This week’s podcast is about how to think tactics that generate short-term growth and results. And we see these coming out of China all the time. In particular, I talk about how Pop Mart used blind boxes. How Joy Spreader and Ruhnn Holding used influencer marketing. And how everyone is using community group buying.

You can listen to this podcast here or at iTunes, Google Podcasts and Himalaya.

Here is the CBS talk with Li Lu.

Three questions for when you are thinking about tactics resulting in high-growth:

-

- Will this short-term tactic or growth hack lose strength? When?

- Is it a required new capability?

- Is it a structural advantage?

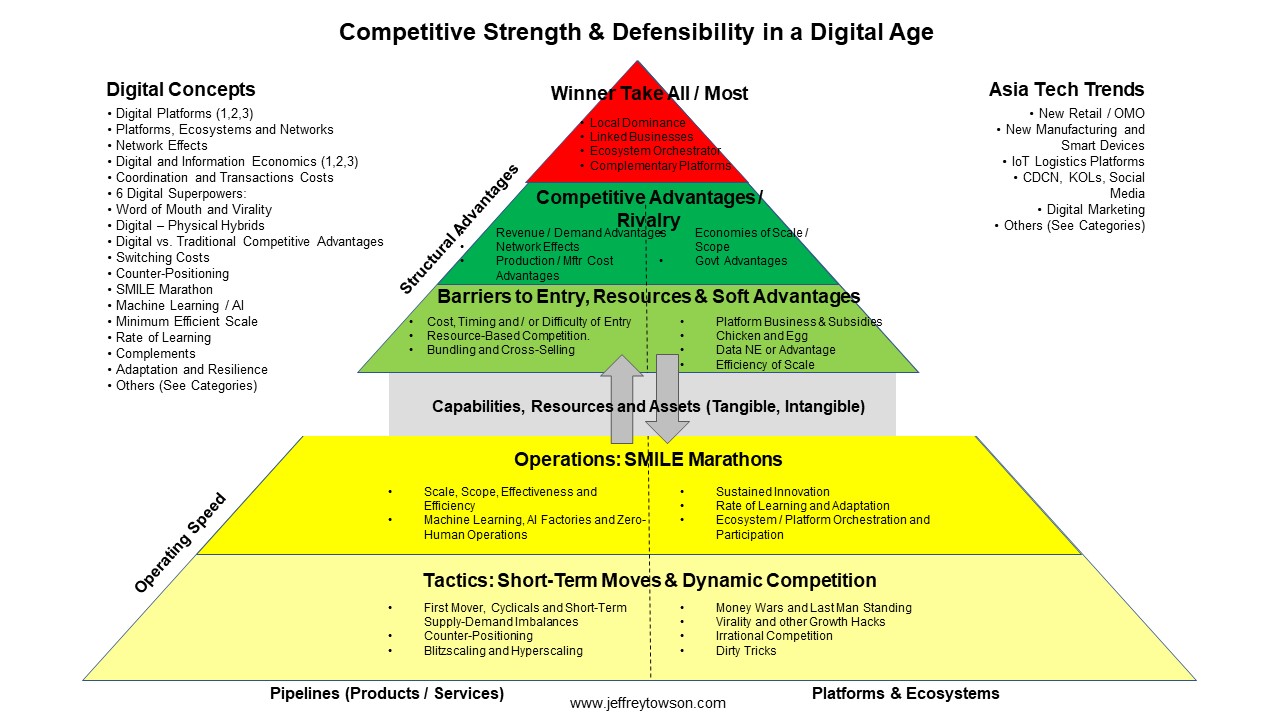

Here is my competition pyramid:

Some blind boxes in Shanghai

From the Concept Library, concepts for this article are:

- Community Group Buying

- Influencers and KOLs

- Virality and Word of Mouth

- Chinese Digital Consumer Network (CDCN)

From the Company Library, companies for this article are:

- Joy Spreader

- Pop Mart

———-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.

——-Transcription Below

:

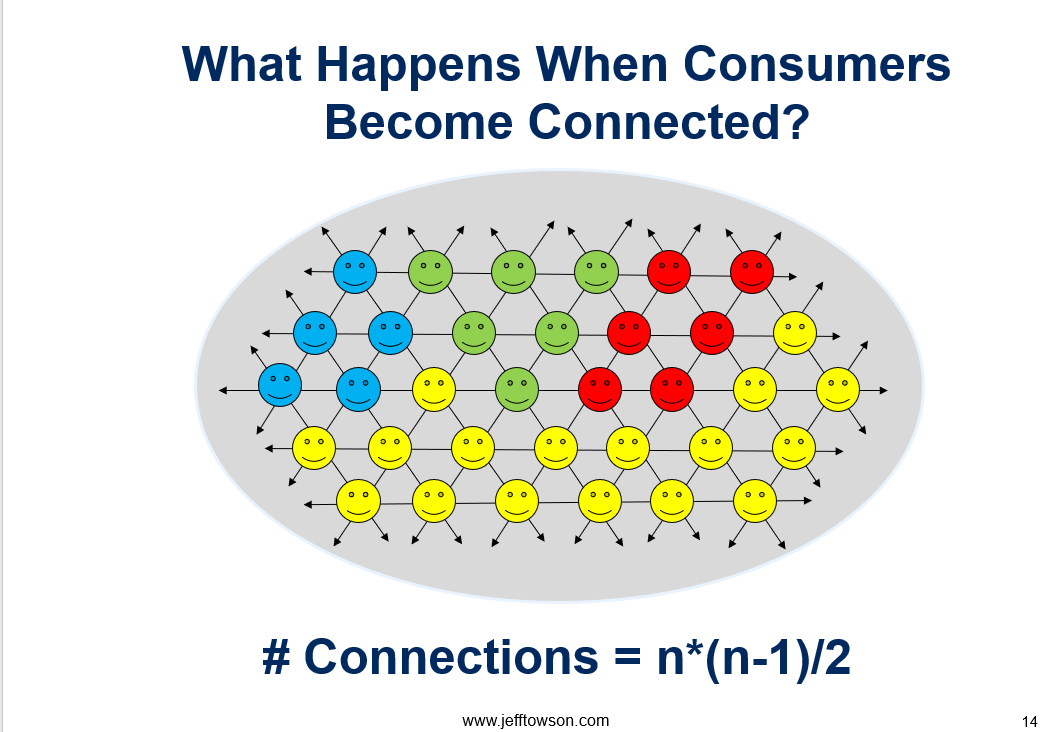

Welcome, welcome everybody. My name is Jeff Towson and this is Tech Strategy. And the topic for today, why you shouldn’t overvalue cool China tactics. And specifically I’ll be talking about community group buying, blind boxes, and influencer marketing. All which have been sort of a recent phenomenon that resulted in fairly spectacular growth that people have paid a lot of attention to. So I want to kind of talk about this and You know, just this general idea that we keep seeing these cool tactics emerging from China that we don’t see anyone else and how to sort of factor that into your decision making and your analysis. And as you can tell, my general statement is don’t overvalue them. Now for those of you who are subscribers, I sent you out kind of a, what’s the right adjective? influencer marketing, KOLs, how to think about that, and really this company JoySpreader Interactive Technologies, which rose quite quickly on the backs of sort of influencer marketing. And I kind of went down a rabbit hole on this one. I’m not sure if that email is gonna stand the test of time terribly well. I think I sent you about six or seven graphics. I spent a good amount of time just digging into that and to some degree getting lost in my head on that one. So anyways, I’ll talk a little bit about that. This is gonna be maybe a more focused version of some of that thinking, which it probably needed in retrospect. I don’t know, I’m mulling that one over. But we’ll sort of talk about influencer marketing as a growth tactic. Fairly powerful in China over the last couple of years. We’ll talk about blind boxes. which for those of you who have maybe been following this company Pop Mart, which went public a couple months ago, that was really their primary growth tactic was blind boxes. And then finally, we’ll talk about community group buying, which virtually every major digital China giant is doing now. This idea that we’re gonna find a local representative in every building, and they’re gonna kinda coordinate group purchases for whatever. services, products, whatever. That’s just a huge thing that’s sweeping over China over the last six months. So I’ll talk about those, which are all sort of, you know, cool China tactics. That’s how I would consider them. They’re very innovative, very unique to China, and we’ll probably see the rest of the world start to copy them. So of these cool China tactics, why are they so powerful, and how do you factor those into your analysis? So that’ll be the topic for today. Now, for those of you who are subscribers, I’ll be sending you a couple… emails this week. I’m going to cover Sun Art, which I was supposed to get to last week, but I didn’t get to. And that’s kind of an interesting online merge offline retailer story, which one of the subscribers suggested I look at, which I did. And it turned out that was pretty good advice. There’s a lot of interesting stuff going on with that company in particular. And then probably talk about Pop Mart some more, just because it’s got some interesting aspects as a B2C company. We’ll talk about that a little bit today, but I’m gonna go into more into PopMart, and then next on the list will be Jihoo, which is also a recent IPO. And for those of you who aren’t subscribers, feel free to go over to jefftausen.com. You can sign up there. There’s a free 30-day trial. See what you think. And let’s see, last thing, my standard qualifier. Nothing in this podcast or in my writing or on my website is considered investment advice. The numbers and information by me. or any guess may be incorrect, the views and opinions may be incorrect or no longer relevant or accurate. Overall, investing is risky. This is not investment. Advice, do your own research. Okay, let’s get into the topic. Now in the last couple days, there was an interesting conference in New York City by basically the Chinese Students Association of Columbia Business School. They put on conferences every year and they had this year lots of speakers, but the one they interviewed was Li Lu, who I believe many of you are familiar with. He’s sort of a colleague of Warren Buffett. He’s a Chinese, I believe Chinese American gentleman now, who came out of Nanjing, went to university there, then went on to Columbia Business School. Very smart guy. I believe he’s a lawyer as well, and then founding his own sort of hedge fund and he did venture capital. And he eventually ended up being sort of a classic Warren Buffett type, identify great companies, hold them long-term and compound wealth investor, founded Himalaya Capital, which is based in Pasadena. He appears to be a close friend of Charlie Munger. He wrote the intro to Charlie Munger’s books. I believe a lot of Charlie’s Munger’s wealth is with Leloo. And typically when you hear Warren Buffett buy something in China, there’s a good chance, which isn’t a lot of things, but it’s a good chance it came from Charlie Munger via Leloo. So he’s a very interesting gentleman, and he gave an interview at Columbia Business School. One of the comments, he doesn’t give a lot of interviews. And honestly, they’re not that helpful because he doesn’t talk about specific companies. So he talks about generalities, which is, it’s not that useful beyond a certain point. But I was listening sort of carefully and I’ll put the link in the show notes if you wanna watch it. And he talked a bit about his investment strategy and how he thinks about it. And he had, I mean, I basically agreed with virtually everything he talked about with regards to China. Obviously he’s from China, he knows the market very, very well, has been investing for a long, long time. He focuses on China, Asia, and the US, which is effectively the same thing I look at, but I focus on digital. And he had some really, I mean, I was pretty much agreed with everything he said, which was that helps me a lot because if, you know, I obviously he’s a lot smarter than I am. So that’s a good validation for me. And he did say something. He said, you know, China, the consumer story of China is really… One, it’s pretty much the biggest consumer story on the planet. It’s the world’s biggest retail market by now. It’s growing the fastest and it’s the most innovative and dynamic, which I think is spot on. So a lot of these tactics I’m going to talk about, you know, that’s what this is about. We see stuff coming out of China. We don’t see anywhere else. And it’s all the time. There’s all this crazy stuff people are coming out of, because it’s just so innovative and creative and, you know, super competitive. So you have to be. sort of dynamic to survive. And we keep seeing these cool tactics. And if you just look back over the last couple years, influencers, live streaming, short video, companies like Mobike, these bike sharing companies, Pop Mart, which we’ll talk about, there’s a company called Shane or Sheen, S-H-E-I-N, which is an e-commerce company based out of China that’s being considered a faster version of fast fashion, doing very well, community group buying. We just keep seeing all these interesting tactics and moves coming out of consumer China. And his sort of point, which I’m paraphrasing badly, was we’re gonna be seeing this more and more over the next 10 to 15 years. So keep an eye on sort of dynamic consumer facing China, especially if it’s digital related, retail, entertainment, things like that. So I know it’s sort of out of his comments, I thought, you know, I should really talk about a couple of these tactics that one, the press talks about these a lot. It gets a lot of attention. I do get asked about these quite frequently, and I think people tend to overvalue them in the longer term. And