Last week, I was giving a talk in Shanghai about the digitization of manufacturing. And how this is creating a data ecosystem that connects consumers, retailers, logistics and manufacturing.

This is something that Alibaba has been focused on with New Manufacturing. Their XunXi project is about being able to respond in real time to changing consumer preferences in apparel. They can personalize to a trend. And increasingly to an individual.

And the real payoff is to shape demand. This is not unlike how fashion brands shape demand with their Paris shows. And they supply that demand with their products.

But one of the attendees of the talk asked me a good question about whether this increased flexibility in product design and manufacturing removed a lot of the strengths of manufacturing at scale. Doesn’t this go against the whole idea of economies of scale?

That question has been sitting in my brain all week.

- What are the advantages and disadvantages of personalization vs. economies of scale? Of increased flexibility in product production and service delivery?

And three concepts really came to mind.

- Personalization / Market of One

- Economies of Scope

- User experience

In this article, I’m going to talk about the first two. In Part 2, I’ll talk about the third.

What Are the Advantages and Disadvantages of Personalization?

In 2021, Chinese online apparel brand and retailer Shein got everyone’s attention. It surpassed Amazon (briefly) as the #1 downloaded ecommerce app in the USA. And it really began to take off in countries all over the world. People started remembering how TikTok did the same thing just 1-2 years prior.

The big strategy point everyone began talking about was “personalization”.

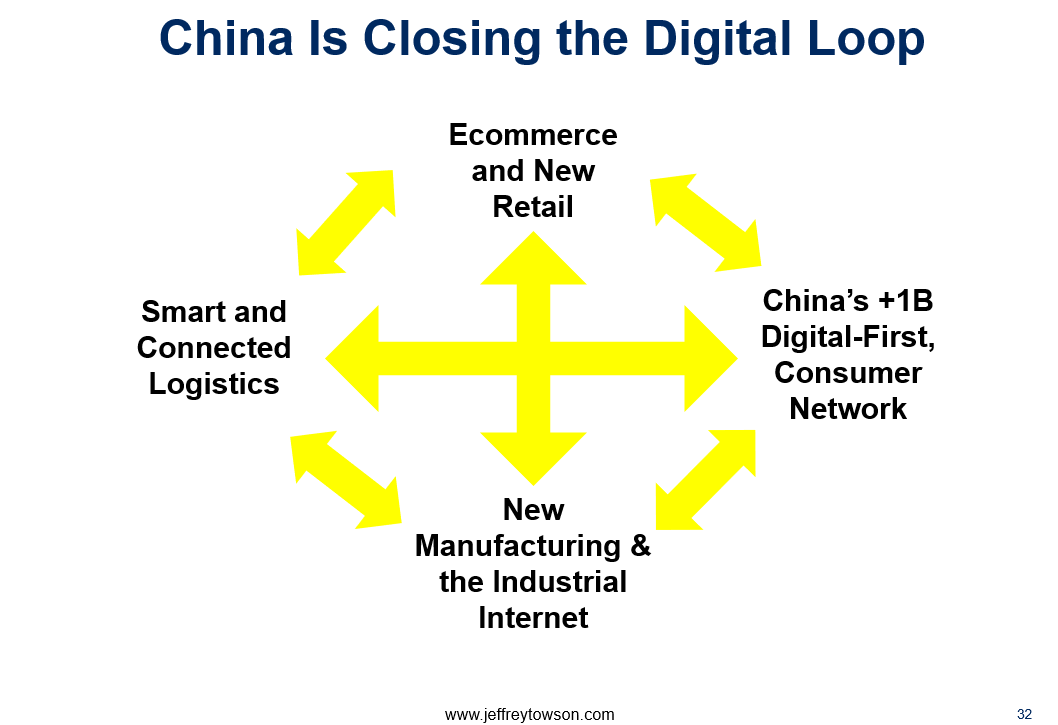

At the time, there were reports of +1,000 new products being added to Shein every day. That is apparently now up to +5,000 new products per day. They were using data to personalize not only the selection of goods you see in the app. But also, the new products created and offered. It was personalization much higher up the supply chain. That’s basically the “Closing the Digital Loop” graphic shown. But cross-border.

It began the discussion that Shein is a newer and faster version of fast fashion. Going from Zara and H&M to Shein is like going from fast to ultra-fast fashion. That was the argument anyways.

My opinion is that Shein’s early growth was mostly from offering really low-priced Chinese apparel to Gen Z women on their smartphones. People love cheap stuff. And the company was particularly good at digital marketing.

That said, increasing personalization is a big and important lever. We see companies like Shein and Alibaba focusing on it. And apparel is a good sector.

Is Personalization a Competitive Advantage? From Data-Driven Personalization to Market of One?

