Salesforce, Inc is the digital giant that gets lost in the shadows of Microsoft, Facebook, and Google. And particularly in the shadow of enterprise juggernaut Microsoft.

But CRM leader Salesforce has been a pretty fantastic business for 20 years. It has been steadily entrenching itself in the sales, marketing, and services departments of digitally transforming businesses globally. And it has found itself in the part of the digital core that matters most – the relationship with and understanding of customers.

However, there are some clouds on the horizon. Generative AI is changing the way companies operate, specifically in how they engage with customers. The technology stack is changing. And Microsoft plus OpenAI is emerging as the ultimate enterprise business model.

In this three-part series, I’ll do a digital strategy deep dive on Salesforce. This is pretty much how I view the company. And, tipping my hand, it’s pretty great.

The Basics of Salesforce, Inc.

Salesforce was co-founded in 1999 by Marc Benioff (and others). A USC graduate, Marc spent 13 years at Oracle in sales, marketing, and product development. He left to found Salesforce, which (big surprise) was a disruptive play in sales, marketing and customer relationship management. He is still chairman and CEO. Note: Oracle head Larry Ellison was an early investor.

The early mission and marketing statement of Salesforce was titled “The End of Software”. It was basically an argument for moving software from CD-ROMs to the web. It was a direct attack on Siebel, the dominant CRM player at the time (which was not web based).

Salesforce and Marc personally have become somewhat the symbol for “software as a service” (SaaS). And the often-repeated story is that Marc thought up the SaaS business model while swimming off of the coast of Hawaii. I’m not sure if that’s really true. It also began moving to the cloud in 2009, with the company’s launch of Service Cloud.

It remains specialized in customer relationship management (CRM) software and applications, but it has expanded services over time to include all aspects of customer engagement. Their SaaS business model now has modules for sales, marketing, service, ecommerce, etc.. And, like Adobe, it has created an integrated software bundle that is difficult to replicate. In its filings, it says it has created a “complete view of the customer by uniting sales, services, marketing, commerce and IT across systems, apps and devices.” It describes itself as a “global CRM that brings customers and companies together.”

Salesforce has been the #1 CRM company for 9 years. And by most measures, it is one of the top 10 tech companies in the USA.

