This week’s podcast is about the struggle of companies like Grab, Dingdong, Meituan, Didi, GoJek and iFood to reach operating profits.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is the link to the TechMoat Consulting.

Here is the link to the China Tech Tour.

——

Related podcasts and articles are:

- Lessons from Grab in Geographic Density and Other Tech Enabled Cost Efficiencies (3 of 4) (Tech Strategy – Daily Article)

- How Alibaba Freshippo and Dingdong Got to Profitability in Ecommerce Groceries (1 of 2) (Tech Strategy – Daily Article)

- How Alibaba Freshippo and Dingdong Got to Profitability in Ecommerce Groceries (2 of 2) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Economies of Scale: Geographic and Distribution Density

- Ecommerce

From the Company Library, companies for this article are:

- Grab

- Dingdong

Photo by Grab Media Resources

——–Transcription Below

Episode 156 – Dingdong.1.transcribe

Sat, May 06, 2023 8:47AM • 48:33

SUMMARY KEYWORDS

dingdong, delivery, drivers, density, orders, profitability, talk, numbers, grab, batching, ding dong, food, model, companies, groceries, china, competitive advantages, geographic, cities, services

SPEAKERS

Jeffrey Towson

Jeffrey Towson 00:00

Welcome, welcome everybody. My name is Jeff Towson, and this is the tech strategy podcast where we analyze the best digital businesses of the US, China and Asia. And the topic for today, ding dong grab, and the struggle for profits in E commerce services. So last week, I did kind of a high level rant last week, which was about China and some other stuff. And I kind of have mixed feelings about that stuff. Because

Jeffrey Towson 00:28

one, I don’t like doing macro, I don’t like doing high level, I don’t like ranting because I feel like my thinking is not as precise as I like it to be. So this week, I thought I’d go in the exact opposite direction, I’d go full micro, like very detailed, specific to companies, you know, sort of full micro, I think, is the way to think about it. And the topic I thought, is really been bubbling around for about six to nine months, which is you have all these local ecommerce services companies grab ding dong, Matewan go Jek de de Uber.

Jeffrey Towson 01:04

And they have questionable profitable profitability. And the business model has not been clear. But we’ve got at least three or four cases in the last six months where those, those businesses have pivoted, and started to really move towards profitability for the first time. So I’d sort of talk about how they’re doing it because we can, we can point to at least two or three examples now where they’ve pulled it off. And I kind of wanted to point to where that’s coming from. And within there, there’s a very important concept, which is geographic density is a type of economies of scale. Hugely important. Nobody talks about it. Well, except for me, as far as I can tell. So talk about that a little bit, but that’ll be kind of the topic for today. So we’re gonna we’re gonna go into the details of some pretty cool companies, in my opinion, and that’ll be the topic. Let’s see basic stuff. Oh, for those of you who are subscribers, I, I sent you some pretty detailed articles on fresh hippo and dingdong in the last week. So I’m going to touch on that. And then sort of spread that out May twine grab Diddy and some others, but there was a lot of detail about this in the last week. So hopefully this will reinforce that a little bit, because I did kind of go in the weeds pretty good on that one. Okay, so that’s, that’s upcoming stuff. We have the China Tech Tour, which is in June, if you’re interested in that, that’s going to be five days on the ground. Beijing Hanzo. Shanghai, I’ve been down at the Chinese Consulate checking out visas, everything looks good. Visiting tech companies, the names the finalists will be released at some point, those that’s a little bit of back and forth on that stuff, always. And then just a lot of deep dives on digital strategy. So if you’re interested and then look a lot of fun going out. If you haven’t been to these places, Beijing is awesome. I really, I think take that for granted because I’ve been going there for so long. 1516 years. It’s just great. Fun. Shanghai’s awesome, hon. Joe has really gotten cool in the last five years or so. So a lot of fun along the way. If you’re interested in that, go to tech Mote consulting.com You’ll see it there are send me a quick note. So we’ll talk about it and see what’s up. It can be for individuals as well as for companies, so let me know. Okay. And with that, I think that’s what I wanted to cover. Oh, my standard disclaimer, nothing in this podcast or in my writings or website is investment advice. The numbers of information from any guests may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment, legal or tax advice, do your own research. And with that, let’s get into the content.

Jeffrey Towson 03:54

So as always, we start with a little theory, the concept for today, which is always in the concept library on my webpage, Jeff towson.com is geographic density, which is a type of economies of scale economies of scale has always been sort of one of the main go to competitive advantages. Now I’ve given you my list of 16 types of competitive advantages. As far as I know, I’ve never see if you look up Morningstar, and some others, they’ll tell you, here’s the six types of modes you can have in this world. A lot of value investors put like, here’s four types, five types. I don’t think it’s right. And I think when you start to apply those to digital companies, it doesn’t work at all. So I broke it down at a more granular level. I think there’s 16 types of competitive advantages.

