This article series is an expansion of the podcast I did about Baidu’s AI Cloud Strategy. Which is pretty great.

First, let me go through the strategy basics of Baidu. Then I’ll get to their AI Cloud Strategy.

The Business Model for Simple Search

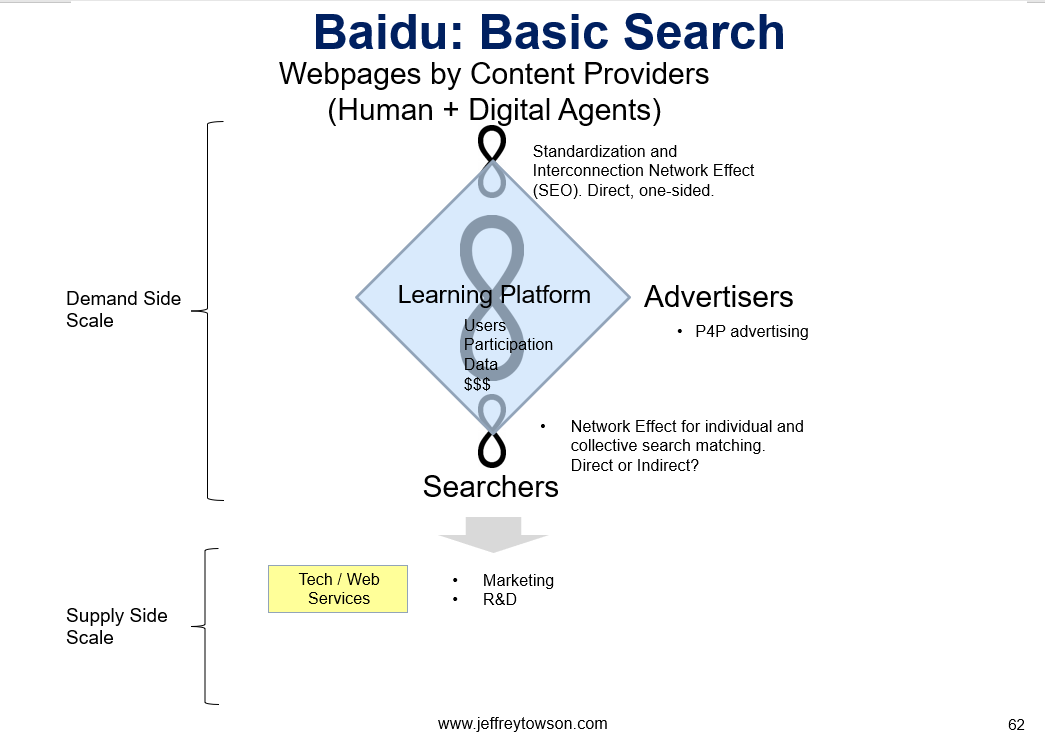

Baidu was founded by Robin Li in 2000 as a search engine, around the same time as Google in the US and Naver in South Korea. The early version of search engine (for a PC world) looked like this:

First, you’ll notice on the left that this is about achieving demand-side scale first. That’s where the power is. In aggregating demand and usage. And search engines are really great at this. They are at the front of the cue for users.

In the blue diamond (my representation of a platform business model), you can see three user groups interacting in a search engine:

- Searchers. This can be individuals and organizations doing searchers. And in early search, this was on web browsers on personal computers. And this was mostly about searching the text within webpages. Maybe some images with tags.

- Webpages by Content Providers. I consider this user group a combination of digital and human agents creating webpages and their content. It includes people. It includes companies. But it is also software. The content on webpages was being formatted and structured to meet the Search Engine Optimization (SEO) specifications of the leading search engines. Some of this happens by software. Some of it is done by people.

- Companies and Advertisers. Who are bidding on search results. This is pay-for-performance (P4P) advertising, which is very different than the attention-based advertising of companies like Facebook, Tencent and ByteDance.

I call this a Learning Platform, which one of my five platform business model types. It’s definitely a platform business model because it is 100% about enabling interactions. And it effectively reduces the search costs (a type of coordination cost), thus enabling users to find the content they want.

The challenge is how to characterize the types of interactions being enabled. With a marketplace it is easy, because the interactions are buy/sell transactions. I think the interactions in search engines are mostly about increasing the learning of the platform. It’s mostly doing matching while constantly learning about constantly evolving content and interests. Hence, learning platform.

I’m not 100% sure about this platform business model type. It’s still somewhat fuzzy for me. Rate of learning hasn’t been a common phenomenon in digital strategy. But it is becoming much more important with AI. We see rate of learning as a digital marathon. We kind of see it as a competitive advantage now. And it does show up on platforms. I’m still working on this. Any thoughts would be appreciated.

