A few months ago, I wrote about Stone Co, which is one of the new digital natives rising in Latin America. My thinking on Stone Co is that the company is mostly serving SMEs with a split focus on financial services and enterprise software and services. That is a bit confusing. And their operations reflect this with a mix of digital activities and local operations.

I put Stone in the category of a “tactical scramble”. They are still doing a lot of tactical stuff, without settling on a clear business model with competitive strengths.

Most new companies start out doing tactics, which I also call “doing whatever works”. They try lots of things and hunt for something that gets traction with customers. Stone found some unmet financial needs at small Brazilian merchants, which had long been neglected by Brazil’s traditional banks. Stone got some traction by offering SMEs payment services and working capital solutions. They helped them take credit cards payments and helped them get their money faster. That got them initial adoption and got the company going.

Stone was also in the right place at the right time. They were an early mover as a digital company in Brazil looking at the financial sector. They raised money and expanded rapidly. So if you look at my list of standard tactics for digital businesses, you can see a lot of Stone’s moves on the list – specifically early mover (T1), counter-positioning (T2) and short-term hypergrowth (T4).

But Stone’s tactics and early products (payment, working capital, etc.) are still mostly short-term moves. Stone needs to move upwards into more defined operating activities that hopefully create competitive advantages over time. But I don’t think Stone is 100% sure where it is going. It looks to me like the company is still mostly doing a tactical scramble.

- Should they focus on building a payment platform?

- Should they build out their credit services for consumers and merchants?

- Should they expand to a full suite of financial products? For SMEs? For consumers?

- Some they go into enterprise software and services? Focused on SMEs? Moving up to larger companies?

Each of those strategies means a different opportunity. And each has different competitors.

In 2020, Stone acquired Linx, which does enterprise software and services, for +$1 billion. So, Stone appears to be going after #4 (enterprise software and services). That means a whole list of very difficult competitors (Microsoft, SAP, cloud players, etc.). I also don’t think it’s a terribly attractive space if they stay focused on SMEs.

Ask yourself this question: What business is Stone in?

I find it hard to get a simple, clear answer to that question. That is usually an indication that a company is still scrambling, hunting for its business model and/or trying to transition.

Which brings me to Nubank.

Ask yourself the same question: What business is Nubank in?

That’s easy. They are building a digital bank. That’s it.

