This week’s podcast is about Xiaomi and ongoing strategy changes and moves. This is a good case for my 6 levels of digital competition. It takes apart the situation fairly effectively. And Apple and Amazon provide good counter-examples.

You can listen to this podcast here or at iTunes and Google Podcasts.

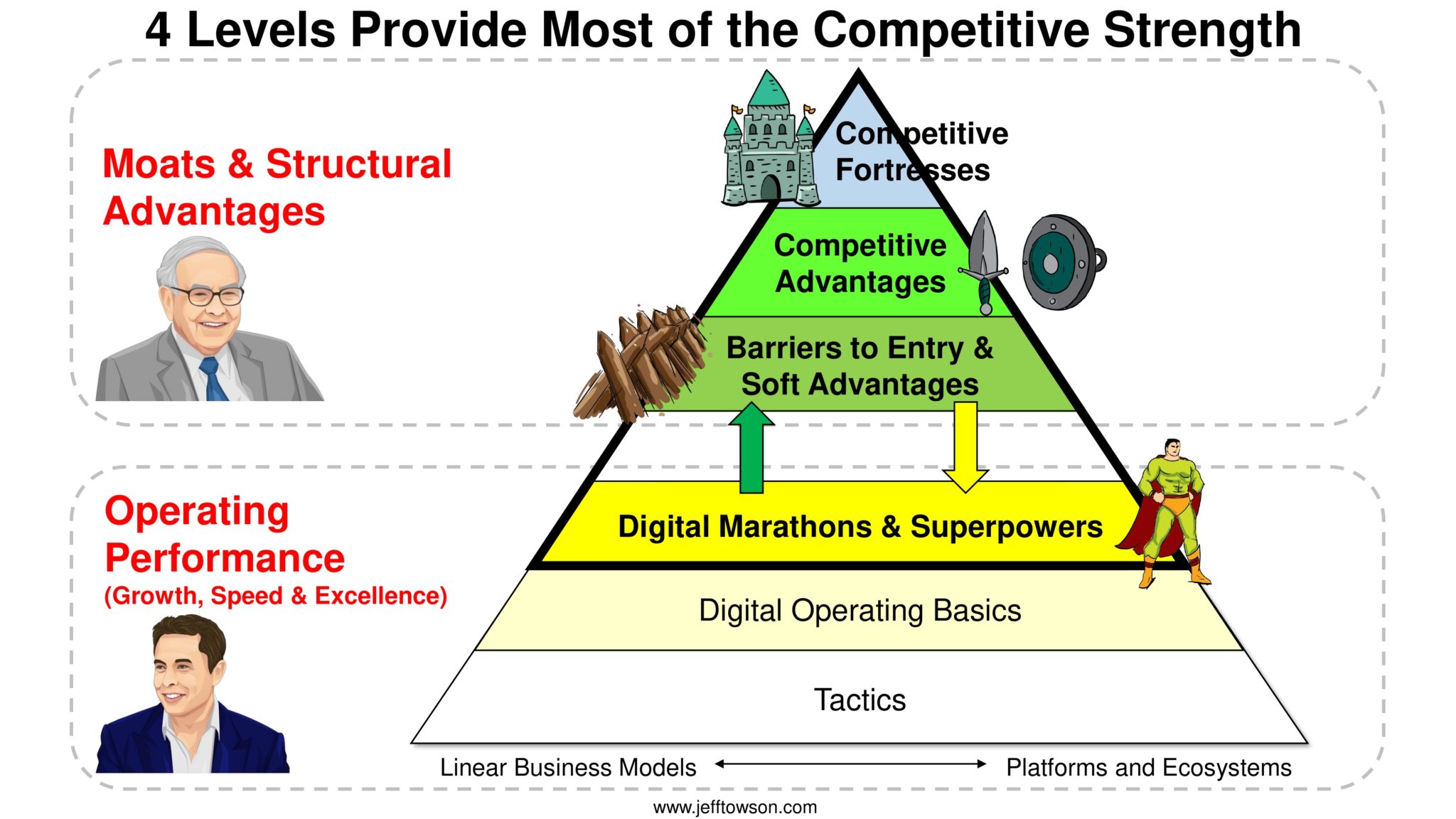

Here are 6 levels of digital competition.

Here’s Amazon strategy description (from 10k).

