This is Part 2 of two articles on Alibaba Investors Day. In Part 1 (Dissecting Alibaba’s 11 Growth Strategies), I wrote about their 5 growth strategies in “Domestic Consumption” (i.e., stuff Chinese consumers spend money on). But CEO Daniel Zhang also outlined 5 growth strategies for Alibaba Cloud. And their cloud business is what everyone has been talking about in the press. Mostly because Alibaba said it would be profitable in 2021.

I’ve argued Alibaba is 100% in the platform building business. That gives them most of their various structural advantages. Although the company is really complicated at this point, so there’s a lot more than this. My simple chart is:

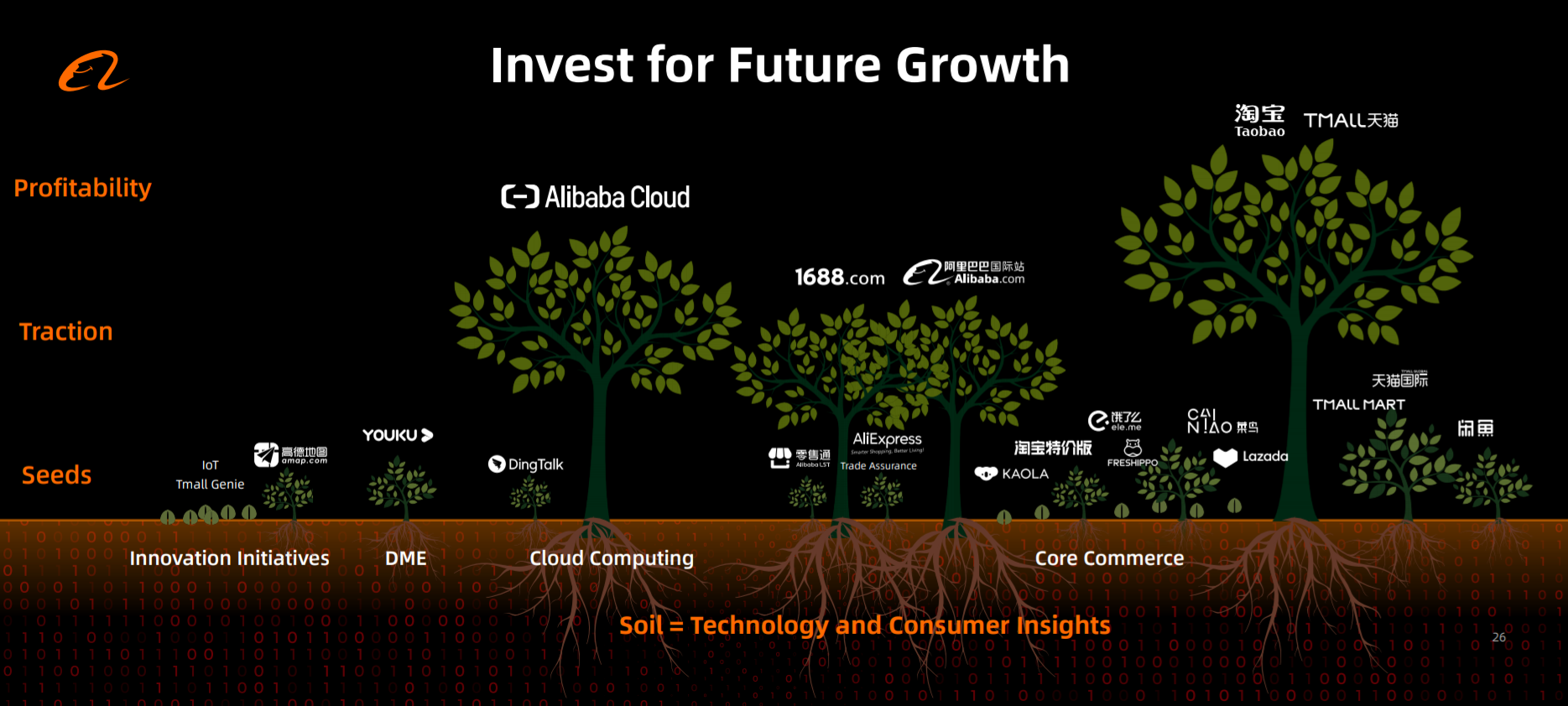

From there, their operating strategy is mostly about sustaining innovation plus rate of learning (the I and L in my SMILE Marathon framework). During the presentations on Investors Day, this is how they presented their businesses and innovation.