Jeffrey Towson 04:46

And when you start looking at digital companies, you can really see that play out differently. So that’s my opinion. But on that list, economies of scale, I’m bigger than a rival I have an advantage versus you which

Jeffrey Towson 05:00

In a sharp in many ways,

Jeffrey Towson 05:02

you can break economies of scale, which people talk about all the time. Usually they talk about economies of scale and scope, which are a little bit different.

Jeffrey Towson 05:11

Usually what people talk about when they’re doing that they’re talking about fixed costs. I’m going to outspend you on marketing, my major fixed cost is my logistics, therefore, I’m bigger than you. So for my per unit costs, my factory is bigger than yours. So my on going fixed costs spending, which can be operating expenses, as well as capital expenditures, maintenance, not growth, therefore, I have a per unit cost that’s lower than you because I’m bigger than you and the fixed cost gets divided. The volume of goods gets divided by the fixed costs. That’s how they do it. Sometimes people talk about purchasing economies, I’m a bigger health insurer than my rival, I’m three times bigger, therefore, I can negotiate lower rates on doctors and hospitals, which is pretty much all health insurance companies do. That’s another type of economies of scale advantages, really five or six different types.

Jeffrey Towson 06:05

The one nobody ever talks about is geographic density,

Jeffrey Towson 06:09

which is I have more customers, or I have more orders within a certain local geography, let’s say downtown Shanghai. And because of that, I’m not going to get a fixed cost advantage. But I’m going to that’s going to play out in multiple ways and grab is absolutely going after this. If you’ve read the grab annual report, 50% of their annual report, strategy wise, in my opinion, is about geographic density. As an advantage, they’re going for

Jeffrey Towson 06:43

FedEx, these express delivery companies have that same thing. Basically, when you start to get more, let’s say I’m,

Jeffrey Towson 06:51

I’m shipping packages around Shanghai, and I have more orders within a certain geography Shanghai,

Jeffrey Towson 07:00

I can start to do things that are going to make me cheaper, faster, and offer greater coverage than a rival who has fewer orders in that town.

Jeffrey Towson 07:15

How do I accomplish that? Well, I can have better coverage, I can say, look, I cover all of Shanghai, you only cover half of Shanghai. And with the areas I cover, I’m faster because I’ve gotten more riders moving around.

Jeffrey Towson 07:31

I’m also going to be able to sort of start batching, where I take 10 orders from this part of town, I put them together in one, let’s say truck or one scooter. And that scooter will go on a very specific route to the other side of town and get those orders there. So you start to batch, you start to optimize the routes for each batching of orders. And then you can also generally be faster, cheaper and cover but usually geographic density for it to play out in those three metrics. And that’s what you’re looking for lower cost, faster delivery, and then sometimes greater coverage, you usually have to pair more orders and more riders more delivery dudes with data technologies.

Jeffrey Towson 08:22

You have to tell every individual rider, I want you to pick up this order at the restaurant. And then I want you to go over to that restaurant and pick up the other order. And because we’re doing it in sort of a data smart way, there will be less wait time when you pick up the order because we’re timing it. And and then I’m going to route you on certain streets that don’t have traffic right now. And you’re going to drop off order one on this street and then go one block over and drop off order to at that street. All of that becomes very dependent on sort of basically machine learning. So you need a lot of density of orders, you need a lot of dudes on scooters, and then you need a lot of machine loader. And if you do that, well, you will start to be cheaper than your competitor. And as you get bigger than them number of orders within a specific area. You can really go after that. And I’ll give you the metrics grab is doing this with and they talk about this very specifically, they’re talking about the degree of batching. They’re using rerouting orders using certain or routes for certain orders, but not others.

Jeffrey Towson 09:32

Now a company like FedEx, they kind of do the same game. But they’re not talking about deliveries within a city they’re generally talking about deliveries between cities and they’re batching their orders at night at the FedEx facility loading it on a plane. It flies all over the world it delivers and then they take it out.

Jeffrey Towson 09:53

There’s great videos of all the FedEx planes around the world that all take off at night.

Jeffrey Towson 10:00

because they all push the orders to an area, they all take off at night, they all land by 6am. And then they route the orders again.

Jeffrey Towson 10:08

Anyways, it’s a big, big deal and digital, people really don’t talk about it enough. But companies like grab Matewan Uber, this is huge for strategy for them. Okay, that’s kind of high level, but I’ll give you some examples of grab. But it’s a major competitive advantage you kind of got to know about this one. And not that many people do. So it’s, it’s kind of a cool area where you can figure stuff out that other people aren’t understanding. Okay.

