This is Part 2 about the 2022 Huawei annual report and my trip to Shenzhen for the event.

In Part 1, I summarized the basic story from the event (“back to business as usual”) and the released financials. Plus, I noted 3 things I thought were not discussed enough.

But my biggest take-away from the event is that Huawei is primarily focused on sustainability, resilience, and trust. Or, more simply, they are mostly focused on survival.

Huawei’s Strategy Has Always Been About Long-Term Survival

Twenty plus years ago, Huawei founder Ren Zhengfei began writing and speaking about how to survive long-term as a technology company. That’s a really good question because it is actually quite rare. Most major tech companies don’t last beyond one or two technology cycles. Maybe they get disrupted by the new technology. Or maybe they lose focus, as the now rich founders move on. Or maybe the culture just becomes lazy and non-innovative.

So, Mr. Ren studied tech companies that did last, like Hewlett Packard. And he explicitly set Huawei on a strategic course to focus on long-term survival. Note how different Huawei is to most technology companies.

- There have never been any big exit events for the founders, like an IPO or other.

- There have never been any really big profits. Telecommunications equipment is not exceptionally profitable. It’s a pretty hard business.

- There has been ongoing big spending in R&D and on internally developed (rather than licensed) products. We don’t see a lot of M&A.

- There has been a lot of recent focus on removing risks from the supply chain. But this is actually nothing new. Huawei’s first product was a licensed Japanese PBX import. And Mr. Ren later lost this contract, which was a shock to his small company. They developed their own version internally. Also recall that HiSilicon was launched as an internal project in the early 1990’s as a way of mitigating their dependence on foreign semiconductors. This project has since evolved into one of China’s leading domestic semiconductor companies.

But across all of this, you really do see a different strategy that what we typically see in Silicon Valley. No VCs. No issued shares that make people rich at the IPO.

What you see is a lot of moves and investments based on ensuring survival against technological change, external shocks, and internal laziness. Huawei’s core strategy has always been about survival. This served the company well when it found itself at the center of the US-China “tech war”.

It’s All About International Carriers – and That Means Continuity, Resilience, and Quality.

The key question for Huawei for the past 2 years has been the retention of its international carrier customers. That’s the foundation of everything.

Huawei needs to have international scale in its ICT business. You cannot win as a telecommunications equipment company with only one country, regardless of the size of the US or China. You need to be international to have the scale to compete in manufacturing cost and research spending. So Huawei’s core business has always been China plus international telecommunications (ICT).

As mentioned, Huawei really began when they started designing and manufacturing their own simple telecommunications equipment (like PBX switches) in the early 1990’s. And that was when they also really began investing in R&D. This began what would become a +30-year march in increasing manufacturing and R&D scale. This march took them from fixed into wireless equipment. From 3G to 4G and then 5G. And into all the technologies surrounding ICT (such as consumer devices and cloud). This march also took them from China to +170 markets. To +$100B in revenue. And eventually to surpass Ericsson as the largest telecommunications manufacturer in the world.

But this all depends on winning internationally. Not just in China.

And ICT has never been a particularly profitable business. Selling equipment and doing all the related services for carriers (installation, maintenance) is difficult. Plus, the technology becomes obsolete fairly quickly, requiring constant re-investment by both Huawei and its customers. And ICT growth is steady but not awesome. Overall, it’s a tough manufacturing and research-intensive business where the only way to win is by getting to global scale. Founder Ren Zhengfei has joked he would gone into a different business if he knew how hard ICT is.

But Huawei’s global carrier business is also its largest source of strength. Because while ICT does not throw off a lot of cash, it does get you +200,000 employees, most of whom are engineers. And with over 100,000 staff in R&D, Huawei has amassed tremendous brainpower and intellectual capabilities. That, ultimately, is the key resource. And, as discussed in past articles, Huawei has very deployed a very effective and well-thought-out HR system that motivates this army of engineers.