Note in the chart, the bottom level is called Seeds. So that’s lots of experimentation and the early stages. Testing for product-market fit. Working out the software. If a project gets going and it starts to scale, they put it in Traction. Again, they are in the digital platform business and getting these platforms to a critical mass of engagement and users is critical (and also difficult). But once they get some traction, the big strengths of platform business models start to show up – especially:

- Network effects.

- Other multi-sided platform advantages like price subsidies and chicken-and-egg.

- Scalability of software products fueled mostly by user effort (and capital).

Growing projects then, sometimes, get to Profitability. And you can see their cash cows at the top. Taobao, Tmall, Alibaba.com and 1688. Ant Financial is another one but is not shown. And from their announcement, this level will also include Alibaba Cloud starting in 2021.

It is really important to note that you can have all the strengths and the competitive dynamics of digital platforms and still not be profitable. As Uber has discovered, competitive dynamics are a requirement but not a guarantee of positive unit economics. Youku and other China video platforms (audience-builder platforms) are also famous for losing lots of money. The costs of content vs. ad revenue just doesn’t work (yet). Platforms that are well known for creating a lot of cash are marketplaces, gaming and payment. Note: Sea Limited in Singapore has three platforms – ecommerce, gaming and payment. The guy doing their strategy knows what he is doing.

What jumps out at me about this Alibaba chart about growth is:

- Most everything listed is a platform business model. Freshippo looks like the only thing that is not. While it is bringing in revenue, it is not obviously scalable. It looks like a more traditional business with lots of digital innovation (so far).

- The big profits are coming from ecommerce (B2C) today – and likely from Ant Group in the future. It is also interesting how they view Alibaba.com and 1688.com (their wholesale business). People don’t pay enough attention to what these B2B businesses are doing.

- Cainiao is probably mis-located on the chart. I think they view logistics as a potential source of profits one day. But more like infrastructure for ecommerce today.

The chart they showed highlights their two big growth plans:

Which brings us to Alibaba Cloud.

Cloud is a Big Unknown. But Alibaba is Positioned to Win Big.

It’s hard to describe what the cloud really is. Because it doesn’t really have an equivalent.

On one level, it is like a new infrastructure for digital. Companies and developers used to build for PCs and on premise servers. That was the main digital space. And that was where the computing power was. But then attention and usage shifted to the web and everyone started building webpages. Computing power was still in PCs and servers but it was the web that was providing connectivity. Then attention shifted to smartphones and everyone started building mobile apps. Connectivity grew dramatically but computing power was somewhat less. So lots of people now argue that the cloud is next computing and connectivity space. It will be the big frontier that everyone builds on.

Ok. That analogy is kind of true. And I like that it highlights that this is about the steady advance of computing power and connectivity. Those are the two things really shaping all this.

But the cloud (distributed computing plus connectivity) is also much more than this. It is making everything smart and connected. And there is long Iist of topics and technologies associated with the cloud. Such as:

- Cloud computing and storage

- Databases and data centers

- Big data and analytics

- AI / Machine learning

- Enterprise grade software

- Consumer software

- Network devices

- IoT devices and it’s operating system

- Cybersecurity

- 5G and other types of connectivity

- Robots and autonomous vehicles.

- Edge computing

There is just a ton of stuff happening in this space. Here is how Alibaba described it:

Yeah. It’s pretty confusing.

And I have only a basic understanding of many of the technologies involved. So if you have expertise in this, try to grin and bear my simplistic explanation.

***

In Podcast 44 (Can Xiaomi or Meitu Win as Platforms / Ecosystems?), I discussed the idea of ecosystems vs. platforms. Platforms are just business models. They are not like traditional firms where you concentrate assets and activity within an organization (mostly). Platform business models enable interactions between users within an ecosystem (by lowering Coasean transaction costs). I think this is a solid definition.

Ecosystems, however, is sort of a catch-all phrase. It can be everything from an industry to a country to a small town. It is a collection of companies, customers and assets that all interact. A rain forest can be an ecosystem So can the automobile supply chain.

Often, ecosystems are about partners working together to create something that could not be done by any individual company. This happens in technology often due to the interoperability requirements of chips, connectivity, software, data and so on. And ecosystem strategy can be a big topic when a major technological shift is happening.