—–

Related articles:

- Why I Really Like Amazon’s Strategy, Despite the Crap Consumer Experience (US-Asia Tech Strategy – Daily Article)

- 3 Big Questions for GoTo (Gojek + Tokopedia) Going Forward (2 of 2)(Winning Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- 6 Levels of Digital Competition

- SMILE Marathon

From the Company Library, companies for this article are:

- Xiaomi

- Amazon

- Apple

Photo by Zana Latif on Unsplash

——-Transcription Below

:

Welcome, welcome everybody. My name is Jeff Towson and this is the Tech Strategy Podcast where we dissect the strategies of the best digital companies of the US, China, and Asia. And the topic for today is Xiaomi. More specifically, what Xiaomi should learn from Apple and Amazon about strategy. And Xiaomi is a really cool company. I really think this, I don’t think people pay nearly enough attention to Xiaomi. For no other reason, they have one the best management teams in tech anywhere. But at the same time, you know, they have had strategy after strategy after strategy, you know, for going on almost a decade now. So there’s a very interesting contrast between very capable management and this sort of uncertainty about where they’re headed. And I think Apple and Amazon literally have the exact opposite scenario. Maybe the management is not awesome, although Amazon’s pretty good, but everyone knows exactly what they’re doing. what they’re doing and yeah it really does work spectacularly well. So there’s kind of an interesting strategy question that cuts all across this. So I thought that would be the topic for today. Now for those of you who are subscribers, I’ve been sending you out a couple articles this week about AI, artificial intelligence, how to think about that. I’ve gone through this before, but it was a couple years ago, so I wanted to kind of touch on that again and just sort of think about how to lay it out. When I think about strategy business models, I mean, it’s hard to ignore the fact that AI is probably the biggest tool in the toolkit. I mean, it really is, if anything is number one, this is it. So sort of fleshing that out a bit more. And we’ll probably spend out more of that in the next day or so. For those of you who aren’t subscribers, feel free to go over to JeffTowson.com. You can sign up there, free 30 day trial, see what you think. And let’s see, standard disclaimer, nothing in this podcast or in my writing or on the website is investment advice. The numbers and information for me and any guests may be incorrect. The views and opinions expressed by me may no longer be relevant or accurate. Overall, investing is risky. This is not investment advice. Do your own research. And with that, let’s get into the topic. Now, as always, there’s always a couple key concepts for this, the concepts for today. Pretty basic stuff, six levels of competition, digital competition, and the Smile Marathon. And that’s sort of, you know, I’ve been talking about this forever and that’s straight out of my books. But I think this is a really useful framework for just running through Xiaomi and coming to a pretty, I think, obvious conclusion on what’s going on and what’s the problem. And that is my sort of go-to framework for just assessing the strategy and business model of a works out pretty effectively in this case. Okay, and I’ll talk about what those are. I mean, first thing to do is, you know, just sort of look at the history of Xiaomi in terms of strategy. Now, I’ve talked about them before. I’ve gone through the early history with Lei Jun coming out of Kingsoft and how he launched this. And, you know, it’s really, really cool history. But the takeaway from that, which you can find in the company library, is that this is one of the best, most capable management teams out there in tech. I mean, this is not a one hit wonder. This is not, hey, they came up with Facebook in the early 2003, four, and that’s pretty much all. No, this is like 10 cent. And Amazon, I’d put in the same bucket. It’s one success after another. And when you see that multiple times in multiple tech paradigms. You know, that’s a pretty impressive team and I think they definitely have that The other way I talk about this is like who am I afraid to compete with? Well, I’m afraid of competing with Lei Jun and his team. I absolutely am and I’m afraid of Amazon I’m afraid of ten cent. I mean there’s certain teams like you just don’t want to get in the ring with them Find someone else who’s not nearly as good My standard joke for students is, you know, how do you win at tennis? If you want to win at tennis, how do you win? And, you know, you can train and you can do all that stuff. The easiest way to win at tennis is just play with people who suck. Like that’s your best strategy. It makes life a lot easier. This is the opposite of that. This is, you know, an impressive team. Okay. So we look at the history of Xiaomi and this is from, a Hong Kong University Business School case called Xiaomi at the Crossroads or at a Crossroads. I was doing this with some students a couple of weeks ago and I thought it was really just kind of a nice history. So I’m gonna pull some factoids from that. But basically, I mean, you can map out, let’s say five to six different phases and or strategies that we have seen come out of Xiaomi. The first one is sort of, you know, just the early years, which is, you know, they were at the very beginning of smartphones in China, 2009, 2010. You know, Lei Jun was already a rich person. He had kind of stepped down from Kingsoft. And you know, he was working with people figuring out what’s next. And he sort of decided that smartphones were going to be the big thing. And he was totally right. And within that, he decided like e-commerce entertainment and some other things were the place to be. And again, he was right. And within that, you know, they, they were an early mover. which is a good tactical