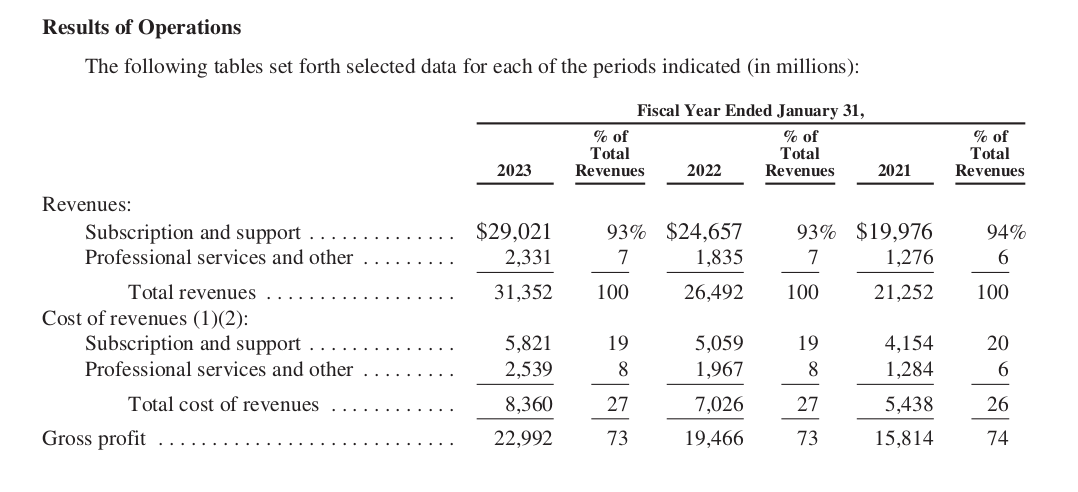

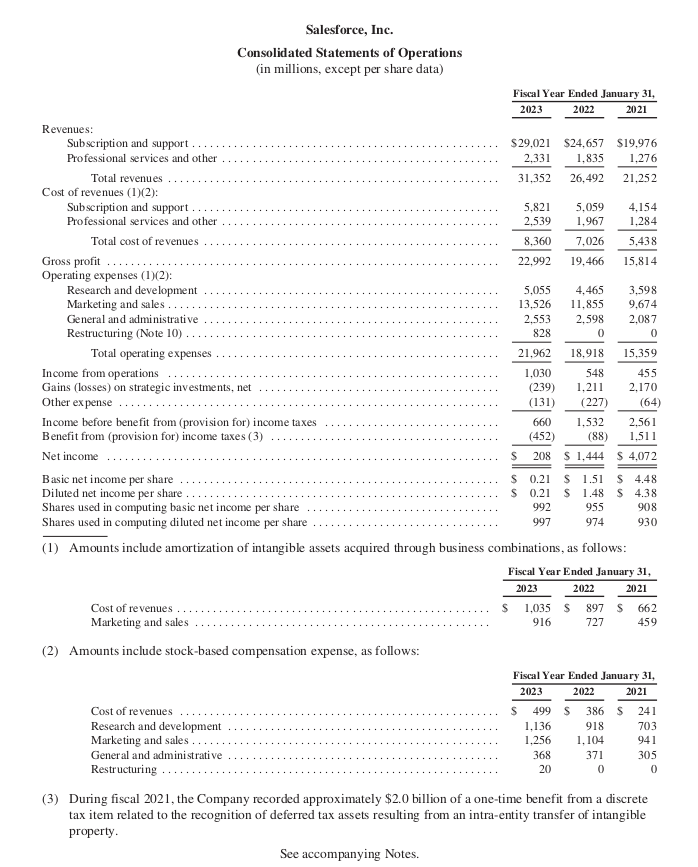

- In 2023, revenue was big at $31B.

- Gross profits were big at 73%

- But most of that gross profit goes into sales and marketing (42% of revenue) and R&D (16% of revenue).

- In 2023, growth in revenue and operating cash flow were 18%.

Here are the recent financials. They’re pretty great.

Unsurprisingly, the company does a lot of small investments. Keeping on top of tech innovations. But it occasionally does larger investments. Most notably the 2021 acquisition of Slack for $17B.

In its filings, Salesforce describes its strategy as the following (my interpretation).

- Continue to grow its suite of integrated CRM solutions.

This means adding new clients and upselling and cross selling the existing clients. Moving down market (Salesforce Easy) to SMEs appears to be a focus.

The other mentioned focus is adding solutions that are specific to industry verticals.

- Offer enterprise collaboration tools and solutions.

This is how they talk about their acquisitions of Slack. As well as for Tableau and MuleSoft. Not sure I buy this.

- Create capabilities in generative AI.

They have launched their Einstein GPT capability. They are integrating this in their core solutions.

That’s a simplistic summary of the recent SEC discussions. My strategy breakdown is a bit different.

My 4 Standard Company Questions

Here are the four questions I used for Arm Holdings. My actual company checklist is a lot longer, but this is a good short version to start with.

- Is growth and value creation benefiting from a secular trend? Is there a tailwind? How is it changing?

- How strong is the customer value proposition? What is the state of the core engine? How is it changing?

- What are the competitive strengths of the business model?

- Are there external CGT factors that will impact 1-3?

The first question is pretty easy for Salesforce. They are riding the digital transformation trend. Every business (big and small) is going digital. And CRM is usually the first and most important target for digital transformation. Like ARM, they are riding a long-term and fairly predictable global trend.

Let me jump right to question 2, about their customer value proposition. This is a lot more interesting.

The Salesforce Value Proposition Is a Proven Winner. This Isn’t Changing.

Salesforce does B2B sales to mostly medium and large enterprises. They are solutions for connecting better with their customers. And to a lesser degree with employees.

Here’s how they describe the benefits of their solutions.

That’s kind of a messy list of benefits. A lot of this is pretty standard and doesn’t explain their stratospheric level of success. I think you can break it into standard software benefits and particularly powerful CRM benefits.

At the simplest level, their core “360 customer solution” provides what most all enterprise SaaS solutions provide:

- Cost savings and increased productivity (by virtue of digitizing workflows).

- Increased agility (again, by virtue of software)

- A short time to value (i.e., it’s easy to deploy and get benefits)

Basically, it makes the enterprise CRM activities cheaper, more productive, and more agile. Fine. But you can say the same about pretty much any software solution for a key enterprise workflow. And because it is a SaaS model this software solutions is also:

- Scalable

- With an easy first step for customers.

SaaS models can have low entry price points (often freemium). And they can scale up as you need them.

That’s fine. But again, that is all pretty standard for software and SaaS. None of that is particularly powerful versus the many other enterprise SaaS offerings. You could say the exact same thing about accounting software.

The reason CRM software is so much more powerful (in my opinion) is because:

- It helps you sell more. It helps you grow your business. Businesses will pay a lot more for growth than for cost savings and efficiency. It is viewed as strategic spending. If this spending gets us more revenue, we should spend as much as possible doing this. More on this in Part 2.

- It helps you improve your customer insights and relationships. Outside of selling more, getting more data and insights about your customers is highly valuable. Customer data fuels all the most valuable stuff in digital strategy. It’s how you do constant improvements. It’s how you remove pain points. It’s how you improve your next products. It’s how you enrich the customer experience. It’s how you get more engagement, which gets you more data. Customer data, insights and relationships are the most valuable assets in digital.

- CRM is also about trust, privacy, and building proprietary information. Businesses are sensitive about who is handling their information. But they are particularly sensitive about their customer information. Nobody likes giving their customer lists to a company they don’t trust. Being trusted important.

