This week’s podcast is a deep dive into Baidu Cloud, a leading provider of cloud and intelligence services. And arguably China’s AI leader.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is Part 2.

Here is the link to the TechMoat Consulting.

Here’s the flywheel

———–

Related articles:

- A Breakdown of the Verisign Business Model (2 of 2) (Tech Strategy – Daily Article)

- 3 Factors Will Determine the Future of Verisign Inc. (Tech Strategy – Podcast 191)

- A Strategy Breakdown of Arm Holdings (1 of 3) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Cloud Services

- AI

- Generative AI

From the Company Library, companies for this article are:

- Baidu

- Baidu Cloud

——–transcription below

Welcome, welcome everybody. My name is Jeff Towson, and this is the Tech Strategy podcast from Techmoat Consulting. And the topic for today, Baidu’s AI strategy, which is basically, in my opinion, a flywheel in industry-specific intelligence. And I’ll break down what that means, but Baidu. Super important company in terms of ai, like top five, globally, top two for China, maybe top three, uh, depending how you define things.

Uh, they’ve been ahead of the curve for AI for a long time. Uh, big moves in the last year. Anyways, I pay a lot of attention to by doing what they’re doing, really as much as I can figure out. So I’m gonna break down what I think they’re doing. Uh, pretty important in my opinion. And that’ll be the topic for today.

I’m gonna do this in two podcasts. ’cause if I do it in one, it’s gonna end up being like an hour, and I think that’s too much. I’m trying to keep ’em at 30 minutes from now on. So that’ll be the topic for today. Um, let’s just skip over the housekeeping stuff. Uh, standard disclaimer, nothing in this podcast or my writing or website is investment advice.

The numbers and information from me and any guests may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment, legal, or tax advice. Do your own research. And with that, let’s get into the content. Okay? I’m also gonna switch over sort of current news and stuff and just get right into the topic.

Um, I’m gonna break this into four parts. I’ll do two in this podcast. I’ll do two in the, the second one, but points, topics for this podcast. Two things, sort of a summary of ai. Really Baidu’s AI cloud business is what we’re talking about. Most of their strategy is about the cloud. And I’ll sort of give you a breakdown of how to think about their business in general.

For those of you who aren’t familiar with Baidu, I’ll go through some of the basics, uh, then jump sort of right into the cloud. And then topic number two, we’re gonna talk about, okay, what is the AI and cloud strategy, which is basically the flywheel, the feedback loop, uh. That’ll be part two, and I’ll tee up a little bit for the next one, which is really this idea of knowledge enhancements.

And that’s kind of something they’re focusing on. If you listen to CEO Robin Lee, he will talk about increased efficiency through knowledge enhancements and building out knowledge graphs, which are very industry specific. That’s kind of the key point. I won’t get too much into that in this one. I’ll tee it up and we’ll go more into the next one.

Okay, so let’s just talk about Baidu to begin with, how to think about the business model. Uh, obviously long history. One of the first, well, really one of the second generation of, of digital companies that came out of China. This is Baidu Alibaba Tencent, all founded 19 ninety-eight 19 ninety-nine. This is really the second wave.

There was an earlier version, sort of an earlier wave, which was, you know, these portal-based businesses that people don’t really talk about very much anymore, but they’re still out there. Um, so this is kind of the second wave. They all got started. Baidu was early Robin Lee. Really good at ai. Well, really good at algorithms back then.

Uh. Early sort of executive in search in the United States. As I’ve mentioned before, you know, he did some early work on Algorithms and page ranking, which when Google was founded, you know, Sergey Brin and them, they, they baited basically cited Robin Lee’s work when they created page rank. So he was really early on, uh, they start out in search engine for China based on PCs before mobile phones.

Very important. Uh, they grow in that business. Over time, 10 years, they become one of the three major players of China. From there, they move into a lot of ancillary businesses, adjacent businesses. That looks a lot like Google. You know, they got into video sharing iQiyi, which is, you could say that’s kind of like YouTube, although it’s pretty different in China.

It’s the leader now for sort of, you know, video content. It’s a, it’s a combination of like Netflix and YouTube, but they’re, they’re number one. Um, and they, they reached operating profits in the last year, which was a long, hard slog. That’s kind of interesting. They had a lot of other businesses that were content related.