I’ll sort of lay out how I see them. But that was kind of the point for today is, you know, these cool China tactics of which there’s going to be a lot. How do you think about them? How do you factor them in your analysis? And I’ll tell you how I do it. Now, Lilo personally, I don’t know him. I’ve never met him, but we’ve kind of been crossing paths for quite a long time. I mean, I went to Columbia Business School. Um, the guy he interviewed with on this, um, session they did the other day is Bruce Greenwald, who was kind of my professor at Columbia. He’s sort of the competition guy there. So I learned a lot of stuff from him. Um, Lilo actually teaches a value investing course. Uh, the value investing course came out of Columbia Business School. That’s where it’s been taught. For 60 years, it was taught by Ben Graham in the 30s and 40s. Warren Buffett was one of his students. It was then passed on to someone else and it was passed on to Bruce Greenwald. So we’ve all sort of been part of this sort of Columbia tradition. And the course that Li Lu and Himalaya taught at and still teach at Guanghua Peking University in Beijing. was value investing. So I kinda, you know, I was teaching at the same time, they were right down the hallway, we used to chat and say hey every now and then. I’ve sort of been, you know, crossing paths and I’ve been out to their headquarters in Pasadena, I’ve been in their office. It’s pretty small. I mean, my family’s sort of from literally Pasadena, San Marino, so it’s just sort of down the street from where my mom grew up. You know, and I kinda knew as people and they fly into China a lot and every now and then say hey and stuff. It’s been sort of crossing paths for a long, long time. And students in China, who I teach quite a few of them, you know, they’ve always been sort of fascinated by Li Lu because they can identify with him. You know, this very smart young Chinese guy who came out of Nanjing, who went to the West, and you know, now he’s colleagues with Warren Buffett. That makes you a rock star in China. So, you know, a lot of the students would always be asking about Li Lu. And I was like, I don’t really know him across paths, but. You know, he seems to be right in that Charlie Munger, Warren Buffett mold of investing, but he’s applying it to China Asia. So anyways, it’s kind of interesting. And I sort of take a lot of comfort from the fact that, you know, my North Star for looking at companies and investing is basically the rise of Chinese and Asian consumers generally. That’s my, you know, that’s where I keep my noise pointed to that as the horizon, as the long term secular trend. And it was kind of nice to hear that I think he’s thinking the same thing. So how do I think about this stuff? I put it on the basically the bottom of my pyramid. If you go to the competitive strength and defensibility pyramid ranking, which you can see on my concept library, you can obviously send this out all the time. And this is how I rank companies in terms of their competitive strength and defensibility. You know, at the top of the pyramid, you’ll see that, you know, I’ll put this in the show notes as well. There’s winner take all, winner take most. This is when you’re just incredibly strong as a competitive position. And there’s only a couple types of businesses, I think, that fit this category. The bigger aspect at the top of the pyramid, which is what I call your structural advantages. Right? This is where you’ve built a business model. You’ve got something that gives you huge defensibility and or advantage. And it’s just very hard to breach. That’s what I’ve put in green at the top of the pyramid. That’s competitive rivalry, competitive advantages, barriers to entry, resources, things like that. And then if you go down to the lower part of the pyramid, it’s in yellow, and I call that operating speed. So that’s the smile marathon for operations, things like that. But the basic idea is like, you have to win on both levels. You have to… compete by being faster than everyone else, that’s your operating speed, and at the same time you want to try and build structural advantages, which is moving up to the top of the pyramid. And that’s most of what I talk about, everything I sort of go through I put within those two buckets, or those two levels of the pyramid. However, if you look at the bottom of the pyramid, which I don’t really ever talk about much, there’s a there’s a layer called tactics, short-term moves and dynamic competition. And this is the, you know, just do whatever works on a weekly basis sort of stuff. You know, okay, you’re getting up on a Monday, you’re running your business, you’re running promotions, you’re competing with your competitor, they started running a promotion across the street as a restaurant, you’ve gotta do the same. You know, that constant back and forth sort of dynamic competition where it’s just a lot of short term moves. And those are basically tactics. And there’s a ton of those. I don’t. You know, it’s different for every industry. I don’t really talk about that much because I don’t feel like I have any real expertise in the various tactics you use in retail versus manufacturing versus hotels versus whatever. I mean, it’s different industry by industry and it’s kind of back and forth all the time. And, you know, venture capitalists talk a lot about tactics. I kind of focus on the structural advantages that get you defensibility over the longer term. This is more of a short-term thing. So venture capitalists tend to talk about tactics because when you’re just getting going, you basically do whatever works. You open your store, nobody shows up. You gotta start selling stuff and you just do whatever works. And whatever works, whatever gets people to come in the door and buy stuff, you just start doing more of that. And those tactics that work end up usually becoming your operating model. You know, we did 50 things to launch our new website, none of them worked. Then we finally found one way of sort of emailing or doing some tactic. That started to get us traffic, so we just did more of that. The tactics sort of lead to your operating activities and then hopefully your operating activities can lead to some structural advantages, so you move up the pyramid. But it’s a whole world of stuff down there. I mean, I don’t go into it too much. The ones I’ve listed on the pyramid, I’ve talked about things like being first mover. If you’re a first mover to an industry, that’s kind of a short-term tactic. You got there early before everyone else. You have some, that’s generally a good thing to do, but it doesn’t last that long. People catch you. Counter positioning, which is what some people talk about. Money wars. Just using your money. Hey, let’s just take our bank account and try and steal market share from our competitor by discounting our products. Now, you can’t do that forever, because it costs money and you generally lose money. hyper scaling, blitz scaling, dirty tricks, you know, scraping your competitor’s website, copying their content, growth hacks, and there’s even, I even put in there what I call irrational competition. Sometimes in the short term, your competitors might do stuff that doesn’t make any sense and you have to decide whether to respond to that. Now this was kind of luck in coffee, which was, you know, a big growth story. They did a lot of stuff that just made no economic sense. We’re going to give away free cups of coffee all over China based on raised venture capital money, and we’re going to try and get traffic and, you know, it doesn’t really make sense. It wasn’t hyper scaling. It wasn’t blitz scaling, you know, it was just subsidizing coffee sales