In Podcast 89 (Truck Alliance’s Fight for Complicated Network Effects), I laid out some of the basic information about the company – and why it is a “next level” marketplace. If selling books was simple ecommerce and selling groceries was advanced, then Didi is simple mobility and Truck Alliance is advanced. It’s just a much more complicated problem and platform. But it’s pretty fascinating.

The Basics of Full Truck Alliance (FTA)

Let me summarize the basic info first. Then I’ll get to the strategy and big questions going-forward. This information is from the filing.

FTA is a two-sided marketplace for services. The user groups are shippers and truck drivers, both of which are pretty fragmented in China. And the market is huge. Logistics in China is a massive market filled with inefficiencies and problems. It is really an ideal target for a platform business model. It’s just that its problems are pretty difficult to solve.

As mentioned, truckers and carriers are pretty fragmented. According to the filing, China has 30M SMEs, which are the shippers. China has +8M carriers, with an average of 4 trucks each. About 80% are individuals with one truck. In contrast, the USA has only 0.6M carriers.

Most of the market is full truck load (FTL), which is >3 tons. That is 70% of the market by gross transaction volume (GTV). FTL is a much simpler process as the trucks can go from point to point. It’s more standardizable.

But less than truckload (LTL) is growing faster. And it benefits from ecommerce and growth in smaller batches. Of course, this is also more complicated in terms of both matching and operations – as it requires cargo pooling and coordinating routes.

China Logistics Is a Situation Begging for a Platform Business Model

The F-1 laid out a good description of the problems to be solved in China logistics.

For shippers, the problems include:

- Difficulty finding truckers. They use brokers and do lots of phone calling. There is lots of bad and out of date information. It typically takes days. Logistics parks and middlemen are used.

- High costs and opaque pricing. There are lots of types of cargo, trucks, truckers and routes. And the markets are often cyclical and changing based on the general economic conditions. Pricing is based on poor information and the use of extensive middlemen and brokers increase the fees.

- Low service quality. There is no tracking. Insurance is difficult. Nobody trusts anybody.

For truckers, the problems include:

- Low truck utilization. There is usually a 2-3 day lead time for a trucker to get the next order. They typically go to logistics parks to find orders, which create a problem in the backhaul. After the cargo is delivered, the trucker then needs to find a nearby park to secure an order for the route home.

- Low income visibility. Orders are sporadic. There is limited ability to plan routes or project cash flow.

- Poor protection of interests. There are frequent disputes with no mechanism for resolution. Shippers can withhold payment. Cargo is often damaged. There is little trust.

Overall, it’s inefficient, fragmented and expensive. And most pricing is based on spot demand and inaccurate and/or asymmetric information.

This situation is right out of Nobel Laureate Ronald Coase and his description of transaction (and coordination) costs.

- Transactions and coordination between parties have certain costs, specifically costs related to search, coordination, negotiation and information asymmetry (includes risk of being cheated).

- The total cost of production of a good is the sum of the production and transaction cost. If the transaction costs are high, then it is more efficient to do this activity inside a firm – as opposed to buying it in the market. So if coordination and transaction costs of contracting an accountant repeatedly is high, it is better to hire them as an employee. If the cost of buying certain services like printing from the market is high, it is better to buy your own printer and do it internally.

- If the transaction costs are small, then a company does things through the marketplace via prices and contracts. As transactions costs fall (this is important), companies push activities outside of the firm.

Isn’t that exactly what logistics sounds like in China?

And platform business models, as “ecosystem orchestrators”, are designed to solve just these sorts of problems. They are in the business of lowering coordination costs. China logistics looks like a problem begging for a platform business model.

But that is easier said than done.