Uh, dictionaries, mapping, things like that. They jumped into some, I would argue not terribly related businesses and O to O services. I know they did food delivery for a while. They exited most of those over time anyways, don’t want to get into too much of that, but basically we go back 10 years. What you’re gonna look at is you’re gonna see fairly steady increases in annual revenue.

Now, 2010 to 2015 was a bit of a struggle for this company because they weren’t growing like Alibaba and Tencent. Uh, just they were, they were dominating what they did, which is search, which is a beautiful business model if you can get into it. But that business just didn’t have the growth, and they started to look a lot smaller than the Alibaba and Tencent.

Um, but, and you could argue. Really for 10 years, they were searching for their next growth engine, which is why they were doing all these sort of adjacent businesses. Uh, I’ve always kind of thought, I mean, I actually wrote about this, this must have been five years ago. I wrote an article, several articles on Baidu saying, look, search is a beautiful business model.

Even at the, the, the country level. This would be Chinese language based search. Fantastic business model. We see the same thing with NAVR in South Korea. We see the same thing with Yandex and Russia. Fantastic business model. You’ll get real dominance. Um, just do search and cloud, like forget everything else.

Just do search and cloud and drop all the other stuff. They were jumping into autonomous vehicles and whatever. Now of course they don’t listen to me at all, but I think actually I was kind of right in retrospect, which is probably luck anyways. Um. Okay. But regardless, if you look at the last 2015 to today, you do see pretty steady revenue growth.

If you look at, say. You know, twenty-twenty-one revenue. About a hundred twenty-four billion REM in B. okay? For US dollars. Divide that by about seven. That gets you, you know, 15 to 20, uh, billion dollars revenue per year. Good. Um, thirty-six thousand employees. Major company. And one of the reasons I like search is because it’s such a unique business model.

I like to make animal analogies like e-commerce companies, you know, they’re kinda like big cats. Yeah, they have the same types of components, but there’s differences between a tiger and a lion and a cheetah and all that. Um, you can see these groups of animals and then you get search engines, which I always say that’s like, that’s like the ant eater.

It’s just a completely different animal. It’s nothing like anything else. And that plays out when you look at the workforce, you’ve got thirty-six thousand people, but they’re doing very different things than what you see an e-commerce company. So anyways, big company, good revenue. Okay, so 124 billion REM and twenty-four billion Renminbi, 2021.

You go back to twenty-fifteen, it was about half that six, you know, 66, something like that. And you go back another five years, it was about a quarter. So it’s actually been growing. Fairly well. It just never had the sort of rocket ship growth we saw in companies like Alibaba and Tencent, but good business.

Okay, so against that number we can look at what are they investing in? You look at headcount, you look at investment, okay? They’ve been flooding money really into ai. I mean, just. You know, 20, you know, 20 billion renminbi per year, 19 billion renminbi per year, which is several billion dollars per year, which when you’re in a specialized business like search that, you know, I like to see this sort of thing.

I like to see a highly specialized business. That’s unlike anything else. And then I like to see lots of investment and workforce into that unique structure. ’cause nobody else is spending that kind of money on these questions. That’s kind of what I look for. Okay. What does that mean in practice? Well, you know, they were building AI chips, uh, the Cunlun AI chips.

Um, you know, they’ve been doing this for 10 years. They’ve got their own sort of self-developed architecture. Uh. You know, they’re down at sort of seven nanometer technology. Now they’re doing the design. Obviously the big political question is the foundry and the manufacturing. But on the design side, you know, they’ve been investing into the entire AI tech stack for 10 years, probably more than 10 years.

’cause they’ve really been doing algorithms since they began. Uh, so they have their own XPU architecture. They’ve got their own sort of chip design end to end. It’s all specialized for this, you know, ai, that’s great to see. Um, they’re sort of doing mass production in 2024 for their third generation Quinlan chip.