and Starbucks rightly just sort of sat it out and saw it and decided we’re not going to do anything. We’re just gonna let them do that for a while because we don’t think it makes sense and we’ll be fine. Turns out that was true. So I mean, you can put in rational competition, dirty tricks, and if you’re gonna be operating in China, Asia, you really do have to know the dirty tricks. Gosh, there’s a lot of them. Now the one I probably have talked about the most is virality. That one of the reasons these tactics get a lot of attention is because they can get you. very significant growth in the short term, often in the early stages of a company. If you get there first in this early mover, you might get a lot of growth. That’s very attractive, but then you gotta think, okay, this tactic is gonna fade away in its power over time. Either because it just stops working, or more likely because your competitors see the tactic you’re using and then they copy it, and it’s not as powerful. Now the one people pay attention to a lot, and that I pay attention to is virality. this idea that you have a product or service where it’s very usage gets you more sales. That would be like Zoom, Groupon, let’s say Dropbox, payment platforms, WeChat, WhatsApp, communication, payment, group buying, things like that, where the very usage of the product gets you growth. Now that one can actually, as a tactic, as a growth hack, can actually last for quite a long time, which I think is the case for WhatsApp and Zoom. and payment that yeah, I mean, if you’re still sending money to people, they have to sign up to get on there. So that tactic actually lasts in terms of virality. But a lot of the things we think are viral, they do fade very quickly. Groupon and group buying was a very powerful thing about 10 years ago. And it flamed out pretty quick. Company like Pinduoduo did group buying when they were just getting started and it was very powerful. And everyone called it social commerce and things like that. You know, if you buy something and then you get four of your friends to buy with you, you get a discount. And that was actually a very powerful move for them for a while, but they’ve pretty much shifted away from that now and they’re more like a traditional, well, they’re more like a standard e-commerce company. So a lot of these tactics, even virality, they don’t last for that long. Some do, but most don’t. Okay, so that said, I mean, I generally sort of think three things in my head when I see a tactic that’s getting a lot of growth. Okay, so when I look at these phenomenon, these short-term tactics, these growth hacks, I generally ask three questions. Number one, will this short-term tactic or growth hack lose strength and when? Because what tends to happen is you see someone with a really powerful growth hack tactic, they show a lot of growth, and then they go IPO really quick. and then you gotta project out, everyone says, oh, look at their growth rate. Well, yeah, but you gotta figure out, is it gonna last or is it gonna flatline pretty quick? Okay, question number two, is this a required new capability? Okay, you’ve got a sort of growth hack or a short-term tactic. Is this just gonna be something that everyone in the business has to do? And let’s say community group buying, pretty much every digital company has decided they have to now offer this. They’re all doing it. Maytwan, Alibaba, JD, Tencent, DD, they’re all offering community group buying. So they’ve basically decided this has gotta be a capability we all have to do. And question number three is, is this a structural advantage? No, if I come up with something clever as a company and I get some growth by doing it, everyone’s gonna copy me. So is this gonna fade? And we’re all gonna stop doing it. Or are we all gonna have to keep doing it because it’s now just a required capability like membership programs at airlines. Membership programs and airlines were a good growth hack for a while, but then they pretty much lost their power. Nobody chooses one airline that much based on points or anything. Now it’s a required capability for all airlines, but I wouldn’t argue it’s a structural advantage for any of them anymore. So that’s kind of the three levels I think. One, is this short-term tactic or growth hack, is it gonna lose strength and when? Is it a required capability for everyone now? And is it a structural advantage for anyone? That kind of gets me a sense of what I’m looking at. And I’ll put those three questions in the show notes as sort of a quick guide. And with that in mind, let’s talk about community group buying. I mean, this is a big, big deal in China. And I think you’ll see this far beyond China. But basically the idea, for those of you who aren’t familiar with it, is… You know, this is for e-commerce. This is for buying mostly goods, physical products, mostly groceries or daily necessities, although it’s expanding beyond that. And you kind of have a designated community leader. That’s basically someone in your apartment building. Maybe it’s one small store down the street. Someone sort of becomes the designated community leader who basically means someone who, they started their own WeChat group. And they sort of. get everyone in the neighborhood or whoever they can reach, say, look, place your orders through me and I’ll make one order for all of us. And if we do it together, we’ll get a discount. So group buying, so it’s a group buying phenomena, but it’s sort of at the community level. And you could see how this sort of came out of the COVID era because for a while in China, when things were quite bad, everyone was buying things online, e-commerce, but they wanted to have contactless delivery where they didn’t want people going down to the lobby to pick up their stuff. So the way it was working there were these sort of kiosks where the delivery people would drop their thing off in a kiosk and then you’d come down and get it later or they drop it off with the security guard in the lobby and only when the driver or the delivery person left could you later come down and pick it up. They wanted to separate. the delivery person from the receiver. Well, it’s kind of a natural extension that that person lobby who’s collecting all the packages would then start to say, hey, let’s just buy together. We’re all buying milk every day because, you know, we can’t get our daily necessities and we’re all buying shampoo every week and we’re all but let’s all just do that together. So, I mean, you can see how COVID really sort of accelerated that. But it’s also just a great idea across the board because, you know, it’s I mean, this is the pitch. If you’re someone who gets a little note from your friend or the person in your building or the person down the street that says, hey, sign up for my WeChat group. You sign up. Immediately on the WeChat group, a little thing comes up and says, hey, if you buy your eggs in the next hour, you can get 30% off. Okay. Well, immediately there’s a benefit because you’re getting a discount of stuff that you buy frequently. So you get a group discount. That’s a powerful pitch. Everyone likes cheaper. Cheaper is always, if you’re going for adoption in this life, cheaper and free are usually the biggest levers you can pull when it comes to at least e-commerce. Why is it cheaper? Well, because we’re buying together and we’re, you know, they’re basically getting a discount because you’re doing a bulk purchase, that’s one, but you’re also getting it cheaper because there’s less delivery. Instead of having the driver come back over and over and over with everybody’s individual package, the driver makes one trip for everybody. So if you’re group buying high