When the SARS virus swept through China / Asia in 2002-2003, it resulted in millions of workers isolating themselves in their homes. And this phenomenon turned out to be pivotal for several, now dominant digital companies. For then small company Alibaba, it created a surge of activity in e-commerce. And for then physical-only retailer JD, it resulted in them trying to sell online for the first time (as their staff couldn’t come into the stores). In many ways, the SARS virus was a leapfrogging event for then nascent digital China.

Today, the coronavirus is causing another isolation phenomenon and this is again impacting digital China. We are seeing a flurry of new behavior and innovations. But this time, China, its digital businesses and the number of people involved are all dramatically larger.

So my question for this article is:

What happens when a pandemic occurs in the world’s largest ecommerce marke? And in the world’s most dynamic mobile application ecosystem?

My answer (thus far) is that I think three areas of digital China are going to be supercharged in terms of usage and innovation. They are public health, enterprise and education. My argument is below.

***

Area 1: Public Health

Mass surveillance makes people uncomfortable for lots of good reasons. Whether it’s video cameras on the streets, tracking online activity or building connection and communication profiles (i.e., metadata). But it turns out system-wide surveillance, big data and AI are really useful tools for tracking and controlling pandemics.

Pandemics and many other public health issues and crisis are, by definition, system-wide phenomena. They require the system-wide collection of information and coordination of activity. And traditionally, this has meant coordinating with hospitals, clinics, doctors and some government institutions. But even in advanced healthcare systems like the US, system-wide information collection and activity coordination is not terribly effective. And in the case of coronavirus, it is even more difficult because the infections are contagious for +10(?) days before symptoms appear. So a lot of the transmission is happening on the streets, in metros, in restaurants and in other locations outside of the medical system.

But digital China has surveillance with video cameras, temperature sensors, online tracking and facial recognition. And these are all linked to AI in the cloud. It turns out this is really effective in this case.

- Video cameras across China could screen for temperature almost everywhere people are. In the past month, Baidu and Intellifusion have been using their AI systems at temperature checkpoints at railway stations and airports. These cameras can (in theory) reduce contagion. And they can definitely reduce waiting times.

- Camera and AI systems by companies like Megvii are already the world leaders at identifying individuals via facial recognition.

- AI, big data and data analysis can track interactions between people. So connections between people and transmission can be studied.

- AI, big data and data analysis systems can also look back in time from an identified case to analyze the individual’s locations and interactions. For example, Qihoo 360 has announced plans for a tool that lets users check if they have recently traveled with someone who contracted the coronavirus. The data apparently can both be self-entered and drawn from the government systems.

A less spooky public health tool is Alibaba’s new global sourcing platform for medical supplies related to coronavirus. This is a B2B platform that matches medical suppliers with the most urgent needs. Here is the description from Alibaba:

“Alibaba will post the specifications of needed medical supplies, including types, models and quantities of products, based on information collected from hospitals and local authorities. Suppliers can provide information about the products they can offer. Once the supplier is verified and the goods [are] certified as an acceptable match, Alibaba will begin the procurement process.”

***

Area 2: Enterprise Saas – Especially Communication / Collaboration Tools

Last month, I attended the WeChat Open Class (article here and here. Podcast here) and one of the discussed initiatives was WeChat Work. This, and Alibaba’s Dingtalk, are the market leaders for collaboration and communication tools within companies in China. But these are only a few years old and China has really lagged the West in B2B and digital enterprise. The West has spent the last 30 years putting ERP and other IT systems into companies so the adoption of digital tools has been faster.

But we are seeing digitization within Chinese companies, especially those that tie to e-commerce and the consumer sector. There is lots of activity in merchants and brands and in logistics. And in financial services. We also see lots of digital initiatives in communications with customers (especially in CRM). But still, the adoption on the enterprise side of digital China has been gradual, not like in B2C.

But now we have a huge portion of the Chinese population trying to work from home for the first time. And companies are trying to figure out how to solve this problem. Unsurprisingly, WeChat Work and DingTalk have been flooded with users and activity. And video conferencing has had huge uptake.

Some factoids:

- Alibaba announced that employees from more than 10 million corporate organizations were working from home on DingTalk last week.

