In Part 1 and Part 2, I laid out Baidu’s core search engine and some of the complexities that have evolved in search over time.

I have three strategy questions for Baidu going forward:

- How competitive will a stand-alone search engine be against China’s larger digital giants over time?

- Can Baidu create a second large business to complement and support core search? What is most likely?

- Is management acting like owners?

My working assumption is that Baidu needs a growth engine that can throw off cash – and that can complement and support their core search engine. Search engines are great businesses. But the competitive dynamics of China are a bit different. Some very large digital China giants are going into search. And I think Baidu needs to be prepared for the possibility that search in China will be a business that is tied to other larger services. Such as ecommerce or gaming.

That may not happen. Stand-alone search may be enough. But I am watching the movements by Alibaba, Tencent and ByteDance into search. And especially Sogou.

***

Baidu is focused on growth and is now aiming to lead in AI. I think they are externalizing and exploiting their AI capability.

Baidu Externalizes and Exploits AI

Baidu is doing what we have seen so many times in digital businesses. They are taking a capability they built to support their primary platform – and they are externalizing it and selling it to the market.

- Amazon did the same thing when it turned its web services capabilities into AWS.

- Alibaba did the same thing when it turned its payment and credit services into Ant Financial.

- JD Logistics is doing the same thing by selling its logistics infrastructure as integrated logistics and fulfilment services. You can see my article on that here.

#1 and #2 worked well because they were immediately commercializable services in very big markets (cloud and payment / credit). #3 is not that clear yet.

Baidu externalizing and exploiting AI is a good strategy. And Baidu has been in the AI business from day one. As stated in many articles, AI is cheap and fast prediction (see the Concept Library section on AI). And cheap prediction at scale is what a search engine does. The search engine predicts what information or knowledge will answer your inquiry. Search engines also predict what images and videos you want to see. Plus, search engines predict what advertisements should go where and by who, in order to maximize clicks.

