I’ve talked a lot about why KOLs and influencers are so important in a connected world. Live streaming and short video are currently the big focus of influencers, but this is a much larger phenomenon.

So why is Baidu is selling iQiyi, China’s #2 video streaming platform?

Consumers Are Networks

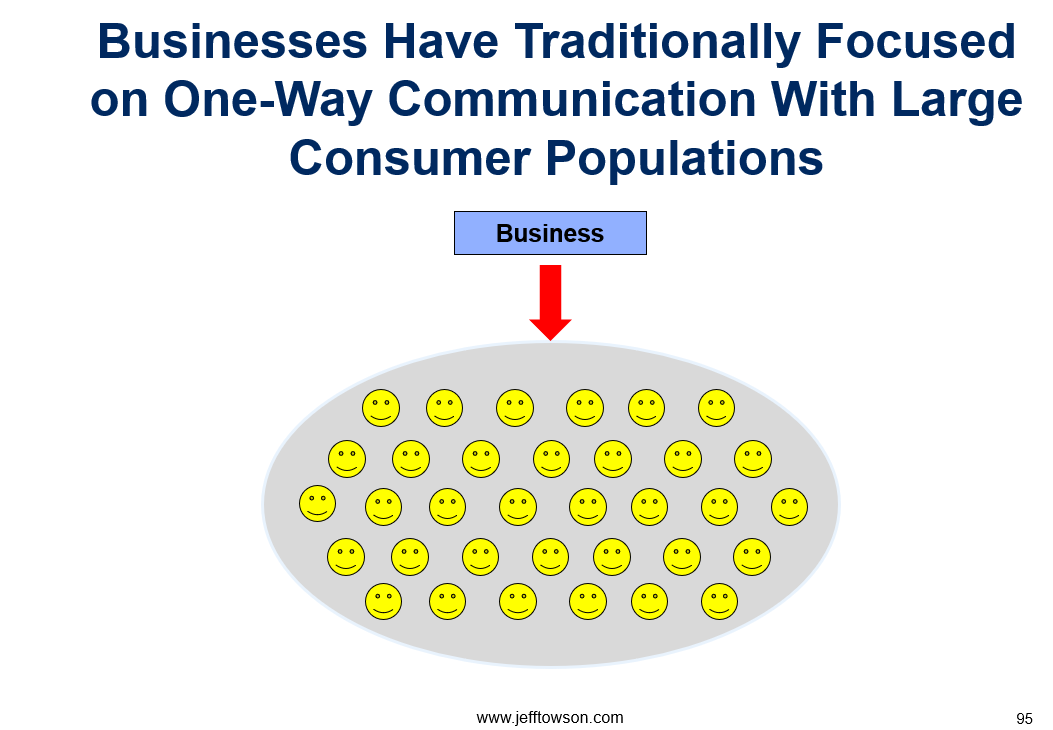

It begins with this simple picture.

This is how B2C businesses have almost always been. Consumers were viewed as a demographic. Usually segmented by geography. Or by simple behavior metrics. And businesses did mostly one-way marketing and engagement to this demographic.