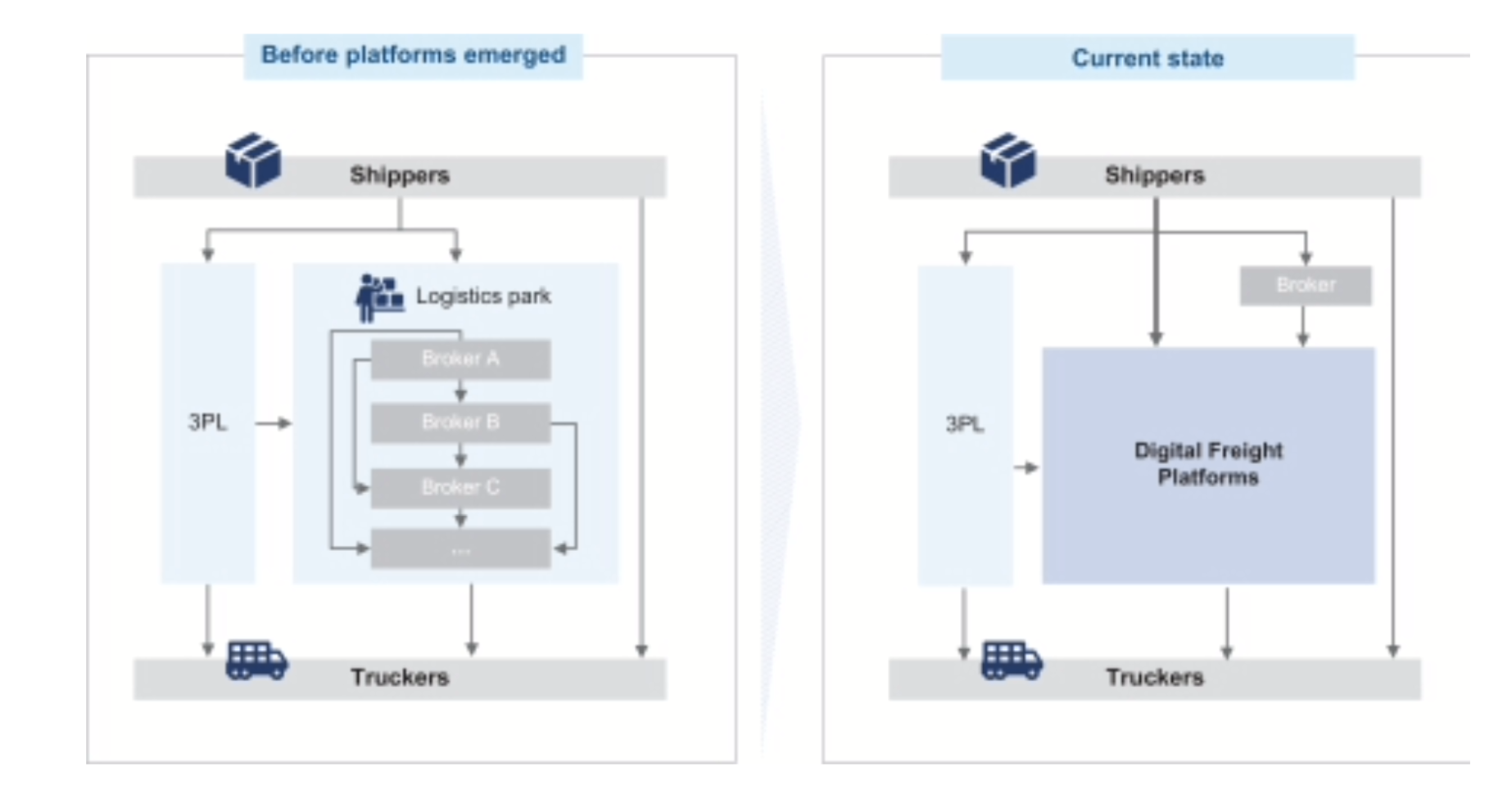

FTA has a bit simpler of an explanation. They say they are trying to move the current logistics parks online. Here’s their graphic for that.

It is worth thinking for a moment about how complicated this really is. Think about all the types of cargo these truckers actually move: fresh produce, grain and grain products, livestock, agriculture products, metals, construction materials, industrial chemicals and paper products.