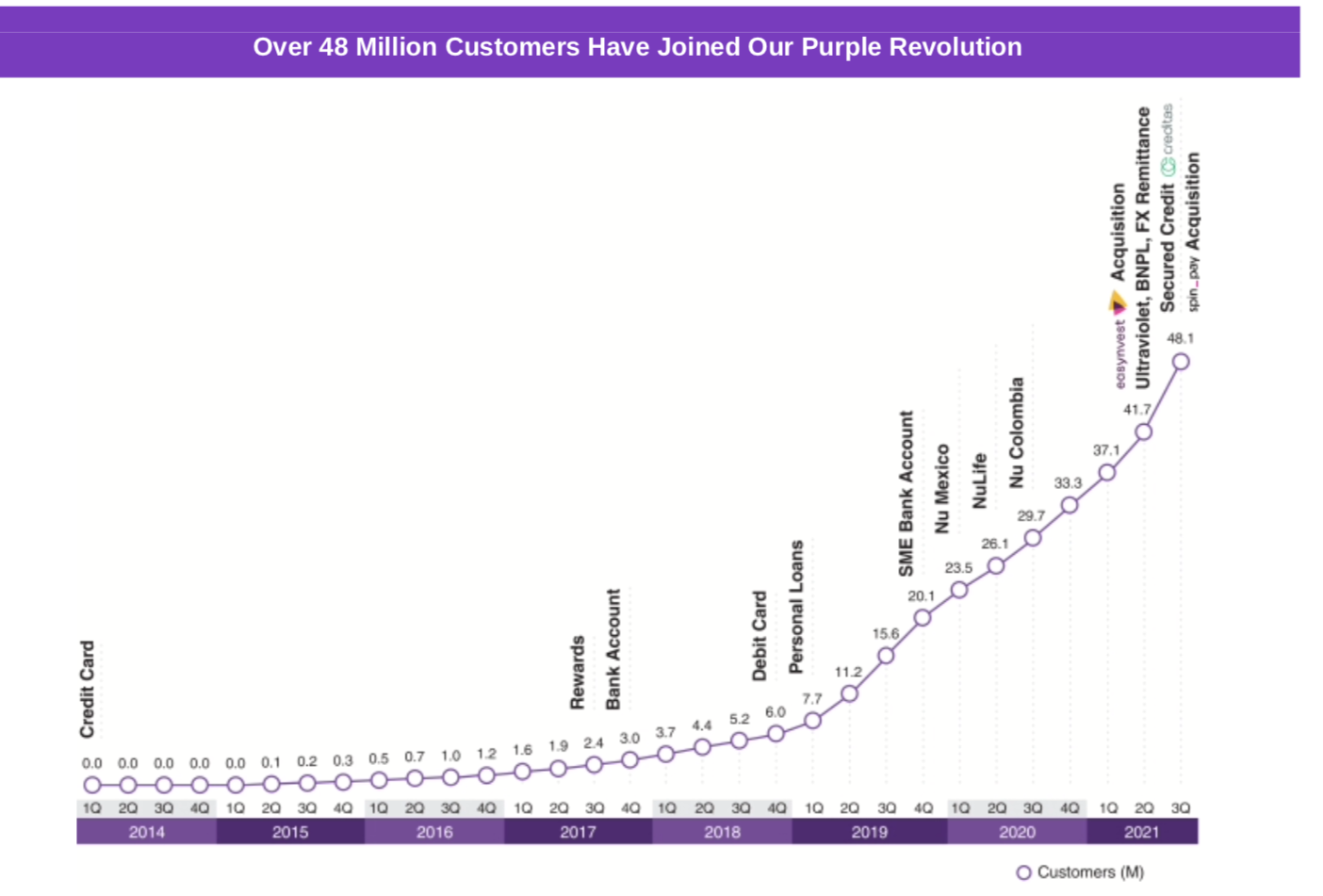

They are building a digital version of a bank. They have focused mostly on consumers thus far. And their product suite is developing along this path. They began by offering credit cards tied to a sleek, convenient mobile app. They expanded into banking accounts. Then they began offering consumer loans. They are also increasingly serving SME as bank clients. And they are now starting to look at wealth management and insurance products. It’s a bank.

Note the below timeline for the company (from their filings).

Nubank is certainly doing lots of tactical stuff. But I don’t see any scrambling in terms of their business model and development path. They are building out the digital operating basics. And they are also building a known business model, with big potential competitive advantages. In my opinion, they are basically copying Ant Financial circa 2016.

Below is my take on Nubank. But, keep in mind, Brazil and Latin America are outside my expertise. I think I understand the business model but I am pretty amateurish in Latin American markets.

An Introduction to Nubank

Nubank was founded in 2013 by Colombian David Vélez, Brazilian Cristina Junqueira and American Edward Wible. They offered a credit card with a mobile app as their core product. And that was a really good pitch to Brazilian consumers who have long been frustrated by a highly consolidated banking sector famous for high fees and poor service. If you haven’t been in a typical Brazilian bank, I don’t know how to describe it to you. I gave up opening a bank account there. Last time I was in Brazil, I exchanged money via a friend to avoid the experience of having to go to a bank. In my experience, Brazilian consumers are some of the most poorly served consumers anywhere.

Enter Nubank’s credit card plus mobile app and you get a big improvement in both greater convenience and lower fees. And you can see them doing this same strategy in most of their products: offer greater convenience and lower fees (often free) versus the traditional banks.

Take a look at the following market description from Nubank’s filing.