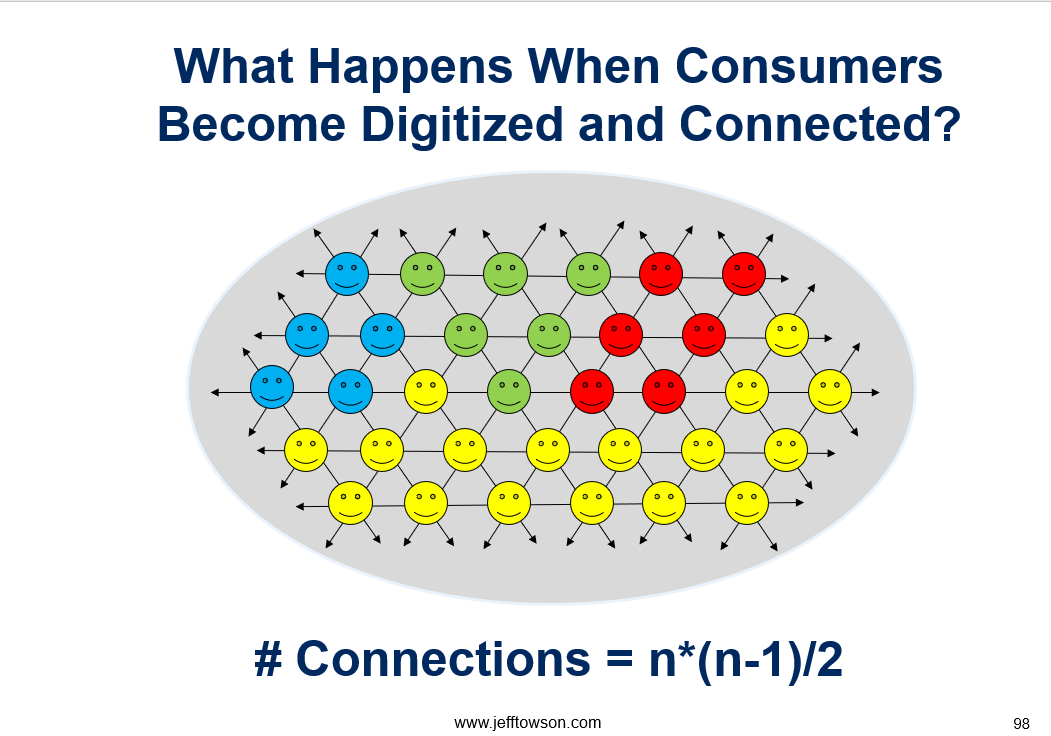

But when consumers got smartphones, they all became digitized and connected. This is a simple idea. But it is incredibly important.

One thing that happened when consumers got digitized and connected, is they became smaller, targetable markets. Because there is lots of data now. Mass markets have been fragmenting. Everything is more complicated now. And it’s getting more so. Soon there will be personalized micro-markets. And eventually, this all may go to “markets of one”, where every consumer is their own market.

But the really big deal is the connections that now exist between consumers (which you can see in the graphic above). And the number of these connections grows exponentially (almost) with the number of consumers (in theory). You can see that in the equation at the bottom. Businesses have realized that the marketing and what they say to the demographic is not nearly as important as what consumers say to each other.

The goal is now to get interactions between consumers going – and about their products. The game has gone from mass market broadcast marketing to network engagement. And there are really two big mechanisms for this: content and community.

That’s the game.

- Create content and communities.

- This activates the consumer network.

- This should dwarf traditional marketing.

And this is really what influencers do. They create content and share it with their audiences. They get engagement. They activate the network. But the best ones create and lead communities.

Which brings me back to iQiyi and audience builder platforms. Because if you combine everything I just said with a platform business model, you basically get an audience-builder.

Audience Builders Are Outstanding at Activating Consumer Networks

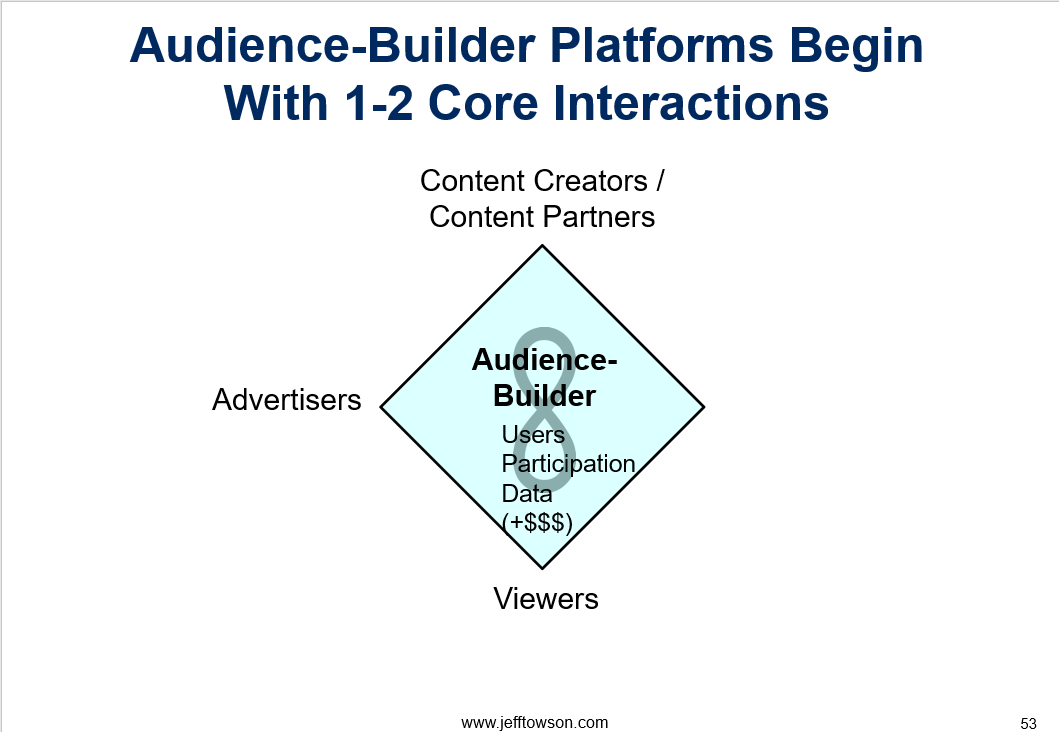

Audience builders (like iQiyi and Youku Tudou) are platforms that enable interactions between content creators and viewers. And the core interaction is really about building an audience (hence the name audience builder).