frequency purchases like groceries, perishable items, daily necessities, you’re gonna save a lot of money on the last mile immediately. Maybe not you as the buyer, but someone’s gonna save money because that’s a lot fewer trips. It’s also kind of more convenient if you’re the buyer. I mean, you don’t have to sort of wait for the package, I guess, the neighbor’s gonna get it. You kind of know the person. If you have a return or a problem or something’s damaged, You know, the service level’s gonna be better. I mean, overall, it’s kinda like, look, it’s cheaper. It’s cheaper because it’s a group purchase. It’s cheaper because there’s less delivery costs and it’s more convenient and it’s kind of a better service because you have a person you can deal with, as opposed to, I’ve got a problem, let’s go into the chat room and try and contact JD or whatever. So that’s, I mean, that’s a pretty good pitch to the consumer. Now, let’s say you wanna be the group buyer. You wanna be the community leader. Well, what do you get? Well, you get a commission. I mean, you get like basically a 10% commission on the sale. Now imagine you’re a local convenience store down the street and nobody’s been coming into your store this year because of COVID. Everyone’s buying online. Well, one, you’re in trouble. And two, if you start taking, you’re already sitting there. I mean, you’re down the street, you’re not doing anything, you’re waiting for people to come in. This is the other version of free money. You know, You all know that I like free stuff, like as a business strategy. Well, free to consumers is great. Free money to merchants also gets a lot of adoption. That person sitting in the store anyways, if they just start organizing group purchases from their phone, sitting at the counter, that’s free money to them. So, you know, big adoption by them. Now the concern to them obviously is how do convenience stores survive in this world of e-commerce? Well, You know, if it’s anything you can wait for, you buy it online. So they’ve been surviving on a lot of immediate purchases, like groceries, because they’re perishable. You generally buy the day you cook or right before. You know, they’ve been sort of, you know, that’s the whole purpose of their store. It’s convenience, i.e. convenience store. This is kind of a body blow to their last strategic position, which is where the stuff you want today, especially if it’s perishable. Groceries and if it’s a daily necessity, that’s where they’ve been retreating to well, this is a direct attack to that So that’s that’s a big problem for them You know, the joke is if you’re a local convenience store You can either you know commit suicide by becoming a group buyer for your neighborhood or you can wait for someone to kill you But those are pretty much your options now. I don’t actually think that’s true. I think we’re seeing a good innovation evolution of the business model Why are there stores down the street from every building? Because that’s where you have to go to get stuff. And there’s a cost structure associated with that kind of retail. This is basically saying, look, we don’t have to depend on physical traffic anymore. We can reach people digitally. So therefore, what we really need is a digital connection and a warehouse, not a store. If I have a warehouse three blocks away from where people live, full of stuff and I’ve got a good digital connection, that’s a better business model than putting little retail stores down the street from where everyone lives. So I think it’s a shift towards that model. I think that’s what these community group buyers are becoming. They’re basically becoming people with warehouses and a smartphone. Now convenience stores are not the only people that are doing this. It’s pretty much anybody who’s sitting at home near you that has a lot of free time. Well that’s a lot of housewives. There’s a lot of housewives sitting around in big huge apartment complexes in China, of which, you know, in China on an average year, they’re building 800, 900,000 new apartments. I mean, there are just, if you ever go on a train outside of anywhere, just go out in second tier cities, things like that, and you just go on a train and you just look out the window, you see just these rows of apartment buildings that go on and on forever and ever. Well, there’s a lot of people sitting in those, so they can all sort of become group buyers. So there’s this sort of ready and willing population that is jumping in, city by city, apartment block by apartment block to become these buyers. And as I mentioned, basically all the digital companies are jumping in. The company you’ll hear about is Xingsheng Youshuan, which kind of means preference, but they’re all using that word, Youshuan, Y-O-U-X-U-A-N in the… you know Tencent and JD have both invested in that particular company but Didi is doing this, Pinduoduo is doing this, Meituan is doing this. They’re all rolling out group buying services that people can use to access their services and then on top of that they’re they’re basically doing a money war or they’re doing a sort of hyperscalene. They’re flooding a lot of money to subsidize this because it’s good for them. it decreases the delivery cost. If you can sort of get everyone to order together, that really does change your cost rate. I mean all these companies have the last mile problem. You know, every time somebody wants one pencil, you’ve got to have another driver on a scooter delivering that one pencil. You know, so if we can get people to order together, there’s a lot of savings there that they can capture. So they’re throwing money at this, there’s subsidies going on. The government has what they think is illegal price subsidies. But going back to my three questions, okay, is this, I mean this is clearly a short term tactic, right? And it’s clearly very powerful. So is this short term tactic and or growth hack gonna lose strength and when? Is it a required new capability? Is it a structural advantages? Now I think we actually have several things going on here at the same time. So I’d tease it apart. Number one, this is absolutely a growth hack. They are. expanding their current business by giving consumers a new way to save money. And it turns out it’s particularly powerful in third, fourth, fifth tier cities where people are much more price sensitive. And it also turns out it’s very effective as a growth hack in rural communities that are far away where the delivery costs are higher. So it’s helping them expand into new and underserved communities for their core services. particularly rural areas, remote towns, lower tier cities. This is a powerful growth hack in that regard. It’s also helping them expand into groceries, perishable items, which they have struggled to get into because when things expire, it’s very difficult to put it in your warehouse. So it’s helping them expand into groceries as well. This is a great growth hack, obviously why they’re involved in it. It is somewhat viral, but not really. You’re creating, I mean, you are kind of turning certain consumers into sales agents. You know, they’re reaching out. So it is somewhat viral. I mean, there is a group buying phenomenon here, but I think it’s more of the growth hack into these sort of new and underserved communities, which is why they’re doing this, mostly. So one, it’s a growth hack. Number two, it’s a money war. You know, they’re using this as a service, they’re throwing money at the problem, they’re subsidizing it. That’ll go on for a while. That’s a short-term tactic. Totally common. Happens in China all the time. There’s some other sort of tactics involved here. There’s a bit of gamification going on that, you know, if