Stone Company in Brazil is a really interesting contrast to Ant Financial in China. And to Square in the USA.

All three companies are somewhat trying to do the same thing:

- To build out an alternative payment platform for SMEs.

- And then to add additional platforms and services on top of that.

It’s a big idea because payment platforms have historically been very powerful. Think MasterCard and Visa. And PayPal and Stripe. And Alipay and WeChat Pay. Although there are now new payment technologies emerging and lots of decentralized finance stuff.

But, thus far, payment platforms have been a powerful business models. And even if they don’t remain dominant as business models, they are still naturally viral and are good for getting users. And we see Stone, Square and Ant all building such platforms. However, the “go to market” strategies of the companies are different. And what they are building on top of payment is different. And this has important lessons for China (i.e., the Ant playbook), the USA (i.e., the original Square playbook) and smaller developing economies (i.e., the Stone playbook).

Let me start with Ant in China (and maybe SE Asia).

Ant Built 3 Complementary Payment Platforms on Top of Alibaba’s Ecommerce Platform

Here are some of the key points in Ant’s history:

- In 2011, Alipay released its mobile app.

- This was really the beginning of mobile payment in China. It took ecommerce from something on a personal computer (at work and home) – to online and offline everywhere. Chinese consumers began scanning QR codes and paying everywhere with their phones. It became part of daily life.

- In 2013, Alipay launched Yuebao with Tianhong Asset Management.

- Yuebao translates to “extra treasure” and it let users put their Alipay balances into a money market fund. This was a big improvement from the tiny rates of return and inconvenience of state banks. And it was Alipay’s first big move from payments to investment services.

- In 2014, their bank subsidiary MYbank got regulatory approval and the platform begin offering credit to consumers and small merchants. That was their big move from payments into credit services. This is really important.

- In 2017, they partnered with TrueMoney in Thailand. Not hugely important but I thought the readers in Thailand would appreciate it.

- In 2018, Alipay expanded into cross-border payments across Asia, usually by partnership.

- In 2019, users of Alipay e-wallets reached 1B people.

- In 2019, Alipay launched Xianghubao, a mutual benefit insurance product. This is one of their key moves into insurance.

- In the six months prior to their IPO filing in 2020, total payment volumes on Alipay totaled 118T RMB. That right. They processed $17 trillion in payments in six months. Compare that to the $100B in mobile payments in the USA for all of 2019.

Here is what I think Ant was building (prior to the government crackdown).