So Nubank is using digital tools to create a digital bank with better service and lower costs. That is a standard playbook for digital companies disrupting traditional incumbents. And Nubank has a particularly attractive target in this regard.

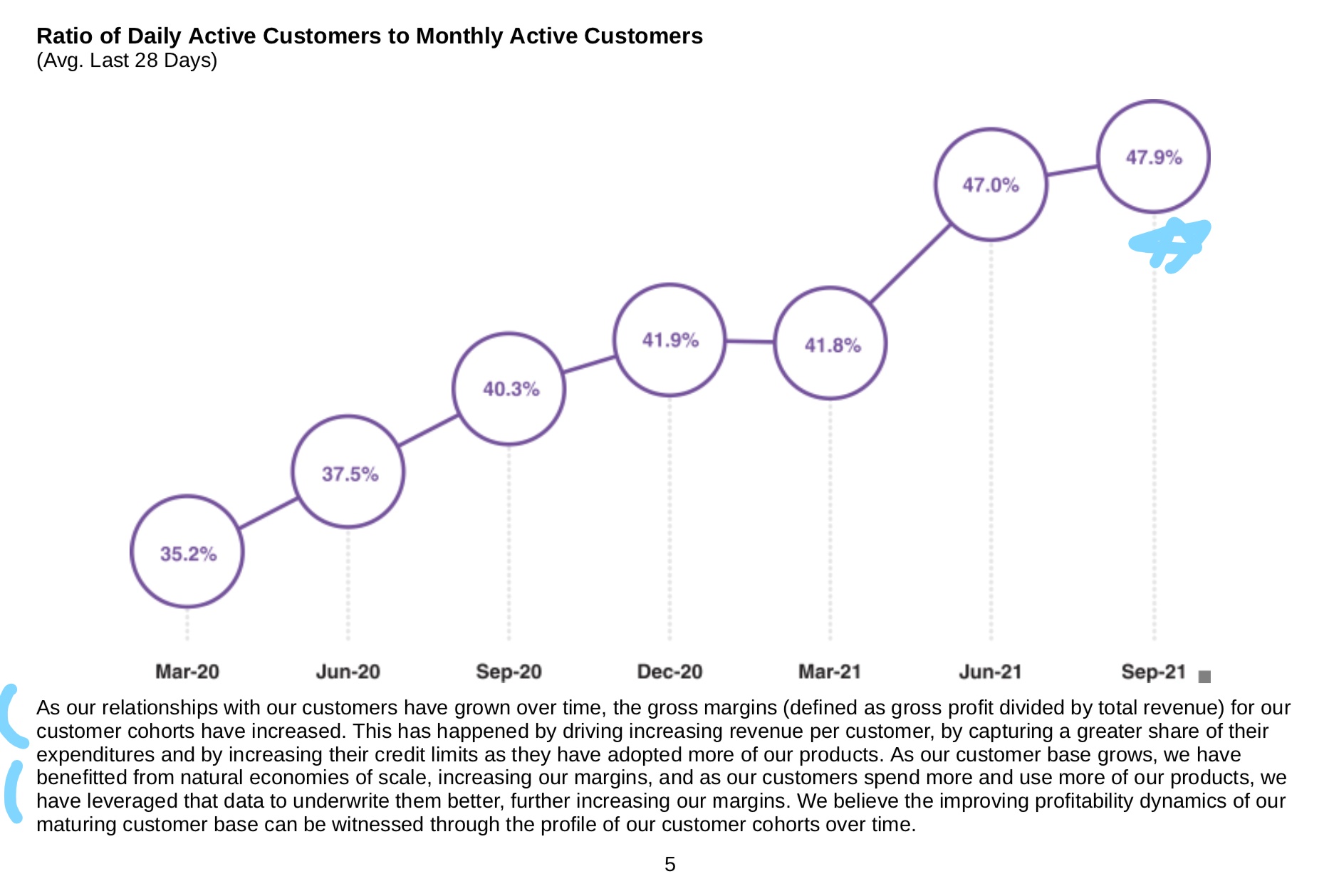

However, Nubank is also building a platform business model. That means their strategy is fundamentally different than a traditional banks, which is a pipeline business. Nubank is not trying to sell a lot of highly profitable financial products (like the banks). They are going for users, engagement, and data. They are platform building. That is a powerful counterstrategy. More on this below.

