It’s Singles’ Day 2019! Woooohooooo!!! I am doing a little dance here in my hotel in Hangzhou. I look ridiculous.

Singles’ Day launched at midnight last night and I was at the media center in Hangzhou for the opening (see above photo). And I spent yesterday with the Alibaba team getting a bit of a tour. A brief recap.

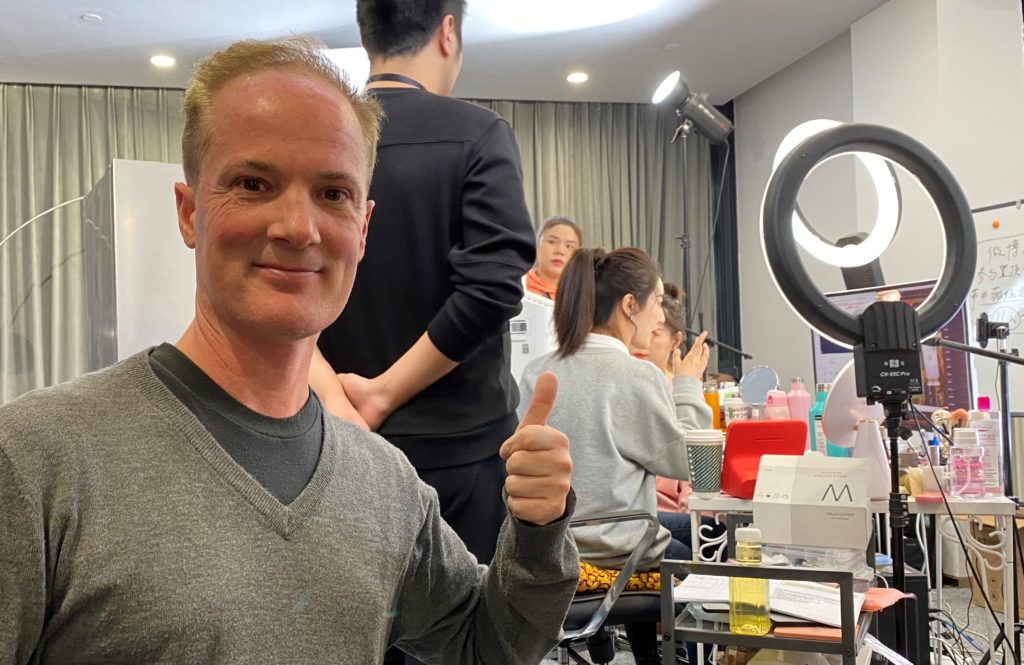

We visited the Alibaba Livestreaming Center.

Content is increasingly driving ecommerce. Especially as consumers’ expectations move beyond just buying stuff at discounts. It’s increasingly about education, authenticity and relationships. And live-streamers are great at this.

We visited China’s #1 celebrity live-streamer Viya, who recently helped Kim Kardashian launch her products in China. This is a young woman who can sell tens of millions of dollars of goods in a day. A couple of photos from her studio.

We also went to the Intime center and met with the CEO.

Department stores are a pretty interesting frontier in new retail. We now know what supermarkets, hotels and convenience stores are going to look like in an online-merge-offline (OMO) world. But department stores are still in sort of an experimental phase. I’ll be writing about this soon. But the big digital levers appear to be

- Increasing efficiency by digitizing operations

- Moving the customer relationship to a mobile app

- Using on-demand delivery to effectively extend the store to a 3km radius.

And today is going to be packed. Meetings with President Michael Evans, CMO Chris Tung (who arguably has the coolest job in China), a brand panel (L’Oreal, Mondelez, Nestle, Allbirds) and a visit to Flyzoo hotel.

I’ll be writing all this up. But I’ve also been carrying around a list of questions I am trying to answer (see list here). But I thought of a couple more. So I thought I would throw them out to the wisdom of the crowd. All thoughts / comments / feedback appreciated.

Question 1: How do you measure the success of a brand or merchant on Singles’ Day?

If you view Singles’ Day as just a sales opportunity, it is not all that interesting. So company XYZ sold a lot (by offering a lot of discounts). Ok. fine.

But if you view Singles’ Day as a brand-building day, then it is much more interesting. If you view it as an opportunity to gather data, that is interesting. Or an opportunity to identify new customers? Or to launch a new product? Those can be a big deal.

So how do you measure the success of a brand on Singles’ Day? I’m not sure yet.

Question 2: How much brand value is going to be created (and lost) in the Alibaba ecosystem on Singles’ Day?

If Singles’ day is the “Olympics of brands”, then there are going to be winners and losers. Are brands and merchants competing for sales – or are they fighting for the value of their brands?