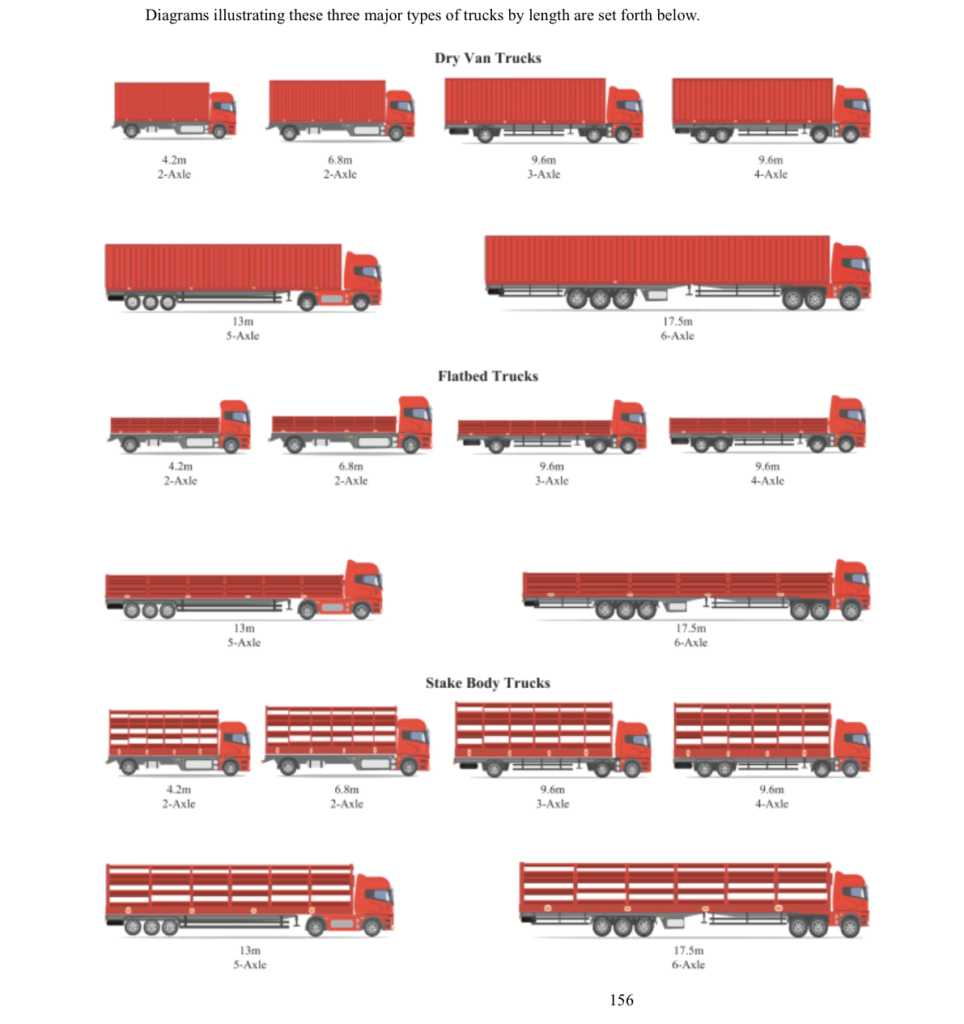

Think of all the different types of trucks they are dealing with:

And think about all the routes. FTA claims to cover +100,000 routes in China. All of their orders are route-specific.

So how are they doing?

FTA’s Activity is Trending Up – But Progress Is Slow

Here are the usage numbers FTA is highlighting.

