In Part 1, I laid out some of the challenges of doing ecommerce in groceries. And two innovative business models that attempted to make it work. One by Alibaba Freshippo and one by Dingdong. Both very interesting. Both, especially Dingdong, being unprofitable.

In the past month, both companies have announced operating profits. That was really surprising. In this article, I’ll lay out how they did it. First, let’s start with Freshippo.

As mentioned, I’ve always thought Alibaba could make the Freshippo business profitable. Mostly because it is not a standalone business. It is part of the Alibaba ecosystem and it’s just a matter of shifting the profits within their ecosystem. They could make Freshippo a profit center or infrastructure for their platform businesses. They could open tons of big physical locations and use them as marketing sites that attract traffic and grow the ecosystem. Or they could open a few smaller locations that are focused on maximizing profits. Freshippo chief executive Hou Yi explained their announced 2022 operating profits as a result of:

- Continued growth in stores (Hema Xiansheng and Hema X) by “double digits”. So, they’re opening lots of stores and building a nationwide footprint.

- An increase in Freshippo-owned brands. For 2022, 35% of items sold were Freshippo brands. Management says this is going to increase to 50%. According to CEO Hou, this is their key to differentiation. I think it is a good way to increase their overall gross profits.

They have also launched discount outlets (called Hema Outlets) and membership stores (called Hema X).

So, this seems pretty straight forward. They are continuing to grow in retail number and formats. And they are pushing private label and owned products, which increases their gross profits.

The more interesting announcement came from Dingdong.

Significant Improvements in Dingdong’s Financials

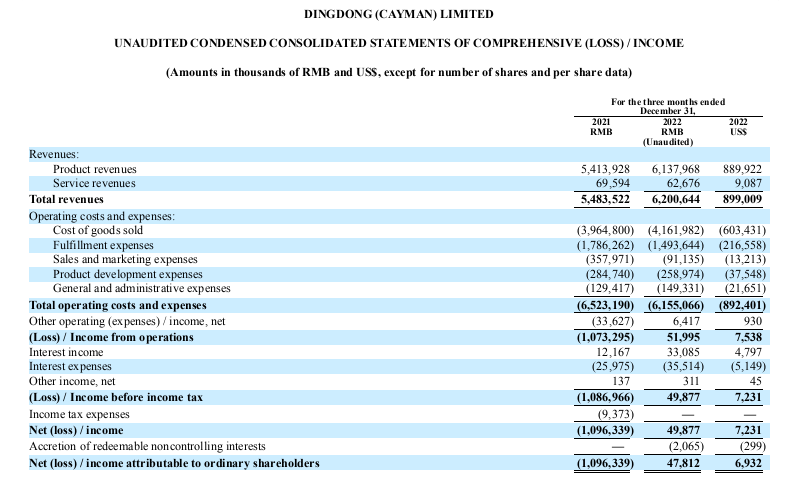

Dingdong is public so we can see their numbers. Here are the 2022 Q4 financials.

Note the following:

- Gross Profit in Q4 2022 increased to 33% of total revenue. That was up from 28% in Q4 of 2021. And far above 20% in 2020. That’s just great progress in reducing the relative COGS.

- Fulfilment costs dropped to 24% of total revenue. This was down from 32% in 2021 Q4. And way down from the 40% of revenue in 2020. This was likely due to an increase in the average order value and improved efficiency in frontline labor.

- Sales and marketing expense dropped by 74% to $13M. That’s big.

- Product development expense decreased 9% to $37M.

So, the key takeaway is the two troubling numbers from 2020 (GP at 20% and fulfilment expense at 40%) had both moved significantly.

However…

- Revenue growth was slow. Total revenues for 4Q increased 13% to $899M. That is a significant change from management big focus on growth in 2019 and 2020. The scalability of the business model was a big part of the story at IPO. Note how “Rapid Growth” was the center of their strategy graphic.

Looking at revenue in Q4 2022, we can see:

- Product revenues increased to $890M. Management says this is primarily by increasing average order value.

- Service revenues are only $10M, which are from the membership program.

- Overall, fourth quarter GMV only increased 12.7% to $981M. And this is in spite of increasing deliveries during China’s lockdowns.

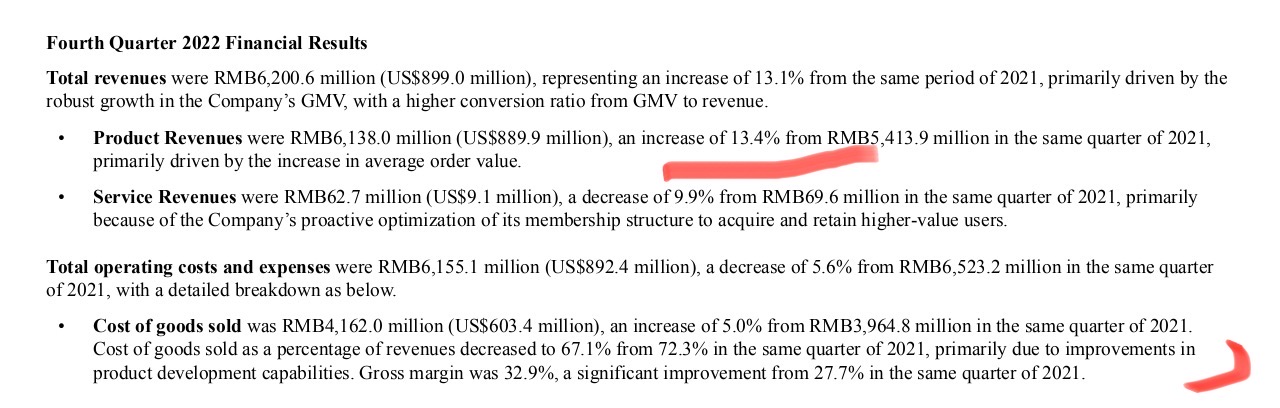

For the decrease in COGS and the increase in gross profit (from Q4 10-Q), management cited “improvements in product development capabilities”.

