I look for four types of competitive advantages on the revenue and demand side:

- Share of the Consumer Mind, Share of the Producer Mind and Customer / User Activity and Buying Behavior. Which contains lots of sub-types such as buying habits, branding and emotional attachment. And not just for consumers and B2B customers. But also for other user groups.

- Switching Costs and Customer / User Lock-In.

- Searching Costs. Example: surgeons, management consultants, complex services.

- Limited sellers and a long-term supply-demand imbalance. Note, this does not include short-term supply-demand imbalance like first mover, resource games and counter-positioning. Those go under short-term and dynamic competition.

Switching costs and customer / user lock-in is an increasingly common approach in digital. If network effects are the favorite competitive advantage in a digital age, customer lock-in is the runner up.

The simplest example is when your accountant comes to you at the end of the year and tells you prices will be increasing 10% this year. And you immediately weigh that 10% increase in price versus the “costs” of switching to another accountant.

- An accountant who doesn’t know your business would have a learning curve.

- It would take time to do the switch.

- The new accountant may not be as good.

- The new accountant may make a mistake which could cost significantly later.

Switching can have a financial cost, a time cost, a hassle factor, some uncertainty and real or perceived risks. So you weigh all that against a 10% price increase and say ok. The “cost”, both real and perceived, of switching is greater than 10%.

Businesses love switching costs. And they take advantage of them in reasonable and sometimes unreasonable ways.

- Storage facilities give customers low initial rates to get them to move their stuff in. Then they raise the rates later because it is physically difficult to move stuff somewhere else.

- Health insurance companies also like raise to rates annual because of the hassle of finding a new plan and going through another medical screening.

- IT systems become the baseline system for enterprises and then try to add as many functions and integrations as possible. The more complicated and operationally integrated the programs, the harder to switch.

- Accounting and software companies offer customized solutions (which are harder to find and replace).

- Apartment leases and gym membership have contract termination penalties.

- Airlines and coffee houses offer miles and points, which means switching costs customers accrued benefits.

Switching costs can be powerful in software. And in digital platforms like marketplaces and audience builders. Both merchants and content creators on platforms invest time, activity and capital. And they can become very dependent on the platform for their customers, operations and data. Most of the powerful competitive advantages on the producer side of platforms are switching costs.

We also see lots of switching costs in IT B2B products. Choosing an ERP system is a major decision for any company as switching becomes exceptionally difficult. It is a major upfront cost. It gets integrated into a greater IT system. Functions and apps become customized. Staff get trained. IBM specifically provides software and services for “critical workflows” of Fortune 500 companies.

There are also smaller ways switching costs can be introduced. Companies can add features to products and services such as automatic bill pay, lines of credit, points accumulation and information storage. A lot of what is pitched as “convenience” to users is about building in smaller switching costs.

Switching costs and lock-in is a much simpler idea than share of the consumer mind. Although it has certain similarities as a demand-side competitive advantage.

- Both are types of customer capture.

- Both can be achieved with different user groups on a platform, not just with customers.

- Both are non-exclusive. Any competitor can also have share of the consumer mind. And any competitor can also have switching costs, although usually not with the same customers.

- Both require additional purchases. There is no value to share of the consumer mind or switching costs if the customer is not doing repeat purchases in the future.

- Both are built over time. Time is an important factor for creating both share of the consumer mind and switching costs. For switching costs, you have to think in terms of multiple rounds of competition and purchasing.

This last point is important.

When there are clear big switching costs up front, such as putting in a new ERP system, you have to break the competition into phases. There is an initial fight for the new client. This tends to be ruthless because whoever wins round one will have strong advantages going forward. In the case of an ERP system, it basically becomes a monopoly situation in round two. This is when calculating lifetime value (LTV) of a customer is important. If the company is going for economic profit, then the initial price plus later revenue should be higher than the LTV. However, if the company is going for defensibility, there are often good reasons to offer a price that matches and is even less than the LTV. Especially in the early days of a platform.

