I wrote about Alibaba’s 11 growth strategies in the fall of 2020. At their investors day, management laid them out in pretty good detail. You can see my write-up at:

This is my update to that article.

***

Basically, Alibaba’s main strategy remains the same. From their most recent investor day announcement:

“During the past fiscal year, we made significant progress on our three key strategies, namely domestic consumption, globalization and cloud computing.” – CEO Daniel Zhang

And the 2020 financials were great.

- “Net cash provided by operating activities was RMB 231,786 million (US$35,378 million), an increase of 28% compared to RMB180,607 million in the fiscal year 2020.”

But the growth strategies fall into two categories:

- Big growth engines

- Potential growth engines

So the question is have these changed in light of the government issues of 2021?

***

Big Growth Engine 1: Domestic Retail Commerce Keeps Chugging Along

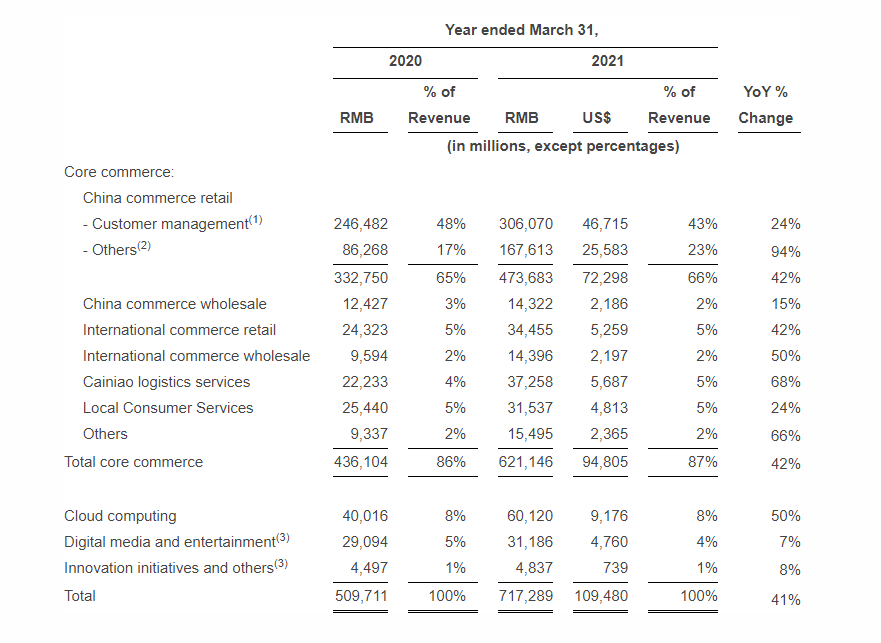

Alibaba’s retail (i.e., B2C) China ecommerce business just keeps growing. Revenue for 2021 was RMB 246.5B, under the heading of “customer management”. It’s an all-purpose term for the marketing, transaction and other fees taken on marketplace activity. And it was up 24% from 2020.

That’s the big engine of Alibaba. Everything else follows from this. And it’s pretty nice when your primary business is massive, rapidly growing, highly defended and really profitable.

Management did comment on their domestic ecommerce priorities this year – and it was basically marketplace platform strategy 101:

- Increase sales.

- “Online physical goods GMV. Excluding unpaid orders, grew 21% year-over-year in fiscal year 2021, driven primarily by the fast-moving-consumer-goods (FMCG) and home furnishing categories.”

- Increase users and engagement.

- For consumers, this included “growing an increasingly diverse consumer base at various income levels as well as presenting different purchase use cases for the same consumer.”

- For merchants, this included “offering rich, highly relevant and curated content and features that enable merchants to engage with consumers through live-streaming, short-form videos, interactive games and microblogs…Taobao Live GMV reached over RMB500 billion (US$76.3 billion) in fiscal year 2021.”

Management also specifically cited:

Focusing on “value for money to expand user base”

Like everyone in consumer China, Alibaba is going after “less developed cities and towns”. Which means selling at lower prices for lower income and more frugal demographics.

Creating more “diverse experiences for existing user base”

Management said “the longer a consumer has shopped on our platforms, the more they spend through more orders across more product categories. In fiscal year 2021, average annual spending per consumer on our China retail marketplaces reached over RMB9,200 (US$1,404).”

Increasing product supply

Management is “increasing the range of branded and imported products, going upstream to directly source agricultural products and expanding the breadth of selection of value-for-money and long-tail products.”

***

Ok. That’s all good. Solid marketplace strategy. But nothing new.

Big Growth Engine 2: Cloud Is Spinning Up

This is where things get interesting. This is clearly the next really big thing for Alibaba. They have a lot of growth initiatives but this one is potentially massive. If ecommerce is the King, cloud is the uncrowned prince of Alibaba.

And in 2021, Alibaba Cloud had RMB 61B in revenue. This was up 50% from 2020. You can see how this stands out against their other businesses.

According to management, “Alibaba Group was ranked third globally and first in the Asia Pacific region in the global Infrastructure-as-a-Service market.”

