I recently visited the Baidu headquarters in Beijing. This was part of our China Tech Tour and it was really a great visit. I’m going to be writing a lot about Baidu shortly but wanted to list the key strategy lessons I took away from the visit.

A disclaimer: None of this is information or opinions from Baidu. The discussions are still off the record at this point (but not the photos and videos). So, these are my own personal lessons. Basically, this is how my own thinking about the company has changed. But this is not anything anyone said during the visit.

China Tech Tour Day 1: Beijing and Baidu

The Tech Tour group was staying in the northwest of Beijing (liangmaqiao) but we had spent the morning at ByteDance (see my account here). Both companies in the northwest of Beijing so it was just a quick bus ride. With our standard stop for coffee on the way of course.

Northwest Beijing is often called the Silicon Valley of China. It’s not really true but the Zhongguancun (ZGC) neighborhood has the been the center of a lot of the action historically. It was originally an electronics shopping area, just down the street from Peking University and Tsinghua University. The area was redeveloped into a tech zone about 15 years ago and we had a bunch of tech companies founded there.

However, there is now a much nicer and more newly developed district about 15 minutes north of Zhongguancun. That is where you find Didi, Baidu and most of the larger companies now. Arriving at Baidu headquarters, we, of course, did a tour of the exhibition hall first.

I always enjoy the exhibition halls at tech companies. And Baidu has some pretty cool screens with information – such as what is currently being searched for in China.

Another screen showed where people are moving to over time (based on Baidu Maps). Big surprise, lots of people have been moving to Beijing over time.

However, the information that really stuck with me was the company’s long history of technology innovations. It was one tech product and certification after another, going back +20 years. From the launch of Baidu Maps in 2005 to their first developed semiconductor. They created their own servers. They are currently working on autonomous driving tech.

And that was really my biggest take-away from the visit. This is much more of a pioneering technology company that I had realized. A company centered much more on engineers than on marketing people.

After the exhibition, we met with public relations and some management. That’s off the record (for now). I’ll be writing a lot more about Baidu in the coming weeks based on that. But, for now, here are my main strategy lessons learned.

Lesson 1: Baidu Has Found its Big Second Act in AI. Get Ready for this Company to Grow.

Robin Li founded Baidu as a search engine for PCs in 2000. And it was focused on search in the Chinese language from day one. That strategy gave rise to much of the Baidu we know today. This propelled it quickly into one of the big three digital companies of China (i.e., the BATs). Baidu was search. Alibaba was ecommerce and Tencent was gaming / social media.

That was the story until around 2010 when two things happened.

- First, China moved from PCs to smartphones, and this was a problem for Baidu. Search has more power on PCs. It is really the key entry point for the browser. And it can search all the public webpages. But it is not the key entry portal for a smartphone. It is just one of many apps. It is also much harder to search all the contents of a smartphone, as much of the information is within apps that can’t be searched.

- Second, Baidu’s revenue had a much slower rate of growth than the other digital giants. Digital advertising revenue based on search volume is historically a great business. But it doesn’t grow forever. People don’t keep doing more and more searches over time. And advertising revenue tends to be flat overall. Baidu search revenue grew from about $4B in 2010 to $18B in 2022. That’s great, but much smaller than what we saw at Tencent and Alibaba. During the same period, Tencent’s revenue grew from $7B to $80B.

So, Baidu was aggressively searching during the past 10 years. They jumped into lots of adjacent businesses, such as food delivery, online travel, and live streaming. But it frequently found itself financially outgunned by Alibaba and Tencent. And many of these businesses were money losing and sold off.

By 2020, Baidu ended up as a multi-modal search engine with mapping. Plus, it had iQiyi, a leading entertainment company which has recently (and finally) reached operating profits. That kind of looks like Google – a search engine, mapping business and entertainment portal. Except Google also has Android.

However, Baidu’s next big growth opportunity has finally arrived with generative AI and cloud.

Baidu has been investing aggressively in artificial intelligence for about a decade.

- They launched their deep learning lab in 2013.

- They launched a conversation chatbot (DuerOS) in 2015.

- They launched their first robotaxis in 2017.

- They launched Paddle Paddle in 2017. More on this below.

- They launched their first AI semiconductors (Kunlun) in 2018. Plus, servers and cloud racks.

- They launched Ernie, this foundation model, in 2019.

So as generative AI has exploded in the past twelve months, Baidu has found itself in a fantastic position. Because it has its own fully-developed AI tech stack – consisting of:

- Kunlun AI Semiconductors.

- Framework Paddle Paddle. Their deep learning platform.

- Foundation Models. This is the Ernie BOT everyone is talking about. This was really first in China for LLM models. But they also have image generation, cross-modal and other models.