move, into the rise of Chinese smartphones. And back then there was some iPhones and basically Samsung in China. They dominated the market. Foreign smartphone makers were about 80 to 90% of the market. And then Xiaomi was really one of the first and it’s not a surprise. They looked a lot like the iPhone but they were much cheaper. He was wearing black turtlenecks and everyone’s like, I think he was copying the business model somewhat, or at least the product, and they rode a tremendous wave. I mean, they just caught this wave, they launched it up. Very, very impressive that we could call that phase one spectacular success. Everyone’s like, Oh my God, this is like the great, you know, Chinese tech company that’s rising. You know, that’s probably phase one. first mover catching a very powerful wave. A couple years go by and Huawei, Vivo, and Oppo, which is sort of the other Chinese smartphone manufacturers all appear on the screen. And yeah, they really took down Xiaomi pretty dramatically. You know. Xiaomi was the market leader. They basically got taken down and they were basically just doing the same thing Xiaomi did to Apple, which is like Apple’s a great phone. We’ll make you a cheaper one. Huawei, Oppo, and Vivo did the same thing. We’ll make you a basic smartphone that’s good but much cheaper than Xiaomi. So they sort of cut them off at the legs. Pretty standard China strategy stuff. They also did real well where… Xiaomi was doing some clever stuff where they were selling only online. They had a big fan following. They were doing these sort of flash sales where they would announce and they would sell out all the available phones. Well, OPPO and Vivo in particular, you know, they focused on retail locations and working with the person at the point of sale. That that turned out to be pretty good. But anyways, that’s kind of the first years everyone thought all Xiaomi’s in trouble. And then they rejiggered, they redid their strategy. They came back in a fairly impressive way, fought their way back into the top five of Chinese smartphones. And then they also went international around the same time. And they pretty much did the same thing they did in China. You know, if China was the first wave of these smartphones in a developing economy, well, there was other waves. India, Indonesia, Latin America, Brazil. They kind of caught the waves in all of them with the same strategy. They did make some headway in Europe as well. That was all very smart. And along the way, they started expanding into other smart devices, smart home, smart air conditioner, and people started to talk about them like an ecosystem and an IoT ecosystem and other things like that. grinding along. The latest thing is now they’re going into electric vehicles. So I mean it’s been a pretty dynamic company over the past 10 years. They move, right? I mean they really do move and launch and execute very very well. Okay, so let’s just look at that through the strategy angle lens. Well, we can see, let’s say, seven, six to seven different strategies. First one, you know, fan fueled growth against an early mover position. Fan fueled growth is really what they were doing in those first years. They had these super fans. Um, they were communicating with them online. they would use them for a lot of very rapid feedback. So, you know, they were making handsets, but pretty much everyone on the Xiaomi team came out of a software background. In fact, their weakness was probably hardware. but they would work with their super fans and they would, you know, they were iterating and launching updates and features to their software every week. And they were getting a lot of feedback from their fans. And so there was this real, I mean, we see this in gaming all the time, where you launch a simple version of the game and you immediately start getting feedback from the players and then you launch feature like daily sometimes, usually it’s every couple days a week. So they were doing these sort of Xiaomi fans carnivals. They were doing launch parties. They were doing these sales events where you know, meet they call me fans Xiaomi would wait for, you know, front of their computer screens to get the new launch dance parties performances, variety shows, lucky draw. I mean, they were just really good at this. Okay, so that was a big part of what they did early days, strategy wise, and outside of that, they also kind of used a very lean model. Let’s be cheaper than say Apple, Samsung at that time. Okay, so they don’t have stores. They don’t have physical stores. They were selling online, very, very. cheap way to do that. They outsourced most of their manufacturing to others. I mean, there was more integration there than say Huawei, OPPO, and Vivo, but they were definitely sort of focusing internally on software and marketing more than anything else. and they were kind of called like the budget smartphone for a while, then they eventually sort of became mid-tier brand, you know, but early days against Apple and Samsung, they were kind of the budget king. And then underneath their Xiaomi phones, they launched their Redmi phones, which were, you know, stepped down, cheaper, Redmi phone, you know, 1,200 kuai, so you’re talking $100, $200, something like that. So early days we saw sort of certain strategic moves, fine. Then we start hearing the triathlon model more and more. And the triathlon model was we’re gonna make hardware, software, and services, that’s what we’ll do, which is exactly what a lot of these hardware companies do. That’s exactly what Apple does. The difference, of course, being that Apple monetizes the hardware. We’ll send you a 700, 800 thousand dollar phone, but we don’t really charge you for all the apps in the store. We don’t charge you for most of that. And, you know, historically they have not made a lot of money on services like cloud, things like that. They’ve shifted much more in that