This week’s podcast is about Alibaba and Singles’ Day. Just my thoughts on what really matters.

You can listen to this podcast here or at iTunes and Google Podcasts.

Here is my new book (released December 1):

My list of 7 things people are getting wrong about Singles’ Day:

- Business model is about building demand-side scale. This is also about economies of scale as a relative advantage.

- Operating model is about user-facing innovation that adds value.

- Consumer facing innovation is likely about live-streaming, metaverse and NFTs.

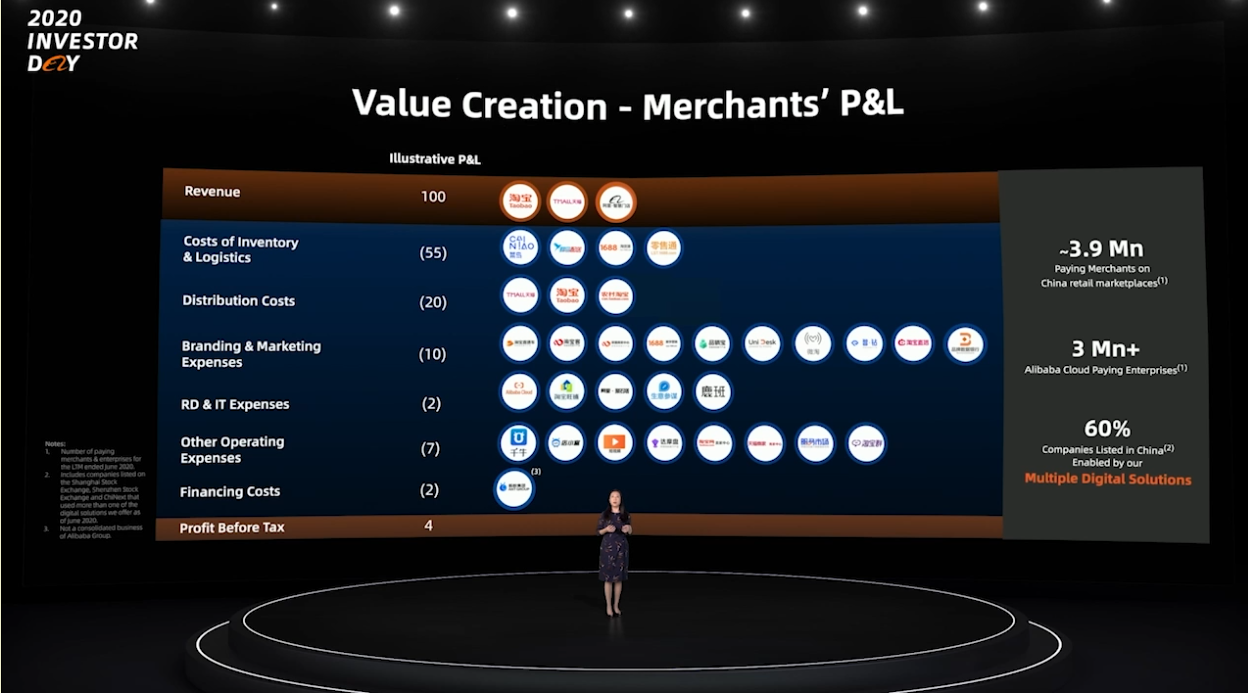

- Merchant-facing innovation is likely about R&D and financing.

- Physical assets have traditionally been about supply-side scale and building a barrier to entry.

- Alibaba is also separating supply side into a new business that is the “new infrastructure of commerce”.

- Singles Day is both a moonshot program and a yearly stress test for the company.

Here are the Digital Operating Basics

Here is the Alibaba slides for adding value to merchants.