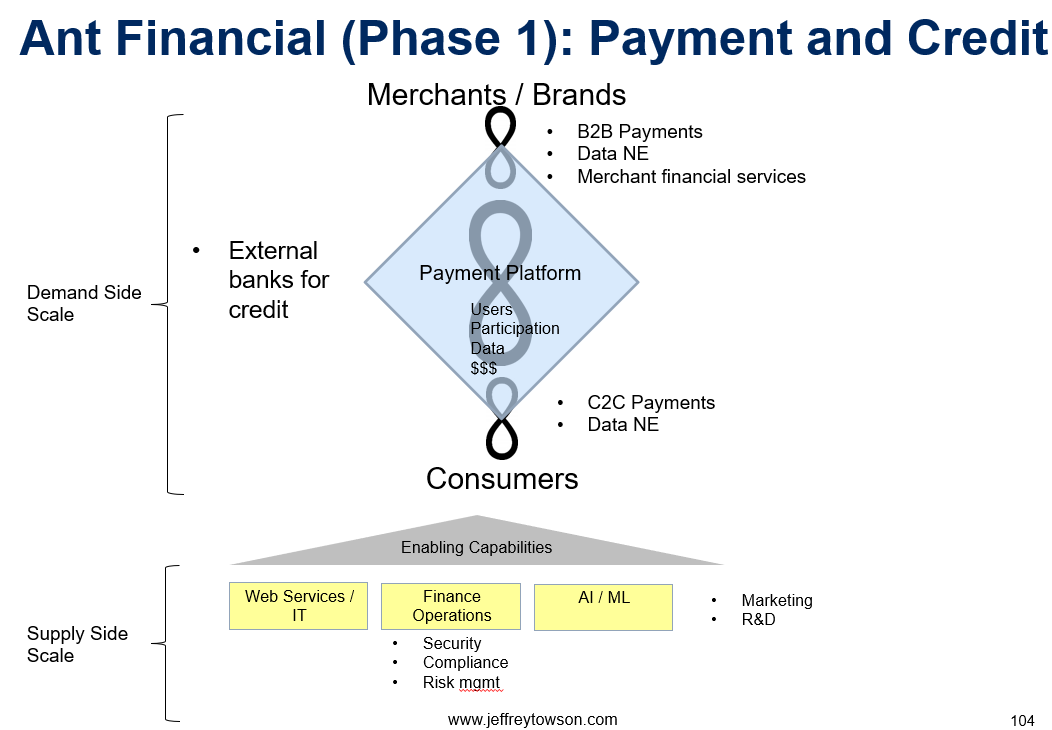

1) A Payment Platform with Credit Services

- A payment platform means merchants are one user group and consumers are another. And there is a network effect between them. These are national platforms. But they can easily go international, which is why they can be so powerful. Think MasterCard. However, with mobile payments, you can also easily send payments to other consumers. And merchants to other merchants. So that is two other network effects.

- I think you can increasingly add credit the idea of payment platforms. It is a small step from pay now to pay later. However, if the credit is coming from a large number of external banks then I consider that another user group. But for mostly internally provided credit, I just consider that a payment platform with credit added as a service.

- Payment platforms also have virality (one of my six digital superpowers). This is a growth hack that enables payment platforms to grow rapidly and bring in lots of users quickly and cheaply.

- Ant refers to its payment platform as the “infrastructure” of finance. I think what they are really saying is that the network that payment creates is the foundation. It is also usually what most attracts users and creates the highest volume of activity.

Here’s how I describe this for Ant.

2) A Marketplace Platform for Financial Services (Credit, Insurance, Investments)

- This is about adding three other user groups – banks, insurance companies and asset management companies. Consumers and merchants can now do interactions with them via a marketplace platform.

- Most of these services get very little activity as people don’t buy investment products very often. These are also complicated services that require risk management. Credit is probably the most active of these.

- It’s hard to build a stand-alone marketplace platform for just digital finance. It’s hard to get enough users and activity levels to make the platform function. But by putting it on top of a payment (plus credit) platform you get the best of both worlds. You get the active network by payments and you get the big money in infrequent financial services purchases. You really do capture Chinese consumers’ accumulating wealth. A marketplace platform for financial services is a great complementary platform.

3) A Marketplace for Simple, High Frequency Consumer Services

- This is basically Alibaba’s version of Meituan. Ant integrated Ele.me, their Meituan competitor, into Alipay a few years back. And this means lots of daily services, like ordering food and buying movie tickets.

- For Ant, most of these services are not huge money. But they do get frequent engagement and lots of valuable data. And they are fairly simple to provide. That is why Ant calls them “Daily Lifestyle Services”.

- For companies like Grab and GoJek, these types of daily lifestyle services are their core business. And these companies are expanding from here into payments.

I don’t think Square and Stone will do the daily life services. So I think both of these companies are trying to build Ant Phase 2.

One last point on Ant.

Pay attention to the supply side enabling capabilities, which are shown in the bottom in yellow. These capabilities are what enable the interactions on the platforms to happen. For example, in ecommerce they are usually about logistics and delivery. But for payment, these enabling capabilities can be very different in different countries. A lot of the “go to market” strategy shows up in different enabling capabilities.

- In China, Ant benefited from a fairly well-developed infrastructure with widely used debit cards. So the enabling capabilities were mostly about IT and web services. And growing machine learning capabilities.

- In the USA, Square benefited from well-developed infrastructure and widely used credit cards. But it was also dependent on the banking payment networks.

- For Stone, we see a complete different sent of enabling capabilities to make it work in Brazil.

More on this in Part 2. But first, Square…

Square Built a Payment Platform by Catering to SMEs and Micro-Merchants. They Are Adding Merchant Services and Credit.

Like Ant, Square began as a payment platform, mostly focused on small businesses. The original Square payment solution was a credit card reader (hardware plus software and services) for underserved and unserved small merchants. Square has focused more on the merchant side than Ant.