direction. A couple in the last couple of years, but that’s never really been Apple’s strong suit. of. great user experience on a well-made device. You know, the software meets hardware into one smart device in your pocket. And that’s what they monetized and did well. Okay, Xiaomi did a little bit of the opposite. They basically, and I’ve talked about this before, they came in with, we’re gonna sell our handsets at three to 5% gross profits, and we will monetize on the software and services, which, you know, they didn’t really do years. They’re doing it more now. They’re making more profits now, but that was kind of their triathlon model. Hardware plus software plus services. So, okay, early strategy. We started hearing something about, they call their IoT ecosystem. This was kind of like 2013, 2014, and Xiaoleijun starts talking about Xiaomi’s going into the internet of things. We’re not just smartphones anymore, we’re gonna build an ecosystem of connected devices that all link in with your phone, and they start sort of investing in a lot of these companies, headsets. air conditioners, fans, they have smart backpacks. I mean they got stuff all over the place. Now we see more of that today. You know Apple’s doing it somewhat, not very much. Alexa, Google, all of these companies are doing it today. Alibaba is in there. But back in 2013 they were really kind of ahead of the curve on this stuff. And they you know they would design some of these in-house. usually the main ones, smartphones, laptops, a couple other things. And then they would work with manufacturers and sort of get them to build them. And, you know, these are usually secondary tertiary devices, but the net net of it is you have an entire ecosystem of IOT devices and they all in theory, you know. wireless routers, headphones, power banks, TVs, vacuum cleaners, air purifiers, water kettles. And that all does sort of add up because we do see that people buy more than one device. It creates some level of switching costs. And the way they would talk about this was the same way they talked about their triathlon model. We’re not going to make money on these things. Three, five percent gross profit. But this is almost like a customer acquisition strategy because everyone who buys a water kettle pretty much at cost. we’ve basically acquired that customer. So it’s almost like you could put this under the marketing expense line for them. And that’s kind of how they were talking about it, because they were still pushing this idea that we’re an internet software and services companies and the hardware serves other functions. Now they eventually gave up on that sort of talking point. Okay, that’s 2013, 14, 15, a lot of IoT ecosystem strategy. 2017, we start hearing about a new triathlon model. You know, still triathlon, but different. This time, the triathlon is now hardware, internet, and new retail. So a little bit different. Now, this one was sort of… They called it the revised triathlon model. This was sort of a lot of disappointments, a lot of struggling market share going up and down. 2017-ish, late June starts saying, look, we’re through the storm. We’ve weathered the storm, we’ve turned the ship around. Now we’ve got to think more about hardware, internet, and new retail. Now one of the things they did to turn their ship around was they opened a lot of retail stores. They were getting pretty… You know, they’ve always, they were selling online, and then they started to sell in some other stores they didn’t control, and then they opened their own stores like Apple, but really they were getting sort of pummeled at the point of sale, where companies like Opo and Vivo were very good at working with sales agents in these little stores, which are all over China, and you know, someone would come up with the Xiaomi phone and the person at the cashier at the counter would say, oh, you should get the new Opo instead. So they were shifting a lot of sales that point. So they opened their own stores, they started to work more at the point of sale physically, and they start to call this their new retail model, which is we’re going to integrate the online and the offline. and we’ll sell all these IoT smartphone products. And if you ever go into a Xiaomi store, they’re actually spectacular. They’re great fun, they have new stuff. You can go by every week and there’ll be new things. Very interesting model. So that’s kind of, you take the new retail. you’ve got the internet bid, which is kind of the software and services thing, and then you’ve got the phones. So a little bit different strategy. In 2018, their sales bounced back pretty good. Numbers are looking better, but when you actually look into their revenue, you realize that the vast majority of their revenue is just coming from smartphone sales. And so they’re calling them an internet service company. But really most people are like, aren’t you a smartphone company? I mean, who are we kidding here? But when they go public, that’s how they called themselves as a smartphone, I’m sorry, an internet company. Okay, so we get to sort of 2019 and we start hearing more and more about another strategy, which is the dual engine strategy. the dual engine strategy, smartphones and AI and IoT. So they start talking a lot more like a smartphone company for the first time, well not for the first time, but more and more, and in there, you can look at their annual filings, and 2019, 20, they’re basically saying, look, we’re a smartphone company. So, we’re talking about the two different different types of smartphones, and we’re talking about the two different and the dual engines of that are smartphones, and AI and IoT. So it’s still got the IoT bit, but suddenly we’re hearing a lot more about AI. That’s 2019. And that was, let’s say, to a significant degree about, let’s call it the un… the underwhelming response to their public filing in Hong Kong, where people are kind of