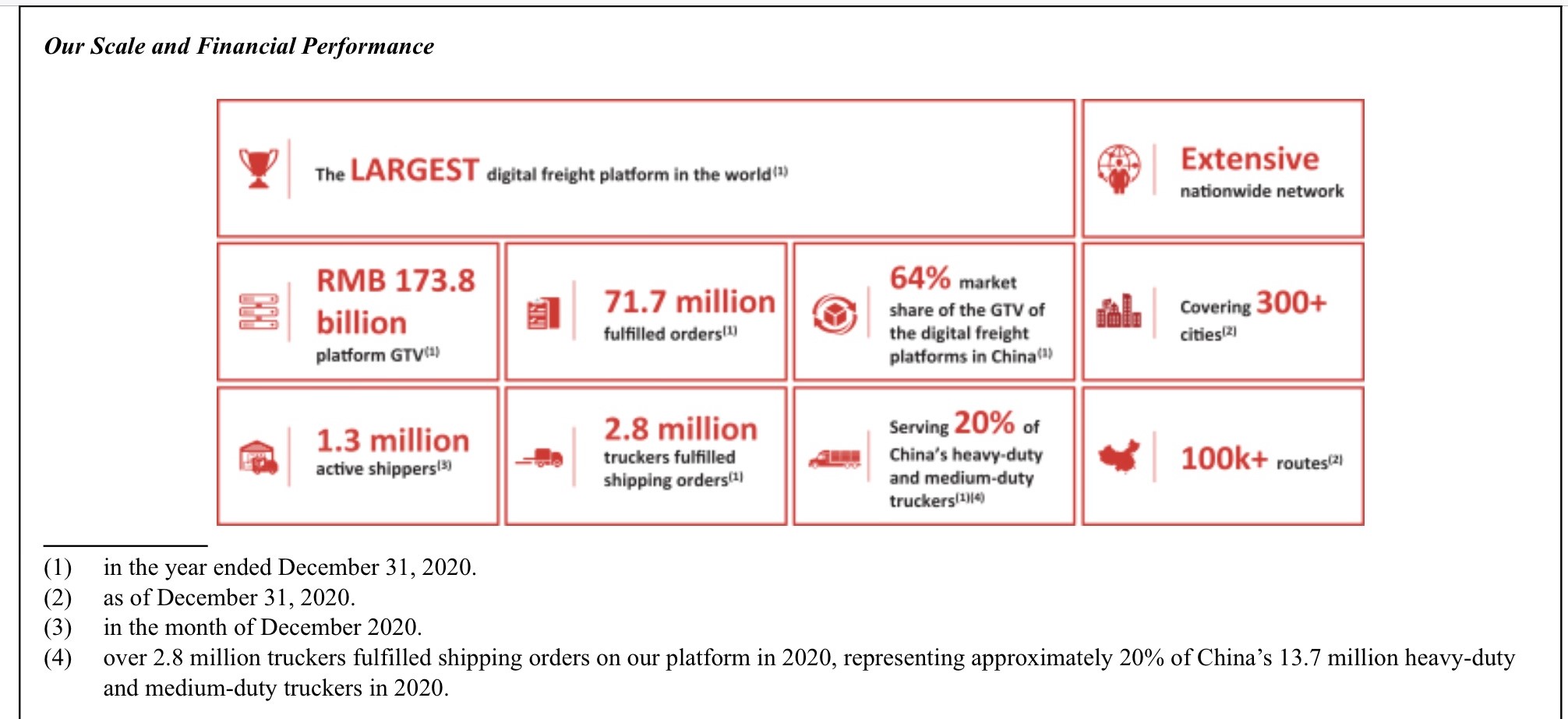

The numbers I took out of that were 1.3M active shippers and about 5M truckers for 2020.