Ok. Let me get to the business model.

Before I do that, here is some more basic information on Nubank. You can skip to the next section if you want.

Nubank’s revenue today comes from two sources.

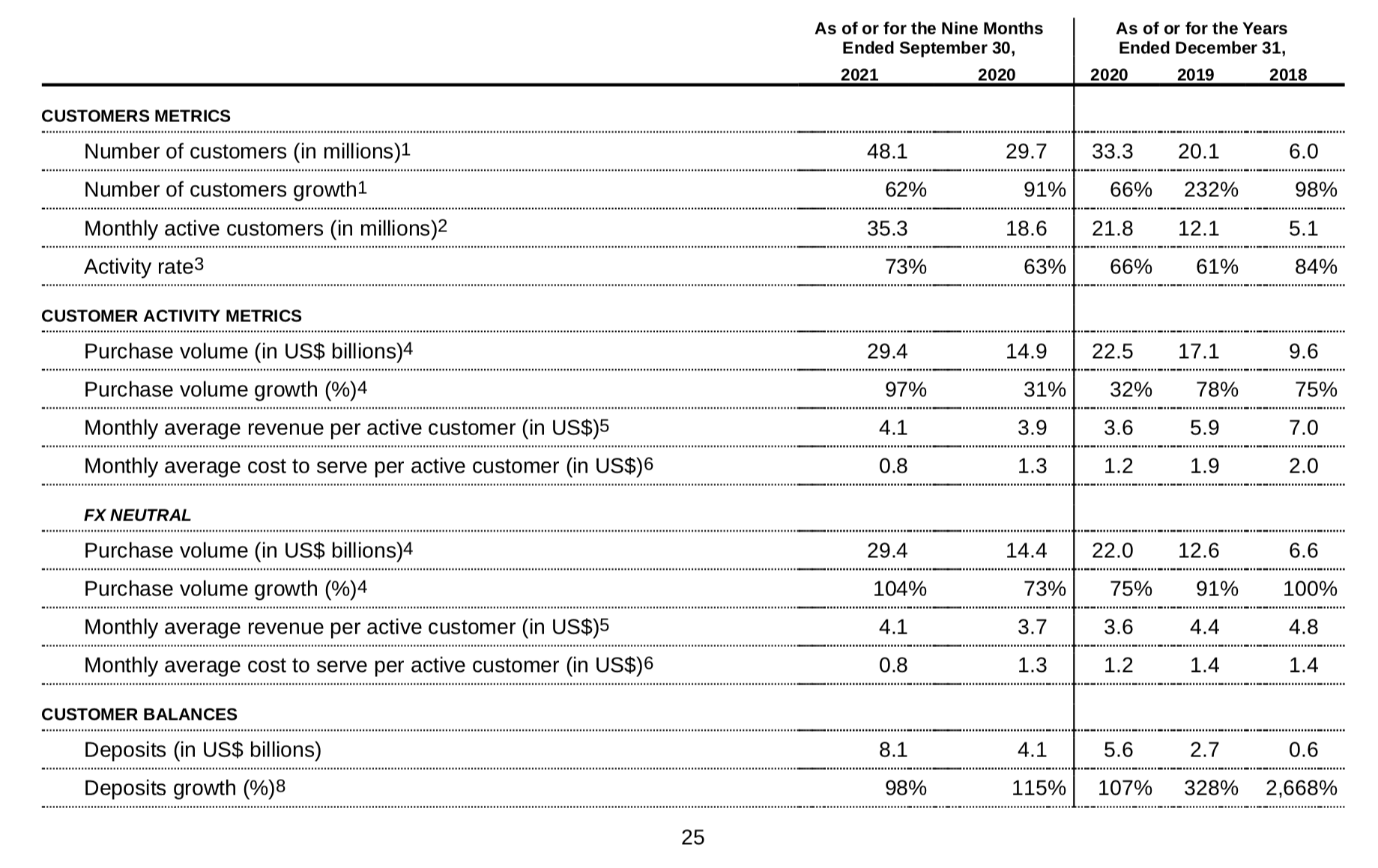

The company is showing growth in activity, revenue, and gross margins.

Nubank’s Business Model is Potentially Very Strong – But Poorly Explained

Ok. Now we’re in my area.

Here is how Nubank explains its business model.

I really don’t like these investment banker graphics for platforms.