Note that in the above graphic, we can see 2-3 network effects (the infinity signs).

The important network effect in search engines is two-sided network effect between the two main user groups. The more users doing searching, the better for the website creators. And the more webpages listed, the better the search results will be for users. You can see this as the big infinity symbol in my graphic.

This is all about the long-tail content and searching. This network effect increases for a long-time. The more obscure and rare content scanned, the better for users. Google and Baidu do really well in the percentage of search queries that have never been asked before.

There’s also a personalization / data network effect on the searcher side. That’s the smaller infinity sign at the bottom. The more you search, the better your own personal results get. It works at the individual and group level. I generally don’t like data network effects as an idea. As I think that is mostly just data driven personalization of services. But in this case, I’m kind of a believer.

Finally, there is also a standardization and interconnection network effect on the supply side. That’s the small infinity sign at the top. The more webpages that standardize according to Baidu’s SEO, the better it is for everyone. Everyone building webpages uses the same formatting. They want to optimize against Baidu SEO. Everyone also uses the same tools and training for building webpages and doing SEO. So, we see standardization as a direct network effect. This is like when everyone writes documents with Word. Or uses PDF. The more people using a standard, the more it creates value for everyone.

We can expand the graphic to include the supply side.

On the supply side, things are pretty simple. They are just building capabilities in IT / Web Services. But these investments are very focused on AI and matching. That’s important. Economies of scale are better when they are specialized.

You can see this at the bottom in yellow. These are the key capabilities that enable the platform interactions. And you can achieve scale in some of them, which is another type of advantage.

The Business Model for Complicated Search

Ok, those first two graphics are reasonable pictures for basic search. And this is how it worked for 2005-2010. But then search became more complicated – including:

- Search moved from PCs to mobile devices. Smartphones were a big change to search. And we also see smart devices, AI speakers, etc. Suddenly, lots of the information was kept with apps. And you can’t really search across all the apps on a smartphone.

- Content types expanded to videos, music, text, images, etc. Text was fairly easy to search. But searching the content of a video is more difficult. The AI had to get much more sophisticated. Note: ByteDance is great at this.

- Some information began to move into walled gardens. Webpages could be searched by anyone. But information within businesses like Tencent and ByteDance can only be searched by those companies.

- Search methods expanded to multiple languages.

- Multi-modal search began to emerge. Users were starting to search by voice. By camera (great). By AR/VR.

- Search required access to lots of locations. Searching from webpages and mobile apps expanded to embedded searches in webpages and mobile apps, from within operating systems, from within maps, from within smart devices and so on.

- Search engines evolved from being a place to search for information to a place to answer complicated questions. Products like Quora and Zhihu emerged to answer more advanced questions.

We can create a graphic for a more complicated Baidu search.

Note how the top of the graphic has expanded to include lots of places where information must be searched.

In the middle, you can see far more complex searches happening. And from different types of devices.

Finally, at the bottom, you can see that AI became a bigger and more important capability during this period. Baidu considers AI their core capability. And they now call themselves an “AI company”.

And at the bottom right, you can see “Search à Feed”. This is important.

Why Baidu Products Went from Search to “Search Plus Feed”

Along the way, Baidu started to call its core products “search plus feed”. From a past 10k, this is how they describe Baidu Feed.

That is really important. It’s worth reading that twice.

WeChat creator Allen Zhang talks a lot about how we interact with information online. His argument goes like this:

- The information you consume shapes you. Historically, we consumed information from our conversations with people. From the town we live in and walk around in. From the books we read. From our school, newspapers, church and so on. And especially from our family. The information you consume constitutes much of your lived experience and it 100% programs you.

- However, the information we consume in the real world is now dwarfed by the information we consume on our smartphones. Smartphones have increased our consumption. They have increased the breadth of our knowledge and relationships. These devices are shaping our experiences and our thinking more than anything else.

- But most of the information you consume on your smartphone is determined by others. Not your family. Not your school. Not your church. Not even from people in your country. The information we consume is determined by algorithms. Some have an interest in manipulating you. Some want to shape you. Some are just non-sensical and want to keep you online.

- The most powerful consumption happens in newsfeeds. You may occasionally search for information. For the answer to a question. Or for a video to watch. But most of the information consumption is passive. You scroll TikTok and Facebook and just watch the next video and story they automatically tee up. Someone else is determining what you consume passively.

From Allen Zhang, “what is pushed determines what the user sees and what kind of world they live in.” And that “push notifications make use lazy”. That we “let them take precedence over what we choose to see”.

Basically, newsfeeds are incredibly powerful. More than search engines, which were the primary way we interacted prior. And companies like ByteDance and Tencent are in the feed and passive consumption content business. They are all about getting user attention and keeping it. And then by monetizing by advertising. They are mostly not in the search for information and knowledge business.