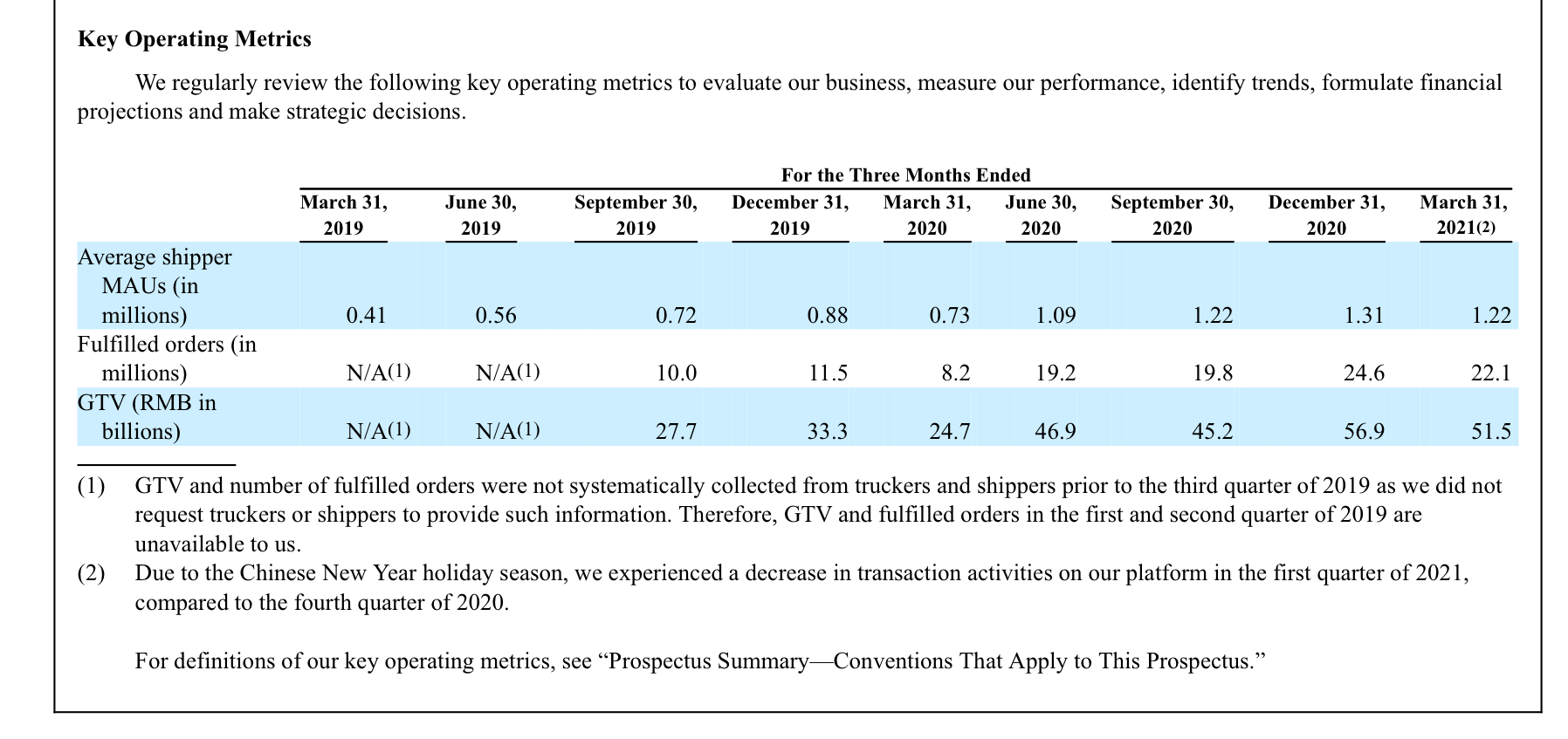

But this is the chart that got my attention. They are showing steady, quarter-by-quarter growth in their key usage metrics.

The financials are not good. FTA says this is because they are in the early stages of monetization, which could be true.

But I think it is more because they struggling to solve this problems of China logistics and grow usage. This is not a rapid adoption situation like Airbnb or Uber. FTA has 50% of their +4,000 staff in sales and marketing. This looks like a long, hard slog for growth.

I actually like their monetization approach.

They began with a freemium model for listing services. Shippers can post an order on the site and then shippers and truckers connect. And it’s free. Then they later offered a membership version that let shippers post more orders. Freemium is a good approach when you are going for network effects and want to encourage usage. But they also try to convince a small percentage of users to pay for some extra benefits.

But the big money is in brokerage and in taking an agent fee on the GTV of the order. They record this as a platform service fee, which you can see under Freight Brokerage below.

Note: Transaction commission is their current trial in charging the truckers, not the shippers.

Value added services is mostly issuing credit to both user groups (to encourage usage).

