth coming from consolidation of the market. But the overall rate of growth depends on the Russian economy.

That is a good question to investigate. The uncertainty in this economy question could be a problem or it could be an opportunity to invest in a great business.

Ozon calls itself the leading ecommerce platform in the large, fragmented, underpenetrated and growing Russian market. And that is true. It depends if you are a believer in that market.

That’s my take. I think it’s worth looking at.

Cheers, jeff

—–

Related articles:

- Walmart, JD and Purchasing Economies at Traditional and Online Retailers (Asia Tech Strategy – Daily Lesson / Update)

- JD Logistics, Coupang and Entry Barriers That Even Tech Can’t Breach (Asia Tech Strategy – Daily Lesson / Update)

From the Concept Library, concepts for this article are:

- Ecommerce

- Marketplace Platforms

From the Company Library, companies for this article are:

- Ozon Holdings

Photo by Random Institute on Unsplash

———-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.