you walk down to the supermarket, they might be like, oh, milk is on sale. Okay, I like a discount. I’ll buy some milk. But there’s not a lot of gamification when you walk to the supermarkets. But when they do these sort of flash sales and you’re on your WeChat group all the time checking for what’s discounted, there’s more engagement. It’s more like a video game than just walking to the supermarket. So when they sort of release, hey, there’s a flash sale. If you buy eggs right now, you get 20% off. You have to sign up in the next hour. So there’s a bit of consumer psychology there. Little bit of gamification going on. That’s interesting. There’s social pressure. You know, there’s a famous company in the US, well not famous, well known, Mary Kay Cosmetics, and their strength was we get people to sell to their friends. You want to sell a lot of anything? Get people to sell your product to their friends and their family because there’s a lot of social pressure on there. If your cousin comes or your neighbor or your friend from college emails you and says, hey by the way, I’m selling makeup, would you, you know, blah, blah, blah, blah, blah. you’re gonna feel some pressure to buy some. So there’s companies in the US in particular that get you kind of close to multi-level marketing, but anytime you can get people to sell to their friends and family, there’s a lot of power in that. So this community selling aspect is interesting. So I think there’s a decent level of psychology going on with this beyond just the hey, it’s a discount and hey, the last mile delivery costs are less. So that’s sort of the first bit. I think… that will probably persist for a long time. I think this is probably here to stay. Okay, is it a structural advantage or just a new capability that everyone has to have? I think it’s probably a requirement for the long term. I think this is a capability these e-commerce companies have to have because it’s gonna lower your logistics cost. It’s gonna combine multiple shipments into one shipment. You’re probably gonna get… some decreased inventory costs as well. I mean, there’s one, there’s the delivery costs, but two, if you’re trying to sell everything to everyone, you have to have a lot of stuff sitting in your inventory. But this is a way to sort of plan out what’s going to be sold because you’re making these offers. So you can probably decrease your inventory costs quite a bit because you know, these are real orders that are going to come. We can stock our inventory against these offers we’re going to make to group buyers. So we don’t have to just keep everything ready for anyone. We can probably lower our inventory costs for a lot of stuff. We can probably replace some retail stores with just warehouses and local agents with smartphones. So that’s gonna decrease some real estate costs. It’s probably more efficient. So I think this is gonna be an ongoing requirement. I doubt it’s gonna be a structural advantage for any particular company. I think this is just gonna kinda be an ongoing requirement you have to have. That’s kinda where I put it mentally. Anyways, that’s sort of the first one I wanted to talk about, community group buying. I think we’re gonna see this go far beyond China. It’s important to understand why it’s so powerful and why everyone’s in. But I would definitely put it under sort of the tactic level. It is a tactic, it is a growth hack for these companies. I do think it’s gonna be a capability requirement for a lot of these e-commerce players going forward. I don’t necessarily see it as a structural advantage. That’s my take. Okay, next cool China tactic is blind boxes. And the company here that really rode on the back of this is Pop Mart, P-O-P-M-A-R-T, Pop Mart. And this is kind of a strange company. I’m gonna do an email about this this week. And it’s a toy company. But it’s not toys for one to five year olds that are just like, hey, here’s a car, here’s a ball. I mean, this is sort of, when they say pop toys, which is popular culture, these are toys that are really, for say teenagers up to 40, which are gonna be more distinctive, and these toys are gonna tie to some aspect of popular culture. So this could be Iron Man figures. This could be Japanese anime. These could be you know all of these interesting characters. This could be Hello Kitty. Any of these things where the toy is really specific to some intellectual property that somebody owns. Somebody owns Hello Kitty. Someone owns Iron Man. Someone owns, I don’t know the Japanese anime characters, but there’s a lot of them. You know somebody owns those and that intellectual property they monetize in a couple ways. They can sell physical toys of those products. They can turn them into entertainment. They can make movies. They can make videos and things like that But you’re basically in the IP business and then you’re monetizing by a couple ways and one of those ways is Selling physical products which has traditionally been done either online you buy these figurines or whatever online or you buy them in physical retail stores Now pop Mart began as a physical retail store. They open lots of stores in China and They kind of vertically integrated backwards into, well, now we do the commercialization of IP, we can help other people sell their IP through our stores. We’ll make figures based on their IP and sell them in our stores. And then they move further up, where we’re gonna have our own IP, and they have a handful of popular characters. I think their number one is Molly, which is like, I don’t know, it’s just this character with, you know, a cute girl with big eyes and blonde hair, and I guess it sells pretty good. So they’ve kind of moved to sort of vertically integrate across the whole end-to-end sector and they even have conventions and things like that. Okay, it’s kind of an interesting business and one of the reasons people notice them a lot is not only do they have these stores, which is where most of their volume moves, they also have, I mean, they’re two biggest ways to sell products, which is either characters they own or characters that they have the exclusive license for or a non-exclusive license. is they sell them online or they sell them in their stores. But they also have robo shops, which are especially a fancy word for a vending machine. And you’ll see them in shopping malls all over China where you walk and you can buy these figurines or whatever from these vending machines. And it’s kind of cool. Okay, so this company’s been around for quite a long time. 2010, I believe they opened their first store. But in the last one, two, three, four years, they have had spectacular growth. revenue growth and they’re profitable. And so let’s say 2017, their revenue was about 160 million rem and B. So, you know, divided up by seven, that gets you sort of a US dollars, 158 million, 2017. 2019, that went up to 1.7 billion. So 10 time increase in their revenue. And it basically translated to their gross profits. They have about a 65% gross profit percentage. and it pretty much translated to their operating profit. So there was a growth phenomenon over the last three to four years, which is, I think we got a lot of people’s attention and then they went public. I don’t really wanna talk about the toy business, even though I think it’s really cool. And I am gonna talk about the toy business in the emails because there’s a lot of cool dynamics to toys. But I think they had a growth hack. What’s the growth hack, which is the point of today? It’s the blind box. I think that’s what did it. And when you actually look at their revenue, let’s say 2019, they had 1.7 billion rem and B of revenue. 