I mostly consider platforms as a simple version of an ecosystem. Yes, it is bigger than a traditional firm. And it reaches out and orchestrates part of an ecosystem. But it is rarely more than 1-2 key interactions being enabled. It is nothing like the complex ecosystems we see in technology, automotive, power and such. But people tend to use the words platform and ecosystem interchangeably. In terms of competition, traditional business competition is like checkers. platform competition is chess and ecosystem competition is 3D chess.

Note how Alibaba describes its “ecosystem partners”:

The cloud (and Alibaba Cloud) look to me like a major effort in ecosystem building. In fact, depending on what the cloud is capable of doing, this may be the biggest most important ecosystem the human race has ever built. So how much of a growth driver will this be for Alibaba?

No idea.

There are so many moving parts and unknowns. It is such a vast undertaking.

- Will all the businesses run on the cloud? Just parts?

- Will the cloud increasingly make decisions and actions?

- Will it run the factories on its own?

- Will it run the trains and airplanes?

- How many industrial robots are going to be powered by the cloud?

- How many IoT devices are going to be in homes, businesses and infrastructure?

There are like 20 major questions I can’t answer at all.

Huawei describes its future network as “ubiquitous connectivity, pervasive intelligence”. I think that is a pretty good description of what is being built. And for Huawei, this includes smart devices, 5G connectivity and intelligent cloud. Alibaba is mostly focused on the cloud aspect.

Here are the solutions Alibaba is talking about.

This is pretty amazing. New retail, finance, public services, manufacturing, transportation and logisticss, media and education. It’s sweeping.

I’m not really sure where this is all going.

What I do understand is that this going to be a game of global scale. There are two smartphone operating systems globally (Android, iOS), not twenty. There are 2-3 PC operating systems, not twenty. I don’t think there are going to be 20 cloud businesses. The competitive dynamics and economics all look to favor scale. So I’m expecting a couple major players and then some specialist plays.