And Daniel Zhang used the word “massive potential” to describe this business. You don’t usually hear the word “massive” in finance.

“I am very excited about the massive potential of our cloud computing business, as the post-pandemic world is facing a massive opportunity for industrial digitization. Cloud infrastructure will eventually replace IT infrastructure, empowering enterprises to achieve digital operations.”

In Podcast 82, I described Alibaba as an “infrastructure plus product” company. Their cloud, logistics, and new retail capabilities serve as “commerce infrastructure” in China. And this enables them to launch product after product as the market needs change. Most of their profits have traditionally come from products (e.g., Taobao) and their infrastructure creates competitive barriers and others strengths. However, Cloud appears to be both infrastructure and product. So it is kind of muddying my framework for this.

Cloud is a big subject. Which I wrote about here.

But management did point to two products for cloud: industrial internet and direct-to-consumer.

“As China’s industrial sector undergoes this digital transformation, manufacturers are moving toward smart manufacturing and direct-to-consumer initiatives while other traditional industries, such as retail, energy, finance and transportation, have all noticed the tremendous value and new opportunities that big data and intelligent applications could create.”

That is an interesting focus.

Whenever I am asked about how digital China is different than the West, I always point to the massive consumer base (enabling scale and specialization) and China’s manufacturing base. Alibaba’s two cloud initiatives appear to be targeting both of these.

***

Ok. Those are the big engines. Let me move on to the potential growth engines.

Potential Growth Engine 1: Cainiao Is Intriguing But Unclear

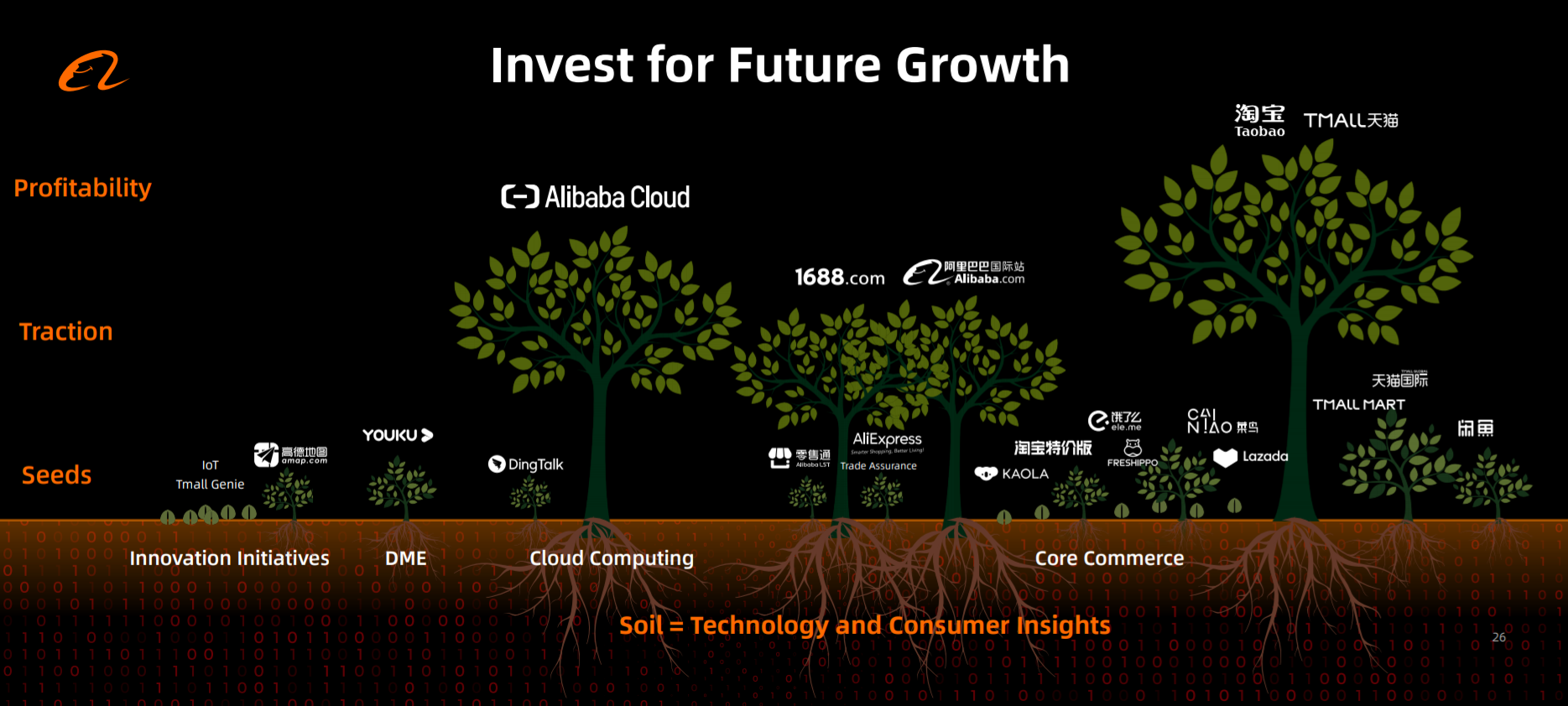

In 2020, Alibaba presented this slide on their various initiatives:

Cloud and retail ecommerce were the big trees. But Cainiao was still kind of a shrub.