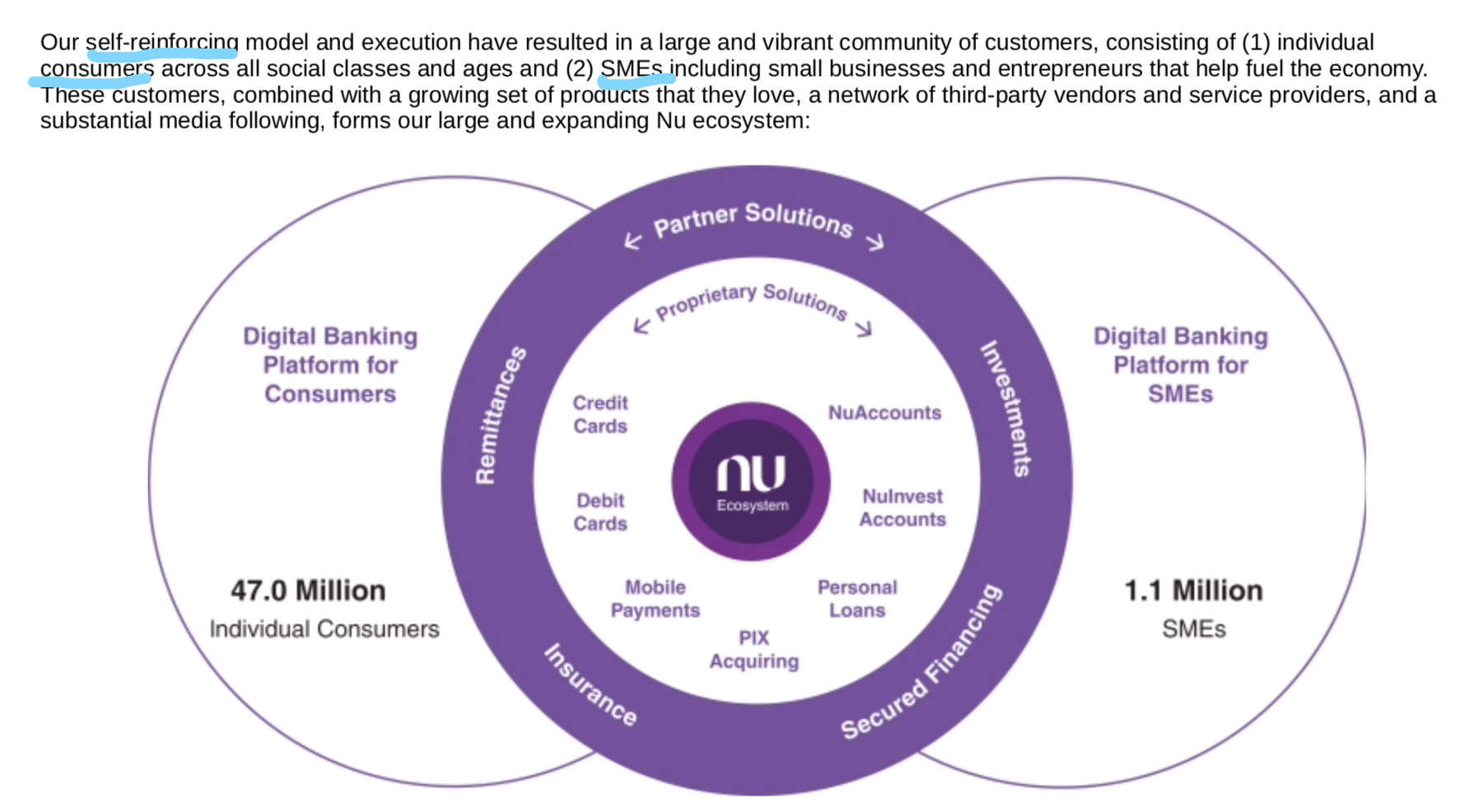

- You can see two user groups identified – consumers and SMEs. The cite 47M consumers and 1.1M SMEs. That’s pretty amazing.

- The company describes itself as a “self-reinforcing model”. That is vague. Ignore that.

What you are really looking at is a payment platform with two user groups. This was built on their initial credit card and mobile payment product. That is the core interaction for the platform strategy. And I really like payment platforms. They have network effects. They can be highly defensible. And they are usually viral, which means they can grow very quickly. They can go cross-border and regional. It’s a great foundation for a digital business. More on this below.

Nubank details a 7 part flywheel that explains its growth.

No, no, no.

This is mixing stuff together. Confusing.

Look at the first three points.

- More customers.

- More engagement and scale.

- More data.

These are the core assets of a platform business model. I put them in the center of all of my blue diamond graphics (see below). These first three points are about growing a platform. Yes, they can help each other. But it’s not a flywheel. It’s just building the core assets or a platform. And payment platforms are very good at this. Especially against traditional businesses.

The next two points are:

- Lower costs

- Attractive fees and rates

These are about achieving and then weaponizing economies of scale.

As you build a digital platform (with no physical branches), you get increasing operating leverage. You can get massive economies of scale in the fixed costs of IT / web services. You can take these cost advantages as profits or you can pass them on to customers as lower fees. That’s what Nubank is doing. They are using digital economics and increasing economies of scale to offer banking products and services at prices traditional banks probably cannot match. And they are flooding money into tech and R&D to push further and further ahead in digital capabilities.

The last point (Better Products and Experiences) is just the digital operating basics. They are turning data into continual customer improvements (DOB2). But you can see them doing the first three.

So this is a payment platform, a well-known business model. And they are focused on building a couple of competitive advantages. Primarily economies of scale and network effects.