——-

Related articles:

- 7 Questions for Alibaba on Singles’ Day (pt 1 of 2)

- Behind the Scenes with Alibaba on Singles’ Day (Jeff’s Asia Tech Class – Podcast 5)

From the Concept Library, concepts for this article are:

- Digital Operating Basics: DOB2 Never-Ending Personalization and Customer Improvement

- Network Effects – Demand side Economies of Scale

- Ecommerce

From the Company Library, companies for this article are:

- Alibaba

——-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.

——-Transcription Below

:

Welcome, welcome everybody. My name is Jeff Towson and this is Tech Strategy. And the topic for today, seven things everyone is getting wrong about Singles Day. So it’s November 10th, which means Singles Day is technically tomorrow, although it’s not really a one day anymore. They kind of expanded it to weeks plus now. So it’s a big shopping festival, but we still call it Singles Day. Anyways, that… day happens starting at midnight tonight. So I thought I would kind of talk about what I think people are sort of getting wrong about this because we’re gonna see the same wave of articles we see every single year. The basic ones are gonna be like, what is singles day? Which seems kind of out of date at this point. They’ll talk about the GMV, they’ll talk about the gala, kind of the same stuff. Everyone will speculate how much will the GMV be. they’ll talk about how a couple of the big live streamers sold billions of goods and things like that. Kind of the same story over and over. And I’ve spent, I’ve gone to these events a couple times in the last year, three times, three or four times, sort of out behind the scenes and, you know, get to talk to management a little bit and sort of see what’s going on. And it’s been great this year, obviously a little bit different with COVID, but anyways, I’m gonna kind of give you what I think is really important here in terms of the business model. and why this is actually important, why it is actually like a big deal in terms of business model and strategy, which is not really the same question as what people tend to report on. So anyways, that’ll be the topic for today, what I think people are kind of getting wrong. And for those of you who are subscribers, I sent you out some stuff on tuya.com, which was, it was a little bit in the weeds on that one. It’s me trying to figure out how to think about enterprise. which is obviously different than a lot of the B2C stuff that traditionally has been the center of China and Asia. So more on the B2B enterprise side. Tuya is an interesting example of that. There’s one other sort of enterprise and quasi cloud focused company I’m going to cover this week, which is Medalia. That is not a Chinese company, that’s Western. But anyways, between those, that’s probably four to five companies on that side that I’ve covered in the last couple weeks. So that’s kind of me trying to take apart the B2B side. For those of you who aren’t subscribers, you can feel free to go over to jeffthousand.com, sign up there, free 30-day trial, see what you think. Last thing, disclaimer, nothing in this podcast or in my writing or website is investment advice. The numbers and information from me and any guests may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment advice. Do your own research. And with that, let’s get into the topic. Okay, so as always, there’s a couple key concepts for today. First one is gonna be network effects, but I’m gonna kind of refer to it differently than I normally do. I’m gonna start talking about it as a competitive advantage that is sort of the demand side equivalent of economies of scale. Usually when we talk about economies of scale, we’re talking about cost structures, things like that, sort of supply side competitive advantage. Well, network effects is also sort of the demand side equivalent. So I’m going to talk about it in terms of that. Second one, we’re going to talk about the digital operating basics of which I’ve given you a list in the last week or two. We’re going to talk about number two on that list of the basics, which is never ending personalization and customer improvement. I’ll talk about that, but those are kind of the two ideas for today. They’re both located in the concept library. Okay. So number one on the list, I’m gonna go through seven things. I’ll go a little bit quick, because that’s kind of a lot. Number one, Singles Day is about building a business model with demand side scale, specifically demand side economies of scale. Now everyone’s gonna talk about GMV. Look at the GMV, look how much stuff was sold. My standard thing is this is about a platform business model. That’s the business structure, the business model. It’s a very powerful model. When you build a platform business model that’s a marketplace, the goal is to get scale on the demand side, control both consumer behavior and also merchants and brands, because there’s more than one user group, obviously. All of that constitutes what I would call