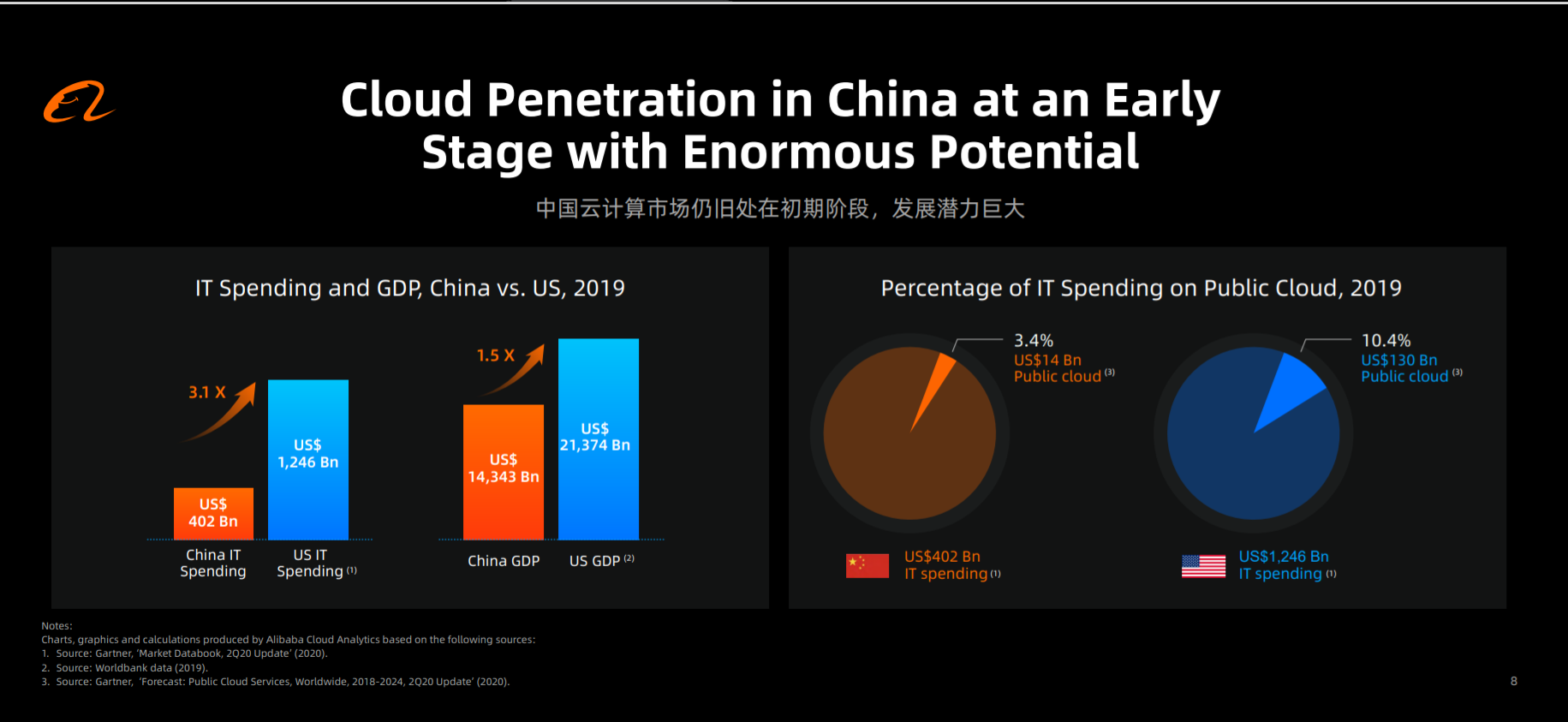

This looks like a global fight between AWS, Microsoft and Google out of the US. And Alibaba, Tencent and Baidu out of China. Alibaba is around 9% of global (#4 after AWS, Microsoft and Google), 26% of Asia (#2 after Amazon) and 45% of China (#1).

But these aren’t meaningful numbers yet. We are looking at the small, early stages of what will be built. And China is a much smaller market than the USA at this point. This is all going to change. What is more important is who is playing to win in cloud. And Alibaba has announced it is spending 200B RMB over the next 3 years on cloud. That kind of spending plus their early lead and capabilities make them a player to watch. They are well positioned to win big in whatever this turns out to be.

And again, they are focused on China and SE Asia.

Keep an Eye on Infrastructure, Platforms and Vertical Solutions

Everyone is building the infrastructure right now. It’s crazy. This is like railroads laying track and phone companies laying copper wire. For infrastructure, I’m keeping an eye on:

- Infrastructure services: Storage. Data centers. Cloud computing.

- Cloud-based services: Database, security, big data.

- Hardware-software integration (chips, servers)

This part is a lot about upfront costs and difficulties. Note: building the first railroad was not just about the cost. It was also the difficulty of getting the land and getting it done. This is sort of similar in that there is a big upfront hurdle. Once Alibaba gets past that, it will then be a lot about fixed costs going forward. So there is a barrier to entry and then lots of operating leverage. In some cases, things are moving quickly, like building out cloud computing and data storage. In other areas, like IoT and edge computing, things are moving slowly. A lot of this depends on adoption rates by governments and business.

As the infrastructure is being built, we are seeing an explosion of digital tools. Lots of new use cases being tried. Lots of new products and services. Sort of like when the iPhone first came out and people started making all types of crazy apps to see what people liked. The two types of services I think are pretty interesting are platform business models (of course) and vertical solutions.

As mentioned, we sometimes see platform business models emerge in industries when they first get digitized. Like how adding GPS to phones enabled platform models in transportation (Uber) and hotels (Airbnb). So we should see some new digital platforms popping up. And the cloud companies will try to take the best of these for themselves, They will let outside developers do the others. This is why Apple and Android both provide their own mapping and messenger services. But neither cares who makes the clock app.

From Alibaba’s discussion, they appear to be mostly focused on DingTalk as an enterprise collaboration platform right now. Recall, collaboration platforms is one my five platform types. DingTalk is actually in the lead in China in this area (mostly because they focused on enterprise messenger after WeChat ran the table on consumer messaging). From enterprise messenger, they will expand to video conferences, collaboration tools, team project tools and so on. Basically it will be similar to what we are seeing in the US with Slack vs. Microsoft Teams. But much simpler versions. WeChat Work, Huawei and ByteDance are also going after these platforms.