- 36kr reported that the number of users on the Dingtalk app exceeded 200 million.

- Huawei’s WeLink and ByteDance’s Lark are also reporting big increases in usage, with some reports of crashing.

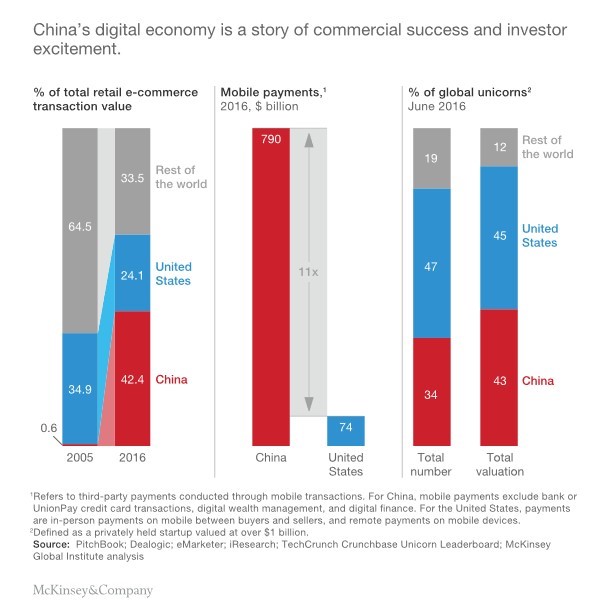

Take a look at the below graphic from a McKinsey & Co report on the huge size of digital China.

Look at the change in the red bar on the lower left. Chinese e-commerce is massive. Now imagine all those people (and their purchasing) sitting at home struggling with how to work. On the enterprise-side, we’re seeing a surge in both adoption and in innovation. For example:

Look at the change in the red bar on the lower left. Chinese e-commerce is massive. Now imagine all those people (and their purchasing) sitting at home struggling with how to work. On the enterprise-side, we’re seeing a surge in both adoption and in innovation. For example:

- DingTalk has introduced a beauty filter so you can make video calls without having to put on make-up. Basically, you can look good while working from home.

- WeChat Work is starting to offer telemedicine services and free online training to hospitals and schools.

- WeChat Work has increased the maximum number of meeting participants for its video conferencing service to 300 people.

Overall, I think we are seeing B2B being supercharged in both usage and innovation. The areas I am looking at the most are:

- Customer sales and CRM. Basically, how can companies keep selling and not lose revenue.

- Team collaboration tools. How can the work keep getting done.

- Any really big government, corporate and SOE contracts for B2B digital tools.

***

Area 3: OMO Education

Edtech has been a frustrating area of digital China. On the good side…

- It has a great consumer story, with Chinese families spending more on private education than any other group on the planet. And education is revered – with everyone trying to get into the right schools and give their kids an edge.

- It has some interesting digital natives like VIPKid and LAIX.

- It has some established companies going digital, like TAL and New Oriental (sort of).

But it hasn’t worked out like people hoped.

- There are big regulatory headwinds with the government having mixed feelings about private and online education. Plus the K-12 and college systems are overwhelmingly state-run and are notoriously slow technology adopters (not uncommon in public education).

- There is also an efficacy problem with AI-driven and online education. It’s not clear how well these approaches work and most parents are preferring to go with proven methods of teaching.

My working hypothesis is that online-merge-offline (OMO) education (both public and private) is the right business model. I think there are still going to be lots of students sitting in classrooms and lots of teachers. But there will better digital tools for both teachers and students. In the private sector, I think TAL is the best example of a mixed online-offline solution at this point.

Enter the coronavirus, which has forced everyone to stay at home. The Ministry of Education is now aggressively rolling out live streaming and other digital tools as fast as they can. Millions of students are starting to watch classes online for the first time time. And tens of thousands of teachers and school administrators are learning how to live-stream and run their classes through smartphones. We are seeing a huge jump in adoption of existing tools by education institutions (public and private). Because they have no choice.

And just like in B2B, a surge in innovation should follow this surge in adoption and usage. How many edtech startups in China are being founded right now? How many big government contracts for online classes and digital tools are being signed this month?

***

That’s basically my take. We’ll see how it plays out.

Thanks for reading, – jeff

———-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.