How much brand value can be created in the Alibaba ecosystem on Singles’ Day? And keep in mind, lots of companies are mostly about their brand value and not the product itself (ketchup, detergent, etc.).

This brings up the interesting question of mass-market versus long-tail brands in a digital world. In the past, big, mass-market brands used to win by outspending their smaller competitors in mass-market channels. So they pay big bucks for ads during the superbowl or on the nightly news.

But e-commerce lets you target specific niches with ads. This can be very helpful to smaller and niche brands that can’t compete via overall brute spending power. So how much brand power is created by the giants and by the smaller niche players today?

Alibaba is doing what it has always said it was going to do. It is creating digital tools that empower SMEs and level the playing field with the big companies. This is, of course, great for consumers. And Singles’ Day absolutely depends on a big supply of major brands and products competing (hello discounts). But I’m looking for how much brand value can be created in mass-market and niche categories.

Question 3: How much R&D and product development is going to done with data-rich services like the TMall Innovation Center?

The TMall Innovation Center (TMIC) is a service that really got my attention. They have tremendous data tools so it’s natural that brands would start working with them on product development. For example, last year Mars launched Spicy Snickers (pretty good), Listerine launched Rosemary Blossom mouthwash (not bad) and Oreo launched wasabi flavored cookies (no comment).

The evolving relationship between Alibaba and merchants / brands is fascinating. It started with creating connections and enabling transactions in a marketplace. It evolved to include logistics and delivery, thereby improving their service, speed and capabilities. Payment and credit were also added.

But if uni-marketing is brands and merchants working with Alibaba on their marketing, customer acquisition and engagement, TMIC is a service that moves Alibaba firmly into product development and research and development. That’s really interesting. Are we going from retail-as-a-service to product development-as-a-service?

Question 4: What does a winning logistics network look like in China?

E-commerce in 2017 was about groceries and fresh (i.e, perishable) food. And it immediately raised the problem of the supply chain. How do you supply a big country like China with fresh, perishable food?

And then new retail came along and the retail footprint became part of the solution to this problem. The retail outlets can also function as nodes in the logistics network. And as they are close to people’s homes, you can push inventory much closer to people, whic means faster delivery (very important in China). It’s a change from the traditional hub-and-spoke logistics networks.

Alibaba has been building a national retail plus logistics footprint. Freshippo, the grocery artist formerly known as Hema, is getting them 100-200 stores. They also bought RT-Mart which got them another 400. So they’re up to let’s say +500 locations. I suspect they are trying to get to like 800 retail outlets, that let them be within 3km of most people’s homes.

But what does a winning national logistics plus retail network look like?

And as the logistics IoT system is built into this network how much of this is going to operate like an open and increasingly intelligent operating platform? We have a good picture of the smart retail systems being built in supermarkets and such. But the intelligent logistics network that supports all this is much less clear.

Question 5: What else is going to work in local services?

Daniel Zhang has called on-demand delivery the “infrastructure of new retail”.

That makes sense. You can deliver quickly and consumers love that. You effectively expand the sales floor from the store itself to a 3km radius around it. You can also order more as you aren’t limited by what you can carry. And you can expand from delivering groceries to other things like OTC and prescription medicine.

But I’m still not clear what is going to work in local services beyond just delivery. Buying movie tickets? Dinner reservations? Massages? Food preparation plus delivery? Beauty treatments? Medical appointments? Home renovation? Visits from your accountant?

New retail plus delivery is letting companies expand from products to products plus services. And Alibaba is slowly but steadily becoming the ultimate B2C marketplace. But I still don’t really have a good sense for what these local services are going to look like.

Question 6: Do all content roads lead to e-commerce?

Bilibili has partnered up with Alibaba. Yet another content-focused company is retreating to e-commerce revenue.

The more I read through the financials of the various content / video / livestreaming companies in China, the more pessimistic I am about advertising and gifting as revenue models (unless the content is overwhelmingly user generated). There are some exceptions to this. Music streaming (iQiyi and Tencent Video have ok financials) and online gaming are generally good if you have the right titles. But most of the other content sites seem to be in poor financial shape.

E-commerce does seem the best solution to the financial problems of content creators. Content does drive e-commerce in a powerful way. No question about it. And it is particularly powerful in a country that is skeptical of advertising and corporate information. KOLs, word of mouth and other types of authentic and personal content are important. I think post-IPO most of these content-creation companies are going to turn to e-commerce.

***

Off to meet our group and do some touring. More info on the way.

Final factoid: In 2018, Cyber Monday in the USA had $7.9B in sales. Last night, Alibaba reached this amount in the first 15 minutes.

Cheers, jeff

——

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.