In the graphic, you can see below the two user groups and the two-sided network effect (the infinity sign). The more content creators the more valuable to viewers and vice-versa. I also put in advertisers as a third user group but don’t worry about that right now.

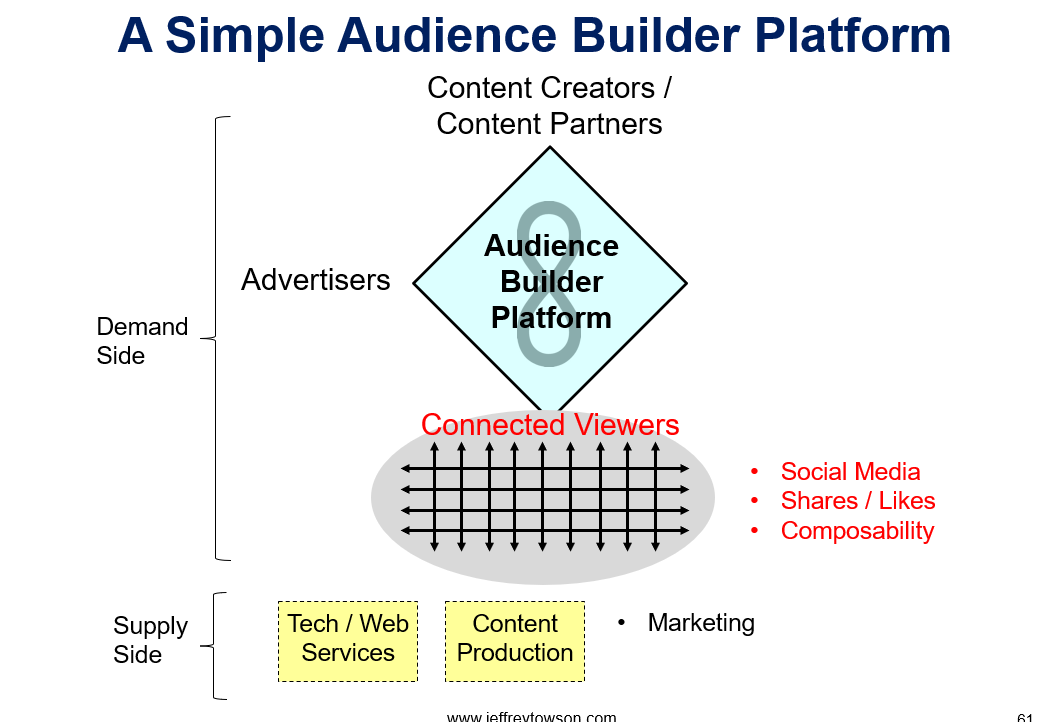

We can flesh this out a bit.

In this graphic, I put in yellow the capabilities needed to enable these interactions. The ones everyone talks about are marketing spend (to attract viewers) and web service. And that is pretty much YouTube and TikTok.

But in China streaming (iQiyi, Tudou, Tencent Video) there is a ton of content creation and purchasing. These platforms are basically a combination of Netflix and YouTube. Lots of user generated content (like YouTube) but also lots of purchasing and in-house content production. And this is why all three of these companies lose so much money. They have been in a content spending race for race. They are all trying to differentiate by having unique content, hence the spending war.

And this is why it is not surprising that Baidu is (likely) selling iQiyi. Back when these wars started, Tencent, Alibaba and Baidu were all about the same size. But now Baidu simply can’t compete with Tencent and Alibaba in content spending. I’ve wanted Baidu to get out of the content business for years.