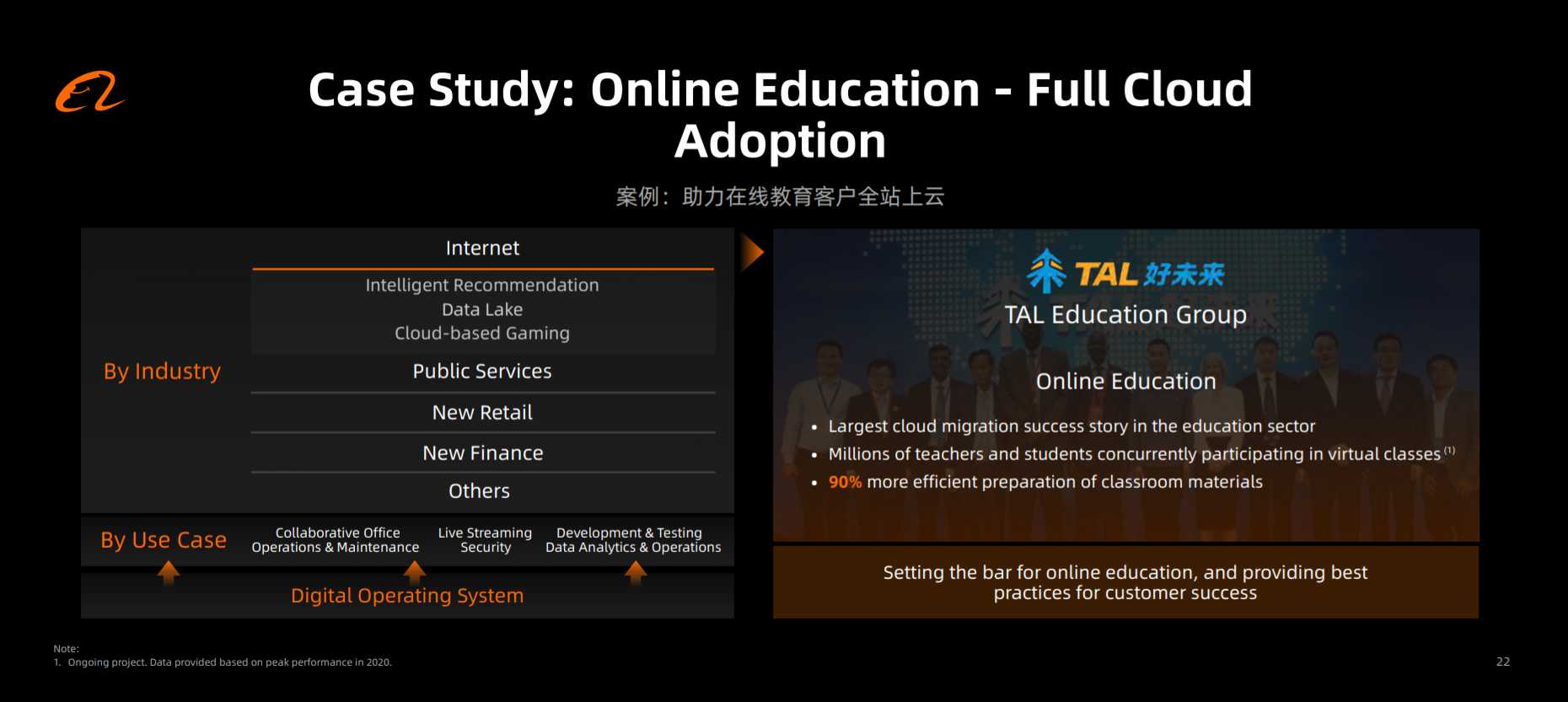

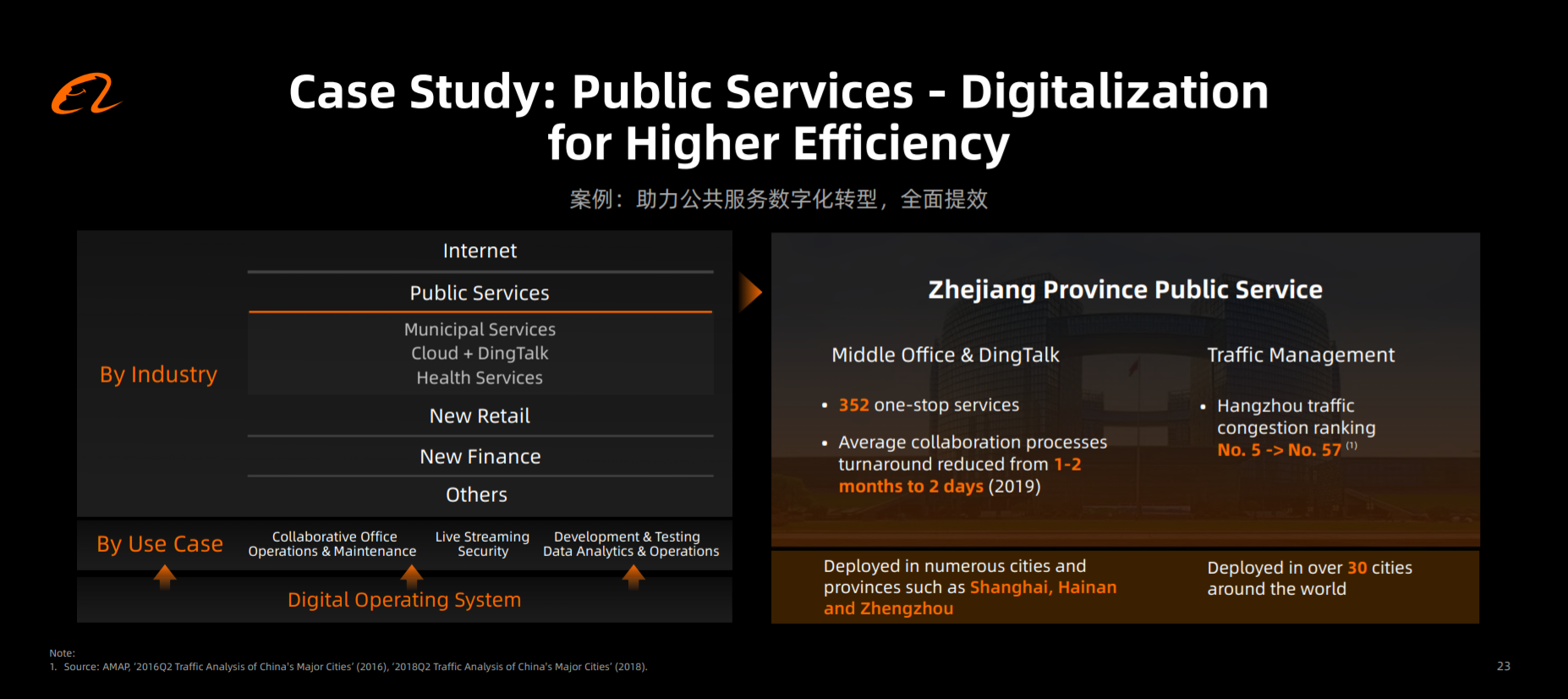

The other area to watch is vertical solutions.

Huawei often talks about how they offer end-to-end solutions that go from device to 5G to cloud. Well, this is just the cloud component of that. There are going to be lots of industry specific solutions. The ones Alibaba cites are the same ones Huawei cites: transportation, education, financial services, and retail. Some of their slides on these.

Dissecting Alibaba’s 5 Growth Strategies for Cloud.

