Logistics in China / Asia has been on my short list for a long time. There is a lot to like about this space.

- Logistics has a long-term secular growth trend. As countries and regions develop and grow, they generally ship more and more things around. It’s a slow but steady trend. We see that in the US. We are seeing it in China. SE Asia is a more complicated version of this.

- Ecommerce directly drives logistics growth and development. All that money flooding into ecommerce and B2C digital tends to spill into logistics. And it forces development and the adoption of tech tools.

- Logistics companies are network-based business models. These companies have many of the dynamics we see in digital giants. They are based on networks. They can have network effects. They are often “winner take most” situations. We definitely see this in express delivery with companies like FedEx and DHL.

- Logistics is being digitized. This is a fascinating phenomenon I have written a lot about. JD Logistics, Alibaba’s Cainiao and maybe Amazon are the leaders here. They are making logistics networks smart and connected. This is creating a new type of business model that I am still trying to figure out.

And all of this is much bigger and faster in China (versus the US). Logistics volume in China now dwarfs the USA.

However…

Logistics are physical networks made of warehouses, trucks, and people. So, these business models are somewhat different that those we see in digital companies. Even though you hear the same terms (nodes, linkages, liquidity, network effects). Plus, we are almost always talking about hub-and-spoke networks, which are different than the point-to-point networks in most software.

Network effects, in particular, can be more complicated and difficult to achieve in physical networks. I spoke about this in Podcast 89 (Truck Alliance’s Fight to Build Complicated Network Effects). I do consider network effects as simple or complicated.

That podcast was about Truck Alliance, which is similar to ANE Logistics. They are both trying to digitize and connect fragmented logistics services across China. Both are finding this harder than they probably initially thought. There is much more operational complexity in the physical world. Creating network effects and functioning platforms with lots of interactions are harder in complex, real-world operations than in digital.

I keep an eye on multiple players in the logistics space in China:

- JD Logistics and Alibaba Cainiao

- SF Express, ZTO, STO, etc.

- Digital logistics natives like ANE Logistics and Truck Alliance

An Introduction to ANE Logistics

ANE Logistics is trying to create an “express freight” business model in China. This is analogous to “express delivery” companies like FedEx. You provide national coverage for shipment and delivery and compete on national coverage, speed of delivery, reliability and cost (usually).

ANE is doing this for “less than truckload” (LTL) freight, instead of the small packages and parcels like express delivery. Given the volume of LTL logistics in China, that is a big vision. The largest LTL freight company in China will be one of, if not the, largest in the world.

But it’s a hard problem to solve.

China is a big country, and it has long been very underdeveloped and inefficient in logistics relative to other countries. It’s not just that logistics is 15% of GDP in most of the country (about 15T RMB) compared to 7-8% in the US. It’s that there are 200-300k companies and a patchwork of local delivery and point-to-point routes. Plus, keep in mind, in half the country, there aren’t even enough roads yet.

My article on Truck Alliance talked about creating a digital platform that enables truck drivers to match with shippers and get contracts. Truck Alliance is closer to Uber and they are digitizing the matching and contracting process. This currently happens at logistics centers scattered across the country. Truckers show up at centers which are filled with agents with truckloads that need shipping. It is messy and slow. And the pricing is opaque. After getting a contract, the trucker delivers it and then heads to another logistics center to get an order to fill their truck for the trip home. The whole thing is a messy, manual process that Truck Alliance is trying to digitize and consolidate. Creating network effects has been very difficult. Sharing videos on TikTok was a lot simpler.

ANE Logistics is a different model. It is about building their own network of warehouses and truck routes that blanket the country. It is more similar to FedEx. They have 147 self-operated warehouses in their in-house network. And +4,000 trucks that operate +2,000 routes (92% of which are two way).