You can also see products and services split into multiple parts of a complete customer solution. Such as selling a big copy machine cheap in round one and then selling expensive ink and servicing in round one. Companies will frequently take a loss on the sale of initial durable goods and make their money on services and consumables later. Or they will take a loss on the core service and make their money on later complements. This is what Xiaomi is trying to do. In contrast, Apple makes their money on the iPhone and then gives away lots of complements to get lock-in (messenger, iCloud storage, music purchases).

Hamilton Helmer has a pretty good list of switching costs in this book 7 Powers. The below is that list combined with my own:

Financial Switching Costs

These are direct monetary costs for switching. Such as buying a new ERP system vs. paying the renewal fee. These financial costs can apply to both the core product and purchased complements. They can include:

- Contractual Commitments. Are there compensatory damages? For example, breaking a lease for an apartment rental.

- Durable Purchases. Switching can mean buying another piece of durable equipment, such as a big copier. However, the cost of replacing IT equipment tends to decline as the durable equipment ages.

- Specialized Suppliers. The cost of a new supplier may rise over time if capabilities are hard to find or maintain.

Procedural Switching Costs

This is an indirect cost. Such as being unfamiliar with a new product or service. Such as retraining costs. A new service may require changes in routines across the organization. There is also the difficulty of existing operational integration. The high connectivity of digital tools can make this especially difficult.

- Brand Specific Training. The costs of learning a new system can include direct costs and lost productivity. These tend to rise over time.

- Information and Databases. The cost of converting data to a new format tends to rise over time as the collection grows.

- Operational and Digital Integration. This includes customization.

- Loyalty Programs and Accumulated Value. This is any lost accumulated benefits from current suppliers. Plus the need to rebuild cumulative use.

Relational Switching Costs

B2B businesses can be a lot about personal relationships. You work with the same suppliers over time. You are all in the same industry. Your career paths keep intersecting. These types of professional relationships can be long-standing. And in some cases can be important in your career. There is a reason McKinsey & Co gets repeat business from the same clients year after year. This is part of the reason people stay with their physicians for decades. Whether B2B or B2C, people are only rational cost-benefit calculators to a point. Breaking relationships can be difficult. There is a familiarity, ease of communication, and mutual positive feelings.

Customers can also have affection for products and services. People really like their iPhones. People love their Teslas. A product can become part of one’s identity. It can create a community of users. Think the communities around certain video games. Switching a product can mean losing an identity and a community.

Real and Perceived Risk and Uncertainty

As mentioned, switching to another unproven product can sometimes create larger risks for a company or individual. There can be larger problems. The risks of buying cheaper brakes for a truck is far larger than the cost of the brakes. It’s just not worth it to switch, even if the risk and uncertainty are just perceived.

***

Ecommerce Merchant Services Are All About Switching Costs from Operational and Technical Integration

One of Alibaba’s core growth strategies is:

“To develop new supply categories and supply-side transformation based on consumer insights.”

When valuing Alibaba, you can assess the total addressable market (TAM) on the consumer side by projecting their ultimate share of wallet. What percentage of consumer spending are they going to capture?