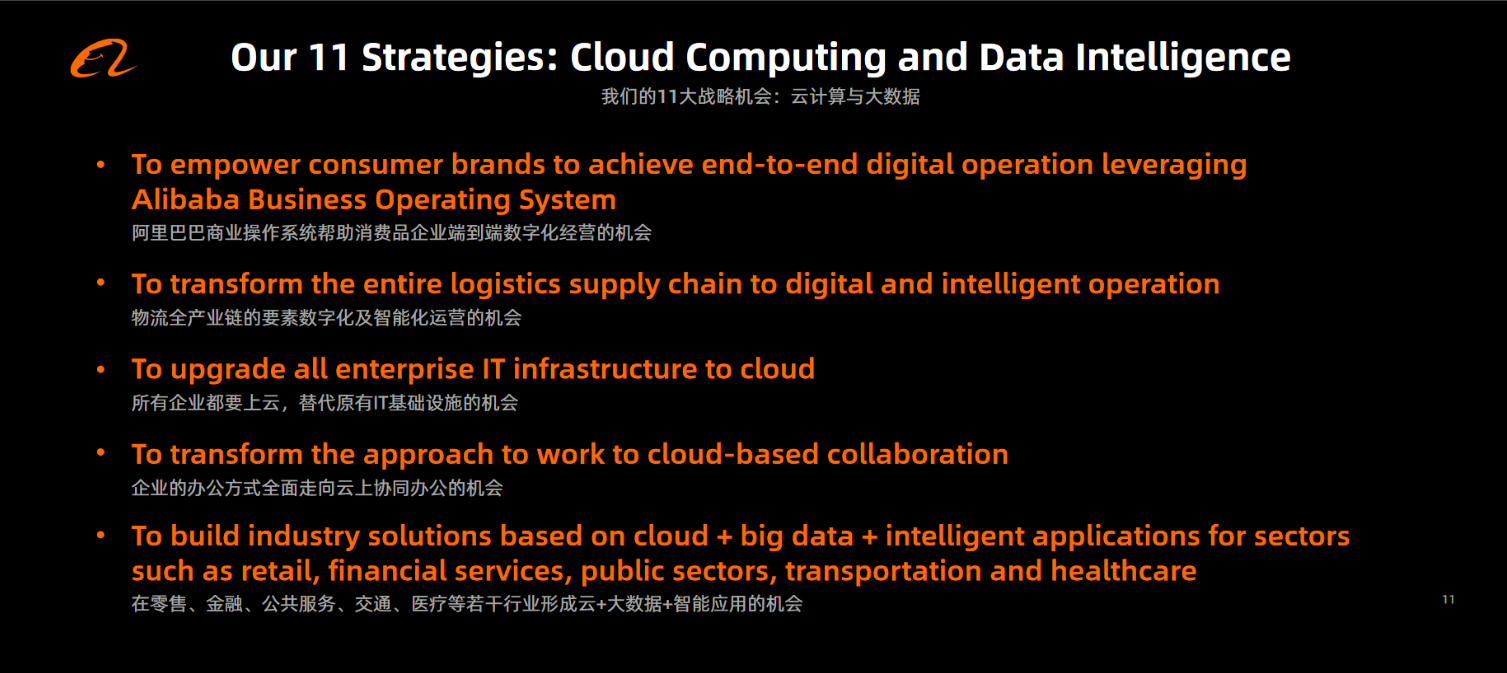

Which brings us back to Daniel Zhang’s strategy chart. He lists 5 growth strategies under Cloud Computing. I will just run through these quickly as they are pretty vague.

“To empower consumer brands to achieve end-to-end digital operation leveraging Alibaba Business Operating Systems”

No big surprise here. They are applying cloud to their core ecommerce businesses, where they are already have tons of users. So that means financial services, IT infrastructure and merchant services are all going to the cloud – and will be informed by data intelligence. I expect them to roll out a full range of use cases here.

“To transform the entire logistics supply chain to digital and intelligent operation”

Same story.

Leveraging Alibaba Cloud into all their activities in logistics and supply chain is a natural approach. Daniel did mention they are going far beyond just digitizing packages. They are going to digitize every vehicle, courier, point of service and other asset of the logistics and supply chain operation.

“To upgrade all enterprise IT infrastructure to cloud “

More of a vision statement.

The West is far ahead of China / Asia (ex-Japan) on the enterprise side. Western companies have been building ERP systems for decades. And a lot of the effort today is about transferring from on premise to cloud.

When you look at Alibaba Cloud, you see a much smaller market today on the B2B enterprise side of China. But it will grow. And there is the question of whether that a strength or a weakness?

Note: legacy systems are often a problem when you make a major technological leap. You don’t want to make your old system obsolete or incompatible. So incumbent leaders have to make things compatible with previously deployed systems. That can be complicated and expensive. And can leave you with sub-optimal solutions.

But a new player can often start fresh and can build a better system that is much more suited to the new paradigm. This is part of why Microsoft lost when mobile operating systems emerged. It was trying to make it compatible with its PC operating system while Android had no such concerns.

China / Asia may end up having some interesting strengths in enterprise cloud because of the absence of legacy systems.

“To transform the approach to work to cloud-based collaboration”

That’s pretty vague. But I think this is DingTalk. They want DingTalk to be a robust collaboration platform with a suite of utilities for businesses.

“To build industry solutions based on cloud + big data + intelligent applications for sectors such as retail, financial services, public sectors, transportation and healthcare”

This seems to be a catch all strategy. I think they are going to do lots of meetings with companies and see who wants to build what on this new infrastructure. There will be lots of use cases and applications (platform and non-platform services). It will happen slow probably. But it could be huge over time.

***

Ok. That’s it. That was kind of a lot for today. But it’s a big important subject. And it’s fun.

Cheers, jeff

——–

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.