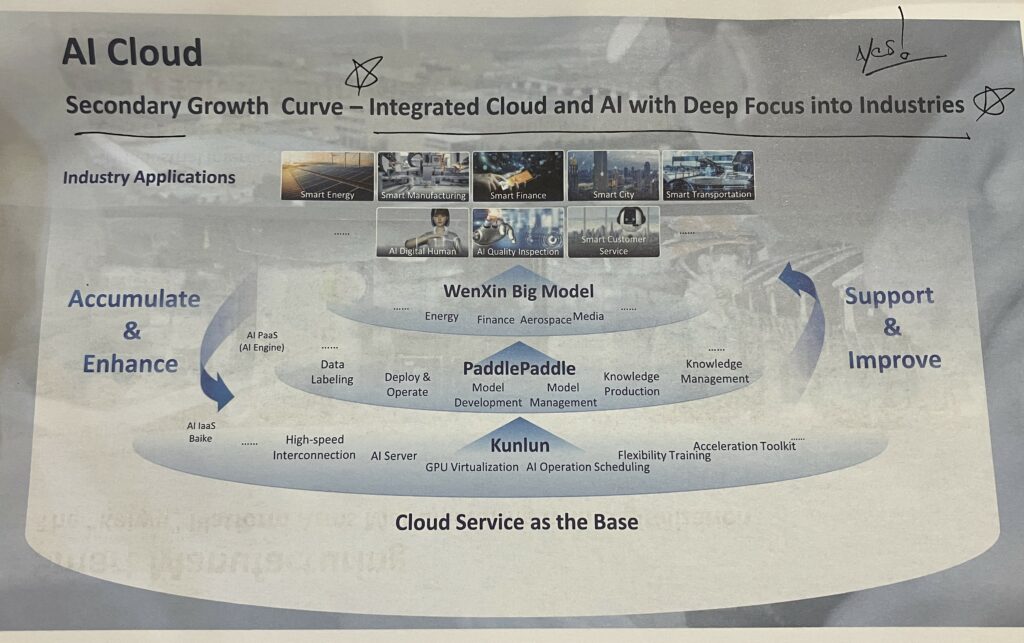

Okay. So you got your own tech stack. Uh, on top of that. So sort of at the compute infrastructure level, they’ve got what they call their industry level. Open source deep learning platform, which is basically paddle, paddle. Um, you know, you’re looking for three levels. As you move into ai, into the tech stack, you’re looking for the infrastructure level, the compute.

Uh, you can also put data processing in there. That’s what Alibaba Cloud does. A lot of people break out that. Um, above that you wanna sort of see the deep learning platform and really sort of community development. This is where you start asking questions like, how many developers. Our writing applications and other things for your deep learning platform and for them, that’s Paddle.

Paddle. The numbers I’ve seen from them, these are from mid 2023, they’ve got about 4.7 million developers. I. Uh, working on their deep learning platform, they got 180,000 enterprises. They got 560,000 models created based on this. And you see them doing the same, um, approach that I talked about for Alibaba Cloud, which is everything’s open source.

Um, lots of sup, uh, tools and kits for developers that support them. Lots of communities where you can post and talk and, you know, um, they’re arguably the leader here for China as far as I can tell. Um, and then obviously open source. Uh, okay, so you got paddle, you got sort of the compute layer, which is Kunlun and other infrastructure servers, things like that.

You got PaddlePaddle on top of that, and then on. Top of that, you get their foundation models, right? This is their version of GPT. Well, now, GPT-IV, they’ve got the Wenshin, which are basically a series of very, very large models, uh, foundation models that others can use, that others can adapt and customize, and which they can themselves build very specific applications that sit on top.

So you’re kinda looking for those four levels, the compute level. The deep learning platform, the big engine, the community. Then you’re looking for the a series of big models, which are open source. For them, it’s Wen Shin, but you can look at Llama, Lambda, GPT, you know all, there’s a small number of tech giants who are building foundation models, and that for them is Wen Shin.

And then on top of that you look at, okay, customization, new apps built on top of this. Our businesses customizing, adapting these into their own businesses. Um, and they provide a lot of tools for doing this. And if you look at their Wen, Shin, their sort of big foundation models, um, you’ve got their sort of natural language processing, their big model.

This is literally their phrase. They’re big models. So they’ve got NLP models for healthcare, for finance, for surge. For information extraction, for image generation, for language understanding. Um, you could go and look at their cross-modal where they can kind of, that’s kinda like multimodal. You can go between various languages.

You can go text to image, you can go intelligent document analysis, you can go from geography to language. Uh, lots of that going on. Uh, and then sort of big compute things that are more, they’re. Let’s say Biocomputing. They have a series of big models like protein structure analysis, chemical compound representation.