Ok. So, what’s the problem?

The problem is the US-China “tech war” created a lot of doubts that could (in theory) impact ICT. International carriers could start to question whether Huawei could stay on the frontier in terms of telco equipment? Would it still have access to leading edge technology? Would there be continuity in its supply chain?

These are the types of concerns carriers can have. They do need to make fairly large, long-term and difficult to reverse decisions when they buy equipment.

So, you can see Huawei bending over backwards to ensure international carriers are getting the highest quality equipment now and in the future. You can see the company going above and beyond to maintain the trust of these customers. The key number I look at is the percentage of Huawei’s ICT revenue coming from international (i.e., non-China) sources. In 2021, it was +50% of carrier revenue. At the time, management said the carrier business has “remained stable”

This is what I heard throughout the presentation by Eric Xu and Sabrina Meng.

- There was a lot of talk about having the highest “quality” equipment.

- There was a lot of talk about ensuring the “continuity” of supply.

- There was a lot of talk about “resilience”. That means diversifying the supply chains and redesigning components to avoid any potential future risks.

- There was details about Huawei’s capital structure and big cash reserves. They are sitting on a lot of cash versus debt.

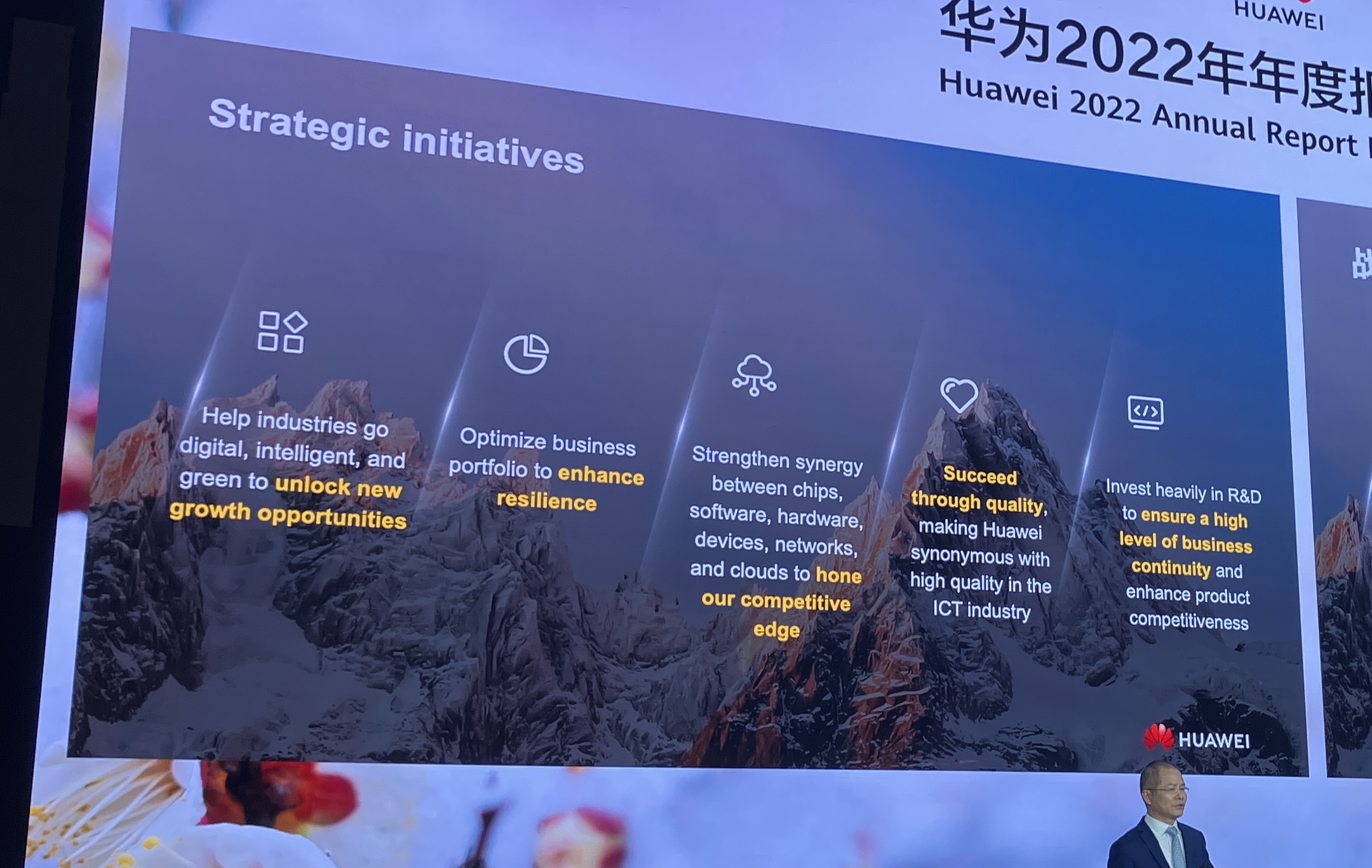

Below is the main chart shown by Eric Xu that details their big 5 strategic initiatives. Note that three of them were about resilience, quality, and continuity.

Actually, you can see these terms throughout their presentations.

Note the comments by Eric Xu on building resilience into the business portfolio:

“We will optimize our business portfolio to enhance resilience…This portfolio includes a mix of our well-established business domains and a handful of more pioneering domains. Some are developing stably while others are growing rapidly. Some rely on advanced process technology and others don’t…Together, they constitute a resilient business portfolio in terms of both structure and potential, forming a solid basis for Huawei’s sustainable survival and development.”