1.4 billion of that was blind boxes. So 84, 85% of their sales 2019 were these blind boxes. Okay, what’s a blind box? Well, simple. It’s a little package where you can buy one of the figures and you don’t get to see it. You don’t know what’s in it. So you walk up to the vending machine or you walk into the store. and they will have a new series. Usually they do these things in series where of this series of Hello Kitty or of this series of Molly, we have 12 different designs and you can buy all of them, one of them, but you don’t know which one you’re getting because it’s in a sealed package. All you see is the blind box. You buy it and you hope you get one you don’t have and you try and get all 12 designs. And often there’s a hidden edition, so there’s 12 designs of let’s say Mali or Hello Kitty in this series, and then there’s a 13th one, which is kind of hidden that you can discover. And each one of these costs about 45 to 55 rem and B, so seven bucks, something like that, one figure per box. And that’s really sort of spiked to their sales. and I’ll put a picture in the show notes you can see one of the vending machines the robo boxes where you go up to the vending machine and all you see are these packages with the sort of title on the front but you have no idea what’s in them so why is that so effective as a tactic I mean it really did spike their business what did they do here well it’s I mean it’s a lot of consumer psychology what if you just go up and buy a figure and let’s say you like these molly characters and you go up and buy them that’s fine And there’s a collector’s aspect to this whole business where people like to get all of them in a series. And then they can often resell them. I mean, it’s kind of a collections thing. So there’s that going on, but when you put it so you’re blind when you buy it, it creates a level of unpredictability. It kind of brings in gambling psychology. Which one am I gonna get? And that makes it, one, it makes it more fun. Which one am I gonna get? I don’t know. the more unpredictable it is, it kind of makes it more fun. You try and get the ones you don’t have. People do say this is a bit of gambling what’s going on. It also really spikes your repeat purchases, because I want to get all seven, or 12 designs in a typical package. So I want to get all 12, so I’m going to keep coming back there, because I want to complete the set. Oh, and I want to get the hidden one. So it’s kind of a, you know. incentivizes repeat purchases. It adds a bit of a gambling aspect. It adds unpredictability and it makes the experience more exciting and more fun. And yeah, it just turns out it really, really works. And you know this, I would put this clearly under the title of growth hack, you know, at least for tactic being used far beyond just toys and physical products now. It’s kind of going all over the place and the government has some real concerns about it. Because it’s kind of a gambling like phenomenon. You do get a bit of a rush when you open the box to see which one you get. So we see being done with virtual goods and e-commerce. We see it in video games with like loot boxes and things like that and you know maybe you get free stuff for your character you get free swords or special device for your character if you spend a little money uh… you can use it to direct traffic you give away you know here’s nine potential items you can get click on one to get a free thing and people go over and it directs traffic so you see this sort of blind box phenomenon being used uh… kind of all over the place right now far beyond just toys and physical products and Yeah, I mean the government has some real concerns about this because they view it as sort of going into gamification and basically gambling psychology, which I think is not unwarranted as an idea. But it makes a lot of sense for collecting sort of collectible toys. Anyways, that’s tactic number two I want to talk about. I don’t think this is any sort of structural advantage. I don’t even necessarily think it’s going to be a required capability. I just think it’s an effective tactic people are going to use from time to time. And this particular company applied it in a very clever way. to the toy business and it really was an effective growth hack for them. I don’t think it’s going to work far beyond. I don’t think it’s going to work in fruits and vegetables or anything. It’s kind of specific to toys. Anyway, second one, take a look at the photo of the Robo shop with all its blind boxes, the photo. It’s pretty interesting. And that brings us to the third and final sort of cool China tactic, which is influencer marketing. I think the world is sort of… caught on to the idea of this is coming out of China. We see these sort of influencers appearing all over the world now. But I mean, it really was a China story and it happened arguably more powerfully there than anywhere else. And the email I sent out the other day about this was, you know, that this is really about activating a network, that the difference, which I tried to show in those graphics, I’m not sure if I succeeded in that really. Now the idea was if you’re a business and you’re trying to reach consumers, which they all know B2C that’s what they do. Okay, you were kind of dealing with the population. And you know, you had these sort of blunt force traditional tools like mass marketing, where you put up billboards and you buy TV spots and all of that and that that game was that was how it was played for a long long time. And then as things became more digital, you were able to do that in more of a niche and you know, instead of one way, pretty stupid blunt force marketing, let’s just put up an ad that everyone sees and hope that our people see it. Now, then it started to get a lot more data driven. It started to get more of a two-way communication where you could reach people through their emails or you could engage with them on a website. And we sort of fragmented the consumers into various behaviors and demographics. A lot of niche companies have done very, very well by focusing on small segments of the population, which is a real contrast to traditional mass marketing. And the question I posed in that email was, OK, if that was the story up until, let’s say, 2010, 2015, what happens when consumers themselves start to become connected to each other? And suddenly the communication you may have as a company with a consumer is absolutely dwarfed by the communication that consumers have to each other about you. Where the linkages between consumers are exponentially larger than any linkage you may have as a customer, as a company directly with the consumer. And I’ll put the graphic, I think this graphic was pretty solid, which was just. you know, just look at this big demographic of consumers and now look at all the connections between them. And I called this the digital consumer network, the CDC and the China Digital Consumer Network, where I’ve kind of argued for a couple of years now, you have to start viewing Chinese consumers as a connected network, where what they say about you to each other is dramatically important than what you may say as a customer or a company to them. And we see this all the time. And we see it all the time. If a company does well and consumers like them and start talking to each other about this company, it takes off like a rocket ship. Or if your company is inherently viral like payment platforms, it takes off like crazy. And the converse is, if you do something consumers don’t like, it takes off like a rocket ship. Well, bad word of mouth will be like, it will just rip through China. Or suddenly on Sunday, one random thing happens like an airline passenger on United Airlines gets dragged down the aisle