demand side scale. That’s where the power is. If you control the demand side, you can build out on the supply side, which means lots of warehouses and things like that. It’s a very powerful business model. Okay, so the metrics you’re looking for is you’re looking for demand side activity, which is not GMV. The… The four numbers I always look for, which if you look at any of my blue diamonds for marketplaces, you’ll always see four things I’ve listed within the blue diamond, which are users, engagement, data, and cashflow. That to me is how you measure the demand side activity. We need lots of users, we need lots of engagement, we need lots of resulting data, and some degree of operational cashflow. So that’s kind of, when I look at Singles Day, that’s what I’m looking for. It’s not necessarily the GMV, that’s fine, whatever. I’m looking for number of merchants, number of brands, number of consumers. What is their level of engagement? Are they on there all day? Are they watching videos? Are they leaving comments? Are they watching live streaming? All of that, those sort of activity measures. And then that results in data, and then also cashflow, which is kind of where the GMV is. That’s all about demand side scale. Now why does that matter? And that gets us to the first concept for today, which is demand side economies of scale. Supply side economies of scale, like your standard example is Walmart, where this is a competitive advantage. It is very powerful, but it is a relative advantage. It is, I am bigger than my competitor, and therefore, as long as I am bigger than them, I have an advantage. Now in the Walmart example, it would be. Because I am a bigger retailer, I can negotiate lower prices, which we would call purchasing power or purchasing economies of scale. And that lets my cost structure be lower and so on. That’s a relative advantage. But if my retailer competitor gets as big as me, that advantage goes away. Fixed cost is another one. If you have certain fixed costs, like marketing or logistics, and I’m bigger. then I’m gonna have a lower per unit cost. All of these things are supply side economies of scale, which are relative advantages. Okay, network effects are often called demand side economies of scale. They’re not exactly the same, but it’s kind of close enough that I think you can use the same language, which is if I have more activity on the demand side, my service will be better. There’s more products you can buy, there’s more merchants, that would be if I’m a consumer. If I’m a merchant and there’s more consumers on a platform, I’m gonna get more sales, I’m gonna get more data, I’m gonna get better services, things like that. So if one platform business model is larger than the other in terms of demand side, it’s also gonna be superior. It’s a competitive advantage, but again, it’s a relative advantage. You have to maintain the differential and scale. So one of the questions I would look for for Alibaba on singles day is I’d be looking for how much activity has increased from this year versus last year. And what are the new sort of what we call frontiers of usage? Where is the new activity coming from? The new user group, the new engagement, all of that, the new data sources. I wanna see all of that sort of increasing. And the standard story you’re gonna hear in the next day is. Fourth and fifth tier cities is a new frontier of usage. Live streaming is a new frontier of usage. International markets. But you wanna look at all of those metrics and that’s all about maintaining, well one, it’s a good thing to grow, but two, it’s about maintaining that scale differential that gets you demand side economies of scale. So that’s kind of point number one. The business model is about demand side scale and. of scale on the demand side. Okay, number two. The operating model, which is different than the business model. Business model is structure. Operating model is daily, weekly, monthly activities. The operating model for Alibaba is about user-facing innovation that adds value. Okay, this gets me to the other concept for today, which is digital operating basics. That’s your standard operating playbook for a digital company. I’ve listed seven things. I will put the list in the show notes of those seven. But number three on that list is, let me read it to you. Number three on that list, digital operating basics, I’m sorry, number two on that list. is never-ending personalization and customer improvements. That if you’re a digital business, you’re always sort of trying to innovate on the user experience. And that user can be a consumer, it can be a merchant, it can be a brand, it can be a driver, it can be whatever. But that sort of customer user-facing innovation plus data is sort of your never-ending well for adding value. Now, why do you wanna add value? Because there’s a problem with economies of scale, generally speaking. If I’m gonna be bigger than my competitor and that’s my source of advantage, I need to be in a market with