But the foundational strategy is the same.

- Focus on an underserved user group to open the door to a classic two-sided payment platform.

- Develop network effects

- Benefit from virality. The virality of payment is a powerful mechanism for growth. It is worth offering payment at a discount just to grow a payment platform this way.

But in the USA, Square still needs the credit and payment card networks controlled by the banks. Like PayPal, they are piggybacking the existing network and don’t have direct access. That makes them subject to the interchange and assessment fees. And to the banks and other intermediaries that provide them access. So, payment fees are still in the 2-3% range (5% for PayPal), while only 0.60% at Alipay.

Both Ant and Square have been growing banks as a third user group. Square has not been as aggressive in this regard. Their activity is still quite limited. Ant had “CreditTech” as a major part of its platform prior to the government crackdown. And the credit part was what they disliked the most.

Square is at a much earlier stage in credit.

- They are currently acquiring AfterPay (announced August 2021).

- They are beginning to offer unsecured business loans to sellers.

- And they use Sequoia Capital to find 3rd party investors to purchase loans originated by bank partners. So repayment can be done as a fixed percentage of each transaction. They say most seller loans are repaid in 8-9 months (with a loss rate of 4%. Note: Ant has a loss rate of 1-2%).

Overall, Credit Tech is the area of Square’s business that offers the most exciting growth options right now. And this is where we are seeing lots of action for Stone as well.

Here’s my take on Square.

Square also says it is building a “seller ecosystem“. This means they are expanding their software and services offerings that can help small businesses start, run and grow. They are adding enterprise services to the financial services they offer merchants. Stone is doing something similar.

This is to help SMEs and micro-merchants that still mostly use non-digital solutions in their operations. And that usually have to stitch together services from lots of providers if they do go digital. But Square is offering hardware, software and financial and enterprise services that can integrate easily. And which the company monetizes by subscription, transactions, and service fees.

That is all pretty interesting. I think this is mostly just additional services. But we could consider this a primitive innovation platform. As will be discussed, this is an area that Stone is moving more aggressively in. As most enterprise software and services are not available for SMEs in developing countries.

For Square, this includes cloud-based, self-serve, and easy set-up services – including:

- Virtual terminals – POS

- Square appointments – for service appointments. Booking, invoicing, and payment.

- Square for retail. Barcode scanning, COGS, etc.

- Square for restaurants.

- Square invoices.

- Square online store.

- Loyalty, marketing, and gift cards.

- Dashboards with real time data insights.

So they are moving into enterprise services. You could consider this an attempt to bring together developers as a new user group. Maybe a smaller and simpler version of the App Store. It is an innovation or coordination platform, although only +30 apps have been built for sellers thus far.

Overall, this is not much of a platform, whether innovation or collaboration. This is more like a suite of services for sellers that will create switching costs and can be bundled. That’s still good strategy. And it is complementary to payment and credit.

***

Ok. So we see somewhat similar business models for both Ant and Square. The payment (plus credit) platform is the key asset.

But we see a different evolution and go-to-market approach. And we see different enabling capabilities that had to be built to make the platform go.

- For Ant, it was mostly about building on the existing ecommerce platform between consumers and merchants. And they mostly built IT systems to enable these interactions.

- For Square, the payment platform was built off serving underserved SMEs. They are adding merchant services and credit. The enabling capabilities have been IT but are also about accessing the US payment networks (and contract manufacturing).

In Part 2, I’ll talk about Brazilian Stone Co, which is really a third approach to payment platforms. And I think it is likely the best playbook for developing economies. It has also fallen in share price dramatically in the past six months.

Cheers, Jeff

———

Related articles:

- What Ant Financial Tells Us About Square’s Future. (Jeff’s Asia Tech Class – Daily Update)

- Ant Financial Is 3 Platform Business Models Combined. (Jeff’s Asia Tech Class – Daily Lesson / Update)

From the Concept Library, concepts for this article are:

- Payment Platforms

From the Company Library, companies for this article are:

- Stone Company

- Ant Financial

- Square

Photo by Clay Banks on Unsplash

———

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.