Jeffrey Towson 10:37

That’s the concept for today geographic density as a type of economy of scale. Now, I wrote I’m going to sort of summarize an article I talked about, which is in the last six weeks, both dingdong which is a Chinese direct to consumers specialized ecommerce site for groceries.

Jeffrey Towson 11:02

That’s all they do. You want fresh groceries, fresh fruits, fresh vegetables, they delivered direct to your home, it’s a little bit like a B InBev Zed delivery, which does. It’s an app in Brazil now in the rest of Latin America starting this year, where you order beer and spirits and all of that. And it’s a app plus a specific delivery model where they deliver right to your home with cold beverages in 15 to 18 minutes. Okay, both of these are sort of specialized ecommerce sites. And they have very specialized offers beverages, fresh groceries, perishable goods, and they have specialized logistics networks they’ve built to do this. And both of those models use what they call sort of a frontline grid network where they don’t go through supermarkets,

Jeffrey Towson 11:51

Alibaba, Amazon,

Jeffrey Towson 11:54

that sort of thing. They don’t go through traditional e commerce which is we have a big warehouse on the edge of town where everything goes and then we we put it to dispatch right now they have they have very small warehouses, which are really just rooms very close to where people live and they have lots of them 1020 3040 In a city and they’re constantly delivering fresh vegetables to those frontline warehouses and then they have delivery people that just go from there for blocks to someone’s house, you can get it fast. So it says alternative frontline warehouse warehouse model. But Zed delivery which is err ABN Bev and dingdong have basically the same model. There’s another company called Miss fresh which is struggling right now they have the same model.

Jeffrey Towson 12:45

A company like Ali Baba with their supermarkets, they have somewhat of a similar model but instead of having these specialized small warehouses, they have hypermarkets that are near people’s houses and they run it through the back. So the back of the hypermarket is really the same thing, but it’s stuck on a retail facility. Anyways, okay, so if we look at, let’s say ding dong first.

Jeffrey Towson 13:13

They, along with Alec, both of these companies, Ding Dong and fresh hippo. They both announced in the last six weeks that they had reached operating profitability,

Jeffrey Towson 13:22

which was very surprising because I’ve spent a lot of time about a year ago looking at dingdong and I was like, I don’t know how this business is ever going to get to profitability.

Jeffrey Towson 13:32

I couldn’t figure out how they were going to do it because the numbers did not look good.

Jeffrey Towson 13:38

But if you go back and let’s say a year ago, late 2021, early 2022 Ding dong was trying to solve the problem of how do you do e commerce in groceries, which has been notoriously difficult for lots of reasons. doing ecommerce in books, Jeff Bezos, Amazon 2001 was relatively straightforward. You put them in a big warehouse outside of town, they don’t go they don’t go bad. It’s not perishable. You have a massive inventory that you can cover in terms of SK use.

Jeffrey Towson 14:15

You can keep the inventory there for a year it’s fine, we’ll ecommerce let’s in groceries was the exact opposite. It was if books was the easiest, this was the hardest. The goods are perishable. You can’t keep the goods in the warehouse. You can’t even keep them in the supply chain. You’ve got to think about when are we going to pick these pineapples? In let’s say Thailand where most pineapples come from, you know, how long do they last? You got to ship them from there to the warehouse into people’s homes. And it’s got to arrive at the person’s home based on when they place their order. Such that it’s it’s ripe right at that moment. Because most things only are ripe for a couple of days. A

Jeffrey Towson 14:58

lot of spoilage

Jeffrey Towson 15:02

groceries tend to have fewer SK use. Instead of hundreds of 1000s of books, you’ve got maybe a couple 1000. So less interesting. Most groceries, fresh goods, vegetables, carrots

Jeffrey Towson 15:19

are commodities. These are not Snickers candy bar where you have a pretty good gross profit because it’s a branded good. And it’s not perishable, but by the way, now, these are apples and oranges and whatever. So very small margin. So if you’re going to use technology to disrupt this business, it’s hard to disrupt something that’s operating on 5% gross profits, and maybe 2% operating profits. How are you going to disrupt that, there’s no room to get under.

Jeffrey Towson 15:49

So apples milks pretty hard to disrupt. Plus, people really want fast, frequent deliveries, it’s not like send me a bunch of books, and I’ll get them next week. You know, people need their groceries immediately. So the delivery is a problem, and they need it two or three times a week. So you’ve got a lot of frequent deliveries, which is usually where the costs are a problem.

Jeffrey Towson 16:12

So that’s bad. And consumers tend to like to buy groceries in person, they like to look at the apple and wander around the aisle and pick stuff, you know, so for a lot of reasons, groceries was like the E commerce area everyone avoided. Well, dingdong myths fresh these companies were founded around 2017 In China, because China is really the frontier for E commerce to solve these problems.