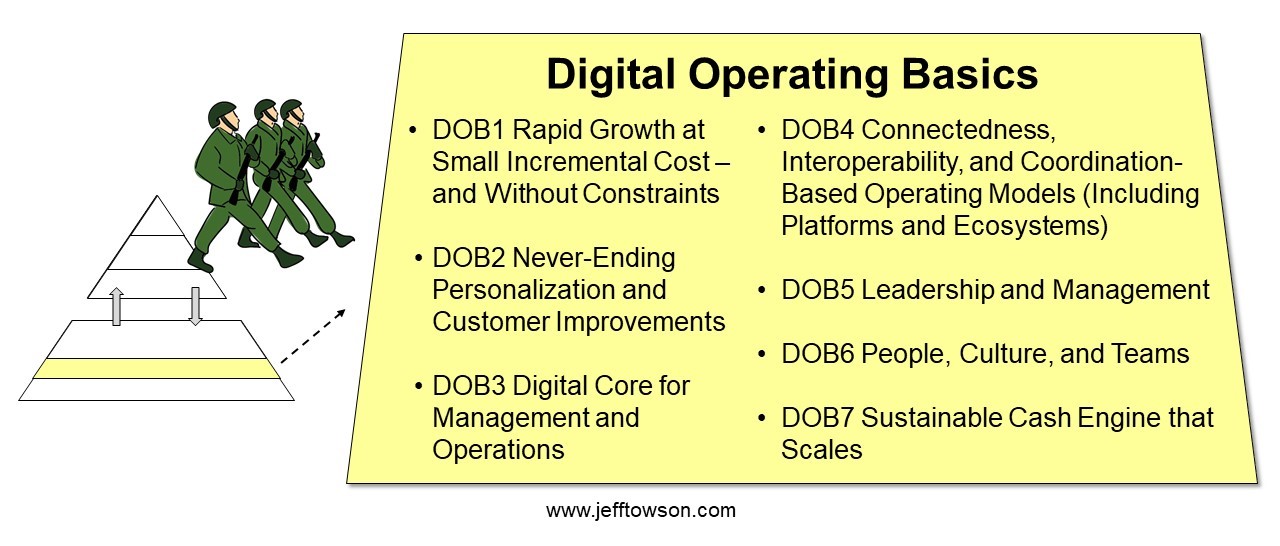

I have said there seven Digital Operating Basics. This is what you have to do as a digital business. They aren’t special. They are necessary. These are mostly table stakes. And in the short-term they can really appear as advantages in operating performance. Especially if one company starts doing them before others.

And in some businesses, personalization is easier than in others. Personalization in fashion and digital content is pretty doable. And, with generative AI, we will likely see increasing personalization of products.

And that is what is happening with Shein. They started doing Personalization and Never-Ending Improvements in the User Experience (#2 below) in apparel before others.

But does this create a competitive advantage?

I don’t think so.

However, I have raised the question of whether we will reach “market of one”. This is the idea that every single customer will become its own market for a business. I’ve raised the question that this could become a digital marathon.

But I’m not really sure about this.

***

Ok. So that’s how I categorize personalization and market of one. It is mostly the digital operating basics. And it can sometimes appear to be an operating advantage when one company starts doing it first. Which is the case with Shein.

But how does this impact economies of scale?

Economies of Scale vs. Economies of Scope

I’ve listed 15 types of competitive advantages, with 5 based on economies of scale. But you’ll notice I actually use the title “Supply-Side Economies of Scale and Scope”. That second one is what really matters here.

Here is my basic take on the advantages of scale:

“Economies of scale and scope…has since expanded beyond just manufacturing and traditional production. It is now about how operations and organizations can become more effective and efficient as scale increases. There are lots of advantages to increasing scale, and this comes about by a variety of mechanisms and factors – such as:

- Specialization and the division of labor, as mentioned by Adam Smith.

- An increasing efficiency of equipment at larger scale, and when used at higher volumes or output.

- A decrease in the friction loss of transportation and industrial equipment.

- Improvements in purchasing and the coordination of inputs.

- Improvements in organizational learning.”

Both are advantages that result from increasing production volume versus rivals. But economies of scope are distinct from economies of scale.

Economies of scale are about doing more of the same thing versus rivals. And it is most often discussed in terms of decreasing the long run average cost of production with increasing volume. Basically, the more you do something, the more efficient you become. If it is about cumulative production, we usually call it a learning effect.

In contrast, economies of scope are about advantages (mostly economic) that result from a larger variety of products and services than rivals.

- Scale is a volume advantage.

- Scope is a variety advantage.

And that starts to sound a lot like personalization and closing the digital loop.