So they have got a big suite of these big models. Um, and I actually like the way Huawei has sort of broken this down. They break it down into sort of L zero, L one, L two, uh, L zero would be these types of big general models that have just. Unique capabilities. L one would be industry specific versions of those models, and Baidu is doing that as well.

They call those their industry big models, which sit on top of these other big models. So they have an industry big model for energy. They have an industry big model for finance. They have an industry big model for aerospace, so that’s sort of L one. And then L two, which would go on top of that would be.

You know, more specific, they would be maybe company specific. Uh, they could be use case specific, like a chat bot that can work for anything. That could be like customer service, that could be security cameras, things like that. So L zero, the big models, Baidu’s got a lot of those. L-I, industry-specific big models, L-II specific application specific companies, and they basically got all of that.

Okay? So that’s kind of a look at what they’re doing, uh, with ai. Uh, now the reason I put bring this up is if you look at. How Baidu describes itself now, it has changed from a couple years ago. They describe themselves as a leading AI company with a strong internet foundation. Uh, basically they’ve taken their mobile ecosystem.

If you look in their 10 K’s, you’ll hear them talk about their mobile ecosystem. This is the series of apps they’ve been building since, you know, 2000. So it’s their Baidu search. Uh, it’s their mapping. It’s, there’s a whole series of these things in there. Uh, Baidu Union, you can go through all of ’em, but they’ve sort of rolled up what they’ve been doing into what they call the mobile ecosystem.

That’s business unit number one. Business unit Number two is AI Cloud, which is pretty much everything I just talked about. So those are kind of. In my opinion, the two big pillars, which to pat myself on the back a little bit, that’s kind of exactly what I said five years ago. Do search, do cloud. Okay.

They’re doing a mobile ecosystem. I still think that’s mostly about search and they’re doing a, I actually said this, I’ll pat myself a little bit more. I actually said they should go into cloud because it’s a very clear business model and they should be strongly differentiated in their cloud offering in terms of ai.

Okay. Their second business unit is now literally called AI Cloud, uh, which they argue they’re kind of, they will say they’re the top AI cloud service provider for China today. Um, which is probably true, and that’s kind of that model I talked about. Um, the other third business unit, which I’ll talk about in part two is their Autonomous driving.

Uh, which is Apollo, which is sort of other innovations. I’m not gonna talk about that today. Uh, I’ve always sort of been more interested in the first two buckets. And anyways, that’s kind of a good way to think about their businesses, the mobile ecosystem, which is mostly search, and then AI specific cloud.

Okay, now a couple comments on their mobile ecosystem business, and then I’ll get to the flywheel, which is the AI cloud strategy. Uh, the mobile ecosystem, the search business really, uh. It’s pretty fascinating how they’ve evolved over time. Um, for those of you who are subscribers, you can go online and search for Baidu.

I, I wrote. Pretty good detail on this a couple years ago. And I literally mapped it out on PowerPoints with, with sort of graphics of how they went from simple to more advanced search and then how they went from advanced search to advanced search plus really content creation. ’cause they were doing videos and other things that fed into their search engine, which is similar to what Google did.

They went from, you know, search engine to YouTube and mapping and other things. Uh, but one of the changes they did do. Uh, several years ago as they stopped talking about search and they started to talk about search plus feed. If you look in any of their 10 K’s, let’s say five years ago, you’ll see this phrase all over the time, search plus feed, which is how do people access information from the internet?

Well, the number one most popular way in term was probably search. That was it for a long time. You do the search engine, you put in a query, you get a result. Uh, but you know, Facebook really changed the game. Where, how do you access from the internet? Well, it’s the Facebook newsfeed. You sit there and you scroll and it tees up one story after the other for you, it’s very passive, but most information that you consume from the internet is passive, not active search.

So you saw Baidu shift and start doing search plus feed as the two main ways that human beings interact with the information online. Now you could argue and I have, is that ChatGPT really created a new way to interact, a new type of human internet interface. There was a new modality for accessing the information of the internet.

We could do search, we could do feed, and now we can do query and conversation, which is really what ChatGPT does. So they kind of went from Baidu search to Baidu Search Plus feed. Now what they’re talking about, if you look at their latest reports, they talk about Intelligent Search plus Intelligent Feed.