Jeffrey Towson 16:42

And the answer, which is what I sort of explained was, you know, we will set up these little warehouses, which are really just rooms on side streets, we will ship the goods there, we’ll have a very special specialized supply chain, cold chain lot of tracking will control it all, from front to back, get it into these local little rooms that are down the street from people’s houses. And then we’ll have delivery dudes going back and forth all day. Pretty much what a B InBev does with beers and stuff.

Jeffrey Towson 17:14

And the benefit of that model was the little warehouses didn’t cost you they call it the frontline fulfillment grid model

Jeffrey Towson 17:24

that was sort of supplied by a regional processing center. And then international supply chain because you got to get vegetables from around the world, especially in China.

Jeffrey Towson 17:33

And they would source 75% of their SK use directly. He was not a marketplace model, really, they would deal with the people selling pineapples out of Thailand or avocados out of Mexico. So it was sort of a direct linear service model, not a marketplace.

Jeffrey Towson 17:52

And they had a very specialized system. And that was the idea 2017 They go public in 2021. At that point, they’re doing deliveries of groceries in 29 cities on their own app, about 7 million monthly transacting users. And it was a very scalable business model. Because you didn’t have to open supermarkets, you know, is so they actually were growing really, really fast. And that was the plan. It’s a cool app. People love it because they do like buying groceries, 7 million monthly transacting users that’s significant. And they were opening city by city by city by city. So on first pass, that all looks like a pretty good specialty ecommerce model.

Jeffrey Towson 18:50

20% gross profits, more or less? And then Okay, so that’s, you know, someone spends 100 bucks 20% of that 80% of that is gone. Just buying the goods buying the they’re buying and selling inventory. So you’re down to 20 bucks. The fulfillment costs for that was $40. So you are already negative 20%

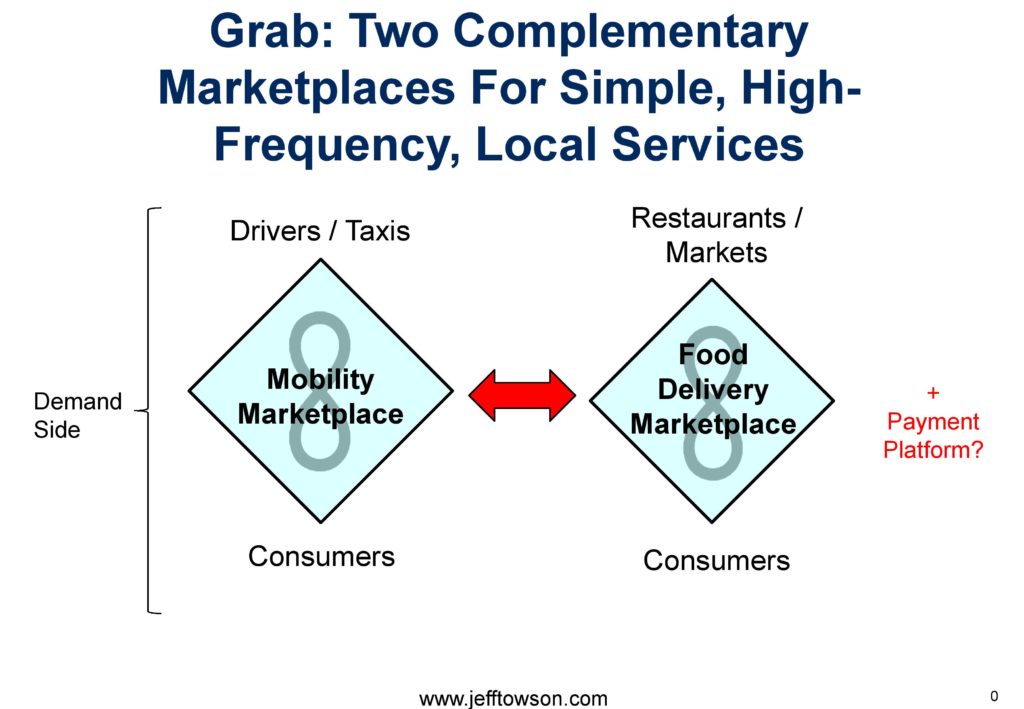

Jeffrey Towson 20:00

places one for food delivery and Mark buying food and one for mobility services. So two complementary marketplace, business models, same picture, consumers love them very popular, lots and lots of growth, very unprofitable.

Jeffrey Towson 20:33

for fourth quarter, first half of 2022, their gross profit was about 25%. And their operating margin negative. So very similar numbers, actually, to dingdong. So we kind of see the same picture over and over. I don’t know what Zed deliveries numbers look like, because they’re not public. And they’re really just starting out. They’re only your tool. But we see the same pattern.