no room for them to grow and catch me. So you want economies of scale in a market that is sharply circumscribed and hopefully not showing much growth. My favorite example of this is a supermarket on the island of Boracay, which is in… the Philippines. It’s a kind of a touristy item. It’s nice. It’s pretty. But there’s one big supermarket on the island. So they have economies of scale in multiple ways as a retailer, but also there’s no room to grow. So if a secondary company comes in, there’s no space for them to grow into that’s going to get them to the same level of scale. They’re going to have to take market share from the leader, which is very hard. So you’re looking for sort of a constrained market. or one without a lot of growth or with a sharp demarcation. Now, unfortunately for platform business models and marketplaces, one, there is a lot of growth. So there is room for a competitor to jump in and grow and catch up in size. And two, the industry barriers boundaries are not terribly well-defined. You can go from products to services to digital goods. I mean, they’re kind of fuzzy boundaries. So if you’re a marketplace platform like Alibaba Taobao and you’re trying to keep this sort of demand side advantage, you don’t have that. So what do you do? If you’re in a growing market with fuzzy barriers, your real solution to that problem, is you have to constantly be innovating and adding value to your user groups beyond what you did last year and beyond what you did the year before. And if you ever read the filing for Ant Financial before they pulled it, that’s exactly what they talked about, that their core strategy was sort of never ending innovation that adds value to their user groups. And that is how they avoid losing their network effect as an advantage. So that’s kind of what you can see Alibaba doing is they’re doing what I would call digital operating basics number two, personalization and customer improvements that never ends. And that’s just what you do every week, every month, every year. And so their operating model is really about that constant innovation. So that’s point number two. Point number three, we can definitely see this on the consumer side on SinglesDeck. we can see constant user-facing innovation for consumers. And that’s really what Singles Day is. It’s them just continually adding to the consumer experience, makes it better and better. Singles Day used to be just about discounts, right? Lots of discounts, buy a bunch of goods cheap. 10 years ago, that’s kind of what it was. And because Chinese consumers really like shopping festivals, but then they started to add entertainment. They started to have a gala. They started to combine content and media with commerce. So that was kind of an innovation on the consumer side. Then they started adding live streaming. Then they started adding, I mean, you can see them just sort of continually adding to the consumer experience. Well, that’s part of that digital operating basics that the desire to improve the consumer experience never ends. Now what we’re seeing this year, I always ask the question for like Alibaba, okay, you’re gonna have singles day. What is the single most important new use case that you’re rolling out this year? For consumers, let’s say. And I think the newest one they’re doing this year is they’re starting to do NFTs and Metaverse. You know, Facebook has been talking about this in the last couple weeks. You know, Mark Zuckerberg’s all in on Metaverse. But as usual, Facebook is a lot of talk and Alibaba just does stuff. So while he’s talking about what they’re gonna do, Alibaba’s already rolling out NFTs and other things that you can buy into on Singles Day. So they’re already moving. Anyways, I think that’s kind of the big new use case they might be moving into, but that’s sort of number three is what consumer facing innovation are they doing? this year. Number four, what are the merchant facing innovations they’re doing? Because you have to play this digital operating basics game for all the user groups. And they’re actually pretty good on the merchant side. They really do quite a lot on the merchant side, the brand side, every year. Singles Day used to be about, hey, you’re a brand or a merchant, sell on Singles Day, you’ll make a bunch of sales. That’s not really what they’re doing anymore. Most merchants and brands are on there now. They’re getting data. They’re launching new products. They’re testing out their strategies. Singles Day is often called the Olympics of brands, which I think is a really good summary for what the day actually is. It’s these brands seeing who are the greatest performers in terms of offering things to consumers, and it’s not just about discounts. So there is a really cool slide that Alibaba presented at their investors day early this year. And they basically showed, I’ll put the slide in the show notes, but they basically showed a slide and this is the title, Value Creation Merchants P&L. And they basically have a P&L