This week’s podcast is Part 1 of Capabilities, Resources and Assets (CRAs). They are a key part of strategy. And link operating performance with structural advantages.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is the link to the TechMoat Consulting.

Here is the link to our China Tech Tour.

Key points:

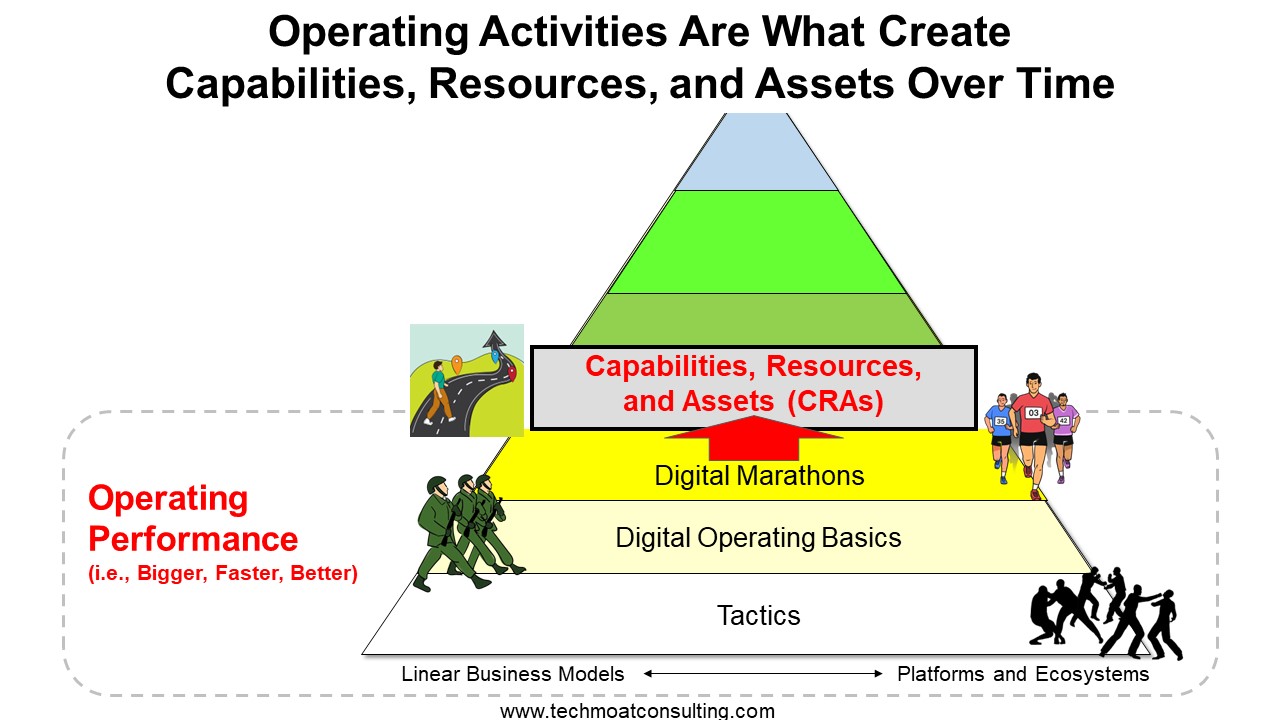

Point 1: Operating performance and structural advantage are separate parts of strategy and management.

Point 2: But they are also linked. By a select list of capabilities, resources, and assets (CRAs)

Point 3: Operating activities create and maintain CRAs, which can be tangible and intangible.

Point 4: Sometimes CRAs can manifest as competitive advantages and barriers to entry.

Point 5: CEOs need to identify moats. And then chart a path of critical CRAs to build and rebuild them.

——–

Related articles:

- Lessons in Digital Operating Basics from Ram Charan. Part 1 of 2 on “Rethinking Competitive Advantage”. (Asia Tech Strategy – Podcast 98)

- Meituan vs. Ctrip vs. Alibaba: Who Will Win in China Services? (Jeff’s Asia Tech Class – Podcast 22)

From the Concept Library, concepts for this article are:

- Capabilities, Resources and Assets

- Intangible Assets

- Serial Moats

From the Company Library, companies for this article are:

- n/a

——-transcription below

:

Welcome, welcome everybody. My name is Jeff Towson and this is the Tech Strategy Podcast from Tecmo Consulting. And the topic for today, a digital strategy lesson, how CRAs are the path from operating activities to competitive advantage. Now CRAs, it’s just shorthand for capabilities, resources and assets. And it’s something I haven’t talked about a huge amount, but if any of you have read sort of my latest one hour Motes and Marathons book, which came out a couple of weeks ago. You’ll notice there’s a lot of focus on that. And it’s not something I’ve talked about in the previous books very much. It’s, I kind of missed it. I should have focused a lot more on it. So anyways, that’s what I’m gonna talk about today. But again, as mentioned, these podcasts are now gonna be relatively short and we’re either gonna do a deep dive on a company or a real quick digital strategy lesson. And today’s a digital strategy lessons about CRAs. So with that, let me give you my standard disclaimer here, and then we’ll go into the topic. Nothing in this podcast or in my writing or website is investment advice. The numbers and information from me and any guests may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment legal or tax advice. Do your own research. And with that, let’s get into the topic. Now we start with a couple current events, three minutes in current events as I say, and couple big things that I think happened in the last week or two. Number one, biggest one I think is Rumble has left Brazil in response to basically government crackdown on free speech and political dissent. You know they have left and this is just the latest. We’ve seen this a couple months ago. The other one that really got my attention was the EU Digital Services Act, which is basically some regulators, government bodies in the EU deciding, we are gonna decide what people can say and can’t say online, and then they basically put a gun to the head of the tech platforms and say, sensor as we wish, or we will start to fine you. Now, it was passed several months ago, but they had never really enacted it yet. Well, they… big surprise, Twitter X is their first target, and they’re launched of an official investigation into that. And okay, what does all that mean? I think it’s pretty straightforward. As I’ve kind of said many times, when you digitize and connect things, the economics change, it becomes usually more powerful, and it also creates the opportunity for control. And let’s say payment systems. Good example of that. If everyone’s passing around money in bill form, okay, money is exchanging hands, buyers, sellers, lots of interactions, but it’s not digital. It’s pieces of paper. There’s no opportunity to control it. Once you digitize it and you move it to either a payment network or God forbid CBDC, it’s now digital, it’s now connected. You can see it all. and it will generally drop to one network effect, basically a natural monopoly, and it will give one entity, whoever controls that system, the ability to control it, cancel payments at will, cancel types of payments at will. And we’re basically seeing the same thing. Now that I think is coming, but we’re seeing the same thing clearly in the information and communication space. Once you… digitize and connect information sharing, posting, you know, WhatsApp, Facebook, Instagram, all of that. Well, it put the companies that built these systems in a tremendous position of power. And let’s not kid ourselves, if you can control the information flows in a society, it is arguably the greatest source of power that’s ever existed. A handful of companies were the, you know, had their hands on the wheel. Elon Musk took over Twitter. He put, He took over one of these. And big surprise, politicians say, no, we wanna be in charge of this. And so they passed laws giving them the ability to demand that the tech companies censor as they see fit. And we’ve seen this everywhere. We’ve seen new regulations out of Canada, we’ve seen it out of the EU, we’ve seen it out of Australia. We’ve seen fairly sweeping censorship laws coming out of Brazil. Not really laws, just sort of judges. It was tried in the US indirectly because it’s actually blatantly unconstitutional. So they tried it sort of behind the scenes by just pressure campaigns on the tech companies. Censor what we say to censor or we’re gonna regulate you. And all of them complied with the exception of two, Rumble and now Twitter. And you can see what are the two companies that are being hit. Rumble, which has already been, you know, had to leave France, has now left Brazil. the entire US government is coming after Twitter right now. So it’s all about power as far as I can tell and unfortunately this position of power now exists in the world and people are gonna fight over it and we’ll see what’s what. Anyways, that was kind of the big news that caught my attention this week and that’s four minutes, that’s enough for this week. One other quick thing to keep an eye on, Pica Labs. There’s three apps I’m trying to get it. it on in terms of AI Pica Labs, Grok, and then Gemini which is the Google multimodal model. I’ve gotten on to Pica which basically does text to video and it’s fantastic. It’s absolutely fantastic. I’m making videos of samurai on the hills of Japan. I’m making cartoon characters. It’s it’s crazy. Anyways, those are the two things that got my attention this week. Okay, let me get into the content. Now, I’m just gonna make three or four points today in sort of sequential order. And this is gonna be some theory, so digital strategy lesson. Okay, point number one, operating performance and structural advantage, MOTES, are different