Jeffrey Towson 20:58

And that’s kind of what I want to talk about today. For this, this idea of local services as an E commerce business model. We see the same picture over and over and over. And so it raises the question, can they become profitable? Well, ding dong just hit profitability a couple of weeks ago, grab, which I wrote quite a lot about, for those of you who are subscribers, I wrote you for in depth articles, I’ll put the links in the show notes about grabs economics about two months ago. I mean, it was four articles. I mean, it was a it was pretty deep dive. But they were going for profitability. And they laid out how they were going to get there. And I’ll sort of that’ll be the point today’s grab is on target. They’re heading that way, ding dong already got there. If you look at Matewan, 2018, same thing they got there. So how did these companies get to profitability? Because that’s their big question. Alright, let me start with dingdong and how they got there. Because it’s a much simpler business model. It’s a linear service, pretty narrow sort of product category, things like that. Basically, if you pull their numbers for the fourth quarter of 2022, a couple of numbers jump out at you. The first is their gross profit, which I’d kind of said was 20%. That that increased to 28%. By the end of 2021, more or less fourth quarter only. But in the fourth quarter of 2022, their gross profit was 33% of revenue. So they really did move that number up. And if you can do that, that’s phenomenal. And the other number I mentioned was the fulfillment cost, I said it was 40%, the fulfillment costs dropped to 24%. And then move down steadily from about 32% At the end of 2022. But that’s way down from the 40%. And the other number, and those are really the two big cost numbers. The other number they moved was their sales and marketing expense, which used to be about, they basically dropped that about 75%. So they slashed their marketing spend. But that number was not that big to begin with. So it was really the first two that moved it more than anything. And okay, that’s cool. But there was another number that moved, which was their revenue growth slowed. Their revenue growth in the fourth quarter of 2022 was 13%. These are year over year numbers. So comparing to 20 21/4 quarter.