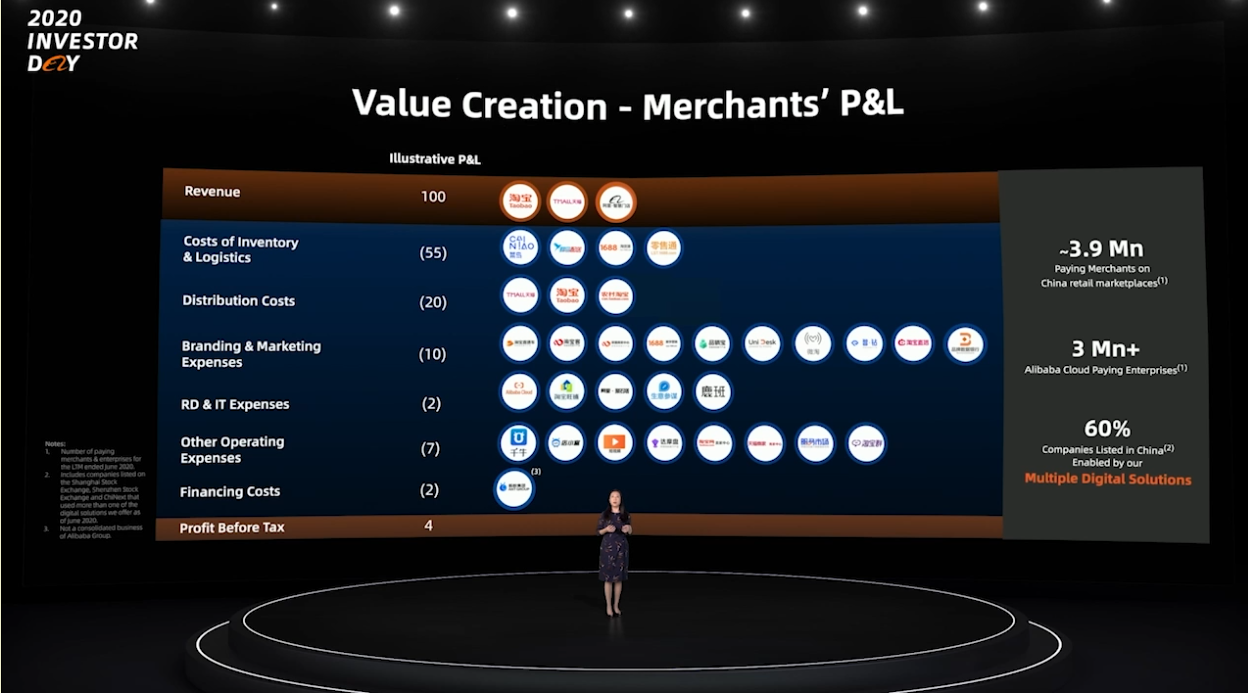

But you can assess the total addressable market on the merchant / brand side (their other user group) by the value added to the operations and income statements of SMEs. Here is a slide from Alibaba CFO Maggie Wu on this.

Look at the left column, where it shows a model P&L for a merchant. With $100 in revenue, the merchant spends $55 on inventory and logistics. And spends $20 on distribution, $10 on branding and marketing and $2 on R&D and IT.

Alibaba is looking to add value to merchants in each of these line items. It is looking to decrease their costs. It is looking to improve their operations. To improve their productivity. This is how they create value for this user group.

Alibaba then takes a small percentage fee of the value of the services they provide. So the more value they add to merchants’ businesses, the larger Alibaba’s revenue becomes. That model income statement is their total addressable market on the merchant side. That is what they are trying to impact. And that is what they mean by “supply-side transformation based on customer insights”.

However, there is another way to view all this. It’s about building switching costs with operational and technical integration.