That’s basically incorporating AI and specifically generative AI into their core business. And I think you’ll see them start to change their language in the next year where they’ll talk about search plus feed. Plus, let’s call it chatbot. Some other way that look, we’re gonna interact with as this, as generative AI gets better and better.

We’re gonna just start talking to our computers, whether by typing or just verbally, and it’s gonna be a real-time conversation. I’ve noticed this myself. I don’t do as many searches as I used to. I am much more used like Bing or Copilot, and I just ask questions and sort of go back and forth. And if you look at a company called Grok, which is, uh, you know, people have been talking about this on the All In podcast, you know, they really position themselves as an alternative to chat GBT based on their token speed that they can respond.

Much, much quicker, and therefore it becomes more of a conversation. So anyways, you’ll see that anyways. If you look at the latest Baidu stuff, they’ll talk about intelligent search bus, intelligent feed, which is different because they’re basically incorporating generative AI into everything they do. And in the next podcast I’ll talk about this, that.

They gave a very good presentation. Robin Lee. Dude, listen to this guy. He is really, really on the frontier of ai. Listen to him at the Baidu World Conference back in September. He gave some great examples of stuff they’re doing, and I’ll talk about this, uh, in the next podcast. Fantastic use cases to talk about, and it’s really a lot of it was incorporating their AI capabilities into their core apps.

That was, I’ll get into that. Okay. I think that’s enough for, well, yeah. I mean, if you go through the history of the search engine for Baidu, it’s actually pretty important, you know, Robin Lee got his patent for hyperlink analysis in 19 ninety-nine, and that was two years ahead of Google’s core patents.

Right. He was. You know, there’s certain people you should listen to in ai. He’s one of them. The company was founded January 1st, 2000. Uh, founded in a hotel, I think in Beijing University search engine, uh, 2002. They kind of started to be head-to-head. They had 800 R&D engineers. They were really head-to-head, technically with Google way back in, you know, 2002.

Uh, they got an acquisition offer from Google in 2005, which they rejected. Uh, anyways, really cool history there. The search is pretty honest. Okay, that’s enough for sort of the core business model and the search. Let’s get to their AI cloud, which is their big, big move in my opinion. And here’s how I sort of view the strategy.

Okay, so AI Cloud at Baidu is going after basically corporate clients, which is, you know, it’s enterprise, um, cloud services, which is what literally all cloud services are focused on. And you raise the question, alright, what is, what are their advantages? How do they win? Alibaba Cloud is way out there. They obviously want to go beyond China to some degree.

Asia for sure. How do you beat Azure? How do you beat, you know. You always gotta know what’s your advantage. Uh, and if you can’t articulate what your advantage is, generally you don’t have one. So what is their advantage? I, and now it’s two. And this is from my reading, and this is, I won’t say it’s their language exactly, but this thinking comes from them, um, much more than from me.

Uh, number one. If you integrate the cloud and ai, you’re gonna get far more effective and efficient development over time. I mean, this is a cloud service built on AI from day one that is different. You know, you get sort of accumulated technical capabilities. You get industry knowledge. Industrial knowledge, uh, which I’ll talk about in in the next podcast.

This idea of knowledge enhancement and knowledge advancement within ai. Um, but what they’re doing is they are building AI and cloud services with industry scenarios. At the very core, it’s all very directed to. What can be used by industry in practice? I mean, there’s a very sort of tight hold on, valuable use cases for industry and that drives that sort of customer end focus drives all the way back through their tech stack, uh, and how they’re sort of integrating.

So one, you get benefit by closely integrating AI and cloud from day one. Uh, and then second, which is the main point of today’s talk is. You get a feedback loop, you get a flywheel where the more you are in industry specific cases being adopted, AI gets data from that. It gets increased intelligence. That basically creates a feedback loop into the foundation models, into the development platform, paddle-paddle, and ultimately maybe into chip development.

That’s Kunlun and I’ll put a, a picture of the flywheel. This is their. Graphic, it’s not mine. Um, that appears to be true. So the flywheel, it’s industries focused from day one. It’s not trying to solve all general knowledge for everyone. Oh, I’m sure they’re doing lots of stuff. It’s very customer focused.

And then two, you’re getting this flywheel all the way back through the AI tech stack. Definitely from applications into. What we called L-one, the industry-focused, customized, um, foundation models. And then into L-zero, the big models that are not industry focused. And then into the development platform.