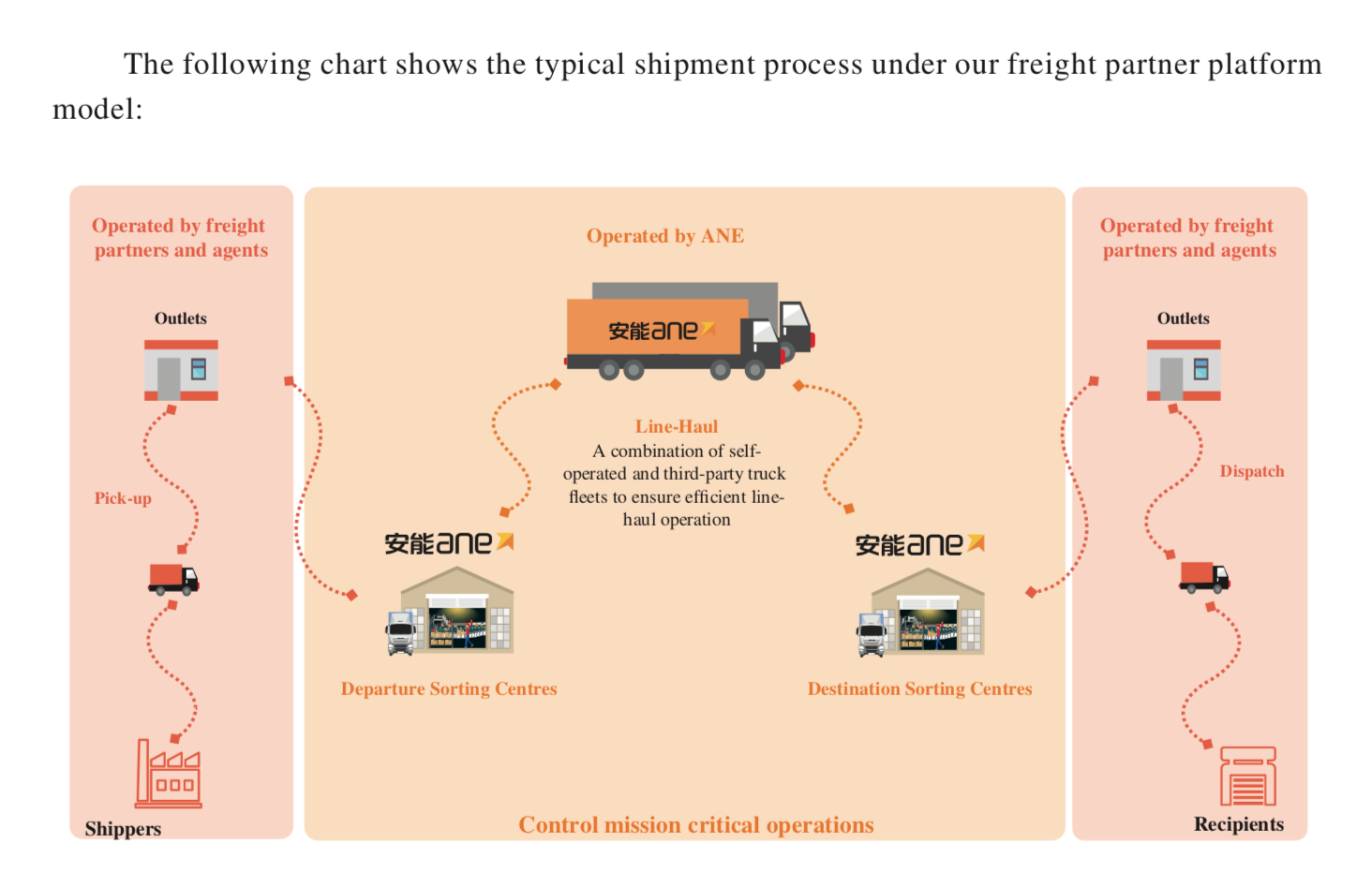

This core network is then connected to 26,400 partners / agents who take the shipping orders from 3.6M customers and deliver them to ANE’s network. They also pick them up for final delivery. The business model looks like this:

So ANE is building a core logistics network that agents / partners put their freight into. ANE calls this a platform, but it’s really a physical network. And the company operates and controls the “mission-critical sorting and line-haul transportation”. Their partners run the outlets and do the pick-up and delivery. This is why I call it a franchise network. ANE’s partners build their own hubs and sell the service for ANE. It makes the business model more scalable and gets ANE cheaper growth. The benefit from the partners’ resources and effort. It’s sort of a cross between FedEx and Subway.

The company claims to be #1 for total freight volume in China at 10.2M tones, up from 7.3M in 2018. I’m not really sure about this #1 claim as it depends how you define the market. But the tonnage shipped is real. And revenue has grown to 7.1B RMB, up from 4.8B RMB (2018).

The growth strategy is what you would expect:

- Expand the shipper base

- Upgrade products / services

- Invest in mission-critical infrastructure (important)

- Enhance operational efficiency

- Tech innovation

My Explanation for ANE’s Business Model

The big difference between Truck Alliance, Uber and ANE Logistics is the type of freight. ANE does LTL. That means there is a lot of sorting and consolidating at the hubs. Getting the right packages in the right trucks smartly and efficiently is how you maximize utilization and speed across the whole network. ANE has a nice graphic about these differences.

The company’s own description of its business model is confusing.

It says it:

- Directly operates and controls the “mission-critical sorting and line-haul transportation operations that are vital for the network reliability and operational efficiency”.