However, it is growing fast.

- “Cainiao Network achieved solid revenue growth of 68% year-over-year, to RMB 37,258 million (US$5,687 million), representing 5% of our total revenue.”

- “Cainiao Network also reached an important milestone of generating positive operating cash flow during fiscal year 2021.”

We also have JD Logistics financials now. And the comparison with Cainiao is interesting.

- JD Logistics reported RMB 49.9B in revenue in 2019, with 31% annual growth.

So both smart logistics giants are moving along solidly. However, keep in mind, a lot of this is inter-party transactions. So it’s a bit muddy. Cainiao says +70% of revenue was from Alibaba. JD Logistics said about 50% was from JD (2019).

The business strategies are also a bit different.

- For Cainiao, “growth will be driven by three important engines: 1) first-mile business based on Cainiao Post and Cainiao Guoguo, 2) fulfillment services from factory to consumers, and 3) cross-border supply chain services for importing and exporting merchants.”

- For JD Logistics, they are offering integrated services for specific industry sectors (FMCG, apparel, furniture, cold chain, etc.). These are detailed here.

In both cases, this is a blue ocean situation. The competitive defenses of big smart logistics networks are impressive. But it’s not clear to me how big and/or proven these markets really are.

Potential Growth Engine 2: New Retail Is Infrastructure Plus Lots of Experimentation

Alibaba has long been “asset light”, compared to “asset heavy” JD. It has been a marketplace platform. And even in logistics, it has mostly been a providing of data and connectivity. But with new retail, Alibaba has been building and acquiring lots of physical retail assets. And it now has a significant direct sales capability. New retail is arguably the least scalable part of the company.

Management reported RMB 86.3B in revenue in 2021 for New Retail and Direct Sales. This goes under the title of Other, but includes Tmall supermarkets, Freshippo and Sun Art Retail. Other revenue was up 94% from 2020 (mostly due to acquisition of Sun Art Retail).

In this income statement, this looks quite large. But much of these revenue has the gross profits of a retailer, not a marketplace platform. But it is a change from their traditional approach. And like Cloud, it is a mix of infrastructure and products and services. You can see this in the language.

“New Retail businesses are supported and strengthened by our ecosystem with an expanding supply chain and increasingly diversified fulfilment services…New Retail commerce infrastructure now offers a full range of high-frequency fulfilment services that include on-demand delivery, same-or-next day delivery and next day pick-up services for a full range of consumable and physical products.”

That’s infrastructure. But they also mention New Retail products:

“As part of our latest exploration in New Retail, we started the Community Marketplaces business in select regions in China. supported by our next-day pickup fulfilment services and the supply capabilities of Freshippo, Sun Art and other partners.”

Here’s a summary of what they have built and acquired thus far.

- “…we had 257 self-operated Freshippo stores (compared to 202 stores as of March 31, 2020), primarily located in tier-one and tier-two cities throughout China.”

- “Taoxianda, our online-offline retail integration service solution for FMCG brands and third-party grocery retail partners, …Sun Art’s digitalization of its hypermarkets… As of March 31, 2021, in addition to Sun Art, Taoxianda helped 42 retail chains to open online stores with services available across 145 cities in China and enabled over 168 retail chains, supermarkets and marketplaces to digitalize their marketing program.”

It’s not clear to me what they are building. But Freshippo looks like Direct Sales. And Taoxianda + Sun Art looks like an emerging platform business model.

***

Ok. That’s the update. Some really interesting details. And New Retail and Cainiao are moving faster than I expected.

One final point on a growth engine that seems to be fading away.

Ele.me: He Who Must Not Be Named

There was very little mention of Ele.me. And that’s ok because local consumer services are a big part of domestic ecommerce.

Alibaba reported RMB 25.4B in Revenue in 2021 for Local Consumer Services. And 24% growth. Note: Meituan was RMB 114.8B in total revenue for 2020. And 18% growth.

Alibaba’s comments on Ele.me were vague. To me, they indicated they are focusing on the high frequency of local services for user acquisition and maybe some cross-selling.

“We will continue to invest in Ele.me’s consumer mindshare as the entry point for local services through converting more of consumers in the Alibaba Ecosystem into Ele.me users as well as cross-selling between food delivery and other on-demand services to increase order frequency.”

***

So net net, the core growth engines remain the same. The government is the main source of uncertainty. And that will only be clarified in time.

That’s it. Thanks for reading.

Jeff

———–

Related articles:

- Dissecting Alibaba’s 11 Growth Strategies. From Investor Day 2020 (pt 1 of 2). (Jeff’s Asia Tech Class – Daily Lesson / Update)

- Cloud is the Big Unknown in Alibaba’s Growth (pt 2 of 2). (Jeff’s Asia Tech Class – Daily Lesson / Update)

From the Company Library, companies for this article are:

- Alibaba

Relevant Concepts from Concept Library:

- n/a

———–

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.