Paddle, paddle, and then in maybe into the, the chip layer, Kunlun tight feed-lap loop is what they’re doing. And they talk about this very openly, which is honestly, it’s pretty impressive. So what does that mean in practice? Well, basically you have Baidu’s AI cloud, which if you view it as an integration of cloud and AI from top to bottom, you have a cloud that is tuned to AI all throughout, and you have an increasingly intelligent transformation engine.

For industry because the AI in AI cloud is built for common scenarios, and they’ve already rolled out quite a few scenarios. Uh, the first, the one you talked about most is Kaiwu, which is basically smart manufacturing. So it’s Kaiwu ai, it’s an industrial internet platform. Uh, they’ve got. Use cases and clients all over the place.

But yeah, they’re basically, this is okay as we tune this entire AI cloud system for various injuries. I assume number one on the list is Kaiwu, which is basically industrial internet manufacturing. And who is the manufacturing giant of the world? It’s China. So lots of, you know, case studies integration.

You should expect them to have a AI system that is more efficient and more intelligent in manufacturing than probably anywhere. You’re not gonna get the, there’s just not enough clients in other parts. Well. This will be an interesting question. How much does one AI platform surpass others in terms of intelligence?

Do you need, is it a situation where the more use cases and the newer adoption you would get, which you would expect to be China, is it gonna be dramatically more intelligent than other places? Or is it all gonna like. AI for language is pretty much good everywhere. Nobody has a real lead in terms of capabilities, in terms of translation yet.

Um, but is it gonna get smarter and smarter? Is there a scale advantage to this? Uh, I suspect there is for manufacturing. Okay. So there’s smart manufacturing. That’s their KaiWu platform. They have smart energy and water management. Uh, that’s power generation. That’s power transmission. That’s oil and gas management.

That’s water management. They’ve got clients all over China. I’m, they publish the names, the state Grid of China. The China Southern Power, Grid, uh, C for oil and gas, CNPC, Sinopec, CNUC, all the giants. Uh, for power generation, I dunno, those of you who are familiar, the state power investment Corp, the National Energy Group, the Huaneng group.

Huadian Group, if you’re familiar with sort of, uh, you know, sort of the national players of China. This, this is a who’s, who’s list of state-backed companies basically. Anyway, so smart energy, water management, smart city, basically. City AI platforms. They’ve got projects in Chengdu, Dalian, Kunming Smart Finance.

Now, this one I think is a bit more, we’ll see what happens here. Okay? They will cite Postal Savings Bank of China Construction, bank of China, Chongqing Industrial Finance Platform. One of the other companies that’s on my shortlist is Ant Financial. Ant Financial. People think about for payment. Uh, they have Alipay Plus, which is kind of a big deal.

They’re deeply integrated with e-commerce. The side of Ant Financial that people don’t talk about as much is they have a tech group, a business technology group that does basically AI and other tech services for the financial players of China. And it’s really, really impressive. I’m gonna write about that in the next week or so.

It’s really impressive. Um, so smart finance, we’ll see. Uh, but I would be kind of watching Ant Financial for that one. Uh, now the one that they sort of talked about a lot over the last couple years was Intelligent driving their Apollo program. Um, pretty impressive. I’m gonna, I’ll talk about this in the next podcast.

I don’t pay as much attention to sort of the intelligent transportation systems, the autonomous driving systems, but it, for, at least for China, it ties deeply in with smart cities. You know, when you’re digitizing the roads and the parking lots and the tunnels and the traffic lights that goes hand in glove with autonomous driving vehicles.

And that’s what Apollo. Is going after to sort of be the operating system for, you know, autonomous vehicles in China. Um, that’ll be interesting to watch. I’ll talk about that. And then you also get intelligent mapping, which they were a major player in mapping. So that, that’s a whole separate question. Uh, other ones to think about.

Healthcare. Um. Uh, when you start talking healthcare in China, you’re talking about state-run hospitals. For the most part. Uh, they are not exactly on the edge of technology. I don’t pay much attention to that, to tell you the truth. Anyways, so that’s kind of the picture, but you’ve got this Baidu AI cloud with this interesting flywheel between smart manufacturing, smart cities, smart transportation, smart finance, smart energy, smart healthcare.