for a merchant with revenue, cost of inventory, cost of logistics, distribution costs, branding and marketing expenses. R&D and IT expenses, other operating expenses, financing costs, profit before tax. That would be a standard P&L for one of their merchants. And they’re just trying to create value for their merchants on every level of their P&L. That lets them sell more, save here, and they basically have listed all their initiatives and how those impact sort of the P&L of a standard merchant. I mean, that is just ongoing value creation. for merchants and it’s pretty impressive what they do and they keep rolling out new things. You know, they started out doing a lot of logistics as a value add for them. We’ll do the delivery for you. They offered them online stores you can set up. That’s value to them. They moved into sales and marketing. Okay, fine. And now we see a lot more sort of in R&D. You know, the T-Mall Innovation Center, which lets these brands develop new products based on Alibaba data. fine. We get live streaming and new types of content that can be created and now they’re offering them new AI tools for fashion and things. I mean they just keep going. And so one of the things I’ve been thinking about a lot is you know within digital operating basics, number two, it really does appear to be that software, digital technology, when you combine that with a lot of data you really have this almost endless well in terms of being able to create new types of value for your users. It doesn’t seem to flatline for most, well, not for most businesses, for some businesses. Now, if you’re running a coffee shop and you go digital, you quickly realize there’s nothing left to do, which Luckin Coffee tried to do. No matter how much software you use, it doesn’t create value for people buying a cup of coffee. But when you get into things like fashion and e-commerce and media, you know, it just seems like it doesn’t end. And, you know, we see these companies continually thinking up new things they can do for their users, keep pushing the barrier. Now within there, this sort of, let’s say, data-driven, user-focused innovation. The biggest lever within that is personalization. That is really the big lever. You know, the more you start to personalize products, services, communication, sales, inventory, product catalog, the more you personalize that person to person to person, that really is the biggest lever. But it’s all under this general idea of, you know, we’re just gonna keep improving the user experience with our software plus data. And that can be merchants, brands, and everyone. I mean, it doesn’t seem to end for certain businesses. Certainly for Alibaba, we don’t see it ending. They keep coming up with new use cases. Okay, so that’s number four. And I think these can all be put into one bucket. So what do I think is important about single stay? The first four, number one, the business model, the structure is about building demand side scale. which is users, engagement, data, money, and also maintaining a differential in scale with your competitors. And we call that a network effect. We call it demand side economies of scale. Number two, the operating model, the activities, day to day, month to month, week to week. That’s mostly about user facing innovation that adds value. And Alibaba, this is definitely what Singles Day is about. This is where they try out a lot of new stuff. Even Singles Day in itself is about doing this. That’s why they created it. Number three, on the consumer side, in terms of user-focused innovation, we’ll see what they roll out. I’m kind of keeping an eye on Metaverse, NFTs, probably live streaming. Those are probably the biggest use cases they’re doing, but I’m always looking for whatever the most important new use case for consumers is. And number four, same question, but on the merchant side. We’ll see what they’re rolling out in terms of the most important new use case that adds value to their merchants. I suspect it’s going to be more R&D. We’ll see what they talk about. They usually have press releases and things like that. OK, so those are the first four things. There’s three more. And these are more on the supply side. So there’s this idea that you build on the demand side first. You get users, you get activity, mostly digital behavior. And then you build out physical assets that enable these transactions. And in this case, that’s a lot of delivery people, it’s a lot of warehouses, it’s a lot of logistics. And I have always really liked that model. Digital on the demand side, physical on the supply side. It creates a nice physical barrier that keeps your competitors at bay. If you’re a purely digital business, Yes, the economics are nice, but it is fairly easy for someone else to jump in. But if you got to build those warehouses, it tends to slow the process. You can see the competitors coming over time. So I like those things. I call them digital physical hybrids. Anyway, so the physical assets for a long