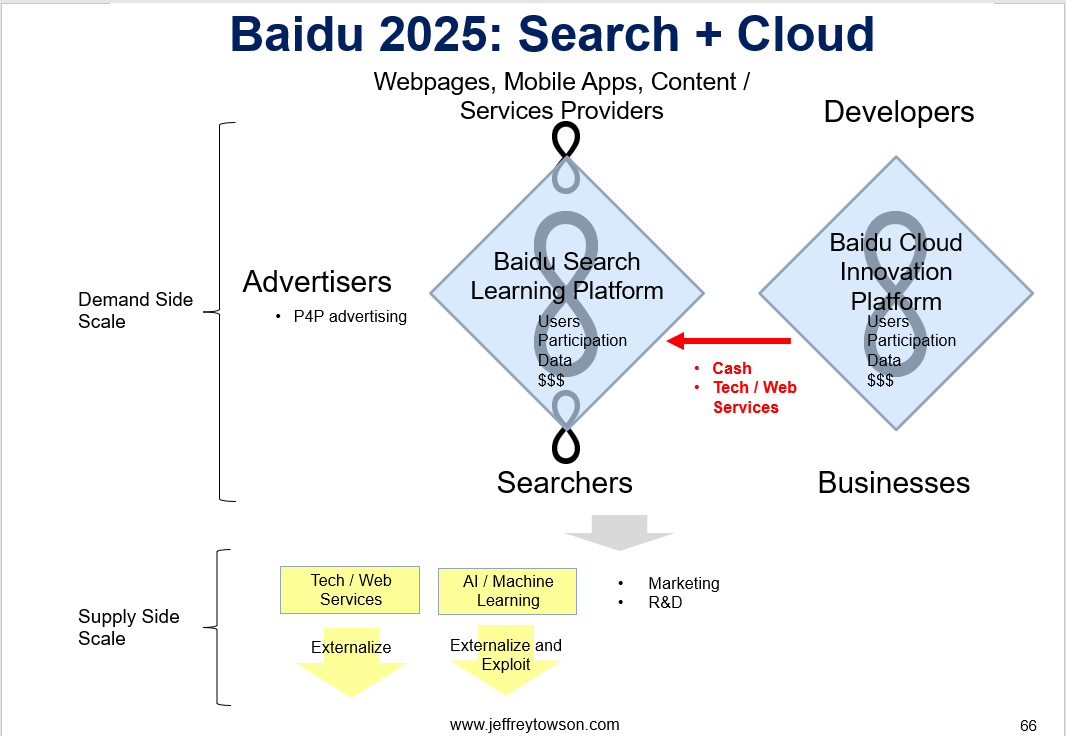

For Baidu, we can put this on the supply-side of their business model.

Baidu has multiple initiatives exploiting their AI capabilities. The Apollo open AI autonomous driving platform is the one Baidu talks about the most. But that is a long way from commercialization. And autonomous vehicles are a very difficult business, with lots of engineering and regulatory challenges. I like that Baidu is trying to just provide the software – and is avoiding the hardware. That modular, Android-like approach could work. Although Tesla seems to be doing well with an integrated, iOS-like approach.

Their Open AI platform is interesting. This strikes me as a Chinese AI version of Github. They are open sourcing their AI tools and letting developers use them and add to them. It is a potentially attractive innovation platform that enables interactions between developers and businesses.