Um, one last one to think about is media, which I didn’t pay enough attention to this one, but one of the interesting things they’re doing is sort of, um, digital avatars and metaverse, like metaverse. Everyone talked about it two years ago, not so much this year. It’s actually pretty impressive that. You can sort of create digital avatars and you can work with these virtual spaces.

And, you know, people aren’t talking about this as much, but if you actually look at the case studies for like Dior in China and you know, the French luxury house, um, they’re doing sort of metaverse stuff that’s actually pretty cool. Uh, Automakers are sort of doing digital marketing and digital advertising.

They have metaverse concerts. This is like September, 2022. You know, they were doing sort of by DO app was holding these virtual conferences where you could port yourself into the metaverse and, well, all of this depends on A.I. So this whole idea of A.I generated content, A IGC. Uh, digital idols. Um, it’s actually kind of impressive and I’ll talk about this in part two, uh, all the case studies, but yeah, people don’t talk about this as much in the west as they did two years ago.

It’s still kind of a big deal. It’s kind of rocking and rolling in China. Anyways, that’s kind of how I would view all this. Uh, in terms of the strategy, the AI strategy, it’s pretty impressive. The more I get into it, the more I’m like, yeah, it’s really what would I do and a couple other companies are doing with ai, ai, cloud, uh, smart industry, this sort of, let’s call it a flywheel, this feedback loop where they are going to, in theory, jump ahead of everyone else in the intelligence of their solutions.

And the flywheel is, look, the more use cases you get, the better. But it also is gonna play out as an innovation platform. Where you’re gonna get more data. That’s a, let’s call it a data network effect. Even though I don’t like that phrase. You’re also gonna get an innovation platform where you’re gonna get better and better industry tuned foundation models.

L one that’s gonna get you more developers creating more apps. It’s gonna get you more customers Integrating and customizing those for their companies. So you’re gonna kind of get a network effect on the innovation platform, and you may get a big one. In terms of data intelligence, and I’m still trying to figure out where that’s gonna happen and where it isn’t.

It’s kind of one of my big question strategy wise. Anyways, that would be an introduction to sort of Baidu’s AI cloud strategy. Uh, which, you know, you can sort of break it into their mobile ecosystem strategy and you can break it into their AI cloud strategy, which I think the fly wheel is the most interesting part, the industry tuned flywheel.

That’s kind of what I’m paying most attention to. Anyways, for those of you who are subscribers, I’m gonna send you a lot of writing on this because you’re really, it’s, it’s hard for me to explain it. Sort of waving my hands on a podcast. It’s easier to read it and see the graphics. It really, it’s pretty complicated actually.

So, uh, sorry for all the hand waving, but that’s kind of what it is. Anyways, I think I’m about at 30 minutes right on schedule in part two. I’ll go into sort of use cases. Um. Which is, yeah, it’s real, it’s real easy to talk about this in theory, but when you actually see the use cases, people are deploying, you’re like, okay, it’s the real deal.

And uh, Robin Lee gave a great presentation on the latest upgrade to Ernie bot. In September, November of last year, and I’ll go through, through some of what he talked about, he’s really worth listening to. He’s the real deal. I mean, listening to him talk about AI’s, like listening to Sam Altman. I mean, he knows the details, like few people know the details.

So I always listen to everything he says. Anyways, that’ll be the the next podcast. I hope that’s helpful. I’m right on time. And I don’t really have any, I’m, I’m traveling around the islands, so if the, the quality of this podcast is not as good, it’s ’cause I’m using the little travel. My, I may have had my best week ever in Southeast Asia.

It has just been fantastic time on the islands kayaking, uh, through the mangroves, you know, sitting on the beach. It’s really been, I even, I was sort of thinking at the end, we’ve been talking about this. Me, me and the girlfriend are here. We’re like. This was like the best week ever. Maybe like I’m, I’m actually gonna write up my itinerary ’cause I’m kind of like, this was like maybe my greatest travel week I’ve ever had.

I should write this up and post it. So I’ll probably do that at some point. Anyways, that’s it. I’m heading, um, back on the plane in a couple hours, so, um, we’ll clean up this podcast to hopefully there’s not too much distortion and we’ll post it. But that is it for me. I hope everyone is doing well and I will talk to you next week.

Bye-Bye.

———

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.