time for Alibaba, I think have been about that. Lots of warehouses, things like that. That’s kind of number five is they’re still more or less building out those physical assets. Definitely logistics. They’ve pretty much finished China, but now they’re moving cross border. So every couple of weeks, you’ll see Alibaba announce something like some new trade deal in Singapore or some new warehouse being put up in Sao Paulo. They keep extending their supply chains around the world. So you still see them building those physical assets within logistics. But domestically they’ve also been adding to this by building out their physical footprint in terms of retail locations. They have their 200 Hema fresh hippo stores. They have three to 400 SunArt hypermarkets and they keep building those. They’re getting up to about 800 to a thousand of these physical stores. And that’s really their physical footprint. The retail locations plus the logistics, that’s their kind of physical footprint domestically. I still think that’s a huge barrier. I think JD has it and I think Alibaba has it. I don’t know anyone else who really does. Pinduoduo is obviously building there. So I like that. So that’s number five. So I’m looking for the next level for their physical barrier, their physical assets. Number six is. they seem to be transitioning their physical assets into its own business model. Where you know they have started Daniel Jang has started to refer to their physical structures as the new infrastructure of commerce. He basically said this earlier this year that we’re in two businesses. We have products and services like Taobao, Taobao Live, community group buying, but we also have an infrastructure. which is the logistics, the physical retail stores, and cloud. Those three things constitute what he calls the new infrastructure of commerce. And they appear to be building that as almost a separate business. So this whole supply side picture appears to be basically an infrastructure business. And he kind of said, you know, I think the infrastructure business is gonna be the bigger opportunity long-term. So. You know, that’s kind of an interesting idea to think about. Which is going to be the larger source of profits for the company long-term? Is it gonna be their products and services like Taobao, T-Mall, Taobao Live, community group buying, because these things will come and go, or is it gonna be the infrastructure that those products and services rely upon, which they will just sell to everyone? and I’m not sure. I’m kind of keeping an eye on this. One of the questions I looked at earlier this year was Sun Art, which is their big Walmart like business, and the question of how much money is Sun Art going to make? And the answer to that is, well, it depends. How does Alibaba see it? Does Alibaba see this as infrastructure that supports their e-commerce business, or do they see it as a profit center in its own right? because they can shift the profits between it as they see fit. And we could say the same thing about cloud. Is this gonna be a profit center or infrastructure that just supports Tmall? I think that one’s pretty clear. It’s gonna be a profit center. Tsai Niao and the other infrastructure, I’m not sure if they’re just gonna have a standard low level profit and it’s gonna be a supporting infrastructure or whether it’s gonna be its own sort of profit center. Anyways. I’m kind of looking for how that’s gonna change this year. How they’re gonna use their infrastructure as more of a standalone business. So I’m keeping an eye on that. And that’s number six. The last one, number seven. Also about the supply side, that Singles Day is a really clever operating organizational mechanism. It’s like a yearly stress test. on your entire infrastructure. Because everything they’re building, whether it’s cloud, payment processing, deliveries, let’s say they decide to automate some of their factories in the last six months, any significant change they’ve done in their operations over the last six months, they all know that on November 11th, there’s gonna be so much volume flooding through their system that anything that doesn’t work perfectly is gonna break. So it’s like a gigantic stress test for their infrastructure. And we’ll see what breaks. Traditionally, nothing has had a problem. But this idea of Singles Day, it’s a really, I mean, imagine like, you know how they did stress tests for banks like 10 years ago after the financial crisis? Like the US government and some others did stress tests for the banks. Imagine if all the banks of the world every 12 months, had to have the volume running through them go up by a factor of 10 to 20 in 24 hours. How many of them would break? Probably most of them or a lot of them. So it’s very interesting how what an effective mechanism Singles Day is both as a stress test, but also anything they’re building. You know, it has to be done by November 11th because, you know, the big day is coming. So it really puts, it’s like the