Jeffrey Towson 23:33

And that was about $900 million for the fourth quarter. So you’re talking about 2.7 $2.8 billion in revenue for the year. But clearly, that is no longer the rapid growth strategy that they had been talking about. So it’s sort of like the growth slowed, but they expanded the margin for gross profit and they they knocked down their fulfillment costs. That was most of how they got there. And they more or less just broke even with operating products profits for the end. Okay. How did they do it? Well, here’s what they say in their numbers. Their cost of goods sold, which is what determines their gross profit. They said they decreased it quote, primarily due to improvements in product development capabilities, unquote. That’s from their their 10 Q. Now, what does that mean primarily due to improvements in product development capabilities? That’s a really interesting phrase. The other thing they said. They said, quote, We will deepen our penetration into existing markets, and continuously tap into our users need to achieve profitability. That’s interesting. Let me read that again. Quote, we will deepen our penetration in to existing markets, that sounds a lot like geographic density. Quote, we will emphasize innovation, particularly in food products to develop and launch new food products catering to a broader range of users, unquote. So they’re pointing to sort of two things. They’re saying we’re going to focus on our product development capabilities. And we’re going to deepen our relationships with users in certain geographic markets. Okay, that’s how they talk about it, here’s how I would talk about it. I think they did three things. They launched private label food kits. For their current customer base, they basically said, Look, we’re not going for growth, with our current product mix in our current business model, this is me speaking here, we’re going to shift away from fresh groceries, that we have to move through this complicated supply chain, we are going to produce our own food kits ready to eat meals. That’s the product development spending, they’re talking about under our own private labor, and we’re going to sell those to our existing customers. That’s how you move the gross profit number. Instead of buying durians out of Thailand and avocados out of Mexico, we’re going to have our own production facilities and make our own food and sell it directly. That’s how you move the cost of goods sold. And we’re going to focus on our existing customer base, not spreading our current business model, which is not that profitable, across more and more cities. The other thing they did, they went for depth in a few cities. And it looks like they have abandoned the growth focus. So that’s deepening their geographic density and a couple places. For 2022, as far as I can tell, about 45% of their GMV is in Shanghai, they closed, they pulled out of a lot of small cities where they didn’t have density. And it looks like there’s basically focusing on those markets. So we’re going to sell more in a couple cities to our existing customers. And we’re going to go for geographic density there. Bam. Okay, which is exactly what grab and Matewan talk about, by the way, I’ll give you an example of that. And then the third thing they did, I think they went for engagement and retention of their core users. That’s the language they use to talk about. We want to end this as a quote, We will emphasize innovation, particularly in food products, to develop and launch new food products to a broader range of users. I think they’re, they’re studying the data coming back from their current users who are engaging, and selling those people more stuff. Because what they begin with, what they did have, was they had a lot of adoption, because it turns out, they actually had a pretty hot product, which is people like fresh groceries, but it just wasn’t profitable. So they’re going to start to sell other things to those people. That’s the innovation and product development capabilities they’re talking about. I think that’s most of what’s going on. And that is a pretty big shift in strategy. And if you look at how they describe themselves now, their standard biography, you know, every company has like a one paragraph biography. So if you look up about dingdong you know, we are a leading fresh grocery ecommerce company in China, blah, blah, blah, blah, blah, we provide users and households with fresh produce prepared food and other food products. They’ve added that prepared food language. Through a convenient and excellent shopping experience. That’s the app supported by an extensive self operated frontline fulfillment grid. That’s their traditional model. Here’s what they’ve added, leveraging our deep insights into consumers evolving needs. Up up above, we have successfully launched a series of private label products spanning a variety of food categories. Many of our private label products are produced at our dingdong production plants. That’s all new. So they basically shifted their product mix and they went from being a specialized distribution channel with an app to more of a production company. Okay. I think I’ve sort of explained that over and over, but yeah, that’s how they got there. Now let me shift gears to grab because I think it’s an interesting contrast grab is not there in terms of profitability yet there’s still there’s a lot of growth focused. Still with grab but the playbook is an interesting contrast. Okay, for those of you aren’t familiar, I’ll give you the 32nd rundown. I mean, grab is the Southeast Asia everything out Right, it is, like in terms of a digital giant in Southeast Asia, it’s gotta be, it’s in the top three brand names, right Lazada, grab shopping, there’s only a couple eight. So I mean, in that regard, it is a b2c winner. And they do, you know, they do two categories, they do mobility, and they do food delivery. So you want to ride across town, you want to get a shuttle, you want to get a motorcycle, whatever you go across town, you want to order from a restaurant, you order for a market food delivery, and then they have this store sort of payment and financial services platform, which they’re still kind of developing. So we’re not going to talk about that. But when it comes to the delivery market, right, I’m sorry, the delivery market, which is foodstuff they’ve got about they claim to have 50% of the market for Southeast Asia, they’re their number one or number two in every major economy in the region. And for mobility, they claim to be 70%. So I mean, they are the, they’re winning by every measure, or at least they’re in the top two. And you’ve got two complimentary platforms. That’s the business model. And they’re very well positioned to do you know what Alibaba does, which is, then you start innovating, and offering new services and new products, because you’ve got consumer engagement, you’ve got the data, you’re very well positioned. And the reason they’re in these two categories is those are the very high frequency services people use. Okay? Now, if you look at their annual report, which I would encourage you to read, because it’s a very well written, it’s a really the language is good how they think about, it’s great. There are really two things that jump out about what they’re doing, in my opinion. Number one, they’re going for geographic density, and other quote, tech driven cost efficiencies. So that kind of point I made earlier, they’re going for geographic density in the markets where they live, more customers more orders within specific geographies. And they’re capturing various types of tech driven cost efficiencies. That’s the using machine learning and other things to reroute drivers, and to package good togethers and do batching and all of that, and I’ll give you how they think about it. The second thing they’re doing is they’re going through growth tactics and other sort of strategic moves to move the revenue line. Those two things together, I think, is how they’re planning to get to operating profits. So let me give you the first one. Now, geographic density. Sorry, that’s my thing. Here’s how I define it. This is my standard quote, geographic density is a competitive advantage that results from having greater customers volume nodes, and or routes within a geographic area than a competitor. For a distribution business, this should show up in a couple of numbers, lower costs, greater coverage, faster distribution times, we got to see it in those numbers, relative to a smaller rival, or you don’t have it. Okay, if you look at the grab September 2022, investor presentation,