Economies of scope as a concept is attributed to economists John Panzar and Robert Willig. Like economies of scale, it has traditionally been looked at in terms of decreasing long run average total cost of production. But in this case, it is from an increasing variety of different, but usually related products.

- The more related products a business produces, the cheaper they all become relative to those produced at separate, independent firms.

- If economies of scale is about a big factory being cheaper than a small factory, economies of scope is about a common factory being cheaper than lots of independent factories.

The math for economies of scope compares the total cost of producing two different products or services at a business to the costs of single firms producing them. Economies of scope is when the joint cost is lower. Diseconomies of scope is when it is higher.

The standard examples for economies of scope are CPG companies like Unilever and Proctor and Gamble. With Proctor & Gamble you have common inputs for its hundreds of hygiene-related products (razors, toothpaste, etc.). And they have large portfolios of consumer products that all rely on certain common costs, especially marketing. Plus, a lot of their competitive strength is from their bargaining power with retailers for their large suite of products.

So, you can see that they have real cost advantages based on their large variety of related products.

However, those are just the cost benefits of economies of scope. Like in economies of scale, there can be other types of advantages – such as:

- Increased flexibility in product and service design and mix. A firm with a wider variety of products can respond more rapidly to changes in market demand, product mix, output rates, and equipment scheduling. We can also see lower training and changeover costs.

- Greater predictability. Ongoing spending in areas like facility maintenance is more predictable when there are multiple product lines.

- Lower risk. A business with more product lines and / or geographies is less exposed to changing customer behavior, government action and technological change.

For this, you can think about companies like Sony and GE, which have very different types of products but rely on common manufacturing, technologies/IP, and R&D capabilities. And this is important given the rapidly changing technology and behavior in their industry.

Research and development (R&D) is a commonly cited source of advantage with economies of scope. For example, Sony long had core capabilities in the miniaturization of consumer electronics, which it successfully used across music players, laptops, cameras, and tablets. Scope advantages emerge when multiple products or services rely on:

- Common capabilities and cost structures.

- Common expertise.

- Indivisible assets.

***

This is where my thinking is right now.

- I can see the increasing impact of personalization on operating performance on the demand-side. It is necessary for most digital businesses. It may become a digital marathon in the future, but it is mostly table stakes.

- I can see real competitive advantages on the supply side by offering a variety of products.

So…

How Is Digital Changing Personalization vs. Economies of Scale and Scope?

This is the question I am struggling with.

- If personalization hurts you in economies of scale, does it help you enough in economies of scope? How does this net out?

The topic of economies of scope quickly becomes a discussion about the advantages and disadvantages of product diversification, which is a big subject.

Product diversification can bring in new revenue streams by both new products and new customers for existing products. For example, the Ansoff Matrix details four types of product strategies and it has a diversification quadrant that offers both the greatest reward and risk.

Discussions about economies of scope quickly become discussions about product diversification. And these quickly become discussions about cross-selling, bundling, and family branding strategies. That’s the demand-side picture.

And ultimately it becomes a discussion about shared spending, resources, capabilities and/or assets in a firm. That’s the supply-side picture.

But doesn’t this all sound familiar?

It’s the same 15 types of competitive advantages I have been talking about. Once you move beyond the simple case of a factory producing lots of one physical product vs. a variety of physical products, the distinction between economies of scale and scope becomes pretty vague. You start talking about fixed costs, shared resources, and common capabilities.

And when you move to digital businesses, the distinction really goes away. Everyone is doing personalization and versioning. Most digital goods and services come in lots of varieties. And with the digitization of manufacturing, we are increasingly seeing this in physical goods.

Here are my conclusions thus far:

- There are very big advantages based on supply-side economies of scale and scope, which I have written a lot about. That’s proven.

- I find the distinction between scale and scope less and less useful as things go digital. I increasingly think it’s just one thing.

- All the other factors cited (strategic fit, synergies, etc.), I put under Linked Businesses, Conglomerates, Cross-Selling and Bundling. These are soft advantages.

- And personalization may reach the level of market of one, which could also be a digital marathon.

That’s it for today. I’ll pull it together in Part 2, which some real conclusions. For today, just remember:

- Personalization = Shein

- Economies of Scope = Unilever and Sony

Cheers, Jeff

——–

- My Interview with Huawei’s Guo Ping on Managing People vs. Managing Rules and Systems (Tech Strategy – Daily Strategy)

- Can Huawei’s HarmonyOS Break Android’s Monopoly? (Asia Tech Strategy – Podcast 73)

From the Concept Library, concepts for this article are:

- Economies of Scope

- Personalization / Market of One

From the Company Library, companies for this article are:

- Shein

- Sony

- Unilever

———–

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.