difference between like, you ever notice what good shape boxers are in? Like boxers are in really good shape because they train really hard. Because usually they have a fight like six months into the future. So, you know, it’s a very real consequence. So they train like crazy because they know in six months they’re gonna get in the ring and get blasted in the face. This is like that for Alibaba. Anything they build, they know within six months, they’re gonna have to get in the ring and see if whatever they’ve launched breaks and works or not. It’s a really kind of clever, I don’t know too many businesses that do this, that just have a massive stress and deadline for their entire operational every 12 months. I think it’s a good mechanism for driving progress. Anyways, so that’s the other thing I’m looking forward to tomorrow is, you know, this sort of yearly moonshot program, the yearly stress test on the entire Alibaba infrastructure and ecosystem. Anyway, so those are my seven. So the first four, and I will list these in the show notes, the first four were really about the demand side, and the last three are about the supply side. And that’s pretty much kind of how I view Alibaba. Now, I guess just last point on this, the standard question is always, what is the GMB gonna be? How much are they gonna sell? And I’ve actually nailed this a couple times. My standard answer is they will sell however much they want to. Usually I used to say it was gonna be 20%. Year after year it was gonna be 20%. Why? Because I think that’s the number they wanted. And they can move these numbers. If they wanna sell more, all they do is extend more credit. Or they offer more promotions. And they can move that number pretty good if they want to. Now this year, last year was a bit different because they extended it to multiple days. So instead of 30 billion, 35 billion, 37 billion, it jumped up to like 75 billion because they kind of changed the goalpost. So normally I would have said just take whatever last year was and add 20% and that’ll be the number for GMV this year because that’s the number they want. Now this year it’s a little bit quirky because of all the political stuff. So it’s unclear to me what the management wants. I don’t think they wanna blow the doors off. I don’t think they wanna spike the numbers and say, hey, we’re back 35% growth this year. Cause I don’t think they wanna get the government’s attention. But I also don’t think they wanna come in at 5%. So I think they’re gonna choose a number in terms of their growth that is kind of understated. So let’s say I’ll put a spike in the ground on this one flag in there. Let’s say I think they’ll come in at 15 to 20 percent and basically stay quiet, keep it off the radar, but let people be a bit comfortable. That’ll be my thing 15 to 20 percent over last year. Okay and I think that’s it for today. Gonna be shorter today. I’ll try and make these a little shorter from time to time. The key concepts for today. Digital operating basics number two. The list of my digital operating basics is in the show notes. Never-ending personalization in customer-facing innovation. And the other idea for today is network effects, which I’ve talked about a lot. But to view this as a competitive advantage relative to someone else based on a difference of size. So network effects as demand-side economies of scale. And those are the two ideas for today. As for me, it’s been a pretty good week. I just moved into my new condo here in Bangkok, so that’s always kind of a pleasant part of life when you kind of get a new home and you move in, you spend your first night there. So I’ve been kind of enjoying that. But yeah, pretty much just hanging out here, getting moved in, going to the gym a lot, all of the sort of normal. It’s been a nice quiet week. And… My new book is all done. It’s coming out on December 1st. If you’re curious of that, you can go down to the show notes. I’ll put a link into Amazon. It’s on sale now. I feel pretty good about that one. It’s going to be one of five books. I’ve basically written kind of a crazy long series of books on digital competition. So there’s actually five parts. So this is going to be part number one. Anyways, that’s it for me. I hope everyone is doing well. Hopefully everyone’s coming out of the various lockdowns wherever you are. Life is pretty much back to normal here, which is great. I was going to head out to Europe in a month or two and do some stuff there, and it turns out they’re shutting down certain parts. I was going to go to Greece, and I just saw the other day, like apparently you can’t go from Thailand to Greece anymore as of Saturday. That is not allowed. So that kind of… wreck the vacation. I’ll have to figure out what I’m gonna do with that. Anyways, but otherwise, I hope everyone’s doing well. I hope this is helpful. If you have any suggestions for companies to look at, please send me a note, I’d really appreciate that. Otherwise, I will talk to you next week. Bye bye.