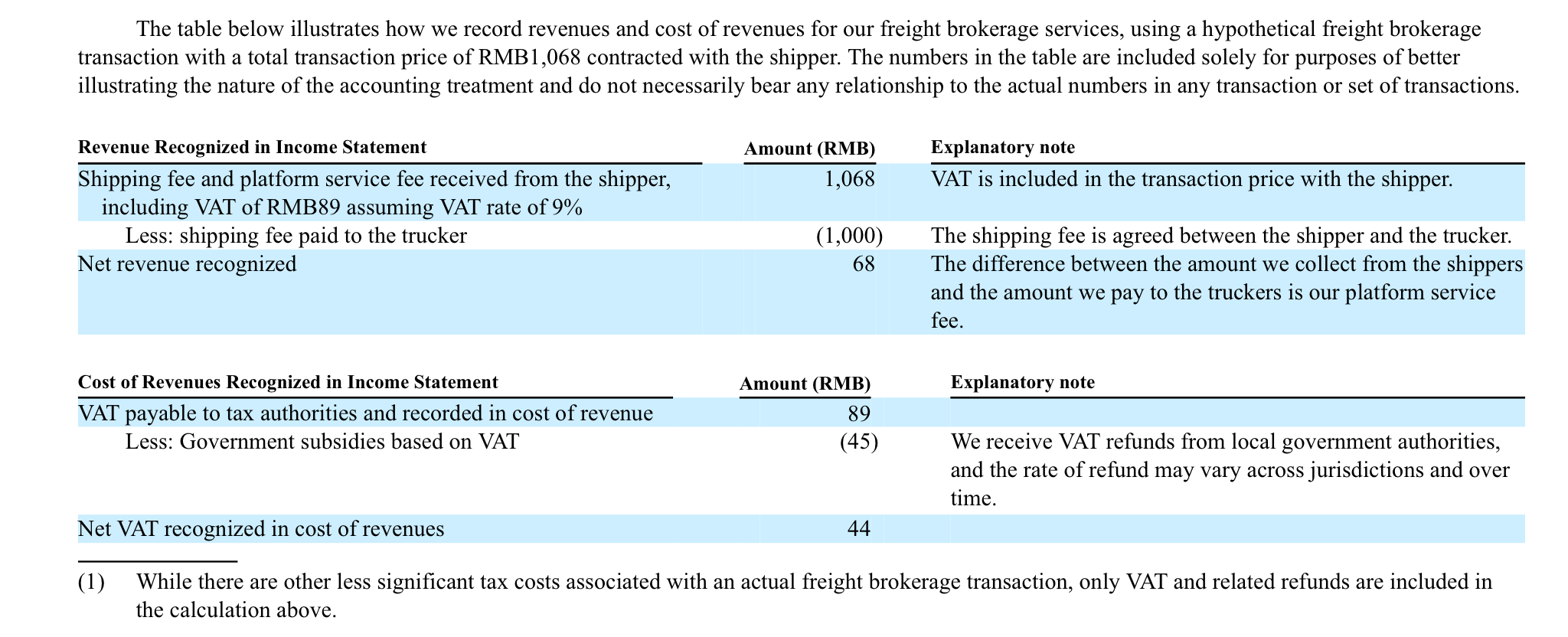

There is a significant issue within Freight Brokerage related to government VAT. Here is a theoretical breakdown of how that plays out in Net Revenue and Cost of Revenue. I won’t go through it here but basically, the VAT is larger than their Net Revenue. And they are dependent on subsidies from local governments to reduce that.

Ok. Here are the three questions going forward that I think really matter.

Question 1: Can FTA Get to Critical Mass in a Cost-Effective Manner?

If the China market for logistics is 15T RMB as the filing claims. And if road transportation is approximately 5T RMB of that. Then a 10% take rate on GTV should create a market of around 500B RMB. Let’s take that as a ballpark number. So how is FTA the market leader at 2.5B RMB?

They are not exactly dominating this market. And growth isn’t surging.

My take is that the company is struggling to build a difficult and complicated platform in a big market. This is not the low hanging mobility fruit of giving people rides to the airport.

Note: Here’s how they describe their “flywheel”.

That’s not bad for an F-1. Usually the flywheels are pretty terrible.

But it’s their description in the risk section that really captures the important points. If you read one section from their filings, it is the below paragraphs. It is worth reading carefully. Several times.

Note the two parts I have highlight. The first one is critical:

“Maintaining a balance between shipper demand and trucks supply for any given route at any given time and our ability to execute operationally may be more important to service quality than the absolute size of the network”.

FTA is in the matching, pricing and network effects business. And that is usually about being the biggest in the market. Like being the #1 ride sharing company in Beijing.

But in this section, FTA is basically saying that their matching, pricing and network effects are more dependent on specific routes at specific times that overall size.

Read that again. Their matching, pricing and network effects are more dependent on having sufficient supply and demand on specific routes at specific times than on overall network size. This is a far more difficult platform strategy. Getting to critical mass is far more difficult in this business.

The second highlighted part is what really concerns me. Which leads me to question #2.

Question 2: Does FTA Have Product Market Fit?

From the previous section:

“…new features and functions that may be received positively by one category of users may be viewed as a negative to another category of users. For example, some truckers may be dissatisfied with the “tap and go” feature, which allows a shipper to post shipping order with a fixed price and is intended to replace price negotiation…because such feature may result in lower prices for certain transactions.’

It gets worse:

“…although we aim to increase truckers’ truck utilization, earnings potential as well as profitability…some truckers may view the increased efficiency in overall freight price discovery and negotiation on our platform as a negative to their gross earnings.”

I read that as a clear indication that FTA has not yet figured out the secret equation for a platform business model in China cargo. A successful platform needs both parties to participate, eagerly. But you can’t give them both everything they want. You need to figure out the secret equation that lets them get both sides at the same time. And this equation needs to be structured into the service fundamentally – and especially in the pricing.