like, you know, it looks to us, even though you’ve been telling this story for a long time, it looks to us like you’re a smartphone maker that doesn’t put in a gross margin. You know, why don’t you just up your gross margin and do that? Now, to their credit, along the way, Xiaomi did start to move the numbers. They did start to show more and more gross profits coming from services and software. And if you look at it today, you can see that. But yeah, the idea that we’re going to combine artificial intelligence and IoT, which they call AIoT, you know, that was kind of their idea. And you could see that. Both of those things directly empower a smartphone. Okay. Little bit more gaming. When they’re talking about services, they’re mostly talking about advertising and gaming. Okay, so that kind of brings us up to speed. I mean, it’s, and then the latest one is we’re going into cars. Electric autonomous vehicles. Lei Jun says this is gonna be the last major sort of initiative of his career. Okay, so that’s six or seven significant sort of strategy adjustments. I would almost call it scrambling over the past 10 years. And they are very, very good at the scramble. Let’s not kid ourselves. They’re executing like crazy and they are moving around, but it’s not like Amazon where we’ve known their strategy for a decade, 15 years. We know exactly what they’re doing. So there’s that level. So I think that kind of brings us up to speed. So the next bit is, okay, let’s take that story and I’m just gonna run my frameworks. That’ll be next, let’s just run the frameworks. So first framework, we’ll use my sort of six levels of digital competition and I put my standard graphic in the show notes there. And we kind of just sort of take it apart. And when I look at strategy, I always sort of do three things. The first thing I always do is I look for, well. There’s actually more to it than three things. Usually I look at the customer experience a lot, and then I start to look at competition, because I’m always looking for the rubber hitting the road in the consumer experience, customer experience, and the competitor view. Can a competitor take part of your business? How hard is it? Okay, we do the customer experience, then I move over to the competitor view, and I just start running my list to see its competitive strength and defensibility, which is my six levels, and then usually I go on, start looking at profits and growth, which are obviously very important, but those things tend to depend on the competition question a lot. And if I see a lot of profits and growth but no defensibility, I’m probably going to lose interest anyways because I think the profits and growth over the longer term are too unpredictable. They might be very nice in the short term, but I don’t know what’s going to happen next. So I always sort of start with the consumer view, the customer view, and the competitive view, which is my six levels. All right, so we start at the bottom and we look at tactics, level six. This is all about operating performance. and we can see that you know Xiaomi is really good at this. There are an endless list of tactics you could look at industry by industry. In my notes I’ve given you about seven or eight of them, but there’s actually a lot more. This is this is the and if you look at the picture I use you see a bunch of people basically punching each other. And when I think of tactics, I think about a brawl in the street. I think about a bunch of people just fighting and kicking and whatever. And you got to be a street fighter. You have to know how to do all of that. When your competitor is does X on a Monday, you got to hit back on Tuesday. Right now, some of the common ones we see in digital life listed like first and early mover. Well, Xiaomi is very good at that. I mean, they were first in it, you know, their smartphones, they were very innovative. They went international early. They pivoted to IoT. They’re good at being ahead of the curve or at least ahead of their competitors. We look at various types of growth hacks, which I listed as tactic number three. You know, they had these super fans, the me fans, they were launching online, they were doing all these sort of tricky things. They’re pretty good at sort of hyper growth, flooding money into something if they need to. And I think probably the part that, and also they’re good at dirty tricks, right? When someone hits them, they know how to hit back. But I think we see such a history of them rising quickly and then maybe taking a hit and losing market share, but then fighting their way back within a year or two. I mean, it’s pretty impressive how fast they are in that regard and effective. And also you could put under their business model changes. Well, they’re pretty agile. Okay. So that’s pretty good. And we can go up to the next level, which would be the digital operating basics. And the little picture I put there instead of people. punching each other in the street, we see what I have a little picture of some basically a military unit walking in you know stride together in a platoon because that’s when you start to take these random back and forth activities and you scale them up and you make them more systemic across your business. Okay, you know they’re good at all of this too like just you know I’ve given you seven on this list you know. Is their leadership and management effective at running a digital business? Yes, they’re outstanding. Do they have a culture and a staff that is very innovative and agile and customer responsive and all of that? Yeah, I mean, Amazon has that, Xiaomi has it, a lot of companies have that. DOB1, are they good at rapid growth? Yeah, they’re very growth focused. Do they focus on never ending customer improvements? Yep. I mean, they’re basically good at all of this except for maybe DOB7, which is, do they have a core engine, digital engine that throws off a lot of cash and