things within a company. Now, obviously, if you’ve looked at anything I’ve written in the last five years, you’ll see me… point to my six levels. I’ll put the JPEG in the notes here if you’re doing this from the webpage. And obviously the top of the pyramid, three types of structural advantage in Moats, the bottom of the pyramid, three types of operating performance. In any company you wanna think about both of those. Operating performance, which I make an analogy to Elon Musk, it’s just how fast and effective you can do things. Are you creative? Is your team great? Are you quick on your feet? Can you make better products? That to me is 10 dudes fighting another 10 dudes. And they all have kind of the same weapons. And we’ll just see which team has a better fighter. Okay, you move up to structural advantage in motes. Okay, these are business aspects that create advantages almost regardless of how good you are at fighting. We got one team of people over there, they got swords, but the other team’s got guns. That’s a structural advantage. The analogy I usually use is like some businesses are cars, they go pretty fast. Some businesses are bicycles. That’s just their structure. Some businesses like tech companies are airplanes. They go super fast. You want to sort of look at a business on both levels, structure versus operating performance. and get an assessment of those things. And you’ll hear value investors talk about this all the time, although they use a little bit different language. Buffett talks about the horse versus the jockey. Some horses are just faster than others, and some jockeys can ride the horse better than others. Generally speaking, a mediocre jockey on a faster horse beats a great jockey on a slower horse, generally. Okay, so you’ll see this, you’ll also hear the difference between management and structural advantage, things like that, but that’s the idea. Okay, now these things are generally considered separate. You have an operating plan for your operating activities, this is what you do day to day, week to week, and you have a plan for your structure, your strategy, this is something a company might do every year, every two years. Okay, my point is, and I like to argue with people on Twitter about this. These things are not actually that separate. They’re linked. They go hand in glove. There are constant interactions between your operating activities that you do as a business and the structural advantages that you have. And in fact, it is your operating activities that create your structural advantages, your moats, your competitive advantages. And when your motes and competitive advantages decay over time, which they do, you need to continually be rebuilding this mote or you need to build a new mote. And that means doing different operating activities. So it’s almost like a cycle. Your operating activities build your mote and then you continually are building and rebuilding with different activities. That’s kind of point number one. These two things are not as separate as people say they are. Okay, point number two. What is the linkage? The linkage between these things is CRAs. CRA capabilities, resources, and assets. Now we could talk in terms of assets like factory, tangible asset. We could talk about intangible assets like you have the intellectual property to Ironman. Intangible assets, tangible assets. Okay, but when you start to look at companies with. you know, not just looking at the balance sheet, you can see that they’re really capabilities that you’re building within an organization. You know, TSMC in Taiwan is, you know, you wouldn’t look at TSMC and say, oh, you can look at this company in terms of its tangible assets. No, it’s, you look at its semiconductor foundry capabilities, which has a lot, which cuts across everything. It’s the expertise, it’s the staffing. It’s the experience. Yes, it’s some other assets, but you really start talking about capabilities that certain companies have in certain things. And another way to think about it would be resources. Okay, you have these sort of network relationships. You’re not just TSMC, which has internal capabilities in semiconductors. You have deep operating relationships with chip designers, with equipment, with EDAs, all of that. So that’s a resource, it’s a capability, but just looking at it as straight assets isn’t usually gonna get you the full picture of what you are building as a company. Most companies are not terribly well represented by their balance sheets. There’s a lot more going on than with that. And there’s a whole set of theory and strategy thinking around resource-based competition. Capability building as the primary thing in competition. So I sort of put those together. So capabilities, resources, and assets. And the goal, when you look at the linkage between operating activities and structural advantage modes, is not to map out every single asset a company has. That would be just a ridiculously detailed and pointless exercise. No, it’s to use your own judgment and realize, look, what… what is really going on in this company that matters, and it’s only really two resources, or it’s only really two to three types of assets that matter. If you look at Walt Disney, you look at the theme parks, massive, tangible assets, and you look at the intellectual property library. That’s most of what matters. There’s a lot of other stuff, but that’s the short list. So there’s a lot of judgment in sort of detailing and deciding. what CRAs really matter. And I’ll put another JPEG in the show notes, which basically puts CRAs as the linkage between structural advantage and operating activities. Okay, that’s point