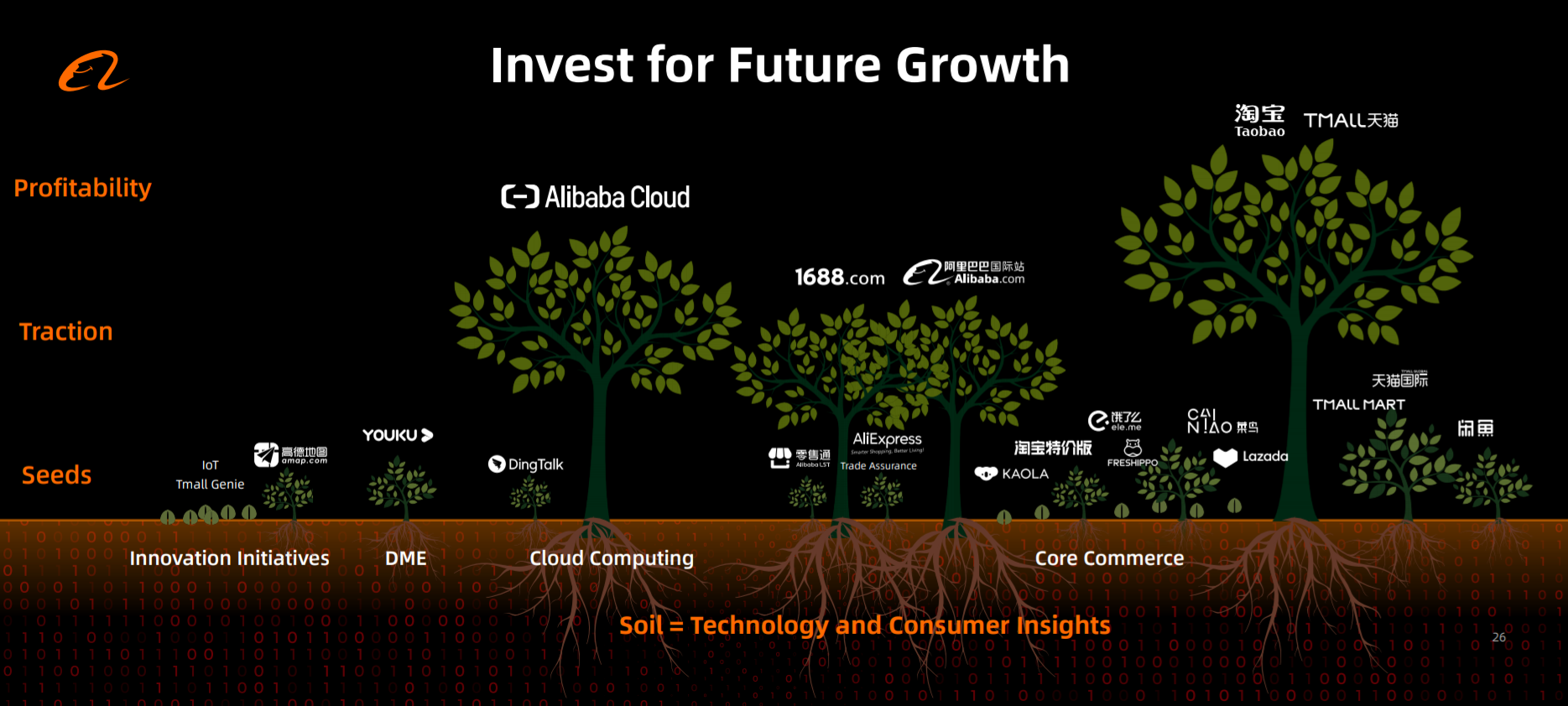

Overall, Baidu as an AI leader reminds me of how Alibaba launches multiple initiatives and then hopes some of these seeds will get traction. And a rare few will grow to trees.

From Alibaba’s 2020 investor presentation:

But, far and away, I think Baidu’s most compelling opportunity is cloud, with a specialization in AI.

Baidu Should Bet Everything On a Cloud Ecosystem or Platform Strategy

I am super bullish on cloud. It will be a winner-take-most business with a few global winners at stunning scale. We know who the big three out of the West are: Amazon AWS, Microsoft Azure and Google Cloud. But China will be a separate market and the big 3-4 are looking like Alibaba, Tencent, Baidu and Huawei. The rest of the world will be a fight between these 6-8 companies.

But these are still very early days in cloud. It’s hard to predict. Plus, this is ultimately about ecosystem or platform building. AWS has been building an innovation platform. But it will be about creating the right partnerships and incentives. So an ecosystem strategy might emerge. As discussed, ecosystem strategy is more powerful but more difficult. Ecosystems are the most effective model for launching new technologies as they leverages the capabilities of many companies. But most attempts fail.

Alibaba appears to be building something closer to an ecosystem.

I wrote about Alibaba cloud here. Saying:

“Cloud is a Big Unknown. But Alibaba is Positioned to Win Big.”

On one level, it is like a new infrastructure for digital. Companies and developers used to build for PCs and on premise servers. That was the main digital space. And that was where the computing power was. But then attention and usage shifted to the web and everyone started building webpages. Computing power was still in PCs and servers but it was the web that was providing connectivity. Then attention shifted to smartphones and everyone started building mobile apps. Connectivity grew dramatically but computing power was somewhat less. So lots of people now argue that the cloud is next computing and connectivity space. It will be the big frontier that everyone builds on.

Ok. That analogy is kind of true. And I like that it highlights that this is about the steady advance of computing power and connectivity. Those are the two things really shaping all this.

But the cloud (distributed computing plus connectivity) is also much more than this. It is making everything smart and connected. And there is long list of topics and technologies associated with the cloud. Such as:

- Cloud computing and storage

- Databases and data centers

- Big data and analytics

- AI / Machine learning

- Enterprise grade software

- Consumer software

- Network devices

- IoT devices and it’s operating system

- Cybersecurity

- 5G and other types of connectivity

- Robots and autonomous vehicles.

- Edge computing”

***

Baidu’s expertise in AI is an interesting approach to cloud. My initial take is that the fight for cloud in China is going to be ecosystem vs. ecosystem. And very resource intensive. How successful Baidu is will depend a lot on their ability to create partnerships. That is what I am watching for. However, it is also nice to see their cloud revenue increase 44% in 2020 to $1.4B.

***

Ok. That said, I have 3 conclusions about Baidu and its strategy going-forward.

Conclusion 1: I Really Like Baidu Search. Although Stand-Alone Search in China May Have Difficulties.