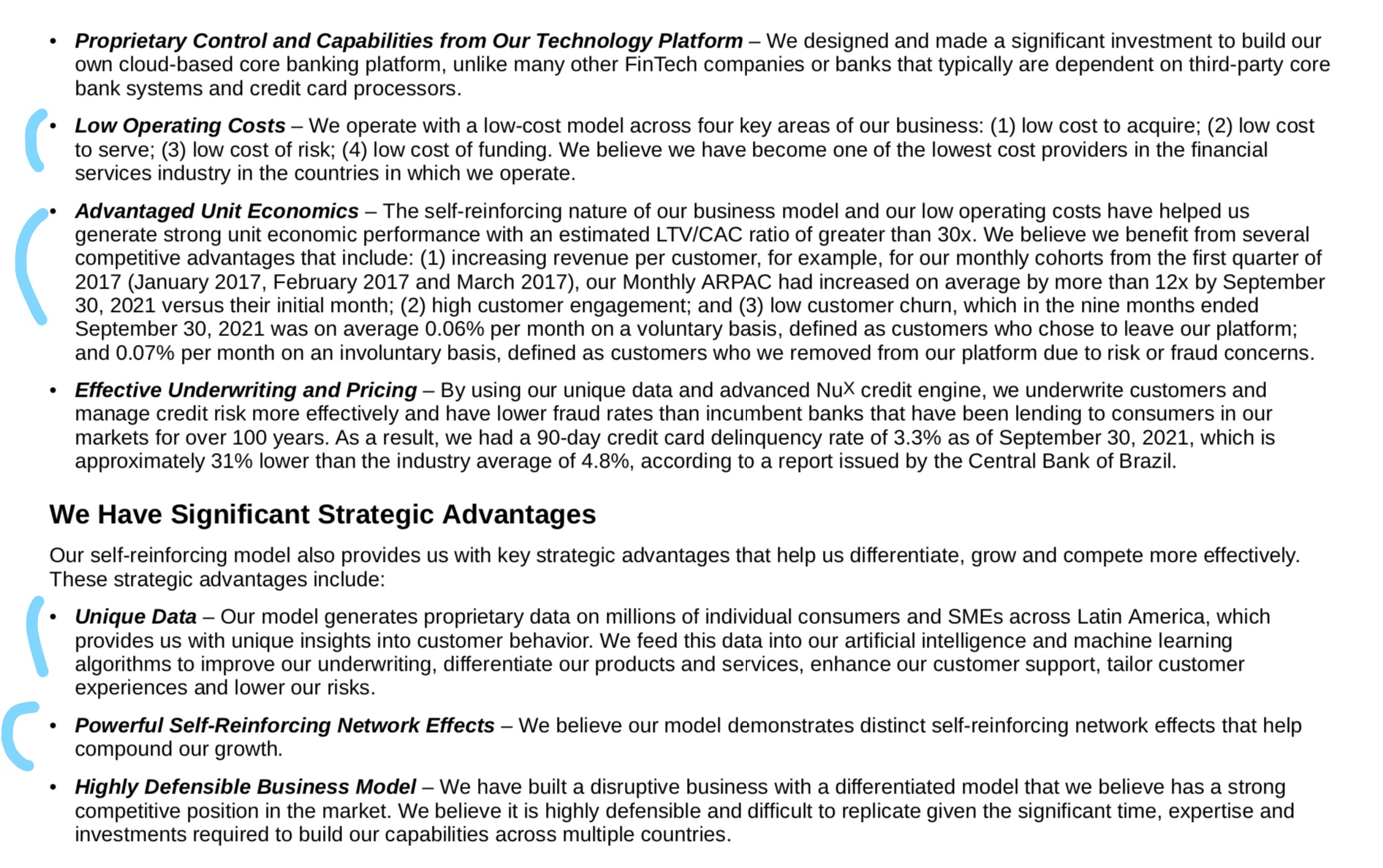

They do mention this in other areas. See the second to the last point below. But it’s all sort of mixed together.

Note:

- You can see they cite their low operating costs and advantaged unit economics.

- They point to unique data, but that is just the digital operating basics again.

- They do mention network effects, which they have. But not as they describe them.

- And finally, they mention a highly defensible business model.

That’s all confusing. There’s a great business model in there. But the language is not helpful.

Here’s my simpler explanation for Nubank.

- Nubank is building a payment platform with additional credit and banking services.

- Nubank is starting to build a marketplace for wealth management and insurance products.

Nubank is basically Ant Financial circa 2016.

That’s it for Part 1. In part 2, I’ll talk how this is just like Ant in 2016. Plus the credit business and what to watch for next for Nubank.

Cheers from Sri Lanka,

jeff

——

Related articles:

- Ant Financial’s Big Money is in Asset-Light Credit Tech (Jeff’s Asia Tech Class – Daily Lesson / Update)

- How Ant Financial / Ant Group is Revolutionizing Finance (1 of 3) (Jeff’s Asia Tech Class – Podcast 47)

From the Concept Library, concepts for this article are:

- Payment Platforms

From the Company Library, companies for this article are:

- Nubank

- Ant Financial

——–

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.