two, that’s the linkage. Point three, it is operating activities that create, maintain, and rebuild the CRAs. Okay. What are… We look at the operating performance of Walmart. What do they do every day? Well, they do a ton of stuff, but there’s a handful of key operating activities they do every day. Top of the list, they build and they run stores. That’s what you do as a retailer. What does that operating activity create over time? Well, over five, 10, 15 years, you end up with a unique set of tangible assets. which is the network of stores within certain geographies and the warehouses that supply them. It’s really a network of tangible assets that is sort of the core asset of Walmart in certain specific geographies like the Midwest of the US. So your operating activities create and maintain your assets. What does Disney do all day? Well, in theory, they design characters, they make films. You know, they create movies, they do a lot of drawing, those operating activities of creating their content over time, the resource that is created or the intangible asset is a library of characters. Right? Now, they also buy them, but you know, that is the net result that falls out of all that activity over time. And you really want to look at this over five to ten years. what CRAs are being created by all this activity that matter over five to 10 years. So you could call that intangible assets. Saudi Aramco, the Saudi oil giant, they drill into the ground, they suck the oil out, they put it on cargo tankers, more and more they’re doing sort of petro activities in the region. Their CRA is almost entirely just the resource. It’s mostly the resource and then some specific tangible assets, but we wouldn’t look at them as like the core critical CRAs are not really their capabilities. It’s not like their deep semiconductor expertise. No, it’s mostly the resource. And then second to that, it’s a series of large tangible assets, refineries they’ve built over time. Anyway, so that’s kind of point number three. The operating activities create, and you know, usually you have to kind of continually create and recreate the key assets, CRAs that matter. Okay, point four, there’s five points total. Point four, sometimes a specific set of CRAs can manifest itself as a structural advantage or mode. Most of the time this doesn’t happen. If you’re a standard restaurant, you’re doing quite a lot of operating activities every day. You’re opening restaurants, you’re fixing the restaurants, you’re changing the menu, you’re doing your supply chain management, your training management, you’re doing a ton of activities. Out of that falls a set of CRAs that are important. You got your stores, you got your warehouses, you got your employee training program. None of those CRAs usually manifest as a competitive advantage. It’s just what you’ve built. But sometimes that happens. And the way I’ve always looked at structural advantage, competitive advantage, barriers to entry, everything in the top part of my pyramid, those are the flip side of a series of specific assets, resources, and capabilities. And this is when people talk about resource-based competition. It’s two sides to the same coin. So when you look at Walmart again, okay, you’ve got all these operating activities, you’re creating all these CRAs over time. A small part of those CRAs manifest as the very powerful competitive advantages Walmart has. Now, first of all, you get a barrier to entry. If you got 1,000 stores in the U.S., Okay, that is very hard to replicate. Fine. But usually the power is not at the barrier to entry level, it’s at the competitive advantage level. Their massive scale gets them lots of efficiencies, basically economies of scale, at the store level and at the warehouse inventory level and in logistics. That’s one of their key competitive advantages is economies of scale based on fixed costs. Another key, so that would be a tangible set of assets manifesting as a competitive advantage, in this case, economies of scale. You could also look at the intangible assets they have, which is over time, they have built a very big customer base. Certain types of relationships with customers are a competitive advantage. They’re an intangible asset that matters. If you have lots and lots of customers on membership loyalty programs or subscription models like Costco, that is a key resource. You could call it an intangible asset or you could call it a resource, but it absolutely matters. And so companies like Starbucks, companies like Costco, they are always trying to sign people up for their membership program. Now that intangible asset can manifest. as switching costs, a share of the consumer mind. So you can look at this from the tangible side or the intangible side, but certain assets that you built out of your operating activities will give you certain competitive advantages. Disney’s an easier one to think about. They create all their movies and their characters. That gets them intellectual property portfolio of characters. Okay, that’s the CRA that matters. And then under US law, that can be trademarked. So you own it, can’t be copied. Government rules like trademark are just a clear competitive advantage, a state-granted competitive advantage. So first one, Walmart, it’s a mix of tangible and intangible assets that manifest into their competitive advantages. In Disney, on that side, it’s more intellectual property, intangible. Coca-Cola would be another example of that. Coca-Cola, they don’t really have any tangible assets that matter. They don’t really have any capabilities that matter. They’re not making semiconductors or anything. They don’t have factories