Final Point: Cloud May Be the Mother of All Switching Costs

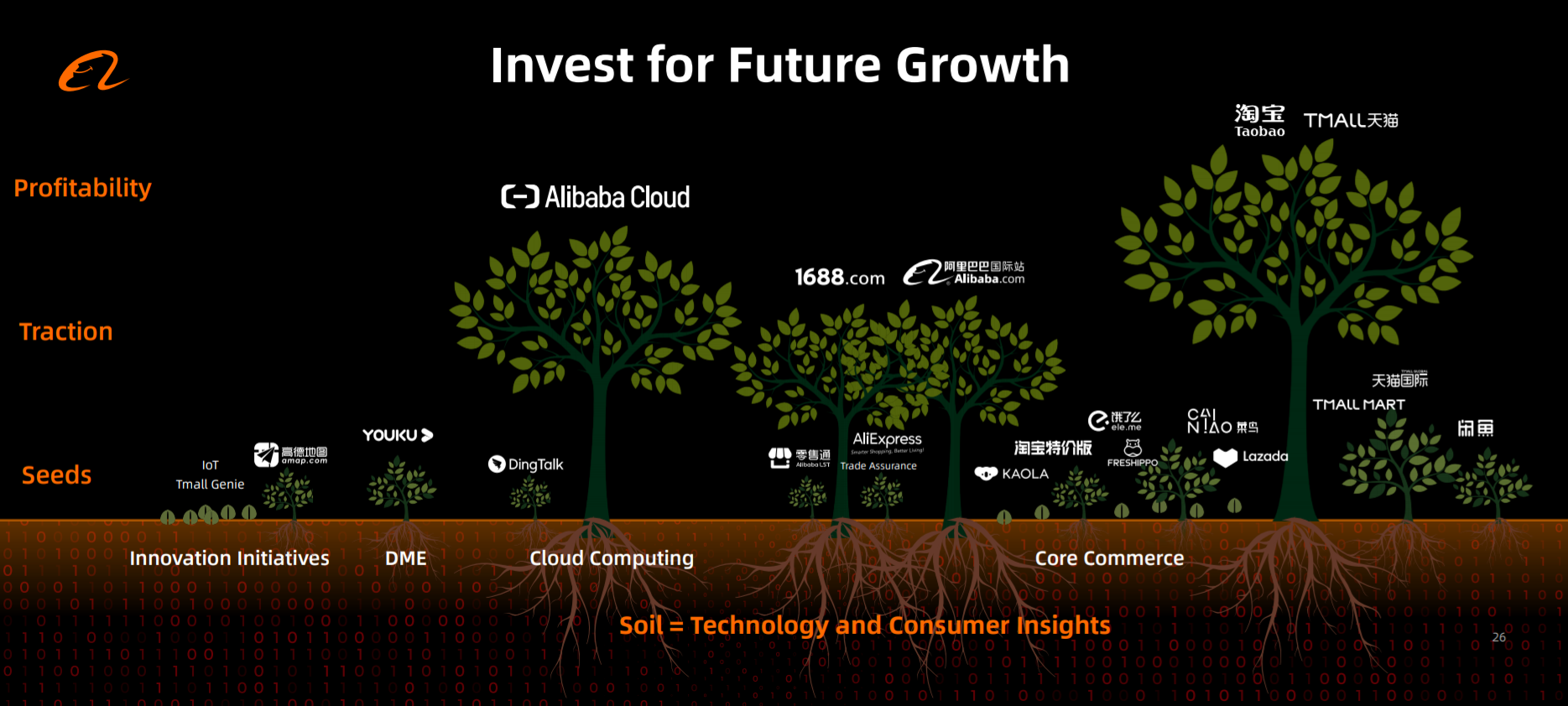

I’ve argued Alibaba is 100% in the platform building business. This is what gives them most of their many structural advantages. After that, their operating strategy is mostly about sustaining innovation plus rate of learning (the I and L in my SMILE Marathon framework). At their 2020 Investors Day, this is how they presented their businesses.

Note the bottom level is called Seeds. That’s Alibaba doing lots of experimentation and testing for product-market fit. If a project gets going and starts to scale, they then put it in Traction (as in “getting traction”). Again, they are mostly in the digital platform business so getting platforms to a critical mass of engagement and users is critical. But once they get some traction, the big strengths of platform business models do start to show up – especially:

- Network effects

- Other multi-sided platform advantages like price subsidies and chicken-and-egg.

- The scalability of software products fueled mostly by user effort (and capital).

And sometimes their platforms reach Profitability. You can see their cash cows at the top: Taobao, Tmall, Alibaba.com and 1688. Ant Financial is another one but is not shown. And from their announcements, this will soon include Alibaba Cloud.

Which brings us to Alibaba Cloud and likely the mother of all switching costs. We are just at the beginning of cloud platforms. But it’s easy to see a new level of switching costs emerging. I’ll leave that for another day. But it’s clearly one of their biggest strengths.

Cheers from Mexico City, Jeff

———–

Related podcasts and articles are:

- Why Digital Platforms Are So Powerful (Asia Tech Strategy – Daily Lesson / Update)

- Switching Costs, Wabco and Buffett’s Critical Companies (Asia Tech Strategy – Podcast 85)

From the Concept Library, concepts for this article are:

- Switching Costs

From the Company Library, companies for this article are:

- Alibaba

————-