That’s really interesting. They were not talking about this much at all a year ago. Note the highlighted section.

That means they are shifting their product mix from being just a specialized delivery channel for groceries and perishable goods. They are now actively developing products in-house, instead of being a distribution channel for suppliers of groceries.

Management also said they are deepening their “penetration into existing markets”.

That is also somewhat different than past comments. The focus is clearly on going deeper into existing markets. Also, note the phrase “continuously tap into our users’ needs”.

So, what really happened?

How Dingdong Reached Profitability

Basically, I think management did three significant things:

1.They launched private label food kits for the captured customer base.

Dingdong launched ready-to-eat meals under their own brand. This business was set up in February 2022 and is now listed as one of their primary business units. This is a departure from their focus on ecommerce groceries and has changed the economics of their business. It means higher gross profits and less reliance on perishable goods. But it also means in-house food production. Not just distribution and delivery.

Management says they are planning for $700M in sales in 2023 in ready-to-eat meals under own brand. They also now cite this product type in their public company bio.

This is what they meant by “improvements in product development capabilities”. They are producing the meals themselves. And this is also about continuously tapping into users’ needs (which they mention). It’s about innovating against their significant user engagement. Basically, they captured a lot of users with their popular but somewhat unprofitable fresh groceries service. Now they are leveraging those relationships into more profitable products.

This is one of my standard rules for digital business.

2. They went for depth in a few cities and abandoned rapid geographic growth.

Shanghai is now +45% of their GMV. And they pulled out of a lot of small cities. It looks like they have abandoned the scalable growth strategy that the CEO talked about in the IPO. They are going for geographic density in a couple of markets, which lowers their fulfilment costs. It can also be a competitive advantage and is the same thing that Grab and Meituan talk about.

- Lessons from Grab in Geographic Density and Other Tech Enabled Cost Efficiencies (3 of 4)(Tech Strategy – Daily Article)

- Geographic Density and How Meituan Finally Became Profitable (Tech Strategy – Daily Article)

3. They went for engagement and retention in their core users.

The Dingdong CEO is talking a lot about expanding on current customer needs. They are focusing on innovating on the users that their on-demand, high frequency grocery business captured. Within this, they have clearly found one winner, which is ready to eat kits. I expect them to do more exploring here and launch new products and services. I put these under the category of margin products.

But they also have a membership program, which you can see as services revenue. This doesn’t you margins, but it is a strong mechanism for user retention. And it lets management decrease marketing spend. I call this an engagement or retention product.

***

That looks like most of their play. And you have to give management credit. They are changing the business model they outlined in their prospectus. And it is working. We can see it impacting the numbers in under one year.

Final Question: What’s Next for Dingdong?

I’ve written about specialty ecommerce competing against the ecommerce giants. Where can they survive? Where can they thrive? Where are they going to get crushed?

And one of the five factors I look for whether the specialty ecommerce company is avoiding what the big boys really want. You just don’t want to be in the strategic pathway of Alibaba or Amazon. And unfortunately, groceries is a strategic priority for both of them, especially Alibaba. It’s not so much for Meituan and JD, both of whom have lost lots of money in this space.

So my main question for Dingdong is now whether Changlin Liang is another Wang Xing.

Meituan CEO Wang Xing is famous for his scrappy ability to jump across various products and services. He reminds me of the guy selling on the street corner who is suddenly selling umbrellas five minutes after it starts raining. Given that Dingdong is in the strategic path of Alibaba, my question is whether Changlin can take his current users and engagement (which are substantial) and jump to other products and services. That’s what Wang Xing would do. And that’s what Changlin did in 2022 and got him to operating profitability. We’ll see what he does in 2023. But this company is a lot more interesting than it was a year ago.

***

That’s it. This is really interesting stuff. We’re seeing a lot of action in on-demand delivery services going for operating profitability (Grab, Ze Delivery, Uber, Didi, Dingdong, etc.). And most of them are using a similar playbook.

Cheers, Jeff

—–

Related articles:

- How Alibaba Freshippo and Dingdong Got to Profitability in Ecommerce Groceries (1 of 2) (Tech Strategy – Daily Article)

- Dingdong vs. Oriental Trading: How to Spot the Specialty Ecommerce Winners (1 of 2) (Asia Tech Strategy – Daily Lesson / Update)

- Can Dingdong Win in Groceries and Specialty Ecommerce? (Asia Tech Strategy – Podcast 90)

- How AB InBev and Zé Delivery Are Changing Ecommerce in Beverages (Tech Strategy – Podcast 139)

From the Concept Library, concepts for this article are:

- Specialty Ecommerce

- Geographic Density

- Grocery

- Retail

From the Company Library, companies for this article are:

- Dingdong

- Alibaba Freshippo

———

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.