If you read their benefits list again, you can see a lot of these words in scattered in the various bullet points. These last three points are why CRM is particularly powerful. And none of this is changing anytime soon. In fact, it’s becoming more powerful over time.

Salesforce Is Selling the Digital Operating Basics

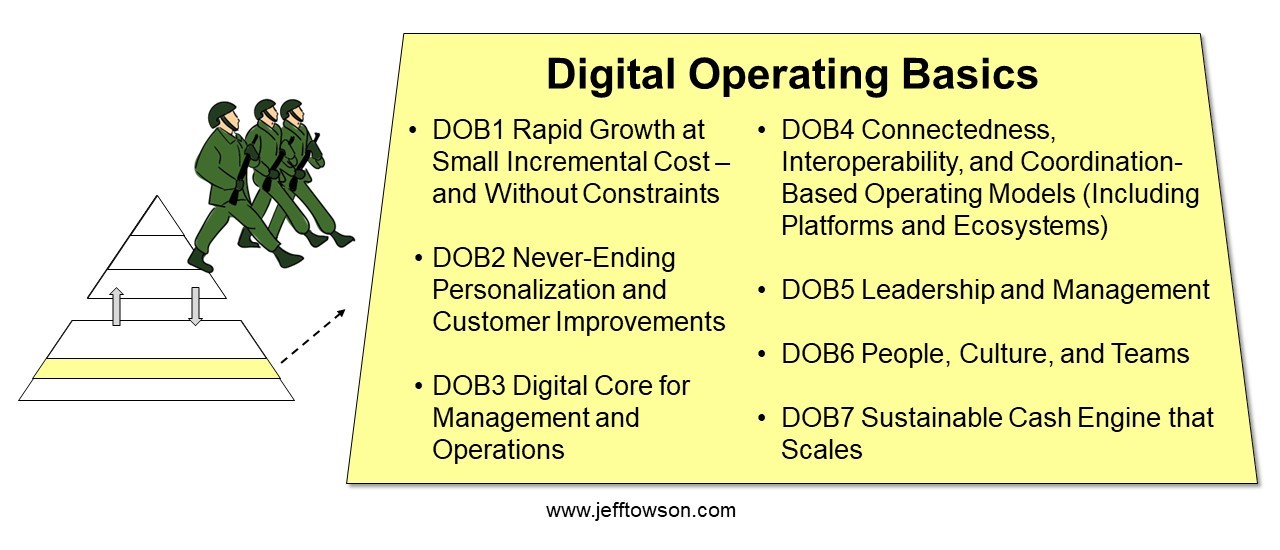

For those of you familiar with my frameworks, you will have already recognized that the Salesforce value proposition sounds a lot like my Digital Operating Basics. That is really what they are selling. Specifically, they are selling DOB2, with some degree of DOB3.

When businesses become digital-first in their operations, they usually start with DOB3. They build a digital core for their management and operations. This creates a central repository for information. It creates transparency. And it enables increasingly sophisticated analytics about the business, its operations, and its customers.

After DOB3 (i.e., start getting data), businesses usually focus on DOB2. They start applying this to selling more. And to improving the customer experience. This usually means personalization.

Looking at the Salesforce value proposition, you can basically see this is what they are offering. They are providing tools to digitize and manage all aspects of the customer relationship. In their own words, they are offering a “complete view of the customer”. That’s DOB3. Their language sounds a lot like Snowflake, which I have written quite a bit about. Snowflake is a data ecosystem company that focuses on digitizing the entire business and creating “a single source of truth”. Salesforce uses similar language and says it creates a “single source of customer truth”.

Salesforce also talks about enabling companies to become “responsive” and “personalized”. That is basically DOB2. They are giving businesses an ability to do constant improvements.

That is most of what Salesforce is offering. They are DOB2 and DOB3 specialists with a complete set of tools and constantly improving solutions.

What we are starting to hear from Salesforce now is more talk about “collaboration” tools. They are talking about helping employees and partners coordinate. They talk about how Slack can become the digital headquarters for businesses. To me, that sounds a bit putting a foot in DOB4. Microsoft and Snowflake use the same language.

I’m not sure I buy that. And the Slack acquisition doesn’t make a lot of sense to me. I think they are still overwhelming selling DOB2 and DOB3 that is highly specialized for customer information and interactions.

***

That’s my take on their customer value proposition. In Part 2, I’ll go through the competitive strengths (my area).

Cheers from Las Vegas, Jeff

———-

Related articles:

- A Strategy Breakdown of Arm Holdings (1 of 3) (Tech Strategy – Daily Article)

- 3 Digital Concepts Powering ARM Holdings (2 of 4) (Tech Strategy – Daily Article)

- Ant Financial Is 3 Platform Business Models Combined. (Jeff’s Asia Tech Class – Daily Lesson / Update)

From the Concept Library, concepts for this article are:

- SaaS

- Enterprise Software: CRM

From the Company Library, companies for this article are:

- Salesforce Inc

———-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.