Jeffrey Towson 33:25

they talk about this and the phrase they use is improving partner driver productivity, unquote. So their slides are like top of the slide, improving driver partner productivity and driver partners, just the dudes on scooters, the car drivers, all those drivers. But they’re going to increase their productivity. How are they doing that? Here’s what they list, unique geo capabilities batching just in time allocations. They’re basically trying to make their drivers much more efficient. And those are all tech driven efficiencies, unique geo capabilities. That’s the GPS that’s tracking every driver that’s managing all of your drivers as a fleet in real time where you’re telling drivers you should go north to blocks and wait there, because we anticipate there’s going to be an order coming from there based on our prediction. Right, they’re telling the drivers where they should all be 15 minutes before they should be there. Based on prediction batching that’s when they tell our driver don’t just go to restaurant a and then deliver it and look for your next order. We want you to go to restaurant a pick that one up, we want you to go to restaurant be on the way which is nearby, pick up the other order which will just be ready and then go and we want you to take this route on this street and then drop off a customer and customer base. So they’re doing this sort of thing. Combining of orders, that’s batching. And then they do just in time allocations where they’re, you know, they’re telling riders a couple minutes before where they should be. Now, the other thing they’re doing is they’re trying to get more loyalty from their drivers, because there’s a lot of churn with drivers, because drivers come on, they sign up, they onboard, and then they all leave. But a certain percentage are very, very good. Here’s what they say, quote, driving efficiencies with back end innovations that shave off time and drive productivities in the delivery funnel? What does that mean? They basically break down every step within the driver process. So there’s food time prep, when is the order ready? When did they allocate it to a driver, that’s just in time, they reduced the wait time where the driver is at the merchant waiting to pick up the order, then they batch the pickups and they batch the drop offs across food markets parcels, and then they have sort of the optimize the route to get to the ultimate user. And they basically track minutes safe. So they claim that they have saved 12 minute, million minutes, or whatever. So they’re breaking all that down. And they’re, you know, they’re going for the drivers have shorter stops when they pick up, they’re carrying larger batches. And overall, you get better productivity from your drivers. So that’s, you know, if you want to look at a great example of going for geographic density with tech driven efficiencies, grab is a great model, because they really talk about in detail. And then they’re making major investments in this area, like high definition matching, mapping and Knapik. Navigation, just in time allocation systems, real world signals to their drivers. So they’re making major investments to keep moving that forward, which their smaller rivals will not be able to match their spending and things like machine learning. So that’s kind of the model. Here’s what they said for September, they said they’ve seen a 22% reduction in driver wait time at merchants, they’ve got a 19% increase in their batch rate. And they’re doing 11% more trips per transit hour for their drivers. So they’ve got really good metrics for all of this stuff. It’s really pretty cool, actually. Now the other one, I’m not really going to talk about their growth strategies. But really, what they’re doing is they’re trying to sort of increase the revenue, the same way that ding dong increased their revenue by shifting their product mix away from groceries, to ready to eat meal kits, but it’s the same basic idea, you know, we’re gonna squeeze every nickel out of the delivery, the fulfillment costs at the same time, we’re going to try and you know, sell more to our customers and sell more profitable stuff. So pretty much the same strategy, just a lot more complicated ad grab. Okay, that’s most of what I wanted to talk about. But it’s an incredibly important aspect of Digital Strategy in these business models, is understanding these local service components. I mean, this is really about operations, right? If we talk about e commerce for products, Taobao, Amazon, we’re talking about a lot of digital stuff. But the operational aspect is warehouses. This is a much different operational model where we’ve got people zooming all over town, and the capabilities you have to build are different. And the competitive advantages you build are also different. We don’t talk about geographic density. For standard ecommerce of products. We talk about other things. So it’s a really interesting space. It’s important question. Let me make one last point. And then I think that’ll be it for today, which is every example I just gave you wasn’t in a developing economy. I didn’t talk about Uber Eats in suburban California. I didn’t talk about DoorDash. I didn’t talk about whatever webbed van. It’s not clear that those companies can get to profitability at all. If I’m talking about Sao Paulo, Manila, Shanghai, what they all have in common, especially the ones in Asia, is you have a massive population in incredibly large and incredibly dense urban centers. We’re not, we’re not talking about suburbs. Right. You know, 40 50% of the human race, lives within four to five hours. is really kind of Thailand. I mean, you bring in India, China to the north, and then most of Southeast Asia, like Indonesia, that gets you about half the human race. Right? So you got all these people, Asian cities in particular are big, you know, 20 million, 10 million 15 million. That is very different than St. Louis, you know, 1 million person City, 2 million versus in China, Purdue and all that, you know, cities are all 5 million, 6 million. And they’re very, very dense. So all of this stuff, the geographic density argument is a lot easier when you’ve got these super dense cities. It’s very hard to do any of this. That’s sort of factor number one. And we said the same thing somewhere like Sao Paulo, very dense city, Mexico City, very dense, Istanbul, very dense. But the other thing these cities have is they have very low labor costs. You have a GDP per capita $5,000 $8,000 $10,000 $12,000. You know, you move to the US and GDP per capita is $50,000. It’s very, that those delivery costs are a real problem. You know, until they can get autonomous robots doing the delivery, it’s very hard to get around that. But it works. Well. I mean, if you’re in Bangkok, if you’re in Shanghai, you mean, there are delivery people everywhere you look on on any street, there’s just armies of dudes on scooters and cars everywhere. You don’t see that. In New York City, you really don’t, you’ll see a couple, but you won’t see that many. You can’t make it work, the labor costs are a problem. That’s one of the reasons like local services in E commerce, the developing world is really exciting. You know, everyone talks about the fact that if you put a smartphone in everyone’s hand in China, which is what’s happened since 2011, you have a tremendous consumer base, you can now connect to and reach whether it’s marketing, sales, content, whatever. Everyone talks about that. What they don’t talk about is once you put a smartphone in everyone’s hand in China, you have a tremendous supply of people that can start providing services. Every hairdresser, every nail salon tech, every babysitter, every person with a car, or a scooter can now jump on and start being the supply side of services, e commerce. So there are millions of people in every city in China, or Sao Paulo, that can start doing deliveries and come to your house. And, you know, all of these services, you know, 2030 different types of services we see you can sort of activate the producer side of the digital marketplace, not just the consumer side.