scales? And it’s like, yeah, not really. I mean, they’re making money, but they’re not a cash machine. You know, they’re not rolling in the money. So that’s probably a bit of a weakness there. But generally speaking, if we sort of look at level one, level two, you know, we’re in Elon Musk land, where it’s all about operating performance, growth, speed, excellence. I think we can see that across the board in Xiaomi. Okay. Then we move up to sort of level three, which is, you know, I’ve said that… competitive strength really comes from the top four levels. You gotta be good at five and six, but most of the big advantages come from the top four levels. And the simple version of that is you gotta have a moat and you gotta have a marathon. Hence the name of the book, Moats and Marathons. Okay, we start looking at marathons. And this is one of the two concepts for today, the smile marathon, which is kind of my thing that I never shut up about. and SMILE, S-M-I-L-E. What does it stand for? Hyperscale, that’s the S. M is machine learning, I is sustained innovation, L is rate of learning, E is ecosystem orchestration or participation. SMILE. Is Xiaomi good at those? One, most businesses have to do all of these. So it’s not like you’re not gonna do, everyone’s doing rate of learning, everyone’s doing innovation, everyone’s doing some degree of machine learning. The question is, of those, are you running a marathon in one of those where you’re consistently focused on one of them for years? Because that’s how you win a marathon, you pull ahead over years and years. Because look, we do everything, but we really focus on sustained innovation in rocket engines. SpaceX and that’s how they pulled ahead so much. TikTok we are running a marathon based on machine learning and they’ve been doing this for eight, nine years now. You know they’re a matching machine learning AI company and everything else is a distant second. Okay when we look at Xiaomi I don’t see them doing any one of these where that’s our primary marathon. I think they’re jumping around between them. They’ve tried to be an ecosystem, so that’s the E. They’ve tried to do sort of innovation, we’re doing some things. Now they’re jumping into AI. That’s machine, if any of them they’ve been consistent on, it’s the idea of scale. Okay, so maybe they’ve been sort of focused on, we just gotta get big. there but I don’t it doesn’t jump out at me that they are pulling ahead in one digital marathon such that they’re becoming really untouchable over two three four five years. I don’t see it I see them sort of bouncing around quite a bit. And why? Well, because, you know, they don’t quite know what their strategy is. So the innovation is a bit unfocused. We don’t see the community. And then we move up to levels two and three, which are really moats. One, two and three levels are moats. Four, five and six are operating performance. Top three is Elon. I’m sorry. Bottom three is Elon Musk. Top three is Warren Buffett land. OK. What moat are they building? I don’t know. I really don’t. I know they’re doing smartphones, but there aren’t a lot of powerful motes in smartphones. Apple has a mote, but it’s not really from their phones, it’s from their ecosystem. The phones are just where they monetize that. Their strategy keeps changing, and when we see them jumping around, it’s like, if you don’t have a clear, consistent strategy, how are you building a mote and running a certain marathon consistently? That’s kind of what, that’s when I run my levels. That’s what jumps out at me. That you’re awesome at tactics and digital operating basics and that type of operating performance. But once we move up into the top four levels, it’s kind of all over the map and it keeps changing. You’ve never settled on what your strategy is. And the simple version for what your strategy is, tell me what moat you’re building, tell me what marathon you’re running. And with Xiaomi, it’s like, I don’t know. I still don’t know. And with that, let’s switch over to Apple, because the title of this podcast is, What Can Xiaomi Learn From Apple and Amazon About Strategy? Well, if I ask you what the strategy is for Apple, what is their moat, what is their marathon, it’s pretty obvious. It’s been obvious for 10 years. It hasn’t changed. They’re sticking with it. And they’re just executing against it. So what is their mode? Well, their biggest mode is two things It’s definitely a network effect Because they’re a platform business model the App Store Right the App Store the ecosystem They are connecting application developers with consumers and users of their phone. It’s an innovation platform just like Microsoft Windows was. So their core business is a digital platform. It’s one of my five types. It’s an innovation type. That’s a massive network effect that’s global in scale, super powerful. That’s a big part of what they’re doing, moat-wise. Second to that, they have share of the consumer mind. They have a powerful brand. They are marketing like crazy. They continually improve the customer experience. The phones are nice. People love the phones. There’s a level of love of the brand that is global. So those would be my two. I think they’re somewhere, they’re like, they’re 49% a luxury brand and 51%, they’re an innovation platform with a network effect. Now second to that, they’ve got some economies of scale in R&D spending and marketing spend. But I think that’s most of what they’re doing. And they’ve pretty much stayed on that playbook for 10 years. I mean, Tim Cook is not a big innovator. He’s an excellent operator. He took that model and took it to global scale. And every year the phones get a little bit better, the camera is a little bit better, it’s a little lighter. But I mean they spent a lot of what Tim Cook has done has just been international growth. They’re everywhere. Okay, so that’s their moat, pretty straightforward. What’s their marathon? I