or anything. The only thing Coca-Cola really has that matters is its connection to customers and its presence in the brains of consumers. that has resulted from 100 years of constant marketing. Their key sort of critical asset, I would say, it’s their legacy brand, and that would manifest as a share of a consumer mind. They’re just in everybody’s brain, and they’ve got to keep maintaining that with their… Now, they also have superior marketing spend, so they have economies of scale in marketing spend. But anyways, you kind of have to draw like a little picture between your activities, create what assets that matter, and what assets that matter, what competitive advantages can they manifest as. You want to see those three steps. And it has always been a mix of tangible and intangible assets. Always. Some companies are much more about the tangible, other companies like Coke are almost entirely intangible. There’s no major tangible assets. Some are more about sophisticated capabilities, semiconductors. Other companies are more about resources like Saudi or Ramco. Anyway, so that’s point number one, two, three, four. And last point, and then I’ll finish up for today. So if you are a CEO or if you are a value investor, if you’re a trader, this isn’t gonna help. You know, for you to win, you’ve really got a couple questions to answer, which is, okay, I kind of know what business I’m in. It’s pretty hard to change that when you’re in a business. I know what daily activities I’m doing. I know what my customers want and I know what I can sell them successfully. We’ve struggled and found that. Okay. Given that, what does winning look like? What would be a business model, a structural advantage? that would make us stronger and stronger over time, because that’s what we want. Well, we have to identify the moats that we can build. What are the competitive advantages specifically? Okay, fine. Then we have to basically connect that to a small number of critical CRAs, such that we wanna be building these assets, resources, and capabilities every day. These needs are… operating activities need to generate this over time. So as the days, weeks, and months go by, the assets that are gonna play out as real competitive strength are always being built. And most companies don’t do that. They just kind of do what they know and they do what sells. But you really wanna have that strategic level. Now, if you’re doing that, that’s basically means, yes, you’re doing your business, you’re doing your operating activities, you’re improving your operating performance. but you are always rebuilding a moat or strengthening an existing moat because you understand the linkage. And I map these out for clients. It’s really pretty simple once you see it. It’s kind of the critical path of all the hundred things you’re doing every month, which are the three things that are gonna make your life easier and easier over time? that are gonna make you stronger and stronger over time or five years from now the competitors you’re worried about, you’re not worried about them anymore. Well, you gotta know which of the three to five key activities you’re doing are the path to that. So my kind of thing, so that’s kind of why this talk was titled, you know, CRAs are the path from operating activity to competitive advantage. And that’s the point. Now, why did I tee all that up? And that’ll be it for today. because in part two of this, I’ll do another short lecture on this, probably in the next week or so, when you start going into digital businesses, it’s the same story, but the language changes because the assets and resources and capabilities you need to build a digital first business are very different than building factories. And… If you are a digital first business, the competitive advantages you wanna see are pretty different than what we have seen historically. That’s why I wrote six books on that particular question. What does winning as a digital business look like? That’s motes and marathons. Okay, if you can identify that, then you can work back and say, and here are the CRAs that matter. And CRAs in digital are different. Suddenly we’re talking about training people in software. Suddenly we’re talking about data ecosystems. We’re talking about a whole different list of CRAs, none of which are on the balance sheet. Anyway, so I’m teeing that up. So this is sort of part one, part two. I’ll figure that out in the next week or so. Anyways, that is it for me. I think I’m right on time here. I had a pretty great holiday season. I think the last one I did was in Vegas. I flew down to Mexico and I was there for about a week or so. I’m just doing some immigration stuff. It was really just sort of administrative, you know, checking some boxes. I’m technically a resident of Mexico now. It’s not exactly a huge priority in my life, but it’s a nice little thing to have in the back pocket. Anyways, back to California to see my family, Christmas, all of that. It’s been pretty great. And then I’ll head back to Asia in a couple of days, which I’m really eager to do, which is really strange. Like, I find it unusual how poorly I fit in so much of American culture. I think I’m totally comfortable in the business and the technology stuff. I’m like a fish in water. But outside of that, no, I just want to go back to my home base. That’s a very strange thing to have happen in life. Anyways, that’s it for me. I’ll probably talk to you in the next couple days back in Asia. But anyways, I hope everyone is doing well. I hope this is helpful. I hope you had a great 2023 and I’ll talk to you next time. Bye bye.

———-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.