In business, it is often the first mover that wins. But that is not usually the case for platforms. Facebook was not the first mover in social networks. It was Friendster and MySpace. Visa and MasterCard were not the first movers in credit cards. It was Diner’s Club and then American Express. The first mover rarely wins in platforms is because it is so difficult to balance the services, incentives, governance and roles to make a platform work. I call this figuring out the magic equation that balances everyone’s interests and gets everyone to participate and invest.

The Boston Consulting Group did a good study on why platforms fail, which I have discussed before. The #2 reason was Wrong Ecosystem Configuration.

From BCG:

“Assuming that an ecosystem has found a substantial problem to solve, the next challenge is to configure the ecosystem to deliver the targeted value proposition. This involves defining the required activities and partners, their responsibilities, and the links among them, and assigning roles to various partners—in particular, the role of orchestrator, which coordinates members, defines standards and rules, and arbitrates conflict. The initial configuration should focus on the core value proposition and incorporate the minimum number of partner types required for its delivery.”

That is a really good paragraph. Ecosystems and platforms are about enabling interactions and lowering Coasean transaction costs. But you have get the users and their participation right. Which is really hard.

FTA’s comments are red flag that they haven’t figured out product-market-fit and the secretion equation. The fact that they are currently doing trials where the truckers pay a commission is another indication that they are struggling to get product market fit.

Last Question: Are the Matching, Pricing and Advanced Network Effects Just Too Hard?

Back in 2000-2010, lots of ecommerce companies went after groceries and fashion. They saw Amazon being successful in books, electronics and general merchandise. And they saw the massive market potential for ecommerce in groceries. So they went after those sectors. And they failed. Lots and lots of companies failed.

It was just too hard. It was too complicated. The technology wasn’t ready. The market participants weren’t ready.

It might be that marketplaces for logistics in China might still be too hard.

I mentioned that FTA is in the matching, pricing and network effects business. And they have to build sufficient supply and demand for many cargo types. And for different distances. And for full truck load (FTL) vs. less than truck load (LTL).

But, as I mentioned in the podcast, they also have to build complicated network effects. I listed 5 complicating factors for this.

- LTL is more complicated. Similar to carpooling, less than truckload cargo requires grouping demand. The matching is more difficult. The pricing is complicated. And the operational aspects are difficult.

- Time-specific matching (i.e., synchronous vs. asynchronous matching). FTA does not have to do immediate matching like ride-sharing – but it is fairly synchronous. Shippers want to do orders immediately. They want drivers that are currently available. And drivers on the road are looking for their next order for the backhaul. Immediately.

- Fluctuations and cyclicality. Unlike many consumer purchases, many cargo orders are very dependent on their industry changes and cycles. Cyclicality impacts both prices and utilization. Cargo orders are also dependent on lots of external factors like general economic conditions.

- Route-specific orders. I think this is FTA’s biggest challenge. To match supply and demand on each of the +100,000 routes is very difficult. It makes getting a ride to the airport look super simple.

- Serial routes. There has to be matching, pricing and network effects for current and sequential orders. They have to match and price with an eye to the routes that will follow.

All of that seems difficult. And we can see these issues in the technology under development at FTA. In particular,

- Freight Matching. Truck type and route are the biggest factors.

- Freight Pricing

- Navigation

- Automated trucking technology (a whole other question).

***

I am really fascinated with the logistics side of ecommerce. You see a lot of great businesses in logistics, with powerful competitive advantages. But my working conclusion for FTA is it is too hard. I’m keeping an eye on it.

That’s it. Cheers, jeff

—-

Related articles:

- Walmart, JD and Purchasing Economies at Traditional and Online Retailers (Asia Tech Strategy – Daily Lesson / Update)

- Beer, Southwest and Why Location and Transportation Cost Advantages Are So Important (Asia Tech Strategy – Daily Lesson / Update)

- Forget Network Effects. Go for Switching Costs. (Asia Tech Strategy – Daily Lesson / Update)

From the Concept Library, concepts for this article are:

- Network Effects – Simple

- Network Effects – Complicated

- Marketplaces for Services

From the Company Library, companies for this article are:

- Full Truck Alliance

Photo by Zetong Li on Unsplash

———

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.