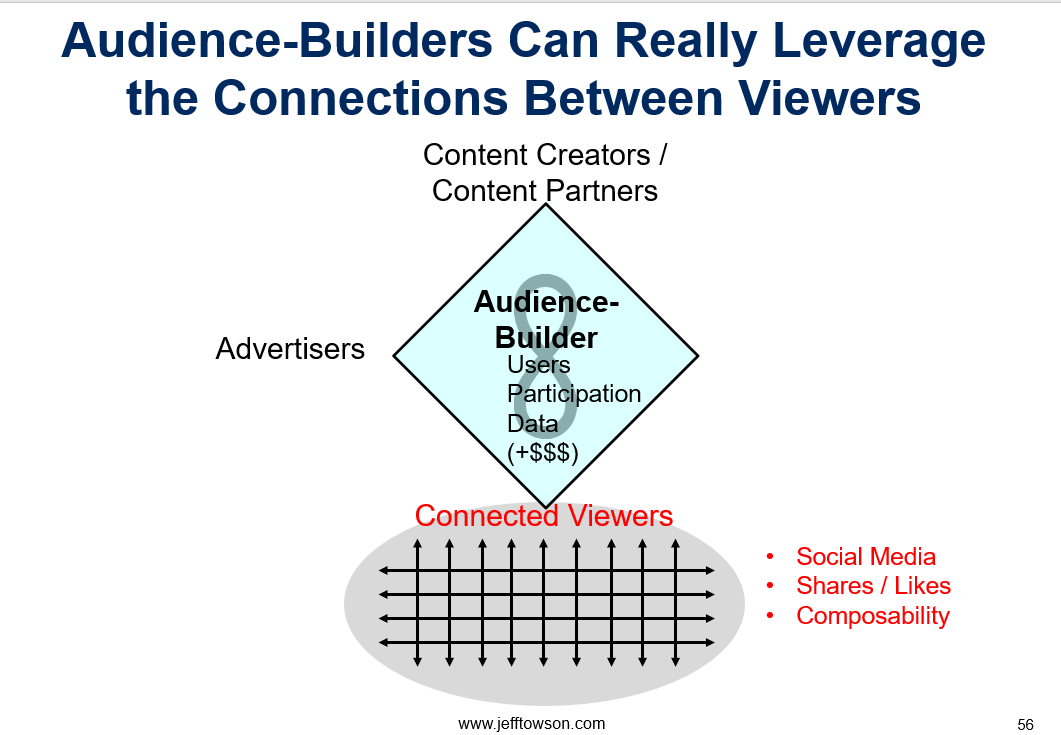

In the graphic, you will also note I have changed viewers to “connected viewers“. And this is the key point. People really like to share content. They like to comment. They like to make reaction videos. And we see three common ways that audience builder platforms activate a consumer network. This is by:

- Sharing and likes

- Commenting and engaging.

- Composability

The first two are easily understandable. But the third one is really important.

You hear this term “composability” by web3 people all the time now. It’s the idea that users can take creations by other users and build upon them. For example, developers use open source code to build their own code. Then they post it and others build upon that. This is an exponential form of innovation that can be really powerful. The lack of composability in much of web2 is its greatest weakness. Content creators and especially developers do not trust the big platforms. So they don’t build.

We see a lesser form of composability at TikTok and YouTube. People make videos and encourage others to create their own versions. Or to make reaction videos.

***

If we put all that together, it is my complete graphic for audience builder platforms.

User Generated Content and Influencer Generated Content Are the Big Game Right Now

“Content creation” can include a lot of stuff. Articles, news, videos, short videos, music, live streaming, photos and other stuff. And depending how complicated the medium is, it can be done by different groups. For example, everyone can make photos and short videos with a smartphone. But movies and tv shows are usually done by companies. I generally put content into three buckets (which are shown in the graphic).

- Professional generated content (PGC). This is by media companies, studios, news organizations and companies. Content sharing companies like Twitter and Toutiao are heavily dependent on this type of content.

- Simple user generated content (UGC). This is by individuals who make videos, write songs, articles and photos. For some media types (articles, short videos, photos), it is really easy for the viewers to become content creators. Platforms like Tiktok and Instagram are built on this type of content.

- High quality user generated content (hUGC). This is where an individual or small groups of users start generating almost professional level of content. YouTube channels are getting pretty high quality. And are starting to have larger audiences than many media companies. A lot of us who do business content are focused on this bucket.

You can see all this in the chart above. And it is important to note how viewers can become content creators (in a way that consumers don’t really become merchants and brands). It’s often a big source of platform growth.

But within all of this, there are two main points:

- Consumer networks are very powerful.

- Audience builders are great at activating them. Both by content and community.

- User generated content and influencer generated content are pretty much the best tools for this right now.

***

Which brings me back to my first question. If audience builder platforms are so powerful, why is Baidu selling iQiyi?

And the answer is they are really powerful. They are one of the few ways to really capture demand. This is why Baidu has sold all its other small businesses but held onto iQiyi. But in China, these platforms just have bad economics. And (it appears) they are finally throwing in the towel.

Ok. That’s it for today.

Cheers, jeff

———-

Related articles:

- Ant Financial Is 3 Platform Business Models Combined. (Jeff’s Asia Tech Class – Daily Lesson / Update)

- Ant Financial’s Big Money is in Asset-Light Credit Tech (Jeff’s Asia Tech Class – Daily Lesson / Update)

From the Concept Library, concepts for this article are:

- Audience Builder Platforms

- Connected Consumers

From the Company Library, companies for this article are:

- Bytedance / TikTok

- iQiyi

Photo by Solen Feyissa on Unsplash

———

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.