think they were going for scale. That’s the S, S-M-I-L-E. But more than that was the E. They are an ecosystem orchestrator. S-M-I-L-E-E is ecosystem. I say ecosystem, I’m talking platforms. They’re a platform orchestrator. Just like Taobao, just like Google, their core thing is we orchestrate the ecosystem of gazillion apps and other connecting devices and services into these handsets. That’s their marathon and they’ve been running that for the same time period. But when we look at their operating performance, so that’s the top four levels. What’s your moat? What’s your marathon? We look at the bottom level, their tactics and their digital operating basics. Um, they’re not awesome. I mean, they’re okay. I think Tim Cook is an excellent operator. I don’t think he’s particularly innovative. I don’t think it’s particularly creative. Nothing like it used to be under Steve Jobs. I don’t see new products rolling out. The Apple Store today looks pretty much like it looked five years ago. So they’re doing that stuff, but, and tactically they’re not, you know, they’re not bouncing back and forth doing something surprising every week. You know, they’re on the moat side, they’re a 10 out of 10. Moten Marathon, they’re a 10 out of 10. And if you ever doubt that, you know, the fact that one of their biggest owners is Warren Buffett, that tells you because he buys Motes. But in their operating performance, six out of 10, they’re OK, not awesome. And if we switch over to looking at Amazon, I think it’s actually more impressive. And I wrote a bit about Amazon a month or so ago. I’ll put the link for an article in the show notes, but I wrote an article called Why I Really Like Amazon Strategy Despite the Crap Consumer Experience. Because I don’t really I don’t think Amazon’s app is terribly good. I mean, it’s nothing compared to Alibaba and Shopee and these, you know, the e-commerce companies out of Asia. I mean, it’s five years behind, but they have such a powerful strategy. And it was I wrote this article and. You know, I basically, and their description of their strategy is as uninspiring as you can imagine. Like at least Apple has a strategy, like, oh I get it, that’s cool. Amazon doesn’t have that at all. I mean it’s e-commerce, it’s AWS, and they’re expanding out into logistics, which looks like it might be another powerful business in its own right. But when you look at their filings, They’re literally in the first paragraph of We’re Amazon, this is who they are. They basically put a three to four, three to four paragraphs that are a very specific playbook for their strategy. And it is uninspiring, but they tell you exactly the numbers that they are moving year after year. And I mean, that is a almost mechanical view of strategy. And it’s a great strategy. It works. They’ve been doing this for 10 plus years. And it’s very, very clear. I can read you to them. I’ll put the slide in the show notes. But here’s point number one. Our financial focus is on long-term sustainable growth in free cash flows. So there’s their primary KPI. Free cash flows are driven primarily by increasing operating income and efficiently managing accounts receivable, inventory, accounts payable, and cash capital expenditures, comma, including our decision to purchase or lease property and equipment. Increases in the operating income primarily result from increases in self sales, efficiently managing our operating costs. I mean, it’s literally like a cookbook. You go to point two. we seek to reduce our variable costs per unit and to work to leverage our fixed costs. Our variable costs include product and content costs, payment processing, and related transaction costs, picking, packaging, and preparing orders for shipment. I mean, it’s, they literally tell you what their variable costs are. And then they go right into our fixed costs include the costs necessary to build and run our technology infrastructure, to build, enhance and add features to our online stores, web services, electronic devices and digital offerings, and to build and optimize our fulfillment networks and related facilities. I mean, it’s like reading a cookbook. Last point, because of our model, we are able to turn our inventory quickly and have a cash generating operating cycle. I mean, that is, they are telling you their moat and they are telling you their marathon in the least inspiring terms, but you could basically just put those numbers on the wall. And that’s what we’re doing. That’s one way to look at strategy. Apple doesn’t talk this way about their strategy, although they’re gonna have the same type of numbers underneath the story I just sort of told you. Now that would be levels one through four, that’s the moat, that’s the marathon, very clear. They know the business model that’s gonna win because it’s proven, they’ve already proven they have a winning model and they’re just continuing onward within it. And then operating performance tactics in Digital Operators Basics are. They’re required, but it’s not why they’re winning. So that’s a really interesting contrast. You can see them sitting in a winning strategy for 10, 15 years and just. moving along, just getting better and better at it, but they’re not changing very much. And you compare that to Xiaomi. So that’s what sort of jumps out at me, is Xiaomi needs to lock down their moat and their marathon and sit in a proven winning business model. Don’t make one up, don’t think this might work, look at something that moved, let’s just do that. And then that will be our core engine. And outside of that, we can do a lot of stuff that we’re doing now, but it’s hard to do all this stuff they’re doing, which is a lot of agile experimenting, innovation. If you don’t have a core operating engine throwing off a lot of cash, and just basically being a fortress, then that’s really what they need. I mean, Amazon and Apple can screw up a lot of initiatives and it doesn’t