in the United States. And it turns out it was an Asian American gentleman who was, I think, after the scandal, it turned out he was a Vietnamese American. Didn’t matter, because it happened on a Sunday in the US and people in China saw it. And it took off like gangbusters in China, such that the CEO of United had to come out and apologize two days later because of the backlash in China. I mean, you see this network activate all the time in positive and negative directions for companies. Well, I argue that influencer marketing is a growth hack, a tactic that activates the network in your favor. I mean, that’s what these influencers do. And I mean, I’m widely considered a B2B influencer in China. So I’m not facing the consumer markets, but I mean. I’m pretty sure that’s how I sit in some spreadsheet in Alibaba and these companies, they have a list of influencers and I think I’m on that list. And you know, on the consumer side, it’s about people that can activate these networks where they create content, they create communities and they get people to talk about companies and products or whatever they want. And that’s a very powerful thing and companies have discovered that we need to reach out to these people. and we need to try and get them to talk about our products or our service or our fall lineup of fashion or our new shoes or we’re L’Oreal and we have a new type of makeup and we want influencers of China to talk about us because that will activate the network on our behalf. And how do they do that? Well, that’s the whole field of influencer marketing. And the company I talked about in the email was JoySpreader, which is a kind of a strange name. JoySpreader Interactive Technologies, but there’s also a company called Ruhon or Ruhon, depending how you pronounce it, Ruhon Holdings. Ruhon Holdings, they are an influencer marketing agency that develops and then supports influencers who are very successful, and they sell those services to companies as an agency, as a talent agency. And then they also do some e-commerce themselves. JoySpreader is a… marketing services company that sells influencer marketing campaigns to various companies. You hire us and we will orchestrate a campaign with 150 influencers in China that will talk about your product and you’ll get a lot of access to their traffic. They will put out your content and your thinking and that’s the digital marketing service they sell. Now I’m not a huge proponent, of that as a company because I think it’s a very difficult business to be in to be in the Influencer marketing business. I think that’s that’s very difficult But so you know these companies Ruhan and JoySpreader I think those are difficult businesses to be in but the overall phenomenon and the growth hack that’s clearly what has propelled those two companies Upwards is this idea of influencers that are able to activate a network on behalf of companies and they’ve grown very quickly on the back of that. Now, is it sustainable? No, I don’t really think so. But it’s a pretty powerful tactic in the short term. I think that’s kind of what I wanted to cover for today is just when you move down to the bottom of the pyramid, just to recap, you move down to the bottom of the pyramid, you get tactics, you get short-terms moves, dynamic competition, there’s a whole lot going in there. And I think in China, it’s just… super dynamic. There is new stuff tactic-wise coming up all the time. And if you’re a CEO there, you have to be so fast on your feet. You have to dodge and bob and weave all the time. That’s why when these companies come out of somewhere like China and then they go into the US, they just run circles around US companies. We see it all the time. So anyways, within that category of tactics, I’m probably not gonna spend much time talking about this. in the podcast or in the emails, just because it’s very industry specific, but I think it’s sort of least important to, if you’re looking to invest in these companies to know how to assess that. And I gave you sort of three basic questions for how to think about those. One, you wanna identify those as tactics. Most tactics by definition are short term. So you wanna clearly identify, look, this is not a structural advantage, this is not operating speed, which are the levels I always talk about. This is a tactic, it’s bottom of the pyramid. This is probably gonna be a short term thing. And then kind of assess, okay, how powerful is it? When’s it gonna expire? Is it a required capability? Blah, blah, blah. So, for today in terms of concepts, I’ll put this all under the category of just tactics. And I’ve listed one, two, three, really four for you today. Community group buying, I think is a tactic you should be aware of. It’s going to be a big deal over the next year. That’s important. Second to that, I think influencers and KOLs are an important tactic to keep in mind. Virality is probably the third one that’s worth keeping on your short list. Outside of that, the other stuff that I’ve mentioned, money wars, fast scaling, blind boxes. I mean, I think stuff like that is just gonna come and go all the time. It’s probably those first three that I think are probably gonna play out longer term, community group buying, influencers and KOLs, and then virality. And generally, I would recommend being fairly suspect when you see a company posting really impressive growth numbers based off some sort of short term tactic, and then they go public pretty quick. That’s probably an indication they don’t think it’s gonna last. Yeah, I always get very suspicious when I see that sort of a very effective tactic and then a fast IPO. It’s like, okay, my radar is flashing red on this one. Anyways, that’s it for the content for today. As for me, things are nice and slow here. It’s a Sunday in Bangkok. It’s been raining as I’ve been doing this, which you maybe have heard on the background a little bit. Nice thing about the rain is it clears out the pollution. So it’s going to be nice and clear. I like that. We’ve also had a bit of a COVID thing going on here in the last couple days. Apparently there’s a reasonably significant outbreak. So people are kind of staying home and it’s probably going to change the border rules, which may throw a wrench into my work. So I was planning to fly out of the country quite shortly, but if it’s going to get dramatically harder to get back in, I may delay that a little bit. I was actually thinking about going to Serbia. Belgrade because I was gonna go there anyways. I was just gonna take a vacation. I wanted to go to Montenegro and sit on the The Adriatic for a little bit. It’s just pretty and it also turns out it’s one of the places you can get a vaccine as a foreigner because I guess they have a bunch of them and they’ve been super effective at Vaccinating so you can sign up as a foreigner and get a vaccine. So I’m actually signed up in for Belgrade and we’ll see if they give me approval for that, but I’m apparently on the list. So that was going to be my plan, go there, get a jab in the arm, and then go sit by the water for a couple weeks and then get a second jab, which was, you know, strangest vacation ever. But I don’t know, it seemed like a decent idea, but now with the rules changing here, I don’t know. Anyways, that’s it for me. I hope everyone is doing well. I hope this was helpful. And if you have any suggestions for companies to look at, please send me an out. I’ve really appreciated those of you who have sent it over the last week or two. Sun Art was really interesting to look at. JoySpreader was interesting to look at. Yeah, I appreciate that, thank you. That’s it. Hope everyone’s doing well, and I will talk to you next week. Bye-bye.