I’m going to be writing more about Ernie and Paddle Paddle in particular as these are really important. Paddle Paddle is their enterprise open-source deep learning platform. It currently has 5.35M active developers using it. Plus, it has +670,000 developed models and is used by +200,000 enterprises.

I’ll go into this in later articles. But the key take-away is Baidu as a full AI tech stack in place. Here is some of their image generation examples.

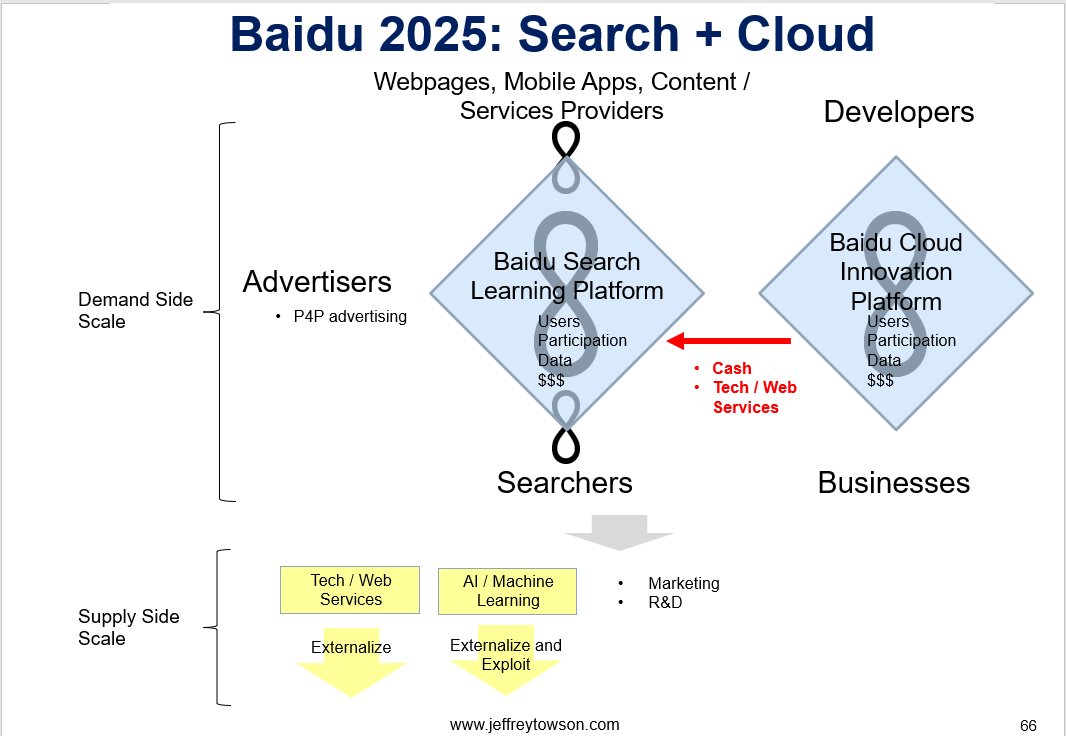

The business model here is “AI + Cloud”. That’s the big new growth engine for Baidu. I believe they are selling this to businesses as Model as a Service (Maas).

I am actually pretty excited about this. I’ve been writing for years about how Baidu needs to stop chasing growth opportunities that are out of its expertise. And largely unproven. Instead, they should focus on two proven and fantastic business models: search and cloud. And they should lead with AI in cloud. I wrote about that here in 2021.

And I even made a graphic for what I thought Baidu should look like in 2025. This (plus autonomous driving) is what they now appear to be doing.

So, Baidu has a full AI technology stack. And they are exceptionally well-positioned for the current explosion of activity in generative AI.

Their integrated tech stack enables them to take an integrated (vs. modular) approach, which is usually much faster and better in complicated emerging technologies. Tesla is doing an integrated approach to autonomous vehicles. Apple did the same with the first smartphone.

Final point.

This second rise of Baidu is actually a common pattern. Leaders in one technology paradigm often miss the jump to the next technology paradigm. Microsoft under Steve Balmer missed out on the switch to smartphones. However, these same companies are then often early to the tech paradigm after that. This is like Microsoft under Satya Nadella, which was early to the move to cloud.

Baidu has followed this pattern. The company appears uniquely well-positioned for the age of AI – because it has been preparing for it for a long time.