matter because they have the fortress. Okay, that is most of what I wanted to cover. Last point, if I was advising Xiaomi, what should they do? Strategy wise, what’s the winning business model? I would say, take your strengths, of which you have a lot of them, and move against an adjacent business model, an adjacent opportunity that is a proven winner. And that almost for sure means you want to build a digital platform that we know will generate cash flow. What’s the easiest one that’s one step away that’s close to what they’re doing where they have a lot of advantages? I would look for a mobile app that is B2C that we could deploy and promote on our smartphones. They have a ton of consumers. Let’s not do something in hardware. Let’s not manufacture anything. Let’s do a software app, mobile app that is a digital platform. And we can put these into three buckets. Bucket number one, look for something that’s already proven, but we have some ability to differentiate. So that might be, look, we know YouTube works, we know Instagram works. Let’s do and how can we jump into that business? Well, it turns out there’s room to differentiate in entertainment and video, which is exactly how TikTok broke in. They use the same business model, but they had enough room to differentiate their service and they jumped in. Let’s look at those types of video businesses, video sharing. Let’s look at e-commerce. Pinduodua did the same thing. proven e-commerce business model JD Alibaba, Pinduo Duo was able to differentiate and be creative enough to jump in. So let’s just take an established digital platform where there’s room to differentiate and go after them. And entertainment and e-commerce are great for that. Option two, bucket number two. We look for an established proven business model, digital platforms. where okay, maybe there’s not room to differentiate, but there’s a weak incumbent. Now an example of that would have been Zoom. There’s no way Zoom should have won. Zoom is a utility. And there’s no way to differentiate Zoom very much. It’s just video conferencing. But Skype was so weak and badly run, and they had to say it’s a weak product. that a strong competitor like Zoom was able to jump in and take it from an incumbent, which they shouldn’t have been able to do. Well, we’ve just said, or I just said, Xiaomi is exceptionally good management. Let’s look for a more utility, commoditized digital platform where the incumbent is weak. And the one that jumps out of my mind there is search engines in China. Nobody loves Baidu, nobody. Now Tencent is going after this and TikTok has talked about going after search, but there’s there’s lots of those sort of utility type apps that you could maybe target someone. Third one, last bucket. Go for something new that is still a mobile app. It’s on our phones and it’s a powerful business model most likely and the one that jumps out there is Metaverse. Metaverse. We know Facebook’s going after it. Apple should be going after it. The one company that should be winning on the B2C side of Metaverse is Apple because they’ve already got, you’ve got their phones in your hand and Metaverse requires hardware. You can’t just be a software company. You have to have goggles and other stuff. So Apple’s already got the software and the hardware. On the B2C side, they should be doing very well in Metaverse, but I don’t think they can innovate terribly well. On the B2B side, it looks like Microsoft. But we know Facebook is going after it. And an interesting company that’s doing this is HTC, which is a pretty much failed smartphone maker out of Taiwan. And they were just too small and it’s just a very hard business. But they actually had a pretty good strategy they tried was, we’re gonna become a AR VR company and we’re gonna try and get there first and build an ecosystem platform for AR VR, which is what they were doing for the last five years. Now it didn’t really work cuz people didn’t adopt AR VR, but it wasn’t a bad strategy for a third tier smartphone maker. It was pretty good. Now in the last couple months they’ve been talking about we’re going after metaverse virtual reality. It’s not a terrible, not a terrible target for a smartphone maker to try and jump in there and then control that platform. It’s more speculative but I suspect they’d be pretty good at that. Those would be my three buckets for Xiaomi. But they’re going after autonomous vehicles, which strikes me as another very, very difficult business where it’s not clear that you can build any real strength. It’s very unproven and it’s going to be incredibly expensive. most of these autonomous vehicle companies are going to fail, the vast majority. So I don’t know kind of why they’re doing that, but it just seems to be what he wants to do. Anyways, that is it for Xiaomi and what they can learn from Amazon and Apple. The two concepts for today, Smile Marathon and the six levels of digital competition. As for me, I’m packing up and I’m heading to Tbilisi, Georgia on Saturday. I’m on my way to Istanbul basically. bit of a vacation but also working on some stuff and then I’m gonna start heading down to Latin America after that. Some sort of working my way across the world which is great. I enjoy doing that and I’ve always kind of wanted to go to Tbilisi because it’s a really interesting country and it’s there’s a lot of there’s a lot of sort of international nomadic types like me. So we’ll see. But if nothing else, you know, they’ve got Georgian wine and it’s apparently a beautiful, beautiful country. So I’m looking forward to that. And then I’ll probably be in Istanbul and sort of along the Turkish coast of the Aegean Sea. Maybe three weeks. So I’m looking forward to that. Anyways, that’s where the next podcast will be. But that is it for me. I hope everyone is doing well and have a great week. Talk to you next week. Bye bye.

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.