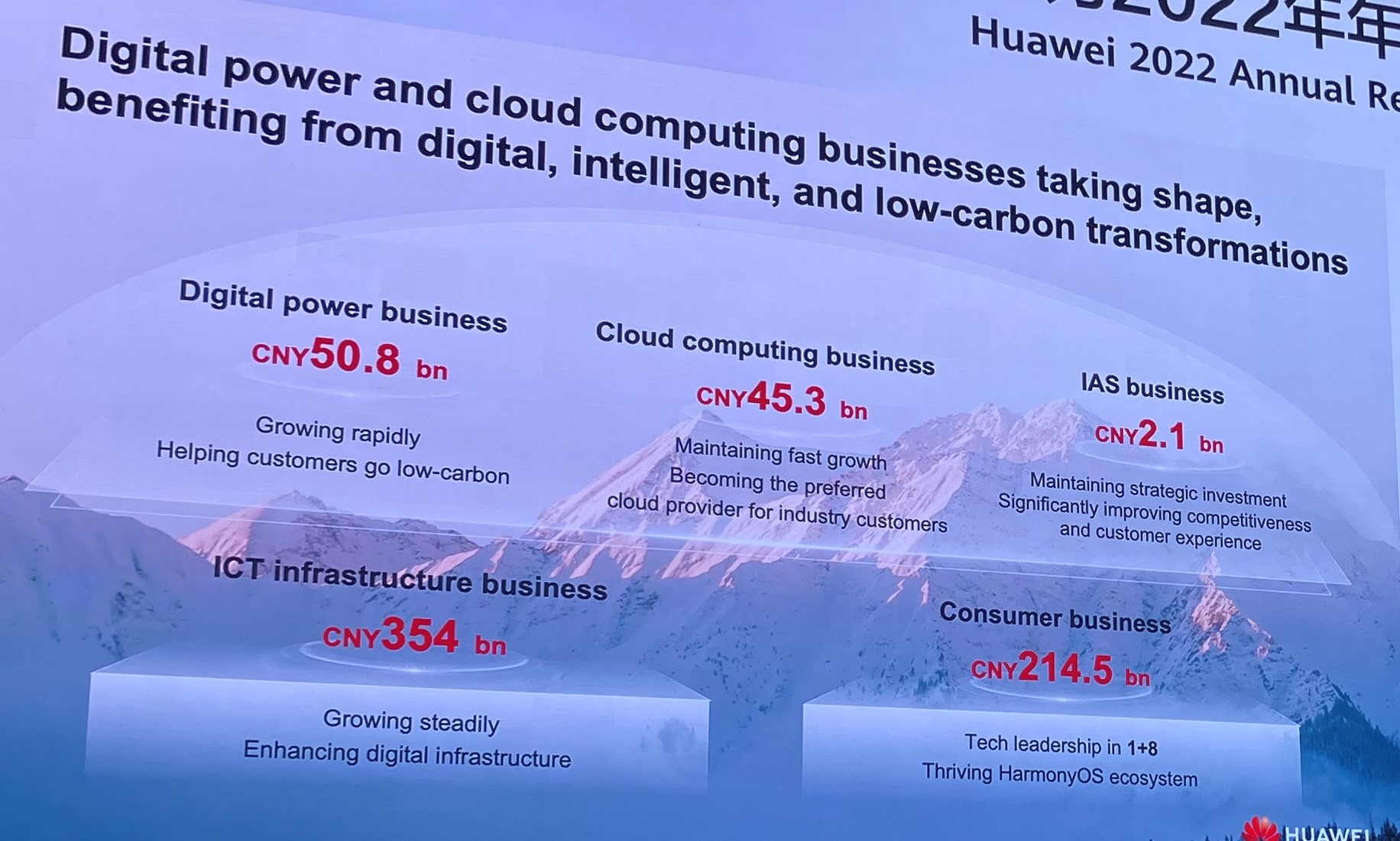

Huawei did restructure into 5 business units. Note how two of them are “developing stably” while the other 2-3 are growing rapidly (but are more speculative).

Mr. Xu also had comments about reassuring customers about quality:

“We aim to succeed through quality and make Huawei synonymous with high quality in the ICT industry…With external restrictions as our new normal, it’s more important than ever that we commit ourselves to maintaining and expanding this reputation for high quality in the ICT industry. Quality is our path to victory.”

“In addition, we need to extend our quality management mechanisms and requirements to every part of the supply chain that we’ve restructured over the past few years. We need to invest more, and improve quality together with our suppliers in order to deliver high quality to our customers.”

And finally, he had interesting comments about building continuity into the supply chain:

“We will invest heavily in R&D to ensure a high level of business continuity and enhance product competitiveness…Through years of hard work, we have made significant progress in component replacement and board redesign, as well as in operating systems, databases, product development tools, CRM, ERP, PDM, and MES…Going forward, sustaining – even increasing – R&D investment in these areas will be crucial for us to ensure a high level of business continuity and fuel nonstop innovation. Our efforts to reshape architecture, strengthen systems engineering, and optimize design will take the competitiveness of our products to new heights. As long as we maintain a high level of business continuity and continue to deliver competitive products, we can ensure Huawei’s sustainable survival and development.”

The Key Question for 2023 is Growth vs. Survival

Ok. That’s it for my assessment. But the question I’m going to be writing about next is growth vs. resilience going forward. You can definitely see that 2022 was really focused on survival. That meant allocating lots of R&D spending and talent to things like restructuring the supply chain. But there was also some focus on the new growth initiatives (digital power, cloud). Smart mining is also really compelling. Plus, the company is already pushing hard in 5.5G and 6G. Here’s a presentation at their exhibition hall on this.

I’m curious how much Huawei is going to pivot towards growth. And how that will play out versus Ericsson and Nokia. I’m going to write about that next and my working hypothesis is:

- Post Restructuring, Huawei is Pulling Away from Ericsson and Nokia in R&D, Tech, and Talent.

That’s it. Cheers, jeff

———

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.