Jeffrey Towson 43:06

And there’s a lot you can do you mean, India, Delhi, you want someone to cook you dinner, cook your dessert, they’ll come to your house and do it, they’ve got a smartphone, and it economically make sense for them. If you walk around these neighborhoods, Jakarta, Bangkok, every street is filled with people making bubble tea, and cooking doughnuts or making stir fry on a motorcycle. Because the GDP per capita makes it profitable for them to do that, well, all of those people now have smartphones, and can start to sell their services online. So that whole side of it, the digital producer side of these countries is super exciting. It’s it’s one of the reasons life in the developing economies, which is where I live. It’s so much better, I can get so many more services every single day on my phone. I mean, then I could ever get in New York or San Francisco. I mean, it’s really better. It’s pretty spectacular, actually. Anyways, that’s something to keep in mind that everything I just said about geographic density and getting to profitability. That may not work in London. And it may not work in New York, and it definitely will probably not work in Bath. And you know, Cambridge and wherever it’s the density is not even near close enough to make those things work. You don’t have the density and you don’t have the labor costs. So anyways, it’s a fun subject is pretty that’s why I study companies like grab and GoJek and because they live in these different markets, and it’s pretty innovative. Okay, that is most that’s pretty much what I wanted to talk about for today. So I told you it was going to be micro that was deep into the micro world, which is I liked that stuff more. But yeah, the main takeaway For today, geographic density is a type of economies of scale competitive advantage, super important. And then companies that are worth taking your time to look at, grab, definitely look at their investor presentations. Ding dong is pretty good. It’s worth looking at. It’s much simpler, you can go through pretty quick. And then we’ll see how Zed delivery does with another sort of specialty delivery model. But for beverages and not groceries. I’m hoping they’ll they’ll put some numbers out at some point. We’ll see that is it for the content for today. As for me, it’s been it’s been a good week, just working away, things are really moving in Asia again, which is great. Lots of flights, lots of trip to China been planned in the last couple of weeks, which is good. What else? I’ve been watching videos about Canada’s history, because I’m technically Canadian, as of 12 months ago, but I’m not really Canadian. And I’m a citizen now. But I don’t really know much about the country. So any Canadian would not consider me though. Technically, yes. In reality, no. But I’ve been watching all these YouTube videos trying to learn more about I don’t know, I didn’t know half of this stuff. I didn’t know there was a war over beaver pelts. The Hudson Bay Company and all these, you know, 5200 200 200 years of wars over traders. And it’s fascinating. It’s super interesting. I still don’t know very much, but I know a lot more than a week ago. The only the only thing like I had an opinion on was like, a couple years ago, Donald Trump when he was president, he made this thing that we the US should buy Greenland, which was everyone thought it was crazy. But they were making fun of him of everything. Right. But I actually thought it was a really good idea. I’m like, why don’t we make them a deal? Like we should? Yeah, we should go from okay. I think that was a mistake that he should have gone for Alberta. Like, that’s when I know, like, if you’re gonna go for a piece of geography up north, like pitch a deal to them should have gone for Alberta. I mean, it is like, you know, the Texas of Canada, there’s resources everywhere, there’s young population, there’s did he should have made them a pitch like, you know, you could come in as a state, which they probably don’t want to be, you could come in like Puerto Rico, like, you know, you’re kind of a state but not really a state, you know, whatever you want. Like we should have gotten them into the country somehow. Although that was that’s kind of me thinking like an American. Maybe. Maybe I need to think about it from the Canadian point of view now. Yeah. So that was my only real takeaway was sui should account for Alberta. That places amazing. Anyways, that’s what I’ve been learning this week. Apparently, I kind of blew it. Apparently, when you become a citizen. One of the little perks they give you is you can go to any museum in Canada free for like a year. But I think that window just closed for me. So I had a whole year of like, free museums around Canada. I could have gone in and yeah, I think I missed it. Oh, well. Anyways, that’s been my week. The Beaver wars were really interesting. It’s kind of great. Anyways, that’s it for me. I hope everyone is doing well. Come out to Asia, come out to China. If you’re interested. Things are popping here again. It’s absolutely fantastic. It’s gonna be a fun year. Anyways, that’s it. I’ll talk to you next week. Bye bye.

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.