Certain businesses are just better than others. Certain businesses have powerful competitive moats in big markets with attractive economics. Such as:

- Marketplace platforms like Taobao, Shopee, and Coupang.

- Alcohol and soda companies with powerful brands and distribution. Like Johnny Walker and Coca-Cola.

- Cloud businesses like AWS.

- Search engines like Naver, Google, Yandex and Baidu.

But that doesn’t mean they all have big growth.

And that is Baidu’s problem. Baidu dominates with a very good business but it isn’t going to grow much. And that’s fine. Just resist the urge to chase growth and accept you are a giant in a stable business. That is how I feel about Naver.

But in China, I am a bit more concerned because Tencent, Alibaba and ByteDance are all getting much bigger financially – and they are moving into search. Stand-alone search in China concerns me in a way it doesn’t in South Korea, Russia or the West. Hence, my thinking about building a cloud business, a proven business model that could be a cash machine in the near future.

Basically, I’m worried about Sogou, which can search within WeChat and externally. And Alibaba, which is great at product search. ByteDance is a question mark.

Why do I like Baidu search so much?

- It is a platform business model with multiple network effects. I’ve discussed this in Part 1. It has a long-tail network effect in information that doesn’t asymptote. And it has a standardization network effect on the content provider side.

- It has big government competitive advantages. Unlike Naver and Google, Baidu has no foreign competitors. Search is political in China. It will only ever be exposed to domestic competition. That hard barrier to Google is a blessing that Naver and others don’t have.

- It has habit formation and a share of the consumer mind on the searcher side. Bing gives just as good search results as Google. But using Google is a habit. It has a share of the consumer mind. And people just keep using it instead of Bing. Baidu has this as well.

- Baidu is specialized for Chinese language, information and knowledge. Translation is getting better but specialization in a language matters. Baidu is much, much better at cataloging, ranking and delivering information and knowledge in Chinese (written, spoken and videos).

Conclusion 2: Baidu Should Build Complementary Search and Cloud Platforms

Cloud and web services is a proven path. This is not like creating the world’s first autonomous cars. We can see how Amazon built AWS by externalizing its IT capabilities. And we can see how it made its $45B in revenue in 2020 (with good operating profits). Cloud offers a proven path to another great business.

I would like to hear Baidu start calling itself a “Search and Cloud Company”. And this would create two complementary platform business models.

Final Conclusion: Capital Allocation is a Concern. Is Management Thinking Like Owners?

I’ve been talking mostly about structural advantages. Business model stuff. How fast is the horse?

But the jockey matters too. A business that throws off a lot of cash can often be undone by management that spends it without regard to shareholder value. If management is thinking about empire building or putting a dent in the universe, shareholder returns can suffer.

Marissa Mayer at Yahoo was a classic example of management of a solid business not thinking like owners. She took over Yahoo, which was a reasonable business, and started flushing its cash flow into one moonshot idea after another. She wanted to be the next Steve Jobs. What Yahoo needed was the next Jack Welch. It needed a CEO that just optimized a good, stable business and provided shareholder returns.

Baidu has spent a ton of money on growth initiatives over the past 5-10 years. They are still spending a lot of money supporting iQiyi every year. And long-term debt has grown from $5.4B in 2017 to $9B in 2020.

That’s my third strategy question:

- How competitive will a stand-alone search engine be against China’s larger digital giants over time?

- Can Baidu create a second large business to complement and support core search? What is most likely?

- Is management acting like owners?

***

Cheers, jeff

———-

Related podcasts and articles are:

- Baidu’s Search Engine Explained in 3 Slides (pt 1 of 3) (Asia Tech Strategy – Daily Update)

- Baidu is Struggling in Content Creation, Push Feeds and the Attention Market (Pt 2 of 3) (Asia Tech Strategy – Daily Update)

From the Concept Library, concepts for this article are:

- Search engines

- Cloud computing

- Innovation platform

- Learning platform

From the Company Library, companies for this article are:

- Baidu (BIDU)

- Baidu Cloud

Photo by Rami Al-zayat on Unsplash

———-