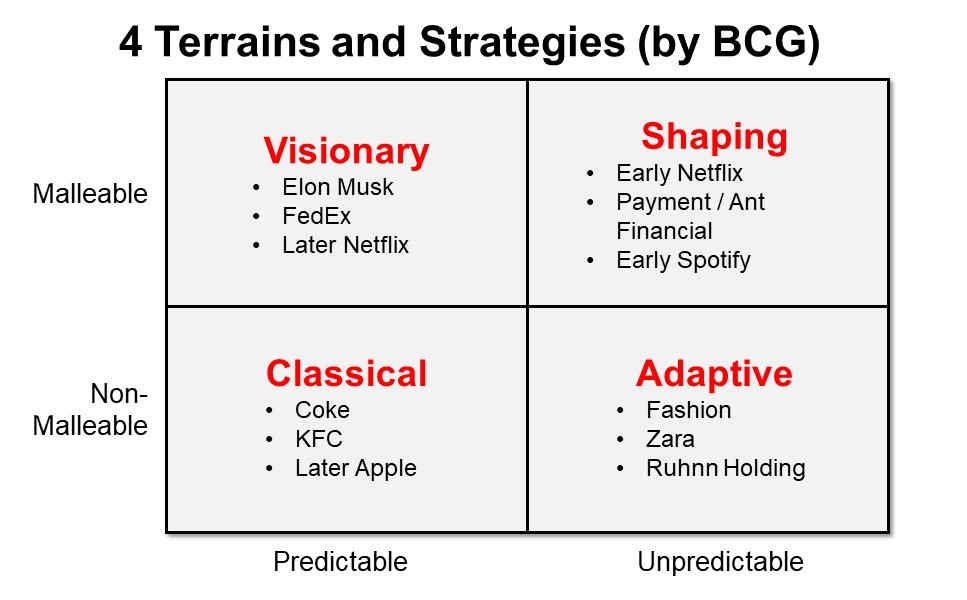

Lesson 2: Baidu’s Strategy is Visionary Plus Shaping. Not Adaptive like ByteDance.

What also struck me during the visit was how much Baidu operates like Microsoft and Tesla. That it makes large, long-term investments in new technologies and then brings them to the market. In terms of the discussed BCG 4 terrains and strategy framework, this is Visionary plus Shaping strategy. They are focusing on building technologies that are somewhat predictable and then investing long-term to bring them to reality. That is very different than the rapid adaptation discussed with ByteDance.

We can definitely see this in their approach to AI.

In truth, search engines have always been in the AI business. So, it was not surprising that they focused on the space early on and made large long-term investments of time and resources. Note: Baidu typically spends +20% of revenue on R&D.

The risk with this strategy is that you have to be right. It requires leadership that is comfortable making big decisions on the future of technology. Keep in mind, Baidu founder Robin Li has been writing algorithms since 1994. After college in the US, he joined IDD Information Services (then part of Dow Jones) and worked on algorithms for the search engines for finding their articles. He then developed the RankDex site-scoring algorithm for search engines and received a US patent for it. RankDex was similar to the PageRank algorithm used by Google. But Robin was two years ahead of Larry Page and Sergey Brin. In fact, Larry Page referred Robin’s work in his patents for PageRank.

So, you’re dealing with a technologist at heart. And one with deep expertise in algorithms. It’s not surprising that he understood where AI was going before others and was comfortable making big bets.

I think Baidu also benefits from a necessity to focus. In 2022, they had around 40,000 employees and $18B in revenue. They simply can’t invest in everything like Alibaba and Tencent. They need to be much more focused and that can be a blessing. You’ll notice that Baidu never really does anything internationally.

I had underestimated how much Baidu was doing a visionary plus shaping strategy. And that this requires a different organization and operating structure than what we see at companies like ByteDance and Tencent. If ByteDance is a decentralized organization that highly adaptive, Baidu is centralized and depends on the right leadership and centralized R&D making big bets on certain technologies.

Lesson 3: Most Other Baidu Initiatives are Incremental Innovation.

Baidu has some other projects. But most of their focus appears to be on their mobile ecosystem and AI. Those are their two big business units, and we see lots of upgrades in multi-modal search.

The only other big bet I saw is autonomous vehicles. Although this really does follow from their capabilities in AI and mapping. So, we could call that incremental innovation.

Overall, the company appears focused on two big growth engines plus lots of incremental innovation.

***

That’s it for today. Here’s some videos from their Apollo autonomous vehicles.

Cheers, Jeff

———

Related podcasts and articles are:

- Baidu’s Search Engine Explained in 3 Slides (pt 1 of 3) (Asia Tech Strategy – Daily Update)

- Baidu is Struggling in Content Creation, Push Feeds and the Attention Market (Pt 2 of 3) (Asia Tech Strategy – Daily Update)

From the Concept Library, concepts for this article are:

- Search engines

- Cloud computing

- Generative AI

- BCG 4 Terrains and Strategies

From the Company Library, companies for this article are:

- Baidu (BIDU)

- Baidu Cloud / Paddle Paddle / Ernie

——–

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.