- Continuously expands its “ecosystem with a highly scalable platform through partnerships with freight partners and agents”.

- This creates a “self-reinforcing ecosystem that is beneficial to all”. Increased volume leads to “reduced marginal costs, improved service quality and improved shipper experience”. This “brings economies of scale and promotes operational efficiency”.

Here is their graphic and explanation. It is wordy but worth reading.

That is not a great explanation. But you can see the key factors mentioned.

- A network of physical assets

- Network effects

- Economies of scale

- Operational efficiency

I think what we are really looking at is a physical network, that is amplified by digitally-enabled franchising. I’ll go into this more in Part 2.

Recall the 3 Types of Networks

I spoke about networks in Podcast 110 (An Intro to ANE Logistics and Franchised Physical Networks). My basic points were:

- Networks and platform business models are different things.

- Networks are assets made of nodes and linkages. These assets can be tangible and intangible. Social networks are made of intangible assets. Railroads are made of tangible assets.

- Platforms are network-based business models that operate on these assets. It’s similar to how a factory is an asset but the business model is the products it produces and sells to the market. One is a cost. One is the creation of economic value. A diploma is an asset with a cost. But what you earn in your career is your business model.

- All platform business models utilize networks, but they don’t all own or control the assets they operate on.

Seeing networks as assets (nodes and linkages) is easy when you think of physical networks, such as railroads and canals. You can see the nodes and the linkages.

It gets harder to visualize when you start talking about networks of connected, compatible devices. These networks are mostly about communications and interoperability. They are called protocol networks. Think fax machines, TCP/IP and ethernet. You can see clear network effects in protocol networks. But the assets are computers and the wires between them. Protocol networks is when people start talking about Metcalfe’s Law.

But protocol networks quickly blur into networks of connected people and companies. If all the smartphones are connected (a protocol network), is it really about the smartphone network or the people using them to make phone calls and share photos? The value and utility of two connected people is different than the value and utility of two connected laptops.

So, we are usually talking about people and company networks. Most of the platform business models I talk about are built on these networks. It can be payments, communications, purchasing, dating, publishing, etc. The linkages between people and companies can be words and even human behavior. Some venture capitalists try to characterize these situations different types of networks – such as utility networks, personal networks, professional networks, market networks, etc. I prefer to keep it at three network types and then break it down into different platform business models.

So ANE Logistics is clearly building is a network of physical assets. And there is really no separation between their network and their platform business model. That separation happens in the digital world but not as much with physical assets. And depending on what we are talking about, the network vs. the platform can have different levels of importance.

- For most mobile apps, the platform is what matters most. The network is just lots of people carrying smartphones in their pockets. When we talk about Alibaba, it’s clear that the value is in the marketplace platform, not the telecommunications network.

- However, certain mobile apps like Facebook have social networks – and these can be far more valuable than any particular service running on it. So it sort of depends how you define it.

The final concept here is network effects, which is different than networks and platforms. It’s a phenomenon that can occur in some network-based businesses. A couple of final reminders about network effects.

- The growing value and/or utility of a network effect can be very different depending on the user group. Even for different user groups on the same platform. One user group, say consumers, can experience far more benefits from network effects than another, say merchants. Value and/or utility are user-group specific.

- The value and/or utility of a network effect (to a user group) does not increase forever. Some network effects increase with more and more usage in a linear fashion. Some even increase exponentially. However, they all flatline eventually and some flatline quite quickly. It’s a powerful mechanism. But trees don’t grow to the sky and network effects don’t increase forever.

- Network effects can also go in reverse and decrease in value and utility just as fast. If users stop using Zoom, the service gets worse. More users will leave, which makes it even worse. And so on. Network effects can be both positive and negative feedback loops.

Ok. That’s enough for today. In Part 2, I’ll go into the competitive advantages of ANE. This is actually really important and worth going into in detail.

Cheers, jeff

——

Get my new book Moats and Marathons (Part 1): How to Build and Measure Competitive Advantage in Digital Businesses

Related articles:

- ANE Logistics and Network Effects in Physical Networks (2 of 3)(Asia Tech Strategy – Daily Lesson / Update)

- Podcast 26: Is Baidu the New AT&T? The Basics of Physical vs. Virtual Networks.

- Will JD Logistics Become a New Type of Ecosystem? (Asia Tech Strategy – Podcast 71)

From the Concept Library, concepts for this article are:

- Networks vs. Platforms vs. Network Effects

- Franchised Networks

- Logistics

From the Company Library, companies for this article are:

- ANE Logistics

Photo by Zetong Li on Unsplash

———-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.