In response, Baidu had to expand its products, including its flagship Baidu App. It went from search to “search plus feed”. From users doing active searches to also doing passive consumption.

Ok. That’s how I view the business model.

The Basics of Baidu’s Business Today

Fast forward to 2024 and Baidu’s search engine has evolved into a suite of apps (mostly on smartphones). They call this their Mobile Ecosystem.

Here’s the current apps (from their webpage). You can just skip this if you are already familiar.

- Baidu App. Their flagship app for search, feed, content, and other services through mobile devices. It has “twin-engine search and feed functions that leverage our AI-powered algorithms and deep user insight to offer users a compelling experience…In December 2020, MAUs and DAUs of Baidu App reached 544 million and 202 million, respectively.”

- Haokan. “User generated and professionally produced short videos, usually several minutes long…Video creators and curators can distribute their content to build a fan base and receive revenue share for their content contribution.”

- Quanmin. “A flash video app for users to create and share short videos, usually less than one minute long, and live videos with entertainment orientation, such as musical, dance, comedy, acting, and lip-sync”

- Baidu Wiki. “A leading wiki in China compiled by experts in specialized fields featuring high-quality columns and videos, such as Encyclopedia of Intangible Cultural Heritage, Digital Museum and Recorder of History.”

- Baidu Knows. “An online community where users can pose questions to other users, such as individuals, professionals, and enterprises.”

- Baidu Experience. “An online platform where users share daily knowledge and experience, providing practical tips and interesting perspectives in areas, such as software, lifestyle, and games, etc.”

- Baidu Post. “A social media built on topical online communities. Users can post text, image, audio and video content and reply to original curation, forming valuable discussion groups.”

Customer services include:

- Baijiahao (BJH Accounts). “Our publisher network aggregates articles, photos, short videos, live videos, and augmented reality clips from MCNs, media outlets, and other professional sources, for distribution through search, feed, and short video products. BJH publisher accounts reached 3.8 million in December 2020, representing a growth of 48% over the same period in 2019.”

- Managed Page. “A hosted mobile alternative for website owners. Site owners may open an account on our platform, use our tools and services powered by AI and engage with users without having to maintain their own site and pay for server, software and bandwidth costs.”

- Baidu Union. They “match the promotional links of our online marketing services customers to the online properties of Baidu Union partners, which consists of a large number of partners, such as third-party websites, wap sites and mobile apps.”

- P4P. “Auction-based P4P services allow customers to bid for priority placement of paid sponsored links and reach users who search for information related to their products or services. We charge our customers on a cost-per-click basis.”

- “Search marketing services are mainly provided to customers through our proprietary online marketing system which drives monetization efficiency by improving relevance in paid search and optimizing value for our customers.”

- “Feed marketing services usually comprise image-based or video-based advertising, appearing between the feed headlines or within the feed content. It is powered by Baidu AI in order to better match goods and services providers with their targeted audience while optimizing user experience.”

- Other Marketing Services. Include “display-based marketing services and other online marketing services based on performance criteria other than cost-per-click.”

The other two apps that really matter are listed in other business units:

- Baidu Maps. This is listed under Baidu’s Intelligent Driving business. It’s “a voice-enabled mobile app providing users with travel-related services, including POI search, route planning, precise navigation, taxi-hailing service and real-time traffic condition information. Baidu Maps has a MAU of 316 million in December 2020.”

- iQIYI. A separately listed company for video content and entertainment.

This is their mobile ecosystem business unit. Which is one of their three business units. Here are some basic numbers.

Ok. That’s it for the basics of Baidu and search. In Part 2, I’ll go into their AI Cloud strategy. Which is the really cool new stuff.

Cheers, Jeff

- A Primer on ERNIE and Baidu’s AI Tech Stack (2 of 4) (Tech Strategy – Daily Article)

- The 4 Pillars of Baidu’s AI Cloud Strategy (3 of 4) (Tech Strategy – Daily Article)

———-

Related podcasts and articles are:

- Introduction to Learning Platforms, Computer Vision and Megvii (Jeff’s Asia Tech Class – Daily Update)

- Baidu Is Externalizing and Exploiting AI. But It’s All About the Cloud. (Pt 3 of 3) (Asia Tech Strategy – Daily Update)

- Can Baidu Thrive As a Stand-Alone Search Engine? (Asia Tech Strategy – Podcast 76)

From the Concept Library, concepts for this article are:

- Learning Platforms

- Standardization and Interoperability Network Effects

- Search Engines

From the Company Library, companies for this article are:

- Baidu (BIDU)

——–—

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.