The Chinese beer market looks similar to beer markets in the rest of the world – mostly regional markets mostly dominated by a few giant beer companies.

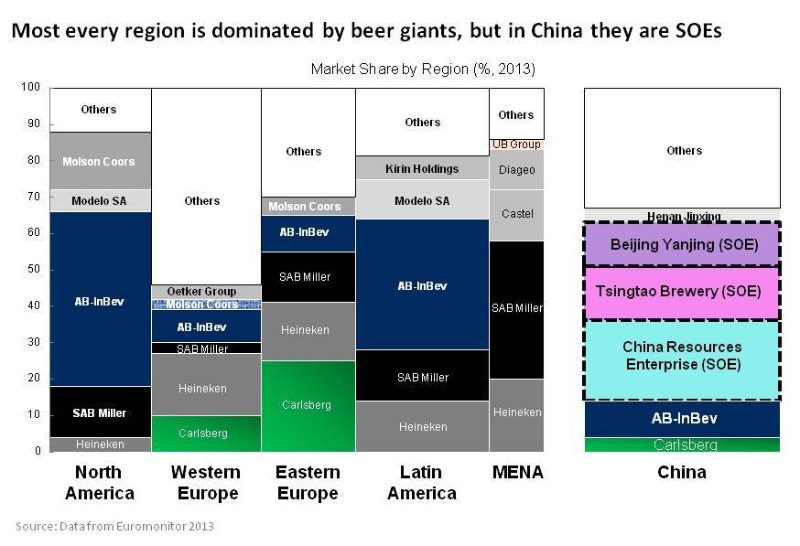

But take a look at the below chart from 2013. You’ll note that China evolved with one big difference with the rest of the world: The dominating beer giants (Tsingao, Yanjing and CR Snow) that emerged over time in China are all State-owned companies.

(Chart by Patrick Pfeiffer)

That raises an interesting question. How have the domestic SOEs won in China against virtually all the foreign and private companies? Beer is not really an active government industry. In fact, the Chinese government seems to not care much about the beer industry or who wins in it.

But Chinese beer, an industry in which the State has little interest beyond perhaps protecting a few brands, has ended up being dominated by State-owned companies anyways. And while these companies are State-owned, they actually operate almost entirely commercially and without any active government support. It’s weird.

How this situation evolved in China has some important lessons about international capitalism versus State capitalism. Here’s my explanation for this.

Starting in the early 1980’s, the Chinese beer industry began a big national consolidation. There was a rolling up of the many State-owned and State-run breweries that had been built in virtually every city over the previous 40 years.

And it turns out that State-owned brewers like Tsingtao are a lot better at acquiring other State-owned breweries. Maybe it was because they were already on the ground and of significant size? Maybe they just got the deals easier? Maybe they got the regulatory approvals faster? Maybe they were fairly good at post-merger integration? My theory is that as the beer industry consolidated, SOEs had certain strengths in doing these deals, in financing them and in getting them approved.

These strengths proved decisive over time. SOE brewers got bigger faster than their more nascent private and foreign rivals. And in beer, being bigger regionally creates real competitive advantages (i.e., local economies of scale in production and distribution). Getting to regional scale first is how you win in beer.

I call this China phenomenon the “EZPass lane”. For those not familiar with EZPass in the US, it’s an radio frequency ID tag for cars that lets you drive through toll booths without stopping (you get billed automatically).

I often think of business in China as a series of highways covered with toll booths. You drive about a mile and then you have to stop at a toll booth. You wait for the person to let you through. And usually you pay a fee. Then you continue on and likely hit another tollbooth pretty fast. In some sectors in China, you are constantly operating in this way. And the more active the government involvement, the more toll booths. You must stop to get approvals to use your money, to open a new branch, to file taxes, to pay business expenses, to hire staff and for lots of other things. China is often rightfully referred to as a “nation of licenses”. It’s also one of the reason guanxi (i.e., knowing the toll booth operator) matters.

But if you can get your approvals faster than your competitors, you can sometimes have a real advantage. You can open branches faster. You can get your pharmaceutical or OTC vitamins approved faster. You can bring goods into the country faster. You can access loans easier. And, in the case of beer, you can do SOE mergers and acquisitions faster. It’s like having an EZPass lane at the toll booth. You go through a fast lane while everyone else waits in line.

My theory is that Chinese beer SOEs had an EZPass lane in a consolidating beer market, relative to private and foreign companies. In many industries, this strength wouldn’t matter (i.e., operating restaurants). But in acquiring SOE breweries in a rapidly consolidating beer industry, it made a decisive difference.

So this, plus a first mover advantage, is my explanation for how commercially-focused SOEs came to dominate beer in China, despite any real government interests in the sector. It has not happened through explicit licensing or government-granted competitive advantages, nor through any particular policy. It was a unique SOE strength that happened to make a difference in this particular situation. A soft “EZPass advantage” and a head start enabled the creation of a real competitive advantage (i.e., economies of scale) over time.

I also think this is a good reminder that commercial SOEs can compete and win in private markets.

Finally, it is worth noting that China Resources Enterprise has now bought the 49% of CR Snow that was owned by foreign giant SABMiller. This was a condition of the AB-Inbev and SABMiller merger and gave China Resources 100% control of the #1 brand in China (Snow beer) and the world. This increased SOE dominance of Chinese beer even more.

Thanks for reading. – Jeff

Here is Part 2.

——–

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.